Hexatronic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexatronic Bundle

Hexatronic operates in a dynamic telecom infrastructure market, where understanding competitive forces is paramount. The threat of new entrants, while present, is somewhat mitigated by capital requirements and established relationships within the industry. Buyer power can be significant, especially for large telecommunication providers, influencing pricing and product innovation.

The intensity of rivalry among existing competitors in the fiber optic and data communication sectors is a key factor shaping Hexatronic's strategy. Suppliers of raw materials and specialized components can exert considerable influence, impacting costs and availability. Furthermore, the threat of substitutes, though less immediate in core fiber optics, requires continuous innovation and adaptation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hexatronic’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The fiber optic infrastructure sector, crucial for Hexatronic, depends heavily on specialized components and raw materials. When a few major suppliers control essential inputs, such as the high-purity glass used in optical fibers or unique polymers for cable jacketing, their leverage naturally grows. This concentration means these suppliers can potentially dictate terms, impacting Hexatronic's costs and production schedules.

Hexatronic's strategic advantage lies in its proactive approach to managing this supplier concentration risk. By cultivating a global supply chain with diverse sourcing options, the company reduces its dependence on any single supplier or region. This diversification is key to maintaining operational resilience and cost control in a market where specialized inputs can be scarce.

Switching costs represent a significant factor in the bargaining power of suppliers for Hexatronic. The process of changing suppliers for key components, especially those integral to their fiber optic solutions, can involve substantial expenses. These costs aren't just about the price of new materials; they encompass re-tooling manufacturing equipment to accommodate different specifications, establishing and verifying new quality assurance protocols, and the administrative burden of renegotiating contracts and supply chain logistics.

These economic penalties and operational disruptions associated with switching suppliers directly empower existing suppliers. If Hexatronic finds it prohibitively expensive or time-consuming to change, their current suppliers gain leverage in pricing and terms. This dynamic is especially pronounced when Hexatronic relies on highly specialized components for which there are a limited number of qualified alternative suppliers in the market. For instance, a supplier of a unique fiber optic connector with proprietary technology would likely wield considerable power.

Suppliers offering highly unique or patented components, like advanced fiber optic materials or specialized coatings designed for extreme conditions, naturally wield more influence. Hexatronic's strategy of providing complete solutions means they could be dependent on such proprietary inputs from their suppliers, reducing their available choices and amplifying supplier leverage. For instance, in 2023, Hexatronic continued to invest heavily in its own R&D, aiming to internalize critical component development to mitigate reliance on external, highly differentiated suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into Hexatronic's market by producing and selling their own fiber optic infrastructure solutions can significantly bolster their bargaining power. This scenario, while less frequent in highly specialized component manufacturing, presents a potential long-term concern if a supplier possesses substantial market understanding and financial resources.

For instance, if a key supplier to Hexatronic, like a specialized fiber optic cable manufacturer, were to develop the capability and strategic intent to offer complete end-to-end solutions, they could directly compete with Hexatronic. This would shift the power dynamic, allowing them to dictate terms or even capture a portion of Hexatronic's customer base.

- Supplier Integration Risk: The potential for suppliers to engage in forward integration, directly entering Hexatronic's market, is a critical factor influencing supplier bargaining power.

- Market Knowledge & Capital: For this threat to be credible, suppliers need not only technical production capabilities but also deep market knowledge and the capital to establish a competitive presence.

- Industry Specialization: While less common in highly specialized B2B component supply chains, the risk of forward integration can increase if a supplier has unique insights or significant leverage over Hexatronic's production processes.

- Strategic Threat: This threat represents a strategic risk that could force Hexatronic to consider alternative sourcing strategies or investments in vertical integration to mitigate potential competitive pressure from its own suppliers.

Importance of Hexatronic to Suppliers

The volume of business Hexatronic provides to its suppliers is a key factor in determining their bargaining power. If Hexatronic constitutes a substantial percentage of a supplier's total revenue, that supplier is likely to be more accommodating with pricing and terms to secure Hexatronic's continued patronage. For instance, if Hexatronic's purchasing volume represents 20% or more of a key component supplier's output, that supplier's incentive to maintain a good relationship and offer competitive pricing is significantly heightened.

Conversely, if Hexatronic is a relatively minor customer for a supplier, its ability to negotiate favorable terms or influence pricing strategies naturally diminishes. Suppliers catering to a broad customer base may not feel the same pressure to bend to Hexatronic's demands if its business is not a critical revenue stream. This dynamic is evident when comparing suppliers who are heavily reliant on large telecommunications infrastructure orders versus those with a more diversified client portfolio.

Hexatronic’s strategic sourcing and supplier relationship management directly impact this power balance. By consolidating purchasing or cultivating long-term partnerships, Hexatronic can increase its leverage. For example, securing exclusive supply agreements for critical fiber optic components can solidify Hexatronic's position, potentially giving it an edge in negotiations.

- Supplier Dependence: If a supplier generates over 25% of its annual revenue from Hexatronic, its bargaining power is reduced.

- Customer Concentration: Hexatronic's ability to negotiate depends on whether it is a major or minor client for its suppliers.

- Strategic Partnerships: Long-term contracts and volume commitments can strengthen Hexatronic's hand in supplier negotiations.

- Component Criticality: The importance of specific components to Hexatronic's final product affects supplier leverage.

The bargaining power of suppliers for Hexatronic is influenced by the concentration of specialized component manufacturers and the criticality of these inputs. When few suppliers dominate the market for essential materials like high-purity glass or unique polymers, their ability to dictate terms increases significantly. This is particularly relevant as Hexatronic operates in a sector reliant on advanced, often proprietary, materials.

| Factor | Impact on Hexatronic | Example Scenario (Hypothetical) | 2024 Data/Trend |

|---|---|---|---|

| Supplier Concentration | High concentration amplifies supplier power. | A single dominant supplier for a critical connector type. | Continued consolidation in specialized materials, leading to fewer, larger suppliers. |

| Switching Costs | High switching costs empower incumbent suppliers. | Re-tooling for new optical fiber jacketing materials can cost millions. | Increased investment in proprietary manufacturing processes by suppliers. |

| Component Differentiation | Unique or patented components give suppliers leverage. | Suppliers of advanced coatings for extreme environment fiber optics. | Hexatronic's R&D investment in 2023 aimed to internalize some critical component development. |

| Customer Dependence | Hexatronic's volume reduces supplier power. | If Hexatronic represents < 10% of a supplier's revenue, their influence is limited. | Hexatronic actively seeks to diversify its supplier base to reduce single-supplier dependency. |

What is included in the product

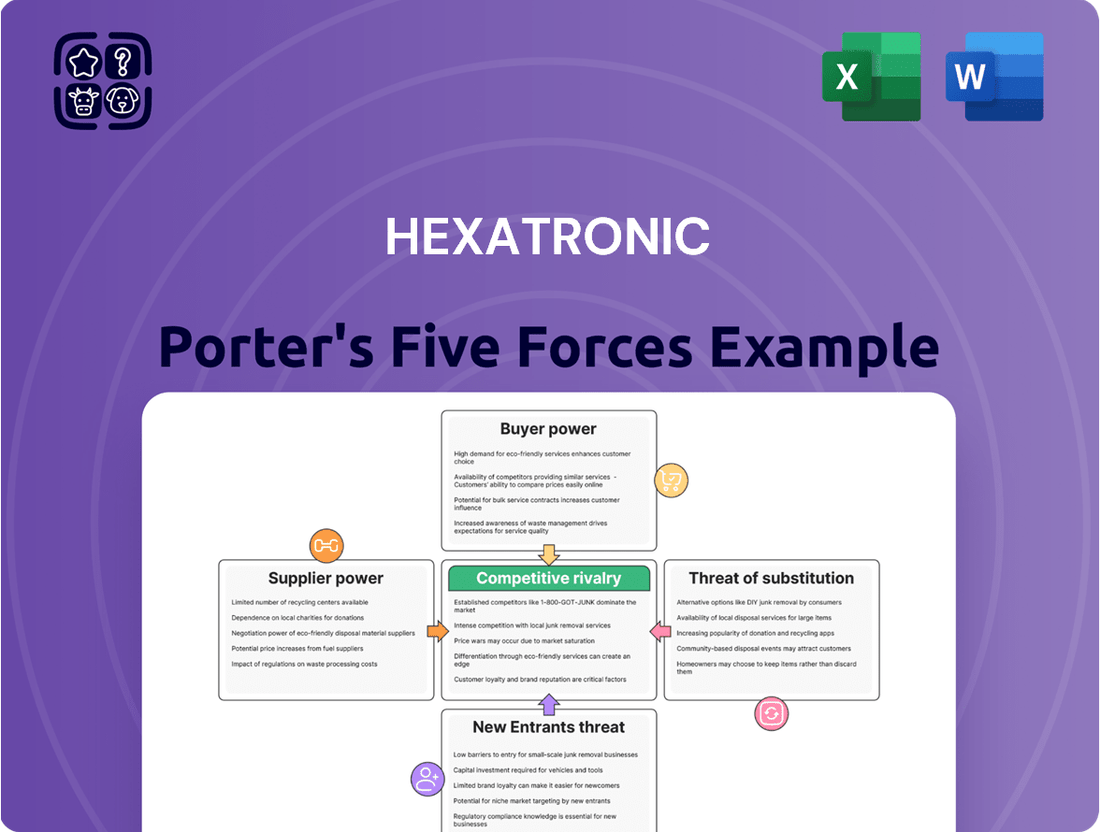

Examines the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants and substitutes impacting Hexatronic's market and profitability.

Instantly visualize competitive pressures with a dynamic spider chart, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Hexatronic’s broad customer base across telecom, data centers, and industrial networks on four continents generally dilutes individual customer bargaining power. However, significant customers, particularly large telecom operators or major data center providers, can exert considerable influence due to the substantial volume of their orders.

For instance, Hexatronic’s strategic partnership with NOVOS FiBER in the US exemplifies these large-scale client relationships, where the sheer size of the contract can grant the customer greater leverage in negotiations.

Customers often face significant costs when considering a switch from one fiber optic solution provider to another. These costs can range from ensuring compatibility between new and existing infrastructure to the expense and time involved in retraining personnel on new systems. Furthermore, switching mid-project can lead to considerable disruption, impacting ongoing operations and timelines.

Hexatronic's approach of offering comprehensive, end-to-end solutions, covering everything from initial design and product supply to installation and ongoing maintenance, inherently raises these switching costs for its clientele. By providing an integrated service, Hexatronic makes it more complex and costly for customers to move to a competitor, thereby diminishing the bargaining power of those customers.

Customers in the fiber optic infrastructure market often exhibit significant price sensitivity, particularly when procuring standardized components. This sensitivity empowers them to negotiate more favorable terms.

Hexatronic's Q2 2025 financial report highlighted this trend, specifically mentioning weaker demand and increased price pressure within its Fiber Solutions segment. This suggests a clear customer inclination towards cost reduction.

The observed price pressure translates directly into customer bargaining power, compelling Hexatronic to prioritize operational efficiency and rigorous cost management to remain competitive.

Threat of Backward Integration by Customers

The bargaining power of customers, particularly large telecom and data center operators, poses a significant threat to Hexatronic through potential backward integration. These major clients, often with substantial financial resources and technical capabilities, could explore manufacturing their own fiber optic components if it appears more economically viable. For instance, a major European telecom provider might evaluate the cost savings and supply chain control gained by producing essential fiber optic cables internally versus continuing to rely on external suppliers like Hexatronic. This credible threat compels Hexatronic to maintain competitive pricing and favorable contract terms to retain these crucial customer relationships.

The potential for customers to integrate backward is a strategic consideration for Hexatronic.

- Significant capital investment and specialized expertise are required for customers to undertake backward integration in fiber optic manufacturing.

- Major telecom and data center companies are the primary drivers of this threat due to their scale and potential cost efficiencies.

- Hexatronic must remain competitive on pricing and terms to mitigate the risk of losing key clients to in-house production.

- The ongoing global demand for fiber optics, projected to grow significantly, may temper the immediate feasibility of widespread customer backward integration. For example, the global fiber optic market was valued at approximately USD 6.2 billion in 2023 and is anticipated to expand at a CAGR of over 8% from 2024 to 2030.

Availability of Substitute Products/Services for Customers

Customers possess significant bargaining power when numerous alternative fiber optic solutions or even non-fiber technologies are readily available. This abundance of choices empowers them to demand better pricing and terms from Hexatronic. For instance, in 2024, the global fiber optic market saw continued growth, with new entrants and established players expanding their product lines, thereby increasing customer options.

Hexatronic can counter this by highlighting its unique value propositions. By focusing on specialized segments such as Harsh Environment solutions, which are critical for demanding industrial applications, or its Data Center offerings that meet high-density connectivity needs, Hexatronic can differentiate itself. These specialized areas often have fewer direct substitutes, thus reducing customer leverage.

- Increased Competition: The fiber optic sector is characterized by a growing number of suppliers offering comparable products, intensifying competition and empowering buyers.

- Threat of Substitutes: While fiber optics dominate high-speed data transmission, the potential, albeit limited in many high-performance scenarios, for alternative technologies to emerge or gain traction in specific niches can influence customer negotiations.

- Hexatronic's Differentiation: Hexatronic leverages its expertise in niche markets like Harsh Environment and Data Center solutions, where specialized performance and reliability reduce the substitutability of its offerings.

- Customer Leverage: The broad availability of standard fiber optic components and services allows customers to easily switch suppliers if Hexatronic's pricing or terms are not competitive, a key factor in 2024 market dynamics.

Hexatronic's customers, especially large entities like telecom operators, wield significant bargaining power due to their substantial order volumes and the potential for backward integration, particularly evident in 2024's competitive landscape.

High switching costs for customers adopting Hexatronic's integrated solutions also serve as a mitigating factor, although price sensitivity remains a key lever for buyers.

The increasing number of suppliers in the fiber optic market in 2024 further amplifies customer options, compelling Hexatronic to focus on specialized offerings to retain leverage.

| Factor | Customer Bargaining Power Influence | Hexatronic's Mitigation Strategy |

|---|---|---|

| Order Volume | High for large customers | Focus on customer retention through value-added services |

| Switching Costs | Low to moderate | Emphasize end-to-end solutions and integration |

| Price Sensitivity | High for standard components | Drive operational efficiency and cost management |

| Availability of Alternatives | High | Differentiate through specialized solutions (e.g., Harsh Environment) |

| Backward Integration Threat | Credible for major players | Maintain competitive pricing and contract terms |

Same Document Delivered

Hexatronic Porter's Five Forces Analysis

This preview showcases the complete Hexatronic Porter's Five Forces Analysis, detailing the competitive landscape within the fiber optic telecommunications sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, offering a comprehensive overview of Hexatronic's industry dynamics. This includes an in-depth examination of supplier power, buyer bargaining power, the threat of new entrants, the threat of substitute products or services, and the intensity of competitive rivalry. The document you see is your deliverable, ready for immediate use—no customization or setup required.

Rivalry Among Competitors

The global fiber optic infrastructure market is teeming with competitors, a mix of giants and niche specialists. Hexatronic navigates this landscape across its Fiber Solutions, Harsh Environment, and Data Center segments, each presenting a unique competitive mosaic. For instance, in the broader fiber optics sector, companies like Corning Incorporated and Prysmian Group are significant players, while specialized areas might see smaller, agile firms dominating.

This sheer number and variety of companies mean that Hexatronic faces intense rivalry across its operational spectrum. In 2023, the global fiber optic cable market was estimated to be valued at over $60 billion, indicating substantial competition for market share. The presence of both large, established entities and innovative smaller companies creates a dynamic environment where price, technological advancement, and customer relationships are critical differentiators.

The fiber optics market is booming, with global demand for fiber optic cables expected to hit 720 million fiber kilometers by 2025, showing a robust 9.3% year-over-year increase. This strong growth typically softens competitive rivalry by expanding the market pie for all players.

However, this isn't a universal shield. In early 2025, Hexatronic's Fiber Solutions segment encountered softer demand and pricing challenges in European and North American markets. This suggests that even within a high-growth industry, specific segments or regions can experience fierce competition, putting pressure on pricing and market share.

Hexatronic distinguishes itself in the fiber optic market by offering comprehensive end-to-end solutions, focusing on superior quality and specialized products tailored for demanding applications like data centers and harsh environments. This focus on unique value propositions and integrated systems can create higher switching costs for customers who are invested in Hexatronic's ecosystem.

While some fiber optic components are commoditized, Hexatronic's emphasis on specialized solutions and robust quality can mitigate intense price competition. However, in market segments where product differentiation is less pronounced, price pressure tends to increase, intensifying rivalry among competitors.

Exit Barriers for Competitors

Hexatronic, like many in the fiber optics sector, faces intensified competitive rivalry due to high exit barriers. These barriers compel companies to stay in the market, even when profits are thin, rather than absorb substantial losses from exiting. This can lead to a prolonged struggle for market share, as seen with the significant capital investment in new manufacturing capabilities, such as Hexatronic's Utah facility, which represents a substantial commitment to future production.

The implications of these exit barriers are significant for competitive dynamics. Companies are less likely to cease operations during downturns, meaning they continue to compete, potentially driving down prices and margins for everyone involved. This creates a scenario where firms must innovate and operate efficiently simply to survive, rather than having the option to gracefully exit a challenging market.

- High Capital Investment: The specialized nature of fiber optic manufacturing, requiring advanced machinery and cleanroom environments, creates substantial sunk costs. For instance, establishing a new facility like Hexatronic's in Utah involves millions in upfront investment in specialized equipment and infrastructure.

- Long-Term Contracts and Commitments: Many companies in this industry operate under long-term supply agreements with major telecommunications providers. Breaking these contracts can incur significant penalties, locking companies into market participation.

- Specialized Workforce and Know-How: The industry relies on a highly skilled workforce with specialized knowledge in fiber optic manufacturing and technology. The cost and time associated with retraining or relocating such a workforce can act as a deterrent to exit.

- Brand Reputation and Customer Relationships: Established players have built strong brand reputations and deep relationships with customers. Exiting the market would mean forfeiting these valuable, albeit intangible, assets.

Strategic Commitments of Competitors

Competitors' strategic commitments, such as substantial investments in new technologies or aggressive pricing, can intensify rivalry. Hexatronic's own commitment to expanding US manufacturing capabilities, for instance, signals a long-term strategy that will influence competitive dynamics.

These commitments often involve significant capital expenditure, aiming to secure market share and technological leadership. For example, some competitors might be heavily investing in advanced automation for fiber optic cable production, a move that could lower costs and increase output capacity.

- Competitors' large-scale investments, like those in new production facilities or cutting-edge R&D, directly impact industry rivalry.

- Hexatronic's strategic decision to invest in US-based manufacturing reflects a commitment to serving the North American market more effectively and potentially reducing lead times.

- Such commitments can lead to price wars or a race for technological superiority, forcing other players to respond in kind.

- Focusing on high-growth segments, such as the booming data center market, represents another key strategic commitment that shapes the competitive landscape.

Competitive rivalry within the fiber optics sector is robust, driven by a large number of global and specialized players, as evidenced by the market's valuation exceeding $60 billion in 2023. Hexatronic operates within this dynamic, facing intense competition across its segments, particularly where product differentiation is less pronounced, leading to increased price pressure. High exit barriers, such as substantial capital investments and specialized workforces, compel companies to remain active competitors, even in less profitable periods, prolonging market share battles.

Hexatronic's strategic commitments, including significant investments in new manufacturing capabilities like its Utah facility, signal its long-term engagement and influence competitive intensity. Competitors' similar strategic moves, such as investing in automation or focusing on high-growth areas like data centers, further fuel this rivalry, potentially triggering price wars or technological races. The ongoing expansion of the fiber optic market, with demand projected to reach 720 million fiber kilometers by 2025, offers growth opportunities but does not entirely negate the pressures of intense competition.

SSubstitutes Threaten

While fiber optics currently dominates the market for high-speed, high-capacity network solutions, the threat of substitutes exists. Advanced wireless technologies, such as the ongoing deployment and evolution of 5G networks, and emerging satellite internet constellations offer viable alternatives for specific connectivity needs, particularly in areas where fiber deployment is challenging or cost-prohibitive. For instance, the global 5G subscriber base was projected to exceed 1.5 billion by the end of 2024, highlighting its growing reach.

Enhanced copper-based systems, though generally offering lower bandwidth than fiber, can still fulfill certain connectivity requirements, especially for shorter distances or less data-intensive applications. However, the overarching trend driven by increasing data consumption and the demand for robust, low-latency connections across diverse sectors like cloud computing, streaming, and the Internet of Things (IoT) significantly favors the continued adoption and expansion of fiber optic infrastructure. The global fiber optics market size was valued at approximately $30 billion in 2023 and is expected to grow substantially, underscoring its strong market position despite potential substitutes.

The threat of substitutes for Hexatronic's fiber optic solutions hinges on their price-performance ratio. While fiber optics generally offers superior bandwidth and signal integrity for demanding, long-haul applications, alternative technologies pose a threat in specific segments. For instance, advancements in wireless technology, particularly in fixed wireless access, are making it a more viable substitute in certain last-mile connectivity scenarios where the ease of deployment and lower initial capital expenditure can outweigh performance trade-offs. In 2024, the global fixed wireless access market was valued at approximately $65 billion and is projected to grow significantly, indicating increasing adoption of these alternatives.

Customer propensity to switch away from Hexatronic’s fiber optic solutions hinges on their unique requirements, current setup, and how they view the advantages and drawbacks of alternative technologies. For mission-critical applications such as data centers and core telecommunication networks, the paramount importance of unwavering reliability and lightning-fast performance significantly diminishes the inclination to move to substitutes, even if initial costs are higher. For instance, the global data center market, valued at over $200 billion in 2023, demands the highest levels of uptime and data transfer speeds, making fiber optics the indispensable choice. Similarly, the massive growth in mobile data traffic, projected to reach 202 exabytes per month globally by 2026, underscores the need for high-capacity fiber backbones that substitutes struggle to match.

Evolution of Substitution Technologies

The threat of substitutes for Hexatronic's fiber optic solutions is evolving with technological advancements. The ongoing rollout of 5G and its subsequent generations presents a potential substitution threat, particularly for certain fiber deployments in specific use cases. For instance, while fixed wireless access (FWA) powered by 5G can offer high-speed internet without the need for physical fiber to the premises in some residential or business areas, it's important to note the inherent dependency.

In fact, 5G networks themselves heavily rely on fiber optic cables for essential backhaul infrastructure, connecting cell towers to the core network. This creates a symbiotic, or complementary, relationship rather than a direct substitution in many scenarios. For example, a report from Light Reading in early 2024 indicated that a significant portion of 5G densification strategies involves expanding fiber deeper into the network.

This reliance means that as 5G adoption grows, the demand for fiber optic backhaul is likely to increase, reinforcing Hexatronic's market position. The company's focus on high-quality, reliable fiber solutions positions it well to benefit from this trend.

Here are key considerations regarding substitution threats:

- Wireless Technologies: Advancements in 5G and future wireless generations offer potential substitutes for some fiber applications, particularly in fixed wireless access.

- Complementary Relationship: 5G infrastructure critically depends on fiber optic cables for backhaul, creating a complementary rather than purely substitutive dynamic.

- Fiber's Resilience: The increasing demand for bandwidth driven by wireless technologies like 5G actually bolsters the need for robust fiber optic networks.

Regulatory and Infrastructure Support for Substitutes

Government policies and infrastructure investments significantly impact the attractiveness of substitute solutions. For instance, in 2024, many governments continued to invest in wireless broadband initiatives, particularly in underserved or remote areas. These efforts aim to bridge digital divides, potentially reducing the immediate urgency for extensive fiber optic network expansion in those specific locations. However, it's crucial to recognize that these wireless technologies themselves often rely on robust fiber backbones for their high-capacity data transmission, meaning fiber remains foundational.

The viability of substitutes is directly tied to the level of support they receive through policy and capital expenditure. For example, if government subsidies heavily favor the deployment of fixed wireless access (FWA) in rural regions, this could temporarily decrease the perceived need for direct fiber-to-the-home (FTTH) connections in those same areas. As of early 2024, several countries reported substantial allocated budgets for 5G FWA rollouts, aiming for widespread coverage by 2025. This strategic infrastructure push can certainly influence customer adoption patterns and the competitive landscape for traditional wired services.

The regulatory environment and public infrastructure spending can create or diminish the threat of substitutes. Initiatives designed to promote widespread wireless internet access, such as government-backed 5G deployment programs in 2024, can make wireless solutions more competitive. While these wireless networks often depend on fiber for backhaul, their increased accessibility and affordability in certain markets can indeed reduce the immediate demand for direct fiber installations in those specific niches.

While fiber optics offers unparalleled performance, advanced wireless technologies like 5G and satellite internet present viable alternatives, especially where fiber deployment is challenging or costly. The global 5G subscriber base was projected to surpass 1.5 billion by the end of 2024, indicating significant adoption of these wireless solutions. However, it's critical to remember that these wireless networks heavily rely on fiber for their backhaul infrastructure, creating a symbiotic relationship. This reliance means that as wireless adoption grows, so does the demand for fiber, reinforcing Hexatronic's market position.

| Technology | 2024 Market Value (USD Billions) | Key Characteristic | Hexatronic Relevance |

|---|---|---|---|

| Fiber Optics | ~35 (Projected) | High Bandwidth, Low Latency, Reliability | Core offering, essential for 5G backhaul |

| 5G Fixed Wireless Access (FWA) | ~70 (Projected) | Convenient Deployment, Speed | Potential substitute in specific last-mile scenarios, but relies on fiber |

| Satellite Internet | ~15 (Projected) | Global Reach, Remote Access | Substitute for specific niche applications, less direct competition |

Entrants Threaten

Entering the fiber optic infrastructure market, especially for manufacturing and large-scale deployment, demands substantial upfront capital. This includes setting up advanced production facilities, investing in cutting-edge research and development, and building robust distribution channels. These significant financial barriers make it challenging for new companies to gain a foothold.

Hexatronic's recent strategic investment in a new US facility located in Utah exemplifies these high capital requirements. Such large-scale investments are a clear signal of the financial commitment needed to compete effectively, acting as a powerful deterrent for potential new entrants who may lack the necessary funding or access to capital.

Established players like Hexatronic leverage significant economies of scale in manufacturing, procurement, and distribution. This allows them to achieve lower per-unit costs, enabling competitive pricing strategies and healthy profit margins. For instance, in 2024, Hexatronic's robust supply chain management likely contributed to their ability to maintain price stability even amidst fluctuating raw material costs.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the established volume of business, they would struggle to negotiate favorable terms with suppliers or spread fixed overheads across a large production base. This initial cost disadvantage makes it challenging for them to compete effectively on price against incumbent firms.

Gaining access to established distribution channels and critical supply chains represents a significant barrier for potential new entrants in the fiber optic solutions market. Building the necessary relationships with major telecom operators, data center clients, and securing reliable suppliers requires substantial time, investment, and the cultivation of trust.

Hexatronic's existing network of partnerships and its proven track record provide a distinct advantage. For instance, in 2023, Hexatronic reported net sales of SEK 7,769 million, underscoring its substantial market presence and the depth of its client relationships. This established infrastructure makes it exceedingly difficult for newcomers to quickly secure market access and ensure a consistent, dependable supply of components.

Brand Identity and Customer Loyalty

Hexatronic's strong brand identity and established customer loyalty present a significant barrier to new entrants. The company has cultivated a reputation for comprehensive solutions and a robust global presence in the fiber optic infrastructure sector. For any new player to gain traction, substantial investments in marketing and relationship building would be essential to challenge Hexatronic's existing credibility and customer commitment.

Consider these points regarding brand identity and customer loyalty as a threat:

- High switching costs: Customers are often locked into existing relationships due to integration of Hexatronic's systems and the associated costs of re-tooling or re-training for a new supplier.

- Reputation for reliability: Hexatronic's proven track record in delivering high-quality, reliable fiber optic solutions fosters deep trust, making it difficult for newcomers to match this perceived level of dependability.

- Customer loyalty programs and support: Hexatronic likely engages in strategies that further entrench customer loyalty, such as dedicated support teams and tailored service agreements, which new entrants would struggle to replicate initially.

- Market penetration: Hexatronic's significant market share, achieved over years of operation, means that new entrants face the daunting task of chipping away at an already established customer base. For instance, in 2024, the global fiber optic market was valued at approximately $20 billion, with established players like Hexatronic holding substantial portions of this.

Regulatory and Legal Barriers

The telecom and infrastructure sectors are heavily regulated, presenting a significant hurdle for new entrants. Companies must navigate a complex web of permits, certifications, and industry standards, which are often time-consuming and expensive to obtain. For instance, in 2024, obtaining the necessary spectrum licenses for mobile operations can cost billions of dollars and involve lengthy approval processes, effectively deterring smaller, less capitalized businesses from entering the market.

These regulatory and legal barriers translate into substantial upfront investment and operational complexity. New companies must dedicate considerable resources to legal counsel and compliance teams, adding to their cost structure. Hexatronic, as an established player, has already invested in meeting these rigorous requirements, giving it a competitive advantage over potential newcomers who would face these same challenges from day one.

- High Capital Requirements: Spectrum licenses and infrastructure build-outs demand significant financial outlay, often in the hundreds of millions or billions.

- Lengthy Approval Processes: Obtaining permits and regulatory approvals can take years, delaying market entry and increasing project risk.

- Compliance Costs: Adhering to technical standards, safety regulations, and environmental laws adds ongoing operational expenses.

- Established Relationships: Incumbent firms often have established relationships with regulatory bodies, easing their compliance journey.

The threat of new entrants into the fiber optic infrastructure market is moderate, primarily due to substantial capital requirements for manufacturing and deployment, which can easily run into millions of dollars. Hexatronic's 2023 net sales of SEK 7,769 million highlight the scale of established players. Furthermore, securing established distribution channels and cultivating customer loyalty, as demonstrated by Hexatronic's market presence, presents significant hurdles for newcomers.

Porter's Five Forces Analysis Data Sources

Our Hexatronic Porter's Five Forces analysis leverages data from Hexatronic's annual reports, investor presentations, and SEC filings, supplemented by industry research from firms like IDC and Gartner, and financial data from Bloomberg.