Hess SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

Hess's strengths lie in its integrated operations and strategic asset base, but it faces significant market volatility. Uncover the full picture behind its competitive positioning and potential challenges with our comprehensive SWOT analysis.

Want to understand the complete strategic landscape of Hess, including its opportunities for expansion and the threats it faces? Purchase the full SWOT analysis to gain access to an in-depth, professionally written report designed to inform your investment decisions and strategic planning.

Strengths

Hess Corporation's ownership of a substantial stake in the Stabroek Block offshore Guyana is a cornerstone strength, featuring a world-class oil discovery with immense proven reserves. This asset is central to both present and future production volumes.

Multiple development projects are actively progressing within the Stabroek Block, poised to considerably boost output. For instance, the Yellowtail development is scheduled to commence production in the third quarter of 2025, with an anticipated initial capacity of around 250,000 barrels of oil per day.

Hess boasts robust operations in the Bakken Shale, a premier tight oil play located in North Dakota. This region is a cornerstone of the company's production strategy, consistently demonstrating strong performance.

In the fourth quarter of 2024, Hess reported net production of 208,000 barrels of oil equivalent per day (boe/d) from the Bakken, a figure anticipated to remain stable. This substantial output underscores the asset's importance, contributing significantly to Hess's overall production alongside its Guyana operations.

Hess holds significant proven oil and gas reserves, amounting to 1.44 billion barrels of oil equivalent (boe) as of year-end 2024. This substantial reserve base is a direct result of their ongoing exploration and development successes.

The company excels in production efficiency, leveraging its technical skills in unconventional resource extraction and its proven experience in challenging offshore drilling projects. This operational strength underpins consistent revenue generation and enhances the company's ability to withstand market fluctuations.

Strategic Asset Diversification (Pre-Merger)

Prior to its proposed merger with Chevron, Hess Corporation showcased a strategically diversified asset base. This included significant holdings in the Bakken Shale, a key U.S. onshore play, and promising offshore exploration blocks in Guyana, which represented a major growth frontier. The company also had interests in the Gulf of Mexico and Southeast Asia, creating a balanced geographical footprint.

This diversification was a key strength, as it reduced exposure to any single region's price volatility or operational challenges. For instance, Hess's 2023 production figures highlighted this balance, with a substantial portion coming from the Bakken, but with the Guyana assets showing immense future potential and contributing to a broader energy outlook. This spread across different geographies and resource types bolstered its overall energy position and provided resilience.

- Bakken Shale Operations: Hess was a significant producer in the Bakken, contributing substantial volumes and cash flow.

- Guyana Offshore Development: The company held a substantial stake in the Stabroek Block offshore Guyana, a world-class discovery with significant growth potential.

- Gulf of Mexico and Southeast Asia: These regions provided additional production and exploration opportunities, further diversifying the portfolio.

- Risk Mitigation: The geographical spread helped mitigate risks associated with over-reliance on any single market or operational environment.

Integration with Chevron

The integration with Chevron, finalized on July 18, 2025, marks a pivotal moment for Hess. This merger embeds Hess within a global energy leader, unlocking substantial synergies and operational efficiencies. The combined entity is poised for accelerated growth, leveraging Chevron's extensive resources and market presence.

This strategic alignment is projected to significantly boost Hess's financial performance. By joining forces with Chevron, Hess gains access to enhanced capital allocation and a broader operational footprint, expected to drive industry-leading free cash flow growth. This integration is anticipated to translate into improved shareholder returns.

Key benefits of the integration include:

- Enhanced Financial Strength: Access to Chevron's robust balance sheet and greater financial resources.

- Operational Scale and Synergies: Combining world-class assets and capabilities to optimize operations and reduce costs.

- Accelerated Growth Potential: Leveraging Chevron's infrastructure and market reach to expand Hess's business segments.

- Improved Shareholder Value: Aims to deliver increased and more consistent returns to investors through combined strength.

Hess's primary strength lies in its significant ownership of the Stabroek Block in Guyana, a world-class discovery with substantial proven reserves. This asset is crucial for its current and future production, with projects like Yellowtail expected to start production in Q3 2025, adding around 250,000 barrels of oil per day.

The company also maintains robust operations in the Bakken Shale, a key U.S. onshore play. In Q4 2024, Hess's Bakken net production was 208,000 boe/d, demonstrating consistent performance. As of year-end 2024, Hess held 1.44 billion barrels of oil equivalent in proven reserves, a testament to its exploration and development success.

Hess's operational efficiency, particularly in unconventional resource extraction and complex offshore projects, is another significant strength. Prior to its merger with Chevron, Hess possessed a diversified asset base, including the Bakken, Guyana, the Gulf of Mexico, and Southeast Asia, which mitigated geographic and operational risks.

The integration with Chevron, completed on July 18, 2025, significantly bolsters Hess's financial strength and operational scale. This merger is anticipated to unlock substantial synergies, accelerate growth, and improve shareholder returns by leveraging Chevron's resources and market presence.

| Asset | Significance | Key Data/Milestone |

|---|---|---|

| Stabroek Block, Guyana | World-class discovery, major growth driver | Yellowtail production start Q3 2025 (approx. 250,000 bpd initial capacity) |

| Bakken Shale, USA | Core onshore production | Q4 2024 net production: 208,000 boe/d |

| Total Proven Reserves (YE 2024) | Foundation for future production | 1.44 billion barrels of oil equivalent (boe) |

What is included in the product

Analyzes Hess’s competitive position through key internal and external factors.

Offers a clear, structured framework to identify and address critical business challenges.

Weaknesses

Hess's financial results, especially within its exploration and production (E&P) operations, are closely tied to the ups and downs of global crude oil prices. For instance, the company reported a notable drop in realized oil selling prices in the first quarter of 2025, which directly impacted its net income and overall earnings.

This significant dependence on the volatile commodity markets introduces a fundamental business risk for Hess. Any sustained decrease in oil prices can substantially erode profitability and hinder the company's ability to generate consistent returns for its shareholders.

Prior to its proposed merger with Chevron, Hess Corporation operated on a significantly smaller scale compared to industry giants. As of early 2024, its market capitalization was considerably less than that of the supermajors, limiting its capacity for massive capital expenditures. This smaller footprint meant Hess might have faced challenges in securing the most lucrative, large-scale exploration and production opportunities or weathering extended periods of low oil prices as robustly as its larger competitors.

Prior to its proposed merger with Chevron, Hess Corporation's operational footprint was heavily concentrated in two key areas: the Bakken Shale formation in North Dakota and Montana, and its significant discoveries offshore Guyana. This geographical concentration, while focused on high-potential resource plays, inherently amplified the company's exposure to region-specific risks. For instance, a significant portion of Hess's 2023 production was tied to the Bakken, where operational disruptions or shifts in state-level regulations could have a disproportionate impact on overall performance.

The offshore Guyana assets, while offering substantial growth prospects, also presented concentrated risks. Any unforeseen operational challenges, such as drilling incidents or production downtime at its Liza Destiny FPSO, could materially affect Hess's output and financial results. This singular reliance on a few key geographic hubs meant that Hess was more vulnerable to localized political instability, environmental incidents, or adverse regulatory changes in these specific regions compared to a more diversified producer.

Debt Levels (Pre-Merger)

Hess Corporation’s pre-merger debt levels presented a potential constraint. As of September 30, 2024, the company reported long-term debt of $8,596 million. While this debt was generally well-managed, it could have impacted financial flexibility, especially in the lead-up to its integration with Chevron.

This level of indebtedness might have increased Hess's susceptibility to adverse market shifts. The substantial debt load could have limited its capacity for further investment or strategic maneuvers prior to the completion of the Chevron acquisition.

- Debt Burden: $8,596 million in long-term debt as of September 30, 2024.

- Financial Flexibility: Potential limitation on future investment and strategic options.

- Market Vulnerability: Increased exposure to economic downturns or energy price volatility.

Undeveloped Acreage Relinquishment

Hess Corporation's decision to relinquish 94% of its net undeveloped acreage over the next three years, particularly in Guyana and Suriname, presents a notable weakness. This strategic move, driven by a focus on core high-potential areas like the Stabroek Block, means a significant portion of its previously held exploration territory will no longer be under its direct purview. The upcoming expiration of the exploration agreement for a key part of the Stabroek Block in 2027 also contributes to this relinquishment.

This substantial acreage return, while optimizing resource allocation, inherently limits Hess's future growth potential in these underexplored regions. By handing back these assets, Hess is effectively ceding opportunities for discovery and development in territories that might yield future value. For instance, while the Stabroek Block continues to be a major focus, the relinquishment of surrounding or less-developed acreage means Hess won't be the primary driver of exploration in those specific zones going forward.

The financial implications of this strategy, while aimed at efficiency, could also be viewed as a missed opportunity. By not retaining these undeveloped areas, Hess might forgo potential upside from future exploration successes or discoveries made by other operators in those relinquished territories. This could impact long-term portfolio diversification and the potential for organic growth beyond its current core assets.

Key aspects of this weakness include:

- Reduced Future Exploration Footprint: Hess is intentionally shrinking its undeveloped acreage, limiting its direct involvement in future exploration activities in vast swathes of territory.

- Opportunity Cost in Underexplored Regions: The relinquishment of acreage in areas like Guyana and Suriname, while strategically sound for current assets, means Hess will not directly benefit from potential discoveries made by others in these relinquished zones.

- Impact of Exploration Agreement Expirations: The approaching expiry of exploration agreements, such as the one for a portion of the Stabroek Block in 2027, is a contributing factor to the planned acreage return, highlighting a structured exit from certain exploration commitments.

Hess's reliance on volatile oil prices is a significant weakness, as demonstrated by its first-quarter 2025 results where lower realized oil prices directly impacted net income. This dependence makes the company vulnerable to market downturns, potentially hindering consistent shareholder returns.

The company's concentrated operational footprint in the Bakken Shale and offshore Guyana also presents a weakness. This focus heightens exposure to region-specific risks, such as operational disruptions or regulatory changes in North Dakota or potential issues with its Guyana FPSO. A more diversified producer might better absorb such localized impacts.

Hess's substantial long-term debt of $8,596 million as of September 30, 2024, could limit its financial flexibility. This debt level might constrain its ability to make significant new investments or respond nimbly to market shifts, particularly in the period leading up to its acquisition by Chevron.

The planned relinquishment of 94% of its undeveloped acreage over the next three years, including areas in Guyana and Suriname, represents a strategic weakness by limiting future exploration opportunities. This move, partly due to expiring exploration agreements like the one for a portion of the Stabroek Block in 2027, cedes potential upside from discoveries made by others in these vast territories.

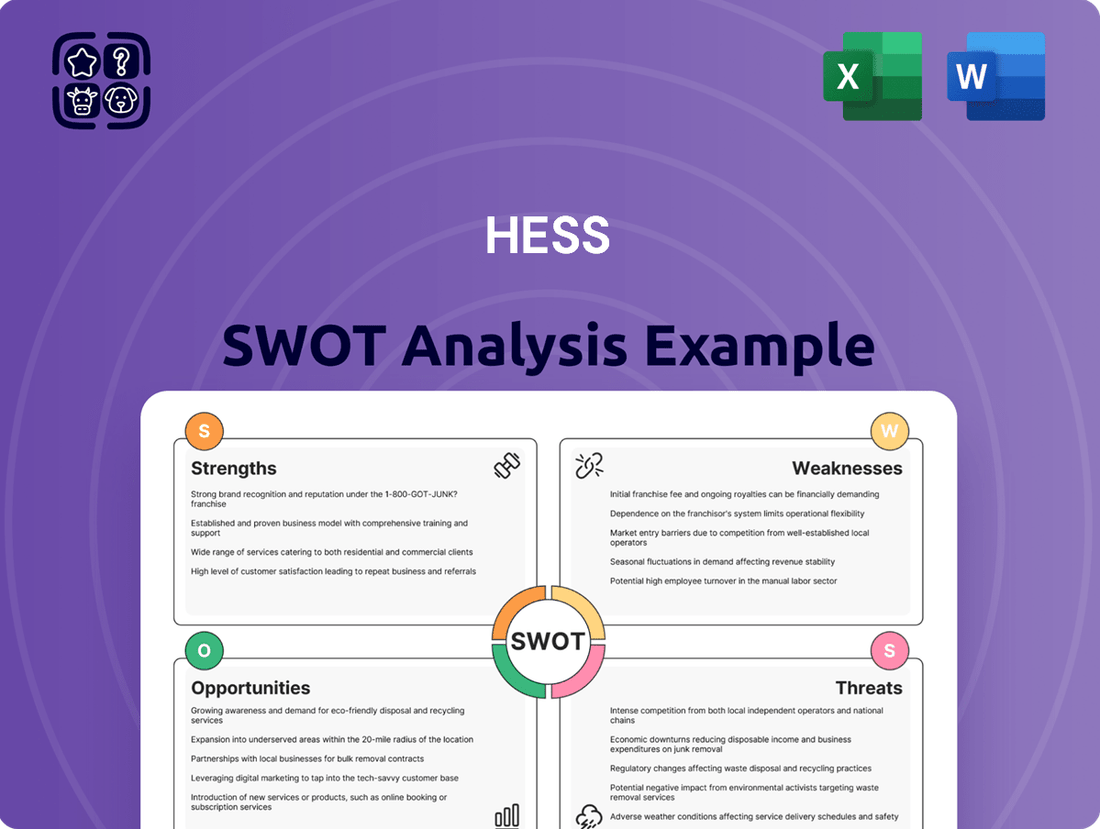

Preview Before You Purchase

Hess SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The Stabroek Block in Guyana offers substantial expansion prospects with several upcoming development projects. These initiatives are poised to significantly increase production capacity.

With an estimated 11 billion barrels of oil equivalent in proven reserves, the deployment of additional FPSO vessels, including Yellowtail (expected Q3 2025), Uaru (2026), and Whiptail (2027), will be crucial. These projects are projected to elevate daily production to approximately 1.2 million barrels by 2027, representing a major growth phase for Hess.

The anticipated completion of Chevron's acquisition of Hess is poised to unlock substantial value, primarily through operational efficiencies and cost savings. The integrated company is projecting to achieve an impressive $1 billion in annual run-rate cost synergies by the close of 2025.

This strategic integration is expected to fuel significant free cash flow generation and boost production volumes, with projections extending well into the 2030s. These gains will be driven by the combined entity's ability to leverage shared expertise and streamline operations.

As part of Chevron, Hess can now tap into cutting-edge exploration and production (E&P) technologies. This includes Chevron's proven expertise in unconventional oil and gas extraction, like advanced hydraulic fracturing techniques, and their sophisticated seismic imaging capabilities. These advancements can significantly improve the efficiency of recovering existing reserves and identify previously uneconomical hydrocarbon deposits.

In 2024, the energy sector saw continued investment in digital transformation within E&P. Companies are increasingly adopting AI-driven reservoir analysis and predictive maintenance for drilling equipment, aiming to reduce downtime and optimize production. For Hess, now integrated with Chevron, this means access to technologies that can lower per-barrel extraction costs and enhance the overall profitability of its asset base.

Increasing Global Energy Demand

Despite ongoing efforts in the energy transition, global demand for crude oil and natural gas is projected to stay strong for many years to come. For instance, the International Energy Agency (IEA) anticipates that oil demand will likely peak around 2030, but will still remain substantial thereafter. Similarly, natural gas demand is expected to see continued growth, particularly in developing economies.

Hess Corporation is well-positioned to benefit from this sustained demand, especially given its substantial natural gas assets. The company’s portfolio aligns with the increasing energy needs of various sectors, including the burgeoning demand driven by Artificial Intelligence (AI) data centers, which require significant and reliable power sources. This offers Hess a stable and growing market for its essential products.

- Sustained Demand: Global oil and gas demand is expected to remain robust for decades, providing a stable market for Hess's core products.

- Natural Gas Strength: Hess's significant natural gas assets are particularly advantageous, aligning with growing global energy needs.

- AI-Driven Growth: The increasing energy requirements for AI infrastructure present a new and expanding opportunity for natural gas consumption.

Midstream Growth Potential

Hess Midstream, a critical player in oil and gas infrastructure, particularly in the Bakken region, is showing robust financial health and expansion. The company anticipates increased volumes across its oil and gas systems throughout 2025, signaling a positive outlook.

This growth trajectory is supported by strategic initiatives to enhance throughput capacity. These efforts are designed to bolster the segment's ability to generate stable, fee-based cash flows, providing a reliable income stream.

Furthermore, Hess Midstream's performance directly contributes to continued capital returns for shareholders. This segment represents a significant opportunity for consistent financial benefits.

- Projected volume growth across oil and gas systems in 2025.

- Focus on expanding throughput capacity for increased efficiency.

- Generation of stable, fee-based cash flows.

- Commitment to continued capital returns to shareholders.

The Stabroek Block in Guyana represents a significant growth engine for Hess, with multiple projects set to boost production. The deployment of FPSOs like Yellowtail (expected Q3 2025), Uaru (2026), and Whiptail (2027) aims to increase daily output to approximately 1.2 million barrels by 2027.

Chevron's acquisition is anticipated to unlock substantial value through $1 billion in annual run-rate cost synergies by the close of 2025, fueling free cash flow and production through the 2030s. Access to Chevron's advanced E&P technologies, including sophisticated seismic imaging and unconventional extraction expertise, will enhance recovery efficiency and identify new hydrocarbon deposits.

Global demand for oil and gas is projected to remain strong, with the IEA forecasting oil demand to peak around 2030 but stay substantial thereafter. Hess's natural gas assets are particularly well-positioned to meet growing energy needs, including those from AI data centers requiring reliable power.

Hess Midstream is experiencing robust growth, with anticipated increased volumes across its systems in 2025. This expansion, focused on enhancing throughput capacity, is designed to generate stable, fee-based cash flows and support continued capital returns to shareholders.

| Opportunity Area | Key Projects/Factors | Projected Impact/Data |

|---|---|---|

| Stabroek Block Expansion | Yellowtail FPSO (Q3 2025), Uaru (2026), Whiptail (2027) | Targeting 1.2 million bpd production by 2027 |

| Chevron Acquisition Synergies | Operational efficiencies and cost savings | $1 billion annual run-rate cost synergies by end of 2025 |

| Technological Advancement | Chevron's E&P technologies (seismic, unconventional extraction) | Improved reserve recovery, identification of uneconomical deposits |

| Sustained Energy Demand | Global oil and gas consumption, AI data center growth | Strong demand for oil through 2030s, growing natural gas needs |

| Hess Midstream Growth | Increased volumes, enhanced throughput capacity | Stable fee-based cash flows, continued capital returns |

Threats

The accelerating global shift towards renewable energy sources represents a significant long-term threat to Hess's traditional oil and gas business. Investments in solar and wind power are surging, with the International Energy Agency projecting that renewables will account for over 90% of global electricity capacity expansion in the coming years. This trend could diminish future demand for hydrocarbons, impacting Hess's revenue streams and asset valuations.

Hess Corporation, like others in the oil and gas sector, faces intensifying regulatory and environmental scrutiny. This includes potential liabilities stemming from operational impacts and the growing risks associated with climate change policies. For instance, in 2024, the U.S. Environmental Protection Agency continued to enforce stricter emissions standards, potentially increasing compliance costs for companies like Hess.

These evolving environmental regulations and the global drive for reduced carbon emissions can translate into higher operating expenses, longer permitting processes for new projects, and increased exposure to legal challenges. The ongoing transition to cleaner energy sources puts pressure on traditional fossil fuel operations, demanding significant investment in adaptation and mitigation strategies.

Hess Corporation's profitability is particularly vulnerable to market volatility, with global crude oil prices being a primary driver. Factors like macroeconomic slowdowns, OPEC+ policy decisions, and geopolitical events can cause significant price swings, directly impacting Hess's earnings. For instance, in the first quarter of 2024, Hess reported an average realized crude oil selling price of $77.77 per barrel, a figure that can fluctuate dramatically based on these external forces.

Arbitration/Legal Challenges (Historical but impactful)

While the arbitration concerning preemptive rights in the Stabroek Block joint operating agreement, initiated by ExxonMobil and CNOOC regarding the Chevron merger, was resolved favorably for Hess and Chevron on July 18, 2025, the process introduced considerable delays and uncertainty. This legal challenge underscored the inherent complexities associated with large-scale merger and acquisition transactions, particularly concerning intricate asset ownership structures and contractual obligations. The resolution, though positive, highlights the financial and operational risks that can arise from such disputes, impacting deal timelines and stakeholder confidence.

Operational Risks

Hess Corporation's exploration and production (E&P) activities, spread across various geographies, face significant operational risks. These risks can directly impact production levels and profitability.

Key threats include political instability in operating regions, potential environmental incidents that could halt operations or incur substantial cleanup costs, and the inherent geological complexities of E&P. For instance, as of late 2024, geopolitical tensions in certain resource-rich areas continue to pose a backdrop of uncertainty for energy companies like Hess.

The success rate of exploration wells is a critical factor. A high rate of dry holes or wells that do not meet production expectations represents a direct financial drain, potentially leading to significant write-downs and impacting the company's bottom line.

- Geopolitical Instability: Ongoing global political shifts can disrupt supply chains and alter regulatory environments in Hess's operating regions.

- Environmental Incidents: The potential for spills or other environmental damage carries significant financial and reputational risks, with strict regulatory oversight in place.

- Geological Uncertainties: The inherent unpredictability of subsurface conditions can lead to lower-than-expected reserves or production volumes.

- Exploration Well Failures: A high incidence of unsuccessful exploration ventures directly impacts capital efficiency and future growth prospects.

The company faces significant threats from the global energy transition, with increasing investment in renewables potentially reducing future demand for oil and gas. Stricter environmental regulations and climate change policies could also escalate compliance costs and operational challenges. Furthermore, Hess's profitability remains highly susceptible to volatile crude oil prices, influenced by macroeconomic factors and geopolitical events. The resolution of the Stabroek Block arbitration, while favorable, highlighted the risks and delays inherent in complex M&A transactions.

| Threat Category | Specific Risk | Impact Example (2024/2025 Data) |

|---|---|---|

| Energy Transition | Reduced demand for hydrocarbons | IEA projects >90% of global electricity capacity expansion from renewables in coming years. |

| Regulatory & Environmental | Increased compliance costs, potential liabilities | EPA's ongoing enforcement of stricter emissions standards in 2024. |

| Market Volatility | Fluctuating crude oil prices impacting earnings | Hess's Q1 2024 realized crude oil price: $77.77/barrel, subject to significant swings. |

| Operational Risks | Geopolitical instability, environmental incidents, exploration failures | Geopolitical tensions in resource-rich areas noted as a backdrop of uncertainty in late 2024. |

SWOT Analysis Data Sources

This Hess SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic overview.