Hess Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

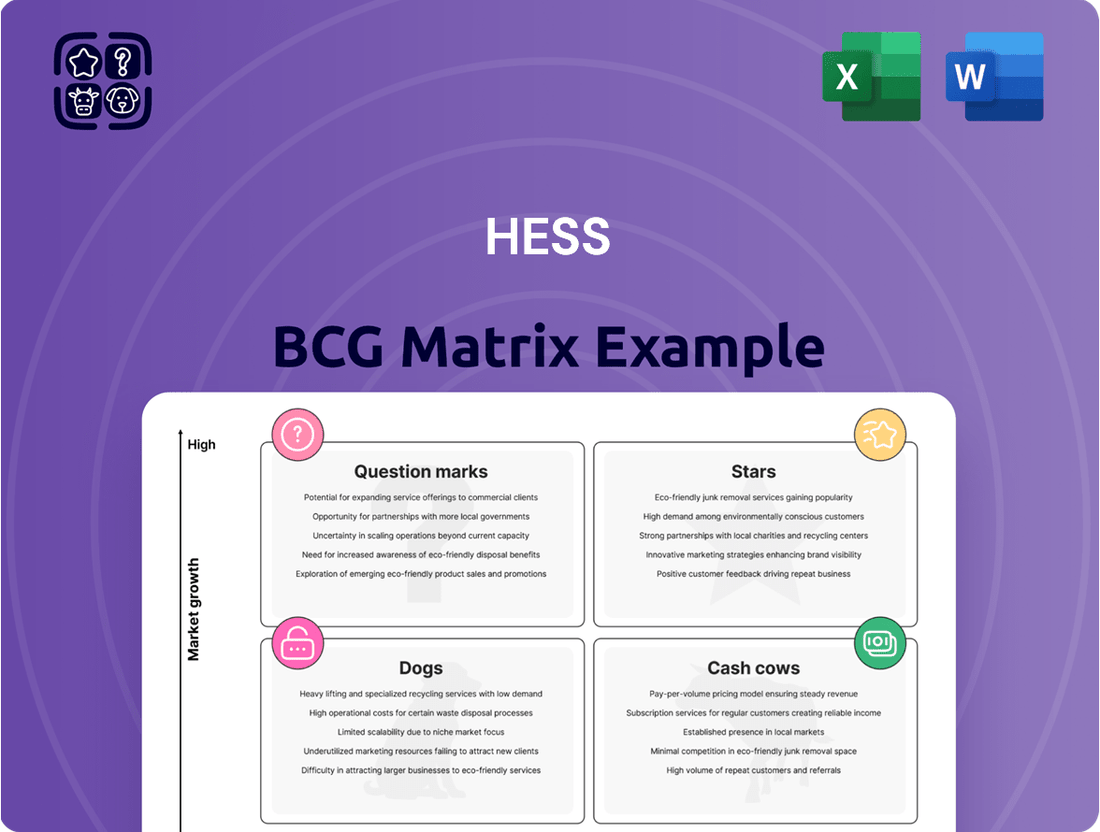

The Hess BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks based on market growth and share. This preview offers a glimpse into how these classifications can illuminate strategic opportunities and challenges. Ready to unlock a comprehensive understanding of your product's market position and receive actionable insights for optimized resource allocation? Purchase the full BCG Matrix for a complete breakdown and strategic roadmap.

Stars

Hess Corporation's 30% stake in the Stabroek Block offshore Guyana is a prime example of a Star asset within the BCG matrix. This is due to its exceptional growth prospects and its dominant position in newly discovered oil reserves, making it a significant driver of Hess's future performance.

The Stabroek Block is recognized as one of the world's most productive and cost-efficient oil fields, a key factor in its Star classification. Its impressive resource base and low operating costs position it for sustained high returns and market leadership.

Further underscoring its Star status, net production from Guyana saw a significant surge in 2024, reaching 186,000 barrels of oil per day (bopd). This is a substantial increase from the 115,000 bopd recorded in 2023, directly attributed to the successful commissioning of new production facilities within the block.

The Yellowtail project, Hess's fourth major development on the Stabroek Block, is a significant growth engine. It is slated to begin production in the third quarter of 2025, boosting the block's capacity by an estimated 250,000 gross barrels of oil per day.

This substantial production increase highlights the rapid expansion and considerable investment occurring in the Stabroek Block. The ONE GUYANA FPSO, crucial for the Yellowtail project, reached its offshore Guyana location in April 2025.

The Uaru project, sanctioned in April 2023, is a key component of Hess Corporation's strategy in Guyana, reinforcing the Stabroek Block's position as a Star in the BCG matrix. This development is projected to have a gross production capacity of around 250,000 barrels of oil per day, with first oil expected in 2026.

This ongoing series of substantial projects, including Uaru, underscores the sustained high growth trajectory and the significant future market share anticipated from the Stabroek Block. Hess's investment in Uaru, alongside other developments like Liza Phase 1 and 2, and Payara, highlights the block's status as a major oil-producing asset.

Whiptail Development

Whiptail, sanctioned in April 2024, represents Hess's sixth major development in the Stabroek Block. This project is anticipated to contribute an additional 250,000 gross barrels of oil per day (bopd) to production capacity by the close of 2027. The swift approval and ongoing development of these substantial projects underscore the significant growth potential in Guyana and the Stabroek Block's strategic importance for Hess's future operations.

The sequential nature of these developments is crucial for maintaining a strong market position within this expanding frontier basin. Hess's commitment to rapid project execution in Guyana is a key element of its portfolio strategy.

- Project Sanction: April 2024

- Production Capacity Addition: 250,000 gross bopd by end of 2027

- Significance: Sixth major development in Stabroek Block, reinforcing Hess's market share in a growing frontier basin.

Long-term Resource Potential

The Stabroek Block in Guyana represents a significant long-term resource potential for Hess, positioning it as a star in the BCG matrix. Discovered resources are projected to sustain up to ten Floating Production, Storage, and Offloading (FPSO) units by the close of 2030, targeting an aggregate gross production capacity of around 1.7 million barrels of oil per day. This extensive resource base underpins Hess's Guyana operations as a high-growth, high-market share asset for many years to come.

- Projected FPSOs by 2030: Up to 10

- Aggregate Gross Production Capacity: Approximately 1.7 million bopd

- Strategic Importance: Key driver for Hess's long-term growth and market share

The substantial, long-term production outlook from the Stabroek Block was a primary factor in Chevron's recent acquisition of Hess. This world-class asset provides a robust foundation for sustained value creation and operational expansion, solidifying its status as a strategic cornerstone for future energy supply.

The Stabroek Block's designation as a Star asset is firmly supported by its impressive growth trajectory and dominant market position. The block's substantial resource base and cost-efficiency are key drivers of its high returns and leadership potential.

Hess's net production from Guyana in 2024 reached 186,000 barrels of oil per day, a significant increase from 2023, reflecting the successful integration of new production facilities. This growth is further bolstered by upcoming projects like Yellowtail, slated for production in Q3 2025, and Uaru, expected to commence in 2026, each adding substantial capacity.

The sanction of the Whiptail project in April 2024, set to add another 250,000 gross bopd by the end of 2027, underscores the rapid development pace. Projections indicate up to ten FPSOs by 2030, targeting 1.7 million bopd in aggregate gross production capacity, solidifying the Stabroek Block's status as a long-term, high-growth asset.

| Project | Sanction Date | Estimated Gross Production Capacity (bopd) | Expected First Oil |

|---|---|---|---|

| Liza Phase 1 | N/A | 120,000 | 2019 |

| Liza Phase 2 | N/A | 220,000 | 2022 |

| Payara | N/A | 220,000 | 2024 |

| Yellowtail | N/A | 250,000 | Q3 2025 |

| Uaru | April 2023 | 250,000 | 2026 |

| Whiptail | April 2024 | 250,000 | Late 2027 |

What is included in the product

Strategic framework for analyzing business units based on market share and growth.

Guides decisions on investment, divestment, and resource allocation for portfolio balance.

Clear visualization of portfolio balance, easing strategic decision-making.

Cash Cows

Hess's Bakken Shale operations are a prime example of a Cash Cow within the BCG framework. These assets hold a significant market share in a mature, but stable, low-growth sector. This stability allows for consistent cash generation.

In 2024, Hess reported an average net production of 204,000 barrels of oil equivalent per day (boepd) from the Bakken. This figure underscores the mature nature of the asset, yet demonstrates its capacity for sustained, reliable output.

Looking ahead to 2025, Hess plans to maintain operational momentum in the Bakken by utilizing four drilling rigs. The strategic focus remains on optimizing existing infrastructure and sustaining current production levels, rather than pursuing aggressive expansion.

Hess Midstream LP operates as a stable Cash Cow within the BCG Matrix, generating consistent and reliable cash flows. Its operations in the Bakken region, encompassing gathering, processing, and terminaling services, are the bedrock of this stability.

The company's financial performance underscores its Cash Cow status. For the first quarter of 2025, Hess Midstream reported a net income of $161 million and an Adjusted EBITDA of $292 million, showcasing robust profitability.

Looking ahead, Hess Midstream projects continued strong cash generation. The full-year 2025 forecast anticipates a net income ranging from $715 million to $765 million and Adjusted EBITDA between $1.235 billion and $1.285 billion, reinforcing its position as a dependable cash-generating entity.

The Bakken asset, though considered mature, consistently delivers robust profit margins. This is largely thanks to its well-established infrastructure and streamlined operational efficiencies, which keep costs down.

Hess’s ongoing commitment to a four-rig drilling program in the Bakken is designed to sustain current production volumes and optimize cash flow from this vital onshore resource. This strategic focus on maintaining productivity in a stable, low-growth market firmly positions it as a Cash Cow.

For instance, in 2024, Hess reported that its Bakken operations generated significant free cash flow, underscoring its role as a reliable profit generator. The company’s capital allocation reflects this, with continued investment aimed at maximizing returns from this mature, yet highly profitable, asset.

Stable Throughput Volumes for Midstream

Hess Midstream's operations are characterized by stable throughput volumes, a key indicator of a cash cow. The company anticipates a roughly 10% increase in throughput volumes across its oil and gas systems in 2025 compared to 2024. This growth highlights consistent demand for its midstream services.

This stability translates into robust cash flow generation. In the first quarter of 2025, Hess Midstream reported an impressive gross adjusted EBITDA margin of 80%. Such high margins mean that a significant portion of revenue directly converts into profit, requiring minimal reinvestment for continued operations.

- Stable Throughput Growth: Hess Midstream projects a 10% increase in throughput volumes in 2025 over 2024.

- High Profitability: Achieved an 80% gross adjusted EBITDA margin in Q1 2025.

- Low Reinvestment Needs: Stable volumes and high margins indicate limited capital expenditure requirements for expansion.

- Strong Cash Flow: The combination of consistent demand and high margins drives substantial cash generation.

Disciplined Capital Allocation in Mature Assets

Hess Corporation demonstrates disciplined capital allocation within its mature Bakken and Midstream assets, treating them as Cash Cows. This strategy prioritizes maintaining operational efficiency and extracting maximum value from existing infrastructure over pursuing aggressive growth. The focus is on generating consistent returns and providing capital to fund other strategic initiatives.

For instance, Hess Midstream's capital expenditures are slated for approximately $300 million in 2025. This funding is designated to support ongoing operations and modest expansion projects, underscoring the mature, cash-generating nature of these assets.

- Bakken and Midstream as Cash Cows: These segments are managed for optimal cash flow generation.

- Disciplined Capital Allocation: Investments are focused on efficiency and value maximization, not high-risk growth.

- 2025 Midstream Capex: Projected at around $300 million to support operations and minor expansions.

- Strategic Role: These assets provide capital for other business areas by being "milked" for gains.

Hess's Bakken operations and its Midstream segment are textbook examples of Cash Cows in the BCG Matrix. These mature, stable businesses generate significant, consistent cash flow with minimal need for reinvestment. Their established infrastructure and optimized operations contribute to high profit margins, making them reliable profit centers for the company.

The Bakken asset, despite its maturity, continues to be a strong performer. In 2024, Hess reported average net production of 204,000 barrels of oil equivalent per day (boepd) from this region, demonstrating sustained output. Hess plans to maintain this through a four-rig drilling program in 2025, focusing on efficiency rather than aggressive expansion.

Hess Midstream LP is equally robust, projecting a 10% increase in throughput volumes for 2025 over 2024. This is supported by strong financial results, including a Q1 2025 net income of $161 million and an Adjusted EBITDA of $292 million, with an impressive 80% gross adjusted EBITDA margin in the same period.

These Cash Cow assets are managed for optimal cash generation, with Hess Midstream's 2025 capital expenditures estimated around $300 million, primarily for operational support and minor expansions. This disciplined approach ensures these segments provide substantial capital for other strategic ventures.

| Metric | 2024 (Est.) | Q1 2025 | 2025 (Proj.) |

| Bakken Net Production (boepd) | 204,000 | - | Sustained |

| Hess Midstream Net Income ($M) | - | 161 | 715 - 765 |

| Hess Midstream Adj. EBITDA ($M) | - | 292 | 1,235 - 1,285 |

| Hess Midstream Throughput Growth (%) | - | - | 10% |

| Hess Midstream Gross Adj. EBITDA Margin (%) | - | 80% | - |

| Hess Midstream Capex ($M) | - | - | ~300 |

What You See Is What You Get

Hess BCG Matrix

The preview you see is the exact, fully formatted Hess BCG Matrix report you will receive upon purchase. This comprehensive document, designed for strategic decision-making, contains all the analysis and insights you need without any watermarks or demo content. It's ready for immediate application in your business planning and presentations.

Dogs

Hess Corporation's former Libya operations, divested in November 2022, clearly fit the profile of a 'Dog' in the BCG matrix. These assets likely struggled with a limited market share within a challenging and low-growth environment, exacerbated by political complexities. The strategic decision to sell these operations underscores a focus on optimizing the portfolio by shedding underperforming or non-core assets.

Hess's former operations in Denmark, divested in August 2021, are classified as a 'Dog' within the BCG matrix. This classification suggests these assets exhibited low market share and low growth potential, aligning with the characteristics of a business unit that is not a strategic priority for the company.

The sale of these Danish assets for an undisclosed sum underscores Hess's strategic move to streamline its portfolio and concentrate on higher-return opportunities, a common practice for companies managing 'Dog' segments. This divestment allows for the reallocation of resources towards more promising ventures.

Non-core, sub-economic fields represent assets within Hess's portfolio that are likely characterized by declining production and minimal future investment. These are typically mature or declining assets with low market share, generating little to no profit.

For instance, in the first quarter of 2024, Hess reported production from various offshore assets in the US Gulf of Mexico. While specific profitability breakdowns for individual sub-economic fields are not disclosed, the overall strategy for such assets is often divestiture or abandonment to free up capital.

These fields, while potentially contributing to overall production volume, are unlikely to be significant profit drivers and may even incur costs that outweigh their revenue. Hess's focus in 2024 and beyond is on its core growth areas, making these smaller, less productive fields candidates for strategic review and potential exit.

Underperforming Legacy Assets

Some legacy assets, especially those with elevated operating expenses or diminishing reserves, can become underperformers if their output doesn't warrant continued investment. These assets might just cover their costs or necessitate ongoing capital infusions with minimal potential for growth.

Hess's strategic focus on high-return opportunities suggests that any assets falling short of this benchmark are candidates for reassessment. For instance, in 2024, Hess continued its strategic divestment of non-core assets, aiming to streamline its portfolio and concentrate capital on its most promising ventures.

- Legacy Assets: Assets with high operating costs or declining reserves that struggle to generate sufficient returns.

- Hess's Strategy: Focus on high-return opportunities and divestment of non-core, underperforming assets.

- 2024 Data Point: Hess's ongoing divestment of non-core assets in 2024 reflects a strategy to re-evaluate and potentially exit underperforming legacy assets.

Divestment of Non-Strategic Assets

Hess Corporation has a history of divesting assets that no longer align with its strategic objectives. For instance, the company divested its interests in Libya in 2019 and its Danish North Sea assets in 2016. These moves exemplify Hess's approach to shedding non-core or underperforming units to enhance focus and capital allocation.

This strategic pruning allows Hess to concentrate its investments on key growth areas, such as its acreage in the Bakken shale play and its significant stake in the Stabroek Block offshore Guyana. By streamlining its portfolio, Hess aims to improve its overall capital efficiency and boost profitability.

- Divestment of Libya Assets: Hess exited its Libyan operations, a move completed in 2019.

- Danish North Sea Sale: The company sold its Danish North Sea assets in 2016.

- Portfolio Streamlining: These actions demonstrate a pattern of shedding non-strategic assets.

- Focus on Core Growth: Divestments enable greater resource allocation to high-potential areas like Guyana.

Hess's former operations in Libya, divested in November 2022, and its Danish North Sea assets, sold in August 2021, are prime examples of 'Dogs' in the BCG matrix. These segments likely faced low market share in slow-growth or declining markets, prompting strategic exits. Such divestments allow Hess to reallocate capital to more promising ventures, a key strategy for managing underperforming assets.

Hess's approach to 'Dogs' involves identifying and divesting non-core or sub-economic fields. These mature assets often have high operating costs and diminishing returns, making them candidates for exit. For instance, in Q1 2024, Hess reported production from the US Gulf of Mexico, but the strategy for less productive fields is typically divestment or abandonment to free up capital.

The company's history, including the 2019 divestment of Libyan interests and the 2016 sale of Danish assets, highlights a consistent strategy of portfolio streamlining. This focus on shedding underperforming units allows Hess to concentrate investments on high-potential areas like the Bakken and offshore Guyana, thereby improving capital efficiency and profitability.

| Asset Category | BCG Classification | Hess Strategy | Example | Year of Divestment |

|---|---|---|---|---|

| Libya Operations | Dog | Divestment of non-core, underperforming assets | Exited operations | 2022 |

| Danish North Sea Assets | Dog | Portfolio streamlining to focus on high-return opportunities | Sold interests | 2021 |

| Sub-economic Fields | Dog | Divestment or abandonment to free up capital | US Gulf of Mexico legacy fields | Ongoing |

| Legacy Assets (High OpEx/Declining Reserves) | Dog | Reassessment and potential exit to enhance capital allocation | Mature, low-production fields | Ongoing |

Question Marks

Hess Corporation's exploration activities offshore Suriname are currently classified as a Question Mark within the BCG Matrix. This region is recognized for its substantial growth potential, with significant exploration and appraisal drilling anticipated in 2025. However, Hess holds a relatively low market share in this developing area.

The high investment required to ascertain the commercial viability and future production capacity of Suriname's offshore resources places it firmly in the Question Mark category. The success or failure of these exploration endeavors will ultimately determine whether this venture evolves into a Star, generating substantial returns, or a Dog, requiring divestment or facing declining prospects.

ExxonMobil, a key partner in the Stabroek Block, is actively pursuing exploration and appraisal drilling, with a notable emphasis on gas prospects. These ongoing efforts represent early-stage discoveries that, while holding significant growth potential, are currently classified as Question Marks within the BCG Matrix.

These discoveries demand substantial future investment, rigorous appraisal, and meticulous development planning to determine their commercial viability and timeline for production. Their ultimate market share remains an unknown quantity, reflecting the inherent uncertainties of early-stage exploration.

Hess's U.S. Gulf of Mexico assets, including the Pickerel project which began production in June 2024, represent ongoing exploration and development efforts. These operations contributed 41,000 boepd in Q1 2025, showcasing their current production capacity.

Given the high-cost operating environment and the nature of tie-backs and smaller discoveries, these Gulf of Mexico activities could be classified as Question Marks within the BCG matrix. Continued investment is crucial to validate their long-term economic viability and potential for significant market share growth.

Future Gas Monetization Projects in Guyana

Future gas monetization projects in Guyana, including standalone gas developments and the expansion of the Gas-to-Energy project, are positioned as potential stars within Hess's portfolio. These ventures tap into the significant associated gas resources of the Stabroek Block, offering high growth prospects. As of early 2024, these projects are in the nascent stages of planning, demanding considerable capital outlay and navigating complex regulatory landscapes, reflecting their current low market share but substantial future potential.

These initiatives represent opportunities for Hess to diversify its revenue streams beyond crude oil production. The Gas-to-Energy project, in particular, aims to utilize associated gas for domestic power generation and potentially for liquefied natural gas (LNG) exports. The success of these projects hinges on securing the necessary financing and regulatory approvals, which are critical for moving from planning to execution. For example, the initial phase of the Gas-to-Energy project is estimated to cost billions of dollars, underscoring the investment required.

- High Growth Potential: Leveraging Guyana's vast offshore gas reserves.

- Low Market Share Currently: Projects are in early planning and development phases.

- Significant Investment Required: Billions of dollars needed for infrastructure and technology.

- Regulatory Hurdles: Approvals and agreements are crucial for project realization.

Energy Transition Initiatives

Hess Corporation is actively addressing the energy transition, aiming for zero routine flaring by the close of 2025. This commitment reflects a broader strategy to reduce its environmental footprint.

Investments in new technologies or alternative energy solutions, if pursued by Hess, would likely be classified as Question Marks within a BCG matrix. These ventures are typically characterized by high research and development costs and uncertain market adoption and profitability.

- Zero Routine Flaring Target: Hess is committed to achieving zero routine flaring by the end of 2025.

- Nascent Stage Ventures: Investments in new energy technologies are in early stages for Hess, with uncertain market share and profitability.

- High R&D Costs: These potential ventures involve significant research and development expenditures.

- Primary Focus: Hess's core business remains the optimization of its oil and gas operations.

Question Marks represent ventures with low market share but high growth potential, requiring significant investment to determine their future success. Hess's exploration in Suriname exemplifies this, where substantial capital is needed to unlock the region's promise, with outcomes potentially leading to Star or Dog status.

The classification of Hess's U.S. Gulf of Mexico assets as Question Marks highlights the ongoing need for investment to confirm their long-term economic viability and market share expansion potential, especially given the high-cost operating environment. These are early-stage plays that demand careful evaluation.

Hess's strategic focus on future gas monetization in Guyana, particularly the Gas-to-Energy project, places these initiatives as Question Marks due to their early planning stages and the immense capital investment required, estimated in the billions, to realize their high growth potential.

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing sales figures, customer surveys, and competitive analysis to provide actionable strategic guidance.