Hess Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

Hess's competitive landscape is shaped by the interplay of five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Understanding these dynamics is crucial for any strategic decision-making concerning Hess.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hess’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hess Corporation's reliance on specialized oilfield service providers for its deepwater Guyana operations and the Bakken shale presents a significant bargaining power dynamic. These service companies possess unique expertise and equipment crucial for Hess's complex extraction processes.

The global oilfield services market is projected for robust expansion, with forecasts indicating substantial growth by 2025, driven by increased upstream investment. This heightened demand, particularly for advanced technologies, can amplify the leverage of dominant service providers.

While technological innovation enhances operational efficiency, the specific demands of Hess's unique operating environments, such as deepwater drilling and challenging shale formations, mean that a select group of highly capable service providers can command considerable pricing power.

The oilfield services sector is seeing significant consolidation, meaning fewer, larger companies are emerging. This trend could give these dominant suppliers more power to negotiate terms with exploration and production (E&P) firms like Hess.

As E&P companies like Hess adopt advanced techniques such as longer laterals, batch drilling, and rig automation to boost efficiency, their choice of service providers becomes more critical. This can shift the balance of power towards service providers who can demonstrate superior technological capabilities and cost-effectiveness.

This consolidation may result in fewer competitive bids for essential services, potentially driving up operational costs for Hess. For instance, in 2024, the market for specialized drilling fluids saw a notable reduction in suppliers, leading to a reported 15% increase in contract costs for some E&P operators.

Fluctuations in crude oil prices significantly influence the profitability and operational tempo of oilfield service companies. For instance, the Producer Price Index for oil and gas extraction saw a notable decrease in late 2023, signaling a potential easing of service costs that could benefit Hess.

However, prolonged periods of elevated oil prices can bolster the negotiating leverage of suppliers. This empowerment allows them to potentially increase charges for essential resources like specialized equipment, advanced technology, and skilled labor, directly impacting Hess's operational expenses.

Labor Availability and Expertise

The availability of a skilled workforce is a significant factor in the bargaining power of suppliers within the oil and gas industry. Specialized roles in drilling and production require extensive training and experience, making a readily available pool of qualified labor crucial for operational success.

Challenges in workforce availability, particularly within sectors like shale oil, can directly impact labor costs for service companies. For example, a shortage of experienced rig workers in 2024 could force service providers to increase wages, a cost that is then often passed on to operators such as Hess. This dynamic highlights how human capital availability directly translates into supplier leverage.

- Workforce Shortages: Reports from industry associations in late 2023 and early 2024 indicated persistent shortages in skilled trades, including petroleum engineers and experienced field technicians.

- Wage Inflation: This scarcity has contributed to an upward pressure on wages for specialized oilfield services, with some reports suggesting wage increases of 5-10% for critical roles year-over-year.

- Impact on Operators: Consequently, companies like Hess face the prospect of higher operating expenses if these labor market conditions persist, impacting their profitability and project timelines.

Technological Dependencies

Hess Corporation's significant investments in high-return areas like the Stabroek Block are heavily reliant on cutting-edge technologies for exploration, drilling, and production. Suppliers offering specialized or proprietary technologies for complex environments, such as deepwater operations, possess considerable bargaining power due to the limited availability of comparable alternatives.

The increasing adoption of artificial intelligence and big data analytics in oilfield operations further amplifies the leverage of technology-focused suppliers. For instance, in 2024, the global oil and gas technology market was valued at approximately $200 billion, with a significant portion dedicated to advanced digital solutions.

- Technological Specialization: Suppliers with unique or patented technologies for challenging extraction environments, like those found in Guyana's Stabroek Block, can dictate terms.

- High Switching Costs: Integrating new, complex technologies often involves substantial costs and time, making it difficult for Hess to switch suppliers easily.

- AI and Data Integration: The growing importance of AI-driven exploration and production optimization means suppliers with advanced data analytics capabilities are in high demand, increasing their bargaining power.

The bargaining power of suppliers for Hess Corporation is elevated due to the specialized nature of oilfield services and equipment required for its operations, particularly in deepwater Guyana and the Bakken shale. Limited availability of unique expertise and technology grants these suppliers significant pricing leverage.

Consolidation within the oilfield services sector further concentrates power among a few dominant players, potentially reducing competitive bidding and increasing costs for Hess. For example, in 2024, a reduction in specialized drilling fluid suppliers led to reported contract cost increases of up to 15% for some exploration and production companies.

Workforce shortages in critical roles, such as experienced rig workers, also empower suppliers. This scarcity, evidenced by 5-10% wage increases for specialized roles in early 2024, forces service providers to raise their rates, directly impacting Hess's operational expenses.

Suppliers offering proprietary technologies for complex extraction environments, like those in the Stabroek Block, hold considerable sway due to high switching costs and the limited availability of comparable alternatives. The global oil and gas technology market, valued around $200 billion in 2024, highlights the demand for such advanced solutions.

| Factor | Impact on Hess | Supporting Data (2024/Late 2023) |

| Specialized Expertise & Technology | Increased costs, limited alternatives | High demand for deepwater and shale tech; limited comparable suppliers |

| Industry Consolidation | Reduced competition, higher pricing power | Fewer, larger service providers emerging; reduced competitive bids |

| Skilled Workforce Shortages | Higher labor costs passed on | 5-10% wage increases for critical roles; shortage of experienced technicians |

| Proprietary Technology | Supplier dictates terms, high switching costs | Valuable AI and data analytics solutions in a $200 billion market |

What is included in the product

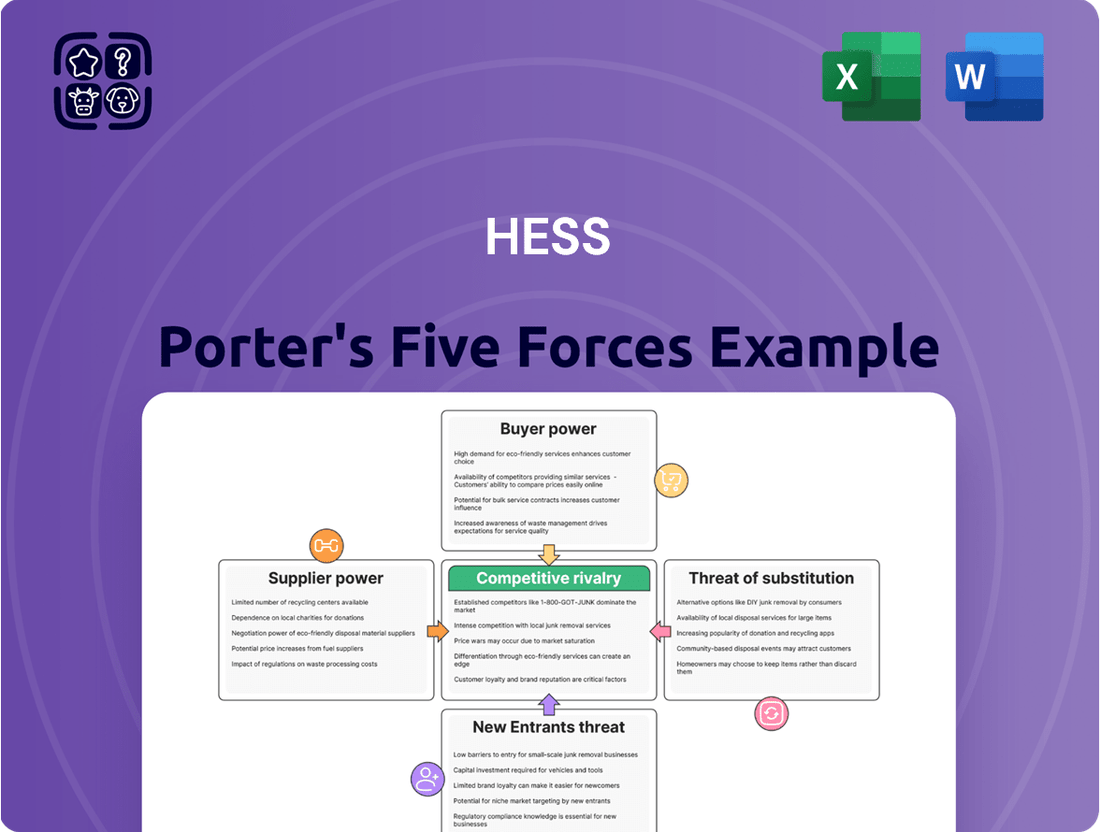

This analysis examines the five competitive forces impacting Hess, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and address competitive threats with a visual breakdown of each of Porter's Five Forces.

Customers Bargaining Power

The commodity nature of crude oil and natural gas significantly amplifies customer bargaining power. Because these resources are largely undifferentiated, buyers see minimal distinction between products from different suppliers, making price the primary deciding factor. In 2024, global oil prices, like Brent crude, fluctuated, with benchmarks often trading within a narrow range, underscoring the price sensitivity of buyers in this market.

This lack of product differentiation means customers can readily switch suppliers if a better price is offered, weakening Hess's ability to command premium pricing. Once extracted, Hess's oil and gas are subject to established global market pricing mechanisms, rather than being influenced by Hess's individual pricing strategies.

The bargaining power of customers in the energy sector is heavily influenced by global supply and demand for crude oil and natural gas. When supply outstrips demand, customers can leverage this imbalance to negotiate more favorable prices, directly impacting energy companies.

Looking ahead, world oil demand is projected to increase by 1.2 million barrels per day in 2025. However, potential economic slowdowns in key markets such as China and North America could moderate this growth, potentially leading to periods of oversupply where customer influence strengthens.

Hess Corporation's primary customers are major refiners, marketers, and national oil companies, all of whom buy hydrocarbons in enormous volumes. This concentrated customer base, characterized by its scale, grants these buyers considerable leverage in negotiations.

The sheer magnitude of their purchases means that even minor concessions on price or terms can translate into significant cost advantages for these large buyers. For instance, in 2024, the global average price for Brent crude oil fluctuated, with significant impacts on the profitability of large-scale transactions for both Hess and its customers.

Low Switching Costs for Buyers

For buyers of crude oil and natural gas, switching suppliers is typically straightforward as long as the product meets the required specifications and transportation logistics are feasible. This low barrier to switching significantly increases price competition among energy producers.

Hess Corporation, like its peers, faces pressure to maintain competitive pricing and reliable supply chains to keep its customers. In 2024, global oil prices experienced volatility, with Brent crude averaging around $80-$85 per barrel for much of the year, highlighting the constant need for cost efficiency and dependable delivery to retain market share.

- Low Switching Costs: Buyers can easily change suppliers if price or service is better elsewhere.

- Intensified Price Competition: This forces producers like Hess to be highly competitive on pricing.

- Focus on Reliability: Maintaining a consistent and dependable supply is crucial for customer retention.

- Market Sensitivity: Fluctuations in global energy prices, such as those seen in 2024, directly impact buyer decisions and supplier competitiveness.

Downstream Integration and Refining Margins

Some of Hess Corporation's direct customers are integrated companies that operate their own refining and marketing segments. This gives them a comprehensive view of the entire oil and gas value chain, from production to final sale. For instance, major integrated oil companies often have sophisticated analytics that track refining margins closely.

The profitability of these integrated customers is directly tied to refining margins, which in turn influences their purchasing decisions and their willingness to pay for crude oil. In 2024, global refining margins saw fluctuations, with average crack spreads for key products like gasoline and diesel varying significantly by region. For example, US Gulf Coast gasoline crack spreads averaged around $15-$20 per barrel for much of the year, while European margins could be higher or lower depending on feedstock costs and product demand.

- Customer Integration: Integrated companies possess insights into the entire value chain, from crude extraction to refined product sales.

- Margin Sensitivity: Customer profitability is directly influenced by refining margins, impacting their crude purchasing power.

- Bargaining Power Enhancement: Understanding the full economics of the oil and gas sector strengthens their negotiating position with suppliers like Hess.

Hess's customers, primarily large refiners and national oil companies, possess significant bargaining power due to the commodity nature of oil and gas. Their ability to easily switch suppliers and their sheer purchasing volume mean price is paramount, directly impacting Hess's pricing strategies and profitability.

This customer concentration, coupled with low switching costs, intensifies price competition. For example, in 2024, Brent crude prices hovered around $80-$85 per barrel, forcing Hess to maintain cost efficiencies to retain these high-volume buyers.

Furthermore, integrated customers who understand the entire value chain, including refining margins, can exert even greater leverage. Fluctuations in refining margins, such as the $15-$20 per barrel average for US Gulf Coast gasoline crack spreads in 2024, directly influence their willingness to pay for crude.

| Customer Type | Bargaining Power Drivers | Impact on Hess | 2024 Market Context |

| Large Refiners | Commodity nature, low switching costs, high volume purchases | Price sensitivity, pressure on margins | Brent crude ~$80-85/barrel |

| National Oil Companies | High volume purchases, potential for direct negotiation | Significant leverage on pricing and terms | Global supply/demand dynamics |

| Integrated Companies | Understanding of refining margins, value chain insight | Ability to negotiate based on downstream profitability | USGC gasoline crack spreads ~$15-20/barrel |

Preview Before You Purchase

Hess Porter's Five Forces Analysis

This preview showcases the comprehensive Hess Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this ready-to-use strategic tool, enabling you to effectively assess market profitability and competitive intensity.

Rivalry Among Competitors

The exploration and production (E&P) sector is inherently capital-intensive, demanding substantial upfront investments in infrastructure, advanced technology, and the intricate development of projects. Hess's own financial planning underscores this, with projected capital and exploratory expenditures set at approximately $4.5 billion for 2025. This significant financial outlay is a testament to the considerable resources needed to simply operate within this industry.

This high level of investment naturally acts as a barrier to new entrants, effectively limiting the number of companies that can realistically compete. However, for existing players like Hess, it also means that the rivalry among established firms is intensified. Companies are constantly vying for the most promising and high-return opportunities, as the sheer cost of entry means that success in securing these ventures is paramount for profitability and market position.

Hess Corporation faces significant competitive rivalry, particularly due to its concentrated operations in key production basins like the Stabroek Block in Guyana and the Bakken Shale in North Dakota. In Guyana, Hess is part of a consortium, sharing influence and competition with major players like ExxonMobil and CNOOC, each holding substantial stakes.

The Bakken Shale, a cornerstone of U.S. oil production, exemplifies this rivalry. Producers here are locked in a constant battle to optimize costs and sustain production levels. For instance, in 2023, the Bakken region continued to be a high-volume producer, with output fluctuating based on market conditions and operational efficiencies, showcasing the intense competition for market share and profitability.

The oil and gas sector is in the midst of a significant consolidation phase. A prime example is Chevron's proposed acquisition of Hess, a deal valued at approximately $53 billion. This move, despite facing arbitration challenges with ExxonMobil, signals a clear trend toward fewer, larger, and more integrated energy companies.

While such mergers reduce the overall number of direct competitors, they simultaneously amplify the market share and influence of the surviving major players. This dynamic intensifies the competitive rivalry among the remaining industry giants, forcing them to compete more aggressively for resources and market dominance.

Global Supply Dynamics and OPEC+ Actions

Competitive rivalry in the oil and gas sector, including for Hess, is significantly shaped by global supply dynamics. Decisions made by OPEC+ to alter production targets directly influence market availability and pricing, thereby affecting all players.

The anticipated unwinding of voluntary OPEC+ production cuts in 2025 is a key factor to watch. This move is expected to boost global oil supply, which could lead to downward pressure on prices and consequently intensify competition, particularly for non-OPEC+ producers like Hess.

- OPEC+ Production Adjustments: OPEC+ has historically used production cuts to stabilize prices. For instance, in late 2023, they extended voluntary cuts into the first quarter of 2024, impacting supply.

- Impact of Unwinding Cuts: Projections suggest that the full unwinding of these voluntary cuts by 2025 could add millions of barrels per day to the global market.

- Hess's Position: As a non-OPEC+ producer, Hess must navigate this evolving supply landscape, where increased global output can alter the competitive advantage and profitability for companies not directly participating in OPEC+ output management.

Focus on Capital Discipline and Shareholder Returns

Exploration and production (E&P) companies, like Hess, are increasingly emphasizing capital discipline and shareholder returns over rapid production expansion. This strategic pivot means a more discerning approach to investments, favoring projects with superior returns. For instance, in 2024, many E&P firms maintained or increased their dividends and share buyback programs, reflecting this commitment to capital returns.

This disciplined strategy fosters more rational competition, as rivals concentrate on optimizing efficiency and profitability. Companies are less likely to engage in costly bidding wars for assets or pursue growth at any cost. This focus on returns can temper aggressive expansionary tactics among competitors.

- Capital Discipline: E&P companies are prioritizing free cash flow generation and debt reduction.

- Shareholder Returns: Increased dividends and share repurchases are common strategies.

- Selective Investments: Focus on projects with high internal rates of return (IRRs) and shorter payback periods.

- Rational Competition: Reduced emphasis on production volume growth can lead to less intense rivalry over market share.

Hess Corporation operates in a highly competitive oil and gas sector, characterized by intense rivalry among established players. The industry's capital-intensive nature and ongoing consolidation, exemplified by the proposed Chevron-Hess merger, mean that surviving companies wield significant market influence, intensifying competition for resources and dominance.

Key operational areas for Hess, such as the Stabroek Block in Guyana and the Bakken Shale, showcase this rivalry. In Guyana, Hess competes with major energy firms like ExxonMobil and CNOOC. The Bakken region, a significant U.S. oil producer, sees companies constantly striving for cost efficiency and production optimization, as evidenced by the region's consistent high output in 2023.

Global supply dynamics, particularly OPEC+ production decisions, directly impact competition. The anticipated unwinding of voluntary production cuts by OPEC+ in 2025 is expected to increase global supply, potentially pressuring prices and intensifying competition for non-OPEC+ producers like Hess.

The industry's shift towards capital discipline and shareholder returns, with E&P firms prioritizing high-return projects and increasing dividends, fosters more rational competition. This focus on efficiency and profitability rather than aggressive expansion can temper the intensity of rivalry among major players.

| Factor | Description | Impact on Hess |

|---|---|---|

| Industry Consolidation | Mergers like Chevron's proposed acquisition of Hess reduce the number of competitors but increase the market share of remaining giants. | Amplifies rivalry among major players, forcing Hess to compete more aggressively for market dominance. |

| Key Production Basins | Concentrated operations in areas like the Stabroek Block and Bakken Shale lead to direct competition with other major energy companies. | Intensifies rivalry for prime acreage, operational efficiency, and market share within these critical regions. |

| Global Supply Dynamics | OPEC+ production adjustments and the potential unwinding of cuts in 2025 influence global supply and pricing. | Hess, as a non-OPEC+ producer, must navigate price volatility and competitive pressures arising from global supply shifts. |

| Capital Discipline | Focus on shareholder returns and selective investments over rapid expansion. | Promotes rational competition, with rivals concentrating on efficiency and profitability rather than aggressive growth tactics. |

SSubstitutes Threaten

The global energy sector is witnessing a profound shift, with renewable energy sources such as solar and wind power achieving unprecedented growth rates. By 2025, renewables are projected to surpass coal as the primary global power source, a transition fueled by declining costs and escalating investments. This accelerated adoption of clean energy presents a significant long-term threat to the demand for fossil fuels, directly impacting companies like Hess.

The threat of substitutes for traditional energy sources is intensifying due to a massive surge in investment towards clean energy technologies. Global investment in clean energy is on track to hit an impressive $2.2 trillion by 2025, which is double the capital directed towards fossil fuels like oil, natural gas, and coal. This substantial financial commitment underscores a fundamental shift in how the energy sector is prioritizing its resources.

This growing investment is fueling the development and adoption of low-emission power solutions, including solar, wind, nuclear, and advanced battery storage systems. As these technologies become more affordable and their global implementation accelerates, they present a more compelling alternative to established energy providers, directly impacting their market position.

The accelerating shift towards electric vehicles (EVs) and the broader electrification of industrial operations presents a substantial threat of substitution for Hess Corporation. As EVs become more affordable and widely adopted, they directly displace demand for gasoline and diesel, Hess's primary refined products.

By the end of 2024, global EV sales are projected to surpass 16 million units, a significant increase from previous years, indicating a clear trend away from internal combustion engine vehicles. This growing EV market penetration directly erodes the customer base for traditional fossil fuels.

Furthermore, the electrification of heavy industry, from manufacturing to shipping, is gaining momentum, further diminishing the long-term need for oil and natural gas. This substitution trend poses a significant, albeit gradual, long-term challenge to Hess's revenue streams and market position.

Government Policies and Energy Transition Goals

Government policies aimed at accelerating the energy transition are a significant threat of substitutes for traditional oil and gas companies. Many nations are actively pursuing decarbonization goals, which directly encourages the adoption of renewable energy sources and electric vehicles. For instance, the United States' Inflation Reduction Act of 2022, with its substantial investments in clean energy, is a prime example of a policy driving the substitution away from fossil fuels.

These regulatory shifts, even with potential political changes, signal a long-term trend towards reduced reliance on oil and gas. The European Union's Fit for 55 package, targeting a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels, further exemplifies this global policy direction. Such initiatives create a more favorable environment for substitute energy technologies to gain market share.

- Policy Driven Substitution: Government mandates and incentives for renewable energy and electric vehicles directly reduce demand for oil and gas products.

- Long-Term Trend: Despite potential short-term policy fluctuations, the overarching global direction is towards lower carbon emissions, favoring substitutes.

- Investment Shifts: Policy support attracts significant capital to renewable energy sectors, making substitutes more competitive and accessible.

- Market Access: Regulations can also create barriers for fossil fuel products while opening doors for cleaner alternatives.

Continued Need for Fossil Fuels in the Short-to-Medium Term

Despite the significant growth in renewable energy sources, fossil fuels remain indispensable for meeting global energy needs in the short to medium term. Their continued importance in transportation, industrial applications, and as a raw material for petrochemicals underscores this reliance. For instance, in 2024, global oil demand is projected to reach 102.1 million barrels per day, a slight increase from 2023, highlighting the persistent demand.

Furthermore, escalating electricity demand, often exacerbated by extreme weather events, necessitates an ongoing supply from fossil fuels like natural gas and coal. This suggests that a complete substitution by renewables is not an immediate reality. The International Energy Agency (IEA) reported that coal consumption in the power sector reached a record high in 2023, with projections indicating a similar trend for 2024, reinforcing the ongoing need for these energy sources.

This sustained demand creates a profitable operating environment for oil and gas companies. However, the underlying threat of substitutes, while not fully realized, persists as technological advancements and policy shifts continue to drive the energy transition.

- Global oil demand projected to reach 102.1 million barrels per day in 2024.

- Coal consumption in the power sector hit a record high in 2023 and is expected to remain strong in 2024.

- Fossil fuels remain critical for transportation, industrial processes, and petrochemical feedstocks.

- The pace of renewable energy adoption, while growing, has not yet fully displaced the need for fossil fuels.

The rise of electric vehicles (EVs) and the electrification of industries pose a significant threat of substitution for Hess. By the end of 2024, global EV sales are anticipated to exceed 16 million units, directly impacting gasoline and diesel demand. This trend is further amplified by the increasing electrification of heavy industry, gradually reducing the long-term need for oil and natural gas.

Government policies actively promoting clean energy and EVs are a major driver of substitution. Initiatives like the US Inflation Reduction Act and the EU's Fit for 55 package are accelerating the adoption of renewable energy sources and electric alternatives. These policies create a more favorable market for substitutes, directly challenging the dominance of fossil fuels.

Despite these shifts, fossil fuels remain vital for current global energy needs, particularly in transportation and industrial applications. In 2024, global oil demand is projected at 102.1 million barrels per day, and coal consumption in power generation remains robust, reaching record highs in 2023 and expected to continue in 2024. This sustained demand offers a temporary buffer for oil and gas companies, though the long-term substitution threat persists.

| Energy Source | Projected 2024 Demand/Status | Substitution Threat Level |

|---|---|---|

| Oil (for transportation fuels) | 102.1 million barrels per day | High (due to EV adoption) |

| Natural Gas (for power generation, industry) | Significant, but facing competition from renewables | Medium to High (depending on region and policy) |

| Coal (for power generation) | Record high in 2023, expected to remain strong in 2024 | Medium (facing long-term pressure from renewables) |

| Renewables (Solar, Wind) | Unprecedented growth, surpassing coal in some projections | Low (already established and growing substitutes) |

| Electric Vehicles | Projected >16 million units sold in 2024 | High (direct substitute for internal combustion engine vehicles) |

Entrants Threaten

The exploration and production (E&P) sector demands immense upfront capital, particularly for complex ventures like deepwater offshore projects or extensive shale plays. Hess Corporation's substantial investments in its Guyana and Bakken operations highlight this significant barrier to entry. Securing billions in funding is a prerequisite, effectively limiting competition to only the most substantial entities.

Gaining access to commercially viable oil and natural gas reserves presents a formidable hurdle for potential new entrants. Hess Corporation, for instance, boasts significant stakes in premier assets such as the Stabroek Block, which has revealed a substantial resource base, and possesses extensive acreage in the Bakken shale play.

Newcomers would face considerable difficulty in securing comparable high-quality, de-risked assets. The majority of prime exploration and production territories are already controlled by established industry participants, making it challenging and costly for new companies to enter the market and compete effectively.

The oil and gas industry, particularly in exploration and production, is characterized by significant technological complexity. Hess, for instance, utilizes advanced seismic imaging and sophisticated reservoir management systems to optimize its operations. New companies entering this space would need to invest heavily in research and development and acquire highly specialized talent to even approach the operational efficiency of established players like Hess.

Regulatory Hurdles and Environmental Compliance

The oil and gas sector faces significant regulatory barriers, especially concerning environmental compliance. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce strict rules on methane emissions from oil and gas operations, requiring substantial investments in leak detection and repair technologies for any new player. Navigating these complex permitting processes, particularly for offshore exploration or unconventional extraction methods, demands considerable time and financial resources. New entrants must allocate significant capital towards ensuring adherence to these regulations and robust risk management frameworks, thereby increasing the cost and difficulty of market entry.

These regulatory challenges translate into substantial upfront costs for potential new entrants. For example, obtaining the necessary permits for a new offshore drilling operation can take years and cost millions of dollars in studies and legal fees. Furthermore, compliance with evolving environmental standards, such as those related to carbon capture and storage or water usage in hydraulic fracturing, requires continuous investment in new technologies and operational adjustments. This creates a high barrier to entry, favoring established companies with existing infrastructure and expertise in regulatory navigation.

- Stringent Environmental Regulations: Global oil and gas operations are governed by strict environmental laws, impacting everything from emissions to waste disposal.

- Complex Permitting Processes: Obtaining approvals for new projects, especially offshore or unconventional ones, can be lengthy and resource-intensive.

- High Compliance Costs: New entrants must invest heavily in technologies and systems to meet environmental standards and manage associated risks.

- Ongoing Investment in Compliance: Adherence to evolving regulations, like methane emission controls, necessitates continuous capital expenditure.

Established Infrastructure and Supply Chains

Established infrastructure and supply chains present a significant barrier to new entrants in the oil and gas sector. Companies like Hess have already invested heavily in extensive midstream and downstream assets, including pipelines, processing facilities, and marketing networks. For instance, Hess's involvement in the transportation and marketing of its produced hydrocarbons means new players must either replicate this massive infrastructure investment or secure costly access, a daunting financial and logistical hurdle.

The sheer scale of these existing networks means new entrants face considerable capital requirements. Building out a comparable infrastructure would likely cost billions of dollars, a sum that many potential competitors cannot readily access. This established physical footprint provides incumbent firms with significant cost advantages and operational efficiencies that are difficult for newcomers to match.

- Hess's integrated operations span exploration, production, transportation, and marketing of oil and gas.

- Midstream infrastructure, such as pipelines and terminals, is a critical and expensive component for moving hydrocarbons.

- Downstream assets, like refineries and retail networks, further solidify incumbents' market positions.

- New entrants must overcome the substantial capital expenditure and logistical complexities of building or acquiring similar infrastructure.

The threat of new entrants in the oil and gas exploration and production (E&P) sector is generally low due to substantial barriers. These include the immense capital required for exploration and development, as evidenced by Hess Corporation's billions invested in its Guyana and Bakken assets. Access to high-quality, de-risked reserves is also a significant hurdle, as prime territories are already controlled by established players. Furthermore, navigating complex technological requirements and stringent regulatory environments, particularly environmental compliance like methane emission controls, adds considerable cost and time for newcomers.

| Barrier Type | Description | Example (Hess Corp.) | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Massive upfront investment for exploration, development, and infrastructure. | Billions invested in Guyana's Stabroek Block and Bakken shale operations. | Limits competition to well-capitalized firms; requires significant debt or equity financing. |

| Access to Reserves | Control of prime, de-risked exploration and production acreage. | Significant stakes in world-class assets like the Stabroek Block. | Newcomers face higher costs and greater geological risk to secure comparable resources. |

| Technological Expertise | Sophisticated E&P technologies and specialized talent. | Advanced seismic imaging and reservoir management systems. | Requires substantial R&D investment and acquisition of skilled personnel. |

| Regulatory & Environmental | Complex permitting, compliance with emissions (e.g., methane), and waste disposal rules. | Adherence to EPA methane emission controls in 2024. | Demands significant capital for compliance technologies and lengthy approval processes. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from industry-specific market research reports, company annual filings, and publicly available financial statements to provide a comprehensive view of competitive dynamics.