Hess Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hess Bundle

Discover how Hess leverages its product innovation, strategic pricing, widespread distribution, and impactful promotions to dominate the market. This analysis goes beyond the surface, revealing the interconnectedness of their marketing efforts.

Ready to gain a competitive edge? Access the full, in-depth 4Ps Marketing Mix Analysis for Hess, complete with actionable insights and real-world examples, perfect for students, professionals, and consultants.

Product

Hess Corporation's core offering is crude oil, sourced from key operations like the Stabroek Block in Guyana and the Bakken Shale in North Dakota.

In 2024, Hess reported a daily crude oil production of 305,000 barrels. The Stabroek Block contributed significantly, with 186,000 barrels of oil per day, while the Bakken Shale averaged 204,000 barrels of oil equivalent per day.

Natural gas is a significant component of Hess's energy portfolio, complementing its crude oil production. In 2024, Hess reported an average daily production of 17 million cubic meters of natural gas.

Natural Gas Liquids (NGLs) represent a significant component of Hess's hydrocarbon production, offering a diversified revenue stream beyond crude oil. These valuable byproducts of natural gas processing include ethane, propane, butane, and natural gasoline, each with distinct market dynamics and applications.

In the first quarter of 2025, Hess achieved an average realized NGL selling price of $24.08 per barrel. This figure reflects the market demand and prevailing prices for these energy commodities, contributing to the company's overall financial performance and marketing mix effectiveness.

Transportation and Marketing Services

Hess Corporation's involvement in transportation and marketing extends beyond its upstream production, utilizing its midstream infrastructure to move and sell its crude oil and natural gas. This segment is crucial for realizing the value of its hydrocarbon assets, particularly in the prolific Bakken and Three Forks Shale plays.

The company's midstream operations encompass gathering, processing, storage, and export services. These integrated capabilities allow Hess to efficiently manage the flow of its products from the wellhead to the market, optimizing logistics and reducing costs.

In 2023, Hess reported significant crude oil and natural gas sales volumes. For instance, its net oil and gas production averaged approximately 370,000 barrels of oil equivalent per day for the full year 2023. This volume directly feeds into its marketing and transportation services.

- Midstream Infrastructure: Hess operates and utilizes gathering systems, processing facilities, and storage assets in the Bakken region.

- Export Capabilities: The company leverages export terminals to access global markets, enhancing the reach and value of its production.

- Market Access: Efficient transportation and marketing ensure Hess can effectively sell its crude oil and natural gas to a diverse customer base.

- 2023 Performance: Hess's total revenue from oil and gas sales in 2023 was approximately $10.1 billion, reflecting the importance of its marketing efforts.

Exploration and Development Expertise

Hess's expertise in exploration, development, and production of crude oil and natural gas serves as a core ongoing 'product' within its value chain. This is demonstrated through consistent investment in resource opportunities offering high returns and complex, multi-phased development projects. For instance, the Yellowtail development on the Stabroek Block, scheduled for startup in Q3 2025, highlights this commitment.

This deep technical capability translates into tangible assets and future production potential. Hess's strategic focus on these high-impact projects is designed to maximize value extraction from its resource base. The company's operational proficiency is a key differentiator, enabling it to effectively manage the complexities inherent in offshore oil and gas extraction.

- Focus on High-Return Resource Opportunities

- Expertise in Multi-Phased Development Projects

- Key Project Example: Yellowtail Development (Stabroek Block)

- Projected Startup: Q3 2025

Hess Corporation's product is primarily crude oil and natural gas, with a significant focus on high-quality, low-cost resources. The company's portfolio is anchored by its stake in the Stabroek Block offshore Guyana, a world-class asset with substantial growth potential. In addition to its offshore operations, Hess maintains a strong presence in the onshore Bakken Shale in North Dakota.

The company's production figures underscore its product offering. In 2024, Hess reported an average daily crude oil production of 305,000 barrels, with the Stabroek Block contributing 186,000 barrels per day. Natural gas production averaged 17 million cubic meters daily in the same year, demonstrating a balanced energy portfolio.

Natural Gas Liquids (NGLs) are also a key product component, providing diversified revenue. Hess achieved an average realized NGL selling price of $24.08 per barrel in Q1 2025. This highlights the market value and demand for these valuable byproducts.

Hess's product strategy is further defined by its commitment to developing complex, multi-phased projects. The Yellowtail development on the Stabroek Block, slated for a Q3 2025 startup, exemplifies this approach, showcasing the company's technical expertise in bringing significant new production online.

| Product Segment | Key Assets/Regions | 2024 Daily Production (Average) | Q1 2025 NGL Price |

|---|---|---|---|

| Crude Oil | Stabroek Block (Guyana), Bakken Shale (USA) | 305,000 barrels | N/A |

| Natural Gas | Stabroek Block (Guyana), Bakken Shale (USA) | 17 million cubic meters | N/A |

| Natural Gas Liquids (NGLs) | Stabroek Block (Guyana), Bakken Shale (USA) | N/A | $24.08 per barrel |

What is included in the product

This analysis offers a comprehensive deep dive into Hess's Product, Price, Place, and Promotion strategies, providing actionable insights for marketers and managers.

It grounds Hess's marketing positioning in actual brand practices and competitive context, making it an ideal benchmark for strategic planning.

Simplifies complex marketing strategies by clearly outlining the 4Ps, alleviating the pain of understanding and executing a cohesive plan.

Place

Hess Corporation's marketing strategy heavily relies on direct sales, bypassing intermediaries to connect directly with major players in the energy market. This approach allows for greater control over pricing and customer relationships.

In 2024, this direct sales model was evident with Hess selling 59 cargos of crude oil sourced from its significant operations in Guyana. These sales were primarily to refiners who process the crude into various petroleum products and to large energy traders who manage the global flow of these commodities.

Hess leverages a robust pipeline infrastructure, a critical component of its marketing mix, to move crude oil, natural gas, and natural gas liquids (NGLs) from its production areas to key market centers. This network is essential for maintaining efficient and cost-effective product delivery.

Hess Midstream, a significant operational segment, manages extensive gathering and transmission pipelines, particularly in the prolific Bakken shale region. In 2023, Hess Midstream reported approximately 1,300 miles of gathering and transportation pipelines, facilitating the movement of over 1 million barrels of oil equivalent per day.

Hess's midstream infrastructure is a cornerstone of its operations, featuring gas processing plants, oil terminals, and storage facilities. These assets are vital for transforming raw hydrocarbons into marketable products and ensuring their secure holding before they reach consumers. In 2023, Hess reported significant throughput across its midstream assets, underscoring their importance in the value chain.

Primarily concentrated in North Dakota, these facilities are strategically positioned to handle the abundant resources from the Bakken shale play. This geographic focus allows Hess to optimize its logistics and processing capabilities, ensuring efficient delivery and maximizing the value extracted from its upstream production. The company continues to invest in expanding and upgrading these critical midstream components.

Strategic Global Locations

Hess's production operations are strategically positioned in vital energy hubs, granting access to significant global markets. These key locations include the United States' Bakken Shale and Gulf of Mexico, the highly productive Stabroek Block in Guyana, and operations in Malaysia.

This strategic placement is reflected in Hess's 2024 net sales distribution, highlighting the importance of these regions to the company's revenue streams.

- United States: Accounted for 48.9% of net sales in 2024, driven by its onshore and offshore assets.

- Guyana: Contributed 43.7% of net sales in 2024, underscoring the significant output from the Stabroek Block.

- Malaysia: Represented 7.4% of net sales in 2024, indicating its role in Hess's international portfolio.

Long-Term Commercial Contracts

Hess Midstream's marketing strategy heavily features long-term, fee-based commercial contracts, a cornerstone of its distribution approach. These agreements, particularly with Hess Corporation (now integrated with Chevron) and other clients, are designed to lock in revenue streams and ensure predictable cash flow.

These contracts are crucial for stability, with some extending as far as 2033. This long-term visibility allows Hess Midstream to maintain consistent utilization of its infrastructure and generate reliable revenues, which is vital for planning and investment.

- Contract Duration: Key agreements extend through 2033, providing a decade of revenue visibility.

- Customer Base: Contracts are secured with Hess Corporation (now Chevron) and a diverse group of third-party customers.

- Revenue Model: Primarily fee-based, ensuring stable income regardless of commodity price fluctuations.

- Utilization: Long-term contracts guarantee consistent system throughput, optimizing asset performance.

Place, as a key element of Hess's marketing mix, is defined by its strategic production locations and robust midstream infrastructure. The company's assets are situated in high-impact regions such as the Bakken Shale and Gulf of Mexico in the United States, the Stabroek Block in Guyana, and Malaysia, providing direct access to global energy markets.

This geographical advantage is crucial for efficient product delivery and market penetration. Hess's midstream segment, encompassing pipelines, processing plants, and storage facilities, ensures that hydrocarbons are moved and prepared for sale. In 2023, Hess Midstream operated approximately 1,300 miles of pipelines, moving over 1 million barrels of oil equivalent daily, highlighting the scale and importance of its physical network.

The company's 2024 net sales distribution underscores the significance of these locations, with the United States accounting for 48.9%, Guyana for 43.7%, and Malaysia for 7.4%. This geographic concentration allows Hess to optimize its logistics and cater directly to major refiners and energy traders.

| Location | 2024 Net Sales Contribution | Key Assets |

|---|---|---|

| United States | 48.9% | Bakken Shale, Gulf of Mexico |

| Guyana | 43.7% | Stabroek Block |

| Malaysia | 7.4% | Offshore production |

Preview the Actual Deliverable

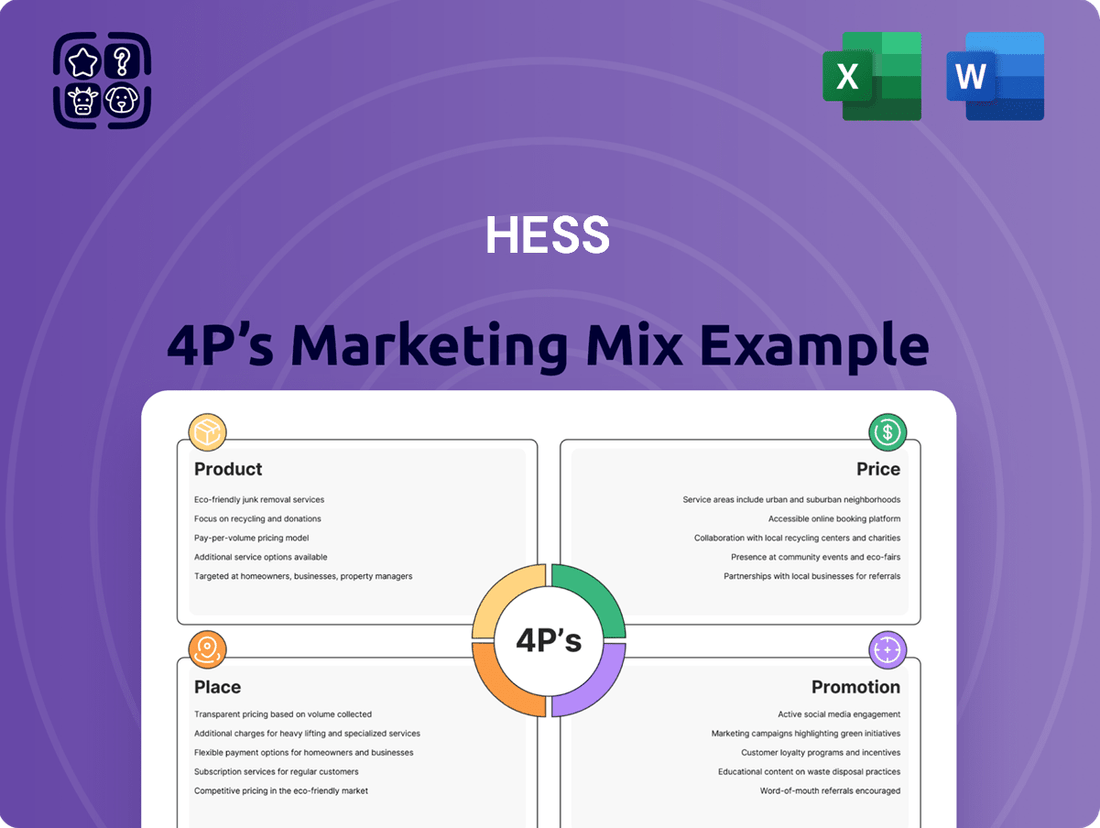

Hess 4P's Marketing Mix Analysis

The preview shown here is the actual Hess 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This means you're viewing the exact, complete version of the analysis you'll download immediately. You can be confident that the detailed breakdown of Product, Price, Place, and Promotion you see is precisely what you'll get.

Promotion

Hess actively engages its financially-literate audience through comprehensive investor relations, including its 2024 Annual Report and Form 10-K, filed by February 27, 2025. This commitment ensures timely access to critical financial data and strategic insights. Regular quarterly earnings releases further facilitate ongoing communication and transparency with investors.

Hess Corporation prioritizes sustainability and ESG performance, communicating this through annual reports and public disclosures. While a 2024 Sustainability Report for Hess Corporation is not being issued due to the ongoing Chevron merger, Hess Midstream released its 2024 Sustainability Report in July 2025. This report underscores their ongoing commitment to transparency and responsible operational practices.

The Hess Corporation website is a crucial digital touchpoint, offering comprehensive information for investors, including financial reports and operational updates. In 2024, Hess continued to emphasize its digital presence to ensure transparency and accessibility for a global audience.

This online platform acts as a central repository for news releases, detailing their exploration and production activities, particularly in key areas like the Stabroek Block offshore Guyana. Hess's commitment to sustainability is also prominently featured, showcasing their environmental, social, and governance (ESG) efforts.

Press Releases and Media Engagement

Hess Corporation actively engages in media relations, regularly issuing press releases to communicate key corporate milestones. These announcements cover crucial information such as quarterly earnings reports, dividend declarations, and significant strategic initiatives, ensuring stakeholders are kept informed.

The company utilizes established business wire services to distribute these press releases, guaranteeing broad reach across major financial news platforms. This strategic dissemination ensures that Hess's financial performance and strategic direction are widely accessible to investors and the broader financial community.

- Earnings Dissemination: In its Q1 2024 earnings release, Hess reported adjusted net income of $235 million, or $0.74 per diluted share, highlighting transparency in financial reporting.

- Strategic Updates: Hess's press releases frequently detail progress on its key projects, such as the Stabroek Block offshore Guyana, providing investors with timely operational updates.

- Dividend Announcements: The company's commitment to shareholder returns is often communicated through press releases detailing dividend payments, reinforcing its financial stability.

Conferences and Presentations

Hess actively engages with the financial community through participation in key industry conferences and dedicated investor presentations. These platforms are crucial for communicating the company's strategic direction, recent financial results, and forward-looking perspectives to a specialized audience of investors and financial analysts.

For instance, in 2024, Hess participated in prominent energy conferences, allowing them to articulate their Bakken and Guyana growth strategies. These presentations often highlight key operational updates and financial performance metrics, such as their projected production volumes and capital expenditure plans. For example, Hess has previously outlined its capital budget, with a significant portion allocated to its high-potential assets, aiming to drive shareholder value.

- Investor Outreach: Hess leverages industry conferences and investor days to directly communicate its strategy and financial performance.

- Targeted Audience: These events focus on reaching investors and financial analysts interested in the energy sector.

- Information Dissemination: Hess uses these forums to share updates on its operational progress, particularly in key growth areas like the Bakken and Guyana.

- Financial Transparency: Presentations typically include detailed financial data and outlooks, supporting informed investment decisions.

Hess utilizes a multi-channel approach for promotion, focusing on investor relations and transparent financial communication. Their website serves as a primary hub for detailed financial reports, operational updates, and ESG initiatives, ensuring accessibility for a global audience.

Press releases are a key promotional tool, disseminating crucial information like quarterly earnings, dividend announcements, and strategic developments through established business wire services to maximize reach within the financial community.

Participation in industry conferences and investor presentations allows Hess to directly engage with investors and analysts, providing in-depth insights into their growth strategies, particularly concerning the Stabroek Block in Guyana and the Bakken region.

Hess's promotional efforts are geared towards fostering investor confidence through clear communication of financial performance and strategic progress, as evidenced by their Q1 2024 adjusted net income of $235 million, or $0.74 per diluted share.

| Communication Channel | Key Information Disseminated | Audience Focus | Example Data (2024) |

|---|---|---|---|

| Investor Relations Website | Annual Reports, 10-K Filings, ESG Reports, Operational Updates | Investors, Financial Analysts, General Public | Timely access to Q1 2024 earnings data |

| Press Releases | Earnings, Dividends, Strategic Milestones, Project Updates | Financial Media, Investors, Stakeholders | Announcements on Stabroek Block progress |

| Industry Conferences & Investor Presentations | Strategy, Financial Performance, Growth Outlooks | Investors, Financial Analysts | Discussions on Bakken and Guyana growth strategies |

Price

The price of Hess's core products, crude oil and natural gas, is heavily influenced by global commodity markets. These prices fluctuate based on supply and demand, geopolitical stability, and broader economic trends. For instance, Hess reported an average realized crude oil price of $77.28 per barrel in 2024, a figure that demonstrates the market's sensitivity to these global factors.

Looking ahead, the market continues to show volatility. In the first quarter of 2025, Hess's average realized crude oil price stood at $71.22 per barrel. This demonstrates the dynamic nature of commodity pricing, where even short-term shifts in global conditions can impact revenue streams significantly.

Hess Midstream's fee-based model shields it from direct commodity price volatility, generating revenue through essential services like gathering, processing, and terminaling. This structure is bolstered by minimum volume commitments and long-term contracts, ensuring predictable and stable income streams for the company. For instance, in the first quarter of 2024, Hess Midstream reported adjusted EBITDA of $340 million, demonstrating the resilience of its fee-based operations despite fluctuating energy markets.

Hess's capital allocation strategy directly influences its pricing power by prioritizing investments in low-cost, high-return exploration and production (E&P) opportunities. This focus aims to enhance profitability and, by extension, shareholder value.

The company's commitment to disciplined capital deployment is evident in its projected E&P capital and exploratory expenditures, which are slated to reach approximately $4.5 billion for 2025. This significant investment underscores a strategic approach to securing future production and maintaining a competitive cost structure.

Market Demand and Supply Considerations

Hess Corporation's production levels and strategic investment decisions are intrinsically tied to the ebb and flow of market demand and projected supply for hydrocarbons, directly shaping the prevailing price environment for oil and gas. For the second quarter of 2025, Hess has guided its production to be within the significant range of 480,000 to 490,000 barrels of oil equivalent per day (boepd). This guidance reflects the company's operational capacity and its outlook on market conditions.

The company's ability to meet this production target is crucial for its financial performance and its position within the energy market. Factors influencing this include exploration success, development timelines, and operational efficiency. Hess's strategic focus on high-return assets, particularly its interests in the Stabroek Block offshore Guyana, plays a pivotal role in its supply-side strategy.

Market demand for energy remains a primary driver for Hess's pricing power. Global economic growth, geopolitical stability, and the transition towards cleaner energy sources all contribute to the complex demand equation. Hess's production guidance for Q2 2025 is a direct response to its assessment of these market dynamics.

- Production Guidance: Hess anticipates producing between 480,000 to 490,000 boepd in Q2 2025.

- Market Influence: Production levels and investment decisions are directly influenced by anticipated market demand and supply dynamics.

- Strategic Assets: Hess's output is significantly supported by its stake in the prolific Stabroek Block.

- Price Environment: These supply and demand factors collectively impact the overall price environment for hydrocarbons.

Financial Performance and Shareholder Returns

Hess's financial strategy focuses on robust operational efficiencies to boost profitability, directly translating into enhanced shareholder value. This commitment is evident in their distribution growth targets and capital return plans.

For instance, Hess Midstream has a clear objective: to achieve at least 5% annual distribution growth per Class A share through 2027. This forward-looking plan aims to provide a consistent and growing income stream for investors.

Furthermore, the company has earmarked significant capital for shareholder returns, with plans to distribute over $1.25 billion to shareholders by 2027. This includes potential share repurchases, which can further boost per-share value.

- Targeted Distribution Growth: Hess Midstream aims for at least 5% annual distribution growth per Class A share through 2027.

- Capital Return Commitment: Over $1.25 billion is slated for return to shareholders by 2027, encompassing dividends and buybacks.

- Operational Efficiency Link: Pricing strategies and operational improvements are designed to underpin these financial performance and shareholder return goals.

Hess's pricing strategy is intrinsically linked to the volatile global commodity markets for crude oil and natural gas. The company's average realized crude oil price was $77.28 per barrel in 2024 and $71.22 per barrel in Q1 2025, illustrating market sensitivity to supply, demand, and geopolitical events.

Hess Midstream, however, benefits from a fee-based model with minimum volume commitments and long-term contracts, ensuring stable revenue streams regardless of commodity price fluctuations. This is evidenced by its Q1 2024 adjusted EBITDA of $340 million.

The company's capital allocation prioritizes low-cost, high-return E&P projects, with approximately $4.5 billion projected for E&P capital and exploratory expenditures in 2025, aiming to enhance profitability and shareholder value.

| Metric | 2024 (Average) | Q1 2025 |

| Realized Crude Oil Price ($/barrel) | 77.28 | 71.22 |

| Hess Midstream Adjusted EBITDA ($ million) | N/A | 340 (Q1 2024) |

| Projected E&P Capital & Exploratory Expenditures (2025) ($ billion) | N/A | 4.5 |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages a robust blend of proprietary market intelligence and publicly available data. We meticulously examine official company statements, financial reports, and direct consumer feedback to ensure a comprehensive understanding of Product, Price, Place, and Promotion strategies.