Herc Rentals SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herc Rentals Bundle

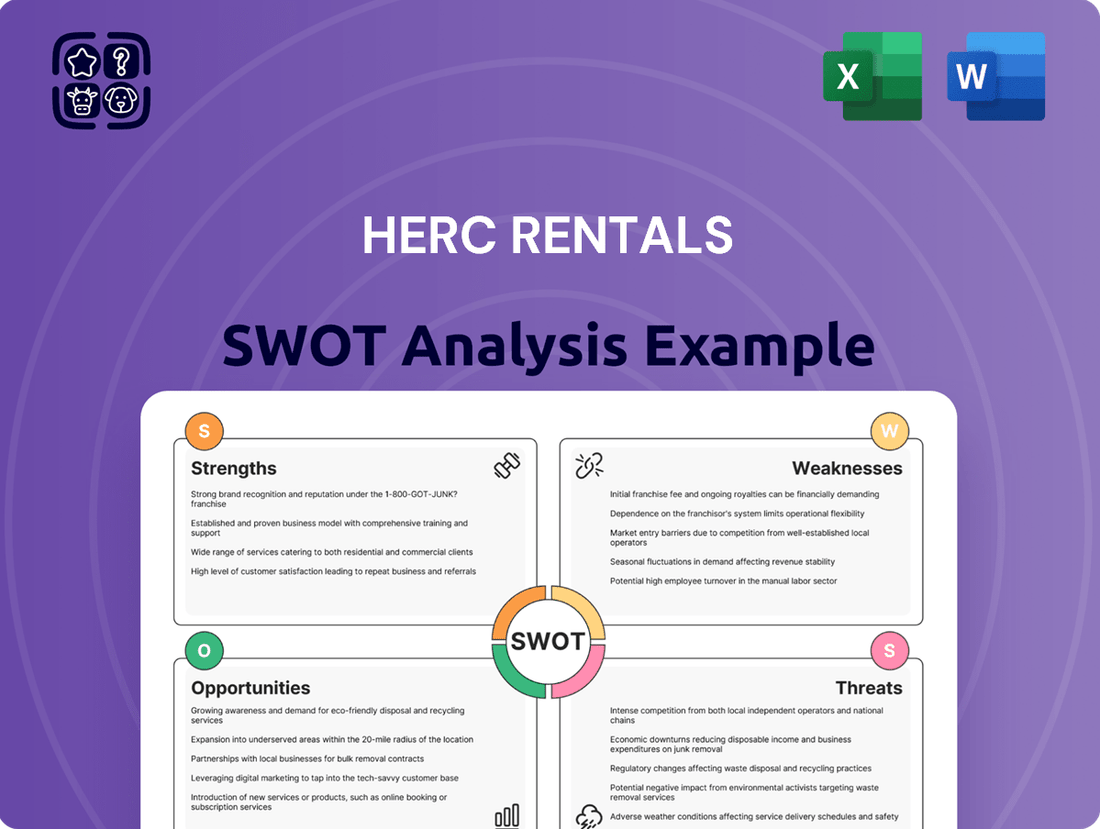

Herc Rentals boasts strong brand recognition and a broad geographic footprint, key strengths in a competitive equipment rental market. However, potential challenges like economic downturns and intense competition warrant a closer look.

Want the full story behind Herc Rentals' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Herc Rentals boasts an impressive operational scale with 622 branches spread across North America. This vast network was further bolstered by the significant acquisition of H&E Equipment Services, solidifying its presence. This extensive reach is a key strength, enabling efficient service delivery to a broad customer base and reinforcing its market standing.

Following the H&E Equipment Services acquisition, Herc Rentals is now the third-largest equipment rental company in North America, and the second-largest in terms of revenue. This elevated market position, supported by its extensive branch network, grants Herc Rentals substantial competitive leverage. It allows the company to capture greater market share and serve a wider array of customer needs effectively.

Herc Rentals boasts a comprehensive fleet, offering everything from aerial lifts and earthmoving equipment to trucks and trailers, serving diverse sectors like construction, industrial, and government. This broad equipment availability is a significant strength, ensuring they can meet a wide range of customer needs.

Beyond just equipment provision, Herc Rentals enhances its offerings with essential value-added services. These include maintenance, repair, and safety training, which not only solidify customer relationships but also create recurring revenue opportunities. For instance, their ProSolutions® segment specifically targets specialized requirements in areas like power generation and climate control, demonstrating a strategic approach to capturing niche market demands.

Herc Rentals has shown impressive financial strength, with 2024 marking a record year for equipment rental revenue and total revenues. This upward trend is expected to continue into 2025, even with a demanding market environment.

The company's strategic focus on capital allocation, smart acquisitions, and establishing new locations is paying off. Evidence of this is the 11% surge in equipment rental revenue observed in 2024, with projections for 4-6% growth in 2025.

Strategic Acquisitions and Synergy Realization

Herc Rentals' strategic acquisition of H&E Equipment Services in June 2025 is a major development. This move significantly broadens Herc's reach across the United States, adding to its extensive fleet and enhancing its capabilities, especially in specialized equipment rental.

The integration of H&E is projected to unlock considerable cost savings and revenue growth opportunities. These synergies are anticipated to boost Herc's operational efficiency and solidify its standing in the competitive equipment rental market.

- Geographic Expansion: The H&E acquisition adds over 100 new locations, significantly increasing Herc's presence in key markets.

- Fleet Growth: Herc's rental fleet is expected to grow by approximately 30%, with a strong emphasis on high-demand specialty equipment.

- Synergy Targets: Management has indicated an expectation of achieving over $100 million in annual run-rate synergies within two years post-acquisition.

Commitment to Sustainability and Operational Excellence

Herc Rentals demonstrates a strong commitment to sustainability, having already achieved its target of a 25% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to a 2019 baseline. This proactive approach to environmental responsibility is further highlighted by their near achievement of their goal for reducing non-toxic waste sent to landfills per revenue dollar.

The company's dedication to operational excellence is clearly reflected in its safety performance. Herc Rentals consistently maintains a Total Recordable Incident Rate (TRIR) that outperforms the industry benchmark, showcasing a culture that prioritizes the well-being of its employees and the efficiency of its operations.

- Sustainability Focus: Reduced Scope 1 and 2 GHG emissions intensity by 25% (vs. 2019 baseline).

- Waste Reduction: Nearing target for non-toxic waste to landfill intensity.

- Safety Performance: Achieved a TRIR below industry average, indicating strong operational safety.

- Operational Excellence: Commitment to high safety standards reinforces efficient and responsible operations.

Herc Rentals' strategic positioning as the third-largest equipment rental company in North America, and second-largest by revenue, provides significant market leverage. This enhanced scale, particularly after the June 2025 acquisition of H&E Equipment Services, allows for broader customer reach and greater market share capture.

The company's comprehensive fleet, catering to diverse sectors like construction and industrial, ensures it can meet a wide array of customer demands. Value-added services such as maintenance, repair, and specialized solutions through its ProSolutions® segment further strengthen customer relationships and create recurring revenue streams.

Financially, Herc Rentals experienced a record year in 2024 for equipment rental and total revenues, with projections for continued growth in 2025. This financial strength supports its strategic capital allocation, acquisitions, and new location development, with equipment rental revenue seeing an 11% surge in 2024 and expected 4-6% growth in 2025.

| Metric | 2024 (Actual/Est.) | 2025 (Projected) | Significance |

|---|---|---|---|

| Equipment Rental Revenue Growth | 11% | 4-6% | Demonstrates strong market demand and Herc's ability to capitalize on it. |

| H&E Acquisition Synergies | N/A | >$100M annual run-rate within 2 years | Highlights significant potential for cost savings and revenue enhancement. |

| Fleet Growth (Post-H&E) | N/A | ~30% | Increases capacity and ability to serve diverse customer needs, especially in specialty equipment. |

What is included in the product

Analyzes Herc Rentals’s competitive position through key internal and external factors, highlighting its strong market presence and operational efficiency while acknowledging potential economic downturns and competitive pressures.

Offers a structured framework to identify and address Herc Rentals' competitive challenges and operational inefficiencies.

Weaknesses

While Herc Holdings saw revenue increases, the company posted net losses in both the second and first quarters of 2025. These losses were largely driven by higher transaction costs linked to the H&E acquisition and losses recognized on assets designated for sale.

A significant concern is Herc Holdings' substantial increase in net debt, which reached $8.3 billion by June 30, 2025. This rise, coupled with an elevated net leverage ratio, points to a potentially challenging short-term financial position and a heavier debt burden.

Herc Rentals faces a formidable competitive environment, with giants like United Rentals and Sunbelt Rentals holding significant market share. This intense rivalry often translates into considerable pricing pressures, making it difficult for Herc to raise or even sustain rental rates, particularly in local markets where growth has softened.

Herc Rentals, like many in the equipment rental sector, faces a significant weakness in its dependence on economic and construction cycles. This means that demand for its services can fluctuate considerably based on broader economic health and the activity levels within the construction industry.

The equipment rental industry thrives on capital investment and maintenance spending by its customers, with construction being a primary driver. When the construction sector slows, particularly residential and certain non-residential segments, Herc Rentals can see a direct impact on its revenue and growth prospects. For instance, rising interest rates in 2024 and into 2025 could dampen new construction starts, directly affecting rental demand.

Integration Risks of Large Acquisitions

The acquisition of H&E Equipment Services, a significant move for Herc Rentals, introduces substantial integration risks. Successfully merging over 160 locations, diverse IT infrastructures, and distinct corporate cultures demands considerable financial and human capital, with meticulous planning being paramount. Failure to achieve seamless integration could hinder the realization of expected operational efficiencies and financial synergies, potentially impacting Herc Rentals' overall performance following the deal, which closed in the first quarter of 2024.

Key integration challenges include:

- System Harmonization: Aligning disparate IT systems from H&E Equipment Services with Herc Rentals' existing platforms is a complex and resource-intensive undertaking.

- Cultural Assimilation: Bridging potential cultural differences between the two organizations is crucial for employee morale and operational cohesion.

- Operational Overlap: Identifying and managing redundancies in operations and supply chains across the expanded network requires careful strategic execution.

- Synergy Realization: The anticipated cost savings and revenue enhancements from the acquisition are contingent on the effectiveness of the integration process.

Sensitivity to Interest Rate Fluctuations and Input Costs

Herc Rentals faces a significant vulnerability due to its sensitivity to interest rate changes. As of early 2025, with central banks maintaining or cautiously adjusting rates, higher borrowing costs directly impact Herc's ability to finance new equipment acquisitions. This can lead to increased debt servicing expenses, potentially squeezing profit margins.

Furthermore, fluctuating interest rates can dampen demand for rental equipment. When borrowing becomes more expensive for customers, they may postpone or scale back projects, directly affecting Herc's revenue streams. This economic sensitivity requires proactive financial management and strategic hedging.

The company also grapples with the challenge of rising input costs and tariff uncertainties. For instance, increased steel prices or import duties on equipment components, continuing trends observed through late 2024 into 2025, directly inflate the cost of maintaining and expanding its fleet. Managing these volatile expenses is crucial for preserving profitability.

- Interest Rate Sensitivity: Increased borrowing costs for fleet expansion and potential dampening of customer demand due to higher financing expenses.

- Rising Input Costs: Higher prices for fuel, steel, and other essential materials used in equipment maintenance and acquisition, impacting operational expenses.

- Tariff Uncertainties: Potential for increased costs on imported equipment or parts due to evolving trade policies, affecting the overall cost of goods.

- Profit Margin Pressure: The combined effect of higher financing and input costs can directly compress Herc Rentals' profit margins if not effectively managed through pricing strategies and cost controls.

Herc Rentals faces significant pressure from intense competition, particularly from larger players like United Rentals and Sunbelt Rentals, which can limit pricing power. Additionally, the company's reliance on economic and construction cycles means demand can be volatile, especially with rising interest rates in 2024-2025 potentially slowing construction starts.

The recent acquisition of H&E Equipment Services presents substantial integration risks, including harmonizing IT systems and cultures, which requires significant capital and careful execution to realize expected synergies. Furthermore, Herc Rentals' sensitivity to interest rate fluctuations directly impacts its ability to finance fleet expansion and can dampen customer demand by increasing their borrowing costs.

Rising input costs for materials like steel, along with potential tariff uncertainties on imported equipment, are also key weaknesses, directly inflating maintenance and acquisition expenses. These combined cost pressures can significantly squeeze Herc Rentals' profit margins if not effectively managed.

Herc Holdings' financial performance in early 2025 was marked by net losses in the first two quarters, largely due to higher transaction costs from the H&E acquisition and losses on assets sold. This was accompanied by a substantial increase in net debt to $8.3 billion by June 30, 2025, elevating its net leverage ratio and indicating a potentially strained short-term financial position.

Full Version Awaits

Herc Rentals SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. This document provides a comprehensive look at Herc Rentals' Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic decision-making.

Opportunities

Herc Rentals is well-positioned to benefit from the expanding specialty equipment rental market, which is seeing robust growth. Specialty solutions already make up an increasing share of their fleet.

The recent acquisition of H&E Equipment Services is a key enabler for Herc's cross-selling strategy. This integration allows them to offer a broader range of specialized equipment, particularly for large-scale commercial and infrastructure projects, thereby unlocking significant revenue synergies.

Government policies like the Infrastructure Investment and Jobs Act (IIJA) are set to inject substantial funds into infrastructure projects, creating a robust demand for rental equipment. This legislation, alongside the Inflation Reduction Act and CHIPS and Science Act, is projected to significantly boost construction activity through 2025.

Herc Rentals is strategically positioned to benefit from this surge. Their broad fleet and established relationships with national accounts allow them to effectively serve the large-scale projects anticipated from these government initiatives, potentially capturing a disproportionate share of the increased construction spending.

The equipment rental sector is rapidly embracing technology, with Herc Rentals poised to capitalize on this shift. Investments in AI, IoT, and telematics can streamline operations and boost fleet efficiency. For instance, by late 2024, the company's continued focus on digital tools is expected to further optimize fleet utilization, a critical factor in rental profitability.

Herc can leverage cloud-based solutions and mobile applications to enhance customer service, offering real-time tracking and seamless online transactions. This digital transformation presents a significant opportunity to differentiate itself in the competitive landscape, potentially leading to increased customer loyalty and market share by 2025.

Market Consolidation and Greenfield

The equipment rental sector is still quite fragmented, offering a prime opportunity for Herc Rentals to grow through strategic acquisitions. This consolidation allows for greater market share and operational efficiencies.

Herc Rentals has a solid history of successfully integrating acquired businesses and establishing new greenfield sites. This dual strategy is key to widening its geographical reach and building stronger market dominance.

By expanding its network, Herc Rentals can achieve significant economies of scale, which translates to better cost management and potentially improved profitability. This approach is crucial for staying competitive in the evolving rental landscape.

- Market Consolidation: The equipment rental industry, despite ongoing activity, still shows significant fragmentation, providing ample room for Herc Rentals to pursue strategic acquisitions and expand its footprint.

- Greenfield Expansion: Herc Rentals' proven ability to successfully open new locations allows for organic growth, targeting underserved markets and increasing its overall market penetration.

- Economies of Scale: Both consolidation and new site development contribute to achieving greater economies of scale, leading to more efficient operations and enhanced cost-effectiveness.

- Strengthened Market Position: By actively engaging in both acquisition and greenfield strategies, Herc Rentals solidifies its competitive standing and enhances its value proposition to customers.

Shift from Equipment Ownership to Rental

The construction industry is increasingly moving away from owning equipment and towards renting it. This shift is a significant opportunity for Herc Rentals. Factors like the high cost of capital, especially with elevated borrowing costs in 2024 and 2025, make renting a more attractive option for many businesses. It offers greater financial flexibility and avoids the burden of large upfront investments.

This trend is secular, meaning it's a long-term change, not just a temporary blip. Companies are realizing the benefits of not having to manage maintenance, depreciation, and eventual resale of heavy machinery. Instead, they can access the latest equipment when they need it, improving operational efficiency. This directly translates to a robust and growing demand for rental services like those provided by Herc.

Consider these points:

- Cost-Effectiveness: Renting avoids the capital expenditure and ongoing costs associated with ownership, such as maintenance and insurance.

- Operational Flexibility: Businesses can scale their equipment needs up or down based on project demands, without being tied to underutilized assets.

- Access to New Technology: Rental companies often update their fleets, allowing users to access newer, more efficient, and technologically advanced equipment.

- Reduced Balance Sheet Burden: Shifting to rentals can improve a company's balance sheet by reducing fixed assets and related liabilities.

Herc Rentals is well-positioned to capitalize on the increasing demand for specialty equipment, a segment experiencing significant growth. Their strategic acquisition of H&E Equipment Services enhances their ability to cross-sell a broader range of specialized solutions, particularly for large infrastructure and commercial projects.

Government initiatives like the Infrastructure Investment and Jobs Act are projected to fuel substantial infrastructure spending through 2025, directly benefiting equipment rental demand. Herc's established national accounts and extensive fleet are ideal for securing business on these large-scale projects.

The ongoing shift in the construction industry towards renting rather than owning equipment presents a secular growth opportunity. This trend is amplified by the high cost of capital, making rental solutions more financially attractive for businesses seeking flexibility and avoiding ownership burdens.

Herc Rentals can further leverage technological advancements, such as AI and IoT, to optimize fleet utilization and enhance customer service through digital platforms. This focus on efficiency and customer experience is crucial for competitive differentiation by 2025.

| Opportunity Area | Key Driver | Projected Impact |

|---|---|---|

| Specialty Equipment Market | Robust growth in specialized solutions | Increased revenue from niche rentals |

| Infrastructure Spending | IIJA, IRA, CHIPS Act funding | Significant demand boost for rental equipment |

| Shift to Rental Model | High capital costs, operational flexibility | Growing preference for renting over ownership |

| Digital Transformation | AI, IoT, telematics adoption | Improved fleet efficiency and customer engagement |

Threats

Herc Rentals, like much of the equipment rental sector, is susceptible to an economic slowdown. We're seeing normalization in growth rates, especially in U.S. and Canadian residential construction, which could dampen demand for rental equipment.

A persistent higher-for-longer interest rate environment poses a significant threat. This could continue to put pressure on local market growth and, consequently, reduce the overall need for rental machinery across various segments.

The equipment rental market is incredibly competitive, with major players like United Rentals and Sunbelt Rentals constantly vying for market share. This intense rivalry often leads to pricing pressures, as companies may lower rates to attract customers, potentially squeezing Herc Rentals' profit margins.

For instance, in the first quarter of 2024, Herc Rentals reported a total revenue of $706 million, a slight increase from the previous year, but the competitive environment means they must carefully manage pricing strategies to avoid losing ground. If competitors aggressively cut prices, Herc could face challenges in maintaining its rental rates, impacting overall profitability and its ability to invest in fleet expansion or technological upgrades.

Herc Rentals is grappling with escalating operating costs, particularly in personnel and facility expenses, driven by expansion efforts through growth, new greenfield sites, and strategic acquisitions. These rising input costs directly challenge their ability to maintain healthy profit margins.

The broader economic climate of inflationary pressures adds another layer of complexity, potentially squeezing profitability if not managed effectively. For instance, in the first quarter of 2024, Herc Rentals reported that its cost of equipment rentals increased, a direct reflection of these inflationary trends impacting their operational expenditures.

Technological Disruption and Evolving Customer Demands

The equipment rental sector is experiencing swift technological advancements, requiring Herc Rentals to constantly integrate new innovations and adapt to shifting customer expectations. For instance, the increasing demand for connected equipment, driven by telematics, allows for better asset tracking and predictive maintenance, a trend Herc must actively incorporate to remain competitive.

A failure to adopt emerging technologies, such as AI for optimizing fleet management or the growing preference for electric and hybrid equipment, poses a significant risk. Companies lagging in this area could see their market share erode and profitability decline as competitors offer more efficient and sustainable solutions. For example, by the end of 2024, the global construction equipment rental market is projected to reach over $120 billion, highlighting the scale of opportunity and the competitive pressure to innovate.

- Technological Obsolescence: Risk of existing fleet becoming outdated if new technologies aren't adopted.

- Customer Preference Shift: Potential loss of business if eco-friendly or digitally integrated equipment isn't offered.

- Competitive Disadvantage: Competitors leveraging advanced telematics or automation could gain an edge in efficiency and service.

Supply Chain Disruptions and Tariff Uncertainties

While the intensity of supply chain disruptions has lessened compared to previous years, the equipment rental sector, including companies like Herc Rentals, still faces potential vulnerabilities. For instance, in late 2023 and early 2024, continued geopolitical tensions or unexpected global events could reintroduce delays in manufacturing and shipping, impacting the availability of new equipment and replacement parts.

Tariff uncertainties present another significant threat. Increases in tariffs on imported construction and heavy equipment, which are common in the industry, could directly translate to higher acquisition costs for rental companies. This would likely necessitate an increase in rental rates for customers, potentially dampening demand or shifting preferences towards shorter-term rentals.

- Supply Chain Vulnerability: Despite improvements, the risk of renewed supply chain disruptions impacting equipment availability and pricing remains a concern for Herc Rentals.

- Tariff Impact: Potential tariff increases on imported machinery could raise operational costs, leading to higher rental prices and affecting market competitiveness.

- Cost Pressures: Elevated equipment costs due to tariffs or supply chain issues could squeeze profit margins if rental rate increases cannot fully offset these expenses.

Intense competition from major players like United Rentals and Sunbelt Rentals creates pricing pressure, potentially impacting Herc Rentals' profit margins. Escalating operating costs, particularly for personnel and facilities due to expansion, also challenge profitability.

Technological advancements require continuous investment, and failure to adopt innovations like telematics or electric equipment could lead to a competitive disadvantage. Supply chain vulnerabilities and potential tariff increases on imported machinery also pose risks to equipment availability and cost.

| Threat Category | Specific Threat | Potential Impact |

|---|---|---|

| Competition | Aggressive pricing by rivals | Reduced profit margins, market share erosion |

| Operating Costs | Rising personnel and facility expenses | Decreased profitability, strain on expansion plans |

| Technology | Lagging adoption of new equipment/telematics | Competitive disadvantage, outdated fleet |

| Supply Chain/Tariffs | Disruptions and tariff increases on imported equipment | Higher acquisition costs, increased rental rates, reduced demand |

SWOT Analysis Data Sources

This analysis leverages a comprehensive blend of data sources, including Herc Rentals' official financial statements, detailed market research reports, and insights from industry experts. These elements combine to provide a robust and well-informed foundation for the SWOT assessment.