Herc Rentals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herc Rentals Bundle

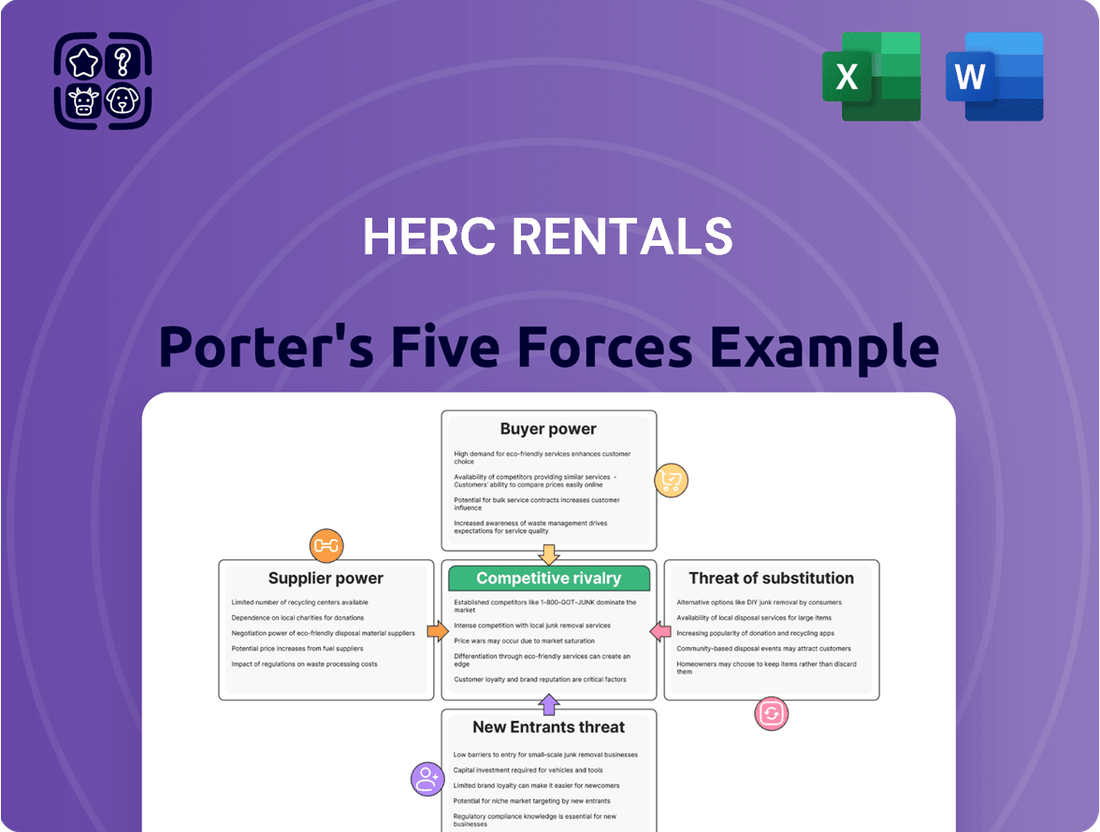

Herc Rentals operates in a competitive equipment rental landscape, where understanding the five key forces is crucial for strategic success. This analysis reveals how buyer power, supplier bargaining, and the threat of new entrants shape the industry.

The full report unlocks a deeper understanding of the competitive intensity within Herc Rentals's market, including the impact of substitute products and rivalry among existing players. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Herc Rentals relies on a number of key equipment manufacturers and other critical suppliers. The concentration of these suppliers and the uniqueness of the equipment they provide significantly influence their bargaining power. If there are few suppliers or if they offer highly specialized, proprietary equipment, Herc Rentals has fewer alternatives, increasing supplier leverage.

Switching costs for Herc Rentals when changing major equipment suppliers can be substantial, impacting their operational flexibility. These costs might involve significant investments in re-training their maintenance and operational staff on new equipment specifications, potentially costing thousands per technician. Furthermore, re-tooling maintenance facilities to accommodate different machinery could require millions in capital expenditure.

Beyond direct operational expenses, Herc Rentals could face the loss of established volume discounts with their current suppliers. For instance, if Herc Rentals procures over $1 billion in equipment annually, a shift could mean forfeiting millions in negotiated price reductions. This financial penalty directly enhances the bargaining power of existing suppliers, as they retain Herc Rentals through the cost of switching.

The bargaining power of suppliers is a key factor for Herc Rentals, particularly concerning the specialized equipment they offer. If the machinery is highly specific to certain construction or industrial needs and difficult for Herc Rentals to source elsewhere, those suppliers gain considerable leverage. For instance, in 2024, Herc Rentals' fleet acquisition strategy heavily relies on manufacturers of advanced aerial work platforms and earthmoving equipment, where unique technological features can create dependency.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant concern for Herc Rentals. If equipment manufacturers, such as those producing heavy machinery or specialized tools, were to enter the rental market directly, they could bypass intermediaries like Herc. This would allow them to capture a larger portion of the value chain and potentially offer more competitive pricing.

This potential shift is particularly relevant given the robust state of the construction and industrial equipment market. For instance, in 2023, the global construction equipment market was valued at approximately $215 billion, with projections indicating continued growth. Such a large market could incentivize major manufacturers to explore direct rental operations to leverage their existing product lines and distribution networks.

- Manufacturers entering the rental market directly bypass Herc Rentals.

- This move by suppliers increases their bargaining power.

- The substantial global construction equipment market ($215 billion in 2023) offers incentives for forward integration.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers in the equipment rental industry. If Herc Rentals can readily find comparable equipment or parts from multiple vendors, their ability to negotiate favorable terms strengthens. This is particularly true for standardized or commodity-like equipment where differentiation among suppliers is minimal.

For instance, if a particular type of aerial lift or generator is offered by numerous manufacturers and rental companies, Herc Rentals can leverage this competition. In 2023, the global equipment rental market reached an estimated $100 billion, indicating a highly competitive landscape with many players offering similar services. This broad market participation inherently provides renters like Herc with options, thereby limiting individual supplier leverage.

- High Availability of Substitutes: When numerous suppliers offer similar equipment or components, Herc Rentals gains leverage.

- Reduced Supplier Dependence: The ability to switch suppliers easily diminishes the power of any single supplier.

- Impact on Pricing: A competitive supply market typically leads to more favorable pricing for Herc Rentals.

The bargaining power of Herc Rentals' suppliers is moderate, primarily due to the specialized nature of some key equipment and the significant switching costs involved. While Herc aims to diversify its supplier base, reliance on a few manufacturers for advanced machinery, like specific types of excavators or specialized aerial platforms, can grant those suppliers leverage. For example, in 2024, the demand for advanced construction technology means that manufacturers with unique, high-performance offerings can dictate terms more effectively.

Switching costs are a substantial factor, as retraining technicians and reconfiguring maintenance facilities for new equipment can incur millions in expenses. Furthermore, losing volume discounts on large fleet purchases, which could amount to millions annually for a company of Herc's size, further entrenches supplier power. This financial disincentive to switch makes it more challenging for Herc to negotiate aggressive pricing from new vendors.

The threat of forward integration by suppliers, while present, is somewhat mitigated by the capital intensity of the rental business. However, major manufacturers could potentially enter the direct rental market, especially in lucrative segments. Given that the global construction equipment market was valued at approximately $215 billion in 2023, the incentive for manufacturers to capture more of the value chain is considerable, potentially increasing their bargaining power by offering direct rental solutions.

The availability of substitute equipment is generally good for standard items, which limits supplier power in those segments. However, for highly specialized or technologically advanced equipment, substitutes are fewer, increasing the bargaining power of those specific suppliers. In 2023, the overall equipment rental market reached about $100 billion, but the availability of direct alternatives varies significantly by equipment type.

| Factor | Impact on Herc Rentals | Supplier Bargaining Power |

|---|---|---|

| Supplier Concentration & Uniqueness of Equipment | High reliance on specific manufacturers for advanced machinery | Moderate to High |

| Switching Costs (Training, Facilities) | Significant financial and operational hurdles to change suppliers | Moderate to High |

| Threat of Forward Integration | Potential for manufacturers to enter rental market directly | Low to Moderate |

| Availability of Substitutes | High for standard equipment, low for specialized machinery | Low for standard, Moderate to High for specialized |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Herc Rentals, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a visual, easy-to-understand breakdown of each Porter's Five Force.

Customers Bargaining Power

Herc Rentals' customer base is quite diverse, serving a wide array of industries including construction, industrial, and infrastructure. While they cater to many smaller clients, a significant portion of their revenue is generated from larger, repeat customers in these sectors. This means that while no single customer dominates, the concentration of business with key industrial clients does grant them some bargaining power.

Herc Rentals operates in a market where switching costs for customers are generally low. This means that if a customer is unhappy with Herc Rentals' pricing, service, or equipment availability, they can often find another equipment rental provider with relative ease. For instance, in 2024, the equipment rental industry is highly competitive, with numerous national and regional players offering similar product lines.

The accessibility of alternative rental companies and the lack of significant specialized integration with Herc Rentals' services further empower customers. This ease of transition means customers can readily compare offers and shift their business if they perceive better value elsewhere, directly impacting Herc Rentals' pricing power and customer retention strategies.

Herc Rentals customers exhibit varying degrees of price sensitivity. For smaller contractors, equipment rental costs can represent a significant portion of their project budget, making them more inclined to seek out lower prices. For instance, in 2024, the average project budget for a small to medium-sized construction firm might range from $50,000 to $500,000, meaning a 10% increase in rental costs could impact their bottom line by $5,000 to $50,000.

The availability of alternative rental providers or the feasibility of purchasing equipment outright also influences this sensitivity. If competitors offer similar equipment at substantially lower rates, or if a customer anticipates needing the equipment for an extended period, they may be less loyal to a single provider and more driven by price. This dynamic is particularly relevant in markets with a high concentration of rental companies.

Availability of Substitute Services/Products for Customers

The availability of substitute services and products significantly impacts Herc Rentals' bargaining power with its customers. If customers can easily obtain similar equipment through other rental companies, purchasing, or even long-term leasing, their ability to negotiate favorable terms with Herc increases. This is particularly relevant in markets where equipment needs are standardized and readily available from multiple sources.

For instance, the rise of the sharing economy and the option for businesses to buy their own equipment can present strong alternatives to renting. In 2024, the equipment rental market continues to see competition from various players, including specialized rental firms and even manufacturers offering direct rental or leasing options. This competitive landscape means customers often have choices beyond a single provider.

- Customer Alternatives: Customers can choose to purchase equipment outright, enter long-term lease agreements, or utilize services from competing equipment rental companies.

- Market Dynamics: The presence of numerous competitors and evolving business models, such as the sharing economy, provides customers with viable alternatives to traditional equipment rentals.

- Impact on Bargaining Power: A wide array of substitutes empowers customers by giving them leverage to negotiate prices and terms, as they can switch to a competitor if Herc Rentals' offerings are not satisfactory.

Customer's Ability to Backward Integrate

The ability of Herc Rentals' customers to backward integrate, meaning they could potentially acquire their own equipment fleets, significantly influences their bargaining power. If a substantial portion of Herc's customer base, particularly larger construction firms or industrial clients, finds it economically viable to own and maintain their equipment, they become less dependent on rental services. This independence allows them to negotiate more favorable terms or even walk away from rental agreements.

Consider the capital expenditure involved. For a large contractor, the upfront cost of purchasing a fleet comparable to what Herc offers could be substantial, potentially running into tens or hundreds of millions of dollars depending on the scale and type of equipment. However, if utilization rates are consistently high, the total cost of ownership might eventually rival or even undercut rental expenses over the long term.

For instance, if a major customer requires a specific type of heavy machinery for a prolonged project, the decision to rent versus buy becomes a critical financial calculation. In 2024, the average cost of a new excavator could range from $100,000 to over $500,000. For a customer needing multiple units for several years, owning might become a strategic consideration, thereby strengthening their position when negotiating rental rates with Herc.

- Customer Integration Threat: The potential for customers to purchase and manage their own equipment fleets directly impacts Herc Rentals' pricing power.

- Economic Viability: For large clients, the cost-benefit analysis of owning versus renting is a key determinant of their ability to backward integrate.

- Fleet Size and Utilization: High utilization rates and the need for specialized or extensive equipment fleets can make self-ownership a more attractive option for customers.

Herc Rentals faces moderate bargaining power from its customers. This is primarily due to the availability of numerous alternative rental providers and the relatively low switching costs involved in changing suppliers. Customers can easily compare pricing and service offerings from competitors, which limits Herc's ability to dictate terms and pricing. For example, in 2024, the competitive landscape of the equipment rental market means customers have a wide array of choices, from national players to regional specialists.

The potential for customers to purchase equipment outright or enter long-term leases also serves as a significant check on Herc's pricing power. For larger clients, especially those with consistent and high equipment utilization needs, the total cost of ownership over an extended period can become comparable to or even less than rental expenses. This economic consideration empowers them to negotiate more aggressively or seek alternative solutions, directly impacting Herc's revenue and market position.

| Factor | Description | Impact on Herc Rentals |

|---|---|---|

| Customer Alternatives | Availability of competing rental companies, equipment purchase options, and long-term leasing. | Moderate to High |

| Switching Costs | Low costs for customers to change rental providers. | Moderate to High |

| Price Sensitivity | Varies by customer size; smaller clients are more price-sensitive. | Moderate |

| Backward Integration Potential | Ability of large customers to acquire their own equipment fleets. | Moderate |

Same Document Delivered

Herc Rentals Porter's Five Forces Analysis

This preview showcases the complete Herc Rentals Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. You're viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring you receive all the insights without any surprises. This comprehensive analysis is ready for immediate use, providing a thorough understanding of Herc Rentals' industry dynamics.

Rivalry Among Competitors

The equipment rental industry is characterized by a significant number of competitors, ranging from large national giants like United Rentals and Sunbelt Rentals to a multitude of smaller regional and local operators. This fragmented landscape means Herc Rentals faces rivalry from entities of varying sizes and market reach.

For instance, as of early 2024, United Rentals reported over $14 billion in total revenue for 2023, while Sunbelt Rentals, a subsidiary of Ashtead Group, also operates on a massive scale. The presence of these substantial players, alongside numerous smaller firms, intensifies competitive pressures across the sector.

A higher concentration of competitors, particularly those of similar size and capability, generally leads to more aggressive pricing strategies and a greater need for differentiation. This dynamic directly impacts Herc Rentals' ability to capture market share and maintain profitability.

The equipment rental industry is experiencing robust growth. For instance, the global equipment rental market was valued at approximately $117.7 billion in 2023 and is projected to reach $174.4 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.7% during this period. This expansion suggests a dynamic market rather than a stagnant one, which can temper the intensity of competitive rivalry as companies focus on capturing new opportunities.

Herc Rentals focuses on differentiating its services beyond just equipment rental. They offer value-added services such as advanced fleet management, on-site maintenance, and specialized training programs designed to enhance customer productivity and safety. This strategic approach aims to reduce reliance on pure price competition, as seen in the industry where undifferentiated services often lead to intense price wars.

Exit Barriers for Competitors

Herc Rentals faces moderate exit barriers in the equipment rental industry. While the company's specialized assets and significant capital investments in its fleet can make it costly for individual competitors to divest entirely, the industry's generally liquid nature for many asset classes mitigates extreme lock-in. For instance, while a large, specialized piece of construction equipment might be difficult to sell quickly at full value, many standard rental items can be repurposed or sold through established secondary markets, reducing the severity of exit costs for smaller or less specialized players.

The presence of long-term leases and service contracts can create some sticky exit barriers, compelling competitors to remain operational to fulfill these obligations. However, the overall capital intensity of the rental business means that even when exiting, companies often incur substantial costs related to asset depreciation and disposal. This can encourage a more gradual withdrawal rather than an immediate cessation of operations.

The competitive rivalry is therefore influenced by these factors, as competitors may be hesitant to leave the market abruptly due to the costs involved, potentially prolonging periods of intense competition even when market conditions are unfavorable. This dynamic can lead to price pressures and a need for operational efficiency to maintain profitability.

Diversity of Competitors

The equipment rental industry is characterized by a wide array of competitors, each with distinct strategies, objectives, and market origins. This diversity means Herc Rentals faces rivalry not only from large, publicly traded corporations with extensive resources but also from privately held regional operators and specialized niche providers focusing on specific equipment types or industries.

This varied competitive landscape can result in unpredictable market dynamics and intensified rivalry. For instance, a large competitor might pursue aggressive pricing strategies to gain market share, while a niche player could focus on superior customer service or highly specialized equipment, creating different competitive pressures.

As of early 2024, the equipment rental market is robust, with major players like United Rentals and Sunbelt Rentals (part of Ashtead Group) holding significant market shares. Herc Rentals, while a substantial player, operates within this dynamic environment where strategic differentiation is key.

- Publicly Traded Giants: Companies like United Rentals and Sunbelt Rentals, with revenues in the billions, leverage economies of scale and broad geographic reach.

- Privately Held Regional Players: These firms often have deep local market knowledge and strong customer relationships within their operating areas.

- Specialized Niche Providers: Competitors focusing on specific equipment categories, such as aerial work platforms or dewatering solutions, offer deep expertise and tailored services.

Herc Rentals operates in a highly competitive equipment rental market, facing rivalry from large national players like United Rentals and Sunbelt Rentals, as well as numerous regional and specialized firms. This broad competitive base means Herc must constantly innovate and differentiate its offerings to maintain its market position.

The industry's growth, with the global market valued at approximately $117.7 billion in 2023 and projected to reach $174.4 billion by 2030, fuels this rivalry as companies vie for market share. Herc's strategy of offering value-added services, such as advanced fleet management and on-site maintenance, aims to counter aggressive pricing from competitors and build customer loyalty.

| Competitor | 2023 Revenue (Approx.) | Key Differentiators |

|---|---|---|

| United Rentals | $14+ billion | Scale, broad fleet, national reach |

| Sunbelt Rentals (Ashtead Group) | Significant (part of Ashtead Group) | Scale, broad fleet, international presence |

| Herc Rentals | $2.3 billion (2023) | Value-added services, specialized solutions |

SSubstitutes Threaten

The direct purchase of equipment presents a significant threat of substitution for Herc Rentals. For large construction firms or industrial clients undertaking long-term projects, the total cost of ownership for purchased equipment can become more economical than sustained rental agreements. This is particularly true when considering the depreciation schedules and potential resale value of assets.

The threat of substitutes for Herc Rentals' equipment rental services includes long-term leasing agreements. These arrangements can provide businesses with predictable costs and access to up-to-date machinery, bypassing the significant upfront investment required for outright purchase. For operations requiring equipment over an extended period, leasing often presents a more appealing alternative than frequent short-term rentals.

Shared economy models, particularly peer-to-peer rentals, represent a growing threat of substitutes for Herc Rentals, especially concerning smaller tools and specialized equipment. These platforms allow individuals and businesses to rent equipment directly from each other, often at competitive prices. For instance, the growth of online marketplaces for equipment rental in 2024 indicates a rising trend where users can bypass traditional rental companies.

Manual Labor or Alternative Methods

The threat of substitutes for Herc Rentals' equipment is present when customers can achieve similar outcomes through manual labor or alternative processes. For example, certain construction or demolition tasks might be feasible with less reliance on heavy machinery, potentially impacting demand for specific rental items.

This substitution risk is particularly relevant in industries where labor costs are a significant factor or where technological advancements offer entirely new ways to accomplish tasks. While Herc Rentals offers efficiency and scale, the availability of cheaper or more accessible alternatives can pose a challenge.

- Manual labor can be a substitute for equipment rental in tasks like smaller-scale landscaping or minor demolition projects, especially in regions with lower labor costs.

- Alternative construction methods, such as pre-fabricated components or advanced building materials, might reduce the need for heavy lifting and earth-moving equipment.

- The cost-effectiveness of manual labor versus equipment rental fluctuates based on project size, duration, and local wage rates, influencing customer decisions.

Outsourcing Services Requiring Equipment

The threat of substitutes for Herc Rentals arises when customers opt to outsource entire tasks, like specific construction phases or landscaping, to third-party service providers who already possess the necessary equipment. This bypasses the need for Herc's rental services altogether.

For instance, a large commercial developer might contract a specialized firm for all excavation and site preparation, rather than renting excavators and bulldozers from Herc. This trend is amplified by the increasing availability of integrated service providers who offer end-to-end solutions.

- Outsourcing Integration: Customers may prefer a single vendor for a project phase, reducing complexity and management overhead.

- Equipment Ownership by Service Providers: Many specialized service companies maintain their own fleets, making them a direct substitute for rental customers.

- Cost-Benefit Analysis: For certain projects, the total cost of outsourcing the task, including equipment and labor, can be competitive with or lower than renting equipment and managing the work internally.

The threat of substitutes for Herc Rentals is significant, encompassing direct equipment purchase, long-term leasing, and the burgeoning shared economy. Customers can bypass rental services by acquiring equipment outright, especially for extended project durations where ownership becomes more economical due to depreciation and resale value. Leasing also offers a predictable cost structure and access to modern machinery, an attractive alternative to short-term rentals.

The rise of peer-to-peer rental platforms in 2024, particularly for smaller tools and specialized equipment, presents a competitive challenge by offering direct rentals between users often at lower price points. Furthermore, the option to outsource entire project phases to specialized service providers who own their equipment directly substitutes for Herc's rental offerings, especially when these providers can offer integrated, end-to-end solutions.

| Substitute Option | Key Advantage for Customer | Impact on Herc Rentals |

|---|---|---|

| Direct Equipment Purchase | Long-term cost savings, asset ownership | Reduced demand for rental of owned equipment |

| Long-Term Leasing | Predictable costs, access to new equipment | Loss of potential long-term rental revenue |

| Shared Economy/P2P Rentals | Potentially lower cost, accessibility for smaller needs | Competition for smaller projects and specialized items |

| Outsourcing Task Completion | Simplified project management, fixed costs | Elimination of rental need for specific project phases |

Entrants Threaten

Entering the equipment rental market, especially for heavy machinery like Herc Rentals operates in, demands significant capital. Companies need to invest heavily in acquiring a diverse and modern fleet, which can easily run into millions of dollars. For instance, a single piece of heavy construction equipment can cost upwards of $500,000, and rental companies need hundreds, if not thousands, of such assets.

Beyond just the machinery, substantial funds are also required for establishing and maintaining physical infrastructure. This includes setting up well-equipped maintenance facilities to keep the fleet operational and building an extensive network of branches to serve a wide geographic area. These upfront costs create a formidable barrier for potential new entrants, limiting the competitive threat.

Herc Rentals benefits significantly from economies of scale, enabling bulk purchasing discounts from equipment manufacturers and optimizing maintenance operations. For instance, in 2023, Herc Rentals reported total revenues of $3.4 billion, indicating a substantial operational footprint that allows for greater bargaining power and cost efficiencies compared to smaller, emerging competitors.

New entrants would find it challenging to replicate Herc Rentals' cost advantages derived from their extensive network and high asset utilization. The sheer volume of equipment Herc Rentals manages translates into lower per-unit operating costs, a barrier that new companies would struggle to overcome without substantial initial investment and time to build similar scale.

Herc Rentals benefits from strong brand loyalty and a solid reputation built over many years. This established trust makes it difficult for new companies to gain a foothold. For instance, in 2023, Herc Rentals reported total revenues of $2.3 billion, showcasing its significant market presence and customer base that new entrants would struggle to replicate quickly.

Access to Distribution Channels and Locations

The threat of new entrants concerning Herc Rentals' access to distribution channels and locations is moderate. Herc operates a vast network of over 270 branches across North America, a significant capital investment for any newcomer to replicate. Acquiring prime real estate, obtaining necessary permits, and building out infrastructure represent substantial upfront costs.

New companies face considerable challenges in matching Herc's established physical presence and the logistical advantages it provides. This extensive footprint allows Herc to serve a wide geographic area efficiently, a critical factor in the equipment rental industry.

Key barriers include:

- Capital Investment: The substantial cost of acquiring and developing numerous rental locations.

- Geographic Reach: The difficulty for new entrants to quickly establish a comparable network across diverse markets.

- Regulatory Hurdles: Navigating local zoning laws and obtaining permits for each new branch.

Regulatory Hurdles and Permits

The equipment rental industry, especially for heavy machinery and transportation, is subject to a complex web of regulatory hurdles. New entrants must secure various licenses, permits, and adhere to stringent safety regulations, which can be a significant barrier. For instance, operating commercial vehicles often requires specific DOT (Department of Transportation) registrations and compliance with hours-of-service rules, adding layers of complexity and cost for those just starting out.

Navigating these requirements is not only time-consuming but also financially burdensome. Obtaining necessary certifications for equipment handling, transportation permits for oversized loads, and environmental compliance documentation can easily run into thousands of dollars before a single rental transaction can occur. This financial and administrative overhead acts as a substantial deterrent for potential new competitors looking to enter Herc Rentals' market.

- Licenses and Permits: Obtaining general business licenses, specialized equipment operation permits, and transportation authorities can be a lengthy and costly process.

- Safety Regulations: Compliance with OSHA (Occupational Safety and Health Administration) standards for equipment handling and operator training is mandatory, requiring investment in safety protocols and training programs.

- Environmental Compliance: Regulations concerning emissions, waste disposal, and spill prevention for certain types of equipment add further complexity and potential capital expenditure for new entrants.

- Transportation Logistics: Specific permits for transporting heavy or oversized equipment, often requiring route surveys and escort vehicles, increase operational costs and logistical challenges for new companies.

The threat of new entrants for Herc Rentals is generally considered moderate. Significant capital investment is required to build a competitive fleet and establish a widespread branch network, a barrier that discourages many potential competitors. For instance, Herc Rentals reported total revenues of $3.4 billion in 2023, indicating the scale of operations necessary to compete effectively.

While the initial capital outlay is high, the established brand reputation and economies of scale enjoyed by Herc Rentals also present challenges for newcomers. Overcoming these factors requires substantial time and resources, further limiting the immediate threat from new entrants entering the equipment rental market.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | Acquiring a diverse fleet and establishing a branch network requires millions of dollars. | High barrier, demanding significant upfront funding. |

| Economies of Scale | Herc Rentals' large operational size allows for bulk purchasing and cost efficiencies. | New entrants struggle to match cost advantages without similar scale. |

| Brand Reputation | Herc Rentals benefits from years of established trust and customer loyalty. | Difficult for new companies to quickly gain market share and customer confidence. |

| Geographic Reach | Herc Rentals operates over 270 branches across North America. | Replicating this extensive network is costly and time-consuming. |

| Regulatory Compliance | Navigating licenses, permits, and safety regulations adds complexity and cost. | Adds financial and administrative burden, slowing market entry. |

Porter's Five Forces Analysis Data Sources

Our Herc Rentals Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports, investor presentations, and industry-specific market research from firms like IBISWorld. We also leverage public financial data from SEC filings and macroeconomic indicators to provide a robust assessment of the competitive landscape.