Herc Rentals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herc Rentals Bundle

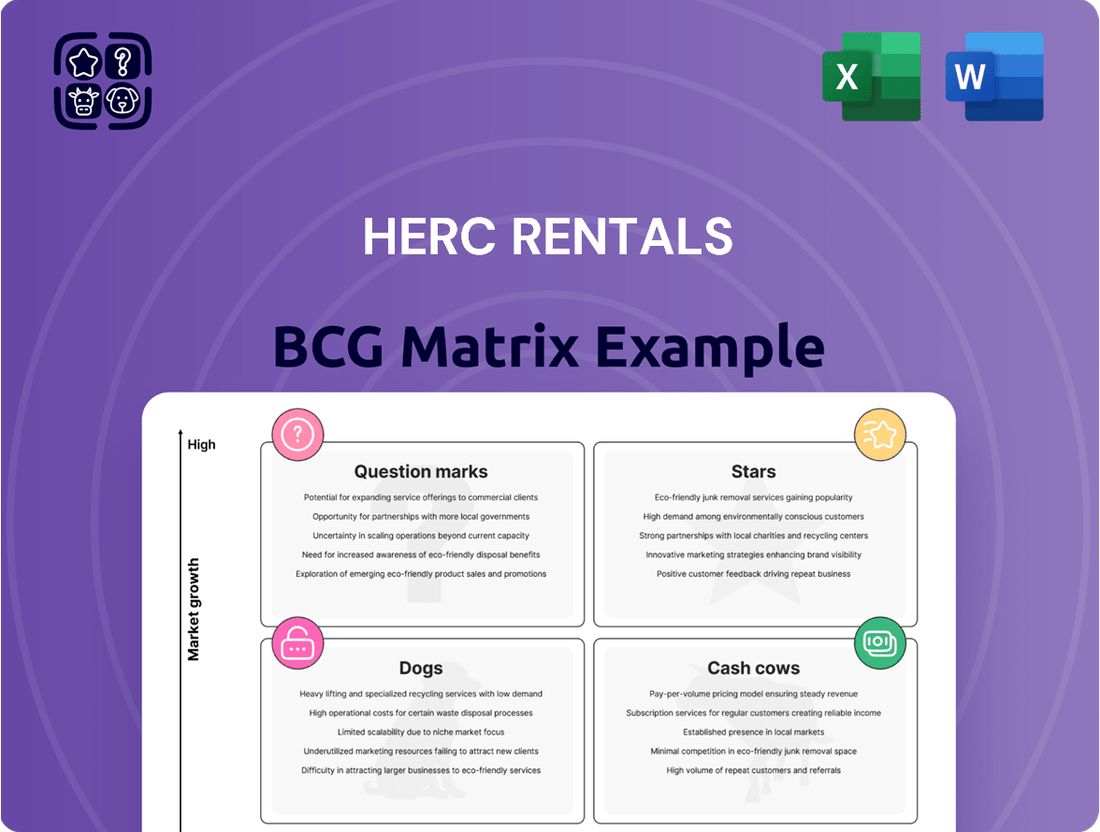

Curious about Herc Rentals' strategic positioning? Our BCG Matrix preview highlights which segments are driving growth and which might need a closer look. Understand their current market share and growth potential at a glance.

Don't miss out on the full picture! Purchase the complete Herc Rentals BCG Matrix to unlock detailed quadrant analysis, identify key growth drivers, and uncover actionable strategies for optimizing their rental fleet and service offerings. It's your roadmap to smarter investment decisions.

Stars

Herc Rentals is leveraging substantial federal and private investment flowing into large-scale construction initiatives. These include the booming data center sector, reshoring manufacturing operations, and the development of Liquefied Natural Gas (LNG) facilities.

These substantial 'mega projects' define a high-growth market where Herc is strategically securing a specific portion of available work. The company is also actively growing its national account relationships to support these large endeavors.

This targeted approach is anticipated to fuel sustained growth for Herc Rentals throughout 2025 and into the foreseeable future, capitalizing on the strong demand for rental equipment in these key infrastructure areas.

Specialty Equipment Rentals is a star in Herc Rentals' BCG Matrix, showing strong growth and a high market share. This segment is a major revenue driver, consistently outperforming other business areas. Herc's strategic focus on expanding its specialty fleet, particularly for large-scale projects, highlights its commitment to this lucrative and expanding niche.

Herc Rentals' acquisition of H&E Equipment Services, their largest to date, positions the company as a significant player in the industry. This move, which adds 622 locations across North America to Herc's network, is a clear indicator of Herc's ambition to move its equipment rental services into a question mark or potentially a star category within the BCG matrix. The expanded geographic reach and fleet size are designed to capture greater market share and build density in crucial markets.

North American Market Expansion and Density

Herc Rentals is actively expanding its presence across North America, focusing on key urban centers to enhance its operational efficiency and market penetration. This strategy involves both acquiring existing businesses and establishing new, strategically located branches.

The company's expansion efforts are geared towards building density within its network, which is crucial for capturing greater market share and realizing revenue synergies. By increasing the number of locations in high-demand areas, Herc aims to improve its ability to serve a wider customer base and optimize logistical operations.

- Strategic Acquisitions and Greenfield Openings: Herc Rentals continues to pursue a dual approach of acquiring established rental companies and opening new greenfield locations to broaden its reach.

- Focus on Urban Markets: The company prioritizes expansion in major metropolitan areas, recognizing these as hubs for significant economic activity and rental demand.

- Building Network Density: This expansion is designed to create a denser network of branches, enabling more efficient service delivery and increased market share.

- Revenue Efficiency and Market Share Growth: The overarching goal is to improve revenue generation and solidify Herc's position in the North American equipment rental sector, which saw substantial growth in 2024, with the overall market expected to reach over $70 billion.

Advanced Digital Capabilities and Telematics

Herc Rentals is significantly investing in advanced digital capabilities, a key driver for its position in the equipment rental market. Their commitment is clearly shown through innovations like ProControl by Herc Rentals™, a telematics platform designed to boost customer efficiency. This focus on data-driven solutions not only supports operational excellence for clients but also solidifies Herc's competitive edge.

The telematics technology integrated into Herc's fleet provides crucial operational insights. For instance, by the end of 2024, a substantial portion of their fleet is expected to be equipped with telematics, offering real-time data on equipment usage, location, and performance. This allows for proactive maintenance and optimized deployment, directly impacting customer productivity and reducing downtime.

- Digital Investment: Herc Rentals' commitment to advanced digital capabilities, exemplified by ProControl by Herc Rentals™, underscores its strategy to enhance customer efficiency.

- Telematics Integration: The company is actively equipping its fleet with telematics, providing valuable data for operational insights and improved asset management.

- Competitive Advantage: This technological leadership positions Herc Rentals favorably in a market where digital solutions and data analytics are increasingly valued.

- Customer Support: By leveraging data and telematics, Herc Rentals aims to offer superior support, helping clients achieve their operational and financial goals.

Specialty Equipment Rentals is a star for Herc Rentals, demonstrating robust growth and a commanding market share. This segment is a primary revenue generator, consistently outperforming other business units. Herc's strategic expansion of its specialty fleet, particularly for large-scale projects, reinforces its commitment to this expanding niche.

The company's significant investment in digital capabilities, including ProControl by Herc Rentals™, highlights its focus on enhancing customer efficiency. By the close of 2024, a substantial portion of Herc's fleet is expected to be telematics-equipped, providing real-time data for optimized asset management and improved customer productivity.

Herc Rentals' strategic acquisitions and expansion into key urban markets are building network density, aiming to capture greater market share. This growth strategy, coupled with their technological advancements, positions them strongly in the North American equipment rental sector, which experienced considerable growth in 2024.

| Segment | Growth Rate | Market Share | Herc's Position |

|---|---|---|---|

| Specialty Equipment Rentals | High | High | Star |

| National Accounts | High | Growing | Potential Star |

| Urban Market Expansion | High | Increasing | Developing Star |

What is included in the product

This analysis categorizes Herc Rentals' offerings, identifying which segments offer high growth and market share (Stars) versus those that are cash-generating but mature (Cash Cows).

It also addresses underperforming units (Dogs) and those with high potential but low share (Question Marks), guiding strategic investment decisions.

A clear BCG Matrix visualizes Herc Rentals' portfolio, alleviating the pain of resource allocation uncertainty.

Cash Cows

Herc Rentals' core equipment rental fleet, a vast collection including aerial lifts, earthmoving machinery, material handling equipment, and general tools, clearly fits the Cash Cow quadrant. This segment boasts a high market share within a mature industry.

In 2024, Herc Rentals reported strong performance in its equipment rental segment, which is largely driven by this core fleet. The company's strategic focus on maintaining and modernizing this fleet ensures its continued ability to generate consistent and significant revenue.

Herc Rentals' established national account business is a prime example of a cash cow. This segment consistently generates substantial revenue, underpinned by stable demand from long-term partnerships and significant federal and private funding for ongoing large-scale projects.

The predictable cash flow from these national accounts requires relatively minimal new investment for maintenance, allowing Herc to leverage this segment for capital generation. For instance, in 2023, Herc reported total revenue of $3.4 billion, with its national accounts contributing a significant portion due to their recurring nature and the scale of projects they support.

Herc Rentals' overall equipment rental revenue is a clear Cash Cow. The company achieved record revenue levels in 2024, with this strong performance continuing into 2025, demonstrating sustained growth in its core rental operations. This robust revenue stream signifies Herc's dominant market position and its ability to consistently generate substantial cash flow.

Value-Added Services (Maintenance & Repair)

Herc Rentals' maintenance and repair services function as a classic Cash Cow within its business portfolio. This segment thrives in a mature market, demanding minimal growth investment due to its established customer base and operational efficiency.

These services are crucial for maintaining the rental fleet's readiness, but they also generate a steady, high-margin revenue stream. In 2024, Herc Rentals continued to leverage these offerings, contributing significantly to the company's overall profitability by capitalizing on the inherent demand for reliable equipment upkeep.

- Stable Revenue: Maintenance and repair services provide a predictable income, insulating Herc from the cyclical nature of pure equipment rental.

- High Margins: The expertise and specialized nature of these services allow for strong profit margins, bolstering overall financial performance.

- Fleet Support: Essential for operational efficiency, these services ensure the rental fleet remains in optimal condition, reducing downtime.

- Mature Market Dominance: Herc's established presence in this segment allows it to command a significant share of a stable, less volatile market.

Efficient Fleet Utilization

Herc Rentals excels in maintaining a high dollar utilization rate for its rental fleet. This efficiency in managing and deploying assets is crucial in the competitive equipment rental industry.

This strong utilization translates directly into consistent revenue generation. By optimizing the use of its existing equipment, Herc Rentals ensures it's getting the most out of its investments, bolstering its cash flow.

- Dollar Utilization Rate: Herc Rentals consistently aims for and achieves robust dollar utilization rates, a key indicator of efficient fleet management.

- Competitive Market: Operating in an established yet competitive rental market, high utilization is vital for sustained profitability.

- Revenue Generation: Efficient fleet deployment directly contributes to predictable and strong revenue streams.

- Asset Optimization: Maximizing the use of its equipment base allows Herc Rentals to generate optimized returns on its capital investments.

Herc Rentals' core equipment rental fleet, encompassing aerial lifts, earthmoving machinery, and general tools, represents a significant Cash Cow. This segment holds a high market share in a mature industry, consistently generating substantial revenue with minimal reinvestment needs.

The company's national account business is another prime example of a Cash Cow, characterized by stable demand and recurring revenue from long-term partnerships. In 2023, Herc Rentals reported total revenue of $3.4 billion, with national accounts playing a crucial role in this consistent cash generation.

Herc Rentals' maintenance and repair services also operate as a Cash Cow, benefiting from a mature market and an established customer base. These high-margin services ensure fleet readiness and contribute significantly to overall profitability, as seen in their strong performance in 2024.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) |

| Core Equipment Rental Fleet | Cash Cow | High market share, mature industry, consistent revenue | Significant portion of total revenue |

| National Accounts | Cash Cow | Stable demand, long-term partnerships, recurring revenue | Substantial recurring revenue |

| Maintenance & Repair Services | Cash Cow | High margins, established customer base, fleet support | Contributes to overall profitability |

What You See Is What You Get

Herc Rentals BCG Matrix

The Herc Rentals BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a ready-to-use report for immediate application in your business planning.

Dogs

Herc Rentals' Cinelease studio entertainment business is classified as a 'Dog' in the BCG matrix. This segment has been experiencing losses and is currently held for sale, signifying its position as a low-growth, low-market-share operation that Herc is actively divesting from.

The unit's performance indicates it is a cash consumer without substantial returns, a characteristic typical of 'Dog' businesses that companies aim to shed to reallocate resources more effectively. For example, in 2023, Herc reported a pre-tax loss of $17 million specifically for its studio entertainment segment, underscoring its underperformance.

Segments within Herc Rentals' local market that are particularly sensitive to sustained high interest rates, such as certain types of commercial construction and infrastructure projects, have shown signs of deceleration. This slowdown translates into a lower growth environment for these specific areas.

When customers postpone or scale back projects due to financing costs, it directly impacts Herc Rentals by reducing demand for equipment. This can lead to lower utilization rates for their assets in these interest-rate sensitive sub-markets, potentially affecting market share if competitors are less exposed to these segments.

For instance, in 2024, the U.S. construction industry, while generally resilient, has seen some project delays attributed to higher borrowing costs, impacting sectors like non-residential construction more than others.

Older, less utilized general rental equipment often falls into the 'Dog' category within Herc Rentals' portfolio. These are items like basic scaffolding or older model generators that see less frequent rental compared to specialized equipment. In 2024, Herc Rentals, like many in the industry, faces the challenge of managing a fleet where a portion of general equipment might have lower dollar utilization rates, potentially impacting overall fleet efficiency.

These assets, while necessary for a comprehensive offering, can tie up valuable capital in a low-growth, low-return environment. The ongoing costs of maintenance, storage, and depreciation for such equipment can outweigh the revenue generated, especially if demand is consistently low. This situation requires careful analysis to determine if continued investment in maintaining these older assets is strategically sound.

Underperforming Legacy Branches

Underperforming legacy branches in low-growth regions can be classified as Dogs in Herc Rentals' BCG Matrix. These locations might consume significant resources without yielding proportional market share gains or robust revenue. For instance, if a branch in a declining industrial area shows a revenue growth rate of 1% compared to Herc's overall 2024 revenue growth of approximately 10%, it would likely fall into this category.

These branches may require strategic evaluation for potential divestment or significant restructuring to improve their performance. Without such actions, they can become a drain on overall profitability. Herc's focus on network optimization suggests a proactive approach to identifying and addressing these underperforming assets.

- Low Growth: Branches in geographical areas with economic stagnation or population decline.

- Market Share Erosion: Locations where Herc's market share is either stagnant or decreasing.

- Profitability Concerns: Branches that consistently report lower profit margins compared to company averages.

Certain Commoditized Equipment Lines

Certain commoditized equipment lines, such as basic scaffolding or standard portable toilets, could be considered Dogs within Herc Rentals' BCG Matrix. These segments often face intense pricing pressures due to widespread availability and minimal product differentiation, leading to lower market share and potentially slim profit margins.

For instance, while specific 2024 market share data for these niche commoditized segments within Herc Rentals isn't publicly detailed, the broader equipment rental market experienced significant competition. In 2023, the general equipment rental industry in North America generated approximately $74.4 billion in revenue, according to the American Rental Association. This indicates a large, competitive landscape where commoditized items struggle to stand out.

- Low Market Share: These items likely hold a small percentage of the overall market for their specific type due to intense competition.

- Intense Pricing Pressure: Competitors often drive down prices for commoditized equipment, squeezing profit margins.

- Minimal Differentiation: The equipment itself offers little unique value, making it difficult to command premium pricing.

- Low Profitability: Despite contributing to fleet size, these lines may contribute minimally to overall profit due to low margins and high competition.

Herc Rentals' Cinelease studio entertainment business is a prime example of a 'Dog' within the BCG matrix. This segment has been divested, highlighting its status as a low-growth, low-market-share operation that consumed resources without substantial returns. In 2023, this segment incurred a pre-tax loss of $17 million, underscoring its underperformance and the strategic decision to exit this market.

Older, less utilized general rental equipment also fits the 'Dog' profile. These items, like basic scaffolding, often have lower dollar utilization rates, impacting overall fleet efficiency. Managing these assets requires careful consideration of maintenance and storage costs against the revenue they generate, especially in a competitive market where differentiation is minimal.

Underperforming legacy branches in economically stagnant regions can also be classified as 'Dogs'. These locations may consume resources without significant market share gains. For instance, a branch with 1% revenue growth in 2024, compared to Herc's overall growth of approximately 10%, would likely be considered a 'Dog' requiring strategic evaluation or divestment.

Certain commoditized equipment lines, such as basic scaffolding, face intense pricing pressure due to widespread availability and lack of differentiation. This leads to low market share and slim profit margins, as seen in the highly competitive North American equipment rental market which generated approximately $74.4 billion in revenue in 2023.

| BCG Category | Herc Rentals Segment Example | Characteristics | Financial Indicator (2023/2024) |

|---|---|---|---|

| Dog | Cinelease Studio Entertainment | Low growth, low market share, cash consumer | $17 million pre-tax loss (2023) |

| Dog | Older General Rental Equipment | Low utilization, high maintenance costs, low differentiation | Lower dollar utilization rates in 2024 for basic items |

| Dog | Underperforming Legacy Branches | Low regional growth, stagnant or declining market share | 1% revenue growth vs. ~10% company average (2024 est.) |

| Dog | Commoditized Equipment Lines (e.g., basic scaffolding) | Intense price competition, minimal differentiation, low margins | Part of a highly competitive $74.4 billion market (2023) |

Question Marks

Herc Rentals is strategically expanding by opening new greenfield locations. These are essentially new market entries where Herc starts with a minimal market share but anticipates significant growth potential in those specific geographic areas. This approach is crucial for capturing future market dominance.

These new sites demand considerable upfront investment. Herc must fund the construction, staffing, and initial inventory to establish a strong presence and begin capturing market share. For example, in 2024, Herc continued its aggressive greenfield expansion, opening numerous new locations across the United States, particularly in high-growth Sun Belt states.

Herc Rentals' acquisition of H&E Equipment Services, while strategically positioning Herc as a long-term Star, currently presents as a Question Mark due to immediate financial impacts. The integration process, including associated dis-synergies, resulted in reported net losses for both the first and second quarters of 2025. This scenario reflects high cash consumption with currently low returns, necessitating significant investment to unlock its future potential.

Herc Rentals is actively investing in and enhancing its digital capabilities and telematics, exemplified by its ProControl system. This strategic move suggests an exploration into new, technology-driven service lines that cater to evolving customer needs in the rental equipment sector.

These innovative solutions are entering markets experiencing significant growth, but Herc's current market share within these specific emerging technology offerings might still be in its nascent stages. This necessitates continued investment to achieve substantial scaling and solidify its competitive position.

Expansion into New End-Markets via Cross-selling

Herc Rentals aims to boost growth by offering its expanded specialty equipment and services to new customer groups, a strategy that aligns with the Stars or Question Marks in a BCG Matrix depending on market share and growth. This cross-selling approach leverages existing capabilities into potentially lucrative, yet less penetrated, areas.

While these new end-markets present significant growth opportunities, Herc's penetration is likely minimal at this stage. For instance, if Herc is targeting the burgeoning renewable energy construction sector with its specialized aerial equipment, its market share in that specific niche might be under 5% initially, necessitating focused sales efforts and potentially new partnerships.

- Leveraging Specialty Fleet: Herc's investment in specialized equipment, such as advanced aerial work platforms or complex earthmoving machinery, provides a competitive edge for cross-selling into niche industries.

- Acquisition Integration: Recent acquisitions, like the one of a specialized tunneling equipment provider in late 2023, directly enable entry into new end-markets and customer segments previously inaccessible.

- Market Penetration Challenge: Gaining traction in these new segments requires substantial investment in targeted marketing and sales, as initial market share is expected to be low, potentially placing these ventures in the Question Mark quadrant of the BCG matrix.

- Growth Potential: The targeted end-markets, such as infrastructure projects or specialized industrial maintenance, often exhibit higher growth rates than traditional rental markets, offering a strong rationale for strategic expansion.

Repurposing General Rental Branches into ProSolutions Facilities

Herc Rentals' strategic move to repurpose general rental branches into ProSolutions facilities is a clear play for future growth, aligning with a Stars or Question Marks quadrant in a BCG-like analysis. This initiative targets high-demand specialty equipment, indicating a focus on segments with significant potential. The company is investing heavily in this transformation, recognizing the need for specialized capacity.

The market share for these newly specialized ProSolutions locations within their specific niches is currently low. However, the key driver for this strategy is the high growth prospect associated with these specialty equipment markets. For example, Herc’s ProSolutions segment reported substantial growth in 2023, with revenue increasing by 18.6% year-over-year, reaching $771 million, demonstrating the market's responsiveness to specialized offerings.

- Focus on High-Demand Niches: Repurposing aims to capture growth in specialty equipment sectors.

- Investment in Transformation: Significant capital is being allocated to create these specialized facilities.

- Low Current Market Share: Initial penetration in these niche markets is modest.

- High Growth Prospects: The underlying markets for specialty equipment are projected to expand significantly.

Herc Rentals' ventures into new specialty equipment markets, such as those supporting renewable energy or advanced manufacturing, represent classic Question Marks. These areas offer substantial growth potential, but Herc's current market share is minimal, requiring significant investment to gain traction.

The company's strategic acquisitions, while aiming for long-term market leadership, initially place the integrated entities in a Question Mark position. This is due to the high cash consumption required for integration and achieving projected synergies, as seen with the H&E Equipment Services acquisition impacting 2025 earnings.

Developing and scaling new technology-driven services, like enhanced telematics or digital platforms, also falls into the Question Mark category. Herc is investing in these innovations, anticipating future demand, but market penetration and profitability are still uncertain, demanding continued capital outlay.

These strategic initiatives require substantial capital to build market share and achieve economies of scale in nascent or newly entered segments.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | BCG Classification |

|---|---|---|---|---|

| Greenfield Expansion (Sun Belt) | High | Low | High | Question Mark |

| H&E Equipment Services Integration | Moderate to High | Low (initially post-acquisition) | Very High | Question Mark |

| ProSolutions Facility Transformation | High (Specialty Equipment) | Low | High | Question Mark |

| Digital Capabilities (ProControl) | High | Low | Moderate | Question Mark |

BCG Matrix Data Sources

Our Herc Rentals BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.