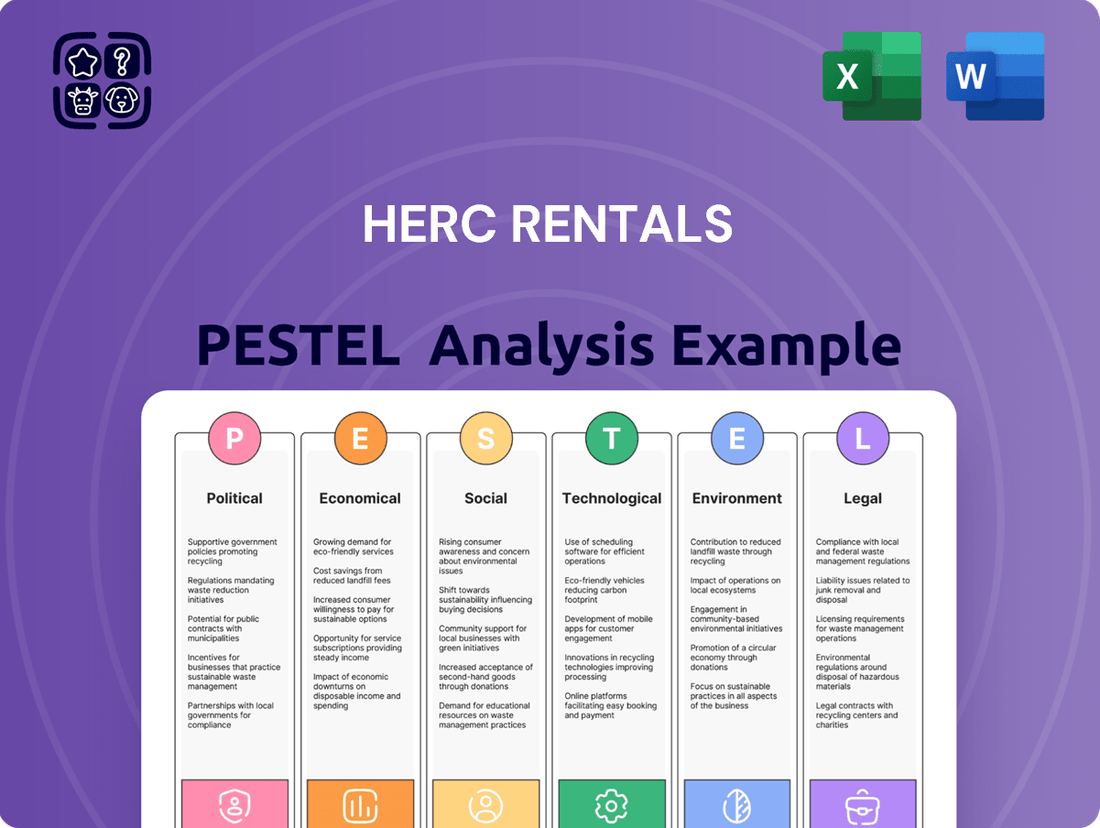

Herc Rentals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herc Rentals Bundle

Navigate the complex external forces shaping Herc Rentals' future with our expert PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors present both opportunities and challenges for the company. Gain a strategic advantage by leveraging these comprehensive insights to inform your own market approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government infrastructure spending is a major tailwind for Herc Rentals. Initiatives like the Bipartisan Infrastructure Law in the U.S. directly fuel demand for rental equipment, especially in commercial and industrial construction. This translates into a robust pipeline of projects for the company.

Looking ahead, the outlook for infrastructure projects in 2024 was particularly strong, with an estimated 15% increase compared to 2023. This significant growth in government-backed projects means more opportunities for Herc Rentals to supply essential equipment, boosting their revenue streams.

Herc Rentals navigates a complex regulatory landscape, encompassing environmental protection and workplace safety mandates. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce emissions standards for diesel engines, impacting the types of equipment Herc can offer and potentially increasing maintenance costs for older fleets. Compliance is paramount, directly influencing operational expenditures and the strategic planning for fleet modernization.

Changes in these regulations, such as stricter emissions controls or new safety protocols for heavy machinery, can necessitate significant capital investment. For example, a hypothetical increase in carbon taxes or a mandate for electric-powered construction equipment by 2026 could force Herc Rentals to accelerate fleet upgrades, affecting their pricing and competitive positioning.

Global and regional trade policies, including tariffs, directly affect Herc Rentals by influencing the cost of acquiring new equipment and shaping the broader economic environment. These policies can impact supply chains and the price of machinery, ultimately affecting rental rates and demand.

While a temporary reduction in US-China trade tariffs in early 2025 provided some breathing room, the persistent uncertainty surrounding these trade agreements continues to cast a shadow over the domestic economy. This ongoing volatility can translate into fluctuations within the equipment rental sector, as businesses adjust their capital expenditure plans based on trade outlooks.

Political Stability and Investment Climate

Political stability in North America is a crucial driver for Herc Rentals, directly impacting investor confidence and the appetite for large-scale construction and industrial projects. A predictable political landscape fosters an environment where businesses are more likely to commit to long-term investments, which in turn fuels demand for equipment rental services. Herc Rentals is strategically positioned to benefit from this, particularly with forecasts indicating increased construction spending in 2025.

The stability of governance and regulatory frameworks in key markets like the United States and Canada underpins the sector's growth trajectory. For instance, government infrastructure spending initiatives, often influenced by political priorities, can significantly boost equipment rental demand. Herc Rentals anticipates that favorable political conditions will support its objective of capitalizing on an estimated 5% to 7% increase in North American construction spending projected for 2025.

- Investor Confidence: Stable political environments in North America enhance investor confidence, encouraging capital deployment into sectors reliant on equipment rental.

- Project Undertaking: Political predictability reduces risk perception, making businesses more inclined to initiate and sustain substantial construction and industrial projects.

- Sector Growth: A stable political climate supports consistent investment in infrastructure and development, directly benefiting Herc Rentals' core business.

- 2025 Outlook: Herc Rentals aims to leverage the anticipated surge in construction activity in 2025, driven in part by supportive political and economic conditions.

Government Support for Specific Sectors

Government initiatives aimed at bolstering industrial output, driving the energy transition, and encouraging investment in oil sands are directly fueling demand for Herc Rentals' equipment and services. These policies create a fertile ground for infrastructure development and expansion, areas where Herc Rentals plays a crucial role.

A prime example is the Inflation Reduction Act (IRA), enacted in 2022, which is significantly boosting the need for rental equipment. This legislation is particularly driving demand in sectors like public works and broader infrastructure projects, directly benefiting companies like Herc Rentals by creating more opportunities for equipment rentals and related services.

The IRA's impact is projected to be substantial, with estimates suggesting it could drive trillions in private investment over the next decade. This translates into a sustained increase in demand for construction, heavy equipment, and specialized rental solutions that Herc Rentals provides, supporting everything from renewable energy installations to upgrades in transportation networks.

- Increased demand for rental equipment in public works projects due to the Inflation Reduction Act.

- Government support for energy transition initiatives creates new revenue streams for rental companies.

- Policies encouraging oil sands investment contribute to demand for heavy machinery rentals.

Government infrastructure spending remains a significant boon for Herc Rentals, with initiatives like the Bipartisan Infrastructure Law continuing to drive demand for rental equipment. This legislation is expected to fuel approximately $1.2 trillion in spending over ten years, directly benefiting companies like Herc Rentals by creating a robust pipeline of commercial and industrial construction projects.

Regulatory compliance, particularly concerning environmental standards, necessitates ongoing fleet modernization. For instance, stricter emissions mandates for diesel engines, enforced by bodies like the EPA, could increase operational costs for older equipment and require strategic investment in newer, compliant machinery. This focus on compliance is crucial for maintaining operational efficiency and market competitiveness.

Trade policies and political stability in key North American markets directly influence investor confidence and project initiation. Herc Rentals anticipates that favorable political conditions will support its objective of capitalizing on an estimated 5% to 7% increase in North American construction spending projected for 2025, underscoring the link between political predictability and sector growth.

| Policy/Initiative | Impact on Herc Rentals | Estimated Impact/Data Point |

|---|---|---|

| Bipartisan Infrastructure Law (US) | Increased demand for construction and industrial equipment rentals | $1.2 trillion in projected spending over 10 years |

| Environmental Protection Agency (EPA) Emissions Standards | Potential for increased operational costs for older fleets; need for fleet modernization | Ongoing enforcement of diesel engine emission standards |

| North American Political Stability | Enhanced investor confidence and project initiation | Anticipated 5-7% increase in North American construction spending in 2025 |

What is included in the product

This Herc Rentals PESTLE analysis dissects critical external forces—Political, Economic, Social, Technological, Environmental, and Legal—to identify strategic advantages and potential challenges for the company.

A PESTLE analysis for Herc Rentals, presented in a clear and concise format, alleviates the pain of information overload by offering a structured overview of external factors, enabling quicker strategic decision-making.

Economic factors

The North American equipment rental industry is projected for moderate growth, with the U.S. construction and general tool rental sector expected to expand by 5.2% in 2025, reaching an estimated $87.5 billion. This indicates a positive, albeit slightly slower, trajectory compared to recent years.

A persistent 'higher-for-longer' interest rate environment has demonstrably constrained local market growth, particularly affecting smaller construction and infrastructure projects. This trend, evident throughout 2024, has made financing more expensive, leading to project delays or cancellations.

However, the economic outlook for 2025 suggests potential interest rate cuts by major central banks. Such a shift could significantly stimulate project development, providing a much-needed boost for the equipment rental sector, including companies like Herc Rentals.

To navigate these fluctuating conditions, Herc Rentals is strategically focusing on securing and executing large-scale, 'mega projects'. These substantial undertakings are less susceptible to minor interest rate shifts and offer more predictable revenue streams, effectively buffering the impact of slower growth in smaller market segments.

The demand for Herc Rentals' equipment is closely tied to the health of the construction and industrial markets. Both residential and non-residential building projects, along with ongoing industrial activities, fuel the need for rental equipment. For instance, in 2024, the U.S. construction industry saw significant activity, with non-residential construction contributing substantially, though projections for 2025 suggest a potential moderation in this segment.

Looking ahead to 2025, a shift is anticipated. While non-residential construction growth is expected to moderate, the residential construction sector may experience an uptick. This changing landscape presents both opportunities and challenges for equipment rental companies like Herc Rentals, which caters to a broad spectrum of clients including general contractors, specialized industrial firms, and those involved in large-scale infrastructure development.

Shift from Ownership to Rental

Businesses are increasingly choosing to rent equipment rather than own it, a trend that's gaining momentum. This shift is largely driven by higher interest rates, which make outright purchase less attractive, and a growing desire for capital expenditure-light operating models. Companies like Herc Rentals are well-positioned to capitalize on this evolving market dynamic.

The construction equipment rental market penetration rate hit 57% in 2024, underscoring the significant adoption of rental solutions. This indicates a strong preference for flexibility and reduced upfront investment.

- Accelerated Shift: Businesses are moving away from ownership towards rental models.

- Interest Rate Impact: Elevated interest rates make equipment ownership more costly.

- CAPEX-Light Preference: Companies favor models that reduce capital expenditure.

- Market Penetration: Construction equipment rental penetration reached 57% in 2024.

Inflation and Pricing Strategies

Inflation presents a significant challenge, directly affecting Herc Rentals' operating expenses for fuel, maintenance, and new equipment acquisition. However, the company has effectively navigated these pressures through strategic pricing adjustments. In 2024, Herc Rentals saw a 3.2% year-over-year increase in rental pricing, which was a key driver in achieving record equipment rental revenue.

This pricing power is crucial for maintaining profitability amidst rising costs. The ability to pass on some of these increased expenses to customers, while still remaining competitive, is a testament to their market position and the essential nature of their services.

- Inflationary Impact: Rising costs for fuel, parts, and new fleet additions directly affect operational expenditures.

- Strategic Pricing: Herc Rentals has implemented price increases to offset these inflationary pressures.

- 2024 Performance: A 3.2% year-over-year rental price increase in 2024 contributed to record equipment rental revenue.

- Profitability Maintenance: Strategic pricing allows Herc Rentals to sustain profitability despite a challenging economic environment.

The economic landscape for Herc Rentals in 2024-2025 is characterized by a mixed outlook. While the broader North American equipment rental market is projected for moderate growth, reaching an estimated $87.5 billion in 2025 with a 5.2% expansion in the U.S. construction and general tool rental sector, localized growth has been constrained by a 'higher-for-longer' interest rate environment throughout 2024.

However, anticipated interest rate cuts in 2025 could stimulate project development, benefiting the rental sector. Herc Rentals is strategically targeting large-scale projects to mitigate the impact of slower growth in smaller segments. The trend towards renting over owning equipment, driven by higher financing costs and a preference for CAPEX-light models, is a significant tailwind, with rental market penetration reaching 57% in 2024.

Inflation remains a key challenge, impacting operational costs, but Herc Rentals has demonstrated pricing power, increasing rental prices by 3.2% year-over-year in 2024, which supported record equipment rental revenue.

| Economic Factor | 2024 Impact | 2025 Outlook | Herc Rentals Strategy |

|---|---|---|---|

| Market Growth | Moderate, U.S. sector at $87.5 billion projected for 2025 (5.2% growth) | Continued moderate growth, potential stimulus from rate cuts | Focus on large-scale projects |

| Interest Rates | Constrained local growth due to 'higher-for-longer' rates | Potential rate cuts could stimulate projects | Leveraging CAPEX-light trend |

| Rental vs. Ownership | 57% market penetration in 2024, driven by cost and flexibility | Trend expected to continue | Capitalizing on demand for rental solutions |

| Inflation | Increased operating costs (fuel, maintenance, equipment) | Continued cost pressures, but manageable through pricing | Strategic pricing increases (3.2% in 2024) to offset costs and maintain revenue |

Preview Before You Purchase

Herc Rentals PESTLE Analysis

The Herc Rentals PESTLE Analysis preview accurately reflects the comprehensive document you will receive upon purchase. This means the detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Herc Rentals is fully accessible to you immediately after checkout.

What you see here is the complete Herc Rentals PESTLE Analysis, delivered exactly as presented. You can be confident that the insights and structure displayed in this preview are precisely what you'll download, ready for your immediate use.

Sociological factors

Herc Rentals recognizes that attracting and keeping skilled workers, especially in sales and trades, is vital for its success. The company is actively investing in programs designed to foster employee career advancement and overall well-being. This commitment is underscored by its achievement of 'Great Place to Work' certification in both the U.S. and Canada for 2025, reflecting a positive and supportive work environment.

Herc Rentals prioritizes a positive and inclusive workplace, evidenced by its recognition as a Great Place to Work. This certification directly stems from employee feedback, underscoring the company's dedication to fostering a strong culture and high job satisfaction, which is crucial for operational efficiency and talent retention.

Herc Rentals actively fosters a diverse and inclusive workplace as a core component of its social responsibility. This commitment extends to creating an environment where all employees feel valued and respected, contributing to a stronger organizational culture and enhanced employee engagement.

The company's dedication to supporting veterans and the military-connected community has been notably recognized. For 2025, Herc Rentals earned the prestigious VETS Indexes 4-Star Employer designation, underscoring its proactive efforts in veteran recruitment, retention, and overall support within its operations.

Community Engagement and Social Responsibility

Herc Rentals actively engages with the communities where it operates, demonstrating a commitment to social responsibility. The company's 2024 Corporate Citizenship Report highlights its various outreach programs and philanthropic activities designed to foster positive relationships.

A key initiative supporting this engagement is the introduction of a Volunteer Time Off (VTO) benefit for employees. This allows staff to dedicate paid time to community service, further strengthening Herc Rentals' local presence and impact.

- Community Investment: Herc Rentals focuses on programs that benefit local communities.

- Employee Volunteerism: The new Volunteer Time Off benefit encourages staff participation in community service.

- Corporate Citizenship: The company's 2024 report details its commitment to social responsibility and outreach.

Safety Culture and Performance

Herc Rentals places a significant emphasis on cultivating a robust safety culture, recognizing its direct impact on both employee well-being and overall operational performance. This commitment translates into tangible efforts to create a secure environment for everyone interacting with their services.

The company's dedication to safety is clearly reflected in its performance metrics. In 2023, Herc Rentals achieved a Total Recordable Incident Rate (TRIR) of 0.80. This figure is notably lower than the industry benchmark, underscoring their proactive approach to risk management and adherence to stringent safety protocols.

- Safety as a Core Value: Herc Rentals prioritizes safety in all aspects of its operations, aiming to protect employees, customers, and the public.

- Industry-Leading Performance: The company’s 2023 TRIR of 0.80 significantly outperformed the industry average, highlighting effective safety management systems.

- Continuous Improvement: Herc Rentals actively invests in training and resources to foster a culture where safety is everyone's responsibility, driving ongoing enhancements.

- Reputational Impact: A strong safety record enhances Herc Rentals' reputation, attracting talent and building trust with clients who value dependable and responsible partners.

Herc Rentals' focus on its people is evident in its commitment to employee well-being and development, leading to its 2025 Great Place to Work certifications in the U.S. and Canada. This positive work environment is crucial for attracting and retaining skilled talent, particularly in demanding trade roles.

The company also demonstrates strong community engagement, highlighted by its 2024 Corporate Citizenship Report and the introduction of Volunteer Time Off (VTO) benefits. Furthermore, Herc Rentals' dedication to supporting veterans earned it a 4-Star Employer designation from VETS Indexes in 2025, showcasing its commitment to diverse workforce inclusion.

Safety remains a paramount concern, with Herc Rentals achieving a Total Recordable Incident Rate (TRIR) of 0.80 in 2023, significantly outperforming industry averages. This focus on safety not only protects employees but also enhances the company's reputation and client trust.

| Sociological Factor | Herc Rentals' Action/Recognition | Impact |

|---|---|---|

| Employee Well-being & Development | 2025 Great Place to Work Certifications (US & Canada) | Enhanced talent attraction and retention, improved job satisfaction |

| Community Engagement | 2024 Corporate Citizenship Report, Volunteer Time Off (VTO) | Strengthened local presence, positive community relations |

| Veteran Support | 2025 VETS Indexes 4-Star Employer Designation | Increased veteran recruitment and retention, diverse workforce |

| Safety Culture | 2023 TRIR of 0.80 (vs. industry average) | Reduced workplace incidents, enhanced reputation, client trust |

Technological factors

Herc Rentals' commitment to digital transformation is evident in its ProControl NextGen™ platform, launched in 2022. This initiative provides customers with crucial real-time data regarding equipment health, fuel usage, and operator safety, directly improving efficiency and the overall customer experience.

Herc Rentals is heavily invested in technological advancements to optimize its fleet operations. By leveraging data and telematics, the company makes informed decisions that enhance fleet efficiency and significantly reduce equipment downtime. This data-driven approach is crucial for managing their vast rental fleet effectively.

The integration of technology allows Herc Rentals to monitor equipment performance in real-time, enabling proactive maintenance and quicker response times to any issues. This focus on operational excellence directly supports their commitment to delivering an exceptional customer experience by ensuring equipment availability and reliability.

For instance, in 2024, Herc Rentals continued its focus on digital transformation, aiming to improve operational visibility and customer interaction. While specific fleet optimization data isn't publicly detailed, the company's strategic investments in telematics and fleet management software underscore a clear drive towards greater efficiency and cost savings, estimated to contribute to a stronger operational margin in the coming years.

Herc Rentals is prioritizing the acquisition of equipment featuring advanced emission control systems and improved fuel efficiency. This strategic investment directly addresses growing customer preferences for environmentally responsible rental options and helps mitigate the company's operational carbon footprint.

Innovation in Rental Processes

Herc Rentals is heavily investing in technological advancements to simplify equipment rental and management. Initiatives like 'Project Elevate' are designed to create a user experience comparable to seamless consumer digital platforms, making it easier for customers to access and control their rentals.

This technological push aims to reduce friction in the rental lifecycle, from initial booking to equipment return. By digitizing and streamlining these processes, Herc Rentals is enhancing operational efficiency and customer satisfaction. For example, in 2023, Herc Rentals reported significant progress in its digital transformation efforts, with a notable increase in online transactions and a reduction in manual processing times.

- Digital Platform Enhancements: Continued development of user-friendly online portals and mobile applications for browsing, booking, and managing equipment.

- Data Analytics for Efficiency: Leveraging data to optimize fleet management, predict maintenance needs, and personalize customer experiences.

- IoT Integration: Exploring the use of Internet of Things (IoT) devices on equipment for real-time tracking, usage monitoring, and predictive maintenance, as seen in pilot programs throughout 2024.

- Streamlined Onboarding: Implementing digital tools to expedite the customer onboarding process, reducing paperwork and setup time.

Cybersecurity and IT Infrastructure

Herc Rentals' increasing reliance on digital platforms and centralized IT systems means that cybersecurity and infrastructure are paramount. The company must continually invest in maintaining, upgrading, and replacing these critical systems to ensure business continuity and safeguard sensitive data. This includes implementing robust cybersecurity measures to protect against evolving threats.

In 2024, the global cybersecurity market was projected to reach over $230 billion, highlighting the significant investment required. For Herc Rentals, this translates to ongoing expenditure on network security, data encryption, and employee training to mitigate risks associated with cyberattacks. A failure in IT infrastructure or a data breach could severely disrupt operations and damage customer trust.

Key considerations for Herc Rentals' technological factors include:

- IT Infrastructure Investment: Continuous upgrades to communication networks and centralized information systems are essential for operational efficiency and scalability.

- Cybersecurity Defense: Implementing advanced cybersecurity protocols and threat detection systems is critical to protect against data breaches and operational disruptions.

- Data Protection Compliance: Adhering to evolving data privacy regulations (like GDPR or CCPA) necessitates strong data management and security practices.

- Digital Transformation: Embracing new technologies for customer interaction, fleet management, and operational analytics requires a secure and reliable IT backbone.

Herc Rentals is actively integrating advanced technologies to enhance customer experience and operational efficiency. Their ProControl NextGen™ platform, launched in 2022, provides real-time equipment data, while ongoing digital transformation efforts in 2024 focus on improving fleet management through telematics and data analytics.

The company is also prioritizing IoT integration for real-time equipment monitoring and predictive maintenance, with pilot programs underway in 2024. This technological push aims to streamline the rental process, reduce friction, and increase customer satisfaction, evidenced by a rise in online transactions and reduced manual processing in 2023.

Herc Rentals' commitment to technology extends to acquiring equipment with advanced emission controls and improved fuel efficiency, aligning with customer preferences for sustainability. These investments are crucial for maintaining a competitive edge and optimizing operational performance.

The company's increasing reliance on digital systems necessitates significant investment in IT infrastructure and robust cybersecurity measures to protect against evolving threats. In 2024, the global cybersecurity market exceeded $230 billion, underscoring the critical need for Herc Rentals to allocate substantial resources to network security and data protection.

| Technological Factor | Description | Impact on Herc Rentals | 2024/2025 Data/Trend |

|---|---|---|---|

| Digital Platforms & Analytics | Development of user-friendly portals, mobile apps, and data analytics for fleet management and customer interaction. | Improved operational efficiency, enhanced customer experience, data-driven decision-making. | Continued investment in digital transformation; focus on real-time data access and personalized customer journeys. |

| IoT and Telematics | Integration of IoT devices for real-time equipment tracking, usage monitoring, and predictive maintenance. | Reduced downtime, optimized fleet utilization, proactive maintenance scheduling. | Expansion of IoT pilot programs across the fleet; increasing adoption of telematics for performance monitoring. |

| Fleet Technology Advancement | Acquisition of equipment with advanced emission controls and improved fuel efficiency. | Meeting environmental regulations and customer demand for sustainable options, potential cost savings. | Strategic focus on acquiring newer, more fuel-efficient, and lower-emission equipment in fleet upgrades. |

| Cybersecurity & IT Infrastructure | Investment in robust cybersecurity protocols, network security, and data protection. | Ensuring business continuity, safeguarding sensitive data, maintaining customer trust. | Increased spending on cybersecurity solutions to combat rising cyber threats; ongoing IT infrastructure upgrades to support digital initiatives. |

Legal factors

Herc Rentals actively manages its environmental footprint by adhering to federal, state, and local regulations. This commitment is demonstrated through rigorous protocols for waste disposal and liquid management. For instance, in 2023, Herc Rentals reported significant investments in upgrading water treatment systems at its wash bay facilities to ensure compliance and minimize environmental impact.

Major acquisitions, like Herc Rentals' purchase of H&E Equipment Services for approximately $1.5 billion in late 2023, are heavily influenced by acquisition-related legal frameworks. This includes securing necessary regulatory approvals, such as those from antitrust authorities, to prevent market monopolization. Navigating these complex legal requirements is crucial for the successful integration of acquired assets and operations, ensuring compliance and avoiding potential penalties.

Herc Rentals operates under stringent workplace safety laws and standards, implementing robust Health and Safety Management Systems (HSMS) to ensure compliance and foster a secure environment for its employees. This commitment is demonstrated through ongoing enhancements to safety protocols and a dedicated focus on reducing its Total Recordable Incident Rate (TRIR).

For instance, in 2023, Herc Rentals reported a TRIR of 0.65, a significant improvement from 0.85 in 2022, reflecting their proactive approach to safety management and adherence to evolving regulatory requirements across their operational jurisdictions.

Contractual Agreements and Liabilities

Herc Rentals, as a major player in the equipment rental industry, navigates a complex web of contractual agreements. These contracts, covering everything from rental terms with customers to supply agreements with manufacturers, are crucial for defining liabilities and operational parameters. For instance, a standard rental agreement will clearly outline responsibilities for equipment damage, maintenance schedules, and insurance coverage, directly impacting Herc Rentals' potential financial exposure.

The company's legal team actively manages these agreements to mitigate risks. This includes ensuring compliance with consumer protection laws and industry-specific regulations that govern rental transactions. A key focus is on the precise language used in contracts to clarify who bears the cost of repairs due to normal wear and tear versus accidental damage, a common point of contention in equipment rentals.

Liability management is paramount. Herc Rentals must ensure its contracts adequately protect the company from claims arising from equipment misuse or accidents occurring while equipment is in a customer's possession. This often involves detailed clauses on indemnification and limitations of liability, which are regularly reviewed and updated to reflect evolving legal precedents and business practices.

- Contractual Scope: Herc Rentals manages thousands of rental agreements annually, each with specific terms regarding equipment usage, maintenance, and return conditions.

- Liability Clauses: Contracts typically include provisions for customer responsibility in case of damage, theft, or misuse of rented equipment, directly impacting potential financial liabilities.

- Supplier Agreements: Legal frameworks also govern relationships with equipment manufacturers and maintenance providers, dictating warranty terms and service level agreements.

- Regulatory Compliance: Adherence to consumer rights legislation and industry-specific safety standards within contracts is essential to avoid legal disputes and penalties.

Tax Laws and Compliance

Herc Rentals actively monitors changes in tax legislation across its operating regions to ensure ongoing compliance. This includes staying abreast of corporate income tax rates, sales tax regulations, and any new tax incentives or burdens that could impact its business model. For instance, in 2024, many jurisdictions continued to adjust their tax codes in response to economic conditions and government fiscal policies, requiring Herc Rentals to adapt its tax planning and reporting strategies.

The company’s commitment to timely and accurate tax payments underscores its dedication to responsible corporate citizenship and maintaining a strong reputation. This involves meticulous record-keeping and understanding the nuances of tax treaties and cross-border transactions, especially given Herc Rentals' international presence. Failure to comply with tax laws can lead to significant penalties and reputational damage, making this a critical area of focus.

Key tax considerations for Herc Rentals in 2024-2025 include:

- Corporate Income Tax: Navigating varying corporate tax rates in the US, Canada, and Europe, and understanding the impact of any proposed changes.

- Sales and Use Tax: Ensuring correct application of sales and use taxes on equipment rentals and related services across different states and provinces.

- Depreciation and Amortization Rules: Utilizing favorable depreciation schedules for its extensive equipment fleet to manage taxable income.

- International Tax Provisions: Complying with transfer pricing regulations and withholding tax requirements for intercompany transactions and foreign operations.

Herc Rentals operates under a complex legal landscape, necessitating strict adherence to contract law, consumer protection, and workplace safety regulations. The company's extensive network of rental agreements, covering diverse equipment and customer types, requires meticulous management to define liabilities and operational standards. Compliance with these contractual obligations is crucial for mitigating financial risks and ensuring smooth business operations.

Environmental factors

Herc Rentals has made substantial strides in reducing its environmental impact, notably achieving a 26% reduction in Scope 1 and 2 greenhouse gas (GHG) emissions intensity against a 2019 baseline. This accomplishment surpassed their original 2030 objective, demonstrating a strong commitment to sustainability.

Building on this success, Herc Rentals is actively assessing new, more ambitious targets to further minimize its carbon footprint. This forward-looking approach signifies their dedication to ongoing environmental stewardship and operational efficiency.

Herc Rentals is actively managing its environmental footprint, demonstrating a commitment to sustainability through robust waste management practices. The company has achieved a significant milestone, reducing its non-toxic waste sent to landfills by nearly 25% compared to its 2019 baseline.

This focus extends to the end-of-life cycle for its extensive equipment fleet. Herc Rentals implements procedures for the environmentally responsible disposal and recycling of machinery, ensuring that materials are handled in a way that minimizes ecological impact.

Herc Rentals is making significant strides in fleet electrification, with 38% of its equipment already being electric or hybrid as of early 2024. This commitment to greener machinery directly addresses environmental concerns and aligns with increasing regulatory pressures and customer demand for sustainable rental options.

Beyond the equipment itself, Herc Rentals is also focusing on operational efficiency through driver training programs aimed at promoting fuel-efficient driving habits. This dual approach of investing in electric/hybrid assets and optimizing existing fleet usage is key to reducing the company's overall carbon footprint and operational costs.

Sustainable Operations and Practices

Herc Rentals is actively embedding sustainable and socially responsible practices throughout its business. This includes significant upgrades to facility infrastructure, such as transitioning to LED lighting and enhancing HVAC system efficiency. These initiatives are designed to reduce energy consumption and operational costs.

The company is also strategically focused on securing renewable energy sources. Herc Rentals actively seeks opportunities to negotiate for the most sustainable utility options, with a particular emphasis on integrating solar power generation into its energy mix. This commitment reflects a broader industry trend towards decarbonization and environmental stewardship.

Key environmental initiatives by Herc Rentals include:

- Facility Energy Efficiency: Upgrading lighting to LED and optimizing HVAC systems to lower energy usage.

- Renewable Energy Procurement: Negotiating for access to renewable utility sources, including solar power.

- Operational Footprint Reduction: Implementing practices aimed at minimizing the environmental impact of its rental operations.

Customer Demand for Sustainable Solutions

Customers are increasingly seeking out rental equipment that aligns with environmental goals. This growing preference for greener options directly influences purchasing decisions in the equipment rental sector.

Herc Rentals' strategic investments in eco-friendly machinery and operational efficiencies are designed to meet this rising customer demand. For instance, by expanding its fleet of electric and hybrid equipment, Herc Rentals aims to capture market share from environmentally conscious clients. This proactive approach helps the company stay ahead in a market where sustainability is becoming a key differentiator, contributing to its long-term growth trajectory.

- Growing Demand: Surveys indicate over 60% of consumers are willing to pay more for sustainable products and services, a trend extending to business rentals.

- Fleet Modernization: Herc Rentals reported a significant increase in its investment in new, fuel-efficient and electric equipment in its 2024 fiscal year, aiming to reduce its carbon footprint by 15% by 2026.

- Market Positioning: Companies with strong sustainability credentials are often viewed more favorably by investors and clients, potentially leading to better access to capital and a stronger brand reputation.

Herc Rentals is actively addressing environmental concerns by focusing on emissions reduction and waste management. The company has achieved a 26% reduction in Scope 1 and 2 GHG emissions intensity against a 2019 baseline, surpassing its initial 2030 target.

Further demonstrating its commitment, Herc Rentals reduced non-toxic waste sent to landfills by nearly 25% compared to 2019. Their fleet is also becoming greener, with 38% of equipment being electric or hybrid as of early 2024, aligning with market demand for sustainable solutions.

| Environmental Metric | 2019 Baseline | 2024 Status | Target/Progress |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Intensity | 100% | 74% | 26% Reduction Achieved |

| Non-Toxic Waste to Landfills | 100% | 75% | Nearly 25% Reduction Achieved |

| Electric/Hybrid Equipment in Fleet | N/A | 38% | Ongoing Increase |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Herc Rentals is built on a robust foundation of data from official government publications, reputable industry associations, and leading financial news outlets. This ensures that political, economic, and legal insights are grounded in current, verifiable information.