Henry Schein PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henry Schein Bundle

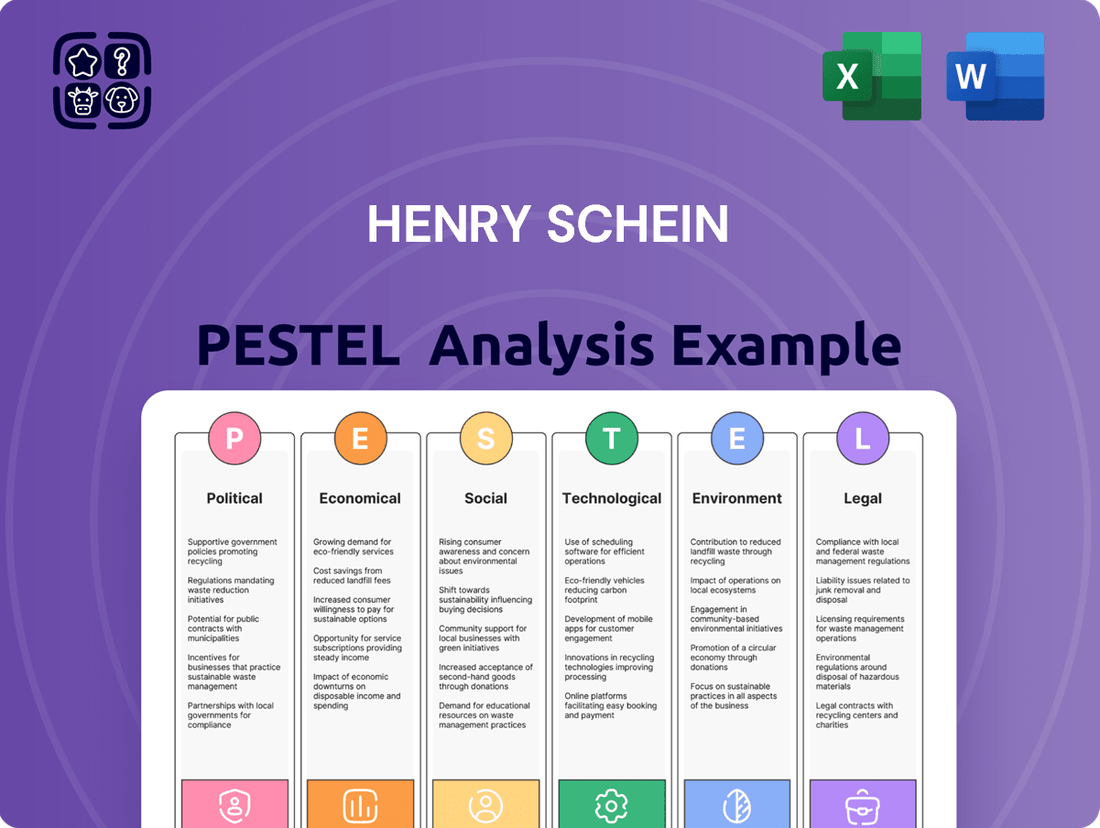

Navigate the complex external forces shaping Henry Schein's future with our expert PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting this healthcare giant. Gain a strategic advantage by leveraging these critical insights for your own business planning and investment decisions. Download the full, actionable report now and stay ahead of the curve.

Political factors

Government healthcare spending is a major driver for companies like Henry Schein, as it directly impacts the demand for the medical and dental supplies they distribute. For instance, the U.S. federal government's healthcare expenditure was projected to reach over $1.8 trillion in 2024, a significant portion of which flows into the healthcare supply chain.

Policy shifts, such as those influenced by the Inflation Reduction Act of 2022, can reshape the pharmaceutical landscape and introduce new compliance requirements. These changes can affect drug pricing, supply chain logistics, and ultimately, the operational costs and market opportunities for distributors like Henry Schein.

Geopolitical shifts and ongoing trade disputes, notably between the United States and China, directly impact global supply chains. Tariffs imposed on medical equipment can significantly increase sourcing costs for companies like Henry Schein, potentially affecting their profitability and pricing strategies for essential healthcare products.

These trade tensions necessitate a strategic approach to supply chain management, pushing companies to diversify their supplier base beyond single regions. For instance, the US imposed tariffs on certain Chinese goods in 2023, and while specific medical equipment exemptions exist, the broader trade climate creates uncertainty for international procurement of vital supplies.

Potential shifts in healthcare reform, such as changes to the Affordable Care Act or new federal mandates impacting medical supply chains, could significantly influence Henry Schein's operational environment. For instance, if proposed legislation in 2024 or 2025 aims to increase price transparency for medical devices, Henry Schein would need to adjust its distribution models and reporting protocols.

Increased regulatory scrutiny, particularly concerning data privacy for patient records handled through their software solutions or compliance with FDA regulations for distributed products, presents ongoing challenges. In 2024, the U.S. Food and Drug Administration (FDA) continued its focus on supply chain integrity, requiring distributors like Henry Schein to maintain robust tracking and verification processes, potentially leading to higher compliance costs.

Public-Private Partnerships and Health Security

Government backing for public-private collaborations to bolster pandemic readiness and the robustness of worldwide healthcare supply chains is a key political consideration. Henry Schein’s engagement in these programs, such as its participation in Operation Warp Speed or similar initiatives, directly impacts its standing in national health security efforts.

These partnerships are crucial for ensuring the availability of essential medical supplies during crises. For instance, in 2024, governments globally allocated significant funding towards strengthening domestic manufacturing capabilities for pharmaceuticals and medical devices, a trend Henry Schein is positioned to benefit from.

- Government investment in healthcare infrastructure: Increased public spending on healthcare systems and supply chain resilience directly supports companies like Henry Schein.

- Regulatory frameworks for public health: Evolving regulations around pandemic preparedness and supply chain security can create opportunities or challenges for market access and operations.

- International cooperation on health crises: Global agreements and collaborations on health security influence the demand for and distribution of medical products.

- Focus on supply chain diversification: Political pressure to reduce reliance on single-source suppliers for critical medical items benefits companies with diversified supply networks.

Lobbying and Advocacy

Henry Schein actively participates in lobbying to shape healthcare policies, particularly concerning vital areas like COVID-19 vaccine distribution and the management of the Strategic National Stockpile. Their advocacy also extends to dental care coverage, aiming to create a regulatory landscape that supports their business operations.

These efforts are crucial for navigating the complex healthcare sector. For instance, in 2023, lobbying expenditures by healthcare companies, including those in distribution, often target legislation impacting supply chain resilience and reimbursement rates. While specific figures for Henry Schein's 2024 lobbying on these exact issues are not yet publicly detailed, their consistent engagement in prior years highlights the ongoing importance of these activities.

- Policy Influence: Henry Schein lobbies on issues such as COVID-19 vaccine access and the Strategic National Stockpile.

- Regulatory Shaping: Efforts aim to create a favorable regulatory environment for the company's business.

- Industry Impact: Advocacy seeks to influence dental care coverage and broader healthcare policies.

Government healthcare spending is a primary driver for Henry Schein, directly influencing demand for their medical and dental supplies. For example, the U.S. federal government's healthcare expenditure was projected to exceed $1.8 trillion in 2024, with a substantial portion supporting the healthcare supply chain.

Policy changes, such as those stemming from the Inflation Reduction Act of 2022, can alter pharmaceutical markets and introduce new compliance demands, impacting drug pricing and supply chain logistics for distributors like Henry Schein.

Geopolitical tensions and trade disputes, particularly between the US and China, affect global supply chains. Tariffs on medical equipment can increase sourcing costs, impacting Henry Schein's profitability and pricing strategies for essential healthcare products.

The company's lobbying efforts are crucial for navigating the healthcare sector, influencing policies on vaccine distribution and the Strategic National Stockpile, as well as advocating for favorable dental care coverage and broader healthcare regulations.

| Political Factor | Impact on Henry Schein | 2024/2025 Relevance |

|---|---|---|

| Government Healthcare Spending | Drives demand for medical/dental supplies | US projected healthcare spending > $1.8 trillion in 2024 |

| Regulatory Changes (e.g., IRA) | Affects pharmaceutical markets, pricing, compliance | Ongoing adaptation to new regulations |

| Trade Disputes & Tariffs | Increases sourcing costs, impacts supply chains | Continued geopolitical uncertainty affecting global trade |

| Lobbying & Policy Influence | Shapes regulatory environment, market access | Active engagement on healthcare policy and supply chain resilience |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Henry Schein's operations. It provides a comprehensive understanding of the external forces shaping the company's strategic landscape.

A clear, actionable summary of the Henry Schein PESTLE analysis, highlighting key external factors that impact the dental and healthcare industries, enabling proactive strategic adjustments and risk mitigation.

Economic factors

The global economic recovery significantly influences demand for medical and dental supplies. As economies rebound, we see a trend of increased patient visits and a greater willingness to undergo elective procedures, directly boosting sectors like Henry Schein's. For instance, in early 2024, many developed nations reported GDP growth exceeding 2%, signaling a healthier consumer base more likely to spend on healthcare.

Conversely, economic slowdowns present challenges. During periods of recession or high inflation, consumers often postpone non-essential medical and dental treatments to save money. This can lead to a noticeable dip in sales for companies like Henry Schein, as seen in some regions during 2023 where inflation rates remained elevated, impacting discretionary healthcare spending.

Looking ahead to 2024 and 2025, projections for global GDP growth are generally positive, with the IMF forecasting around 3% growth. This anticipated economic expansion is expected to translate into sustained or increased demand for healthcare services and products, creating a more favorable market environment for Henry Schein’s diverse product and service offerings.

Inflationary pressures in the U.S. during 2024 could impact Henry Schein by increasing operating costs, from raw materials to logistics. For instance, if the Consumer Price Index (CPI) continues its upward trend, it may force the company to absorb some of these costs or pass them on to customers, potentially affecting sales volume.

Deflation, though less common, would present a different challenge, potentially leading to lower revenue if prices for medical supplies and services decrease. Conversely, fluctuations in the U.S. dollar's value against other currencies directly influence Henry Schein's international operations. A stronger dollar in 2024 could make its products more expensive for overseas buyers, dampening international sales, while a weaker dollar would boost the value of its foreign earnings when translated back into U.S. dollars.

Elevated interest rates, such as the Federal Reserve's target range of 5.25% to 5.50% as of early 2024, can significantly tighten capital availability for healthcare practices. This financial pressure often forces them to postpone or reduce investments in costly new equipment and advanced technologies, directly affecting demand for Henry Schein's higher-ticket products.

Consequently, healthcare providers may increasingly prioritize cost-containment strategies, potentially shifting towards refurbished equipment or delaying upgrades. This trend could lead to a slowdown in sales for Henry Schein's premium offerings and a greater emphasis on more budget-friendly solutions, impacting overall revenue streams.

Acquisition and Investment Strategy

Henry Schein's economic growth is significantly bolstered by its strategic acquisition approach, enabling it to broaden its market presence and diversify its product portfolio. This strategy is crucial for staying competitive in the dynamic healthcare distribution sector.

Recent financial maneuvers, like the investment from KKR, underscore this strategy by injecting capital that fuels expansion and operational enhancements. For instance, KKR's investment in Henry Schein's dental business in 2022, valued at approximately $1.5 billion, highlights the capital flexibility and support for long-term growth initiatives.

- Market Share Expansion: Acquisitions allow Henry Schein to consolidate its position and gain access to new customer segments.

- Product Diversification: Integrating acquired companies brings new products and services, creating a more comprehensive offering.

- Capital Infusion: Strategic investments, such as the one from KKR, provide essential funding for innovation and market penetration.

- Synergistic Growth: Merging operations often leads to cost efficiencies and enhanced revenue streams through cross-selling opportunities.

Sales Growth and Earnings Outlook

Henry Schein's economic outlook is closely tied to its sales growth and earnings per share (EPS) projections. The company has expressed optimism regarding its performance, anticipating continued sales expansion and a rise in adjusted EPS for 2025. This positive outlook underscores management's belief in the company's core business strengths, even as it navigates various market challenges.

Looking at specific financial forecasts, Henry Schein projected mid-single-digit to low-double-digit growth in net sales for 2025. Furthermore, the company guided for adjusted diluted EPS in the range of $5.00 to $5.20 for the same year, indicating a healthy earnings trajectory. These figures are crucial for investors assessing the company's financial health and future potential.

- Projected 2025 Net Sales Growth: Mid-single-digit to low-double-digit increase.

- Projected 2025 Adjusted Diluted EPS: $5.00 to $5.20.

- Underlying Business Fundamentals: Management confidence in core operations despite market headwinds.

Economic factors significantly shape Henry Schein's operational landscape, influencing both demand and cost structures. Global GDP growth, projected around 3% for 2024-2025 by the IMF, generally supports increased healthcare spending. However, persistent inflation in 2024, with the U.S. CPI showing upward trends, directly impacts operating costs and consumer purchasing power for elective procedures.

Elevated interest rates, such as the Federal Reserve's 5.25%-5.50% range in early 2024, constrain capital for healthcare practices, potentially delaying investments in new equipment. This environment necessitates strategic acquisitions and capital infusions, like KKR's 2022 investment, to fuel expansion and maintain competitiveness.

Henry Schein projects mid-single-digit to low-double-digit net sales growth for 2025, with adjusted diluted EPS estimated between $5.00 and $5.20, reflecting confidence in its core business despite economic headwinds.

| Economic Indicator | 2024 Projection/Status | Impact on Henry Schein |

|---|---|---|

| Global GDP Growth | ~3% (IMF forecast for 2024-2025) | Supports increased healthcare demand. |

| U.S. Inflation (CPI) | Elevated/Upward trend in 2024 | Increases operating costs, may curb discretionary spending. |

| U.S. Interest Rates | 5.25%-5.50% (Fed target range, early 2024) | Tightens capital for healthcare practices, impacting equipment sales. |

| Projected 2025 Net Sales Growth | Mid-single-digit to low-double-digit | Indicates anticipated revenue expansion. |

| Projected 2025 Adjusted Diluted EPS | $5.00 - $5.20 | Signals positive earnings trajectory. |

Preview Before You Purchase

Henry Schein PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis for Henry Schein.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Henry Schein.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the external forces shaping Henry Schein's business strategy.

Sociological factors

The world's population is getting older, and this demographic shift is a major driver for increased demand in healthcare. As people age, they generally need more medical and dental services, which directly benefits companies like Henry Schein that supply these sectors. For instance, by 2030, it's projected that one in six people globally will be 65 or older, a significant increase from today.

This growing senior population translates into a greater need for ongoing medical treatments, preventative care, and specialized dental services. Henry Schein is well-positioned to capitalize on this trend, as their product and service offerings cater directly to the expanding healthcare requirements of an aging demographic. The World Health Organization estimates that the number of people aged 60 and over will more than double by 2050, reaching 2.1 billion.

Societal emphasis on health equity and expanding access to care for underserved communities directly influences Henry Schein's corporate citizenship initiatives. For instance, in 2023, the company continued its partnerships aimed at improving oral health in low-income areas, reflecting a growing societal demand for equitable healthcare solutions.

Henry Schein's efforts to catalyze healthcare access and promote preventive care align with broader societal health goals, particularly in light of increased public awareness post-pandemic. In 2024, there's a notable trend in patient demand for telehealth and remote monitoring services, a shift Henry Schein is addressing through its digital health solutions.

Henry Schein's dedication to diversity and inclusion, evident in its efforts to educate employees and boost board representation, aligns with growing societal expectations for workplace fairness. This commitment is crucial for fostering a positive corporate reputation and enhancing employee morale.

In 2023, Henry Schein reported that women held 42% of management positions, a step towards greater gender balance. The company also actively participates in initiatives aimed at increasing representation from underrepresented ethnic and racial groups within its leadership ranks.

Corporate Citizenship and Social Responsibility

Henry Schein's dedication to corporate citizenship is evident through its global program, Henry Schein Cares. This initiative actively supports healthcare access, employee development, and community engagement, reflecting a strong commitment to social responsibility. In 2023, the company continued to invest in programs that align with societal expectations for ethical business practices.

The company's focus on these pillars not only strengthens its brand image but also fosters deeper connections with stakeholders. By prioritizing social impact, Henry Schein aims to build trust and demonstrate its value beyond financial performance, a crucial element in today's socially conscious business environment.

- Healthcare Access: Henry Schein Cares supports initiatives aimed at improving dental, medical, and animal health services globally.

- Employee Empowerment: The program encourages volunteerism and professional development, fostering a motivated and engaged workforce.

- Community Building: Henry Schein actively partners with organizations to drive positive change and address community needs.

Public Health Campaigns and Prevention

Henry Schein's commitment to public health is evident in initiatives like its 'Prevention Is Power™' campaign. This program actively supports healthcare professionals in educating patients about preventive care, fostering a more proactive approach to health management across society.

This focus resonates with a growing societal trend where individuals are increasingly taking charge of their well-being. For instance, in 2024, surveys indicated a significant rise in consumer spending on preventative health services and wellness products, reflecting a broader cultural shift towards prioritizing long-term health outcomes.

- Societal Emphasis on Proactive Health: Growing consumer demand for preventative care and wellness solutions.

- Empowering Healthcare Professionals: Initiatives that equip providers to educate patients on preventive measures.

- Improved Health Outcomes: The ultimate goal of these campaigns is to enhance overall public health and reduce disease burden.

Societal shifts towards valuing health equity and access to care are significant for Henry Schein. The company's initiatives, like those supporting oral health in underserved communities in 2023, directly address this growing expectation for inclusive healthcare. This focus aligns with a global push for better health outcomes for all populations.

Technological factors

The healthcare sector's embrace of digital health technologies, from telehealth platforms to AI-driven diagnostics, is fundamentally reshaping how medical and dental supplies are managed. Henry Schein is at the forefront of this shift, investing heavily in its own technological solutions.

Henry Schein's commitment is evident in its robust portfolio of practice management software, e-services, and other digital tools. These offerings are designed to streamline operations for office-based practitioners, ultimately boosting efficiency and elevating the quality of patient care. For instance, their practice management software aims to simplify scheduling, billing, and patient records, freeing up valuable time for clinicians.

In 2023, Henry Schein reported that its Technology segment revenue grew by 7.4% to $1.3 billion, highlighting the increasing demand for its digital solutions. This growth underscores the critical role technology plays in enabling healthcare providers to adapt to evolving patient expectations and operational demands.

Artificial intelligence is rapidly transforming dentistry and broader healthcare. AI-powered diagnostic tools are becoming more sophisticated, aiding in everything from early disease detection to treatment planning. In 2024, the global AI in healthcare market was valued at over $20 billion, with significant growth projected as more AI solutions are integrated into clinical workflows.

Henry Schein is actively embracing this technological shift. The company is forging new partnerships specifically to introduce AI into dental education and everyday clinical settings. This strategic move aims to enhance diagnostic precision for practitioners and streamline operational efficiency, ultimately benefiting patient care.

Henry Schein's commitment to e-commerce is evident in its ongoing development of global platforms designed to elevate customer engagement and operational efficiency. These digital marketplaces are vital for providing a seamless purchasing experience for dental professionals. For instance, in 2024, the company continued to invest in its digital infrastructure, aiming to capture a larger share of the burgeoning online dental supply market.

Furthermore, the company is actively expanding its integrated digital workflow solutions, empowering dental practices to optimize their operations and achieve higher performance. These solutions, which often integrate with e-commerce functionalities, aim to streamline everything from patient scheduling to billing. By 2025, Henry Schein anticipates these digital tools will be instrumental in driving practice profitability for a significant portion of its client base.

Telehealth and Remote Monitoring Advancements

The healthcare industry's rapid embrace of telehealth and remote monitoring presents a significant technological shift. For a company like Henry Schein, this means adapting its product and service portfolio to seamlessly integrate with these virtual care models. For instance, the global telehealth market was projected to reach $296.5 billion by 2027, indicating a substantial opportunity for companies that can support this expansion.

These advancements require Henry Schein to consider how its dental and medical supplies, software solutions, and practice management services can facilitate remote patient interactions and data collection. The ability to support dentists and physicians in delivering care outside traditional brick-and-mortar settings will be crucial for sustained growth.

Key areas of adaptation include:

- Digital Integration: Ensuring software and hardware are compatible with telehealth platforms.

- Remote Diagnostic Tools: Exploring opportunities in connected devices for at-home monitoring.

- Supply Chain Adaptability: Streamlining delivery of products to patients' homes or remote clinics.

- Data Security and Privacy: Implementing robust measures to protect sensitive patient information in a digital environment.

Data Protection and Cybersecurity

As businesses like Henry Schein increasingly depend on digital platforms, robust data protection and cybersecurity measures are paramount technological concerns. The company has demonstrated its commitment to this by establishing Global Principles on Data Protection and Security, alongside guidelines for the Responsible Use of AI Systems. This proactive approach is crucial in an era where data breaches can have significant financial and reputational consequences.

The evolving threat landscape necessitates continuous investment in cybersecurity. For instance, in 2023, the global average cost of a data breach reached an all-time high of $4.45 million, according to IBM's Cost of a Data Breach Report. This underscores the financial imperative for companies like Henry Schein to implement and maintain strong defenses against cyberattacks.

Henry Schein's focus on these principles reflects a broader industry trend. Key technological considerations include:

- Advanced threat detection: Implementing AI-powered tools to identify and neutralize cyber threats in real-time.

- Data encryption: Ensuring sensitive customer and company data is protected through robust encryption methods.

- Regular security audits: Conducting frequent assessments of systems and protocols to identify and address vulnerabilities.

- Employee training: Educating staff on best practices for data security and recognizing phishing attempts.

Henry Schein's technological strategy centers on integrating digital solutions to enhance efficiency and patient care, evident in its practice management software and e-commerce platforms. The company's Technology segment revenue saw a 7.4% increase in 2023, reaching $1.3 billion, underscoring the growing demand for its digital offerings.

The increasing adoption of AI in healthcare, with the global market exceeding $20 billion in 2024, presents opportunities for Henry Schein to partner on AI integration in dental education and clinical settings, aiming to improve diagnostics and operational workflows.

Furthermore, the expansion of telehealth services, projected to reach $296.5 billion by 2027, necessitates Henry Schein's adaptation to support remote patient interactions and data collection, requiring digital integration and adaptable supply chains.

Ensuring robust data protection and cybersecurity is paramount, with Henry Schein implementing Global Principles on Data Protection and Security. The rising cost of data breaches, averaging $4.45 million in 2023, highlights the critical need for continuous investment in advanced threat detection and data encryption.

| Technology Area | Henry Schein's Focus | Market Trend/Data Point |

|---|---|---|

| Digital Health Platforms | Practice management software, e-services | Technology segment revenue grew 7.4% to $1.3B in 2023 |

| Artificial Intelligence | Partnerships for AI in dental education/clinical settings | Global AI in healthcare market > $20B in 2024 |

| E-commerce & Digital Workflows | Global e-commerce platforms, integrated digital solutions | Continued investment in digital infrastructure in 2024 |

| Telehealth Integration | Adapting products/services for virtual care | Global telehealth market projected to reach $296.5B by 2027 |

| Cybersecurity & Data Protection | Global Principles on Data Protection and Security | Average cost of data breach reached $4.45M in 2023 |

Legal factors

Henry Schein operates in a heavily regulated healthcare sector, necessitating strict compliance with evolving standards for product safety, data privacy, and distribution practices. For instance, the U.S. Food and Drug Administration (FDA) continuously updates regulations for medical devices and pharmaceuticals, impacting how Schein imports, stores, and distributes these critical products. Failure to comply can result in significant fines and operational disruptions, underscoring the importance of robust internal controls and staying ahead of regulatory changes.

Henry Schein operates within a stringent legal framework concerning data protection and privacy, particularly given its involvement with sensitive healthcare information. Regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe mandate robust data handling practices. Failure to comply can result in significant penalties, impacting operational continuity and financial performance.

As a major player in the healthcare distribution sector, Henry Schein operates under stringent anti-trust and competition laws globally. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, in 2023, the Federal Trade Commission (FTC) continued its focus on healthcare market concentration, a trend likely to impact large distributors like Henry Schein.

Henry Schein's significant market share, particularly in its core segments like dental and medical supplies, means its acquisition strategies are frequently reviewed by regulatory bodies. These reviews aim to assess whether proposed mergers or acquisitions would substantially lessen competition or tend to create a monopoly. The company's growth through acquisitions, such as its 2022 acquisition of Condor Dental, underscores the importance of navigating these legal frameworks carefully.

Product Liability and Safety Regulations

Henry Schein, a major distributor of medical and dental supplies, operates under stringent product liability and safety regulations. These rules are critical for ensuring the quality and safety of the vast array of products they handle, from surgical instruments to dental implants. For instance, the U.S. Food and Drug Administration (FDA) oversees medical device safety, and in 2023, the FDA continued to emphasize post-market surveillance and recall procedures for medical products, impacting companies like Henry Schein that distribute these items.

Failure to adhere to these regulations can result in significant legal repercussions and severe damage to Henry Schein's reputation. The company must maintain robust quality control and compliance systems. In 2024, the healthcare industry saw an increased focus on supply chain integrity, with regulatory bodies scrutinizing distributors for compliance with Good Distribution Practices (GDP), which directly affects how Henry Schein manages its product safety protocols.

- Regulatory Compliance: Henry Schein must navigate complex regulations governing product safety and liability in the medical and dental sectors.

- Risk Management: Non-compliance can lead to costly lawsuits, fines, and a tarnished brand image, impacting market trust.

- Supply Chain Scrutiny: Increased regulatory attention on supply chain integrity in 2024 means distributors face heightened expectations for product safety verification.

- Quality Assurance: Maintaining high standards in product handling, storage, and distribution is paramount to avoid legal challenges and ensure customer safety.

Intellectual Property Rights and Patents

Intellectual property rights are crucial for Henry Schein, as the healthcare sector thrives on innovation. The company must actively manage its patents and trademarks, especially for its own branded products and the technologies it distributes. This ensures protection of its innovations and prevents costly infringement issues. For example, in 2023, the global intellectual property market was valued in the trillions, highlighting the significant economic importance of protecting proprietary assets.

Navigating patent landscapes is essential for Henry Schein’s distribution business. The company must ensure that the products it sells do not infringe on existing patents held by competitors. Failure to do so can lead to legal battles and significant financial penalties. In 2024, patent litigation remains a substantial concern across many industries, including healthcare, with companies investing heavily in patent prosecution and enforcement.

- Patent Protection: Henry Schein actively seeks patent protection for its proprietary product innovations to maintain a competitive edge.

- Infringement Avoidance: Diligent review of existing patents is undertaken to avoid infringing on the intellectual property of other entities within the healthcare supply chain.

- Brand Security: Trademark registration and enforcement are vital for safeguarding the Henry Schein corporate brand and its reputation in the market.

- Licensing Agreements: The company may engage in licensing agreements to utilize patented technologies or to allow others to use its own patented innovations.

Henry Schein's operations are significantly shaped by global and regional legal frameworks, particularly those pertaining to healthcare product distribution and data privacy. The company must adhere to stringent regulations like HIPAA and GDPR to safeguard sensitive patient information, with non-compliance potentially leading to substantial fines. In 2024, regulatory bodies continued to scrutinize supply chains for integrity, emphasizing Good Distribution Practices (GDP) which directly impacts Henry Schein's product safety protocols and requires robust quality assurance measures.

Antitrust and competition laws are also critical legal considerations for Henry Schein, given its substantial market share in the dental and medical supply sectors. Regulatory bodies actively monitor market concentration to prevent monopolistic practices, influencing the company's acquisition strategies. For instance, the Federal Trade Commission (FTC) maintained its focus on healthcare market consolidation throughout 2023, a trend that necessitates careful navigation of these legal boundaries for large distributors.

Product liability and safety regulations are paramount, with the FDA continuously updating standards for medical devices and pharmaceuticals. Henry Schein's role as a distributor means it is subject to these rules regarding importation, storage, and distribution, with failures resulting in significant penalties and operational disruptions. The company's commitment to intellectual property rights, including patent protection and trademark enforcement, is also vital for maintaining its competitive position and preventing infringement issues in the innovative healthcare market.

Environmental factors

Henry Schein acknowledges climate change's profound effect on health and actively works to lessen its environmental impact. The company has committed to achieving Net Zero emissions by 2050, a goal supported by strategic initiatives focused on operational efficiency, increasing its use of renewable electricity, and collaborating with its supply chain partners to reduce overall emissions.

Henry Schein is committed to minimizing its environmental footprint through robust waste reduction and recycling programs. The company has made significant strides in diverting waste from landfills, notably by enhancing its North American distribution recycling initiatives.

These efforts have paid off, with Henry Schein exceeding its recycling targets. For instance, in 2023, the company reported a substantial increase in its recycling rates across its distribution network, driven by process improvements aimed at reducing plastic usage.

Henry Schein is actively prioritizing sustainable sourcing, aiming to procure products and services from environmentally responsible suppliers. This strategic focus is crucial for mitigating risks and enhancing brand reputation in an increasingly eco-conscious market.

The company engages with its suppliers on collaborative decarbonization initiatives, recognizing that a significant portion of its environmental impact lies within its extended supply chain. This partnership approach fosters shared responsibility and drives collective progress towards sustainability goals.

Strengthening and diversifying the supply chain with an environmental perspective is a key objective for Henry Schein. For instance, by 2024, the company aimed to increase its spend with diverse and sustainable suppliers, reflecting a commitment to both environmental stewardship and inclusive economic growth.

Carbon-Neutral Shipping and Logistics

Henry Schein is actively working to lessen its environmental footprint by offering carbon-neutral shipping options within its U.S. distribution network. This initiative, a partnership with specific carriers, directly addresses the environmental impact of its extensive logistics operations.

This commitment aligns with broader industry trends and growing consumer demand for sustainable business practices. For instance, the global logistics market is increasingly prioritizing green solutions, with investments in electric vehicles and alternative fuels on the rise. By 2024, the demand for sustainable logistics solutions is expected to see significant growth, driven by regulatory pressures and corporate ESG (Environmental, Social, and Governance) goals.

- Carbon-Neutral Shipping: Henry Schein's partnership offers customers a way to reduce the emissions associated with product delivery.

- Logistics Impact: This addresses a key environmental concern for companies with large distribution networks.

- Industry Trend: The move towards sustainable logistics is a growing imperative across many sectors.

Environmental Reporting and Transparency

Henry Schein demonstrates a commitment to environmental reporting by adhering to recognized international frameworks. The company aligns its sustainability disclosures with standards set by the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI). This adherence facilitates a clear assessment of their environmental impact by investors and other stakeholders.

This transparency is crucial for building trust and allowing for informed decision-making regarding the company's environmental, social, and governance (ESG) performance. For instance, in their 2023 ESG report, Henry Schein highlighted progress in reducing greenhouse gas emissions, with Scope 1 and 2 emissions decreasing by 4% compared to their 2022 baseline. This focus on quantifiable data allows for a more robust evaluation of their environmental stewardship.

Key aspects of their environmental reporting include:

- Alignment with SASB and GRI Standards: Ensuring consistency and comparability in sustainability disclosures.

- Greenhouse Gas Emission Tracking: Reporting on Scope 1, 2, and 3 emissions to monitor climate impact.

- Waste Management and Circularity Initiatives: Detailing efforts to reduce waste generation and promote recycling.

- Water Usage Monitoring: Providing data on water consumption across operations.

Henry Schein is actively addressing environmental concerns, including climate change and waste reduction, as core components of its operational strategy. The company has set a Net Zero emissions target for 2050, supported by initiatives like increasing renewable electricity usage and engaging supply chain partners in decarbonization efforts.

The company's commitment to waste reduction is evident in its enhanced recycling programs, particularly in North America, which have successfully diverted significant amounts of waste from landfills. For example, in 2023, Henry Schein saw a notable increase in recycling rates across its distribution network.

Furthermore, Henry Schein is prioritizing sustainable sourcing and is actively collaborating with suppliers on decarbonization, recognizing the importance of the extended supply chain in achieving its environmental goals. This includes aiming to increase spending with diverse and sustainable suppliers by 2024.

| Environmental Focus Area | Target/Initiative | Progress/Data Point |

|---|---|---|

| Climate Change | Net Zero Emissions by 2050 | Focus on operational efficiency, renewable electricity, supply chain collaboration. |

| Waste Management | Waste Reduction & Recycling Programs | Exceeded recycling targets in 2023; process improvements reducing plastic usage. |

| Sustainable Sourcing | Increased Spend with Sustainable Suppliers | Aim to increase spend by 2024. |

| Logistics | Carbon-Neutral Shipping Options (US Distribution) | Partnership with carriers to reduce logistics emissions. |

| Reporting | Alignment with SASB & GRI | Scope 1 & 2 emissions decreased by 4% in 2023 vs. 2022 baseline. |

PESTLE Analysis Data Sources

Our Henry Schein PESTLE analysis is informed by a diverse range of data, including reports from leading market research firms, government publications on healthcare policy, and economic indicators from international financial institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the dental and medical supply industry.