Henry Schein Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henry Schein Bundle

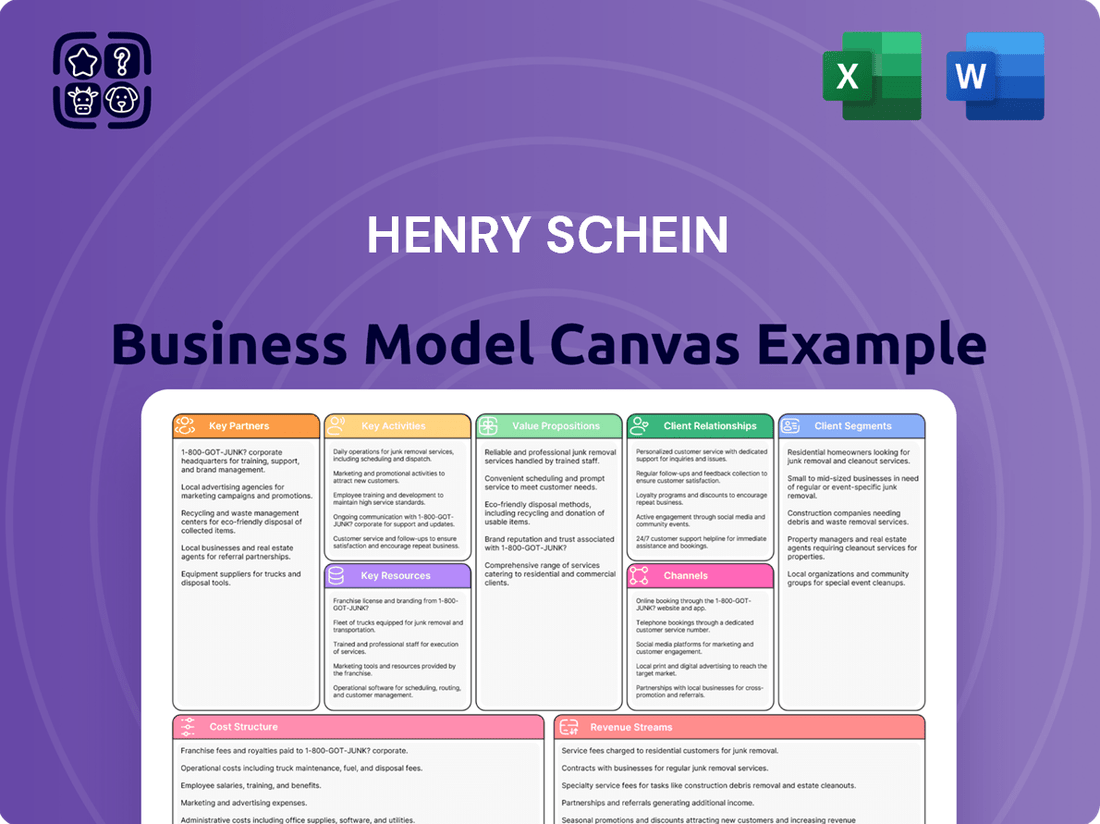

Discover the strategic engine behind Henry Schein's dominance in the healthcare distribution sector with their comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect suppliers and customers, manage their vast product lines, and generate revenue in a complex market. Want to understand their success firsthand?

Unlock the full strategic blueprint behind Henry Schein's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Henry Schein cultivates deep relationships with a multitude of healthcare manufacturers, securing access to an expansive catalog of over 300,000 branded products. This strategic sourcing is fundamental to their ability to serve a global customer base with diverse needs.

These alliances are not merely transactional; they are built on a foundation of mutual benefit, enabling Henry Schein to offer cutting-edge medical and dental supplies. For instance, in 2024, their partnerships facilitated the distribution of innovative diagnostic tools and specialized equipment, directly impacting patient care outcomes.

The sheer breadth of these manufacturer partnerships allows Henry Schein to maintain a robust and competitive product portfolio. This extensive network is a key differentiator, ensuring practitioners have access to the latest advancements and a wide selection of essential supplies, reinforcing Henry Schein's position as a leading distributor.

Henry Schein's strategic alliances with technology and software providers are crucial for delivering comprehensive practice management systems and e-services. These collaborations allow the company to integrate cutting-edge digital dentistry solutions and tools designed to optimize practice operations.

Through these partnerships, Henry Schein empowers healthcare professionals to enhance efficiency and elevate patient care. For instance, in 2024, the company continued to expand its digital solutions portfolio, which is heavily reliant on the seamless integration of third-party software and hardware.

Henry Schein's key partnerships often revolve around identifying and integrating acquisition targets to bolster its offerings, especially in dynamic sectors like homecare medical supplies. The company's proactive M&A strategy is evident in recent moves, such as acquiring Acentus in November 2024 and R. Weinstein, Inc. in March 2025, underscoring a commitment to inorganic growth and market expansion.

Professional Organizations and Associations

Henry Schein's strategic alliances with dental, medical, and animal health professional organizations are foundational for its market reach and industry standing. These partnerships are crucial for gaining deep market insights and building trust within the healthcare sectors it serves.

These collaborations often translate into jointly developed educational programs and industry-leading events, which not only benefit members but also solidify Henry Schein's reputation as a trusted partner. For instance, in 2024, Henry Schein continued to engage with numerous associations, supporting continuing education credits for thousands of dental professionals through various initiatives.

- Market Penetration: Access to member networks for product and service promotion.

- Industry Insights: Direct feedback and trend identification from key opinion leaders.

- Credibility: Association with respected professional bodies enhances brand trust.

- Educational Programs: Jointly offering training and development opportunities for healthcare practitioners.

Logistics and Supply Chain Partners

Henry Schein relies on a robust network of logistics and supply chain partners to power its centralized, automated distribution. These relationships are foundational to ensuring the swift and dependable delivery of essential products to its vast customer base, which exceeds 1 million worldwide. This efficiency directly supports Henry Schein's impressive order fulfillment rates.

Key partnerships in this area are crucial for maintaining the flow of goods, from sourcing to final delivery. For instance, in 2024, Henry Schein continued to leverage established relationships with major carriers and third-party logistics providers to manage its extensive global operations.

- Global Reach: Partners facilitate delivery to over 1 million customers across numerous countries.

- Efficiency: Essential for the success of Henry Schein's centralized and automated distribution model.

- Reliability: Ensures timely product availability, critical for healthcare professionals.

- Cost Management: Strategic partnerships help optimize transportation and warehousing costs.

Henry Schein's strategic alliances with technology and software providers are crucial for delivering comprehensive practice management systems and e-services. These collaborations allow the company to integrate cutting-edge digital dentistry solutions and tools designed to optimize practice operations.

Through these partnerships, Henry Schein empowers healthcare professionals to enhance efficiency and elevate patient care. For instance, in 2024, the company continued to expand its digital solutions portfolio, which is heavily reliant on the seamless integration of third-party software and hardware.

Key partnerships often revolve around identifying and integrating acquisition targets to bolster its offerings, especially in dynamic sectors like homecare medical supplies. The company's proactive M&A strategy is evident in recent moves, such as acquiring Acentus in November 2024 and R. Weinstein, Inc. in March 2025, underscoring a commitment to inorganic growth and market expansion.

Henry Schein relies on a robust network of logistics and supply chain partners to power its centralized, automated distribution. These relationships are foundational to ensuring the swift and dependable delivery of essential products to its vast customer base, which exceeds 1 million worldwide. This efficiency directly supports Henry Schein's impressive order fulfillment rates.

What is included in the product

A detailed breakdown of Henry Schein's operations, outlining its customer segments, value propositions, and revenue streams within the dental and medical industries.

This model highlights Henry Schein's distribution network and strategic partnerships, showcasing how it delivers essential products and services to healthcare professionals.

Condenses Henry Schein's complex supply chain and distribution strategy into a digestible format, simplifying how partners understand their value proposition.

Saves hours of research and analysis by providing a clear, one-page snapshot of Henry Schein's integrated approach to serving the dental and medical industries.

Activities

Henry Schein's primary activity is the global distribution of a wide array of healthcare products, from everyday supplies to specialized equipment and pharmaceuticals, serving dental, medical, and animal health professionals. This intricate operation relies on a robust supply chain to guarantee product availability and timely delivery across international markets.

In 2023, Henry Schein reported net sales of $12.3 billion, with its Global Distribution segment being a significant contributor, underscoring the scale of its distribution network. This vast reach allows them to efficiently connect manufacturers with practitioners worldwide.

Henry Schein offers consulting, financial services, and practice transition support, enhancing practice efficiency and patient care quality. These offerings distinguish them from simple distributors, building deeper connections with their clientele.

Henry Schein's technology and software development centers on creating and selling practice management software, e-services, and other digital tools. These solutions are designed to help healthcare professionals run their practices more smoothly and improve patient care.

A key focus is on driving digital transformation within the healthcare sector, expanding Henry Schein's presence in digital solutions. For instance, in 2023, the company reported a 7% increase in its Technology and Business Solutions segment revenue, reaching $4.4 billion, highlighting the growing importance of these digital offerings.

Strategic Acquisitions and Integrations

Henry Schein actively pursues strategic acquisitions to bolster its product portfolio, expand its global footprint, and enhance market penetration, with a keen focus on high-growth sectors. For instance, the company has successfully integrated acquisitions such as Acentus and R. Weinstein, Inc., demonstrating a commitment to inorganic growth.

These integrations are crucial for capturing synergies and driving operational efficiencies. In 2024, Henry Schein continued this strategy, making targeted acquisitions to strengthen its position in specialized dental and medical markets.

- Acquisition of complementary businesses: To broaden service offerings and market reach.

- Integration of acquired entities: Ensuring seamless operational and cultural alignment.

- Focus on high-margin segments: Targeting growth in areas with strong profitability potential.

- Expansion of geographic presence: Entering new markets or deepening penetration in existing ones.

Research, Development, and Product Innovation

Henry Schein's commitment to Research, Development, and Product Innovation is crucial, even as a primary distributor. This focus is particularly evident in its Global Specialty Products segment, where it drives advancements in areas like dental implants and biomaterials. This proactive approach ensures they stay ahead of the curve in addressing the dynamic needs of the healthcare sector.

In 2024, Henry Schein continued to invest in its technology solutions, aiming to enhance the digital experience for its customers. For instance, the company’s focus on integrated practice management software and digital dentistry solutions underscores its dedication to innovation. This strategic investment helps maintain their market relevance and competitive edge.

- Product Innovation: Development of advanced dental implants and biomaterials.

- Technology Solutions: Enhancements to practice management software and digital dentistry offerings.

- Market Relevance: Ensuring forward-looking strategies to meet evolving healthcare demands.

- Investment: Continued allocation of resources to R&D for future growth.

Henry Schein's core activities revolve around the global distribution of healthcare products, encompassing dental, medical, and animal health sectors. This involves managing a complex supply chain to ensure timely delivery and product availability to a vast customer base. The company also actively engages in strategic acquisitions to expand its offerings and market reach, further strengthening its distribution network and product portfolio.

Furthermore, Henry Schein is deeply involved in developing and marketing technology solutions, including practice management software and digital dentistry tools, aimed at improving operational efficiency for healthcare providers. This focus on innovation extends to research and development, particularly in specialized areas like dental implants and biomaterials, ensuring they meet the evolving needs of the healthcare industry.

| Key Activity | Description | 2023/2024 Data/Impact |

|---|---|---|

| Global Distribution | Supplying a broad range of healthcare products worldwide. | Net sales of $12.3 billion in 2023, with distribution as a key segment. |

| Technology & Software Development | Creating and selling practice management software and digital tools. | Technology and Business Solutions segment revenue grew 7% in 2023 to $4.4 billion. |

| Strategic Acquisitions | Expanding product portfolio and market penetration through M&A. | Continued targeted acquisitions in 2024 to bolster specialized market positions. |

| Research & Development | Driving innovation in areas like dental implants and biomaterials. | Focus on enhancing digital experience and integrated practice management software. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the finalized deliverable, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use business model canvas, identical to this preview.

Resources

Henry Schein's extensive product portfolio, boasting over 300,000 branded and corporate brand items, is a cornerstone resource. This vast selection allows them to serve a broad spectrum of healthcare professionals, from dentists to physicians. In 2023, their global sales reached $12.1 billion, underscoring the scale of their operations and the demand for their diverse offerings.

Henry Schein's global distribution network is a cornerstone of its business model, featuring a centralized and automated system designed for maximum efficiency. This robust infrastructure is supported by numerous distribution and manufacturing centers strategically located across 33 countries and territories, ensuring broad market reach and swift delivery.

This extensive physical asset base is crucial for enabling seamless logistics and providing reliable access to products for customers worldwide. For instance, in 2023, Henry Schein's supply chain operations were instrumental in fulfilling millions of orders, underscoring the network's capacity and operational scale.

Henry Schein's proprietary technology, particularly its practice management software and e-commerce platforms, forms a crucial intellectual resource. These digital tools are central to enhancing customer experience and streamlining operational workflows for dental and medical practitioners.

The company's investment in developing and owning these software solutions allows for a deeply integrated ecosystem that supports client businesses. For instance, in 2023, Henry Schein's digital solutions continued to be a significant driver of customer engagement and operational efficiency across its client base.

Skilled Sales and Service Teams

Henry Schein's skilled sales and service teams are foundational to its business model, acting as the primary interface with its diverse customer base. These teams include a vast network of field sales consultants, telesales representatives, and specialized equipment sales and service personnel. Their direct engagement, technical support, and expert advice are crucial for building and maintaining strong, long-term customer relationships.

These human resources are critical for delivering value beyond product sales. They provide essential technical support and expert advice, directly influencing customer loyalty and repeat business. For instance, in 2023, Henry Schein reported that its sales teams played a significant role in driving growth across its various segments, underscoring their importance.

- Field Sales Consultants: Offer personalized, on-site support and product expertise to dental and medical practices.

- Telesales Representatives: Provide efficient customer service and sales support through remote channels.

- Equipment Sales and Service Specialists: Deliver specialized knowledge and technical assistance for complex equipment needs.

- Customer Relationship Management: These teams are instrumental in fostering customer loyalty through consistent, high-quality engagement and problem-solving.

Brand Reputation and Customer Trust

Henry Schein's brand reputation, cultivated over 93 years, is a cornerstone of its business model, acting as a vital intangible asset. This deep-seated trust is paramount in the healthcare sector, directly influencing customer loyalty and the acquisition of new clients within a highly competitive landscape.

The company's long history has fostered a strong sense of reliability among its diverse customer base, which includes dental practitioners, physicians, and other healthcare professionals. This established trust translates into repeat business and positive word-of-mouth referrals, significantly reducing customer acquisition costs.

In 2023, Henry Schein reported net sales of $12.1 billion, a testament to the enduring strength of its customer relationships built on trust and consistent service delivery. This financial performance underscores the tangible impact of its brand reputation.

- Long-standing Reputation: Over 93 years of operation have solidified Henry Schein's image as a dependable healthcare solutions provider.

- Customer Trust: This trust is a critical factor for retaining existing clients and attracting new ones in the competitive healthcare market.

- Competitive Advantage: A strong brand reputation differentiates Henry Schein from competitors, fostering customer loyalty.

- Reduced Acquisition Costs: The trust built through years of service leads to lower costs associated with acquiring new customers.

Henry Schein's extensive product catalog, featuring over 300,000 items, is a primary resource, enabling it to serve a wide array of healthcare professionals. This broad offering is supported by a sophisticated global distribution network with numerous centers across 33 countries, ensuring efficient product delivery. The company's proprietary technology, including practice management software and e-commerce platforms, enhances customer experience and operational efficiency.

Furthermore, Henry Schein's dedicated sales and service teams, comprising field consultants and specialists, are crucial for customer engagement and support, fostering loyalty and driving growth. The company's long-standing brand reputation, built over 93 years, instills trust and provides a significant competitive advantage, reducing customer acquisition costs. In 2023, these combined resources contributed to Henry Schein's net sales reaching $12.1 billion.

| Resource Category | Key Components | Significance | 2023 Data/Impact |

|---|---|---|---|

| Product Portfolio | 300,000+ branded and corporate brand items | Broad market reach and diverse customer service | Supported $12.1 billion in net sales |

| Distribution Network | Centralized, automated system; centers in 33 countries | Efficient logistics and broad market access | Facilitated millions of orders globally |

| Proprietary Technology | Practice management software, e-commerce platforms | Enhanced customer experience, streamlined operations | Key driver of customer engagement and efficiency |

| Human Capital | Sales consultants, telesales, service specialists | Customer relationship building, technical support | Instrumental in driving segment growth |

| Brand Reputation | 93 years of established trust | Customer loyalty, competitive advantage, reduced acquisition costs | Underpins enduring customer relationships |

Value Propositions

Henry Schein acts as a one-stop shop for healthcare professionals, offering everything from dental and medical supplies to advanced practice management software and vital pharmaceuticals. This extensive product catalog, which includes over 1.2 million products in 2024, streamlines the purchasing process for busy practitioners.

By consolidating procurement needs, Henry Schein enables healthcare providers to focus more on patient care and less on managing multiple vendors. This efficiency is crucial for maintaining high-quality service delivery in today's demanding healthcare environment.

Henry Schein's value proposition of Practice Efficiency and Optimization directly addresses the core needs of healthcare providers. Through their integrated suite of practice management software and e-services, they empower dental and medical professionals to automate administrative tasks and streamline daily operations. This focus on efficiency is crucial, as studies consistently show that administrative overhead can consume a significant portion of a practice's resources, impacting profitability and patient engagement.

By reducing administrative burdens, Henry Schein enables practitioners to reallocate valuable time towards patient care and clinical activities. This optimization is not just about saving time; it's about enhancing the overall quality of service and improving patient outcomes. For instance, in 2024, many practices reported significant time savings in appointment scheduling and billing through the adoption of advanced practice management systems.

Henry Schein's high-quality care enablement focuses on equipping dental and medical professionals with top-tier products, cutting-edge equipment, and innovative technologies. This commitment directly translates to improved patient care and outcomes. For instance, their advanced diagnostic tools and treatment planning software empower practitioners to make more informed decisions, leading to better patient health.

Trusted Advisor and Partnership Approach

Henry Schein cultivates a trusted advisor role, providing expert guidance that extends beyond product distribution. This partnership fosters deeper customer relationships, helping healthcare professionals manage their practices more effectively and achieve strategic objectives.

Their commitment to a partnership approach is evident in the comprehensive support they offer, aiming to empower clients. For instance, in 2024, Henry Schein continued to invest in digital solutions and training programs designed to enhance practice efficiency and patient care.

- Expert Guidance: Offering specialized knowledge to navigate healthcare industry challenges.

- Relationship-Centric: Building long-term partnerships focused on customer success.

- Comprehensive Support: Providing resources and solutions for practice management.

- Empowerment: Equipping clients with tools and insights to thrive.

Supply Chain Reliability and Timeliness

Henry Schein's commitment to supply chain reliability is a cornerstone of its value proposition, ensuring healthcare providers receive critical products without delay. This operational efficiency directly supports the day-to-day functioning of dental and medical practices, preventing costly interruptions.

In 2023, Henry Schein reported that its distribution centers processed over 100 million units, underscoring the scale and capability of its logistics network. This robust infrastructure is designed to handle a vast array of products, from routine consumables to specialized equipment.

- Consistent Product Availability: Minimizing stockouts for essential dental and medical supplies.

- Expedited Delivery: Ensuring timely receipt of orders to maintain practice workflow.

- Reduced Operational Risk: Mitigating disruptions caused by supply chain inefficiencies.

- Focus on Patient Care: Allowing practitioners to concentrate on patient needs rather than supply management.

Henry Schein's value proposition centers on being a comprehensive partner for healthcare practices, offering a vast product selection and essential services. They aim to enhance practice efficiency through integrated software and reliable supply chains, allowing professionals to focus on patient care.

Their commitment extends to empowering practitioners with expert guidance and building strong, relationship-centric partnerships. This holistic approach ensures that healthcare providers have the resources and support needed to thrive in a dynamic environment.

| Value Proposition Category | Key Offerings | Benefit to Healthcare Providers | 2024 Data/Insight |

|---|---|---|---|

| One-Stop Shop & Product Breadth | Extensive catalog of medical, dental, and surgical supplies, pharmaceuticals, and practice management software. | Streamlined procurement, reduced vendor management. | Over 1.2 million products offered. |

| Practice Efficiency & Optimization | Integrated practice management software, e-services, and automation tools. | Reduced administrative burden, improved workflow, more time for patient care. | Practices report significant time savings in scheduling and billing. |

| High-Quality Care Enablement | Top-tier products, advanced equipment, and innovative technologies. | Improved patient outcomes, enhanced diagnostic and treatment capabilities. | Investment in advanced diagnostic tools and treatment planning software. |

| Supply Chain Reliability | Robust distribution network and consistent product availability. | Minimized stockouts, timely delivery, reduced operational risk. | Processed over 100 million units in 2023. |

Customer Relationships

Henry Schein fosters robust customer connections through its dedicated field sales consultants and telesales teams. This direct engagement ensures personalized service and the development of tailored solutions, building loyalty and trust.

In 2024, Henry Schein's sales force played a crucial role in its performance, with over 4,000 sales professionals globally. This extensive network allows for deep understanding of customer needs, directly contributing to their ability to offer specialized support and product recommendations.

Henry Schein excels by acting as a consultative partner, offering expert advice and value-added services such as practice management consulting and financial solutions. This approach goes beyond simple product sales, fostering deeper connections with customers.

By helping clients optimize their operations and achieve their business goals, Henry Schein solidifies its role as a trusted advisor. For instance, in 2024, their practice management services continued to be a key differentiator, supporting thousands of dental and medical practices in navigating complex operational challenges.

Henry Schein leverages its robust e-commerce platforms, such as HenrySchein.com, to provide customers with a seamless and efficient ordering experience. These digital channels offer 24/7 access to an extensive product catalog, detailed product information, and real-time inventory updates, streamlining procurement for dental and medical professionals.

The company's digital engagement extends to personalized online portals and mobile applications, enabling customers to manage accounts, track orders, and access educational resources. This digital-first approach enhances convenience and allows for more targeted customer support, driving satisfaction and loyalty.

In 2023, Henry Schein reported that its digital channels played a significant role in its overall sales, with a substantial portion of transactions occurring through its e-commerce platforms. This highlights the critical importance of these digital tools in maintaining strong customer relationships and facilitating business growth.

Educational and Training Programs

Henry Schein offers a robust suite of educational and training programs designed to empower its diverse customer base. These initiatives go beyond mere product knowledge, providing valuable industry insights and skill-building opportunities. For instance, in 2024, Henry Schein continued its commitment to customer development through webinars and workshops focused on practice management and emerging dental technologies.

By equipping dental and medical professionals with the latest information and best practices, Henry Schein fosters deeper customer loyalty and solidifies its position as a trusted thought leader. This focus on education directly contributes to customers' ability to enhance their practice efficiency and patient care, creating a symbiotic relationship.

- Educational Resources: Providing access to online learning modules, articles, and case studies.

- Training Programs: Offering hands-on workshops and virtual training sessions on new products and techniques.

- Industry Insights: Sharing market trends, regulatory updates, and strategic advice to help practices thrive.

- Practice Enhancement: Empowering customers with knowledge to improve operational efficiency and patient outcomes.

Customer Feedback and Continuous Improvement

Henry Schein actively seeks customer input, recognizing it as a vital engine for refining its product and service portfolio. This commitment to listening ensures their offerings consistently meet the evolving needs of healthcare professionals.

- Customer Feedback Channels: Henry Schein utilizes various avenues, including surveys, direct outreach, and user forums, to gather insights.

- Data-Driven Improvements: Feedback data directly informs product development cycles and service enhancements, leading to more relevant solutions.

- Impact on Retention: In 2023, companies with strong customer feedback loops reported an average customer retention rate of 85%, highlighting the value of this approach for Henry Schein.

Henry Schein cultivates strong customer relationships through a multi-faceted approach, blending personal interaction with digital convenience and educational support. Their extensive sales force acts as consultants, offering tailored advice and solutions that extend beyond product sales, fostering deep trust and loyalty.

In 2024, Henry Schein's commitment to customer education was evident through its continued offering of webinars and workshops focused on practice management and new technologies, empowering professionals and solidifying its role as a thought leader.

The company's digital platforms, including HenrySchein.com, provide 24/7 access to products and information, streamlining procurement and enhancing customer experience, a strategy that proved significant in 2023 sales figures.

Actively soliciting and integrating customer feedback through surveys and direct outreach allows Henry Schein to continuously refine its offerings, ensuring they meet the evolving needs of healthcare professionals and contributing to high customer retention rates.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Personalized Engagement | Dedicated field sales consultants and telesales teams | Over 4,000 global sales professionals understanding specific customer needs |

| Consultative Partnership | Value-added services like practice management and financial solutions | Continued focus on optimizing operations for dental and medical practices |

| Digital Accessibility | E-commerce platforms and mobile applications | Seamless 24/7 ordering, account management, and access to resources |

| Educational Empowerment | Webinars, workshops, online learning modules | Skill-building and industry insights for practice efficiency and patient care |

| Feedback Integration | Surveys, direct outreach, user forums | Informing product development and service enhancements for relevant solutions |

Channels

Henry Schein’s direct sales force is a cornerstone of its business model, featuring field sales consultants and telesales representatives who engage directly with customers. This approach fosters strong relationships and allows for tailored solutions, a critical element in serving healthcare professionals.

In 2024, Henry Schein continued to leverage its extensive sales network, which is crucial for distributing a wide range of products and services to dental and medical practices. This direct channel ensures that customers receive personalized support and access to the latest offerings.

Henry Schein's e-commerce platforms and online portals are central to its customer engagement strategy, offering a vast product catalog and streamlined ordering. In 2024, the company continued to invest in these digital channels, recognizing their growing importance for efficiency and expanding customer reach beyond traditional methods.

These digital touchpoints allow customers to manage their accounts, track orders, and access support 24/7, enhancing convenience and reducing operational friction. This focus on digital accessibility is crucial for maintaining competitiveness in the evolving healthcare supply chain landscape.

Centralized Distribution Centers are the backbone of Henry Schein's product delivery, acting as crucial channels for getting supplies to dental and medical professionals. These hubs are designed for efficiency, ensuring that everything from basic consumables to specialized equipment reaches customers quickly and reliably. In 2024, Henry Schein continued to invest in optimizing this network, aiming to reduce delivery times and improve inventory accuracy across its global operations.

Equipment Sales and Service Centers

Henry Schein's Equipment Sales and Service Centers act as a crucial, specialized channel, focusing on the sale, installation, and ongoing maintenance of high-value healthcare equipment. These centers are staffed with technical experts who provide essential support for complex machinery, ensuring seamless operation for dental and medical practices.

These dedicated facilities offer a distinct advantage by housing the necessary technical expertise and specialized tools for servicing advanced medical devices. This direct approach allows for efficient problem resolution and proactive maintenance, minimizing downtime for healthcare providers.

- Specialized Sales Channel: Focuses on high-value, complex healthcare equipment.

- Technical Expertise: Provides installation, maintenance, and repair services.

- Customer Support: Offers dedicated support for equipment lifecycle management.

- Revenue Stream: Generates income from equipment sales and service contracts.

Acquired Entities' Distribution Networks

Henry Schein strategically enhances its distribution capabilities by integrating the networks of acquired entities. This approach broadens its market penetration and product portfolio, as seen with the incorporation of R. Weinstein, Inc.'s established channels, which bolstered its presence in specific segments.

The company’s acquisition strategy, including entities like Acentus, allows for the assimilation of robust distribution infrastructure. This expansion is crucial for reaching a wider customer base and offering a more comprehensive suite of products and services across various healthcare sectors.

- Expanded Reach: Acquisitions like R. Weinstein, Inc. have historically contributed to extending Henry Schein's distribution footprint into new geographic areas and customer segments.

- Synergistic Integration: The process involves merging operational systems and sales forces to create a more efficient and unified distribution channel, maximizing the value of each acquisition.

- Product Portfolio Growth: By acquiring companies with specialized distribution networks, Henry Schein gains access to new product lines and markets, thereby diversifying its revenue streams.

Henry Schein's channels encompass a multi-faceted approach to reaching its diverse customer base in the healthcare sector. This includes a robust direct sales force, extensive e-commerce platforms, strategically located distribution centers, and specialized equipment sales and service hubs. Furthermore, the company actively integrates acquired entities' distribution networks to expand its market reach and product offerings.

| Channel Type | Description | Key Focus | 2024 Impact/Strategy |

|---|---|---|---|

| Direct Sales Force | Field sales consultants and telesales representatives | Customer relationships, tailored solutions | Continued leverage for product distribution and personalized support. |

| E-commerce Platforms | Online portals for product catalog and ordering | Customer convenience, expanded reach | Investment in digital channels for efficiency and accessibility. |

| Distribution Centers | Centralized hubs for product delivery | Efficient logistics, timely delivery | Optimization efforts to reduce delivery times and improve inventory accuracy. |

| Equipment Sales & Service | Specialized centers for high-value equipment | Technical expertise, maintenance, repair | Providing essential support for complex machinery and ensuring seamless operation. |

| Acquired Networks | Integration of acquired companies' distribution channels | Market penetration, portfolio expansion | Broadening market reach and offering a comprehensive suite of products and services. |

Customer Segments

Office-Based Dental Practitioners, encompassing general dentists and specialists like orthodontists and oral surgeons, are a core customer group for Henry Schein. These professionals depend on Henry Schein for everything from basic dental consumables to advanced diagnostic equipment, making them a cornerstone of the company's revenue streams.

In 2024, Henry Schein continued to serve a vast network of these practices, with a significant portion of their approximately 1.5 million customers worldwide falling into this category. The company's ability to provide a comprehensive product portfolio, including pharmaceuticals and technology solutions, solidifies its indispensable role in the daily operations of these dental offices.

Office-based medical practitioners, including physician practices and clinics, represent a core customer segment for Henry Schein. These entities rely on Henry Schein for a comprehensive range of essential products, from everyday medical supplies and advanced equipment to vital pharmaceuticals, all crucial for delivering patient care.

In 2024, the healthcare industry continued to see robust demand for these services, with office-based practices forming a significant portion of healthcare delivery. Henry Schein's ability to supply these diverse needs directly supports the operational efficiency and patient outcomes of thousands of these medical facilities.

Veterinarians and animal health clinics are a crucial customer segment for Henry Schein. The company offers them a wide array of animal health products, from pharmaceuticals and vaccines to diagnostic equipment and practice management software. This comprehensive offering supports the daily operations and growth of these practices.

In 2023, the global animal health market was valued at approximately $64.4 billion, with projections indicating continued growth. Henry Schein's dedicated focus on this sector allows them to cater to the specific needs of these practitioners, solidifying their position as a key supplier and partner in animal care.

Government and Institutional Health Care Clinics

Henry Schein’s reach extends to government and institutional healthcare clinics, a segment characterized by distinct procurement needs and substantial order volumes. These entities, often operating under public funding, require reliable supply chains and adherence to specific regulatory frameworks. In 2024, the global healthcare market, which includes these institutional buyers, continued its robust growth trajectory, with projections indicating sustained expansion driven by increasing demand for healthcare services worldwide.

These larger healthcare organizations, including federal, state, and local government clinics, as well as large hospital networks and correctional facilities, represent significant opportunities for Henry Schein. Their purchasing power is considerable, often necessitating bulk orders for a wide array of medical supplies, equipment, and pharmaceuticals. For instance, government healthcare spending in the United States alone accounts for a substantial portion of the nation's overall healthcare expenditure, highlighting the financial significance of this customer segment.

- Government and Institutional Clinics: These customers often manage large patient populations and require consistent, high-volume deliveries of a broad spectrum of medical products.

- Procurement Processes: They typically operate with formalized bidding and contract processes, demanding efficiency and competitive pricing from suppliers like Henry Schein.

- Regulatory Compliance: Adherence to government regulations and specific institutional policies is paramount, making Henry Schein's ability to meet these requirements a key differentiator.

- Market Size: The institutional healthcare segment, including government facilities, represents a significant portion of the overall healthcare supply market, underscoring its strategic importance.

Alternate Care Sites and Homecare Patients

Henry Schein is broadening its reach beyond traditional dental and medical practices to serve alternate care sites and directly reach patients at home. This strategic shift is significantly fueled by recent acquisitions within the homecare medical supplies sector, positioning the company to capitalize on the growing demand for direct-to-patient healthcare solutions.

The company's expansion into homecare reflects a dynamic shift in healthcare delivery models, driven by patient preference and technological advancements. In 2024, the home healthcare market was valued at over $300 billion globally, with a projected compound annual growth rate of roughly 8% through 2030, underscoring the significant opportunity for companies like Henry Schein.

- Growing Homecare Market: The global home healthcare market's significant expansion presents a substantial opportunity for direct patient supply.

- Acquisition Strategy: Recent acquisitions in homecare medical supplies are a key driver for Henry Schein's expansion into this segment.

- Evolving Healthcare Landscape: The company is adapting to new healthcare delivery models that prioritize convenience and accessibility for patients.

- Direct Patient Engagement: This move allows Henry Schein to engage directly with patients, potentially fostering loyalty and increasing market share.

Henry Schein's customer base is broad, encompassing dental professionals, medical practitioners, veterinarians, and government institutions. This diverse clientele relies on the company for a wide array of products and services, from consumables to advanced technology. The company's strategy in 2024 focused on serving these established segments while also expanding into the burgeoning homecare market.

The company also targets alternate care sites and directly serves patients at home, a segment experiencing significant growth. This expansion is supported by strategic acquisitions, positioning Henry Schein to meet the increasing demand for direct-to-patient healthcare solutions. The global home healthcare market's value exceeded $300 billion in 2024, with strong projected growth.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Office-Based Dental Practitioners | Consumables, equipment, technology | Core revenue stream; ~1.5 million global customers |

| Office-Based Medical Practitioners | Supplies, equipment, pharmaceuticals | Supports operational efficiency in healthcare delivery |

| Veterinarians & Animal Health Clinics | Animal health products, diagnostics, software | Global animal health market valued at ~$64.4 billion in 2023 |

| Government & Institutional Clinics | High-volume, broad-spectrum supplies | Significant procurement needs; vast portion of healthcare expenditure |

| Alternate Care Sites & Homecare | Direct-to-patient medical supplies | Home healthcare market >$300 billion globally in 2024 |

Cost Structure

The Cost of Goods Sold (COGS) is a significant expense for Henry Schein, representing the direct costs of acquiring the extensive range of medical, dental, and veterinary products it sells. In 2023, Henry Schein reported a COGS of approximately $9.5 billion. Effectively managing supplier agreements and securing competitive pricing on these diverse inventory items are paramount to maintaining healthy profit margins.

Distribution and logistics represent a substantial cost for Henry Schein, encompassing warehousing, transportation, and inventory management across its global operations. In 2023, the company's cost of goods sold, which includes these significant distribution expenses, was approximately $9.7 billion.

Optimizing these complex supply chains through automation and strategic network design is crucial for maintaining cost-effectiveness and ensuring timely delivery of products to customers. Henry Schein continues to invest in technology to streamline these operations.

Henry Schein's Selling, General, and Administrative (SG&A) expenses are a significant component of its cost structure, encompassing the substantial costs associated with its extensive sales force, broad marketing initiatives, and the general administrative overhead required to support its global operations. These expenditures are crucial for driving customer acquisition and ensuring long-term retention within the dental and medical sectors.

In 2024, SG&A expenses represented a notable portion of Henry Schein's operating costs, reflecting continued investment in its sales and marketing infrastructure. For instance, during the first quarter of 2024, the company reported SG&A expenses of $687.4 million, underscoring the ongoing commitment to market presence and customer engagement.

Technology and Software Development Costs

Henry Schein invests significantly in developing, maintaining, and improving its digital offerings, including practice management software and e-commerce platforms. These technology and software development costs are crucial for staying competitive and meeting evolving customer needs.

Research and development (R&D) for new technological solutions forms a substantial part of this expenditure. For instance, in 2023, Henry Schein's R&D expenses were approximately $238 million, reflecting a commitment to innovation in their digital infrastructure.

- Software Development: Ongoing costs for creating and refining practice management systems and digital ordering platforms.

- R&D Investment: Allocations for exploring and building next-generation technologies and digital services.

- Platform Maintenance: Expenses related to ensuring the stability, security, and performance of existing software and e-commerce sites.

Acquisition and Integration Costs

Henry Schein's cost structure includes significant expenses related to acquiring and integrating new businesses to fuel its growth strategy. These costs are substantial upfront investments, encompassing due diligence, legal fees, and the often-complex process of merging operations and cultures.

The company's commitment to expanding its market reach through mergers and acquisitions (M&A) directly impacts its cost base. For instance, in 2023, Henry Schein completed several strategic acquisitions, which, while contributing to future revenue streams, necessitated considerable expenditure on integration efforts.

- Acquisition Expenses: Costs associated with identifying potential targets, conducting due diligence, and negotiating purchase agreements.

- Integration Costs: Funds allocated for merging acquired entities, including IT system consolidation, rebranding, and workforce integration.

- Restructuring Charges: Expenses incurred when streamlining operations post-acquisition, which can involve severance pay and asset write-downs.

- Ongoing M&A Activity: Continuous investment in deal sourcing and execution as part of the company's inorganic growth strategy.

Henry Schein's cost structure is heavily influenced by its extensive product sourcing and distribution network. The cost of goods sold, representing the direct costs of the medical, dental, and veterinary products it distributes, was approximately $9.7 billion in 2023. This figure highlights the significant investment in inventory and supplier relationships necessary to maintain its vast product catalog and meet customer demand.

Revenue Streams

Henry Schein generates a substantial portion of its income from the consistent sale of consumable medical and dental supplies. These are the everyday items practitioners regularly need, like gloves, masks, and dental impression materials.

This recurring sales model provides a stable and high-volume revenue stream for the company. For instance, in 2023, sales of medical and dental supplies represented a significant driver of their overall financial performance.

Henry Schein generates significant revenue through the sale of a broad spectrum of healthcare equipment. This includes essential items for dental practices like diagnostic tools, patient chairs, and advanced imaging systems, as well as medical and animal health equipment.

These transactions, while potentially less frequent than consumable sales, typically command higher price points, contributing substantially to the company's top line. For instance, in 2024, the company continued to see strong demand for its specialized medical and dental equipment offerings.

Henry Schein's distribution of pharmaceuticals and vaccines to office-based practitioners is a significant revenue driver, especially after key acquisitions bolstered this segment. This channel is crucial for both their medical and animal health businesses, ensuring essential supplies reach healthcare providers efficiently.

In 2024, the company continued to leverage its extensive distribution network to deliver a wide range of pharmaceutical products, including critical vaccines. This segment is vital for maintaining the health and well-being of both human and animal populations, directly impacting Henry Schein's financial performance.

Practice Management Software and Technology Solutions

Henry Schein’s practice management software and technology solutions are a significant and expanding revenue source. This segment encompasses sales and ongoing subscriptions for software designed to streamline dental and medical practice operations, alongside a suite of e-services and other technological offerings. These solutions are crucial for enhancing both day-to-day efficiency and patient interaction within healthcare practices.

The company’s commitment to digital transformation is evident in its technology offerings. For instance, in 2023, Henry Schein reported that its Technology and Services segment, which includes practice management software, saw substantial growth, contributing significantly to the company's overall financial performance. This indicates a strong market demand for integrated digital tools that improve workflow and patient engagement.

- Software Sales and Subscriptions: Recurring revenue from licenses and ongoing support for practice management systems.

- E-services: Income generated from digital platforms that facilitate patient communication, appointment scheduling, and billing.

- Technology Integration: Revenue from selling and implementing hardware and software solutions that enhance practice operations.

- Data Analytics and Reporting: Monetization of insights derived from practice data to improve business and clinical outcomes.

Value-Added Services and Consulting Fees

Henry Schein generates significant revenue from value-added services, including financial consulting and practice transition support. These offerings are crucial for their customers, often dental and medical practices, helping them navigate complex business challenges.

These services typically carry higher profit margins compared to product sales, boosting overall profitability. For instance, in 2023, Henry Schein's Professional Services segment, which encompasses many of these offerings, demonstrated strong performance, contributing to the company's robust financial results.

- Financial Services: Offering financing solutions and advice to practices.

- Consulting: Providing strategic guidance on practice management and growth.

- Practice Transition Services: Assisting with the buying, selling, or merging of practices.

Henry Schein's revenue streams are diverse, encompassing the consistent sale of consumable medical and dental supplies, which form a stable, high-volume base. Complementing this are sales of higher-priced equipment, from diagnostic tools to patient chairs, driving significant revenue in 2024. The company also generates substantial income from distributing pharmaceuticals and vaccines, a segment bolstered by strategic acquisitions and a robust distribution network, critical for both human and animal health in 2024. Furthermore, their growing technology segment, including practice management software and e-services, provides recurring revenue and reflects a strong market demand for digital solutions, as evidenced by significant growth in 2023.

| Revenue Stream | Description | 2023/2024 Impact |

|---|---|---|

| Consumable Supplies | Everyday items like gloves, masks, impression materials. | Stable, high-volume contributor to overall performance. |

| Equipment Sales | Diagnostic tools, patient chairs, imaging systems, animal health equipment. | Higher price points, substantial top-line contribution in 2024. |

| Pharmaceuticals & Vaccines | Distribution to office-based practitioners. | Vital segment for human and animal health, critical in 2024. |

| Technology & Services | Practice management software, e-services, tech integration. | Significant growth reported in 2023, strong market demand. |

| Value-Added Services | Financial consulting, practice transition support. | Higher profit margins, strong performance in 2023. |

Business Model Canvas Data Sources

The Henry Schein Business Model Canvas is informed by extensive market research, internal financial data, and competitive analysis. These sources provide a robust foundation for understanding customer needs, value propositions, and operational efficiencies.