Henry Schein Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henry Schein Bundle

Unlock the strategic potential of Henry Schein's product portfolio with a glimpse into their BCG Matrix. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full report for a comprehensive breakdown and actionable insights to drive your business forward.

Stars

Henry Schein's Global Specialty Products segment, encompassing dental implants, biomaterials, orthodontics, and endodontic solutions, is a shining example of a Star in the BCG Matrix. In 2024, this vital area generated $1.4 billion in sales, reflecting a robust 8.7% year-over-year growth.

This substantial sales increase underscores the high demand and rapid expansion within specialized dental markets. The segment's performance highlights its position as a market leader, driven by ongoing innovation and customer adoption of advanced dental technologies.

Henry Schein's digital dentistry solutions, encompassing advanced digital workflow tools and 3D printing, are positioned as stars in their BCG matrix. The company's strong emphasis on digitalization, evident at events like the 2025 International Dental Show, targets a rapidly expanding market.

These innovative offerings are designed to significantly boost practice efficiency and elevate the patient experience, fueling strong market adoption and growth. Data from 2024 indicates the global digital dentistry market was valued at approximately $2.5 billion, with projections showing a compound annual growth rate of over 10% leading up to 2030, underscoring the star status of these solutions for Henry Schein.

Henry Schein's cloud-based practice management software, including Dentrix Ascend and Dentally, is a key player in a rapidly expanding market. These solutions are seeing robust sales, reflecting the increasing demand for modern, accessible dental office management tools.

The broader dental practice management software market is on a strong upward trajectory. Specifically, cloud-based solutions are projected to experience a substantial compound annual growth rate (CAGR) of 14.21% through 2030. This surge is fueled by advantages like seamless software updates and the ability to monitor system uptime remotely, making them highly attractive to dental practices.

Given this market dynamism and the inherent benefits of cloud technology, Henry Schein's investment and development in Dentrix Ascend and Dentally position these offerings for significant growth. They are well-placed to capture a larger share of this expanding digital health sector.

Homecare Medical Products Platform

Henry Schein's homecare medical products platform is a significant player, boasting an annual revenue exceeding $350 million. This robust revenue base is further strengthened by strategic moves, such as the acquisition of Acentus in November 2024, demonstrating a clear commitment to expanding its footprint in this sector.

The company's focus on direct-to-patient delivery, particularly for Continuous Glucose Monitors (CGMs), highlights its recognition of this market's substantial growth potential. This strategy directly addresses evolving customer needs and the increasing demand for convenient, home-based healthcare solutions.

- Annual Revenue: Exceeds $350 million.

- Strategic Acquisition: Acentus acquired in November 2024.

- Growth Focus: Direct delivery of Continuous Glucose Monitors (CGMs) to patients.

- Market Trend: Addressing expanding customer needs for home-based healthcare.

Value-Added Services (Dental)

Henry Schein's dental value-added services are a significant growth driver. These services, encompassing consulting, financial support, and practice transition assistance, generated $233 million in sales in 2024, marking a robust 21.5% increase.

This segment is crucial for bolstering Henry Schein's primary dental distribution operations. The high profit margins associated with these services underscore their strategic importance and highlight a burgeoning market where the company holds a distinct competitive edge.

- Consulting Services: Offering expert advice on practice management and operational efficiency.

- Financial Services: Providing financing solutions and support for dental practices.

- Practice Transition Services: Assisting dentists with buying, selling, or merging practices.

- Sales Growth: Achieved 21.5% growth in 2024, reaching $233 million.

Stars within Henry Schein's portfolio represent high-growth, high-market-share offerings. These are the segments driving significant revenue and demonstrating strong future potential.

The company's digital dentistry solutions, including advanced workflow tools and 3D printing, are prime examples of Stars. In 2024, the global digital dentistry market was valued at approximately $2.5 billion, with a projected CAGR exceeding 10% through 2030, indicating robust growth potential for these innovative products.

Similarly, Henry Schein's cloud-based practice management software, such as Dentrix Ascend and Dentally, are classified as Stars. The cloud-based segment of this market is expected to grow at a CAGR of 14.21% through 2030, driven by efficiency and remote management benefits.

The Global Specialty Products segment, encompassing dental implants, biomaterials, orthodontics, and endodontic solutions, also shines as a Star. This segment achieved $1.4 billion in sales in 2024, reflecting an impressive 8.7% year-over-year growth, underscoring its leading market position.

| Segment/Product | 2024 Sales (USD Billions) | 2024 Growth (%) | Market Trend |

|---|---|---|---|

| Global Specialty Products | 1.4 | 8.7 | High demand, rapid expansion in specialized dental markets |

| Digital Dentistry Solutions | N/A (Part of broader market) | N/A | Global market ~ $2.5B, projected CAGR > 10% (to 2030) |

| Cloud Practice Management Software | N/A (Part of broader market) | N/A | Cloud segment CAGR ~ 14.21% (to 2030) |

What is included in the product

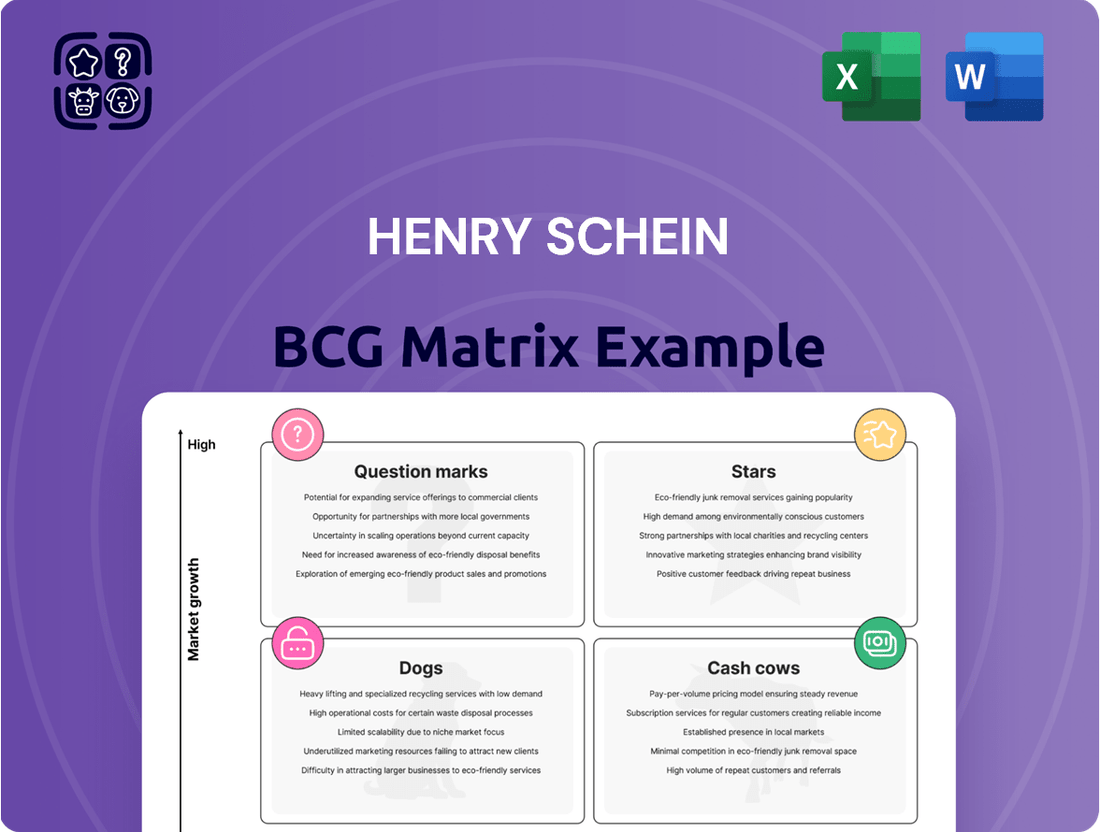

The Henry Schein BCG Matrix offers a strategic framework to analyze its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides decisions on investment, divestment, or holding strategies for each business unit within Henry Schein's diverse offerings.

A clear visual of Henry Schein's business units, categorized by growth and market share, alleviates the pain of strategic uncertainty.

Cash Cows

Henry Schein's global dental distribution of consumable supplies represents a classic cash cow. In 2024, this segment brought in a substantial $6.7 billion in revenue, with dental merchandise alone accounting for $4.7 billion of that total.

Despite a modest 0.4% growth rate for the segment in 2024, the consistent demand and Henry Schein's dominant market position ensure a steady and significant cash flow. This segment is vital for funding other areas of the business.

Traditional Dental Equipment Sales within Henry Schein’s portfolio are considered Cash Cows. The global dental equipment market was valued at $1.7 billion in 2024, experiencing a 2.9% growth rate.

This segment, while not exhibiting the rapid expansion of newer digital technologies, benefits from consistent demand for fundamental items such as imaging equipment, sterilization units, and CAD/CAM systems.

These essential products maintain a significant market share, providing Henry Schein with a dependable and steady stream of revenue.

Established on-premise practice management software, like those offered by Henry Schein, continues to be a significant revenue generator. In 2024, these systems captured a substantial 45.23% of the market, demonstrating their enduring appeal to dental practices prioritizing specific IT setups or regulatory compliance.

Henry Schein's mature portfolio in this segment reflects a strong market position, translating into consistent cash flow. While cloud solutions are expanding, the established on-premise offerings remain a core strength, providing a stable foundation for the company's financial performance.

Medical-Surgical Products Distribution

The medical-surgical products distribution segment for Henry Schein, a global leader serving office-based medical practitioners, functions as a classic Cash Cow within the BCG Matrix. This business unit commands a significant market share, ensuring a steady stream of revenue. Its broad product portfolio, encompassing everything from basic supplies to specialized equipment, provides a stable foundation for consistent cash generation, even when facing market shifts such as the increased demand for personal protective equipment (PPE) seen in recent years.

In 2024, Henry Schein's global distribution of medical-surgical products continued to be a bedrock of its financial performance. While specific figures for this segment are often integrated into broader reporting, the company's overall revenue for the first quarter of 2024 reached $3.1 billion, demonstrating the scale of its operations. This segment benefits from the essential nature of its offerings, which are consistently required by healthcare providers regardless of economic cycles.

- Stable Market Share: Henry Schein's extensive network and established relationships in the medical-surgical distribution sector solidify its dominant position.

- Consistent Cash Flow Generation: The high demand for essential medical supplies translates into predictable and substantial cash inflows for the company.

- Resilience to Market Fluctuations: While specific product demands may vary, the overall need for medical-surgical products remains a constant, providing a buffer against volatility.

- Foundation for Investment: The robust cash flow generated by this segment allows Henry Schein to invest in its other business units, such as emerging technologies and international expansion.

Animal Health Distribution (Pre-spin-off)

Before its spin-off, Henry Schein's Animal Health Distribution segment operated as a classic cash cow. This division held a substantial market share within the animal health sector, a market characterized by its maturity and consistent demand for essential products and services. Its strong performance provided a reliable and significant source of cash flow for the broader Henry Schein organization.

This historical segment's financial profile aligns perfectly with the cash cow definition in the BCG Matrix. It generated more cash than it consumed, allowing Henry Schein to reinvest in other business areas or distribute to shareholders. For instance, in 2018, the year before the spin-off, Henry Schein reported that its Animal Health segment generated approximately $3.7 billion in revenue.

- High Market Share: The segment commanded a leading position in the animal health distribution market.

- Mature Market: Operating in an established and stable industry provided predictable revenue streams.

- Strong Cash Generation: The business consistently produced surplus cash, a hallmark of a cash cow.

- Pre-Spin-off Contribution: In 2018, this segment represented a significant portion of Henry Schein's overall revenue, highlighting its importance.

Henry Schein’s established dental distribution of consumable supplies is a prime example of a cash cow. In 2024, this segment generated $6.7 billion in revenue, with dental merchandise contributing $4.7 billion. This segment's modest 0.4% growth in 2024 underscores its stability and consistent cash flow, crucial for funding other business areas.

Traditional Dental Equipment Sales also represent cash cows for Henry Schein. The global dental equipment market, valued at $1.7 billion in 2024 with a 2.9% growth rate, sees consistent demand for essential items like imaging and sterilization units. These products maintain a strong market share, ensuring a steady revenue stream.

Mature on-premise practice management software continues to be a significant revenue generator for Henry Schein, holding 45.23% of the market in 2024. This segment's strong market position translates into consistent cash flow, providing a stable financial foundation.

The medical-surgical products distribution segment is another key cash cow for Henry Schein. Serving office-based medical practitioners globally, this unit benefits from consistent demand for essential supplies, contributing significantly to the company's overall performance, as evidenced by the $3.1 billion in revenue reported for Q1 2024.

| Business Segment | 2024 Revenue (USD Billions) | 2024 Growth Rate | BCG Category |

| Global Dental Distribution (Consumables) | 6.7 | 0.4% | Cash Cow |

| Traditional Dental Equipment Sales | 1.7 (Market Value) | 2.9% | Cash Cow |

| Established On-Premise Practice Management Software | Significant Market Share (45.23%) | Stable | Cash Cow |

| Medical-Surgical Products Distribution | Integral to $3.1B Q1 2024 Revenue | Stable | Cash Cow |

Full Transparency, Always

Henry Schein BCG Matrix

The Henry Schein BCG Matrix preview you're examining is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed, analysis-ready report ready for your strategic planning. You can confidently use this preview as a direct representation of the valuable, actionable insights you'll gain.

Dogs

Henry Schein's Global Technology segment is experiencing robust growth, largely driven by its newer cloud-based practice management systems. In 2023, this segment reported significant revenue increases, reflecting strong adoption of these modern solutions by dental and medical practices.

However, this positive trend is being partially tempered by declining sales of older, on-premise software. These legacy products are being phased out, or sunset, as the company shifts its focus and investment towards its more advanced cloud offerings. This strategic move is typical for companies managing a product lifecycle, where older, less competitive products are gradually retired.

Personal Protective Equipment (PPE) and COVID Test Kits are currently considered Dogs for Henry Schein. Sales for these items have seen a significant downturn as the urgency surrounding the pandemic has lessened.

While these products were essential and saw booming sales during the height of COVID-19, their market growth has slowed considerably. This decline in demand, coupled with a shrinking market share post-pandemic, places them in the Dog category within the BCG Matrix.

Henry Schein's overall net sales in the first quarter of 2025 experienced a modest dip of 0.1% compared to the previous year. When we strip out the effects of personal protective equipment (PPE) and COVID test kits, the underlying sales growth, measured in constant currency, was 2.0%.

This performance suggests that certain fundamental distribution products, those outside of specialized or technology-focused categories, might be facing stagnant or even shrinking internal sales. If these products are also losing ground in terms of market share, they would fit the profile of Henry Schein's Dogs in the BCG Matrix.

Underperforming Acquired Businesses

Henry Schein strategically acquires companies to drive expansion, but some acquired businesses may struggle to integrate and deliver expected results. If these businesses have a low market share and low growth potential, they can become question marks in the BCG matrix, demanding considerable resources without generating sufficient returns.

The company itself has noted that transitional challenges are a common occurrence following acquisitions. For instance, in their 2023 annual report, Henry Schein highlighted integration costs and potential disruptions impacting the performance of newly acquired entities. These underperforming units can strain financial resources, diverting attention from more promising ventures.

- Underperforming Acquired Businesses

- Low Market Share & Growth: These businesses typically operate in niche markets or face intense competition, limiting their ability to capture significant market share or achieve rapid expansion.

- Integration Challenges: Difficulties in merging operations, systems, and cultures post-acquisition can lead to inefficiencies and hinder the realization of anticipated synergies.

- Resource Drain: Without strong performance, these units require ongoing investment for turnaround efforts or maintenance, potentially impacting overall profitability and the allocation of capital to more strategic areas.

- Strategic Review: Management must continuously assess these acquired assets, deciding whether to invest further, divest, or restructure to improve their market position and financial contribution.

Geographic Markets with Stagnant Growth

Geographic markets with stagnant growth and a low market share for Henry Schein's products are classified as Dogs in the BCG Matrix. This means that in these regions, the dental and medical markets are not expanding, and Henry Schein isn't a dominant player. For instance, if Henry Schein has a minimal presence in a European country where dental procedure volumes have seen less than 1% annual growth over the past three years, these operations would likely fall into the Dog category. Such markets demand a critical assessment of their future viability and resource allocation.

These situations necessitate a strategic decision regarding continued investment.

- Low Market Growth: Regions exhibiting minimal to no expansion in their healthcare sectors.

- Low Market Share: Henry Schein's competitive standing in these areas is weak.

- Resource Reallocation: Funds and attention might be better utilized in more promising markets.

- Divestment Consideration: Exiting these markets could be a strategic move to cut losses.

Dogs represent business units or product lines with low market share in low-growth markets. For Henry Schein, this category primarily includes products like Personal Protective Equipment (PPE) and COVID Test Kits, whose demand has significantly decreased post-pandemic. Additionally, acquired businesses that struggle with integration and fail to gain traction, or geographic markets with stagnant growth and minimal company presence, also fit this profile. These segments require careful evaluation for potential divestment or restructuring to optimize resource allocation.

| Category | Market Growth | Market Share | Henry Schein Examples | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | PPE, COVID Test Kits, Underperforming acquired units, Stagnant geographic markets | Divest, Harvest, or Restructure |

Question Marks

The dental practice management software market is experiencing a significant shift towards AI and advanced analytics, enabling better decision-making and enhanced patient care. Henry Schein One's integrated solutions are a prime example of this trend, positioning the company in a high-growth segment of the market.

While Henry Schein has a strong presence, its market share in this specific niche of advanced AI-driven dental software is currently lower than some competitors who have been longer established in this specialized area. This dynamic suggests Henry Schein is a potential star, with room for substantial growth and market penetration.

Henry Schein's strategic focus on expanding beyond its core dental and medical offerings into new digital health solutions positions these ventures as potential Question Marks in the BCG Matrix. These areas, while promising for high growth and margins, represent nascent markets where the company currently holds a relatively low market share.

Significant investment will be necessary for Henry Schein to cultivate these digital health solutions, aiming to increase their market share and eventually transition them into Stars. For instance, their investment in telehealth platforms or AI-driven diagnostic tools, while not yet dominant, taps into a rapidly expanding sector, projecting a compound annual growth rate (CAGR) of over 18% for digital health globally through 2027.

Henry Schein's strategic expansion into new homecare medical product categories, following acquisitions like Acentus, positions them to tap into high-growth markets. While continuous glucose monitors (CGMs) are a current focus, the company is exploring less established areas where initial market share might be low, necessitating significant strategic investment.

These emerging categories, such as advanced wound care or remote patient monitoring devices, represent potential 'question marks' in the BCG matrix. For instance, the global remote patient monitoring market was valued at approximately $30.1 billion in 2023 and is projected to grow substantially, offering a fertile ground for Henry Schein to establish a foothold.

Targeted Niche Specialty Products with High Innovation

Within Henry Schein's Global Specialty Products, targeted niche specialty products with high innovation represent potential stars. These are likely areas where the company is focusing significant research and development to capture emerging trends in dental and medical care. While their current market share might be modest, their high-growth market potential makes them crucial for future expansion.

These innovative niche products are characterized by substantial investment needs in R&D and marketing. They aim to address specific, fast-evolving segments within the healthcare industry. For instance, advancements in personalized medicine or specialized dental materials could fall into this category.

- High Growth Potential: These products are positioned in markets experiencing rapid expansion, often driven by technological advancements or changing patient needs.

- Significant Investment: Substantial capital is allocated to research, development, and market penetration for these innovative offerings.

- Niche Focus: They cater to specialized segments within the broader dental and medical markets, requiring tailored solutions.

- Early Stage Market Position: Despite growth prospects, Henry Schein's current market share in these specific niches may be relatively small, necessitating strategic market building.

International Market Expansion in Developing Regions

Expanding into developing regions presents a significant opportunity for Henry Schein, aligning with the potential for high growth in healthcare services. Currently operating in 33 countries, the company's low market share in these emerging markets signifies them as question marks within the BCG matrix.

These markets require substantial investment to build infrastructure, establish robust distribution networks, and effectively penetrate the market. Successful development could transform these question marks into Stars, generating substantial future returns.

For instance, the healthcare spending in many developing regions is projected to grow considerably. According to recent analyses, some emerging markets in Asia and Africa are expected to see healthcare expenditure growth rates exceeding 10% annually in the coming years, far outpacing mature markets.

- Market Potential: Developing regions often exhibit unmet healthcare needs and a growing middle class, driving demand for services and products.

- Investment Requirements: Significant capital is needed for logistics, local partnerships, and regulatory navigation.

- Risk vs. Reward: While initial investment is high, the long-term reward of capturing a dominant market share in a rapidly expanding sector is substantial.

- Strategic Focus: Henry Schein must prioritize these question marks for focused investment to foster their growth into future Stars.

Henry Schein's ventures into new digital health solutions and emerging homecare product categories are prime examples of Question Marks. These areas, while experiencing high growth, currently represent markets where the company's market share is relatively low, demanding significant strategic investment to foster growth and market penetration.

The company's expansion into developing regions also falls into the Question Mark category. These markets, though offering substantial growth potential, require considerable investment in infrastructure and distribution to build a strong presence and transform them into future Stars.

These Question Mark initiatives are characterized by their high growth potential and the necessity for substantial capital investment in research, development, and market building. Successfully nurturing these segments is crucial for Henry Schein's long-term strategic expansion and revenue diversification.

| BCG Category | Henry Schein Examples | Market Characteristics | Investment Needs | Strategic Goal |

|---|---|---|---|---|

| Question Marks | New Digital Health Solutions (AI, Telehealth) | High Market Growth, Low Market Share | Significant R&D, Marketing, Infrastructure | Increase Market Share, Transition to Stars |

| Question Marks | Emerging Homecare Products (e.g., Remote Patient Monitoring) | Rapidly Expanding Market, Nascent Presence | Capital for Product Development, Sales Channels | Establish Foothold, Capture Growth |

| Question Marks | Expansion into Developing Regions | High Untapped Demand, Developing Infrastructure | Logistics, Partnerships, Regulatory Navigation | Build Market Presence, Future Dominance |

BCG Matrix Data Sources

Our Henry Schein BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.