Henry Schein Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henry Schein Bundle

Henry Schein's position in the dental and medical supply industry is shaped by intense competition, significant buyer power from large healthcare organizations, and a constant threat from new entrants and substitutes. Understanding these forces is crucial for navigating this dynamic market.

The complete Porter's Five Forces Analysis unlocks a deeper understanding of Henry Schein's strategic landscape, detailing the precise impact of each force. Gain actionable insights to drive smarter decision-making and secure a competitive edge.

Suppliers Bargaining Power

A concentrated supplier base for specialized medical and dental equipment, pharmaceuticals, and critical raw materials significantly bolsters supplier bargaining power. When only a handful of companies control essential niche products, Henry Schein faces limited alternatives, potentially resulting in less favorable pricing and contract terms. This dynamic is especially pronounced for patented or highly innovative products where few, if any, substitutes exist.

Suppliers providing highly specialized or proprietary products, like advanced dental imaging systems or unique drug compounds, can command more leverage. Henry Schein's ability to offer a complete product range to its clients depends heavily on these unique suppliers, making it difficult to change without disrupting its own inventory.

The growing integration of artificial intelligence in fields such as veterinary diagnostics and dental imaging is likely to introduce new, specialized suppliers. These newcomers, with their cutting-edge technology, could possess significantly higher bargaining power, potentially impacting Henry Schein's sourcing costs and strategies.

The costs associated with switching suppliers for Henry Schein, particularly for practice management software and specialized dental or medical equipment, can be substantial. These switching costs often include the expense of re-qualifying products to meet regulatory standards, integrating new systems with existing workflows, and the potential for significant disruption to the supply chain and customer operations. For example, a dental practice might incur thousands of dollars in retraining staff and data migration when changing practice management software, thereby increasing the bargaining power of the incumbent software supplier.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly amplify their bargaining power against Henry Schein. If suppliers possess the capability and the motivation to bypass distributors like Henry Schein and sell directly to dental and medical practitioners, they gain leverage, potentially dictating terms or capturing a larger share of the value chain.

This trend is already observable in adjacent healthcare sectors. For instance, specialty pharmaceutical companies increasingly explore direct-to-patient or direct-to-provider models, especially for innovative or high-margin products. This suggests a potential avenue for dental and medical equipment manufacturers to consider similar strategies, particularly for advanced technologies or niche product lines.

Consider the broader market dynamics:

- Increased Manufacturer Control: Suppliers integrating forward can gain direct customer relationships and control over the entire sales and distribution process.

- Potential for Margin Erosion: If key suppliers shift to direct sales, Henry Schein could face reduced sales volumes and pressure on its distribution margins.

- Competitive Response: Henry Schein's ability to counter this threat relies on its value-added services, economies of scale, and strong relationships with a broad base of practitioners that manufacturers may find difficult to replicate independently.

Importance of Henry Schein to Suppliers

Henry Schein's immense scale as the world's largest provider of healthcare products and services to office-based dental and medical practitioners grants it considerable leverage over its suppliers. This vast distribution network represents a crucial sales channel for many manufacturers, making Henry Schein a highly desirable customer.

For many suppliers, the potential loss of Henry Schein as a significant customer could have a detrimental impact on their revenue streams and market access. This dependency inherently diminishes the bargaining power of these suppliers.

In 2023, Henry Schein reported net sales of $12.3 billion, underscoring the substantial volume of business it conducts with its supply base. This financial scale translates directly into supplier reliance.

- Significant Sales Channel: Henry Schein's extensive reach offers suppliers access to a broad customer base, often exceeding what they could achieve independently.

- Revenue Dependence: For many smaller or specialized suppliers, a substantial portion of their annual revenue may be directly tied to their relationship with Henry Schein.

- Market Access: Being a preferred supplier for Henry Schein can also confer a degree of market validation and open doors to further business opportunities.

The bargaining power of suppliers to Henry Schein is influenced by several factors, including supplier concentration, product differentiation, and switching costs. While a concentrated supplier base for specialized items can increase their leverage, Henry Schein's vast scale as a distributor often mitigates this by making it a critical sales channel for many manufacturers.

Suppliers of unique or patented products, such as advanced dental imaging technology, hold significant power due to limited alternatives for Henry Schein. However, the potential for suppliers to integrate forward and bypass distributors like Henry Schein poses a threat, potentially impacting Henry Schein's margins and market access.

In 2023, Henry Schein's substantial net sales of $12.3 billion highlight its importance to suppliers, creating a degree of reliance that can reduce their bargaining power. This scale provides Henry Schein with considerable leverage, especially when compared to smaller suppliers who depend heavily on its distribution network.

| Factor | Impact on Supplier Bargaining Power | Example for Henry Schein |

|---|---|---|

| Supplier Concentration | High for niche products | Few suppliers of specialized veterinary diagnostic equipment |

| Product Differentiation | High for proprietary technology | Advanced dental CAD/CAM systems |

| Switching Costs | High for integrated systems | Changing practice management software |

| Forward Integration Threat | Increases supplier leverage | Specialty pharma selling directly to clinics |

| Henry Schein's Scale | Decreases supplier leverage | $12.3 billion in 2023 net sales |

What is included in the product

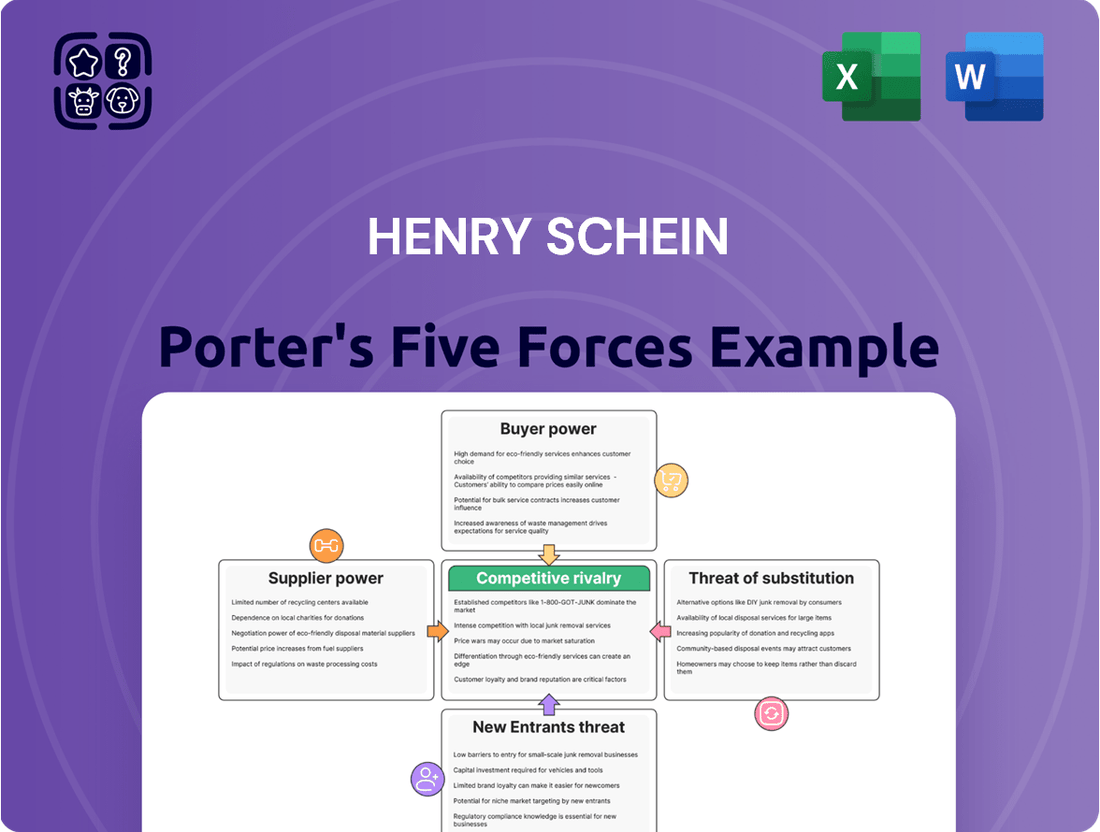

This analysis dissects the competitive forces impacting Henry Schein, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the dental and medical supply industry.

Instantly identify and address competitive pressures with a visual breakdown of each force, empowering strategic adjustments.

Customers Bargaining Power

Henry Schein’s customer base, primarily consisting of office-based dental, medical, and animal health practitioners, is quite broad. This fragmentation means that most individual customers have relatively little sway over pricing or terms due to their smaller order sizes.

However, the landscape is shifting. Large dental support organizations (DSOs), expansive hospital systems, and major veterinary groups represent a growing segment of Henry Schein's clientele. These larger entities, by consolidating purchasing power, can negotiate more advantageous terms and pricing, thereby increasing their bargaining leverage.

Customers in the healthcare sector, especially smaller practices, are increasingly feeling the pinch. With rising operational costs, a persistent labor shortage, and pressure on reimbursements, these businesses are becoming more sensitive to the prices they pay for supplies and services. This financial strain naturally makes them more inclined to seek out the best deals.

This heightened price sensitivity directly translates into greater bargaining power for customers. They are more likely to push for lower prices or explore switching to alternative suppliers, particularly when it comes to products that are seen as standard or easily substitutable. For instance, in 2024, many independent dental practices reported that supply costs represented a significant portion of their overhead, sometimes exceeding 20%, making them highly receptive to competitive pricing.

Customers of Henry Schein have a significant number of alternative distributors to choose from, which directly impacts their bargaining power. These alternatives include major players like Patterson Companies, Benco Dental, McKesson, and Cardinal Health, alongside numerous smaller, regional distributors.

This wide array of choices empowers customers. They can readily switch to a competitor if they find Henry Schein's pricing, service levels, or product availability unsatisfactory. For instance, the dental distribution market, where Henry Schein operates, is competitive. In 2023, Patterson Companies reported revenue of $7.7 billion, showcasing the scale of its operations and its ability to serve as a viable alternative.

Low Switching Costs for Customers

For many dental and medical consumable supplies and common equipment, customers face low switching costs. This ease of transition to alternative suppliers means they can readily shift their business to competitors if pricing or service isn't satisfactory. For instance, a dental practice needing basic impression materials can easily source them from various distributors without significant disruption.

However, the situation changes for more complex, integrated solutions. For practice management software, for example, switching costs can be considerably higher. These costs often involve the expense and effort of data migration, retraining staff on new systems, and potential integration challenges with existing hardware or other software. This creates a stickier customer relationship for providers of such comprehensive solutions.

- Low Switching Costs for Consumables: Customers can easily switch suppliers for routine items like gloves, masks, or basic instruments, putting pressure on Henry Schein's pricing and service for these products.

- Higher Switching Costs for Integrated Solutions: For practice management software and advanced equipment, the investment in data migration, training, and integration makes switching more costly for customers, offering Henry Schein more pricing power.

- Customer Bargaining Power Impact: The mix of low and high switching costs across its product portfolio influences the overall bargaining power of Henry Schein's diverse customer base.

Customer Knowledge and Information

Customers today possess unprecedented access to information, significantly bolstering their bargaining power. With digital transparency, buyers can readily compare pricing, research product features, and understand market alternatives. For instance, in 2024, online review platforms and price comparison websites are ubiquitous, allowing consumers to make highly informed decisions, often before engaging with a seller. This readily available data empowers them to negotiate more effectively for better terms and value.

The proliferation of online resources means customers are not only aware of competitive pricing but also of emerging trends and substitutes. This knowledge shift means they can readily switch to competitors if a company fails to meet their expectations or price points. In 2024, the ease of accessing detailed product specifications and customer feedback online means that a company’s value proposition is constantly scrutinized by a well-informed customer base.

- Informed Purchasing: Customers can easily research product pricing, features, and availability from multiple vendors.

- Price Sensitivity: Increased information access makes customers more aware of competitive pricing, driving down margins.

- Availability of Alternatives: Customers can quickly identify and evaluate substitute products or services, reducing switching costs.

- Digital Transparency: Online reviews, forums, and comparison sites empower customers with knowledge about product quality and service.

Henry Schein's customer base, while broad, includes increasingly powerful buyers like large dental support organizations and hospital systems. These consolidated entities leverage their purchasing volume to negotiate better pricing and terms, directly increasing their bargaining power. In 2024, such large groups often accounted for a substantial portion of a distributor's revenue, making their demands difficult to ignore.

The availability of numerous alternative suppliers, such as Patterson Companies and McKesson, further amplifies customer bargaining power. Customers can readily compare offerings and switch to competitors if Henry Schein's pricing or service falls short. For instance, the dental distribution market is highly competitive, with major players like Patterson Companies reporting significant revenues, underscoring the viable alternatives available to customers.

Low switching costs for many standard dental and medical supplies mean customers can easily shift their business. However, for integrated solutions like practice management software, higher switching costs due to data migration and training can create stickier customer relationships. This duality influences how much leverage customers have across Henry Schein's diverse product lines.

Digital transparency in 2024 allows customers to easily compare prices and research products, making them more price-sensitive and informed negotiators. This ease of information access empowers them to seek better value and readily identify substitutes, thereby increasing their overall bargaining leverage.

| Factor | Impact on Bargaining Power | Supporting Data/Observation (2023-2024) |

| Customer Concentration | Increases power for large buyers | Large DSOs and hospital systems represent growing segments, capable of leveraging volume for better terms. |

| Availability of Alternatives | Increases power | Companies like Patterson Companies (2023 revenue: $7.7 billion) offer significant competitive alternatives. |

| Switching Costs (Consumables) | Increases power | Low costs for basic supplies allow easy vendor shifts. |

| Switching Costs (Software/Integrated) | Decreases power | Higher costs for practice management software create customer loyalty. |

| Information Access | Increases power | Online comparison tools and reviews empower informed price negotiations. |

Preview the Actual Deliverable

Henry Schein Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Henry Schein Porter's Five Forces Analysis presented here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the dental and medical supply industry. It is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Henry Schein faces substantial competitive rivalry, particularly from large, established players like Patterson Companies and Benco Dental within the dental distribution sector. These companies, along with major distributors such as McKesson and Cardinal Health in the broader medical and animal health markets, contribute to an intensely competitive environment.

The healthcare distribution market is showing robust growth, with a global valuation of USD 1.04 trillion in 2024. This upward trend is expected to continue, reaching USD 1.99 trillion by 2033, reflecting a compound annual growth rate of 7.6%.

This expanding market, particularly within dental equipment and supplies, offers opportunities for all participants. However, the very growth that can ease competitive tensions also fuels intense rivalry as companies vie for a larger share of this expanding pie.

Companies in the dental and medical supply industry, including Henry Schein, engage in fierce competition. They differentiate themselves not just on price, but also on the sheer variety of products available, crucial value-added services such as practice management software and financial assistance, and the reliability of their supply chains and customer service.

Henry Schein's approach to standing out in this crowded market centers on its extensive product catalog and the integration of these offerings with valuable support services. This strategy aims to provide a more complete solution for dental and medical practices, fostering loyalty beyond simple transactional relationships.

For instance, in 2024, Henry Schein reported net sales of $12.3 billion, underscoring the scale of its operations and its ability to offer a wide array of products. The company's focus on practice management solutions, which often integrate with their supply offerings, represents a significant differentiator, helping practices operate more efficiently.

Switching Costs for Competitors' Customers

Henry Schein works to make it difficult for customers to switch away by offering integrated solutions and building strong relationships. However, competitors are also actively employing these same tactics to keep their own customers. This dynamic directly impacts how easily Henry Schein can attract new business versus how well rivals can hold onto their existing client base.

The effectiveness of these switching costs is a key battleground. For instance, a competitor might offer deep discounts on bundled services or invest heavily in customer support to foster loyalty. In 2023, the dental supply market saw significant competition, with companies like Patterson Dental and Dentsply Sirona also focusing on customer retention through loyalty programs and integrated technology platforms. This means that while Henry Schein aims to lock in customers, rivals are equally adept at doing so.

- Integrated Solutions: Henry Schein’s practice management software and supply chain integration aim to create a seamless experience, making it cumbersome for customers to replicate this elsewhere.

- Customer Relationships: Dedicated sales representatives and personalized service foster loyalty, increasing the emotional and practical cost of switching.

- Competitor Strategies: Rivals like Patterson Dental and Dentsply Sirona also invest in similar integrated offerings and customer service initiatives to minimize churn.

- Market Impact: The success of switching cost strategies on both sides influences market share dynamics and the overall ease of customer acquisition and retention.

Industry Consolidation and Acquisitions

The healthcare distribution sector is experiencing significant consolidation. Larger entities are actively acquiring smaller competitors to bolster their market share, broaden their product offerings, and extend their operational footprints. This trend is reshaping the competitive dynamics for all players, including Henry Schein.

Henry Schein has been an active participant in this consolidation, notably acquiring Acentus in early 2025. This strategic move not only enhances Henry Schein's capabilities but also influences the competitive intensity within the industry by integrating a competitor's operations and customer base.

- Industry Consolidation: The healthcare distribution market has seen a trend towards consolidation, with larger companies acquiring smaller ones.

- Market Share and Portfolio Expansion: Acquisitions are driven by the desire to increase market share and broaden product and service portfolios.

- Geographic Reach: Companies also acquire others to expand their geographical presence and serve a wider customer base.

- Henry Schein's Acquisitions: Henry Schein's acquisition of Acentus in early 2025 exemplifies this consolidation trend, impacting the competitive landscape.

The competitive rivalry within the healthcare distribution sector, where Henry Schein operates, is intense. This is driven by a growing market, estimated at USD 1.04 trillion in 2024, with projections to reach USD 1.99 trillion by 2033. Major players like Patterson Companies, Benco Dental, McKesson, and Cardinal Health actively compete on product breadth, value-added services, and supply chain reliability.

| Competitor | Key Offerings | 2024 Market Presence Indicator (Illustrative) |

| Patterson Companies | Dental and animal health products, technology solutions | Significant market share in dental distribution |

| Benco Dental | Comprehensive dental supplies and equipment, practice design services | Strong regional presence, focus on customer service |

| McKesson | Broad healthcare products and services, pharmaceuticals | Dominant player in medical and pharmaceutical distribution |

| Cardinal Health | Medical products, pharmaceuticals, and supply chain services | Extensive network and diverse product portfolio |

SSubstitutes Threaten

The rise of direct sales by manufacturers presents a notable threat to distributors like Henry Schein. Many pharmaceutical and medical device companies are increasingly exploring direct-to-consumer or direct-to-provider models. For instance, in 2024, a significant percentage of medical device manufacturers reported plans to expand their direct sales efforts, aiming to capture a larger share of the market and potentially bypass traditional distribution channels.

The proliferation of online retailers and e-commerce platforms presents a significant threat of substitutes for traditional distributors like Henry Schein. These digital marketplaces, ranging from broad online general retailers to specialized medical supply e-tailers, provide healthcare practitioners with alternative avenues to procure necessary goods. In 2024, the global e-commerce market continued its robust growth, with healthcare product sales online showing a notable upward trend, driven by convenience and competitive pricing structures that can directly challenge established distribution channels.

Compounding pharmacies present a unique threat of substitutes for certain medical products. These pharmacies can create personalized medications, offering alternatives to mass-produced drugs, especially for patients with specific needs or allergies. This custom approach can bypass the need for standard pharmaceutical offerings.

Furthermore, the potential for healthcare providers or patients to re-program or re-use existing medical devices acts as another form of substitution. While not always widespread, this capability can reduce the demand for new device purchases. For instance, in 2023, the market for refurbished medical equipment continued to grow, indicating a tangible shift towards extending device lifecycles and avoiding new acquisitions.

In-house Procurement by Large Healthcare Systems

Large healthcare systems, such as integrated delivery networks, are increasingly capable of bringing procurement and distribution functions in-house. This trend presents a significant substitute threat for traditional distributors like Henry Schein, particularly for high-volume, standardized medical supplies.

By centralizing these operations, these systems can potentially achieve cost savings and greater control over their supply chains. For instance, a study by McKesson in 2024 indicated that many large health systems are exploring or implementing direct sourcing models for a significant percentage of their consumables. This allows them to bypass intermediary markups.

- In-house procurement offers cost reduction by eliminating distributor margins.

- Large healthcare systems can leverage their scale for direct negotiations with manufacturers.

- This strategy provides greater control over inventory management and supply chain logistics.

- The threat is amplified for commodity products where price is the primary differentiator.

Telehealth and Digital Health Solutions

The growing adoption of telehealth and digital health solutions presents a subtle threat of substitution for Henry Schein. While these platforms can create demand for new technology solutions, they also facilitate a shift in healthcare delivery. This evolution could indirectly reduce the need for certain traditional physical products as care models become more digitized.

For example, as remote patient monitoring becomes more prevalent, the demand for in-person diagnostic supplies might see a gradual decline in specific use cases. By 2024, the global telehealth market was projected to reach hundreds of billions of dollars, indicating a significant shift in healthcare consumption patterns.

- Telehealth Expansion: The increasing use of virtual consultations and remote diagnostics can lessen the reliance on in-office visits, potentially impacting the sales of traditional medical supplies.

- Digital Health Integration: As more health data is managed and accessed digitally, the need for physical records and associated supplies could decrease.

- Evolving Care Models: The shift towards preventative and home-based care, enabled by digital tools, might substitute for some of the products typically used in traditional clinical settings.

The threat of substitutes for Henry Schein is multifaceted, encompassing direct sales by manufacturers, online retailers, and even in-house procurement by large healthcare systems. These alternatives offer competitive pricing, convenience, and greater control, directly challenging traditional distribution models. For instance, in 2024, many medical device manufacturers expanded direct sales, while the online healthcare market continued its rapid growth, providing accessible alternatives for practitioners.

| Substitute Type | Description | Impact on Henry Schein | 2024 Data/Trend |

|---|---|---|---|

| Manufacturer Direct Sales | Companies selling directly to providers/consumers. | Bypasses distributors, reduces intermediary role. | Increased manufacturer investment in direct channels. |

| Online Retailers/E-commerce | Digital marketplaces for medical supplies. | Offers convenience and competitive pricing. | Robust growth in online healthcare product sales. |

| In-house Procurement | Large healthcare systems managing their own distribution. | Leverages scale for cost savings and control. | Growing exploration of direct sourcing by health systems. |

Entrants Threaten

The healthcare distribution industry demands a significant upfront financial commitment. Newcomers must invest heavily in establishing robust warehousing facilities, sophisticated logistics networks, efficient inventory management systems, and advanced technology platforms. For instance, building a national distribution network can easily run into hundreds of millions of dollars.

Established companies like Henry Schein already leverage considerable economies of scale. This means they can spread their fixed costs over a much larger volume of goods, leading to lower per-unit costs. In 2023, Henry Schein reported net sales of $12.3 billion, demonstrating the sheer volume they handle, which allows them to negotiate better prices with suppliers and offer more competitive pricing to customers, creating a formidable barrier for smaller, less capitalized entrants.

Regulatory hurdles are a major deterrent for new companies wanting to enter the dental supply market. The healthcare sector, including dental products, is laden with stringent rules concerning everything from how products are handled and stored to how they are distributed and the overall compliance. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its rigorous oversight of medical devices, which includes many dental products, requiring extensive pre-market approvals and post-market surveillance.

Navigating these intricate regulatory landscapes presents a formidable barrier. New entrants must invest heavily in understanding and adhering to these complex frameworks, which can be time-consuming and costly. Failure to comply can result in severe penalties, further discouraging potential new players from entering the market and challenging established firms like Henry Schein.

Henry Schein benefits significantly from established relationships and deep-rooted brand loyalty, making it challenging for new entrants to gain traction. Over decades, the company has cultivated trust with a broad customer base, providing a wide array of products and essential value-added services.

For instance, in 2023, Henry Schein reported net sales of $12.3 billion, underscoring its substantial market presence built on these enduring customer connections. New competitors must not only offer competitive pricing but also replicate the extensive product breadth and service reliability that customers expect from Henry Schein.

Supply Chain Complexity and Expertise

The sheer complexity of managing a global supply chain for a vast array of healthcare products presents a significant barrier for potential new entrants. This includes navigating the intricate logistics for items requiring specific temperature controls, such as vaccines and certain pharmaceuticals, as well as handling the stringent regulations surrounding controlled substances.

Developing the necessary expertise in global logistics, sophisticated inventory management systems, and cultivating robust relationships with a multitude of specialized suppliers is a time-consuming and capital-intensive undertaking. For instance, in 2023, the global healthcare logistics market was valued at over $200 billion, highlighting the scale of investment required to establish a competitive presence.

- Global Reach: New entrants must establish distribution networks across numerous countries, each with unique regulatory frameworks and logistical challenges.

- Specialized Handling: Expertise in cold chain management and secure handling of pharmaceuticals is critical, demanding significant investment in infrastructure and training.

- Supplier Relationships: Building trust and securing reliable supply agreements with a diverse base of manufacturers and distributors takes considerable time and effort.

- Regulatory Compliance: Adhering to varying international and national regulations for healthcare products adds another layer of complexity and cost.

Access to Supplier Networks

Henry Schein's robust supplier network presents a formidable barrier to new entrants. Establishing and nurturing relationships with a diverse range of manufacturers for dental, medical, and animal health products requires significant time and investment. For instance, in 2023, Henry Schein reported sourcing products from thousands of manufacturers globally, a scale that is difficult for newcomers to replicate quickly or cost-effectively.

New competitors would face considerable challenges in securing comparable access to essential products and negotiating favorable terms. This existing network not only ensures product availability but also provides leverage in pricing and product selection, advantages that are hard-won and not easily replicated.

- Established Supplier Relationships: Henry Schein has cultivated deep, long-standing partnerships with numerous manufacturers.

- Economies of Scale: The company's size allows for bulk purchasing, leading to better pricing and terms from suppliers.

- Product Breadth and Depth: Access to a wide variety of products across multiple health sectors is a key differentiator.

- Supply Chain Efficiency: Years of operation have allowed Henry Schein to optimize its supply chain, reducing costs and lead times.

The threat of new entrants in the healthcare distribution sector, particularly for a company like Henry Schein, is significantly mitigated by substantial capital requirements and established economies of scale. New players face immense costs in building infrastructure and logistics, while incumbents benefit from lower per-unit costs due to high sales volumes, as evidenced by Henry Schein's $12.3 billion in net sales in 2023.

Furthermore, stringent regulatory compliance, as seen with the FDA's oversight of medical devices in 2024, creates a high barrier. Navigating these complex rules demands significant investment and expertise, deterring less prepared newcomers.

Finally, deep-rooted customer loyalty and extensive supplier networks built over decades by established firms like Henry Schein are difficult for new entrants to overcome, requiring substantial time and capital to replicate the breadth of products and service reliability customers expect.

Porter's Five Forces Analysis Data Sources

Our Henry Schein Porter's Five Forces analysis is built upon a foundation of comprehensive data, including financial reports from publicly traded companies, market research from industry-specific firms, and regulatory filings that detail industry operations and compliance.