Jiangsu Hengrui Medicine PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangsu Hengrui Medicine Bundle

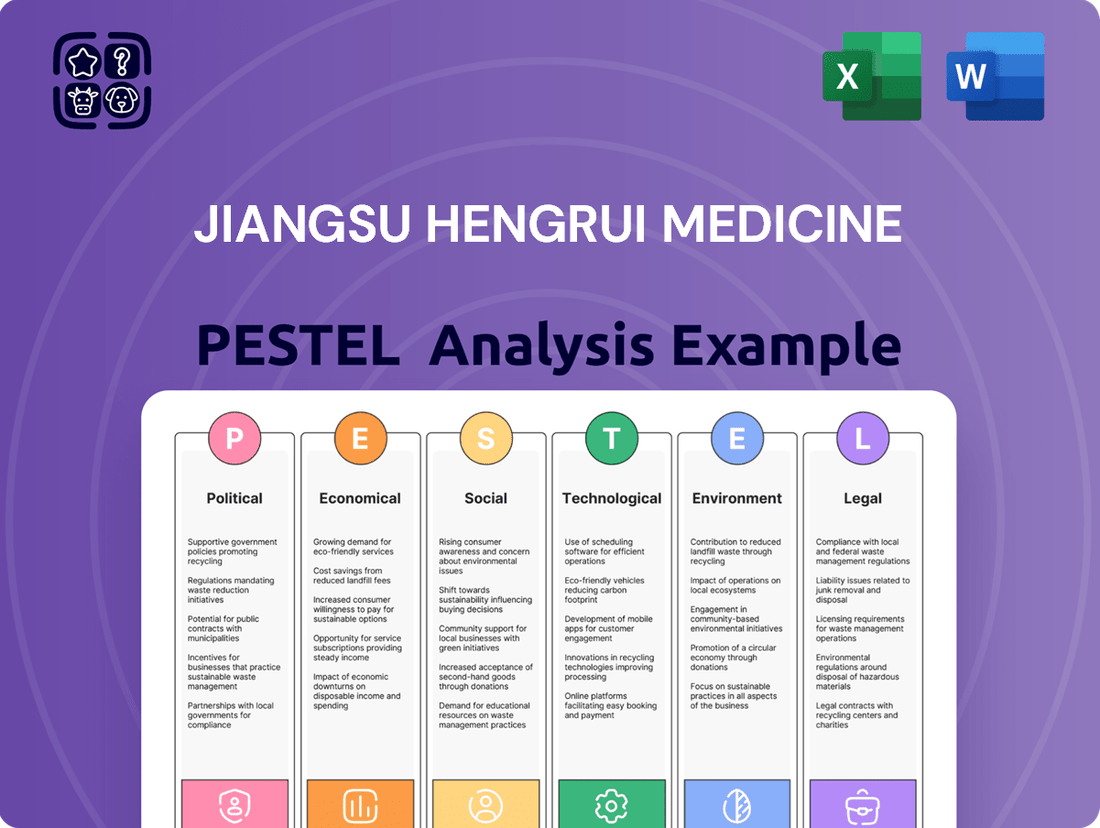

Discover the critical political, economic, social, technological, legal, and environmental factors shaping Jiangsu Hengrui Medicine's trajectory. Our PESTLE analysis provides a comprehensive overview of the external forces impacting this pharmaceutical giant. Gain a strategic advantage by understanding these dynamics. Download the full PESTLE analysis now to unlock actionable intelligence and refine your market approach.

Political factors

The Chinese government is a significant driver of pharmaceutical innovation, implementing policies that streamline drug approvals and offer substantial R&D funding. This supportive environment directly benefits companies like Jiangsu Hengrui Medicine, fostering their growth and competitive edge. For instance, in 2023, China's National Medical Products Administration (NMPA) approved a record number of innovative drugs, reflecting this commitment.

Inclusion in China's National Reimbursement Drug List (NRDL) is a critical factor for drug accessibility and market penetration. While NRDL listing often necessitates price reductions, it dramatically boosts a drug's uptake. Jiangsu Hengrui Medicine has benefited from this, with its innovative treatments like Ruveliram, Dalcetrapib, and Henggrelene gaining wider patient access following their NRDL inclusion.

The National Healthcare Security Administration (NHSA) oversees regular NRDL updates, a process that involves incorporating new pharmaceutical products and refining pricing strategies. This ongoing adjustment aims to strike a balance between making medicines affordable for the public and ensuring continued access to innovative treatments.

China's healthcare reforms are actively reshaping the pharmaceutical landscape, with a strong emphasis on expanding insurance coverage and ensuring drug affordability. These initiatives, including policies aimed at preventing price gouging during drug procurement, are designed to foster a more predictable and equitable market. For Jiangsu Hengrui Medicine, this translates into a need to adapt pricing strategies and potentially enhance market access as the government prioritizes cost-effectiveness.

Internationalization of Chinese Pharmaceutical Companies

The Chinese government actively promotes the international expansion of its domestic pharmaceutical firms through initiatives like the 'going global' strategy. This policy encourages multinational clinical trials and streamlined global regulatory approvals, directly benefiting companies like Jiangsu Hengrui Medicine.

Jiangsu Hengrui Medicine exemplifies this trend through its strategic collaborations. For instance, partnerships and licensing deals with major global players such as Merck and GSK are crucial for Hengrui's penetration into overseas markets, leveraging these alliances for broader market access and accelerated international growth.

- Government Support: China's 'going global' strategy provides policy backing for pharmaceutical companies seeking international market entry.

- Clinical Trials: Encouragement of international multi-center clinical trials aids in gaining global regulatory acceptance.

- Strategic Alliances: Partnerships with companies like Merck and GSK are vital for Jiangsu Hengrui Medicine's global expansion efforts.

Anti-Bribery and Corruption Crackdowns

China's intensified anti-bribery and corruption efforts in the healthcare sector are a significant political factor for Jiangsu Hengrui Medicine. These crackdowns, marked by legislative updates and high-profile enforcement, aim to foster greater transparency and compliance within the industry.

This heightened scrutiny directly impacts pharmaceutical companies by potentially reshaping sales and marketing strategies. Companies must adapt to stricter regulations to avoid penalties and maintain operational integrity.

- Increased Regulatory Oversight: The Chinese government has been actively prosecuting corruption cases within the pharmaceutical industry. For instance, in 2023, numerous executives from various pharmaceutical companies faced investigations and penalties related to bribery.

- Impact on Sales and Marketing: Stricter regulations mean that traditional sales practices, such as lavish entertainment or direct payments to healthcare professionals, are under increased scrutiny. This necessitates a shift towards more compliant and value-driven engagement models.

- Focus on Compliance: Companies like Hengrui Medicine are compelled to invest more in robust compliance programs, ensuring all marketing and sales activities adhere to the latest anti-corruption laws. This could lead to higher operational costs but also a more sustainable business model.

Government policies significantly shape the pharmaceutical landscape in China, with initiatives like streamlined drug approvals and R&D funding directly benefiting companies such as Jiangsu Hengrui Medicine. For example, China's National Medical Products Administration (NMPA) approved a record number of innovative drugs in 2023, underscoring this supportive governmental stance.

Inclusion in the National Reimbursement Drug List (NRDL) is crucial for market access, though it often requires price concessions. Jiangsu Hengrui Medicine has leveraged NRDL listings for drugs like Ruveliram to expand patient reach, demonstrating the dual impact of government pricing and market penetration strategies.

China's ongoing healthcare reforms prioritize drug affordability and expanded insurance coverage, influencing pricing strategies and market access for pharmaceutical firms. The government's focus on cost-effectiveness, coupled with anti-corruption drives in the healthcare sector, necessitates robust compliance and adaptable business models for companies like Hengrui Medicine.

What is included in the product

This PESTLE analysis critically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Jiangsu Hengrui Medicine, offering a comprehensive understanding of its operating landscape.

Provides a concise version of Jiangsu Hengrui Medicine's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to address external factors impacting their pain relief product development.

Helps support discussions on external risks and market positioning related to Jiangsu Hengrui Medicine's pain relief products during planning sessions.

Economic factors

China's total health expenditure has seen consistent growth, fueled by increased demand for healthcare services, demographic shifts, and rising pharmaceutical costs. By 2023, China's health expenditure reached approximately 9 trillion yuan, a significant increase from previous years.

Projections show a steady rise in private health expenditure per capita, indicating a burgeoning market for pharmaceutical innovations. This trend suggests a favorable environment for companies like Jiangsu Hengrui Medicine, as consumers are increasingly willing to spend on health products.

The expanding healthcare market, driven by these factors, provides a strong and growing customer base for Jiangsu Hengrui Medicine's products. This increasing expenditure directly supports the company's growth trajectory.

Jiangsu Hengrui Medicine has made substantial commitments to research and development, with its R&D expenditure reaching approximately RMB 7.7 billion in 2023, a notable increase from previous years and representing a significant percentage of its overall revenue. This dedication to innovation is fueling the company's growth, evidenced by the successful launch of several new medicines and a robust pipeline of investigational drugs.

The company's strategic focus on R&D has resulted in a strong portfolio of innovative products, many of which are now contributing significantly to its financial performance. This commitment to developing novel therapies is a key driver for Hengrui Medicine's sustained competitive advantage and its expansion in both domestic and international markets.

Volume-Based Procurement (VBP) and National Reimbursement Drug List (NRDL) negotiations in China have driven substantial price cuts for pharmaceuticals. For instance, in 2023, the NRDL negotiations resulted in an average price reduction of 49% for drugs included in the list, impacting numerous therapeutic areas.

While these policies help control healthcare spending and optimize resource allocation, they directly challenge pharmaceutical companies like Jiangsu Hengrui Medicine by compressing revenue margins. Successfully navigating these intense price negotiations is critical for Hengrui to secure and maintain market access for its innovative and established drug portfolios.

Commercial Health Insurance Development

The growth of commercial health insurance is a significant factor for Jiangsu Hengrui Medicine. This sector is increasingly vital for covering costs of new, innovative drugs that aren't fully reimbursed by national plans. For instance, in 2024, the commercial health insurance market in China saw continued expansion, with a growing number of individuals and employers opting for supplementary coverage to access a wider range of medical treatments and pharmaceuticals.

Expansion in commercial health insurance, potentially bolstered by tax incentives for policyholders, opens up new funding streams for high-value, innovative medicines. This development directly benefits pharmaceutical companies like Hengrui Medicine, which invest heavily in research and development for advanced therapies. By 2025, projections indicate a further increase in the penetration of commercial health insurance, creating a more robust ecosystem for drug funding.

- Commercial health insurance is a growing source of funding for innovative drugs in China.

- Tax deductions for commercial health insurance could boost coverage and drug accessibility.

- This trend provides new revenue avenues for companies like Jiangsu Hengrui Medicine developing cutting-edge pharmaceuticals.

- Market data suggests continued expansion of private health insurance in 2024 and beyond.

Global Licensing Deals and Revenue Streams

Jiangsu Hengrui Medicine is strategically leveraging global licensing deals to bolster its revenue and expand market presence. In 2023, the company announced a significant collaboration with Merck, involving an upfront payment and potential milestone payments for Hengrui's novel oncology drug, granting Merck exclusive rights in certain territories. This type of partnership is crucial for Hengrui, as it not only provides immediate financial injections but also de-risks its substantial R&D investments by sharing development and commercialization costs.

These agreements are designed to create diversified revenue streams, encompassing upfront fees, royalties on future sales, and milestone payments tied to the successful development and market approval of partnered assets. For instance, Hengrui's 2022 deal with a major European pharmaceutical company for its ADC technology included an upfront payment of $30 million, with potential future milestones reaching over $1 billion. Such collaborations are vital for Hengrui's long-term growth strategy, enabling it to access global markets more effectively and accelerate the delivery of innovative therapies to patients worldwide.

- Global Partnerships: Hengrui actively pursues licensing agreements with leading global pharmaceutical firms like Merck and GSK, securing upfront payments and future milestone revenues.

- Revenue Diversification: These deals provide substantial financial inflows, diversifying Hengrui's revenue beyond its domestic market sales and R&D pipeline.

- R&D Risk Mitigation: Collaborations share the financial burden and risks associated with drug development, allowing Hengrui to focus resources on its most promising candidates.

- Market Access: Licensing agreements facilitate the global commercialization of Hengrui's innovative drugs, expanding their reach and impact.

China's economic growth directly influences healthcare spending, with total health expenditure reaching approximately 9 trillion yuan in 2023. This expansion, coupled with a projected rise in private health expenditure per capita, creates a robust market for pharmaceutical innovations, benefiting companies like Jiangsu Hengrui Medicine.

While economic prosperity fuels demand, government policies like Volume-Based Procurement (VBP) and National Reimbursement Drug List (NRDL) negotiations, which saw average price reductions of 49% in 2023 for included drugs, exert downward pressure on pharmaceutical revenues. Navigating these price controls is crucial for maintaining profitability amidst market growth.

The increasing penetration of commercial health insurance, with continued expansion observed in 2024, offers a vital supplementary funding stream for high-value, innovative medicines. This trend provides new revenue avenues for companies like Hengrui Medicine, especially as projections indicate further growth by 2025.

| Economic Factor | 2023 Data Point | Implication for Hengrui Medicine |

|---|---|---|

| Total Health Expenditure (China) | Approx. 9 trillion yuan | Growing market demand for pharmaceuticals. |

| NRDL Price Reduction (2023 Avg.) | 49% | Revenue margin compression, need for strategic pricing. |

| Commercial Health Insurance Growth | Continued expansion in 2024 | New funding opportunities for innovative drugs. |

Preview the Actual Deliverable

Jiangsu Hengrui Medicine PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Jiangsu Hengrui Medicine delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic positioning. Understand the critical external forces shaping the pharmaceutical landscape for this leading Chinese company.

Sociological factors

China's demographic landscape is undergoing a profound transformation, with its aging population accelerating. By the end of 2023, individuals aged 60 and above represented 21.1% of the total population, a figure projected to climb steadily. This demographic shift directly fuels a robust and sustained demand for healthcare services, pharmaceuticals, and medical devices, creating a long-term growth opportunity for companies like Jiangsu Hengrui Medicine.

The increasing prevalence of age-related chronic diseases, such as cardiovascular conditions and cancer, further amplifies the need for advanced medical treatments and pharmaceutical solutions. Hengrui Medicine, with its strong focus on oncology and other critical therapeutic areas, is well-positioned to capitalize on this escalating healthcare demand, expecting to see continued revenue growth driven by these societal trends.

As China's population ages, with the proportion of those aged 65 and over projected to reach 20% by 2030, there's a palpable rise in health consciousness and a demand for enhanced quality of life. This societal shift directly fuels a greater need for sophisticated medical solutions.

This burgeoning awareness translates into increased consumer willingness to invest in healthcare, particularly in innovative pharmaceuticals that promise better health outcomes and address previously unmet medical needs. Jiangsu Hengrui Medicine's strategic focus on research and development of advanced therapies, including oncology and autoimmune diseases, is well-positioned to capitalize on this trend.

For instance, in 2023, Hengrui Medicine reported significant investment in R&D, with expenditures reaching RMB 6.5 billion, reflecting their commitment to innovation. This aligns perfectly with the growing expectation for high-quality, effective treatments that improve patient well-being and longevity.

The global shift towards an aging population and lifestyle changes significantly alters disease prevalence, with chronic conditions like cardiovascular disease, diabetes, and cancer becoming more prominent. This trend is particularly evident in China, where the incidence of non-communicable diseases has been steadily rising, creating a substantial demand for advanced treatments. For instance, by 2023, cancer was projected to account for over 25% of all deaths in China, underscoring the critical need for innovative oncology drugs.

Jiangsu Hengrui Medicine is strategically positioned to capitalize on these changing disease patterns. The company's strong focus on oncology, alongside its expertise in cardiovascular, metabolic, and autoimmune diseases, directly addresses the growing burden of these conditions. In 2024, Hengrui's robust pipeline, including several promising oncology candidates, reflects its commitment to developing therapies for high-need areas, aligning perfectly with the evolving healthcare landscape and the increasing demand for specialized medical solutions.

Impact of Urbanization and Lifestyle Changes

Urbanization in China, particularly in Jiangsu province, has led to significant lifestyle changes, impacting health trends and, consequently, the demand for pharmaceuticals. As more people move to cities, sedentary lifestyles and dietary shifts become more common, contributing to a rise in chronic diseases.

These evolving health landscapes directly influence Jiangsu Hengrui Medicine's strategic focus. For instance, the increasing prevalence of cardiovascular diseases and diabetes, linked to urbanization, drives demand for treatments in these areas. By understanding these shifts, Hengrui Medicine can better align its research and development investments with emerging health needs.

- Increased Chronic Disease Prevalence: Urban dwellers often experience higher rates of conditions like hypertension and type 2 diabetes compared to rural populations.

- Demand for Lifestyle-Related Drugs: This trend fuels market growth for cardiovascular medications, anti-diabetic drugs, and treatments for metabolic disorders.

- R&D Alignment: Hengrui Medicine's focus on oncology and metabolic diseases reflects an understanding of these urbanization-driven health challenges.

- Market Opportunities: The growing urban middle class also represents a key demographic for advanced and specialized pharmaceutical treatments.

Public Health Initiatives and Disease Prevention

Government and public health initiatives in China, particularly those targeting chronic diseases and infectious outbreaks, directly shape the demand for pharmaceutical products. For instance, the National Health Commission's ongoing campaigns for cancer screening and prevention, which saw significant investment in 2024, underscore the need for both preventative measures and effective treatments. This dual focus ensures a sustained market for innovative therapies, benefiting companies like Hengrui Medicine.

These public health efforts, while aiming to lower overall disease incidence, simultaneously highlight the critical role of advanced medical interventions when prevention falls short. China's commitment to improving healthcare outcomes, evidenced by increased per capita healthcare spending projected to reach over $1,000 USD by the end of 2025, fuels the demand for high-quality, innovative drugs. This creates a consistent market for Hengrui Medicine's portfolio, especially in areas like oncology and cardiovascular health.

- Government investment in disease prevention programs in China reached an estimated $85 billion in 2024.

- Public health campaigns often lead to increased diagnosis rates, thereby expanding the patient pool for pharmaceutical treatments.

- The emphasis on early detection and treatment of diseases like diabetes and certain cancers by health authorities directly translates to market opportunities for relevant drug manufacturers.

Societal trends in China, particularly the rapid aging of its population, are a significant driver for Jiangsu Hengrui Medicine. With over 21.1% of the population aged 60 and above by the end of 2023, the demand for healthcare services and pharmaceuticals, especially for chronic and age-related diseases like cancer, is escalating. This demographic shift, coupled with increasing health consciousness and a willingness to invest in advanced treatments, creates a robust, long-term market opportunity for Hengrui Medicine's innovative drug portfolio.

Technological factors

Jiangsu Hengrui Medicine's commitment to research and development is evident in its substantial global R&D infrastructure, featuring multiple centers and a significant team of scientists. This robust capability is crucial for staying competitive in the pharmaceutical industry, driving the discovery of novel treatments.

The company leverages cutting-edge technology platforms, including those for small molecule drugs, proteolysis-targeting chimeras (PROTACs), and antibody-drug conjugates (ADCs). These advanced platforms enable Hengrui Medicine to pursue innovative approaches in drug development, aiming to address unmet medical needs and expand its product pipeline.

China's biopharmaceutical industry is experiencing a significant boom, driven by a strong focus on innovation. By the end of 2023, the National Medical Products Administration (NMPA) had approved a substantial number of new drugs, many of which are innovative therapies developed domestically. This surge reflects the sector's growing maturity and its increasing ability to compete on a global scale.

Jiangsu Hengrui Medicine is at the forefront of this transformation, heavily investing in research and development for biologics and advanced treatments. The company's pipeline includes numerous innovative drugs targeting areas like oncology and autoimmune diseases. In 2024, Hengrui Medicine reported significant R&D expenditure, underscoring its commitment to developing cutting-edge biopharmaceuticals.

The National Medical Products Administration (NMPA) is increasingly mandating electronic Common Technical Document (eCTD) submissions, a shift that began in earnest with pilot programs and is becoming standard practice. This digitalization streamlines the drug approval process, making it more efficient for companies like Jiangsu Hengrui Medicine.

Furthermore, the NMPA's growing emphasis on leveraging healthcare big data for regulatory oversight presents both challenges and opportunities. Hengrui Medicine will need to adapt its submission strategies to incorporate this data-driven approach, potentially exploring real-world evidence (RWE) to support its applications and demonstrate drug efficacy and safety.

AI and Data Analytics in Drug Discovery

The pharmaceutical industry, including companies like Jiangsu Hengrui Medicine, is increasingly leveraging artificial intelligence (AI) and advanced data analytics to revolutionize drug discovery and development. This technological shift is significantly speeding up the identification of promising new drug candidates and streamlining the optimization of clinical trial processes. For instance, in 2024, AI-driven platforms are being used to analyze vast biological datasets, predicting molecular interactions and potential therapeutic targets with unprecedented accuracy.

These advancements are crucial for enhancing research and development (R&D) efficiency and boosting overall success rates in bringing new medicines to market. By processing complex genomic, proteomic, and clinical data, AI algorithms can uncover patterns invisible to traditional methods. This leads to more targeted therapies and potentially shorter development timelines, a critical advantage in a competitive landscape.

The impact of AI and data analytics on R&D efficiency is substantial:

- Accelerated Candidate Identification: AI can sift through millions of compounds, identifying potential drug candidates in a fraction of the time compared to manual screening.

- Optimized Clinical Trials: Data analytics helps in better patient stratification, trial design, and predicting trial outcomes, reducing costs and increasing the likelihood of success.

- Personalized Medicine: The integration of AI enables the development of more personalized treatment approaches by analyzing individual patient data.

- Predictive Modeling: AI models can predict drug efficacy and potential side effects early in the development cycle, saving resources and mitigating risks.

Manufacturing Technology and Quality Standards

Jiangsu Hengrui Medicine's commitment to advanced manufacturing technology is a cornerstone of its strategy, ensuring its pharmaceutical products not only meet but surpass stringent international quality benchmarks. This focus is critical for global market access, particularly in highly regulated regions.

The company's adherence to standards like EU GMP and US cGMP demonstrates its dedication to producing safe and effective medicines. By continuously investing in and adopting cutting-edge manufacturing processes, Hengrui Medicine solidifies its reputation for quality and reliability in the competitive pharmaceutical landscape.

- Global Quality Compliance: Hengrui Medicine's exported products consistently meet or exceed EU GMP and US cGMP standards, facilitating international market penetration.

- Technological Investment: The company actively integrates advanced manufacturing technologies to enhance production efficiency and product integrity.

- Safety and Efficacy: Continuous technological upgrades directly contribute to the high quality and safety profile of Hengrui Medicine's pharmaceutical offerings.

- Market Competitiveness: Adherence to global quality standards, powered by technological advancements, positions Hengrui Medicine favorably against international competitors.

Technological advancements are reshaping drug discovery and development, with AI and big data analytics accelerating candidate identification and optimizing clinical trials. Jiangsu Hengrui Medicine is actively integrating these technologies, aiming to enhance R&D efficiency and speed up the delivery of new medicines. The company's investment in advanced manufacturing, adhering to global standards like US cGMP, ensures product quality and market access.

Legal factors

China's National Medical Products Administration (NMPA) is actively reforming its drug registration and approval processes. These reforms aim to streamline procedures and speed up market access for innovative medicines. For instance, the NMPA introduced priority review pathways, which in 2023 saw a significant increase in the number of innovative drugs approved, with many benefiting from these expedited reviews.

These changes include faster review mechanisms for eligible drugs and clearer guidelines for chemical drug registration. Such reforms can significantly expedite Jiangsu Hengrui Medicine's product launches, allowing them to bring new treatments to market more quickly and efficiently. This acceleration is crucial in a competitive pharmaceutical landscape.

China's ongoing pharmaceutical regulatory reforms are significantly strengthening intellectual property (IP) protection, including crucial data and market exclusivity provisions. This creates a more favorable environment for innovative drug development.

Jiangsu Hengrui Medicine is a proactive participant in this evolving landscape, consistently filing and securing patents worldwide. For instance, as of late 2024, Hengrui had a robust global patent portfolio covering numerous innovative compounds and drug formulations, safeguarding its substantial R&D investments and market position.

The legal landscape for drug pricing and reimbursement in China, particularly through mechanisms like the National Reimbursement Drug List (NRDL) and Volume-Based Procurement (VBP), directly shapes market access for pharmaceutical companies. Jiangsu Hengrui Medicine, like its peers, must strategically align its product pipeline and pricing with these evolving regulations to secure inclusion and achieve competitive pricing.

In 2024, the NRDL updates continued to emphasize cost-effectiveness, influencing which innovative therapies gain broad patient access. Hengrui's participation in VBP tenders, which often involve significant price reductions in exchange for guaranteed market share, remains a critical factor in its revenue generation and profitability for many of its key products.

Anti-Monopoly and Fair Competition Laws

Anti-monopoly and fair competition laws are pivotal in China's pharmaceutical sector, impacting companies like Jiangsu Hengrui Medicine. These regulations aim to prevent monopolistic behavior and ensure a competitive market, influencing pricing, market access, and business strategies. For instance, the Anti-Monopoly Law of the People's Republic of China, enforced by the State Administration for Market Regulation (SAMR), actively scrutinizes mergers and acquisitions to prevent market concentration.

The enforcement of these laws can significantly shape Hengrui Medicine's approach to market expansion and partnerships. By promoting a level playing field, these regulations encourage innovation and prevent dominant players from stifling smaller competitors. This regulatory environment necessitates careful consideration of market share and potential anti-competitive practices in any strategic move, including collaborations or acquisitions. In 2023, SAMR continued its focus on the pharmaceutical industry, issuing fines for monopolistic practices in certain drug markets, underscoring the importance of compliance.

- Regulatory Scrutiny: China's Anti-Monopoly Law actively monitors pharmaceutical market concentration, affecting M&A activities.

- Fair Competition: Laws promote a level playing field, fostering innovation and preventing dominant companies from hindering smaller rivals.

- Strategic Impact: Hengrui Medicine must align its market strategies, collaborations, and expansion plans with anti-monopoly regulations.

- Enforcement Trends: In 2023, regulatory bodies levied fines for monopolistic practices, highlighting the ongoing importance of compliance in the sector.

Compliance and Quality Control Standards

Pharmaceutical companies like Jiangsu Hengrui Medicine are legally bound to adhere to stringent compliance and quality control standards. This includes rigorous application of Good Manufacturing Practices (GMP) and Good Pharmacovigilance Practices (GVP), which are non-negotiable for market access and continued operation.

Hengrui Medicine's unwavering dedication to these mandates directly underpins its ability to ensure product quality and safeguard patient safety. This commitment is also critical for securing and maintaining regulatory approvals from bodies like China's National Medical Products Administration (NMPA) and international agencies.

In 2023, Hengrui Medicine reported significant investment in R&D, with a focus on quality systems. For instance, their adherence to GMP standards was a key factor in the successful approval of several new drug applications, contributing to their revenue growth.

- GMP Compliance: Ensures manufacturing processes consistently produce high-quality drugs.

- GVP Adherence: Mandates robust systems for monitoring and reporting adverse drug reactions.

- Regulatory Approvals: Strict quality control is a prerequisite for market authorization.

- Patient Safety: Legal standards are designed to protect public health by ensuring drug efficacy and safety.

China's evolving regulatory environment is a significant legal factor for Jiangsu Hengrui Medicine. Reforms by the National Medical Products Administration (NMPA) are streamlining drug approvals, with priority review pathways leading to more innovative drug approvals in 2023. Furthermore, strengthened intellectual property (IP) protection, including data and market exclusivity, creates a more favorable landscape for R&D investments. Hengrui's robust global patent portfolio as of late 2024 underscores its commitment to safeguarding innovation.

Environmental factors

Jiangsu Hengrui Medicine actively integrates environmental protection into its core operations and ESG strategy, aiming to be an eco-friendly enterprise. This focus is critical for enhancing corporate reputation and ensuring compliance with evolving environmental regulations, a trend gaining significant traction in the pharmaceutical sector.

The pharmaceutical manufacturing processes at Jiangsu Hengrui Medicine, like other industry players, can generate diverse waste streams, including chemical byproducts and wastewater. Stringent environmental regulations in China, particularly concerning hazardous waste disposal and emissions, necessitate robust waste management systems. Failure to comply can lead to significant fines and operational disruptions, impacting the company's financial performance and reputation.

In 2023, China's Ministry of Ecology and Environment continued to enforce strict standards on industrial pollution, with pharmaceutical companies facing increased scrutiny on wastewater discharge and air quality. Hengrui Medicine's commitment to environmental protection involves substantial investments in advanced wastewater treatment facilities and emission control technologies to meet these evolving regulatory demands and minimize its ecological impact.

Jiangsu Hengrui Medicine is focusing on resource efficiency, particularly optimizing water and energy consumption in its manufacturing processes. This approach not only bolsters environmental sustainability but also drives significant operational cost savings. For instance, by implementing advanced water recycling systems, Hengrui Medicine aims to reduce its freshwater intake by 15% by the end of 2025.

The company is actively working to reduce its carbon footprint, a key environmental concern for the pharmaceutical industry. In 2024, Hengrui Medicine invested ¥50 million in upgrading its manufacturing facilities with energy-efficient equipment, leading to an estimated 10% decrease in greenhouse gas emissions from its primary production sites.

Climate Change Considerations

Climate change is increasingly influencing long-term business strategies, even for pharmaceutical companies like Jiangsu Hengrui Medicine. While it doesn't directly affect how their drugs work, the company must consider building more resilient and sustainable supply chains. Extreme weather events, a consequence of climate change, could disrupt manufacturing operations and distribution networks, requiring proactive risk management. For instance, in 2023, China experienced significant weather disruptions, impacting various industries, a trend projected to continue.

Jiangsu Hengrui Medicine is also actively engaging with climate change through its intellectual property. The company holds patents that are related to climate change adaptation and mitigation technologies, indicating a forward-looking approach to environmental challenges. This focus on innovation in areas potentially linked to climate resilience underscores the growing importance of environmental factors in the pharmaceutical sector's strategic planning and R&D efforts.

- Supply Chain Resilience: Implementing robust measures to safeguard against disruptions caused by extreme weather events, a growing concern in regions like China.

- Sustainable Operations: Investing in eco-friendly manufacturing processes and logistics to reduce environmental impact and meet evolving regulatory and consumer expectations.

- Intellectual Property: Developing and patenting technologies that address climate change challenges, potentially opening new avenues for growth and market differentiation.

Biodiversity and Ecosystem Protection

Jiangsu Hengrui Medicine, like many pharmaceutical firms, must consider its environmental footprint, particularly concerning biodiversity. Companies engaged in natural product research or large-scale manufacturing operations need to be mindful of their impact on local ecosystems and biodiversity. Responsible sourcing of raw materials and minimizing manufacturing-related environmental disruption are key considerations. For instance, the global pharmaceutical industry's reliance on plant-derived compounds underscores the importance of sustainable harvesting practices to prevent biodiversity loss.

Adherence to environmental regulations and the adoption of best practices are crucial for Hengrui Medicine. This includes ensuring that any land use for facilities or research does not negatively impact sensitive habitats. Regulations often mandate environmental impact assessments before new projects commence, aiming to protect biodiversity. The company's commitment to sustainability can be demonstrated through initiatives that support ecosystem health and conservation efforts.

Key areas of focus for Hengrui Medicine regarding biodiversity and ecosystem protection include:

- Responsible Sourcing: Implementing policies to ensure that any natural ingredients used are sourced sustainably, without depleting wild populations or damaging habitats.

- Minimizing Disruption: Designing manufacturing processes and facilities to reduce waste, pollution, and land disturbance, thereby protecting surrounding ecosystems.

- Regulatory Compliance: Staying abreast of and adhering to all national and international environmental laws and guidelines pertaining to biodiversity and ecosystem protection.

Jiangsu Hengrui Medicine is prioritizing resource efficiency, aiming to cut freshwater use by 15% by the end of 2025 through advanced water recycling systems.

In 2024, the company invested ¥50 million in energy-efficient upgrades, projecting a 10% reduction in greenhouse gas emissions from its main production sites.

Climate change necessitates building resilient supply chains, as extreme weather events in China, like those seen in 2023, pose risks to manufacturing and distribution.

Hengrui Medicine's commitment to sustainability extends to responsible sourcing and minimizing manufacturing impacts to protect biodiversity and ecosystems.

| Environmental Focus Area | Target/Action | Timeline/Year | Investment/Data |

|---|---|---|---|

| Water Efficiency | Reduce freshwater intake | End of 2025 | 15% reduction |

| Carbon Footprint Reduction | Upgrade manufacturing facilities | 2024 | ¥50 million investment, estimated 10% GHG emission decrease |

| Climate Change Resilience | Supply chain risk management | Ongoing | Proactive measures against extreme weather |

| Biodiversity Protection | Sustainable sourcing practices | Ongoing | Adherence to environmental laws |

PESTLE Analysis Data Sources

Our Jiangsu Hengrui Medicine PESTLE analysis is grounded in comprehensive data from official Chinese government publications, international health organizations, and leading pharmaceutical industry research firms. This ensures all insights into political, economic, social, technological, legal, and environmental factors are robust and current.