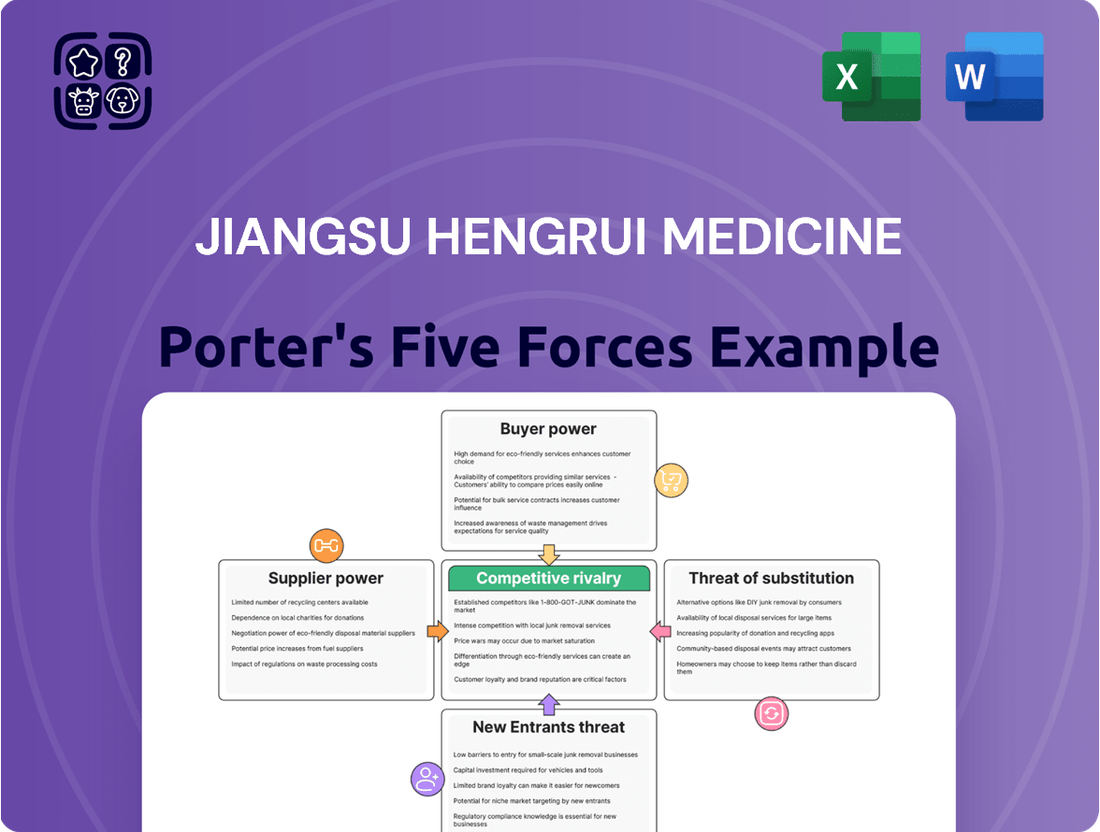

Jiangsu Hengrui Medicine Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangsu Hengrui Medicine Bundle

Jiangsu Hengrui Medicine faces significant competitive pressures, with moderate threat from new entrants and intense rivalry among existing players. Buyer power is a key consideration, as are the bargaining powers of suppliers and the constant threat of substitute products. Understanding these forces is crucial for strategic planning.

Ready to move beyond the basics? Get a full strategic breakdown of Jiangsu Hengrui Medicine’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Jiangsu Hengrui Medicine's reliance on highly specialized raw materials and active pharmaceutical ingredients (APIs) for its innovative drug development significantly influences supplier bargaining power. The proprietary and unique nature of these components, crucial for novel therapies targeting unmet medical needs, grants suppliers considerable leverage. This dependency means that Hengrui's production costs and supply chain resilience are directly affected by any shifts in supplier pricing or material availability.

While Hengrui Medicine has robust internal R&D and manufacturing, the pharmaceutical sector frequently relies on specialized Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). This reliance can grant these external service providers significant bargaining power, particularly when their expertise or capacity is in high demand for complex biologics or cutting-edge drug development.

The availability of high-quality, compliant, and specialized CRO/CMO services directly impacts supplier power. Increased demand for niche capabilities can drive up costs for pharmaceutical companies like Hengrui. For instance, in 2024, the global CRO market was projected to reach over $80 billion, indicating substantial reliance and potential leverage for leading providers.

Developing innovative medicines, especially in areas like oncology and immunology, demands sophisticated technologies and specialized equipment. Hengrui Medicine relies on suppliers providing these advanced tools, which are often costly and require expert handling.

Suppliers of cutting-edge machinery, analytical instruments, and proprietary software hold significant leverage. This is due to the substantial investment required for these assets, the niche expertise needed for their operation, and frequently a limited pool of alternative suppliers. This reality can translate into considerable capital outlays and sustained operational expenses for Hengrui.

Scarcity of Skilled Talent and Scientific Expertise

The pharmaceutical industry, especially in areas like innovative drug discovery, absolutely needs a highly skilled workforce. Think research scientists, clinical development experts, and people who understand regulatory affairs. The global shortage of these specialists, particularly those with experience in the newest biopharmaceutical innovations, means they have considerable bargaining power.

Hengrui Medicine must make smart investments in attracting, keeping, and developing talent. This is crucial for securing the human capital needed to drive its ambitious pipeline forward. For instance, as of early 2024, the demand for biopharmaceutical researchers with expertise in areas like AI-driven drug discovery significantly outstripped supply, leading to higher salary expectations and specialized recruitment challenges.

- Talent Scarcity Impact: The limited pool of specialized pharmaceutical talent grants individuals significant leverage in negotiations, impacting recruitment costs and project timelines for companies like Hengrui.

- R&D Dependency: Hengrui's reliance on cutting-edge R&D means that access to top-tier scientific expertise is a critical success factor, directly influencing its ability to innovate and bring new drugs to market.

- Strategic Imperative: Proactive investment in talent management, including competitive compensation, continuous learning opportunities, and a strong research environment, is essential for Hengrui to maintain its competitive edge.

Intellectual Property and Licensing Agreements from Technology Providers

Suppliers of foundational intellectual property, patented technologies, or licensed drug components can wield significant bargaining power over pharmaceutical firms like Hengrui. The company's capacity to develop certain innovative drugs often hinges on in-licensing specific technologies or compounds from academic institutions, biotech startups, or other established pharmaceutical entities.

The negotiated terms and exclusivity clauses within these intellectual property agreements directly influence the cost and strategic maneuverability Hengrui possesses concerning these critical inputs. For instance, in 2023, Hengrui announced a significant collaboration and licensing agreement with a U.S.-based biotech firm for a novel oncology candidate, involving upfront payments and milestone achievements potentially reaching hundreds of millions of dollars, underscoring the substantial financial commitment and supplier leverage in such deals.

- Dependency on Key Patents: Hengrui's reliance on patented active pharmaceutical ingredients (APIs) or novel drug delivery systems from external suppliers can create strong supplier leverage.

- Licensing Deal Costs: The financial terms of in-licensing agreements, including upfront fees, royalties, and milestone payments, directly impact Hengrui's R&D expenditure and profit margins.

- Exclusivity Provisions: Exclusive licensing rights granted to Hengrui can reduce immediate competition for a specific drug but may also increase the cost and limit flexibility if alternative suppliers or technologies emerge.

- Supplier Concentration: If only a few specialized technology providers or patent holders exist for a critical component, their bargaining power is amplified.

Jiangsu Hengrui Medicine's dependence on specialized raw materials and APIs for its innovative drug pipeline significantly amplifies supplier bargaining power. The unique nature of these components, essential for novel therapies, grants suppliers considerable leverage, directly impacting Hengrui's production costs and supply chain stability.

The pharmaceutical sector's reliance on specialized Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) also grants these service providers significant leverage, especially for complex biologics. The global CRO market's projected growth to over $80 billion in 2024 highlights the substantial reliance and potential power of leading providers.

Suppliers of advanced technologies, specialized equipment, and proprietary software hold considerable sway due to high asset costs, niche expertise requirements, and limited alternative providers. This can lead to substantial capital expenditures and ongoing operational expenses for Hengrui.

The scarcity of highly skilled talent, particularly research scientists and clinical development experts in biopharmaceuticals, gives these individuals significant bargaining power. As of early 2024, demand for biopharmaceutical researchers with expertise in AI-driven drug discovery far outstripped supply, driving up salary expectations and complicating recruitment.

Foundational intellectual property and licensed drug components from external entities also empower suppliers. Hengrui's reliance on in-licensing specific technologies, as seen in a 2023 collaboration with a U.S. biotech firm for an oncology candidate potentially valued at hundreds of millions, underscores the substantial financial commitments and supplier leverage involved.

| Factor | Impact on Hengrui | Supplier Leverage | Example/Data (2023-2024) |

|---|---|---|---|

| Specialized Raw Materials/APIs | Cost and supply chain stability | High | Proprietary nature of components for novel therapies. |

| CRO/CMO Services | R&D speed and manufacturing capacity | Moderate to High | Global CRO market projected over $80 billion (2024). |

| Advanced Technology/Equipment | Capital expenditure and operational cost | High | Niche expertise and limited alternative suppliers for cutting-edge machinery. |

| Specialized Talent | Innovation pipeline and project timelines | High | Demand for AI drug discovery experts significantly outstripping supply (early 2024). |

| Intellectual Property/Licensing | Drug development costs and strategic options | High | Multi-million dollar licensing deals for oncology candidates (2023). |

What is included in the product

This Porter's Five Forces analysis unpacks the competitive landscape for Jiangsu Hengrui Medicine, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Uncover competitive advantages and threats with a clear, actionable Porter's Five Forces analysis of Jiangsu Hengrui Medicine, enabling targeted pain point relief.

Customers Bargaining Power

In China, government procurement programs like Volume-Based Procurement (VBP) and the National Reimbursement Drug List (NRDL) wield considerable influence, acting as powerful customers for pharmaceutical firms. These initiatives allow for aggressive price negotiations, with discounts frequently reaching 50% to 90% in return for guaranteed market entry and substantial sales volumes.

While inclusion in the NRDL broadens patient access to medications, it necessitates significant price reductions, directly affecting Hengrui's revenue streams and profit margins on those specific drugs.

The growing consolidation of hospitals and healthcare networks, both in China and internationally, significantly bolsters customer bargaining power. These larger entities, by pooling their purchasing volume, can negotiate more advantageous terms and pricing from pharmaceutical manufacturers like Hengrui Medicine.

In 2024, the trend of hospital mergers and acquisitions continued globally, creating larger purchasing blocs. This increased scale allows these consolidated healthcare systems to exert greater pressure on pharmaceutical companies for lower prices and preferential treatment, impacting Hengrui's revenue streams.

As integrated healthcare systems expand, Hengrui Medicine faces heightened pressure to offer competitive pricing to secure formulary access and widespread market penetration for its innovative drugs. This dynamic directly influences Hengrui's ability to maintain its profit margins.

The bargaining power of customers, particularly in the pharmaceutical sector, is significantly shaped by reimbursement policies. For Jiangsu Hengrui Medicine, the extent to which its drugs are covered by national health insurance, like China's National Reimbursement Drug List (NRDL), and commercial insurance schemes directly influences patient affordability and, consequently, drug adoption rates. In 2023, China's NRDL negotiations saw a substantial number of innovative drugs added, with an average price cut of 60% for newly included drugs, highlighting the price sensitivity and bargaining leverage of the government as a major customer.

When a drug lacks comprehensive reimbursement, patients or healthcare providers, acting as proxies for patients, naturally exert more pressure on pricing. They will actively seek out more affordable or better-covered alternatives, thereby increasing the bargaining power of these customer segments. Hengrui's strategic imperative to secure a place on the NRDL is crucial for broad market access and penetration, a move that was underscored by the inclusion of several of its innovative oncology drugs in the 2023 NRDL update. However, this access is invariably linked to price concessions, a direct manifestation of customer bargaining power.

Availability of Generic and Biosimilar Alternatives

The increasing availability of generic and biosimilar drugs directly enhances customer bargaining power. These lower-cost alternatives put pressure on pharmaceutical companies, including those focused on innovation like Hengrui, by offering comparable treatments at a reduced price point. This trend is particularly relevant as the global pharmaceutical industry faces a significant patent cliff between 2024 and 2028, with numerous blockbuster drugs losing patent protection.

This patent cliff creates substantial opportunities for generic and biosimilar manufacturers. For instance, by 2027, it's projected that over $200 billion in annual revenue from originator drugs will be exposed to generic or biosimilar competition. While Hengrui's strategy centers on novel drug development, the broader market shift towards more affordable generics and biosimilars can indirectly influence pricing expectations across therapeutic areas, even for innovative treatments.

The bargaining power of customers is amplified by:

- Increased availability of cost-effective generic and biosimilar options.

- The significant patent cliff from 2024-2028, opening doors for lower-priced alternatives.

- Potential for price erosion across therapeutic categories due to generic competition.

Increasing Patient Awareness and Digital Health Adoption

Patients in China are increasingly informed about treatments and drug prices thanks to digital health platforms and awareness campaigns. This growing transparency allows patients to participate more actively in their care decisions and explore alternative, potentially more affordable options, which bolsters their bargaining power.

The widespread adoption of telemedicine in China further amplifies this trend. For instance, by mid-2024, over 70% of Chinese hospitals had established online consultation services, making it easier for patients to compare offerings and access information from various providers.

- Growing Patient Information Access: Digital health platforms and public campaigns in China are making treatment options, efficacy, and pricing more transparent.

- Enhanced Decision-Making: Patients are empowered to actively participate in treatment choices and seek cost-effective alternatives.

- Telemedicine's Role: The normalization of telemedicine facilitates easier comparison of services and access to information, indirectly increasing patient bargaining power.

The bargaining power of customers is a significant force impacting Jiangsu Hengrui Medicine, especially within China's evolving healthcare landscape. Government procurement programs like Volume-Based Procurement (VBP) and the National Reimbursement Drug List (NRDL) exert substantial influence, often leading to price reductions of 50% to 90% in exchange for market access. This dynamic was evident in 2023 when newly included drugs on the NRDL saw average price cuts of 60%, directly affecting revenue streams.

Furthermore, the consolidation of hospitals and healthcare networks globally, a trend continuing into 2024 with increased mergers and acquisitions, creates larger purchasing blocs. These entities can negotiate more favorable terms, further pressuring pharmaceutical companies like Hengrui for lower prices. The increasing availability of generic and biosimilar drugs, amplified by a significant patent cliff expected between 2024 and 2028, also empowers customers by offering lower-cost alternatives, potentially eroding prices even for innovative treatments. By mid-2024, over 70% of Chinese hospitals offered online consultations, facilitating easier price comparisons for informed patients.

| Factor | Impact on Hengrui Medicine | 2024 Relevance |

| Government Procurement (VBP/NRDL) | Significant price reductions required for market access. | Continued aggressive negotiation tactics by government bodies. |

| Hospital Consolidation | Increased leverage for larger healthcare systems to demand lower prices. | Global trend of M&A in healthcare creating larger buying groups. |

| Generic/Biosimilar Competition | Pressure on pricing due to availability of lower-cost alternatives. | Patent cliff from 2024-2028 exposes originator drugs to competition. |

| Patient Information Access | Empowered patients seeking cost-effective options. | Telemedicine adoption (over 70% of Chinese hospitals by mid-2024) aids price comparison. |

Same Document Delivered

Jiangsu Hengrui Medicine Porter's Five Forces Analysis

This preview showcases the comprehensive Jiangsu Hengrui Medicine Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You'll gain immediate access to this professionally formatted and ready-to-use analysis, empowering your strategic decision-making.

Rivalry Among Competitors

The Chinese pharmaceutical landscape is a battleground, with both homegrown innovators and global giants vying for market share. Jiangsu Hengrui Medicine, a key player, finds itself in direct competition, particularly in high-demand areas like oncology, where numerous companies are racing to bring new treatments to market. This fierce rivalry means Hengrui must consistently invest heavily in research and development and strategically position itself to stay ahead.

In the innovative pharmaceutical sector, fierce competition hinges on the continuous discovery, development, and successful launch of new drugs. Hengrui's commitment to this is evident in its significant R&D investment, reaching 29.40% of its revenue in 2024, alongside a promising pipeline of over 90 innovative drug candidates. This dedication to innovation is crucial for distinguishing itself and maintaining a competitive advantage.

China's Volume-Based Procurement (VBP) policy has dramatically intensified competition within the pharmaceutical sector. This policy compels drug manufacturers to bid aggressively on price to secure inclusion in national procurement lists, resulting in substantial price cuts across many medications. For instance, in the 2023 VBP rounds, average price reductions for selected drugs reached as high as 50% or more for some categories, directly impacting profitability.

While VBP can broaden market access for companies that win bids, it significantly compresses profit margins. This pressure is especially acute for established, less differentiated, or off-patent drugs where price becomes the primary competitive differentiator. Hengrui Medicine, like its peers, faces the challenge of maintaining profitability amidst these price pressures, necessitating careful strategic planning.

To navigate this evolving landscape, Hengrui must strategically position itself. This could involve a greater emphasis on developing and marketing highly innovative drugs that may command premium pricing or be less susceptible to the immediate price erosion characteristic of VBP rounds for older generics. Focusing on R&D for novel therapies is crucial for long-term competitive advantage.

Accelerating Internationalization and Global Partnerships

Competitive rivalry is intensifying as Chinese pharmaceutical companies like Hengrui Medicine actively pursue internationalization. This global push involves out-licensing deals and conducting clinical trials abroad, directly fueling competition in drug development worldwide. For instance, Hengrui's significant multi-billion dollar partnerships with giants like GSK and Merck & Co. in 2023 and early 2024 underscore this strategy. These collaborations aim to tap into established global commercial networks and broaden market access, but simultaneously signal a more crowded and competitive arena for bringing new drugs to market.

This trend means Hengrui faces heightened rivalry not just from domestic players but also from established global pharmaceutical leaders. The increasing number of international clinical trials conducted by Chinese firms, often involving advanced therapies, directly challenges the pipelines and market entry strategies of Western pharmaceutical companies. Hengrui's own reported R&D expenditure, which has seen consistent year-on-year growth, reaching over RMB 10 billion in 2023, reflects this commitment to innovation in a globally competitive environment.

The strategic out-licensing deals, such as Hengrui's agreement with a major US pharmaceutical company in late 2023 for its novel oncology drug, represent a key tactic in navigating this intensified rivalry. While these partnerships provide crucial funding and global reach, they also place Hengrui's innovations directly alongside those of its international partners and competitors in the global marketplace. This dynamic forces all players to accelerate their research, development, and commercialization efforts to maintain a competitive edge.

- Global Expansion: Chinese pharma companies, including Hengrui, are increasingly engaging in out-licensing and international clinical trials.

- Major Partnerships: Hengrui’s multi-billion dollar deals with GSK and Merck & Co. exemplify leveraging global commercial infrastructure.

- Intensified Competition: These moves signal a more competitive landscape for drug development and global commercialization.

- R&D Investment: Hengrui's R&D spending exceeding RMB 10 billion in 2023 highlights its commitment to innovation amidst global rivalry.

Focus on Oncology and Other High-Growth Therapeutic Areas

Hengrui Medicine's strategic focus on oncology, cardiovascular, metabolic diseases, and immunology places it squarely in some of the most dynamic and fiercely contested global pharmaceutical markets. These therapeutic areas are experiencing significant growth driven by increasing chronic disease prevalence and cancer diagnoses worldwide. For instance, the global oncology market alone was valued at approximately $200 billion in 2023 and is projected to grow substantially, attracting significant investment and innovation. This intense competition means Hengrui must consistently innovate and differentiate its offerings to maintain its market share.

The competitive rivalry in these high-growth segments is intense due to the high potential for returns and the unmet medical needs they address. Companies are pouring resources into research and development, leading to a rapid pace of new drug approvals and pipeline advancements. This dynamic environment necessitates that Hengrui not only maintains its strong position in oncology, where it has achieved notable successes, but also actively pursues market segmentation and strategic partnerships to stay ahead of emerging therapies and new entrants.

Hengrui's commitment to oncology is a key driver of its growth, but it also exposes the company to significant competitive pressures. The market is characterized by:

- A crowded pipeline: Numerous domestic and international pharmaceutical companies are developing novel cancer treatments.

- Rapid technological advancements: Innovations in areas like targeted therapies, immunotherapy, and personalized medicine constantly reshape the competitive landscape.

- Pricing pressures: Healthcare systems globally are increasingly scrutinizing drug prices, impacting profitability.

- Regulatory hurdles: Navigating complex regulatory pathways for new drug approvals adds another layer of challenge.

The competitive rivalry within the Chinese pharmaceutical market is exceptionally high, driven by a mix of domestic innovation and global competition. Hengrui Medicine faces intense pressure from numerous companies, especially in lucrative therapeutic areas like oncology. This necessitates continuous, substantial investment in research and development to maintain its market position and differentiate its product offerings.

China's Volume-Based Procurement (VBP) policy further amplifies this rivalry by forcing aggressive price competition, leading to significant margin compression for many drugs. Hengrui, like its peers, must strategically navigate these price pressures, often by focusing on highly innovative therapies less susceptible to VBP's immediate impact.

Furthermore, Hengrui's internationalization strategy, including out-licensing and global clinical trials, places it in direct competition with established global pharmaceutical giants. This global push, exemplified by its multi-billion dollar partnerships in 2023 and early 2024, requires sustained R&D investment, exceeding RMB 10 billion in 2023, to compete on a worldwide stage.

The company's strategic focus on high-growth therapeutic areas such as oncology, a market valued at approximately $200 billion in 2023, intensifies competition. This segment is characterized by a crowded pipeline, rapid technological advancements in areas like immunotherapy, and increasing pricing scrutiny from healthcare systems globally.

SSubstitutes Threaten

The most significant threat of substitution for Jiangsu Hengrui Medicine arises from generic and biosimilar drugs. These alternatives, offering identical or highly similar therapeutic profiles, become available at substantially reduced costs once the patents on innovative drugs expire. This dynamic directly impacts Hengrui's market share for established products.

China's Volume-Based Procurement (VBP) policy actively encourages the adoption of generics by aggressively lowering their prices. This policy creates a strong incentive for healthcare providers and patients to switch from more expensive, branded innovative medicines to these cost-effective alternatives, thereby intensifying the substitution threat.

While Hengrui prioritizes research and development for novel therapies, the broader market trend undeniably favors affordability. This persistent shift towards generics and biosimilars represents a continuous substitution risk, especially for Hengrui's older or less unique product lines where price becomes a more dominant purchasing factor.

Patients often consider alternatives to pharmaceutical treatments, such as surgical procedures, radiation therapy, or even lifestyle changes like diet and exercise. For certain conditions, these non-drug interventions can be just as effective, potentially lowering the need for specific medications. For instance, in 2023, the global market for minimally invasive surgery was valued at over $20 billion, showcasing a significant shift towards non-pharmacological solutions.

The growing acceptance and integration of Traditional Chinese Medicine (TCM) within China's healthcare system also represent a culturally significant substitute. In 2024, the TCM market in China was projected to reach over $150 billion, indicating a strong preference for these traditional methods alongside or instead of Western pharmaceuticals for many ailments.

The pharmaceutical industry's rapid innovation presents a significant threat of substitutes for established treatments. Breakthroughs in cell and gene therapies, advanced biologics, and AI-powered drug discovery are creating new treatment paradigms that can outperform existing options. For instance, the global cell and gene therapy market was valued at approximately $10 billion in 2023 and is projected to grow substantially, highlighting the increasing impact of these novel approaches.

These advanced therapies, despite their initial high costs, offer the potential for improved efficacy, reduced side effects, or even curative outcomes, directly challenging conventional drug classes. This dynamic necessitates continuous adaptation by established players.

Jiangsu Hengrui Medicine's strategic focus on developing innovative drugs, such as Antibody-Drug Conjugates (ADCs) and bispecific antibodies, demonstrates a proactive approach to this threat. Hengrui's investment in these areas, exemplified by their pipeline advancements and partnerships, positions them to compete within this evolving therapeutic landscape and leverage these emerging substitutes as opportunities.

Off-Label Drug Use and Drug Repurposing

The threat of substitutes for Jiangsu Hengrui Medicine's products is influenced by off-label drug use and drug repurposing. Existing medications, even if not officially approved for a particular condition, can be employed if strong clinical data validates their effectiveness. This practice can present a more affordable alternative to newly patented drugs.

For instance, older drugs might be repurposed for novel therapeutic applications. If such a repurposed drug provides similar benefits at a lower cost than a new therapy, it can directly compete. This informal substitution can chip away at the market share of innovative, branded treatments.

- Off-label use: Physicians may prescribe drugs for conditions not listed on their official labels based on clinical judgment and emerging research.

- Drug repurposing: Identifying new therapeutic uses for existing drugs, often older or previously approved ones, can lead to lower development costs and faster market entry compared to novel drug discovery.

- Cost advantage: Repurposed or off-label used drugs can offer a significant price advantage, especially if the original drug is off-patent or has lower manufacturing costs.

- Market impact: This can reduce the demand for newer, more expensive patented drugs, thereby impacting revenue and market share for companies like Hengrui Medicine if their innovative products face such competition.

Emphasis on Preventive Healthcare and Early Diagnostics

The growing focus on preventive healthcare and early diagnostics presents a significant threat of substitutes for Jiangsu Hengrui Medicine. As societies and governments increasingly prioritize proactive health measures, the demand for late-stage, high-cost treatments could diminish. For instance, advancements in early cancer detection and management through improved screening technologies and targeted therapies might lessen the reliance on traditional chemotherapy or complex drug regimens.

This shift could directly impact Hengrui's revenue streams if fewer patients require their advanced therapeutic interventions. Consider the potential impact of widespread adoption of AI-powered diagnostic tools, which are projected to grow significantly. A 2024 report indicated that the global AI in healthcare market was valued at approximately $20.5 billion and is expected to expand rapidly, suggesting a future where diseases are caught much earlier.

- Reduced Demand for Late-Stage Treatments: Early detection and intervention can decrease the need for expensive, advanced pharmaceuticals.

- Rise of Preventive Solutions: Vaccines, lifestyle interventions, and improved diagnostics act as substitutes for therapeutic drugs.

- Impact on Pharmaceutical Revenue: Companies heavily reliant on treating advanced diseases may see a decline in demand.

- Market Shift Towards Early Intervention: The healthcare landscape is evolving to favor proactive health management over reactive treatment.

The threat of substitutes for Jiangsu Hengrui Medicine is multifaceted, encompassing generics, biosimilars, alternative medical treatments, and emerging therapies. China's Volume-Based Procurement policy actively encourages generics, creating a strong incentive for cost-effective alternatives. For instance, in 2023, the global market for minimally invasive surgery, a non-drug alternative, exceeded $20 billion, highlighting a growing preference for non-pharmacological solutions. The TCM market in China was projected to surpass $150 billion in 2024, indicating a significant culturally driven substitute.

| Substitute Category | Example | Market Size/Trend | Impact on Hengrui |

|---|---|---|---|

| Generics & Biosimilars | Off-patent drugs | VBP policy drives adoption | Reduces market share for older products |

| Non-Drug Treatments | Minimally invasive surgery | Valued over $20 billion (2023) | Decreases demand for certain pharmaceuticals |

| Traditional Medicine | Traditional Chinese Medicine (TCM) | Projected >$150 billion (2024, China) | Offers alternative treatment pathways |

| Advanced Therapies | Cell & Gene Therapy | Valued ~$10 billion (2023) | Challenges established drug classes with superior efficacy |

Entrants Threaten

The pharmaceutical sector, including companies like Jiangsu Hengrui Medicine, faces a significant threat from new entrants due to exceptionally high research and development (R&D) costs and lengthy development timelines. Bringing a new drug to market can easily take over a decade and cost billions, with no certainty of approval or commercial success. This financial and temporal hurdle deters many potential competitors.

Jiangsu Hengrui Medicine's commitment to innovation is evident in its substantial R&D expenditures, which have surpassed $5 billion in recent years. This level of investment creates a considerable barrier, making it difficult for new players to match the established firms' capacity for discovery and development.

The threat of new entrants in the pharmaceutical sector, particularly for companies like Jiangsu Hengrui Medicine, is significantly mitigated by the sheer complexity and cost associated with regulatory approvals. Navigating agencies such as China's NMPA, the US FDA, and the EMA requires deep expertise and substantial financial investment. For instance, bringing a new drug to market can cost upwards of $2 billion and take over a decade, a substantial hurdle for any newcomer.

Strong intellectual property protection, particularly patents on innovative drugs, creates a significant barrier for new entrants in the pharmaceutical sector. For instance, Hengrui Medicine, like other major players, benefits from patent exclusivity on its key therapies, making it difficult for newcomers to replicate their success without substantial investment in their own R&D. The lengthy and costly process of developing novel compounds or complex biosimilars, coupled with the expense of patent litigation, further deters potential competitors.

Need for Specialized Manufacturing Capabilities and Extensive Distribution Networks

Manufacturing innovative pharmaceuticals, particularly biologics and complex small molecules, demands highly specialized, capital-intensive, and strictly regulated facilities. For instance, the global biologics market, valued at approximately $270 billion in 2023, requires significant investment in advanced manufacturing technologies and quality control systems, creating a substantial barrier.

Establishing robust and efficient distribution networks is equally critical for reaching healthcare providers and patients. In 2024, pharmaceutical companies are investing heavily in cold chain logistics and digital supply chain solutions to ensure product integrity and timely delivery, a costly endeavor that deters new players.

- Specialized Manufacturing: Biologics production alone can cost hundreds of millions of dollars for a single facility.

- Capital Intensity: The pharmaceutical industry's R&D and manufacturing capital expenditure was over $150 billion globally in 2023.

- Distribution Networks: Building a national distribution network can cost tens of millions, with ongoing operational expenses.

- Regulatory Compliance: Meeting stringent Good Manufacturing Practices (GMP) adds significant cost and complexity.

Established Brand Reputation, Trust, and Existing Relationships

Building a strong brand reputation, securing the trust of healthcare professionals, and cultivating enduring relationships with hospitals, key opinion leaders, and regulatory bodies are time-intensive endeavors. Jiangsu Hengrui Medicine, a dominant force in China's pharmaceutical sector with a growing international presence, benefits immensely from its established credibility, creating a significant barrier for newcomers aiming to swiftly penetrate critical therapeutic areas, especially oncology.

Hengrui Medicine's established brand equity is a formidable defense against new entrants. For instance, in 2023, the company reported revenue of approximately RMB 28.5 billion (around $4 billion USD), underscoring its market penetration and financial strength, which allows for sustained investment in marketing and relationship building. This deep-rooted trust is not easily replicated by emerging companies.

- Established Brand Reputation: Hengrui Medicine has spent years building its name, making it a trusted provider in the pharmaceutical industry.

- Healthcare Professional Trust: Gaining the confidence of doctors and specialists is crucial, and Hengrui has cultivated this through consistent product quality and clinical trial results.

- Key Stakeholder Relationships: Long-term partnerships with hospitals, influential medical experts, and government health agencies provide Hengrui with preferential market access and insights.

- Market Share Defense: These established advantages make it exceptionally challenging for new pharmaceutical companies to quickly gain traction and market share, particularly in highly regulated and specialized fields like oncology.

The threat of new entrants for Jiangsu Hengrui Medicine is considerably low due to the immense capital required for research, development, and manufacturing. For example, the global pharmaceutical R&D spending was estimated to be over $240 billion in 2023, with drug development often exceeding $1 billion per successful product. This high cost, coupled with stringent regulatory hurdles and the need for specialized facilities, creates significant barriers to entry.

| Barrier Type | Estimated Cost/Timeframe | Impact on New Entrants |

|---|---|---|

| R&D Investment | $1 billion+ per drug | Extremely High |

| Regulatory Approval | 10-15 years, $2 billion+ | Extremely High |

| Specialized Manufacturing | Hundreds of millions per facility | Very High |

| Intellectual Property | Patent protection periods | High |

Porter's Five Forces Analysis Data Sources

Our Jiangsu Hengrui Medicine Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific market research, and regulatory filings from relevant health authorities. This comprehensive data set allows for a thorough examination of competitive dynamics within the pharmaceutical sector.