Jiangsu Hengrui Medicine Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangsu Hengrui Medicine Bundle

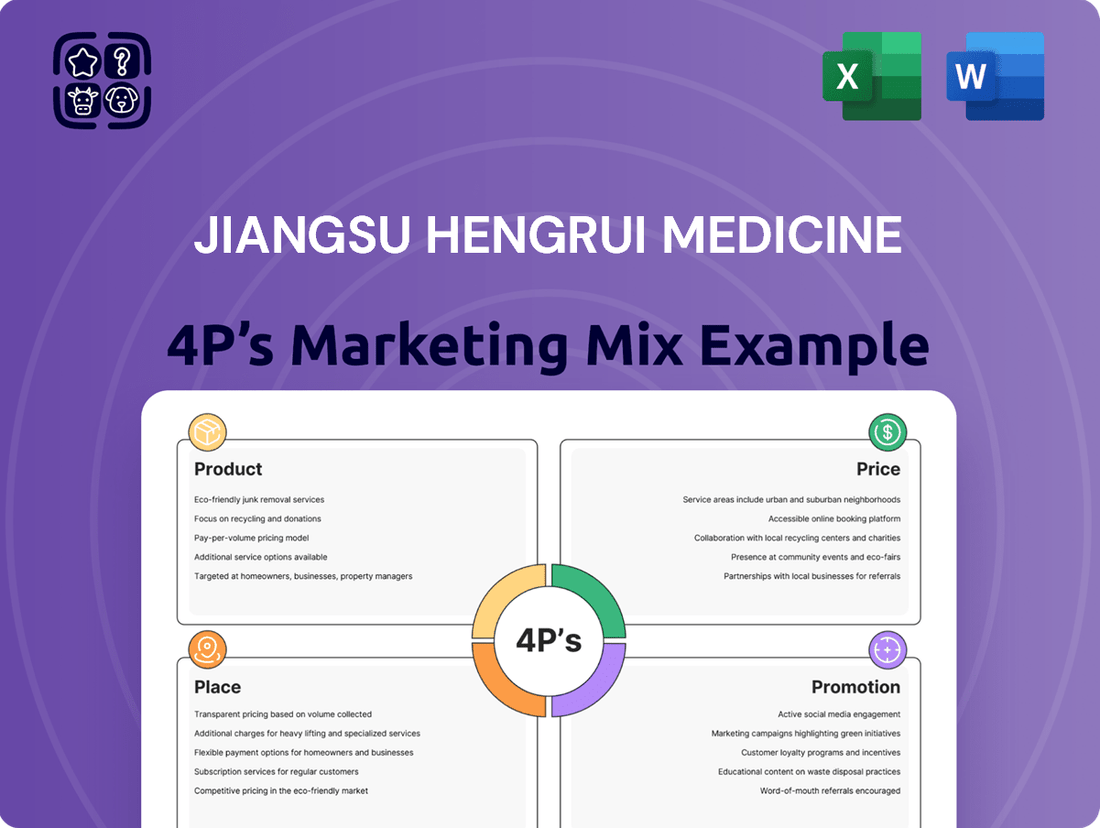

Jiangsu Hengrui Medicine's marketing prowess is built on a strategic foundation of Product, Price, Place, and Promotion. Discover how their innovative product pipeline, competitive pricing, extensive distribution network, and targeted promotional campaigns contribute to their market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Jiangsu Hengrui Medicine. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Jiangsu Hengrui Medicine boasts an impressive Product strategy centered on its innovative drug pipeline, featuring roughly 90 drug candidates. This commitment to research and development is further evidenced by their active engagement in approximately 400 clinical trials as of December 31, 2024, spanning a wide array of medical fields. This substantial pipeline demonstrates Hengrui's dedication to pioneering new treatments and tackling critical healthcare challenges.

Jiangsu Hengrui Medicine strategically directs its research and development towards key medical fields. These include oncology, where they've seen significant progress, as well as metabolic and cardiovascular diseases, immunological and respiratory conditions, and neuroscience. This focused approach helps them channel resources effectively into areas with substantial unmet medical needs.

By concentrating on these critical therapeutic areas, Hengrui aims to develop innovative treatments for widespread and impactful diseases. For instance, in 2023, the company reported substantial investment in R&D, with figures indicating a strong commitment to advancing therapies in oncology, a sector that represents a significant portion of their pipeline and market focus.

Jiangsu Hengrui Medicine's product strategy is anchored by its robust pipeline of commercialized innovative drugs. By the close of 2024, the company had successfully brought 23 new molecular entity drugs and 4 additional innovative drugs to market within China. This impressive portfolio reflects a significant return on their substantial investment in research and development, translating scientific breakthroughs into accessible treatments for patients.

International Collaborations for Development

Jiangsu Hengrui Medicine prioritizes international collaborations as a key element of its 'Promotion' strategy, aiming to broaden its product pipeline and market presence. These partnerships are crucial for accessing new technologies and expanding global distribution networks.

Hengrui's commitment to international development is evident in recent significant agreements. In July 2025, the company entered into a strategic partnership with GSK, targeting the development of up to twelve novel medicines. This collaboration specifically includes advancing a promising PDE3/4 inhibitor, with the potential to become a leading treatment for Chronic Obstructive Pulmonary Disease (COPD).

Further strengthening its international portfolio, Hengrui also secured a licensing agreement with Merck in March 2025 for HRS-5346. This deal underscores Hengrui's proactive approach to acquiring and developing innovative assets through global alliances.

- July 2025: Partnership with GSK to develop up to 12 innovative medicines.

- Focus: Development of a potential best-in-class PDE3/4 inhibitor for COPD.

- March 2025: Licensing deal with Merck for HRS-5346.

- Objective: Expand product offerings and global reach through strategic alliances.

Commitment to Unmet Medical Needs

Jiangsu Hengrui Medicine's product strategy is deeply rooted in addressing significant unmet medical needs. This patient-focused philosophy guides their development of innovative medicines, aiming to enhance patient well-being worldwide. Their commitment is evident in their substantial investments in research and development.

For instance, Hengrui's R&D expenditure reached approximately RMB 10.5 billion in 2023, a testament to their dedication to pioneering new treatments. This investment fuels their pipeline, which includes numerous novel drug candidates targeting diseases with limited therapeutic options.

- Focus on Unmet Needs: Hengrui prioritizes developing drugs for conditions lacking effective treatments.

- Patient-Centric Approach: Their goal is to improve global patient outcomes through novel therapies.

- R&D Investment: Significant financial resources are allocated to research and development, reflecting their commitment.

- Pipeline Development: Hengrui actively builds a pipeline of innovative drugs to meet diverse medical challenges.

Jiangsu Hengrui Medicine's product strategy is characterized by a diverse and innovative pipeline, featuring approximately 90 drug candidates as of December 31, 2024. The company's commitment to advancing healthcare is further demonstrated by its active participation in around 400 clinical trials globally, underscoring a broad approach to addressing various medical needs.

Hengrui strategically focuses its extensive research and development efforts on critical therapeutic areas, including oncology, metabolic and cardiovascular diseases, immunology, respiratory conditions, and neuroscience. This targeted approach ensures that resources are concentrated on areas with significant unmet patient needs, aiming to deliver impactful treatments.

The company has successfully commercialized a robust portfolio, with 23 new molecular entity drugs and 4 additional innovative drugs available in China by the end of 2024. This achievement reflects substantial R&D investments, translating scientific progress into tangible patient benefits.

| Product Metric | 2023 Data | 2024 Data (as of Dec 31) |

|---|---|---|

| R&D Expenditure (RMB billions) | ~10.5 | N/A |

| Drug Candidates in Pipeline | N/A | ~90 |

| Active Clinical Trials | N/A | ~400 |

| Commercialized Innovative Drugs (China) | N/A | 27 (23 NME + 4 additional) |

What is included in the product

This analysis provides a comprehensive breakdown of Jiangsu Hengrui Medicine's marketing strategies, examining its product innovation, pricing approaches, distribution channels, and promotional activities.

It offers a detailed look at how Jiangsu Hengrui Medicine leverages its 4P's to maintain a competitive edge in the pharmaceutical market.

Provides a clear, concise overview of Jiangsu Hengrui Medicine's 4Ps marketing strategy, simplifying complex pharmaceutical marketing for quick understanding and actionable insights.

Acts as a vital tool for leadership to rapidly assess Hengrui's market positioning and identify areas for enhanced pain point relief in their product offerings.

Place

Jiangsu Hengrui Medicine's extensive domestic sales network is a cornerstone of its market presence in China. As of September 30, 2024, the company commands an industry-leading sales and marketing team of approximately 9,000 professionals.

This formidable team ensures deep penetration across China's healthcare landscape, reaching over 22,000 hospitals and more than 200,000 offline retail pharmacies. Their reach extends across more than 30 provincial-level regions, guaranteeing broad accessibility for Hengrui's pharmaceutical products.

By the end of 2024, Hengrui Medicine's pharmaceutical products were available in more than 40 countries, showcasing significant global reach. This accelerated commercialization strategy is a key component of their marketing efforts.

The company is aggressively pursuing further global market development, with a strategic emphasis on expanding into emerging markets. This focus aims to make their innovative treatments accessible to a wider patient base worldwide.

To bolster its global ambitions, Hengrui Medicine has strategically established 14 research and development centers worldwide. This expansive network includes key subsidiaries in the United States, Europe, Australia, and Japan, underscoring a significant international footprint.

Further demonstrating its commitment to global drug development, Hengrui has initiated over 20 clinical trials outside of China. These trials are being conducted across various international regions, reflecting a serious investment in bringing its innovations to a worldwide patient population.

Strategic Out-licensing Agreements

Jiangsu Hengrui Medicine has strategically leveraged out-licensing agreements to expand the global reach of its pharmaceutical innovations. Since 2018, the company has actively pursued partnerships, demonstrating a commitment to making its drug candidates accessible beyond Greater China.

These collaborations are crucial for market penetration. For instance, the out-licensing deal with GSK for Hengrui's novel drug candidates in oncology and immunology exemplifies this strategy. Such agreements provide Hengrui with upfront payments, milestone payments, and royalties, bolstering its financial resources for continued research and development.

- Global Market Access: Out-licensing facilitates entry into new geographical markets, increasing the potential patient base for Hengrui's therapies.

- Financial Benefits: These deals generate non-dilutive capital through upfront fees and milestone payments, supporting ongoing R&D efforts.

- Risk Sharing: Partnering with established global pharmaceutical companies helps share the development and commercialization risks associated with bringing new drugs to market.

- Focus on Core Competencies: By out-licensing, Hengrui can concentrate its resources on its core strengths in drug discovery and early-stage development within its primary markets.

Adherence to Global Quality Standards

Jiangsu Hengrui Medicine's commitment to quality is a cornerstone of its global strategy. The company maintains manufacturing facilities across China, all of which are designed to meet or exceed international quality benchmarks for its exported pharmaceuticals.

This dedication ensures broad market acceptance, as Hengrui's products comply with rigorous standards such as EU Good Manufacturing Practice (GMP), U.S. current Good Manufacturing Practice (cGMP), and the International Council for Harmonisation (ICH) Quality Guidelines. For instance, in 2023, Hengrui reported that its key manufacturing sites underwent successful inspections by international regulatory bodies, reinforcing its adherence to global quality protocols.

- EU GMP Compliance: Facilitates market access in European Union countries.

- U.S. cGMP Compliance: Essential for exporting to the United States market.

- ICH Quality Guidelines: Ensures consistency and reliability across product development and manufacturing.

- Global Market Acceptance: Demonstrates the company's capability to produce high-quality medicines for diverse international markets.

Jiangsu Hengrui Medicine's global distribution network is robust, with products available in over 40 countries by the end of 2024. This reach is supported by 14 international R&D centers and over 20 clinical trials conducted outside China, underscoring a commitment to global accessibility.

The company's strategic out-licensing agreements, such as the one with GSK, are crucial for market penetration and financial growth. These partnerships not only expand the patient base for Hengrui's therapies but also provide vital capital through upfront payments and milestone achievements.

Quality assurance is paramount, with manufacturing facilities adhering to international standards like EU GMP and U.S. cGMP. Successful inspections in 2023 by global regulatory bodies validate Hengrui's ability to meet stringent quality protocols, ensuring broad market acceptance.

| Market Reach | R&D Footprint | Quality Compliance |

|---|---|---|

| 40+ countries (end of 2024) | 14 R&D centers globally | EU GMP |

| 20+ international clinical trials | Subsidiaries in US, Europe, Australia, Japan | U.S. cGMP |

| Out-licensing agreements (e.g., GSK) | Focus on emerging markets | ICH Quality Guidelines |

Preview the Actual Deliverable

Jiangsu Hengrui Medicine 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Jiangsu Hengrui Medicine 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain a complete understanding of their strategies without any hidden content.

Promotion

Hengrui Medicine prioritizes scientific communication, actively disseminating research and clinical trial data for its innovative products. This strategy is crucial for building trust and awareness within the global medical community.

The company's commitment is evident in its consistent presence at major international medical conferences, where it presents cutting-edge findings. For instance, in 2024, Hengrui presented numerous abstracts and data sets at key oncology and medical congresses, showcasing advancements in areas like lung cancer and gastric cancer treatments.

Furthermore, Hengrui ensures its research is published in high-impact, peer-reviewed scientific journals. This rigorous approach to data dissemination, including detailed clinical trial outcomes and real-world evidence, solidifies its reputation as a leader in pharmaceutical innovation.

Jiangsu Hengrui Medicine actively leverages strategic global partnerships as a core promotional strategy. Collaborations with major multinational pharmaceutical companies, such as GSK and Merck, are crucial for expanding its market presence. These alliances grant Hengrui access to extensive global distribution networks and advanced research and development capabilities, significantly boosting the visibility and impact of its novel treatments.

Jiangsu Hengrui Medicine prioritizes robust investor relations and financial transparency. The company actively engages in regular financial reporting, including quarterly and annual updates, to showcase its strong performance and outline future growth strategies. This commitment to openness is designed to attract a broad range of investors, from individual shareholders to institutional funds, by fostering trust and clearly communicating the company's value proposition.

Emphasis on Innovation and Corporate Branding

Jiangsu Hengrui Medicine actively cultivates its corporate brand by emphasizing its commitment to innovation. This strategy involves showcasing significant investments in research and development, aiming to position the company as a frontrunner in creating new therapeutic solutions. Their robust pipeline of novel drugs is a key element in this branding effort.

The company's branding narrative consistently highlights its role as a pioneer in tackling critical global health issues. This is supported by their substantial R&D expenditure, which reached approximately RMB 6.8 billion in 2023, demonstrating a tangible commitment to innovation. This focus on cutting-edge drug development aims to solidify Hengrui Medicine's reputation as a forward-thinking pharmaceutical leader.

- Innovation Focus: Hengrui Medicine consistently promotes its brand as a leader in pharmaceutical innovation.

- R&D Investment: The company highlights substantial investments in research and development, with 2023 R&D expenditure around RMB 6.8 billion.

- Pipeline Strength: A robust pipeline of novel drugs is showcased to reinforce their pioneering image.

- Global Health Impact: Hengrui Medicine positions itself as a key player in addressing global health challenges through its innovative efforts.

Proactive Public Relations and Media Outreach

Jiangsu Hengrui Medicine actively engages in proactive public relations and media outreach to shape its narrative. This includes disseminating press releases detailing key developments like the approval of new cancer therapies or significant advancements in their R&D pipeline.

Targeted media engagement is crucial for Hengrui, ensuring that important announcements, such as positive Phase 3 clinical trial data for innovative treatments, reach relevant industry publications and financial news outlets. This strategic communication aims to build brand recognition and foster a positive perception among investors, healthcare professionals, and the general public.

For instance, in 2024, Hengrui's successful international collaborations and the subsequent media coverage contributed to a stronger global presence. Their commitment to transparency in sharing clinical trial outcomes, like those for their novel oncology drugs, bolsters confidence and highlights their dedication to medical progress.

- New Drug Approvals: Hengrui frequently uses PR to announce regulatory approvals, such as the 2024 approval of its novel PD-1 inhibitor in a new indication.

- Clinical Trial Results: Positive data from trials, like those reported in mid-2024 for their lung cancer treatment, are communicated through press releases to key medical journals and news services.

- International Partnerships: Announcements of strategic alliances, such as the 2024 collaboration with a global pharmaceutical firm, are amplified through media outreach to underscore global expansion.

- Corporate Milestones: Major achievements, including listing on international stock exchanges or significant R&D investments, are proactively shared to enhance corporate reputation.

Hengrui Medicine's promotional efforts center on scientific credibility and strategic partnerships. The company actively disseminates clinical trial data and research findings, presenting at major international medical conferences in 2024 and publishing in high-impact journals. These efforts build trust and awareness within the medical community, showcasing advancements in areas like oncology.

Global collaborations, such as those with GSK and Merck, are key to expanding market reach and leveraging distribution networks. Hengrui also prioritizes investor relations through transparent financial reporting and actively cultivates its corporate brand by highlighting significant R&D investments, with approximately RMB 6.8 billion spent in 2023, and a strong pipeline of novel drugs.

Proactive public relations and media outreach are used to announce key developments, including new drug approvals and positive clinical trial results. For instance, the 2024 approval of a novel PD-1 inhibitor and mid-2024 positive data for a lung cancer treatment were widely publicized, reinforcing their commitment to medical progress and global expansion.

| Promotional Activity | Key Focus Areas | 2023/2024 Highlights |

|---|---|---|

| Scientific Communication | Research & Clinical Trial Data Dissemination | Presentations at major oncology conferences (2024); Publication in peer-reviewed journals. |

| Strategic Partnerships | Market Expansion & R&D Collaboration | Alliances with global pharmaceutical firms (e.g., GSK, Merck); Expanded distribution networks. |

| Corporate Branding | Innovation & R&D Investment | RMB 6.8 billion R&D expenditure (2023); Showcase of robust drug pipeline. |

| Public Relations | New Approvals & Trial Results | Announcements of new drug indications (e.g., PD-1 inhibitor in 2024); Positive Phase 3 data for lung cancer treatments (mid-2024). |

Price

Jiangsu Hengrui Medicine benefits from extensive national medical insurance coverage in China. As of recent data, 13 of its innovative drugs are included in the national reimbursement list. This is a significant factor in making their treatments more accessible to a wider patient population across the country, reducing out-of-pocket expenses for essential medications.

Hengrui Medicine is committed to an equitable global pricing strategy as it grows internationally. This involves a deep understanding of varying economic conditions and healthcare needs in different countries.

The company aims to make its innovative medicines accessible by considering local purchasing power and healthcare system capacities. For instance, in 2023, Hengrui's international sales represented a growing portion of its revenue, underscoring the importance of this accessible pricing approach in markets like Southeast Asia and Latin America.

Government procurement policies, particularly centralized drug bidding, exert substantial influence on Jiangsu Hengrui Medicine's pricing strategies in China. These policies are designed to reduce drug expenses, a factor that directly impacts the profitability of pharmaceutical companies. For instance, the volume-based bidding process often leads to significant price reductions for successful bidders.

In 2023, China's National Healthcare Security Administration (NHSA) continued its efforts to control pharmaceutical costs through centralized procurement. Hengrui, like its peers, navigates these competitive bidding rounds where winning bids can secure substantial market share but at considerably lower prices than previously achieved. This dynamic necessitates a keen focus on cost management and product innovation to maintain margins.

The impact of these policies is evident in the revenue streams of companies like Hengrui, as winning bids for key products can lead to increased sales volume but at a reduced per-unit price. This pricing pressure underscores the importance of a robust product pipeline and efficient manufacturing processes to offset the impact of government-driven cost reductions.

Structured Licensing and Royalty Agreements

Jiangsu Hengrui Medicine's pricing strategy is significantly shaped by its international licensing and royalty agreements. These complex financial structures, often involving upfront fees, milestone payments tied to development progress, and tiered royalties based on sales performance, directly influence how Hengrui's innovative drugs are priced and generate revenue across diverse global markets.

For instance, agreements with major pharmaceutical players like GSK and Merck are crucial. These partnerships allow Hengrui to leverage established distribution networks and market access, but they also necessitate careful negotiation of royalty rates. These rates can range from low single digits to over 20% of net sales, depending on the drug's stage of development and market exclusivity.

- Upfront Payments: These provide immediate capital infusion upon agreement signing.

- Milestone Payments: Triggered by achieving specific development or regulatory goals, these payments reward Hengrui for successful drug advancement.

- Tiered Royalties: A percentage of net sales that increases as sales volume grows, incentivizing both parties to maximize market penetration.

- Global Pricing Alignment: Royalty structures often influence Hengrui's pricing decisions to ensure profitability across different regulatory and economic environments.

Value-Based Pricing for Innovative Therapies

Jiangsu Hengrui Medicine’s pricing strategy for its innovative therapies is deeply rooted in value-based principles. This means the price reflects the significant clinical advantages and improved patient health outcomes that their novel treatments offer, rather than just production costs.

This approach is particularly relevant for drugs addressing critical unmet medical needs, where the therapeutic benefit to patients and the healthcare system is substantial. For instance, Hengrui's oncology pipeline, a key area of innovation, often targets diseases with limited treatment options, justifying premium pricing based on efficacy and quality of life improvements.

By focusing on the overall value proposition, Hengrui aims to secure market access and reimbursement, ensuring their groundbreaking medicines reach the patients who need them most. This strategy is supported by data demonstrating superior efficacy or safety profiles compared to existing treatments.

- Value-Based Pricing: Prices are set based on clinical benefits and patient outcomes, not just manufacturing costs.

- Addressing Unmet Needs: Hengrui’s innovative drugs, especially in oncology, target conditions with few alternatives, supporting higher price points.

- Market Access & Reimbursement: The strategy facilitates securing market approval and favorable reimbursement from healthcare providers.

- Data-Driven Justification: Pricing is backed by evidence of superior efficacy, safety, and quality-of-life improvements.

Jiangsu Hengrui Medicine’s pricing reflects a dual approach: leveraging national medical insurance coverage in China for accessibility, with 13 innovative drugs on the reimbursement list as of recent data, while pursuing an equitable global strategy that considers local economic conditions. This balance is crucial for market penetration and patient access, especially as international sales grew significantly in 2023.

Government procurement, particularly China's centralized drug bidding, significantly pressures prices downwards, as seen in 2023 NHSA cost control efforts. Hengrui must manage these volume-based bids, which secure market share but reduce per-unit revenue, necessitating efficient operations and a strong product pipeline.

International licensing agreements, such as those with GSK and Merck, also shape pricing through royalty structures that can range from low single digits to over 20% of net sales, influencing global price alignment to ensure profitability across diverse markets.

The company employs value-based pricing for its innovative therapies, particularly in oncology, where superior clinical outcomes and addressing unmet medical needs justify premium pricing. This strategy is supported by data demonstrating enhanced efficacy and quality-of-life improvements.

4P's Marketing Mix Analysis Data Sources

Our Jiangsu Hengrui Medicine 4P's Marketing Mix Analysis is constructed using a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry-specific market research and competitive analysis reports to ensure accuracy.