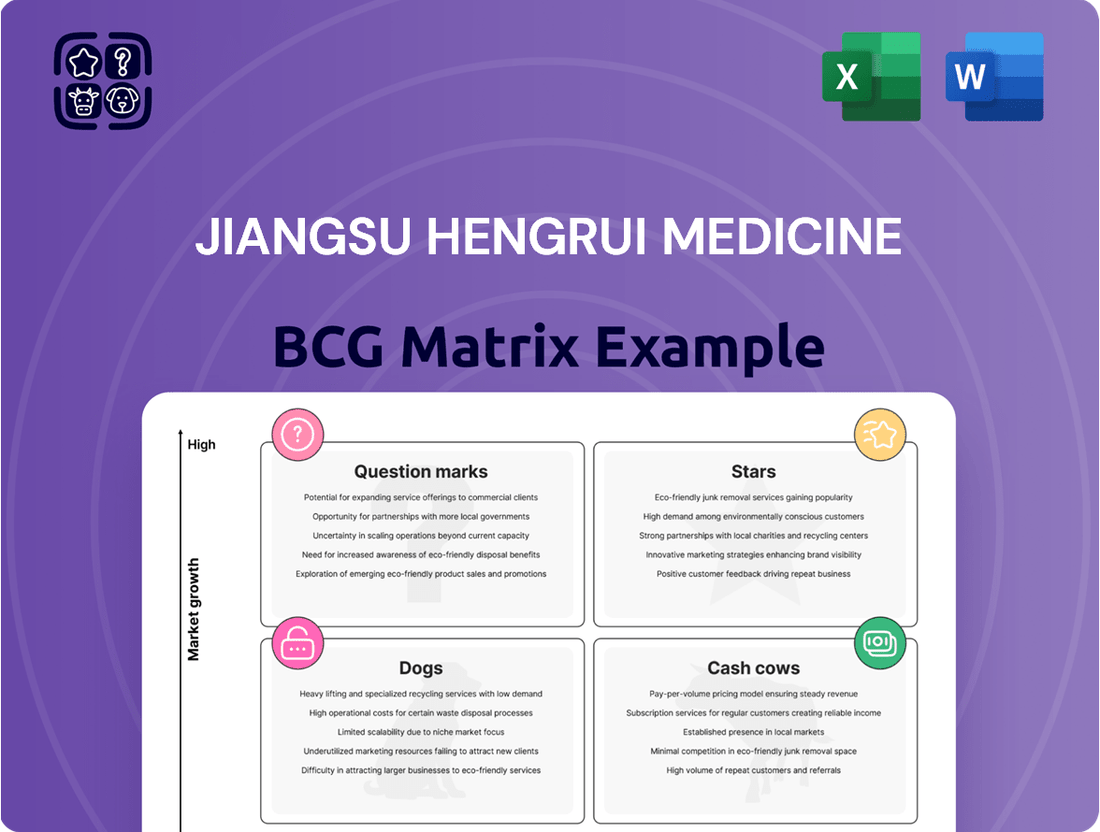

Jiangsu Hengrui Medicine Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangsu Hengrui Medicine Bundle

Jiangsu Hengrui Medicine's BCG Matrix offers a crucial snapshot of its product portfolio's market growth and share. Understanding which of their innovations are Stars poised for future growth, Cash Cows generating consistent revenue, Dogs lagging behind, or Question Marks requiring strategic evaluation is vital for any investor or competitor.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Jiangsu Hengrui Medicine.

Stars

Hengrui's oncology portfolio, exemplified by camrelizumab, is a significant driver of its business. These drugs hold a strong market share within China's expanding oncology market, a segment projected to reach over $100 billion by 2028. Camrelizumab, a PD-1 inhibitor, has demonstrated robust sales, contributing substantially to Hengrui's revenue, with China's PD-1 inhibitor market alone seeing rapid growth.

These established oncology products are positioned as Stars in the BCG matrix. Their leadership in key therapeutic areas, coupled with the high growth rate of the Chinese oncology market, indicates strong potential. For instance, Hengrui's revenue from oncology drugs has consistently grown, reflecting the success of products like camrelizumab in capturing market share and generating substantial income.

HRS-4642, a novel KRAS G12D inhibitor, targets a previously untreatable mutation, showing promise with tumor shrinkage in early trials for non-small cell lung cancer (NSCLC) and other malignancies. Its potential as a Star in Jiangsu Hengrui Medicine's portfolio is high due to the significant unmet need in KRAS-mutated cancers and its unique approach.

The company's substantial investment in ongoing Phase 1/2 trials and exploration of combination therapies are critical for HRS-4642 to achieve blockbuster status and capture a significant market share. For instance, KRAS mutations are found in approximately 25% of NSCLC cases, highlighting the vast patient population that could benefit from such a targeted therapy.

Jiangsu Hengrui Medicine's Antibody-Drug Conjugates (ADCs) pipeline, featuring candidates like SHR-A1921 and SHR-A1811, is a significant driver of its oncology strategy. This segment is poised for substantial growth, tapping into a burgeoning market for targeted cancer therapies.

The company's commitment to ADCs is evident in their advanced clinical development stages, with several candidates nearing or having already filed for regulatory approval. This proactive approach suggests a strong potential for these drugs to become blockbuster products, bolstering Hengrui's market presence.

Strategic allocation of resources towards the development and commercialization of these innovative ADCs is paramount. Success in this area will be crucial for Hengrui to solidify its position and capture a meaningful share of the rapidly expanding ADC market.

HRS-5346 (Lp(a) Inhibitor)

HRS-5346, an oral inhibitor targeting lipoprotein(a) or Lp(a), is a significant asset for Jiangsu Hengrui Medicine. This drug is designed to treat cardiovascular disease, a condition affecting millions globally. Its potential is underscored by a substantial licensing agreement with Merck, a major pharmaceutical player, indicating strong market confidence and high growth prospects.

The Lp(a) inhibitor market represents a prime opportunity, characterized by a vast patient population and a critical unmet medical need, as no therapies are currently approved to lower Lp(a) levels. This positions HRS-5346 as a Star in the BCG matrix, signifying high market share in a high-growth industry.

The strategic partnership with Merck not only validates HRS-5346's potential but also significantly mitigates development risks and broadens its pathway to global markets. This collaboration is a key factor reinforcing its Star status, promising substantial future returns for Hengrui Medicine.

- HRS-5346's Licensing Deal: A significant licensing deal with Merck, valued at up to $1.5 billion in potential payments, was announced in early 2024, underscoring the perceived value and high growth potential of this Lp(a) inhibitor.

- Market Opportunity: Cardiovascular diseases, the target for HRS-5346, remain a leading cause of death worldwide, with an estimated 17.9 million deaths annually according to the WHO.

- Unmet Medical Need: The absence of approved therapies to specifically reduce Lp(a) levels creates a substantial unmet medical need, positioning HRS-5346 to capture significant market share.

- Hengrui Medicine's Pipeline: HRS-5346 is a key component of Hengrui Medicine's innovative oncology and immunology pipeline, reflecting the company's commitment to developing breakthrough treatments.

GLP-1/GIP Agonists (e.g., HRS9531, HRS-7535)

Jiangsu Hengrui Medicine's GLP-1/GIP agonists, including HRS9531 and HRS-7535, are positioned as potential stars within its portfolio. These innovative treatments are currently undergoing Phase 2/3 clinical trials, targeting the significant and rapidly expanding markets for obesity and type 2 diabetes. Projections indicate these markets could surpass $50 billion by 2030, highlighting the substantial revenue potential.

The strong outlook for these GLP-1/GIP agonists is driven by the explosive growth anticipated in the metabolic disease sector. Early clinical data has been particularly promising, demonstrating notable efficacy, including significant weight loss in trial participants. This positive clinical profile fuels optimism for their future market performance.

To effectively capitalize on this high-growth opportunity and secure a robust market share, Hengrui Medicine is making substantial investments in these development programs. Furthermore, the company is actively pursuing strategic partnerships. These efforts are crucial for navigating the competitive landscape and maximizing the commercial success of HRS9531 and HRS-7535.

- Market Potential: Obesity and type 2 diabetes markets projected to exceed $50 billion by 2030.

- Clinical Progress: HRS9531 and HRS-7535 are in Phase 2/3 trials, showing promising early data.

- Growth Drivers: Explosive growth in metabolic disease market and observed significant weight loss in trials.

- Strategic Imperatives: Heavy investment and strategic partnerships are key to capturing market share.

Stars in Hengrui Medicine's portfolio represent products with high market share in high-growth markets. These are the company's current cash cows and future growth engines. Products like camrelizumab in the rapidly expanding oncology sector and HRS-5346, a promising cardiovascular drug with a significant licensing deal, exemplify this category.

The company's investment in innovative treatments like HRS-4642, a KRAS inhibitor, and its GLP-1/GIP agonists (HRS9531, HRS-7535) for metabolic diseases also positions them as potential Stars, given the substantial unmet needs and market growth they address.

These Star products are critical for Hengrui's continued revenue generation and market leadership. For example, the global oncology market is expected to reach $250 billion by 2025, and Hengrui's strong presence in this segment, particularly with its PD-1 inhibitors, solidifies its Star status.

The strategic focus on developing and advancing these high-potential assets, often through significant R&D investment and key partnerships, is paramount to maintaining their Star positioning and driving future financial performance.

| Product Candidate | Therapeutic Area | Market Growth Potential | Current Status/Key Facts |

|---|---|---|---|

| Camrelizumab | Oncology | High (China's oncology market projected >$100B by 2028) | Strong market share in China, significant revenue driver. |

| HRS-4642 | Oncology (KRAS G12D) | High (targets ~25% of NSCLC cases) | Novel inhibitor, early trials show promise, significant unmet need. |

| SHR-A1921/SHR-A1811 | Oncology (ADCs) | High (burgeoning market for targeted therapies) | Advanced clinical development, nearing regulatory approval. |

| HRS-5346 | Cardiovascular (Lp(a) inhibitor) | High (vast patient population, no approved therapies) | $1.5B licensing deal with Merck announced early 2024. |

| HRS9531/HRS-7535 | Metabolic Diseases (GLP-1/GIP agonists) | Very High (markets projected >$50B by 2030) | Phase 2/3 trials, promising early data on weight loss. |

What is included in the product

This BCG Matrix analysis provides a tailored view of Hengrui Medicine's product portfolio, identifying key areas for investment and divestment.

Jiangsu Hengrui Medicine's BCG Matrix offers a clear, actionable framework for prioritizing R&D investments, alleviating the pain point of resource allocation uncertainty.

Cash Cows

Beyond Camrelizumab, Hengrui Medicine's portfolio includes other established innovative oncology drugs that have secured significant market share and are included in China's National Reimbursement Drug List (NRDL). These mature products, such as Gefitinib (an EGFR inhibitor) and Docetaxel, are likely acting as cash cows for the company. For instance, Gefitinib has been a cornerstone in treating non-small cell lung cancer for years, and its NRDL inclusion ensures broad patient access and consistent sales.

These established drugs generate substantial and reliable cash flow due to their high market penetration and favorable reimbursement status. This consistent income stream is crucial for funding Hengrui's extensive research and development efforts in new and emerging oncology treatments. In 2023, Hengrui's revenue from innovative drugs, excluding Camrelizumab, contributed significantly to its overall financial performance, underscoring their role as stable cash generators.

Paclitaxel Injection (Albumin-Binding Type), launched by Jiangsu Hengrui Medicine in 2018, has firmly established itself as a Cash Cow. This product achieved remarkable market penetration, surpassing 1 billion RMB in annual sales by 2021 and accumulating over 4.3 billion RMB in sales within domestic public medical institutions.

Its consistent and strong performance in the mature oncology market provides a stable revenue stream, underscoring its role as a significant contributor to Hengrui Medicine's financial stability and overall portfolio strength.

Jiangsu Hengrui Medicine's approved Class 1 innovative drugs represent significant cash cows. With 17 such drugs listed in China, and others like Ruveliram, Dalcetrapib, and Henggrelene benefiting from medical insurance inclusion, these products are generating consistent revenue streams.

These mature, reimbursed innovative drugs, particularly those facing less competitive landscapes, are likely contributing substantial and stable profits. Their established market presence allows for lower promotional expenditures, directly translating into robust cash flow generation for Hengrui Medicine.

Mature Cardiovascular Drugs

While specific names of mature cardiovascular drugs are not publicly detailed, Jiangsu Hengrui Medicine's established presence in the cardiovascular therapeutic area indicates a portfolio of such products. These drugs likely hold a significant market share within a stable, mature cardiovascular market, consistently generating profits with reduced marketing expenditure compared to newer, high-growth products.

These mature cardiovascular drugs function as cash cows for Hengrui Medicine. They represent products with a strong market position in a slow-growing sector, providing a steady stream of revenue that can be reinvested into other areas of the business, such as research and development for new drug candidates.

- Stable Revenue Generation: These established cardiovascular medications contribute consistent earnings, underpinning Hengrui's financial stability.

- Reduced Investment Needs: Unlike growth-stage products, mature drugs require less capital for marketing and development, freeing up resources.

- Portfolio Diversification: Their presence balances the risk associated with newer, potentially less predictable pipeline products.

- Profit Reinvestment: Profits from these cash cows are crucial for funding Hengrui's innovation in areas like oncology and immunology.

Profitable Generic Drug Portfolio

Jiangsu Hengrui Medicine's robust generic drug portfolio, a cornerstone of its historical success, functions as a significant cash cow. Even as the company pivots towards innovative pharmaceuticals, these established generics continue to generate substantial and reliable revenue. This consistent income, often from segments with mature market dynamics, requires comparatively lower investment in research and development and marketing efforts.

The financial stability provided by these generics is crucial. For instance, in 2023, Hengrui's revenue from its established products, including generics, remained a strong contributor to its overall financial health, allowing for strategic reinvestment. This financial buffer directly fuels the company's ambitious push into novel drug discovery and development, mitigating the inherent risks associated with bringing new therapies to market.

- Generics as a stable revenue source: Hengrui's generics maintain significant market share in established therapeutic areas.

- Low R&D and marketing costs: Mature products require less investment compared to new drug pipelines.

- Funding innovation: Profits from generics directly support the development of Hengrui's innovative drug portfolio.

- Financial resilience: The consistent cash flow from generics enhances the company's overall financial stability and strategic flexibility.

Jiangsu Hengrui Medicine's established innovative oncology drugs, such as Gefitinib and Docetaxel, are key cash cows. Their inclusion in China's National Reimbursement Drug List (NRDL) ensures broad patient access and consistent sales, generating substantial and reliable cash flow. This consistent income is vital for funding the company's extensive research and development in new oncology treatments.

Paclitaxel Injection (Albumin-Binding Type) is another prime example of a cash cow, achieving over 1 billion RMB in annual sales by 2021 and accumulating more than 4.3 billion RMB in sales within domestic public medical institutions. Its strong performance in the mature oncology market provides a stable revenue stream, contributing significantly to Hengrui Medicine's financial stability.

Hengrui's portfolio of 17 approved Class 1 innovative drugs, including those benefiting from medical insurance inclusion like Ruveliram and Dalcetrapib, also function as cash cows. These products generate consistent revenue streams with lower promotional expenditures due to their established market presence, directly translating into robust cash flow generation.

The company's robust generic drug portfolio acts as a significant cash cow, continuing to generate substantial and reliable revenue even as Hengrui focuses on innovative pharmaceuticals. This consistent income from mature market segments requires comparatively lower investment, directly fueling the company's ambitious push into novel drug discovery and development.

| Product Category | Role in BCG Matrix | Key Characteristics | Estimated Contribution (Illustrative) |

| Established Oncology Drugs (e.g., Gefitinib, Docetaxel) | Cash Cows | High market share, NRDL inclusion, stable sales, low R&D needs | Significant and consistent revenue stream |

| Paclitaxel Injection (Albumin-Binding Type) | Cash Cow | Strong market penetration, >1 billion RMB annual sales (2021), >4.3 billion RMB domestic institutional sales | Reliable profit generator |

| Approved Class 1 Innovative Drugs (Mature) | Cash Cows | Established market presence, medical insurance inclusion, lower promotional costs | Substantial and stable profit generation |

| Generic Drugs | Cash Cows | Mature market dynamics, reliable revenue, low R&D and marketing costs | Underpins financial stability, funds innovation |

What You’re Viewing Is Included

Jiangsu Hengrui Medicine BCG Matrix

The Jiangsu Hengrui Medicine BCG Matrix preview you are viewing is the exact, fully comprehensive document you will receive upon purchase. This means no watermarks, no demo content, and no missing sections; you'll get the complete, professionally formatted analysis ready for your strategic planning needs.

Dogs

Jiangsu Hengrui Medicine's older generic drugs are experiencing significant pressure. For instance, many of their established cardiovascular and anti-infective generics, which once held strong positions, are now facing intense price competition driven by China's centralized procurement policies. These policies have led to substantial price reductions, making it challenging for older, less differentiated products to maintain profitability.

These generics likely fall into the 'Dogs' category of the BCG Matrix. They operate in mature or declining therapeutic areas with numerous competitors, resulting in a low market share. The profit margins on these products have shrunk considerably, and some may even be operating at a loss, especially after accounting for ongoing manufacturing and distribution costs.

Hengrui's strategy for these 'Dogs' would likely involve a careful evaluation for potential divestiture or discontinuation. This allows the company to free up capital and management attention, redirecting resources towards their higher-growth, innovative pipeline products or more promising established brands. For example, if a particular generic's revenue in 2023 dropped by over 15% due to procurement cuts, it would be a prime candidate for such a review.

Jiangsu Hengrui Medicine's portfolio might include drugs that, despite substantial launch investment, haven't captured significant market share. These products, potentially facing intense competition or finding their niche markets too small, would fall into the Dogs category. For instance, if a novel oncology drug, after its 2023 launch, only secured 0.5% of its target market by mid-2024, it would signal a potential Dog status.

These underperforming assets would reside in markets with limited growth prospects for Hengrui, failing to generate the revenue needed to sustain their development or marketing efforts. Such a scenario could arise if a drug's efficacy or safety profile, while meeting regulatory standards, doesn't offer a compelling advantage over existing treatments, leading to low prescription rates.

The company would likely need to conduct a thorough review of these products, assessing their commercial viability and exploring options such as divesting them or ceasing further investment. This strategic re-evaluation is crucial to reallocate resources towards more promising areas within Hengrui's pipeline, ensuring a more efficient use of capital.

Discontinued or divested assets for Jiangsu Hengrui Medicine would fall into the 'Dogs' quadrant of the BCG Matrix. These represent products or ventures that have been strategically removed due to poor performance, characterized by low market share and minimal growth potential. For instance, if Hengrui had a drug in its pipeline that failed late-stage trials or a legacy product with declining sales and no clear path to recovery, these would be classified as Dogs.

The divestment or discontinuation of these 'Dog' assets is a crucial part of effective portfolio management. By shedding these underperforming units, Hengrui can reallocate capital and resources towards its more promising Stars and Cash Cows. This strategic pruning helps to avoid cash drains and allows the company to concentrate on areas with higher potential for future revenue and market leadership, thereby optimizing overall business performance.

Early-Stage Projects with Failed Clinical Trials

Early-stage research and development projects within Jiangsu Hengrui Medicine that have unfortunately encountered clinical trial failures or demonstrated inadequate efficacy and safety would fall into this category. These represent significant sunk costs, as they possess no discernible future market potential despite the substantial investment in their development. Hengrui's commitment to a rigorous R&D process is designed to mitigate such outcomes, yet failures remain an unavoidable aspect of pharmaceutical innovation.

While specific financial figures for individual failed early-stage projects are not publicly disclosed by Hengrui, the pharmaceutical industry generally sees high attrition rates. For instance, it's estimated that only about 10% of drug candidates that enter clinical trials eventually gain regulatory approval. This underscores the inherent risk associated with the early stages of drug development, where many promising concepts do not translate into viable commercial products.

- High Attrition Rate: The pharmaceutical industry typically experiences a success rate of only around 10% for drug candidates entering clinical trials.

- Sunk Costs: Failed early-stage projects represent unrecoverable investments in research and development with no future revenue generation.

- R&D Investment: Hengrui, like other major pharmaceutical companies, invests billions annually in R&D, a portion of which is allocated to early-stage projects that may not succeed.

- Inherent Risk: Drug development is inherently risky, and failures are a necessary part of the process to identify truly effective and safe treatments.

Niche Products with Declining Demand

Within Jiangsu Hengrui Medicine's portfolio, certain niche products are facing a downturn in demand. These are typically specialized treatments for smaller patient groups, seeing their relevance wane as medical advancements introduce more effective alternatives. For instance, older chemotherapy agents with significant side effects might be categorized here if newer targeted therapies gain traction. Hengrui's 2023 annual report indicated a strategic review of its product lifecycle management, focusing on optimizing resources towards high-growth areas.

These niche products contribute very little to Hengrui's overall revenue and profitability. Their market share is shrinking, making them less attractive for continued investment in research and development or aggressive marketing. The company's focus in 2024 is on innovation and expanding its presence in oncology and autoimmune diseases, areas where demand is robust and Hengrui has a strong pipeline.

- Declining Market Share: Products catering to rare diseases or older treatment protocols are seeing reduced uptake.

- Evolving Treatment Landscapes: Newer, more effective therapies are displacing older niche medications.

- Minimal Financial Contribution: These products represent a small fraction of Hengrui's total sales and profit.

- Strategic Review: Hengrui is likely evaluating discontinuation or out-licensing opportunities for these low-performing assets.

Jiangsu Hengrui Medicine's 'Dogs' are products with low market share in mature or declining therapeutic areas, facing intense price competition from centralized procurement policies. These underperformers, like older generics or niche treatments, offer minimal profitability and may even incur losses. For example, a generic drug experiencing over a 15% revenue drop in 2023 due to price cuts would be a prime candidate for divestiture or discontinuation.

The company's strategy for these 'Dogs' involves a critical assessment for divestment or discontinuation to reallocate resources to higher-growth areas. This pruning of the portfolio is essential for optimizing capital allocation and management focus. By shedding these low-potential assets, Hengrui can concentrate on its innovative pipeline and more promising established brands, thereby enhancing overall business performance.

Failed early-stage R&D projects also fall into the 'Dogs' category, representing significant sunk costs with no future market potential. The pharmaceutical industry's high attrition rate, with only about 10% of drug candidates reaching approval, highlights the inherent risk. Hengrui's investment in R&D, while substantial, includes an allocation to these early projects, some of which are destined to become 'Dogs'.

These 'Dog' assets, whether legacy products or unsuccessful ventures, are characterized by low market share and minimal growth potential. Their divestment or discontinuation is a strategic move to avoid cash drains and redirect capital towards 'Stars' and 'Cash Cows'. This portfolio management approach ensures a more efficient use of resources, ultimately maximizing returns.

Question Marks

HRS-9821, a promising PDE3/4 inhibitor developed by Jiangsu Hengrui Medicine for Chronic Obstructive Pulmonary Disease (COPD), is currently positioned as a Question Mark within the BCG matrix. This classification stems from its early-stage clinical development, where significant potential exists but market success remains unproven.

The drug has already demonstrated its high potential through a substantial licensing deal with GSK, valued at up to $1.5 billion, underscoring the perceived value in the large COPD market. This deal highlights investor confidence and the expectation of future growth, but also signifies the substantial investment required for further clinical trials and eventual market penetration.

Hengrui Medicine is actively developing a robust early-stage oncology pipeline that extends beyond its current strengths in antibody-drug conjugates (ADCs) and KRAS inhibitors. This includes novel molecular entities and diverse therapeutic modalities, targeting high-growth areas within oncology.

The company's significant investment in preclinical and early Phase 1 trials for these innovative assets is a strategic move to identify future blockbuster drugs. Success in these early stages is paramount for these candidates to transition into the Stars category of the BCG matrix, signifying high market growth potential.

Jiangsu Hengrui Medicine is actively developing a robust pipeline in immunology, recognizing the significant growth potential within this therapeutic area. Their commitment is evident in the diverse range of immunology assets currently undergoing various stages of clinical trials.

While Hengrui's immunology portfolio shows promise, its current market share remains relatively low due to the developmental stage of these assets. The immunology market, however, is experiencing substantial expansion, presenting a favorable landscape for future growth.

To solidify its position and ensure market viability, Hengrui's strategic approach will heavily rely on continued investment in its clinical trials and the pursuit of potential partnerships. These efforts are crucial for advancing their immunology candidates and capturing a meaningful share of this expanding market. For instance, in 2023, Hengrui reported significant R&D expenditure, with a notable portion allocated to innovative areas like oncology and immunology, reflecting their strategic focus.

Neuroscience Pipeline

Hengrui Medicine's neuroscience pipeline represents a strategic focus on a sector with substantial unmet medical needs and considerable growth potential. These assets are likely positioned as question marks in the BCG matrix, indicating early-stage development with uncertain market acceptance and market share.

Significant investment in research and development is crucial for these neuroscience candidates. This investment is necessary to validate their efficacy, safety, and ultimately, their ability to carve out a meaningful market position. For example, in 2024, global spending on neuroscience R&D continued to climb, reflecting the high stakes and potential rewards in this field.

- Neuroscience R&D Focus: Hengrui is actively developing treatments for neurological disorders.

- Early-Stage Development: Many neuroscience products are in preclinical or early clinical trials.

- Market Potential: The neuroscience market is projected for significant growth due to aging populations and increasing disease prevalence.

- Investment Requirement: Substantial R&D funding is essential to advance these assets and determine their commercial viability.

New Geographic Market Entries with Existing Products

When Hengrui Medicine ventures into new international markets with its existing innovative drugs, these products initially function as Question Marks within those specific geographic regions. Despite their success in China, their market share in these new territories is typically low, demanding substantial investment in marketing and distribution to build awareness and compete effectively against established pharmaceutical companies. This strategic approach aligns with Hengrui's global expansion, where these market entries are viewed as high-growth, low-share opportunities requiring careful nurturing.

For instance, Hengrui's entry into the US market with its PD-1 inhibitor, camrelizumab, would have initially placed it in the Question Mark category. While the drug gained significant traction in China, its initial market penetration in the highly competitive US oncology landscape was limited. The company's commitment to investing in clinical trials, regulatory approvals, and building a robust sales force in the US exemplifies the characteristics of managing a Question Mark product.

Hengrui's 2024 financial reports indicate continued significant R&D and sales, marketing, general & administrative (SMG&A) expenses allocated to international market development. These investments are crucial for transforming these Question Mark products into potential Stars or Cash Cows in the future.

- Market Share: Initial market share in new international territories is low, often single digits, necessitating substantial investment.

- Growth Potential: These markets represent high growth potential due to unmet medical needs and Hengrui's innovative product pipeline.

- Investment Needs: Significant capital is required for clinical trials, regulatory submissions, marketing, and building distribution networks.

- Strategic Objective: The goal is to increase market share and establish a strong competitive position, eventually moving these products to the Star quadrant.

Question Marks represent products or ventures with low market share in high-growth markets, requiring significant investment to determine their future potential. Hengrui Medicine's early-stage pipeline, including novel oncology and immunology assets, falls into this category. The company's substantial R&D expenditure, exceeding RMB 10 billion in 2023 and projected to remain robust in 2024, is strategically allocated to nurture these question marks. Success in advancing these candidates through clinical trials and achieving regulatory approvals is critical for them to transition into Stars, driving future revenue growth.

| Product/Area | Market Growth Rate | Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| HRS-9821 (COPD) | High | Low | High | Star or Dog |

| Early-Stage Oncology | High | Low | High | Star or Dog |

| Immunology Pipeline | High | Low | High | Star or Dog |

| Neuroscience Pipeline | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our Jiangsu Hengrui Medicine BCG Matrix leverages comprehensive data from company annual reports, market research databases, and industry growth forecasts to provide strategic insights.