Henkell & Co. Sektkellerei KG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkell & Co. Sektkellerei KG Bundle

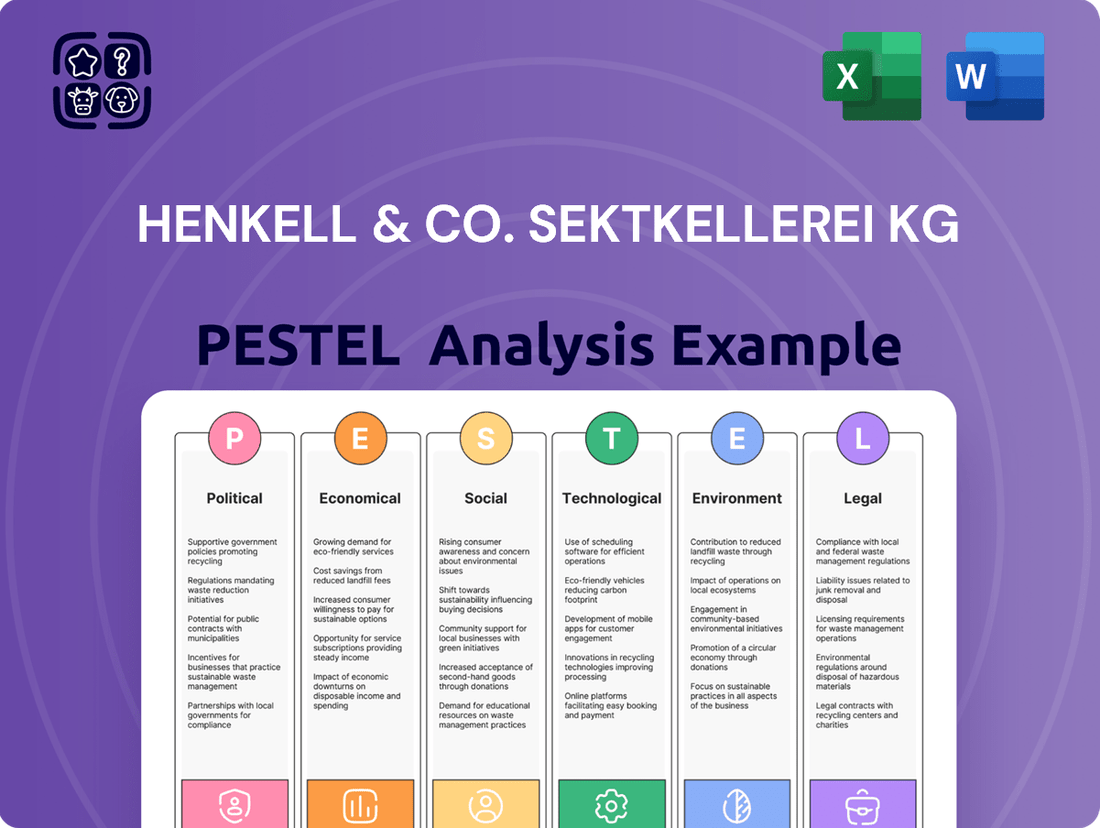

Understand how shifting political landscapes and evolving consumer preferences are impacting Henkell & Co. Sektkellerei KG's market position. Our PESTEL analysis reveals critical external forces, from economic volatility to technological advancements, that shape the sparkling wine industry. Gain a competitive edge by leveraging these insights for strategic planning. Download the full version now and unlock actionable intelligence.

Political factors

Government regulations, including excise duties and marketing restrictions, significantly influence the alcoholic beverage industry. For instance, in 2024, many European Union countries are reviewing or have implemented changes to alcohol taxation, with some nations considering increases to fund public health initiatives.

Henkell & Co. Sektkellerei KG, as a global player, must navigate diverse and often complex regulatory landscapes across different countries and regions. This means adapting to varying legal frameworks concerning production, distribution, and sales of alcoholic beverages.

Changes in these policies, such as increased alcohol taxes or stricter advertising rules, can directly impact sales volumes and profitability. For example, a hypothetical 5% increase in excise duty in a key market could reduce profit margins on affected products by a similar percentage, necessitating strategic pricing adjustments.

International trade agreements and tariffs significantly influence Henkell Freixenet's operational costs and market access. For example, the European Union's trade policies, including those with key markets like the United States, directly impact the price competitiveness of their sparkling wines. In 2024, ongoing trade discussions and potential adjustments to existing agreements could reshape import duties, affecting profitability in regions where Henkell Freixenet has a strong presence.

The imposition or removal of tariffs, such as those that might affect sparkling wine imports into the Americas, presents a direct challenge or opportunity. A hypothetical 10% US tariff on sparkling wine, for instance, could increase the landed cost for Henkell Freixenet, potentially reducing demand or forcing price adjustments. Monitoring these geopolitical shifts is crucial for navigating market dynamics and identifying new trade avenues.

Political stability in Henkell Freixenet's key markets, especially across Europe, the Americas, and Eastern Europe, directly impacts consistent operations and consumer trust. For instance, the ongoing geopolitical climate in Eastern Europe presents a notable variable impacting market conditions.

Geopolitical conflicts and the resulting uncertainties can significantly sway consumer behavior and overall market dynamics. Henkell Freixenet's CEO has specifically highlighted these factors as influential for the 2024 and 2025 fiscal years, underscoring their importance to the company's outlook.

EU Agricultural and Wine Policies

As a major player in the European beverage market, Henkell & Co. Sektkellerei KG is significantly influenced by the European Union's agricultural and wine policies. These policies encompass a range of measures, including subsidies, production quotas, and stringent quality standards that directly affect operational costs and market access. For instance, the Common Agricultural Policy (CAP) often includes support mechanisms for wine production, which can alter the competitive landscape.

Recent EU interventions have aimed to stabilize the wine sector, which has faced challenges. Measures like emergency distillation, designed to remove surplus wine from the market, and green harvesting, where grapes are removed from the vine before ripening to reduce yields, have been employed. These actions directly impact supply levels and can lead to price fluctuations for grapes and finished wine products. For the 2023/2024 season, the EU allocated funds to support these measures, aiming to bolster the sector's resilience.

Furthermore, the EU's increasing emphasis on sustainability is reshaping winemaking practices. Initiatives promoting environmentally friendly viticulture, reduced water usage, and lower carbon footprints are becoming central to policy frameworks. Henkell & Co. Sektkellerei KG must adapt its production methods and supply chain to align with these evolving sustainability goals, which may involve investments in new technologies and processes. The EU's Farm to Fork Strategy, for example, sets ambitious targets for sustainable food systems, including agriculture and wine production.

- EU Subsidies: The CAP provides direct payments and rural development funds that can support vineyard maintenance and modernization, influencing production costs for wineries.

- Market Interventions: In 2023, the EU Commission approved measures for emergency distillation in several member states to address market imbalances, impacting the availability of wine for various uses.

- Sustainability Directives: EU regulations are increasingly focusing on reducing pesticide use and promoting organic farming, with targets set to increase organic agricultural land, including vineyards, by 2030.

Lobbying and Industry Influence

The alcoholic beverage sector, including wine producers like Henkell & Co. Sektkellerei KG, actively engages in lobbying to shape legislation and public discourse. For instance, the German wine industry, through its representative bodies, actively advocates for favorable alcohol policies and works to influence public perception of wine consumption.

Henkell Freixenet, as a significant entity within this market, likely participates in these industry-wide advocacy efforts. Their involvement aims to secure a regulatory landscape that supports their business operations and market growth, potentially impacting areas like taxation, labeling requirements, and advertising regulations.

- Industry Associations: Major beverage companies often fund and participate in trade associations that represent their collective interests.

- Policy Advocacy: These associations lobby governments on issues such as excise duties, marketing restrictions, and health-related regulations.

- Public Perception Campaigns: Lobbying also extends to shaping public opinion through awareness campaigns and promoting responsible consumption messages.

Government policies, including excise taxes and advertising restrictions, directly impact Henkell & Co. Sektkellerei KG's profitability and market reach. For example, in 2024, several EU nations considered increasing alcohol taxes to fund public health, potentially affecting sales volumes.

Navigating diverse international regulations is crucial for global beverage companies. In 2024, ongoing trade discussions and potential adjustments to import duties, particularly between the EU and the US, could significantly alter the cost competitiveness of Henkell Freixenet's sparkling wines.

Political stability and geopolitical events are key considerations for Henkell Freixenet's operations. The company's CEO noted these factors as influential for the 2024-2025 fiscal years, highlighting their impact on market dynamics and consumer behavior.

The EU's agricultural policies, such as the Common Agricultural Policy (CAP), influence wine production costs and market access. Measures like emergency distillation, utilized in 2023 to manage surplus wine, directly affect supply and pricing, with the EU allocating funds to support sector resilience.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Henkell & Co. Sektkellerei KG, offering actionable insights for strategic decision-making.

It delves into the Political, Economic, Social, Technological, Environmental, and Legal landscapes, highlighting key trends and their implications for the company's operations and future growth.

This PESTLE analysis for Henkell & Co. Sektkellerei KG acts as a pain point reliever by providing a clear, actionable framework for navigating complex external factors, thereby reducing uncertainty in strategic decision-making.

Economic factors

Global economic growth and consumer spending are crucial for Henkell & Co. Sektkellerei KG. In 2024, Henkell Freixenet saw moderate revenue growth, but faced challenges from tense markets and declining demand in certain areas. This highlights how economic shifts directly impact the beverage sector.

Inflationary pressures, a significant economic factor in 2024 and projected into 2025, are making consumers more cautious. This can lead to a greater price sensitivity, potentially pushing consumers towards more affordable sparkling wine, wine, and spirit options, affecting Henkell's sales volumes.

Inflationary pressures and escalating raw material costs, especially for key inputs like grapes and packaging, are directly impacting Henkell & Co. Sektkellerei KG's production expenses and overall profit margins. For example, recent reports indicate that the cost of glass bottles, a crucial component for sparkling wine, has seen significant increases in 2024, with some projections suggesting a rise of up to 15% compared to the previous year.

The drought conditions impacting Cava production in Spain, a significant market for Henkell, have exacerbated these issues, leading to higher raw material costs and a notable imbalance between supply and demand. This situation has compelled the company to make strategic adjustments, such as temporarily pausing Freixenet Cava sales in specific markets to manage inventory and mitigate the impact of these cost surges.

Henkell & Co. Sektkellerei KG, operating globally, faces significant exposure to exchange rate fluctuations. These currency movements directly affect the translation of its international sales and profits back into its reporting currency, the Euro. For instance, a stronger Euro could reduce the Euro-denominated value of earnings generated in weaker currencies.

While specific 2024 impacts aren't highlighted, the general economic climate suggests continued volatility. For example, the Euro experienced fluctuations against the US Dollar throughout 2023 and into early 2024, trading within a range that would necessitate careful financial management for companies like Henkell Freixenet. This ongoing economic reality means currency risk management is a constant consideration for their international operations.

Market Competition and Pricing Strategies

The sparkling wine, wine, and spirits sectors are intensely competitive, with Henkell Freixenet navigating a landscape populated by many local and international competitors. This dynamic environment necessitates a sharp focus on differentiation and value proposition.

To sustain its market standing, Henkell Freixenet prioritizes its strategic core brands, drives innovation, and pursues premiumization. These efforts are crucial in addressing declining demand in certain market segments and fending off competition from more accessible alternatives, such as Prosecco, which has gained significant traction.

- Market Share Dynamics: In 2023, the global sparkling wine market was valued at approximately $37.5 billion, with significant growth driven by premium segments. However, price sensitivity remains a key factor, particularly in the face of affordable imports.

- Brand Portfolio Strategy: Henkell Freixenet's success hinges on its ability to effectively position its diverse brand portfolio, from accessible sparkling wines to premium spirits, catering to varied consumer preferences and price points.

- Innovation and Premiumization Trends: The company's investment in new product development and marketing for higher-margin premium offerings is a critical strategy to counter volume declines and enhance profitability in a challenging competitive landscape.

Emerging Market Opportunities

While established markets present hurdles, Henkell Freixenet is strategically tapping into the burgeoning potential of emerging economies. Eastern Europe and select regions in the Americas stand out as key growth frontiers, demonstrating promising trajectories for the company's portfolio.

The company's recent performance underscores this trend. Poland, for instance, has exhibited robust growth, contributing positively to Henkell Freixenet's overall expansion. Simultaneously, market share gains in the United States and Brazil are helping to counterbalance downturns experienced elsewhere, highlighting the strategic importance of these developing markets.

- Poland's Sparkling Wine Market Growth: Poland's sparkling wine consumption saw a notable increase, with projections indicating continued upward momentum through 2025, driven by rising disposable incomes and a growing appreciation for premium beverages.

- US Sparkling Wine Market Expansion: The US market for sparkling wine is expected to grow at a compound annual growth rate (CAGR) of over 4% from 2023 to 2028, a significant opportunity for Henkell Freixenet to expand its market share.

- Brazilian Beverage Market Dynamics: Brazil's beverage sector, including wine and spirits, continues to show resilience and growth potential, with consumers increasingly seeking quality and variety, benefiting companies with diversified offerings like Henkell Freixenet.

Economic headwinds continue to shape Henkell & Co. Sektkellerei KG's operational landscape, with inflation remaining a key concern for 2024 and projected into 2025. This persistent inflation directly impacts consumer purchasing power, leading to increased price sensitivity and a potential shift towards more budget-friendly options within the sparkling wine, wine, and spirits categories.

The company is also contending with rising raw material costs, particularly for grapes and packaging. For instance, the price of glass bottles, essential for sparkling wine production, saw increases of up to 15% in 2024. Exacerbating this, drought conditions in key production regions like Spain have driven up grape costs and created supply-demand imbalances, forcing strategic decisions like temporary sales pauses in certain markets to manage inventory and costs.

Currency fluctuations present another significant economic factor for Henkell Freixenet, given its global operations. Movements in exchange rates directly affect the translation of international sales and profits into Euros. For example, the Euro's trading range against the US Dollar throughout 2023 and into early 2024 highlights the ongoing need for robust currency risk management strategies.

Emerging markets offer growth opportunities, with Poland showing robust growth in sparkling wine consumption. The US market is also expanding, projected to grow at a CAGR of over 4% from 2023 to 2028, presenting a significant avenue for Henkell Freixenet. Brazil's beverage sector also demonstrates resilience and growth potential, benefiting companies with diverse portfolios.

| Economic Factor | 2024 Impact/Projection | Relevance to Henkell |

|---|---|---|

| Inflation | Persistent, impacting consumer spending and driving price sensitivity. | Potential shift to lower-priced alternatives; pressure on margins. |

| Raw Material Costs | Increases in grape and packaging costs (e.g., glass bottles up to 15% in 2024). | Higher production expenses, impacting profit margins. |

| Drought Conditions (Spain) | Increased grape costs, supply-demand imbalance for Cava. | Necessitates strategic inventory and sales management. |

| Exchange Rate Fluctuations | Volatility in currency values impacts international earnings translation. | Requires ongoing currency risk management for global operations. |

| Emerging Market Growth | Poland showing robust growth; US market projected CAGR >4% (2023-2028). | Key growth frontiers for portfolio expansion and market share gains. |

Same Document Delivered

Henkell & Co. Sektkellerei KG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Henkell & Co. Sektkellerei KG covers all key political, economic, social, technological, legal, and environmental factors impacting the company. You can trust that the detailed insights and strategic considerations presented are precisely what you'll be working with.

Sociological factors

Consumers are increasingly favoring mindful drinking and health-conscious choices, leading to a surge in demand for low- and no-alcohol options. Henkell Freixenet has actively addressed this by broadening its non-alcoholic beverage range, a segment experiencing robust expansion.

This evolving preference is particularly pronounced among younger demographics, with Gen Z being a key driver of the trend towards reduced alcohol consumption and healthier alternatives.

The premiumization trend is a significant sociological factor influencing the beverage industry. Consumers are increasingly prioritizing quality over quantity, choosing fewer, more expensive items. This shift is evident in the wine and spirits market, where demand for premium and super-premium products continues to grow, even as overall consumption volumes may stagnate or decline. For instance, in 2024, the global premium spirits market was valued at over $100 billion and is projected to grow further, demonstrating consumer willingness to invest in superior experiences.

Henkell Freixenet is strategically positioned to capitalize on this by concentrating on its core brands and introducing higher-end offerings. This approach aligns with consumer desires for craftsmanship and exclusivity. The company's focus on quality in production and branding resonates with this premiumization movement, allowing them to command higher price points and maintain profitability despite potential volume challenges. This strategy is crucial for navigating evolving consumer preferences in the 2024-2025 period.

Consumer habits are indeed changing, with a notable shift in how and where alcoholic beverages are enjoyed. While the allure of premium drinks in social settings remains strong, there's a clear upward trend in the preference for enjoying these same quality products within the comfort of one's home. This evolving landscape directly impacts distribution strategies and marketing approaches for beverage companies like Henkell Freixenet.

For instance, data from 2023 indicated a continued strength in on-premise sales for sparkling wine, yet at-home consumption occasions saw significant growth, particularly in the premium segment. This dichotomy necessitates a flexible approach, with companies needing to cater to both vibrant social venues and the increasing demand for sophisticated at-home experiences, influencing everything from packaging to promotional activities.

Demographic Shifts and Ageing Populations

Demographic shifts, particularly the ageing of populations in key European markets, significantly shape alcohol consumption. For instance, Germany's population aged 65 and over is projected to reach approximately 22.5 million by 2025, up from around 17.1 million in 2015. This trend generally correlates with higher wine consumption among older demographics.

However, the beverage industry, including Henkell & Co. Sektkellerei KG, is actively targeting younger consumers of legal drinking age. These younger cohorts often prefer different product characteristics and consumption occasions. Data from 2024 indicates a growing demand for low-alcohol-by-volume (ABV) and non-alcoholic alternatives, with the global low/no-alcohol market expected to reach over $20 billion by 2027.

- Ageing Consumer Base: Increased proportion of older individuals in markets like Germany and France, influencing preferences towards traditional products like wine.

- Youthful Consumer Focus: Growing demand from younger legal drinking age consumers for innovative products, including low-ABV and non-alcoholic options.

- Shifting Consumption Habits: Younger consumers often prioritize experiences and health-conscious choices, impacting traditional alcohol sales.

- Market Adaptation: Companies are responding by diversifying portfolios to cater to both established and emerging consumer segments.

Cultural and Lifestyle Influences

Cultural shifts are significantly reshaping consumer preferences in the beverage sector. Growing emphasis on wellness and mental clarity is driving a noticeable trend towards moderation and mindful consumption, impacting traditional alcoholic beverage sales.

The increasing acceptance of sobriety and the rising popularity of functional beverages, which offer perceived health benefits, are key lifestyle trends. For instance, the global non-alcoholic beverage market was valued at approximately $1.1 trillion in 2023 and is projected to grow, reflecting this consumer pivot.

Henkell Freixenet is strategically responding to these evolving lifestyles. Their product development, including the introduction of non-alcoholic aperitifs and sparkling wines, directly addresses the demand for sophisticated, alcohol-free options. This proactive approach aligns with market data showing a substantial increase in demand for these alternatives.

- Wellness Trend Impact: Consumers are increasingly prioritizing health, leading to a greater interest in beverages that support mental clarity and overall well-being.

- Sobriety Acceptance: The social acceptance of sobriety and reduced alcohol consumption is growing, creating a larger market for non-alcoholic alternatives.

- Functional Beverages Growth: The demand for beverages with added functional benefits, such as adaptogens or vitamins, is on the rise.

- Henkell Freixenet's Response: The company's investment in non-alcoholic product lines, like their non-alcoholic Freixenet Italian Sparkling, demonstrates a direct alignment with these consumer lifestyle changes.

Sociological factors are significantly influencing the beverage market, with a notable shift towards health and wellness. Consumers, particularly younger demographics, are increasingly seeking low- and no-alcohol options, a trend Henkell Freixenet is actively addressing with its expanding non-alcoholic portfolio.

The premiumization trend continues to drive consumer choices, with a preference for higher-quality products, even if it means purchasing less volume. This is evident in the global premium spirits market, valued over $100 billion in 2024, a segment Henkell Freixenet is targeting with its focus on craftsmanship and exclusivity.

Demographic shifts, such as ageing populations in Europe, influence consumption patterns, often favoring traditional products like wine. However, companies like Henkell & Co. Sektkellerei KG are also strategically engaging younger consumers, who exhibit a strong demand for innovative, low-ABV, and non-alcoholic alternatives, a market projected to exceed $20 billion by 2027.

| Sociological Factor | Trend Description | Market Impact | Henkell Freixenet's Response | Relevant Data (2024/2025) |

| Health & Wellness | Increased demand for low/no-alcohol and mindful drinking | Growth in non-alcoholic beverage segment | Expansion of non-alcoholic product lines | Global low/no-alcohol market projected to exceed $20 billion by 2027 |

| Premiumization | Consumer preference for quality over quantity | Growth in premium and super-premium product sales | Focus on core brands and higher-end offerings | Global premium spirits market valued over $100 billion in 2024 |

| Demographics | Ageing populations in Europe; younger consumers' preferences | Varying consumption patterns across age groups | Targeting both older and younger legal drinking age consumers | Germany's population aged 65+ projected to reach ~22.5 million by 2025 |

Technological factors

Technological advancements are revolutionizing winemaking, with precision viticulture becoming a key driver. Tools like drones, satellite imagery, and IoT sensors enable hyper-localized vineyard management, leading to better grape quality and potentially higher yields. For instance, in 2024, many vineyards are adopting AI-powered analytics from sensor data to predict disease outbreaks and optimize irrigation, directly impacting the consistency and quality of the grapes used by companies like Henkell Freixenet.

These innovations allow for a more data-driven approach to every stage of production. By understanding vineyard conditions at a granular level, Henkell Freixenet can fine-tune harvesting times and winemaking processes, ensuring a more consistent product year after year. This technological edge is crucial for maintaining brand reputation and meeting consumer expectations for high-quality sparkling wines and other beverages.

Automation and AI are transforming the wine sector, with applications ranging from vineyard management to sophisticated cellar operations. These technologies offer significant gains in efficiency and precision, impacting how companies like Henkell & Co. Sektkellerei KG operate.

AI algorithms can now analyze vast datasets related to fermentation, predict potential quality issues, and even assist in the complex art of wine blending, leading to more consistent and potentially innovative product development. For instance, some wineries are using AI to optimize irrigation and pest control, reducing resource waste.

The global market for AI in agriculture, which includes viticulture, was projected to reach billions by 2024, highlighting the significant investment and adoption of these advanced technologies. This trend suggests a competitive advantage for firms that effectively integrate AI into their operational strategies.

The global e-commerce market for alcoholic beverages experienced substantial growth, projected to reach over $50 billion by 2025, with online wine sales a major contributor. This trend highlights the increasing consumer preference for digital purchasing channels. Wineries are actively developing sophisticated online storefronts and engaging in digital marketing campaigns to capture this expanding market share.

Henkell Freixenet is well-positioned to leverage these technological shifts. By investing in enhanced e-commerce capabilities and virtual tasting experiences, the company can directly connect with consumers, fostering brand loyalty and driving sales. Digital marketing strategies, including targeted social media advertising and content creation, will be crucial for reaching new demographics and expanding market reach in 2024 and beyond.

Supply Chain Digitization and Transparency

The digitalization of Henkell & Co. Sektkellerei KG's supply chain, incorporating technologies like blockchain, significantly boosts transparency and traceability for its alcoholic beverages. This is crucial for verifying authenticity and provenance, enabling consumers to track a product's journey from its origin to the final bottle.

This enhanced visibility helps combat counterfeiting and assures consumers of product integrity. For instance, a 2024 report indicated that 65% of consumers are more likely to purchase a product if they can verify its origin through digital means. This trend is expected to grow as digital supply chain solutions become more prevalent.

Key benefits of this technological advancement include:

- Improved Brand Trust: Consumers gain confidence in product authenticity.

- Enhanced Traceability: Detailed tracking from raw materials to finished goods.

- Operational Efficiency: Streamlined logistics and reduced errors.

- Regulatory Compliance: Easier adherence to food safety and origin regulations.

Product Innovation and Development

Technological advancements are crucial for Henkell & Co. Sektkellerei KG's product innovation, particularly in developing new categories like low and no-alcohol sparkling wines. This allows the company to adapt to evolving consumer preferences for healthier options.

Henkell Freixenet has demonstrated strong capabilities in this space, earning accolades for its non-alcoholic product lines. For instance, their non-alcoholic sparkling wine offerings have seen significant market traction, reflecting successful R&D and market responsiveness.

- Innovation in Low/No-Alcohol: Development of advanced production techniques for non-alcoholic sparkling wines.

- Award-Winning Products: Recognition for quality and taste in the non-alcoholic segment, boosting brand image.

- Portfolio Expansion: Strategic introduction of new products to cater to growing consumer demand for healthier alternatives.

Technological advancements are reshaping viticulture and winemaking for companies like Henkell & Co. Sektkellerei KG. Precision farming techniques, utilizing drones and AI-driven analytics for vineyard management, are becoming standard. These tools optimize grape quality and yield by providing hyper-localized data, crucial for consistent production in 2024 and beyond.

Automation and AI are streamlining operations from the vineyard to the cellar, enhancing efficiency and precision in winemaking processes. AI algorithms assist in predicting fermentation issues and even in wine blending, contributing to product consistency and innovation. The global market for AI in agriculture, including viticulture, was projected to reach billions by 2024, underscoring the significant adoption of these technologies.

Digitalization is also transforming sales and supply chains. The global e-commerce market for alcoholic beverages, with online wine sales as a major driver, was projected to exceed $50 billion by 2025. Henkell Freixenet’s investment in e-commerce and digital marketing is essential for reaching consumers and expanding market share. Furthermore, technologies like blockchain are enhancing supply chain transparency and traceability, with a 2024 report indicating 65% of consumers favor products with verifiable origins.

Legal factors

Alcohol taxation and excise duties represent a crucial legal consideration for Henkell & Co. Sektkellerei KG. The European Union establishes harmonized minimum excise duty rates across member states. While wine currently benefits from a zero minimum excise tax rate within the EU, there's an active dialogue surrounding potential revisions to directives concerning minimum rates for various alcoholic beverages, often driven by public health objectives.

Any adjustments to these excise duties can have a direct and significant impact on Henkell's product pricing strategies and, consequently, on consumer affordability. For instance, a hypothetical increase in excise duty could necessitate price hikes, potentially affecting sales volumes, especially in price-sensitive markets.

Marketing and advertising alcoholic beverages is a complex landscape for Henkell & Co. Sektkellerei KG, with rules differing significantly across nations and even within regions. These regulations dictate what can be said, who it can be targeted towards, and often mandate the inclusion of responsible drinking messages. For instance, in 2024, many European countries continue to enforce strict guidelines on alcohol advertising, impacting campaign strategies and media placement.

The European Union's 'Europe's Beating Cancer Plan,' updated in 2024, further emphasizes the need for greater oversight on consumer information and alcohol advertising. This initiative aims to reduce alcohol-related harm by potentially leading to more stringent rules on how products like Henkell's sparkling wines are promoted, requiring careful navigation by the company to ensure compliance and effective brand communication.

Henkell & Co. Sektkellerei KG operates under rigorous food safety and quality regulations across its global markets. These legal frameworks, such as the EU's General Food Law Regulation (EC) No 178/2002, mandate strict controls on everything from raw material sourcing to final product labeling, ensuring consumer protection and product integrity.

Failure to comply with these standards can lead to significant legal repercussions, including product recalls and substantial fines. For instance, in 2024, the European Food Safety Authority (EFSA) reported a notable increase in food fraud incidents, highlighting the critical need for robust compliance measures to safeguard brand reputation and avoid costly penalties.

Intellectual Property and Brand Protection

Protecting its intellectual property, particularly trademarks for renowned brands such as Henkell Trocken and Freixenet, is a critical legal imperative for Henkell & Co. Sektkellerei KG. This necessitates robust global registration and vigilant defense against counterfeiting and unauthorized usage, a challenge amplified by its extensive product range and international reach.

The company actively safeguards its brand equity through legal channels, aiming to maintain market integrity and consumer trust. For instance, in 2024, the global luxury goods market, where brand perception is paramount, saw significant efforts in combating counterfeit products, a trend directly impacting premium beverage brands like those within the Henkell portfolio.

- Global Trademark Registration: Ensuring comprehensive protection across key international markets.

- Counterfeit Prevention: Implementing legal strategies to combat the illicit trade in fake products.

- Brand Defense: Actively pursuing legal action against infringers to preserve brand value.

- Regulatory Compliance: Adhering to evolving intellectual property laws in diverse operating regions.

Labor Laws and Employment Regulations

Henkell & Co. Sektkellerei KG, as a significant employer across various jurisdictions, must meticulously adhere to a complex web of labor laws and employment regulations. These statutes govern critical aspects of the employer-employee relationship, including minimum wage requirements, working hour limits, workplace safety standards, and procedures for workforce adjustments such as layoffs. Failure to comply can result in substantial fines and reputational damage.

Recent events underscore the practical implications of these legal frameworks. For instance, reports in late 2023 and early 2024 indicated workforce reductions within the Henkell Freixenet group, specifically impacting operations related to Cava production. These decisions, while driven by market challenges in that segment, are invariably shaped by national labor laws dictating notice periods, severance pay, and consultation processes with employee representatives.

- Compliance Burden: Navigating diverse national labor laws (e.g., Germany's Kündigungsschutzgesetz, Spain's Estatuto de los Trabajadores) is a constant operational challenge for a multinational like Henkell.

- Wage and Hour Laws: Adherence to collective bargaining agreements and statutory minimum wages in each operating country is essential, impacting labor cost structures.

- Workforce Reduction Scrutiny: Layoffs, such as those reportedly affecting Cava production, are subject to strict legal review, requiring thorough justification and adherence to procedural fairness.

- Employee Representation: Engagement with works councils or unions in countries like Germany is a legal requirement for significant employment decisions.

Henkell & Co. Sektkellerei KG must navigate evolving alcohol taxation, with the EU actively discussing potential changes to minimum excise duty rates, impacting pricing and sales volumes. Stringent advertising regulations across diverse markets, influenced by public health initiatives like the EU's 2024 Cancer Plan, necessitate careful campaign design to ensure compliance and effective brand messaging.

The company's commitment to food safety and quality is legally mandated by frameworks such as the EU's General Food Law, requiring rigorous controls from sourcing to labeling, with non-compliance risking recalls and fines, as highlighted by EFSA's 2024 observations on food fraud.

Protecting its valuable intellectual property, including brands like Henkell Trocken and Freixenet, is a critical legal focus, involving global trademark registration and active defense against counterfeiting, a significant concern in the 2024 luxury goods market.

Labor laws across its operating regions dictate employment practices, from wages to safety, with workforce adjustments subject to strict legal scrutiny, as seen in reported 2023-2024 reductions impacting Cava production, requiring adherence to national regulations and employee representation protocols.

Environmental factors

Climate change is a major long-term hurdle for the wine sector, affecting grape harvests, yields, and the cost of raw materials. Extended droughts, for instance, directly impact vineyards. Henkell Freixenet has seen this firsthand, with drought conditions influencing Cava production and necessitating strategic shifts to adapt.

These environmental shifts also open doors for vineyard expansion into previously unsuitable regions, creating new growth avenues. For example, some areas in Northern Europe are becoming more viable for viticulture due to rising temperatures, a trend that could benefit companies like Henkell & Co. Sektkellerei KG in the coming years.

Water scarcity is a significant environmental challenge, especially for wine-producing areas that frequently face drought conditions. This directly impacts grape cultivation and overall winery operations.

Wineries, including those within the Henkell Freixenet group, are prioritizing water efficiency and conservation. This involves adopting advanced irrigation techniques and reducing water consumption throughout the production process.

For Henkell Freixenet, with its extensive global footprint in wine and spirits, developing comprehensive water management plans is crucial for maintaining sustainable production and mitigating risks associated with water availability. For instance, in 2023, regions like Spain, a key market for cava production, experienced severe drought, leading to reduced yields and increased operational costs for water-intensive processes.

The wine sector is increasingly embracing sustainability, with a notable shift towards regenerative agriculture. These practices aim to improve soil vitality, boost biodiversity, and increase carbon capture, reflecting a growing environmental consciousness. Companies are recognizing the long-term benefits for both the planet and their operations.

Henkell Freixenet, a family-owned entity, is actively integrating sustainable development into its global business strategy. This commitment aligns with the industry's broader movement towards environmentally responsible operations, ensuring the company's future growth is built on a foundation of ecological stewardship.

Packaging and Waste Management

Environmental concerns are pushing wineries, including those like Henkell & Co. Sektkellerei KG, towards more sustainable packaging. This includes a shift to lighter glass bottles and initiatives aimed at minimizing waste sent to landfills. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR) is driving innovation, with targets for increased recycling and reduced packaging waste by 2030.

Companies are increasingly focused on quantifying and managing their carbon footprint throughout the entire value chain. This encompasses everything from raw material sourcing and production to the packaging materials used. By 2024, many beverage companies are reporting on Scope 3 emissions, which often include the environmental impact of packaging, aiming for reductions in line with global climate goals.

- Sustainable Packaging Adoption: Wineries are exploring lighter glass, recycled content, and alternative materials to reduce environmental impact.

- Waste Reduction Targets: Companies are setting ambitious goals to decrease landfill waste, often aligning with regulatory pressures and consumer expectations.

- Carbon Footprint Management: A comprehensive approach to measuring and reducing emissions across the supply chain, with a notable focus on packaging's contribution.

Biodiversity and Ecosystem Protection

Henkell & Co. Sektkellerei KG, like many in the beverage industry, faces growing pressure to protect biodiversity and enhance the ecosystems surrounding its vineyards. This involves actively promoting native flora and beneficial insect populations to foster a more resilient and self-sustaining agricultural environment.

Sustainable viticulture practices are becoming paramount, aiming to reduce the ecological footprint of wine production. This includes initiatives like organic farming, water conservation, and minimizing pesticide use, all contributing to a healthier planet and a higher quality product.

The company's commitment to these practices is not just about environmental stewardship; it's also about long-term business sustainability. For instance, the European Union's Farm to Fork strategy, a key component of the European Green Deal, sets ambitious targets for sustainable food systems, including a 50% reduction in pesticide use by 2030, which directly impacts agricultural practices in wine regions.

Key initiatives and considerations for Henkell & Co. Sektkellerei KG include:

- Vineyard Biodiversity Programs: Implementing strategies to encourage the growth of native wildflowers and grasses between rows of vines to support pollinators and beneficial insects.

- Water Management: Adopting water-efficient irrigation techniques and exploring rainwater harvesting to conserve this vital resource, especially in drought-prone regions.

- Pest and Disease Control: Prioritizing biological control methods and integrated pest management (IPM) over synthetic chemicals to protect vineyard health and surrounding ecosystems.

- Soil Health: Utilizing cover crops and organic fertilizers to improve soil structure, fertility, and water retention, reducing erosion and enhancing carbon sequestration.

Environmental factors significantly shape the operations of Henkell & Co. Sektkellerei KG, particularly concerning climate change and water availability. Droughts, as experienced in Spain in 2023, directly impact grape yields and increase operational costs. The company is actively implementing water conservation measures and exploring sustainable packaging solutions, influenced by regulations like the EU's PPWR, aiming for reduced waste and carbon footprints by 2030.

The company is also focusing on enhancing vineyard biodiversity and adopting sustainable viticulture practices. This includes using organic farming methods and integrated pest management, aligning with the EU's Farm to Fork strategy's goal of a 50% pesticide reduction by 2030. These efforts are crucial for long-term business sustainability and ecological stewardship.

| Environmental Factor | Impact on Henkell & Co. Sektkellerei KG | Industry Trend/Initiative |

|---|---|---|

| Climate Change & Drought | Reduced grape yields, increased water costs (e.g., Spain 2023 drought impacting Cava production). | Shift to drought-resistant grape varietals, expansion into new viticulture regions. |

| Water Scarcity | Operational challenges in water-intensive processes. | Adoption of advanced irrigation, rainwater harvesting, water-use efficiency targets. |

| Sustainability & Biodiversity | Need to protect vineyard ecosystems, improve soil health. | Regenerative agriculture, organic farming, promoting native flora, integrated pest management (IPM). |

| Packaging & Waste | Pressure to reduce environmental impact of packaging materials. | Lighter glass bottles, increased recycled content, waste reduction targets (e.g., EU PPWR by 2030). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Henkell & Co. Sektkellerei KG is meticulously constructed using data from official government statistics agencies, leading market research firms, and reputable industry publications. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the sparkling wine sector.