Henkell & Co. Sektkellerei KG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkell & Co. Sektkellerei KG Bundle

Henkell & Co. Sektkellerei KG faces moderate bargaining power from its suppliers due to the specialized nature of grape sourcing and bottling materials. The competitive rivalry within the sparkling wine market is intense, with numerous established brands and private labels vying for consumer attention.

The threat of new entrants is moderate, as significant capital investment and established distribution networks are required to compete effectively. Buyers, particularly large retailers and distributors, possess considerable bargaining power, influencing pricing and promotional activities.

The threat of substitutes, such as other alcoholic beverages and non-alcoholic sparkling drinks, is also a key consideration for Henkell. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Henkell & Co. Sektkellerei KG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for key ingredients, especially high-quality grapes for sparkling wine, significantly impacts Henkell & Co. Sektkellerei KG's bargaining power. A limited number of specialized grape producers can exert considerable influence, potentially driving up raw material costs for the company. For instance, in 2024, certain premium grape varietals crucial for specific sparkling wine styles saw price increases of up to 8% due to regional harvest challenges and strong demand from multiple wineries.

The availability of alternative inputs significantly influences the bargaining power of suppliers for Henkell Freixenet. For instance, if there are many different grape varietals or alternative sources for wine base that can be used in sparkling wine production, suppliers have less leverage. This is because Henkell Freixenet can switch to a different supplier or input if prices become too high or terms are unfavorable.

Switching costs for Henkell & Co. Sektkellerei KG are a significant factor in assessing supplier power. These costs encompass the effort and financial investment required to transition to alternative suppliers for critical inputs like grapes, packaging materials, or even specialized machinery. For instance, establishing new, reliable relationships with vineyards accustomed to Henkell's specific quality standards can be time-consuming and costly, as can retooling production lines to accommodate different bottle shapes or sizes.

The current market environment, particularly in 2024, highlights potential increases in these switching costs. Challenges in securing consistent supplies of glass bottles, a key component for sparkling wine, have been reported by various beverage producers. Coupled with escalating global freight and logistics expenses, the financial and operational burden of finding and onboarding new suppliers for these essential materials is likely to be higher, thereby strengthening the bargaining position of existing suppliers.

Uniqueness of Supplier Offerings

The uniqueness of supplier offerings significantly influences bargaining power. For Henkell & Co. Sektkellerei KG, proprietary yeast strains or specific regional grape characteristics that are crucial for their premium sparkling wines can give suppliers more leverage. If these inputs are difficult to substitute and are key to Henkell's unique selling proposition, suppliers can command higher prices or more favorable terms.

For instance, a supplier of a rare, high-quality grape variety from a specific German vineyard, essential for a particular Henkell Sekt, would possess considerable bargaining power. The difficulty in sourcing equivalent grapes elsewhere means Henkell is reliant on this supplier. This reliance is amplified if the supplier’s grapes contribute directly to the brand's perceived quality and exclusivity.

- Proprietary Yeast Strains: Suppliers of specialized yeast strains, vital for achieving specific flavor profiles in sparkling wine, can exert strong influence.

- Regional Grape Characteristics: Grapes from protected designation of origin (PDO) regions, possessing unique terroir-driven qualities, are often irreplaceable inputs.

- Brand Differentiation: When these unique inputs are directly tied to the brand's premium positioning and unique selling points, supplier power is enhanced.

- Limited Substitutability: The absence of readily available alternatives for these specialized inputs locks Henkell into existing supplier relationships, increasing supplier leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Henkell's business, such as grape growers or bottle manufacturers starting their own sparkling wine or spirit brands, could significantly shift bargaining power. This move would allow them to capture more of the value chain, potentially impacting Henkell's market share and profitability.

While direct forward integration by raw material suppliers like grape growers into complex beverage production is less common due to significant capital and expertise requirements, the possibility remains a factor in supplier negotiations. For instance, a major bottle manufacturer could leverage its existing infrastructure to enter the beverage market, creating a new competitive threat for Henkell.

- Potential for Increased Supplier Power: Suppliers moving into Henkell's market space directly increases their leverage in pricing and terms.

- Impact on Negotiations: The mere possibility of forward integration can influence Henkell's negotiation strategies and cost structures.

- Industry Dynamics: While not a widespread phenomenon in the beverage sector, it's a strategic consideration that can shape supplier relationships.

The bargaining power of suppliers for Henkell & Co. Sektkellerei KG is influenced by several factors, including supplier concentration, availability of substitutes, switching costs, unique supplier offerings, and the threat of forward integration. In 2024, challenges in securing key inputs like premium grapes and glass bottles have amplified supplier leverage.

For example, a 2024 report indicated an 8% price increase for certain premium grape varietals due to regional harvest issues, directly impacting Henkell's raw material costs. Similarly, escalating global logistics expenses in 2024 have made it more costly for Henkell to switch suppliers for essential materials like packaging, further strengthening the position of existing suppliers.

The uniqueness of inputs, such as proprietary yeast strains or specific regional grape characteristics crucial for Henkell's premium products, also grants suppliers significant power. The limited substitutability of these specialized inputs means Henkell often relies heavily on these suppliers, allowing them to command higher prices and more favorable terms.

| Factor | Impact on Henkell's Supplier Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | High if few suppliers for key inputs | Regional harvest challenges in 2024 limited premium grape availability. |

| Availability of Substitutes | Lowers supplier power | Availability of alternative grape varietals or wine bases can mitigate this. |

| Switching Costs | High switching costs increase supplier power | Increased global logistics costs in 2024 raised the expense of finding new suppliers. |

| Uniqueness of Offerings | Increases supplier power | Proprietary yeast strains or unique regional grape characteristics are difficult to substitute. |

| Threat of Forward Integration | Can increase supplier power | While less common for growers, bottle manufacturers entering beverage markets pose a threat. |

What is included in the product

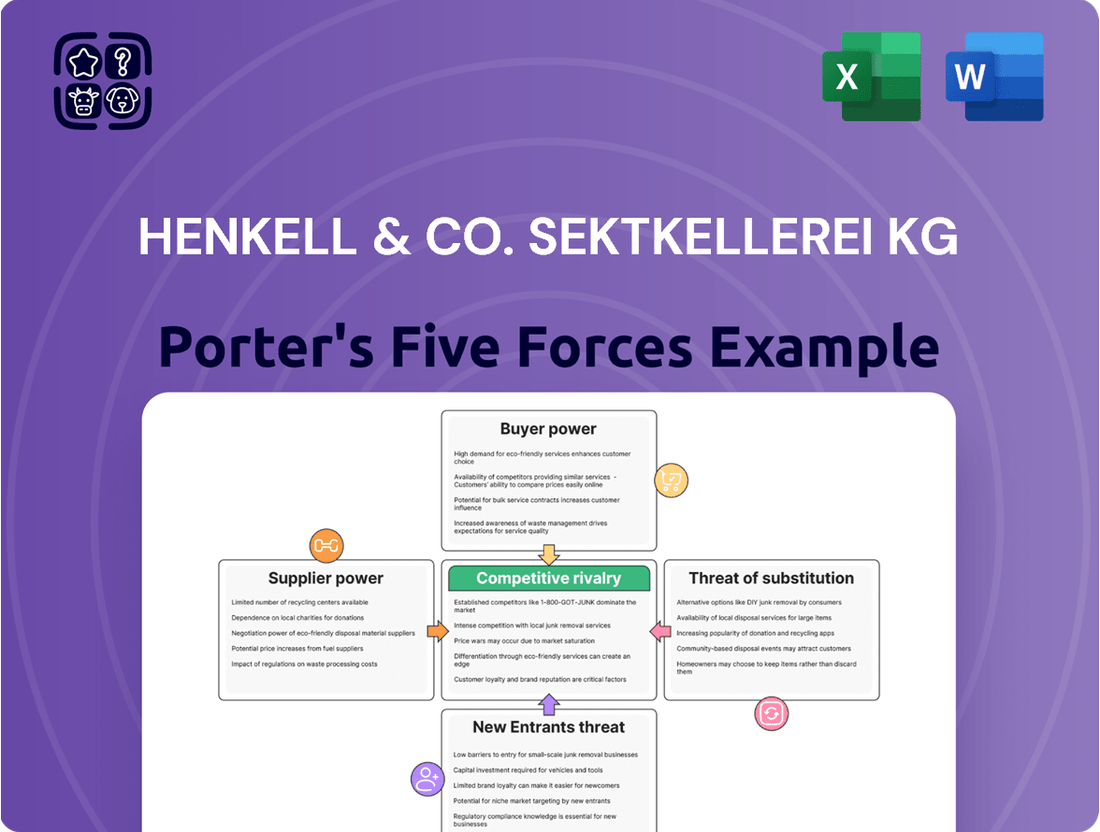

This analysis tailors Porter's Five Forces to Henkell & Co. Sektkellerei KG, revealing the competitive intensity, buyer power, supplier leverage, threat of substitutes, and new entrant barriers shaping its sparkling wine and spirits market.

A clear, one-sheet summary of Henkell & Co. Sektkellerei KG's Porter's Five Forces—perfect for quickly identifying and addressing competitive pressures.

Instantly understand strategic pressure points with a powerful spider/radar chart, simplifying complex market dynamics for Henkell & Co. Sektkellerei KG.

Customers Bargaining Power

Consumer price sensitivity for sparkling wine, wine, and spirits significantly influences Henkell Freixenet's pricing strategies. In 2024, with ongoing inflationary pressures impacting household budgets, many consumers are demonstrating increased price consciousness, especially in the mid-range and entry-level segments of the market.

While consumers in premium segments often prioritize quality and brand over price, the general economic climate in 2024 empowers buyers with more leverage. This means that if Henkell Freixenet's pricing is perceived as too high relative to competitors or perceived value, consumers have readily available lower-priced alternatives, thereby strengthening their bargaining power.

The availability of substitute products, ranging from beer and still wine to spirits and the burgeoning non-alcoholic beverage sector, significantly amplifies customer bargaining power for Henkell & Co. Sektkellerei KG. Consumers can readily switch between various alcoholic and non-alcoholic options, especially with the growing trend towards moderation. This wide array of choices means customers are less reliant on Henkell Freixenet's specific offerings.

The bargaining power of customers is significantly influenced by buyer concentration and the volume of purchases. For Henkell & Co. Sektkellerei KG, large retail chains and major distributors represent key customer segments. In 2024, the top five supermarket chains in Germany, a key market for Henkell, accounted for over 60% of grocery sales, highlighting their substantial market influence.

These high-volume buyers can leverage their purchasing power to negotiate more favorable pricing, demand extensive promotional support, and dictate terms of sale. For instance, a large retailer might insist on specific shelf placement or co-branded marketing campaigns, directly impacting Henkell's operational costs and profitability. This concentration means Henkell must carefully manage relationships to mitigate potential margin erosion.

Information Availability to Customers

Customers today have an unprecedented amount of information at their fingertips. Online reviews, detailed product comparisons, and social media discussions mean they can easily research alternatives and benchmark prices before making a purchase. This readily available data significantly shifts the balance of power towards the consumer.

For Henkell & Co. Sektkellerei KG, this means customers are more discerning than ever. They can quickly compare Henkell's sparkling wines against competitors, looking at not just price but also quality, origin, and customer sentiment. This transparency forces the company to be highly competitive on pricing and to clearly articulate the unique value proposition of its products to stand out in a crowded market.

- Increased Information Access: Consumers can access detailed product information, reviews, and price comparisons online.

- Price Transparency: Websites and apps allow for easy price comparisons across different retailers and brands.

- Impact on Competition: Enhanced customer knowledge intensifies price competition and demands greater value demonstration from companies like Henkell & Co. Sektkellerei KG.

Switching Costs for Customers

The bargaining power of customers is amplified by relatively low switching costs in the alcoholic beverage sector. Consumers can readily shift between brands of sparkling wine, wine, or spirits without incurring substantial financial penalties or significant effort. This ease of transition empowers customers, compelling companies like Henkell & Co. Sektkellerei KG to focus on competitive pricing and cultivating robust brand loyalty to retain market share.

For instance, in 2024, the global wine and spirits market saw continued consumer exploration, with data indicating that a significant percentage of consumers tried new brands or categories. This trend underscores the low barriers to switching. Henkell Freixenet must therefore invest in marketing and product differentiation to maintain customer allegiance.

- Low Switching Costs: Consumers can easily move between brands of sparkling wine, wine, and spirits.

- Increased Bargaining Power: This ease of switching gives customers more leverage over pricing.

- Competitive Pricing Pressure: Henkell Freixenet must remain competitive to retain customers.

- Brand Loyalty is Key: Strong brand identity and consistent quality are crucial for customer retention.

The bargaining power of customers for Henkell & Co. Sektkellerei KG is substantial, driven by widespread access to information and low switching costs. In 2024, consumers can easily compare prices and quality across numerous brands of sparkling wine, wine, and spirits online, intensifying price competition. This transparency, coupled with the ease of trying new products, means Henkell Freixenet must continuously offer competitive pricing and strong value propositions to retain its customer base.

| Factor | Impact on Henkell Freixenet | 2024 Relevance |

|---|---|---|

| Information Access | Empowers consumers to compare prices and quality easily. | Increased online research and review platforms. |

| Switching Costs | Low costs allow consumers to readily switch brands. | Consumers actively explore new brands and alternatives. |

| Price Sensitivity | Consumers are increasingly mindful of pricing due to economic factors. | Inflationary pressures in 2024 heightened consumer price consciousness. |

| Availability of Substitutes | Wide range of alcoholic and non-alcoholic alternatives exists. | Growth in the non-alcoholic beverage sector offers more choices. |

What You See Is What You Get

Henkell & Co. Sektkellerei KG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Henkell & Co. Sektkellerei KG's Porter's Five Forces Analysis, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of competitive rivalry within the sparkling wine market. This comprehensive analysis provides actionable insights into the company's strategic positioning and competitive landscape.

Rivalry Among Competitors

The sparkling wine, wine, and spirits industry is quite crowded, with a mix of large global companies and smaller, more localized players. Henkell Freixenet, as part of a major international entity, still contends with a substantial number of rivals.

Established giants such as Constellation Brands, E & J Gallo Winery, and Pernod Ricard Winemakers are significant competitors, all actively pursuing market share. These companies boast extensive portfolios and wide distribution networks, intensifying the competitive landscape for Henkell Freixenet.

The sparkling wine industry is projected for growth, with the global market anticipated to expand. However, the broader beverage alcohol sector has faced headwinds, including declining volumes in certain categories. This dynamic can heighten competitive rivalry as companies vie for market share in a potentially more constrained overall market.

Henkell Freixenet actively differentiates its sparkling wine and beverage portfolio by emphasizing quality, rich heritage, and targeted marketing campaigns. This strategy aims to carve out distinct market positions for its various brands.

Despite these efforts, the competitive landscape is robust, with rivals also boasting diverse product ranges. Competitors frequently introduce premium offerings, non-alcoholic alternatives, and novel product concepts, necessitating ongoing investment in brand enhancement and innovation to maintain a competitive edge.

Exit Barriers

High exit barriers significantly influence competitive rivalry within the wine and spirits sector, including for companies like Henkell & Co. Sektkellerei KG. These barriers make it difficult and costly for businesses to leave the market, even when facing declining profits. This often results in prolonged periods of intense competition as companies are hesitant to divest substantial investments.

Key exit barriers in this industry include:

- Significant Fixed Assets: The wine and spirits industry requires substantial investment in vineyards, wineries, bottling plants, and specialized storage facilities. For instance, establishing a new vineyard can take years to mature and become productive, representing a long-term, illiquid asset.

- Established Distribution Networks: Building and maintaining extensive distribution channels, including relationships with wholesalers, retailers, and export markets, is a major commitment. Divesting these networks can be complex and may not recoup the initial investment, forcing companies to continue operating.

- Brand Loyalty and Reputation: Companies invest heavily in building brand recognition and consumer loyalty over decades. The goodwill associated with established brands is a valuable intangible asset that is difficult to sell or transfer, encouraging continued market participation.

- Labor Agreements and Specialized Skills: The industry often relies on skilled labor, including vintners, distillers, and sales professionals. Existing labor contracts and the need for specialized knowledge can add to the cost and complexity of exiting the market.

Brand Identity and Loyalty

Strong brand identity and customer loyalty are crucial for Henkell & Co. Sektkellerei KG in managing competitive rivalry. Brands like Henkell Trocken have built a loyal following, making it harder for competitors to sway customers. This loyalty acts as a significant barrier, reducing the intensity of direct competition.

Henkell Freixenet actively cultivates this loyalty through strategic brand management and innovation. By focusing on core brands and introducing new products, such as non-alcoholic beverages and aperitifs, the company differentiates itself. This strategy aims to attract and retain customers in a highly competitive sparkling wine and beverage market.

- Brand Strength: Henkell Trocken's established reputation and consistent quality foster strong customer allegiance.

- Innovation Focus: Investments in new product categories, like non-alcoholic sparkling wines, cater to evolving consumer preferences and reduce reliance on traditional offerings.

- Market Differentiation: A diverse portfolio, including aperitifs and premium sparkling wines, allows Henkell Freixenet to target different market segments and build deeper customer relationships.

- Loyalty Programs: While specific details for 2024 are emerging, companies in this sector often leverage marketing campaigns and partnerships to reinforce brand loyalty and encourage repeat purchases.

The competitive rivalry within the sparkling wine and spirits sector is intense, with major global players like Constellation Brands and Pernod Ricard actively vying for market share. Henkell Freixenet, as part of Henkell & Co. Sektkellerei KG, faces this pressure from established giants with extensive portfolios and broad distribution networks. The industry's high exit barriers, including significant fixed assets like vineyards and wineries, and the substantial investment in established distribution channels, mean companies often remain in the market even when facing profitability challenges, thus sustaining the rivalry.

Henkell Freixenet counters this by focusing on brand differentiation, emphasizing quality and heritage, and innovating with offerings like non-alcoholic beverages. For example, the global sparkling wine market was projected to reach approximately $40 billion by 2024, indicating significant growth potential but also a highly attractive market for competitors. Despite these efforts, rivals continually introduce premium products and novel concepts, requiring continuous investment in brand building and innovation to maintain a competitive edge.

SSubstitutes Threaten

The threat of substitutes for Henkell & Co. Sektkellerei KG's sparkling wine and wine products is significant, with other alcoholic beverages like beer, still wines, and spirits posing direct competition. Consumer choices are often swayed by taste preferences, the specific occasion, and price points, all of which can divert demand away from Henkell's portfolio. For instance, in 2024, the global beer market was projected to reach over $700 billion, demonstrating a substantial alternative for consumers seeking alcoholic refreshment.

The rising popularity of non-alcoholic beverages presents a significant threat of substitutes for Henkell & Co. Sektkellerei KG. Consumers are increasingly prioritizing health and moderation, leading them to choose sparkling wines, spirits, and functional drinks without alcohol. This trend saw the global non-alcoholic beverage market reach an estimated USD 1.2 trillion in 2023, with projections indicating continued robust growth.

The growing consumer trend towards moderation and mindful drinking presents a significant threat to Henkell & Co. Sektkellerei KG. This shift means less alcohol is being consumed overall, with a clear preference emerging for beverages with lower alcohol by volume (ABV) or even non-alcoholic alternatives. For instance, a 2024 report indicated that 30% of consumers are actively seeking out low- or no-alcohol options, directly impacting the demand for traditional sparkling wines and spirits that form the core of Henkell's business.

Price-Performance Ratio of Substitutes

The price-performance ratio of substitutes significantly impacts consumer decisions for sparkling wine and spirits. If non-alcoholic sparkling beverages or other alcoholic drinks, like craft beers or ready-to-drink cocktails, offer comparable perceived value or enjoyment at a lower cost, consumers may opt for these alternatives, thereby increasing the threat of substitution for Henkell & Co. Sektkellerei KG.

In 2024, the non-alcoholic beverage market continued its robust growth, with some reports indicating an average annual growth rate of over 5%. This expansion means more sophisticated and appealing alternatives are readily available. For instance, premium non-alcoholic sparkling wines are increasingly mimicking the taste and mouthfeel of traditional sparkling wines, presenting a direct challenge on both price and performance.

- Growing Non-Alcoholic Segment: The increasing availability and quality of non-alcoholic sparkling wines and spirits offer consumers a compelling alternative with a potentially better price-performance ratio, especially for health-conscious or occasion-specific drinkers.

- Competitive Pricing of Other Alcoholic Beverages: Categories like craft beer and ready-to-drink cocktails often compete on price and novelty, providing consumers with diverse options that can be perceived as offering similar social or sensory benefits at a more accessible price point than premium sparkling wines.

- Consumer Perception of Value: If consumers believe that substitutes provide comparable satisfaction or meet their needs equally well for less money, the switching costs are perceived as low, making the threat of substitution more potent for established players like Henkell & Co. Sektkellerei KG.

Ease of Substitution

The threat of substitutes for Henkell & Co. Sektkellerei KG is significant due to the high ease of switching for consumers. There are minimal switching costs associated with choosing alternative beverages for various occasions, making this a persistent factor for the company.

Consumers can readily opt for different types of alcoholic or non-alcoholic drinks, such as wine, beer, spirits, or even premium juices, depending on the event and their preferences. This broad availability of alternatives puts pressure on Henkell Freixenet to maintain competitive pricing and product appeal.

For instance, in 2024, the global non-alcoholic beverage market, which includes many potential substitutes, was projected to reach over $1.3 trillion, showcasing the vast array of choices available to consumers beyond sparkling wine.

- High Consumer Mobility: Consumers face virtually no financial or logistical hurdles when switching from Henkell Freixenet products to other beverage categories.

- Diverse Beverage Landscape: The market offers a wide array of substitutes, from craft beers and artisanal spirits to premium non-alcoholic options, catering to diverse tastes and occasions.

- Price Sensitivity: The availability of numerous substitutes often leads to greater price sensitivity among consumers, impacting Henkell Freixenet's pricing power.

- Occasion-Based Choices: For many social gatherings or personal consumption moments, sparkling wine is not the only or indispensable choice, allowing for easy substitution.

The threat of substitutes for Henkell & Co. Sektkellerei KG is substantial, driven by the broad availability of alternative beverages across alcoholic and non-alcoholic categories. Consumers can easily switch to beer, spirits, still wines, or increasingly sophisticated non-alcoholic options based on price, occasion, or health preferences. For example, the global non-alcoholic beverage market was valued at approximately $1.3 trillion in 2024, highlighting the vast competitive landscape.

| Substitute Category | 2024 Market Value (Est.) | Key Drivers for Substitution |

|---|---|---|

| Non-Alcoholic Beverages | >$1.3 Trillion | Health consciousness, moderation, taste innovation |

| Beer | >$700 Billion | Price accessibility, diverse flavor profiles, social occasions |

| Spirits | >$150 Billion | Premiumization, cocktail culture, gifting |

| Still Wines | >$400 Billion | Food pairing, regional preferences, perceived sophistication |

Entrants Threaten

The capital requirements for entering the sparkling wine, wine, and spirits industry are substantial. This includes costs for acquiring vineyards or securing long-term grape supply contracts, establishing modern production facilities, building aging cellars, and developing robust distribution networks. For example, establishing a new winery with a modest production capacity can easily require millions of dollars in upfront investment.

New entrants into the sparkling wine and spirits market, like that occupied by Henkell & Co. Sektkellerei KG, often find securing shelf space and distribution agreements a significant hurdle. Established players benefit from decades of building relationships with major retailers and hospitality venues, making it difficult for newcomers to gain comparable access. For instance, in 2024, major supermarket chains continued to consolidate their supplier lists, favoring brands with proven sales volume and established marketing support, which newcomers typically lack.

Strong brand loyalty is a significant barrier for new entrants in the sparkling wine market, particularly for companies like Henkell & Co. Sektkellerei KG. Brands such as Henkell Trocken and Freixenet have cultivated deep consumer trust and recognition over many years, making it challenging for newcomers to capture market share. For instance, in 2024, Henkell Freixenet reported a robust performance, indicating the continued strength of its established brands in consumer preference.

Regulatory Hurdles and Licensing

The wine and spirits industry presents significant regulatory challenges for newcomers. Navigating complex licensing, production standards, and marketing restrictions across different regions and countries is a substantial undertaking. For example, in 2024, obtaining a federal Alcohol and Tobacco Tax and Trade Bureau (TTB) permit in the United States can take several months and involve detailed application processes, adding considerable time and expense for any new entrant aiming to operate within the U.S. market.

These extensive regulatory frameworks act as a formidable barrier to entry. New companies must invest heavily in legal counsel and compliance personnel to ensure adherence to diverse and often evolving rules. This can include strict labeling requirements, advertising limitations, and distribution channel regulations, all of which demand significant upfront capital and expertise that established players like Henkell & Co. Sektkellerei KG have already mastered.

- Licensing Complexity: Obtaining necessary permits and licenses can be a lengthy and costly process, varying significantly by jurisdiction.

- Production Standards: Adherence to specific quality control and production methods is mandated, requiring investment in compliant facilities and processes.

- Marketing Restrictions: Rules governing advertising and promotion of alcoholic beverages can limit how new entrants reach consumers, impacting market penetration strategies.

- Regional Variations: The patchwork of regulations across different countries and even states within countries adds layers of complexity for global or multi-regional expansion.

Experience and Expertise

The winemaking industry, especially for premium sparkling wines, requires a substantial investment in specialized knowledge. This includes deep understanding of viticulture, the art and science of grape cultivation, and enology, the study of winemaking. Furthermore, the intricate process of blending wines to achieve consistent quality and distinct flavor profiles is a skill honed over years, if not decades. Newcomers often struggle to replicate the nuanced expertise that established companies like Henkell Freixenet have cultivated, making it a significant barrier to entry.

For instance, the global sparkling wine market was valued at approximately USD 35.6 billion in 2023 and is projected to reach USD 54.8 billion by 2030, growing at a CAGR of 6.3%. This robust growth attracts new players, but the technical know-how to compete effectively remains a hurdle. Henkell Freixenet, with its long history dating back to 1832, possesses invaluable institutional knowledge and a team of highly experienced enologists and vineyard managers. This deep expertise translates into consistent product quality and brand reputation, which are difficult for new entrants to match quickly.

- Technical Expertise: Winemaking, particularly for sparkling wines, demands extensive knowledge in grape growing and fermentation processes.

- Skilled Workforce: Access to experienced enologists and vineyard managers is crucial, and this talent pool is often limited.

- Quality Consistency: New entrants may find it challenging to achieve the consistent high quality that consumers expect from established brands like Henkell Freixenet.

- Brand Reputation: Years of producing quality products build a strong brand reputation, which is a significant advantage over new, unproven competitors.

The threat of new entrants for Henkell & Co. Sektkellerei KG is moderate. Significant capital is required for vineyards, production facilities, and distribution, with new wineries often needing millions upfront. Established brands benefit from decades of relationships with retailers, making distribution access difficult for newcomers, a trend reinforced in 2024 as major chains consolidated suppliers. Strong brand loyalty, exemplified by Henkell Freixenet's consistent performance in 2024, further deters new entrants.

Navigating complex regulations, including licensing, production standards, and marketing restrictions, presents another substantial barrier. For instance, obtaining a TTB permit in the US in 2024 could take months and involve detailed processes. Furthermore, the specialized knowledge in viticulture and enology, coupled with the difficulty in replicating the nuanced expertise of established players like Henkell Freixenet, acts as a significant deterrent.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2024/2025 Relevant) |

|---|---|---|---|

| Capital Requirements | High upfront investment for land, facilities, and distribution. | Significant hurdle, limiting the number of potential entrants. | Establishing a modest winery can cost millions; global sparkling wine market valued at ~$35.6 billion in 2023. |

| Distribution & Shelf Space | Securing access to retail and hospitality channels. | Challenging due to established relationships and consolidation trends. | Major supermarkets in 2024 favored brands with proven sales and marketing support. |

| Brand Loyalty & Reputation | Consumer trust and recognition built over time. | Makes it difficult for new brands to gain market share. | Henkell Freixenet's robust performance in 2024 indicates continued consumer preference for established brands. |

| Regulatory Hurdles | Complex licensing, production, and marketing rules. | Adds time, cost, and expertise requirements for compliance. | US TTB permit process can take months; varying regulations across regions increase complexity. |

| Technical Expertise | Knowledge in viticulture, enology, and blending. | Difficult for newcomers to replicate consistent quality and flavor profiles. | Henkell Freixenet's long history (since 1832) provides invaluable institutional knowledge. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Henkell & Co. Sektkellerei KG is built upon comprehensive data from industry-specific market research reports, financial statements of key competitors, and publicly available company disclosures. We also incorporate insights from trade publications and economic databases to provide a robust assessment of the competitive landscape.