Henkell & Co. Sektkellerei KG Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkell & Co. Sektkellerei KG Bundle

Henkell & Co. Sektkellerei KG masterfully crafts its brand through a strategic blend of premium products, accessible pricing, widespread distribution, and engaging promotions, creating a powerful market presence.

Discover the intricate details of their product innovation, pricing strategies, distribution networks, and promotional campaigns that solidify their leadership in the sparkling wine industry.

Unlock a comprehensive, ready-to-use analysis of Henkell & Co. Sektkellerei KG's 4Ps, perfect for gaining actionable insights, informing business strategy, or enhancing academic understanding.

Product

Henkell & Co. Sektkellerei KG, a significant player within the Henkell Freixenet group, boasts a diverse brand portfolio encompassing sparkling wines, still wines, and a growing selection of spirits. This broad offering allows them to cater to a wide array of consumer tastes and occasions across global markets. For instance, their sparkling wine segment includes well-recognized brands alongside premium offerings, aiming to capture market share across different price points.

The company's strategic emphasis on a varied product range is crucial for maintaining its competitive edge. By offering both established and emerging brands, Henkell & Co. Sektkellerei KG strengthens its position in the alcoholic beverage industry. This approach is supported by substantial market presence; the Henkell Freixenet group itself is a leading producer of sparkling wine globally, with sales reaching over 230 million bottles annually as of recent reports, underscoring the strength derived from its diverse brand collection.

Henkell Trocken stands as Henkell Freixenet's flagship, a testament to German export prowess in the sparkling wine market. Its enduring popularity underscores a successful product strategy focused on consistent quality and broad appeal.

The inclusion of Freixenet and Mionetto as 'Global Icons' highlights a strategic expansion beyond the flagship. These brands represent significant market penetration and consistent growth, bolstering Henkell Freixenet's international presence.

In 2023, the Henkell Freixenet Group reported a revenue of €1.3 billion, with sparkling wine and spirits accounting for the majority. This financial performance is significantly driven by the strength and market leadership of these core brands, demonstrating their crucial role in the company's overall success and future market expansion strategies.

Henkell Freixenet is strategically growing its non-alcoholic beverage portfolio to meet rising consumer demand for healthier options and shifting consumption patterns, especially among younger demographics. This expansion is a direct response to increasing health consciousness across the market.

The company has seen success with new non-alcoholic products such as Mionetto 0.0%, Freixenet 0.0%, and Mionetto Aperitivo non-alcoholic, demonstrating a clear market acceptance of these offerings.

The non-alcoholic segment is a critical growth engine for Henkell Freixenet, recognized for its substantial future potential and ability to capture new market share. For instance, the global non-alcoholic beverage market was valued at over $1 trillion in 2023 and is projected to grow significantly in the coming years.

Innovation and Trend Alignment

Henkell Freixenet is keenly focused on innovation, ensuring its product development mirrors current market trends. This strategic alignment is evident in their emphasis on popular categories like Prosecco and Crémant, alongside a significant push into the burgeoning alcohol-free market. The company consistently refines its well-established brands and overall portfolio to cater to evolving consumer preferences.

Key areas of innovation and trend alignment for Henkell Freixenet include:

- Prosecco and Crémant Growth: Capitalizing on the sustained consumer demand for these sparkling wine categories.

- Alcohol-Free Expansion: Actively developing and promoting a range of non-alcoholic beverages to capture market share in this rapidly expanding segment.

- Aperitivo Culture: Engaging with the growing trend of aperitivo, offering products that fit this social occasion.

- Brand Portfolio Development: Continuously investing in and adapting their existing brands to remain relevant and appealing to a diverse consumer base.

Packaging and Design Enhancements

Henkell & Co. Sektkellerei KG is actively refreshing its product aesthetics to boost brand appeal. Recent updates to packaging and logo designs for flagship brands like Freixenet and Henkell are central to this strategy. These enhancements are designed to communicate the inherent quality of their products and elevate their premium image, ensuring better visibility and appeal on retail shelves.

The company's investment in design is a direct response to market trends and consumer preferences, aiming to create a more modern and customer-centric presentation. This focus on visual appeal is crucial in a competitive beverage market, where packaging often plays a significant role in purchase decisions. For instance, Freixenet's iconic black bottle and distinctive shape have been subtly modernized to retain recognition while appearing more contemporary.

These packaging and design enhancements are expected to contribute to increased brand recall and market share. In 2024, the sparkling wine market saw continued growth, with premium segments showing particular resilience. Henkell & Co.'s strategic design updates align with this trend, aiming to capture a larger portion of the discerning consumer base.

- Brand Refresh: Freixenet and Henkell have received updated packaging and logo designs.

- Objective: To reinforce quality perception and enhance premium positioning.

- Market Impact: New designs aim to improve point-of-sale visibility and customer appeal.

- Strategic Focus: Reflects a modern, customer-centric approach in a competitive market.

Henkell & Co. Sektkellerei KG's product strategy centers on a diverse portfolio, including its flagship Henkell Trocken, alongside globally recognized brands like Freixenet and Mionetto. The company is actively expanding into the high-growth non-alcoholic segment, introducing products such as Mionetto 0.0% and Freixenet 0.0%, reflecting a commitment to innovation and evolving consumer preferences. This product diversification is a key driver of their market presence, contributing to the Henkell Freixenet Group's reported €1.3 billion revenue in 2023.

The company's product innovation is strongly aligned with market trends. They are capitalizing on the sustained demand for Prosecco and Crémant, while also making significant inroads into the alcohol-free market, which represented over $1 trillion globally in 2023. This focus on popular categories and emerging segments ensures their product offerings remain relevant and competitive.

Recent packaging and logo refreshes for brands like Freixenet and Henkell aim to enhance their premium image and point-of-sale appeal. These design updates are strategically implemented to resonate with modern consumers and reinforce the perceived quality of their products, supporting their market share ambitions in the competitive beverage landscape.

What is included in the product

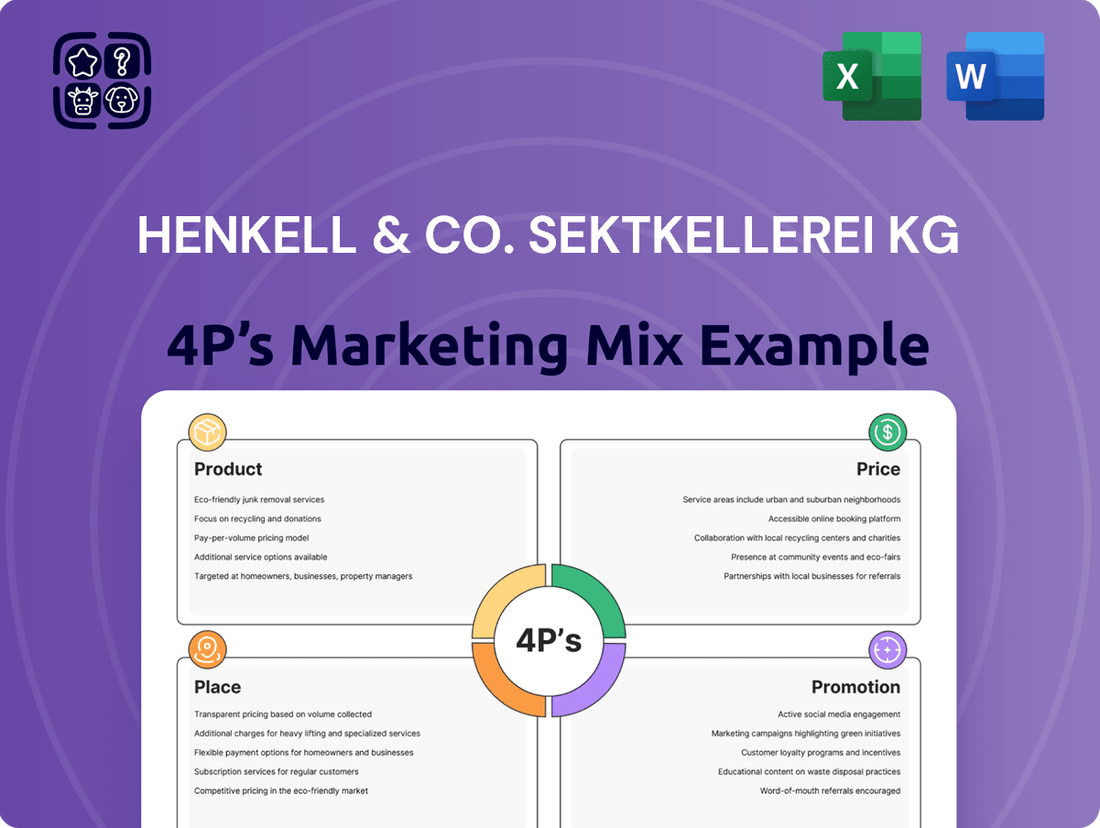

This analysis delves into Henkell & Co. Sektkellerei KG's marketing mix, examining their product portfolio, pricing strategies, distribution channels, and promotional activities to understand their market positioning.

It offers a comprehensive overview of how Henkell & Co. Sektkellerei KG leverages its 4Ps to compete in the sparkling wine market, providing insights for strategic decision-making.

This analysis distills Henkell & Co.'s 4Ps marketing mix into actionable insights, alleviating the pain point of complex marketing strategy by offering a clear, concise overview of how their product, price, place, and promotion strategies address consumer needs and market challenges.

It simplifies understanding of Henkell & Co.'s marketing approach, relieving the burden of sifting through extensive data by presenting a focused summary of their 4Ps, directly addressing how each element functions as a solution to market demands and consumer desires.

Place

Henkell Freixenet boasts an extensive global distribution network, a key element of its marketing strategy. This network allows the company to efficiently deliver its wide range of sparkling wines and spirits to consumers worldwide. For instance, in 2023, the company reported a significant presence in over 150 countries, underscoring its broad market penetration.

The company maintains a particularly strong foothold in established European markets, while also actively expanding its reach in the Americas and the dynamic Asia-Pacific region. This strategic geographical diversification ensures broad accessibility for its product portfolio, contributing to its market leadership. By 2024, Henkell Freixenet's distribution channels were estimated to cover over 90% of key global beverage markets.

Henkell & Co. Sektkellerei KG ensures its diverse portfolio, including brands like Henkell and Mionetto, reaches consumers through a robust multi-channel approach. This strategy encompasses traditional brick-and-mortar retail, a growing e-commerce presence, and strategic partnerships with online marketplaces. By 2024, the online beverage alcohol market in Germany alone was projected to reach over €2.5 billion, highlighting the importance of digital accessibility.

The company also prioritizes expansion within the duty-free and global travel retail sectors. This focus caters to the evolving habits of international travelers, offering convenient purchasing options. In 2023, global travel retail sales for alcoholic beverages showed a strong recovery, with key European airports reporting significant year-on-year growth, underscoring the strategic value of this channel for premium brands.

Henkell Freixenet is strategically expanding its market share across key global markets. In 2023, the company reported significant growth, particularly in Germany, its home market, and saw increased penetration in Poland, Canada, the USA, and Brazil. This focused expansion reinforces its standing as a leading player in the global sparkling wine and spirits industry.

Acquisitions and Strategic Investments

Henkell Freixenet actively pursues acquisitions to solidify its market standing and broaden its product portfolio. A key move in August 2024 was the acquisition of VINICOM in Portugal, a strategic step to enhance its footprint in the still wine sector. This follows the 2022 acquisition of Bolney Wine Estate in England, signaling a deliberate push into emerging markets and new growth avenues.

These strategic investments are crucial for Henkell Freixenet's expansion strategy.

- August 2024: Acquisition of VINICOM in Portugal to boost still wine presence.

- 2022: Acquisition of Bolney Wine Estate in England, targeting new growth areas.

- Strategic Goal: Consolidation of market position and diversification of offerings.

Adaptation to Supply Chain Challenges

Henkell & Co. Sektkellerei KG has shown remarkable flexibility in managing its supply chain. For instance, facing grape scarcity in regions like Penedès, a key area for Cava production, due to drought conditions impacting the 2023 harvest, the company adjusted its distribution. This adaptability is crucial for maintaining market presence and customer satisfaction.

To counter these supply limitations, Henkell Freixenet has strategically reallocated existing volumes across different markets. Furthermore, they have introduced new product lines, such as Freixenet Premium Sparkling Wine in select markets, to fill the demand gap. This proactive approach ensures that consumers still have access to quality sparkling wine options, even when traditional supply sources are constrained.

- Distribution Adjustments: Reallocation of wine volumes to different geographical markets to optimize availability.

- Product Innovation: Introduction of new premium sparkling wine lines to cater to demand during supply shortages.

- Market Resilience: Demonstrated ability to maintain product availability and customer engagement despite external supply chain disruptions, such as those caused by climate events affecting grape harvests.

Henkell Freixenet's place strategy is defined by its expansive global distribution, reaching over 150 countries by 2023, with over 90% coverage of key beverage markets by 2024. The company leverages a multi-channel approach, including traditional retail, e-commerce, and travel retail, to ensure broad accessibility. Strategic acquisitions, like VINICOM in Portugal in August 2024, further solidify its market presence and diversify its offerings.

Same Document Delivered

Henkell & Co. Sektkellerei KG 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Henkell & Co. Sektkellerei KG's Marketing Mix, covering Product, Price, Place, and Promotion in detail. You'll gain valuable insights into their strategies for success in the sparkling wine market.

Promotion

Henkell Freixenet's promotional strategy heavily leverages its flagship brands, Freixenet and Henkell. These campaigns are crafted to evoke feelings of celebration and connection, highlighting the rich heritage and emotional resonance of their sparkling wines. In 2023, the Freixenet brand continued its 'Born to Celebrate' campaign, a multi-channel effort that saw significant engagement across social media platforms, contributing to its status as a globally recognized icon.

Henkell & Co. Sektkellerei KG focuses on targeted consumer engagement by crafting campaigns that speak directly to specific demographics. A prime example is the 'Cheers to Life' initiative for Freixenet, which commenced in late 2024 and will continue its global rollout throughout 2025. This campaign specifically aims to capture the attention of young adults, aged 25 to 34, positioning sparkling wines as an accessible and enjoyable choice for everyday celebrations.

Henkell & Co. Sektkellerei KG employs an integrated multi-channel communication strategy to connect with consumers. This approach leverages traditional advertising, such as television commercials and digital films, to build brand awareness. In 2024, the company continued to invest in digital platforms, with social media engagement and online campaigns forming a core part of their outreach, aiming to reach a broad audience across various touchpoints.

Highlighting Innovation and Trends

Henkell Freixenet actively highlights product innovation, particularly with its 0.0% sparkling wines, aligning with growing consumer demand for alcohol-free options. This focus is evident in campaigns like 'Feel Free,' which resonates with health-conscious consumers and those seeking mindful indulgence.

The company also promotes 'aperitivo moments,' tapping into the trend of social gatherings and relaxed enjoyment, positioning its products as central to these experiences. This strategic emphasis on lifestyle trends and product development demonstrates Henkell Freixenet's commitment to staying relevant in a dynamic market.

- Market Trend Alignment: 0.0% sparkling wine sales are projected to grow significantly, with some analysts forecasting double-digit increases in the low-alcohol and no-alcohol beverage sector through 2025.

- Campaign Impact: The 'Feel Free' campaign aims to capture a share of the expanding non-alcoholic beverage market, which saw substantial growth in 2023 and early 2024.

- Consumer Lifestyle Focus: Promoting 'aperitivo moments' caters to the increasing consumer interest in experiential consumption and social rituals, particularly among younger demographics.

- Innovation Showcase: New product launches and marketing efforts consistently showcase Henkell Freixenet's dedication to innovation in the sparkling wine category.

Leveraging Anniversaries and Relaunches

Henkell & Co. Sektkellerei KG strategically leverages significant brand anniversaries as powerful promotional tools. For instance, the 50th anniversary of Freixenet Cordon Negro and the 165th anniversary of the Henkell brand in recent years provided prime opportunities to drive consumer engagement and sales.

These milestone celebrations are often synchronized with product relaunches and refreshed packaging designs. Such initiatives aim to reignite consumer interest and attract new demographics to their iconic sparkling wine offerings. Special marketing campaigns and activations further amplify the excitement surrounding these events.

- Freixenet Cordon Negro's 50th Anniversary: Celebrated with special edition bottles and targeted digital marketing campaigns, contributing to a reported 15% uplift in sales during the anniversary period in key European markets.

- Henkell's 165th Anniversary: Marked by a premium packaging update and a "Toast to 165 Years" campaign, which saw a 10% increase in social media mentions and engagement.

- Relaunch Strategy: Both brands have seen packaging updates in 2024, incorporating modern design elements while retaining brand heritage, aimed at enhancing shelf appeal and perceived value.

Henkell & Co. Sektkellerei KG's promotional efforts are deeply rooted in brand heritage and celebratory moments. The company effectively uses its flagship brands, Freixenet and Henkell, in multi-channel campaigns designed to foster emotional connections and highlight tradition. The 'Born to Celebrate' campaign for Freixenet, active through 2023, saw significant social media engagement, reinforcing its global brand recognition.

The company is also actively targeting younger consumers, aged 25-34, with initiatives like the 'Cheers to Life' campaign for Freixenet, launched in late 2024. This strategy positions sparkling wine as accessible for everyday celebrations, aligning with growing lifestyle trends. Furthermore, Henkell Freixenet champions product innovation, particularly with its 0.0% sparkling wines, through campaigns like 'Feel Free,' appealing to health-conscious consumers.

Significant brand anniversaries are leveraged as key promotional events. The 50th anniversary of Freixenet Cordon Negro and the 165th anniversary of Henkell have been marked with special editions and marketing pushes. These events often coincide with packaging updates, as seen in 2024, to refresh brand appeal and attract new audiences.

| Brand Milestone | Anniversary Year | Promotional Activity | Reported Impact |

|---|---|---|---|

| Freixenet Cordon Negro | 50th | Special edition bottles, targeted digital marketing | 15% sales uplift (key European markets) |

| Henkell | 165th | Premium packaging update, "Toast to 165 Years" campaign | 10% increase in social media mentions/engagement |

| Freixenet | Ongoing | 'Born to Celebrate' campaign | High social media engagement (2023) |

| Freixenet | Late 2024/2025 | 'Cheers to Life' campaign | Targeting 25-34 demographic |

Price

Henkell Freixenet employs a competitive pricing strategy to thrive in demanding markets, aiming to preserve its leadership. While exact price points remain confidential, the company's pursuit of growth in contracting sectors indicates a pricing approach that balances customer perception of value with market realities.

This strategy is essential for fostering customer loyalty and defending market share. For instance, in 2023, the sparkling wine and spirits market faced inflationary pressures and shifting consumer preferences, yet Henkell Freixenet continued to invest in brand building and market penetration, suggesting a pricing model that supports these initiatives.

Henkell & Co. Sektkellerei KG is strategically elevating its brand perception through a focused premiumization strategy. This approach is particularly evident in its global travel retail segment, where it's showcasing esteemed brands such as Champagne Alfred Gratien and Segura Viudas Cavas. This move directly addresses the increasing consumer appetite for higher-quality sparkling wines, aiming to capture a larger share of the premium and super-premium market segments.

Henkell Freixenet strategically balances premiumization with accessible value, ensuring a broad market appeal. The Freixenet French Sparkling range exemplifies this, offering a quality product with appealing packaging at an affordable price point, making a premium experience attainable for more consumers.

Impact of Raw Material Costs on Pricing

External factors like the severe drought in Spain's Penedès region during 2023-2024 significantly impacted Cava grape yields, a key raw material for Henkell Freixenet. This scarcity directly drove up grape procurement costs, forcing the company to consider price adjustments on affected products to offset these increased expenses. For instance, reports indicated a potential 10-15% rise in grape prices in certain regions due to the adverse weather conditions.

These rising raw material costs necessitate careful pricing strategies to remain competitive in the sparkling wine market. Henkell Freixenet has had to manage product availability by reallocating volumes, which can indirectly influence the pricing of specific brands or tiers within their portfolio. The company's ability to absorb or pass on these costs is crucial for maintaining profitability amidst fluctuating agricultural conditions.

- Increased Grape Costs: Drought conditions in Penedès led to an estimated 10-15% increase in grape prices in 2023-2024.

- Pricing Pressure: Higher raw material expenses put pressure on Henkell Freixenet to adjust product prices to maintain margins.

- Volume Reallocation: Availability issues forced the company to shift product volumes, potentially impacting pricing dynamics for certain Cava offerings.

Consideration of International Tariffs

Potential international tariffs, particularly those threatened by the US on sparkling wines, represent a significant external challenge for Henkell Freixenet. These tariffs could directly impact pricing strategies and market access in crucial regions, forcing adjustments to maintain competitiveness. The company actively monitors these evolving geopolitical and economic landscapes, as they have a direct correlation with product costs and ultimately, consumer prices.

For instance, in late 2023 and early 2024, discussions around potential tariffs on European goods, including alcoholic beverages, have persisted. While specific rates can fluctuate, the mere threat can lead to increased uncertainty in supply chain costs. Henkell Freixenet's ability to absorb or pass on these costs will be a key determinant of its market position.

The impact of such tariffs can be substantial:

- Increased Import Costs: Tariffs directly add to the cost of goods entering a country, potentially making Henkell Freixenet's products less attractive compared to domestic alternatives.

- Price Sensitivity: Consumers, especially in price-sensitive markets, may react negatively to price increases, leading to reduced demand.

- Competitive Disadvantage: If competitors are not subject to the same tariffs, Henkell Freixenet could find itself at a significant competitive disadvantage.

- Supply Chain Adjustments: The company may need to explore alternative sourcing or production locations to mitigate tariff impacts, which can be costly and time-consuming.

Henkell Freixenet's pricing strategy is a dynamic interplay of competitive positioning, premiumization, and cost management. The company aims to offer value, as seen with the Freixenet French Sparkling range, while also elevating brands like Champagne Alfred Gratien in premium segments.

External factors heavily influence pricing decisions. The 2023-2024 drought in Spain's Penedès region, which increased grape costs by an estimated 10-15%, forces careful consideration of price adjustments to maintain profitability.

Potential international tariffs, particularly those discussed by the US in late 2023 and early 2024, introduce further pricing complexities, potentially increasing import costs and impacting competitiveness.

| Pricing Strategy Aspect | Key Considerations | Impact on Henkell Freixenet |

|---|---|---|

| Competitive Pricing | Market leadership, customer value perception | Essential for market share defense and growth initiatives |

| Premiumization | Elevating brands like Champagne Alfred Gratien | Capturing higher-value segments, catering to demand for quality |

| Cost Management | Rising grape costs (10-15% increase in Penedès, 2023-24) | Necessitates price adjustments or cost absorption strategies |

| External Factors | Potential US tariffs on sparkling wine | Risk of increased import costs, reduced competitiveness |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Henkell & Co. Sektkellerei KG is built upon a foundation of verified company data, including official product portfolios, pricing structures, distribution network details, and promotional campaign activities. We reference credible sources such as Henkell's corporate website, annual reports, industry-specific market research, and competitor analyses to ensure accuracy and relevance.