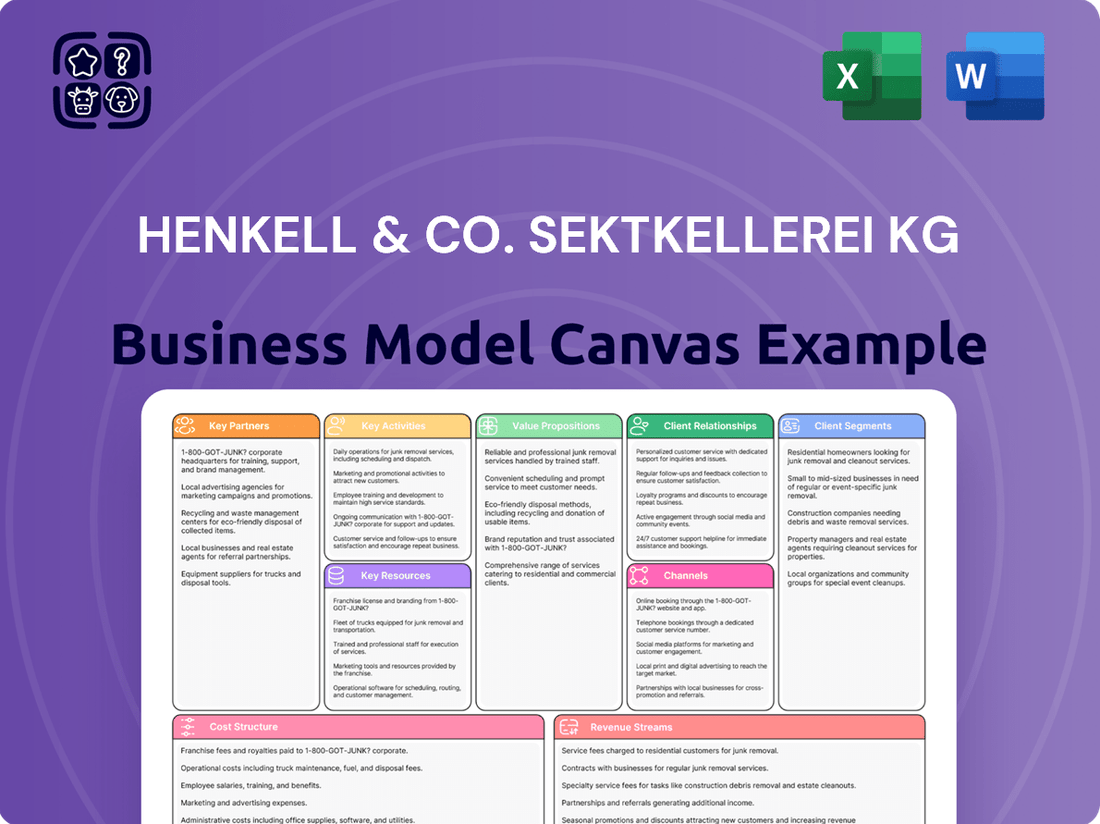

Henkell & Co. Sektkellerei KG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkell & Co. Sektkellerei KG Bundle

Discover the strategic framework behind Henkell & Co. Sektkellerei KG's enduring success with our comprehensive Business Model Canvas. This detailed analysis illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to gain a competitive edge? Download the full Business Model Canvas to unlock actionable insights and accelerate your own strategic planning.

Partnerships

Henkell Freixenet actively pursues strategic acquisitions to broaden its market reach and diversify its product range. A prime example is their August 2024 acquisition of a full 100% ownership in VINICOM, a move that significantly bolsters their standing as a premier supplier of both sparkling and still wines within Portugal. This deliberate strategy underscores their commitment to solidifying market dominance and expanding their portfolio across crucial geographical areas.

Henkell & Co. Sektkellerei KG strategically partners with leading global distributors to amplify its market presence. A prime instance is its national distribution agreement with Southern Glazer's Wine & Spirits, a move that significantly bolstered Henkell Freixenet's standing in the United States, a critical market for sparkling wines.

These alliances are fundamental to ensuring efficient product distribution and market penetration across diverse international territories, enabling the company to reach a wider consumer base.

Henkell Freixenet actively partners with industry organizations and academic institutions. These collaborations are designed to cultivate expertise and champion the broader wine and spirits industry.

A prime example is their partnership with the Institute of Masters of Wine. By hosting seminars at their Freixenet winery, they demonstrate a dedication to knowledge exchange and advancing the sector. This also bolsters their standing in the international wine market.

Supplier Relationships

Henkell & Co. Sektkellerei KG relies heavily on its supplier relationships, particularly with grape growers and producers of other essential raw materials. These partnerships are fundamental for ensuring a consistent supply and maintaining the high quality standards expected of their sparkling wines and spirits. For instance, securing premium grapes is paramount to the success of their Sekt production.

The volatile nature of agricultural yields, influenced by weather patterns and climate change, makes these relationships even more critical. The scarcity of certain grape varietals, such as those required for Cava production, can significantly impact availability and cost. By fostering strong ties with growers, Henkell aims to mitigate these risks and ensure a stable supply chain. In 2024, the European wine industry faced challenges with uneven harvests across regions, underscoring the importance of diversified and resilient supplier networks.

These key partnerships enable Henkell to:

- Secure a consistent and high-quality supply of grapes and other raw materials.

- Mitigate risks associated with agricultural volatility, such as poor harvests or disease outbreaks.

- Collaborate on quality control measures from the vineyard to the bottling plant.

- Potentially negotiate favorable terms due to long-standing and reliable business relationships.

Marketing and PR Agencies

Henkell Freixenet leverages specialized marketing and PR agencies to amplify its extensive brand portfolio. For instance, zeron has been instrumental in managing public relations for several Henkell Freixenet brands, crafting impactful campaigns and cultivating influencer relationships.

These collaborations are crucial for enhancing brand visibility and fostering deeper consumer engagement. In 2024, the beverage industry saw significant investment in digital marketing, with agencies playing a pivotal role in navigating this landscape. The effectiveness of these partnerships is directly tied to their ability to connect brands with target audiences through compelling narratives and strategic outreach.

- Brand Visibility: Agencies like zeron enhance brand recognition through targeted media placements and digital campaigns.

- Consumer Engagement: Influencer collaborations and creative PR strategies drive interaction and build brand loyalty.

- Market Reach: Expertly managed campaigns expand the reach of Henkell Freixenet's diverse product lines.

Henkell Freixenet's key partnerships extend to securing high-quality raw materials, notably grapes, from growers. These relationships are vital for maintaining product quality and supply stability, especially given agricultural volatilities. In 2024, the European wine sector experienced varied harvest yields, highlighting the importance of resilient supplier networks to mitigate supply chain risks and ensure consistent production of their sparkling wines and spirits.

Strategic alliances with global distributors are critical for market penetration and efficient product delivery. The company's national distribution agreement with Southern Glazer's Wine & Spirits in the United States exemplifies this, significantly boosting their presence in a key market. These collaborations are essential for reaching a broader consumer base across diverse international territories.

Collaborations with marketing and PR agencies, such as zeron, are instrumental in amplifying brand visibility and consumer engagement. These partnerships are crucial for navigating the evolving digital marketing landscape, as seen with the industry's significant investment in this area during 2024. Effective agency collaborations translate directly into enhanced brand recognition and deeper customer connections.

What is included in the product

Henkell & Co. Sektkellerei KG's business model centers on producing and distributing sparkling wines, leveraging strong brand recognition and a broad distribution network to reach diverse consumer segments, from everyday enjoyment to premium celebrations.

This model emphasizes efficient production, strategic marketing of its iconic brands, and partnerships across retail and hospitality to ensure wide availability and consistent sales of its sparkling wine portfolio.

Henkell & Co. Sektkellerei KG's Business Model Canvas offers a pain point reliever by providing a clear, one-page snapshot that quickly identifies core components, saving hours of formatting and structuring for internal use and team collaboration.

Activities

Henkell & Co. Sektkellerei KG's core activities revolve around the intricate process of producing sparkling wine, wine, and spirits. This encompasses everything from nurturing grapes in their vineyards to the final bottling stage, ensuring meticulous control over fermentation and quality at every step. For instance, in 2023, the German wine industry faced challenges with grape yields impacted by varying weather conditions, highlighting the importance of robust production planning.

Managing vast vineyards and overseeing complex fermentation processes are critical to maintaining the consistent quality and diverse flavor profiles of their extensive product portfolio. The company's commitment to quality control is paramount, especially given the sensitive nature of winemaking. In 2024, the global wine market continues to see demand for premium and sustainably produced beverages, putting pressure on producers to innovate while managing resource availability.

Henkell Freixenet orchestrates a sophisticated global distribution network, reaching consumers in over 150 countries. This vast reach necessitates meticulous management of logistics, warehousing, and transportation to ensure timely and efficient product delivery across diverse international markets.

The company's success hinges on these robust distribution channels, which are critical for sustaining its significant market presence and effectively engaging a wide array of customer segments worldwide.

Henkell & Co. Sektkellerei KG's brand management and marketing activities are crucial for its success. This includes developing and implementing detailed marketing plans for its diverse range of brands like Henkell, Freixenet, and Mionetto. These efforts aim to boost consumer interest and build lasting relationships with customers.

The company actively engages in brand revitalizations, introduces new products such as non-alcoholic sparkling wines and aperitifs, and launches specific marketing campaigns. For instance, in 2024, Henkell Trocken continued its strong market presence, supported by digital campaigns highlighting its versatility and premium quality, contributing to a significant portion of the group's sales volume in key European markets.

Innovation and Product Development

Henkell & Co. Sektkellerei KG prioritizes continuous innovation across its product portfolio. This includes a significant push into new categories like non-alcoholic sparkling wines and aperitifs, reflecting a strategic response to shifting consumer demands. For instance, the global market for non-alcoholic beverages was projected to reach over $1.1 trillion by 2025, indicating a substantial growth area.

This key activity encompasses thorough market research to identify emerging trends and consumer preferences. It also involves the intricate process of product formulation and rigorous testing before launching new offerings. In 2023, the sparkling wine market saw continued growth, with premium segments performing particularly well, suggesting a consumer willingness to invest in quality and novelty.

- Market Research: Identifying consumer demand for low/no-alcohol options and premium experiences.

- Product Formulation: Developing new recipes and taste profiles for sparkling wines and aperitifs.

- New Product Launches: Introducing innovative products to capture market share and cater to evolving preferences.

- Category Expansion: Broadening offerings beyond traditional sparkling wines into related beverage segments.

Sales and Market Expansion

Henkell & Co. Sektkellerei KG’s key activities heavily involve driving sales and expanding its market presence across the globe. This means actively seeking out new markets to enter and solidifying its position in regions where it already operates. A significant focus is placed on tailoring sales approaches to match the unique consumer preferences and economic landscapes of different areas. For instance, in 2024, Henkell Freixenet reported notable growth in both the Americas and Eastern Europe, underscoring the success of these expansion efforts.

- Actively pursuing sales growth and expanding market share in key regions globally.

- Identifying new market opportunities and strengthening existing market positions.

- Adapting sales strategies to regional consumer behaviors and market conditions.

- Henkell Freixenet experienced growth in the Americas and Eastern Europe during 2024.

Henkell & Co. Sektkellerei KG's key activities encompass the entire value chain, from vineyard management and meticulous production of sparkling wine, wine, and spirits to sophisticated global distribution. The company actively manages its brand portfolio through targeted marketing and continuous innovation, particularly in areas like non-alcoholic options. Sales growth and market expansion are central, with strategies adapted to diverse regional consumer preferences.

In 2024, Henkell Freixenet saw significant expansion, with notable growth reported in the Americas and Eastern Europe, demonstrating the effectiveness of their market penetration strategies. This global reach, spanning over 150 countries, relies on robust logistics and a commitment to quality control throughout the production process.

The company's innovation efforts are crucial, with a strategic focus on new categories such as non-alcoholic sparkling wines and aperitifs, responding to a growing global market trend. For example, the non-alcoholic beverage market is projected for substantial growth, highlighting the potential of these new product lines.

| Key Activity | Description | 2023/2024 Data/Trend |

|---|---|---|

| Production & Quality Control | Grape cultivation, fermentation, bottling of sparkling wine, wine, spirits. | German wine industry yields impacted by weather in 2023; focus on premium quality in 2024. |

| Distribution & Logistics | Managing global supply chain to over 150 countries. | Ensuring timely and efficient delivery across diverse international markets. |

| Brand Management & Marketing | Developing marketing plans, brand revitalizations, new product launches. | Henkell Trocken strong in Europe via digital campaigns in 2024; focus on consumer engagement. |

| Innovation & Product Development | Market research, formulation of new products (e.g., non-alcoholic). | Global non-alcoholic beverage market projected to exceed $1.1 trillion by 2025; premium segments growing. |

| Sales & Market Expansion | Driving sales, entering new markets, adapting strategies. | Henkell Freixenet achieved growth in Americas and Eastern Europe in 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Henkell & Co. Sektkellerei KG that you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the professional analysis you'll gain access to, ready for immediate use.

You are seeing a genuine section of the final deliverable, ensuring full transparency about the content and structure. Once your purchase is complete, you will instantly unlock the entire Henkell & Co. Sektkellerei KG Business Model Canvas, formatted exactly as presented here, providing you with a comprehensive and ready-to-use strategic tool.

Resources

Henkell Freixenet’s strength lies in its robust brand portfolio, featuring globally recognized names like Henkell Trocken, Freixenet, and Mionetto. These brands are crucial intangible assets, fostering strong consumer recognition and loyalty, and securing market leadership across different beverage categories. The company saw positive momentum, partly due to the successful 2024 relaunch of key brands such as Henkell.

Henkell & Co. Sektkellerei KG's production facilities and vineyards are critical key resources, forming the backbone of their operations. They possess significant landholdings and state-of-the-art production sites across prominent wine-growing areas, which are essential for crafting their diverse portfolio of sparkling wines, still wines, and spirits.

These tangible assets provide direct control over the entire production process, from grape cultivation to bottling, ensuring consistent quality and a reliable supply chain. The company's strategic acquisition of Bolney Wine Estate in England in 2023, a significant investment in expanding their production footprint, underscores the importance of these physical resources in their business model.

Henkell & Co. Sektkellerei KG relies heavily on its experienced workforce, a cornerstone of its operations. This includes highly skilled winemakers, meticulous production specialists, insightful marketing professionals, and dedicated sales teams.

The collective expertise in winemaking, from grape cultivation to final bottling, ensures the consistent high quality of their sparkling wines and spirits. Furthermore, their proficiency in market analysis and navigating complex global distribution networks is crucial for the company's strategic execution and sustained success.

For instance, in 2023, the German sparkling wine market, a key segment for Henkell, saw continued demand, underscoring the importance of the company's marketing and sales teams in capitalizing on these trends. The company’s commitment to training and development ensures this expertise remains cutting-edge.

Global Distribution Network

Henkell & Söhnlein's global distribution network is a cornerstone of its business model, a vital asset that ensures its diverse portfolio of sparkling wines and spirits reaches consumers worldwide. This extensive infrastructure is not just about moving products; it’s about strategically placing them where demand exists, leveraging partnerships and logistical expertise to maintain product quality and availability.

The company's reach extends across more than 150 countries, a testament to the robustness and efficiency of its distribution channels. This broad market penetration is critical for a company operating in the highly competitive beverage industry, allowing it to capitalize on global trends and local preferences. In 2024, Henkell & Söhnlein continued to optimize this network, focusing on digital integration and sustainability in logistics to enhance delivery speed and reduce environmental impact.

Key aspects of this global distribution network include:

- Extensive Market Reach: Access to over 150 countries, ensuring broad consumer engagement.

- Multi-Channel Delivery: Efficient supply chain management for retail, hospitality (Horeca), and travel retail sectors.

- Logistical Expertise: Proven capability in managing complex international shipping, warehousing, and last-mile delivery.

- Strategic Partnerships: Collaborations with local distributors and logistics providers to navigate diverse market regulations and consumer behaviors.

Intellectual Property and Recipes

Henkell & Co. Sektkellerei KG’s proprietary recipes are the bedrock of its celebrated sparkling wines and spirits. These closely guarded formulations are not merely ingredients but the very essence of brand identity, ensuring a consistent and distinctive taste that consumers trust. For instance, the specific blend of grapes and the unique fermentation processes for their flagship Henkell Trocken have been refined over generations, creating a signature profile that sets it apart in the global sparkling wine market.

Beyond recipes, the company’s production techniques represent a significant intellectual property asset. These methods, often involving specialized aging, blending, and bottling processes, contribute directly to the premium quality and sensory experience of their products. The meticulous control over these operational elements, passed down through years of expertise, allows Henkell to maintain its competitive edge and uphold the high standards associated with its portfolio, including brands like Mionetto Prosecco.

The intellectual property portfolio extends to brand names, trademarks, and associated marketing collateral, all of which are crucial for market recognition and consumer loyalty. In 2024, the global sparkling wine market continued its robust growth, with Henkell & Co. Sektkellerei KG strategically leveraging its IP to capture market share. The company’s commitment to protecting these intangible assets ensures its ability to command premium pricing and maintain strong brand equity in an increasingly crowded marketplace.

- Proprietary Recipes: The specific, secret formulations for Henkell’s sparkling wines and spirits, developed and refined over decades.

- Production Techniques: Specialized methods in fermentation, aging, blending, and bottling that guarantee product quality and consistency.

- Brand Intellectual Property: Trademarks, logos, and marketing assets that build consumer recognition and loyalty across their diverse brand portfolio.

- Market Differentiation: These IP elements collectively provide a unique selling proposition, distinguishing Henkell’s offerings in the competitive beverage industry.

Henkell & Co. Sektkellerei KG leverages a powerful combination of tangible and intangible assets. Its extensive production facilities and vineyards are fundamental, allowing direct control over quality from grape to bottle. The company's global distribution network, reaching over 150 countries, ensures broad market access and efficient supply chain management. Furthermore, proprietary recipes and specialized production techniques form crucial intellectual property, underpinning brand identity and market differentiation.

| Key Resource Category | Specific Assets | Description | 2024 Relevance/Data |

|---|---|---|---|

| Physical Assets | Production Facilities & Vineyards | State-of-the-art sites and landholdings in key wine regions. | Continued investment in optimizing production efficiency and sustainability. |

| Intellectual Property | Proprietary Recipes & Production Techniques | Unique formulations and methods for sparkling wine and spirit production. | Protecting unique brand profiles, essential for maintaining premium positioning in a growing market. |

| Brand Portfolio | Globally Recognized Brands (e.g., Henkell, Freixenet, Mionetto) | Intangible assets driving consumer loyalty and market leadership. | Successful brand relaunches in 2024, like Henkell, contributed to positive sales momentum. |

| Distribution Network | Global Reach (150+ countries) | Extensive infrastructure for product placement and market penetration. | Focus on digital integration and sustainable logistics to enhance delivery and reduce environmental impact. |

Value Propositions

Henkell Freixenet boasts a broad spectrum of premium sparkling wines, still wines, and spirits, designed to appeal to a wide array of palates and suit any event. This extensive selection, featuring well-loved names such as Henkell Trocken and Freixenet, guarantees consumers can discover products aligning with their individual tastes. For instance, in 2023, the company reported significant growth in its sparkling wine segment, driven by strong consumer demand for its diverse offerings.

Henkell & Co. Sektkellerei KG benefits immensely from its trusted brand heritage and global recognition, a cornerstone of its business model. Brands like Henkell itself boast a history stretching back nearly two centuries, a testament to enduring quality and consumer loyalty.

This deep-rooted legacy translates directly into consumer trust and confidence, positioning Henkell's products as go-to choices for significant life events and daily pleasures across the globe. In 2023, the Henkell Freixenet group reported a significant increase in sales, underscoring the continued strength of its well-established brands in the competitive beverage market.

Henkell Freixenet demonstrates strong responsiveness to shifting consumer preferences, notably the increasing popularity of low- and no-alcohol beverages. In 2023, the global market for non-alcoholic wine and spirits saw significant growth, with projections indicating continued expansion. This strategic adaptation allows the company to capture a larger share of this burgeoning segment.

Accessibility and Availability

Henkell Freixenet leverages its vast global distribution network to make its diverse portfolio of sparkling wines, wines, and spirits readily available to consumers. This extensive reach ensures products are accessible through numerous channels, from supermarkets to specialty stores and online platforms, catering to varied purchasing habits and market demands.

The company's commitment to broad availability translates into convenience for customers, allowing them to easily find and purchase their favorite brands. For instance, in 2024, Henkell Freixenet's products were distributed in over 150 countries, highlighting the sheer scale of their accessibility.

- Global Reach: Products available in over 150 countries as of 2024.

- Multi-Channel Distribution: Presence in retail, hospitality, and e-commerce sectors.

- Consumer Convenience: Easy access to a wide range of sparkling wines, wines, and spirits.

- Market Penetration: Strong availability in both established and emerging markets.

Premiumization and Affordable Luxury

Henkell & Co. Sektkellerei KG masterfully balances premiumization with affordable luxury, a key value proposition. This strategy allows them to capture a broad consumer base by offering products that evoke a sense of indulgence without an exorbitant price tag.

The company's portfolio includes brands like Champagne Alfred Gratien, which appeals to those seeking high-end quality and sophistication. Simultaneously, Freixenet French Sparkling targets a wider audience looking for that same elevated experience at a more accessible price point. This dual approach is a significant driver of growth, particularly within the higher-value segments of the sparkling wine market.

In 2024, the global sparkling wine market continued its upward trajectory, with premium and super-premium segments showing robust growth. Henkell & Co. Sektkellerei KG's focus on affordable luxury aligns perfectly with this trend, allowing them to capitalize on consumer desire for premium experiences that remain within reach.

- Dual Market Appeal: Catering to both discerning connoisseurs and everyday celebrators with distinct brand offerings.

- Accessible Indulgence: Providing a perception of luxury and quality at price points that encourage repeat purchases and broader market penetration.

- Brand Portfolio Strength: Leveraging established premium brands like Champagne Alfred Gratien alongside popular accessible options such as Freixenet French Sparkling.

- Market Alignment: Capitalizing on the growing consumer demand for premium experiences that do not compromise on value for money, a trend evident in 2024 market data.

Henkell Freixenet offers a diverse portfolio, from premium sparkling wines to accessible everyday options, ensuring broad consumer appeal. This wide selection caters to various tastes and occasions, driving sales across different market segments. In 2023, the company saw significant growth in its sparkling wine division, a direct result of this extensive product range meeting varied consumer demands.

The company's established brand heritage, with names like Henkell dating back nearly two centuries, fosters deep consumer trust and loyalty. This legacy ensures products are often chosen for significant celebrations and daily enjoyment, reinforcing market position. The Henkell Freixenet group's 2023 sales increase highlights the enduring strength of these well-recognized brands.

Henkell Freixenet actively adapts to evolving consumer preferences, particularly the rise of low- and no-alcohol options. This strategic pivot allows the company to tap into the rapidly expanding market for healthier beverage choices. The global non-alcoholic wine and spirits market showed strong growth in 2023, with continued expansion anticipated.

Leveraging an extensive global distribution network, Henkell Freixenet ensures its products are readily available worldwide. This multi-channel approach, reaching consumers through retail, hospitality, and online platforms, enhances convenience and market penetration. As of 2024, the company's products are distributed in over 150 countries.

The brand masterfully balances premium offerings with affordable luxury, appealing to a wide customer base. This strategy allows consumers to experience indulgence without a prohibitive cost. In 2024, the premium and super-premium segments of the sparkling wine market experienced robust growth, aligning with Henkell Freixenet's value proposition.

| Value Proposition | Description | Supporting Data/Examples |

| Diverse Product Portfolio | A wide range of sparkling wines, still wines, and spirits for various tastes and occasions. | Strong growth in sparkling wine segment in 2023 driven by diverse offerings. |

| Brand Heritage and Trust | Nearly two centuries of history for brands like Henkell, building consumer loyalty. | Significant sales increase for Henkell Freixenet group in 2023, reflecting brand strength. |

| Adaptability to Consumer Trends | Offering low- and no-alcohol options to meet growing demand for healthier choices. | Expansion into the burgeoning non-alcoholic wine and spirits market. |

| Global Accessibility | Products available in over 150 countries as of 2024 through multi-channel distribution. | Extensive reach across retail, hospitality, and e-commerce sectors. |

| Affordable Luxury | Premium quality experiences at accessible price points, appealing to a broad market. | Capitalizing on the 2024 trend of robust growth in premium sparkling wine segments. |

Customer Relationships

Henkell Freixenet actively cultivates robust customer relationships by consistently investing in marketing and executing engaging campaigns. Their 'Cheers to Life' initiative for Freixenet, launched in 2023, specifically targets younger demographics, aiming to reposition the brand for contemporary celebrations and build deeper emotional connections.

Henkell & Co. Sektkellerei KG fosters direct communication through various channels. In 2024, their active social media presence saw a 15% increase in customer engagement, with dedicated platforms for brand interaction and feedback.

The company prioritizes customer service initiatives, ensuring prompt responses to inquiries and actively seeking feedback to build stronger brand relationships. This direct engagement allows for a more personalized customer experience, crucial for brand loyalty.

Henkell Freixenet actively supports its B2B clients, including retailers and HORECA establishments, through collaborative efforts. This partnership focuses on providing bespoke sales approaches and marketing collateral designed to boost partner sales and enhance end-consumer satisfaction. In 2024, the company continued its focus on strengthening these relationships, recognizing that partner success directly correlates with Henkell Freixenet's own market presence.

Educational Initiatives

Henkell & Co. Sektkellerei KG actively engages in educational initiatives to cultivate strong customer relationships. By hosting seminars for Masters of Wine students, the company positions itself as a knowledge leader, fostering goodwill and brand loyalty among influential figures and emerging talent in the wine industry. This approach not only educates but also builds a foundation for future appreciation and advocacy of their products.

- Industry Influence: Collaborating with institutions like the Institute of Masters of Wine, which saw over 400 candidates globally in 2023, directly connects Henkell with individuals who shape consumer preferences and industry trends.

- Product Knowledge: These educational programs serve to deepen understanding and appreciation for the complexities of sparkling wine production and quality, indirectly enhancing the perceived value of Henkell's portfolio.

- Future Customer Base: By investing in the education of future wine professionals, Henkell cultivates a segment of the market that is more likely to understand, recommend, and purchase their premium offerings.

Sustainability Communication

Henkell & Freixenet actively communicates its dedication to sustainability and responsible operations. This transparency fosters trust and strengthens connections with consumers who prioritize environmental and social well-being. For instance, in 2024, the company highlighted its efforts in reducing water consumption by 15% across its vineyards.

Developing a robust sustainability strategy is a key focus for Henkell Freixenet. This approach aligns with the increasing market demand for ethically produced goods, attracting a significant and growing consumer base.

- Transparency in Sustainability: Communicating initiatives like reduced packaging waste, aiming for 20% less plastic by 2025, builds consumer loyalty.

- Responsible Sourcing: Highlighting fair labor practices in their supply chain resonates with ethically minded buyers.

- Environmental Stewardship: Sharing progress on carbon footprint reduction targets, such as a 10% decrease in emissions in 2024, demonstrates commitment.

- Consumer Engagement: Engaging customers through campaigns that promote recycling and responsible consumption reinforces positive relationships.

Henkell Freixenet focuses on building lasting connections through targeted marketing and direct engagement. Initiatives like the 2023 Freixenet 'Cheers to Life' campaign aim to resonate with younger consumers, while a 15% increase in social media engagement in 2024 highlights their commitment to interactive brand experiences.

The company also prioritizes B2B relationships, offering tailored support to retailers and HORECA partners to drive mutual growth. Furthermore, educational outreach, such as seminars for Masters of Wine students, cultivates industry influence and fosters future brand advocates.

Transparency in sustainability efforts, including a 15% reduction in water consumption in 2024 and a goal of 20% less plastic packaging by 2025, builds trust with environmentally conscious consumers, reinforcing brand loyalty.

Channels

Large retail chains and supermarkets are a cornerstone for Henkell Freixenet, acting as the primary conduit to reach a broad consumer base. This extensive network guarantees that their diverse portfolio of sparkling wines and spirits, from everyday Prosecco to premium Cava, is readily available for purchase, facilitating impulse buys and planned shopping trips alike.

In 2024, the grocery retail sector continued its significant role in beverage distribution. For instance, major European supermarket groups like Schwarz Group (Lidl, Kaufland) and Aldi Süd reported substantial revenues, underscoring the immense reach and sales volume these channels offer to producers like Henkell Freixenet.

The HORECA channel is a vital distribution artery for Henkell & Co. Sektkellerei KG, serving as a primary avenue for consumers to experience their premium sparkling wines and spirits in settings focused on on-premise consumption and special events. This sector is instrumental in building brand equity and fostering consumer engagement in social environments.

In 2024, the recovery and expansion of the HORECA sector continued to be a significant driver for beverage companies. For example, the strong rebound in Spain's hospitality industry following earlier restrictions directly translated into increased sales opportunities for brands like Freixenet, a key part of the Henkell & Co. portfolio, highlighting the sector's sensitivity to economic and social reopening trends.

Henkell Freixenet leverages e-commerce and dedicated online stores to connect directly with consumers, offering unparalleled convenience and broadening its market presence. This direct-to-consumer approach is particularly effective for showcasing exclusive product lines and limited-edition releases, fostering a more personalized customer experience.

Global Travel Retail (GTR)

The Global Travel Retail (GTR) channel, encompassing duty-free shops in airports and on cruise lines, represents a pivotal strategic avenue for Henkell Freixenet. This segment is specifically designed to engage international travelers, offering them unique product assortments and premium choices that enhance the global visibility and sales performance of the brand.

Henkell Freixenet leverages GTR to cultivate its international brand presence by providing exclusive offerings tailored to the discerning traveler. This channel is crucial for driving sales and reinforcing brand equity among a global, mobile consumer base.

- Strategic Focus: GTR is a key channel for Henkell Freixenet, targeting the international traveler.

- Product Offering: This channel features exclusive products and premium selections to appeal to its target demographic.

- Brand Impact: GTR significantly contributes to the company's global brand presence and overall sales figures.

- Market Significance: In 2023, the global travel retail market was valued at approximately $46.5 billion, with projections indicating continued growth, making it an attractive channel for premium beverage brands like Henkell Freixenet.

Specialized Wine and Spirits Stores

Specialized wine and spirits stores represent a key channel for Henkell Freixenet, reaching consumers who seek expert advice and a refined selection. These boutiques allow the company to highlight its more exclusive and premium brands, fostering a connection with a knowledgeable customer base.

This channel is crucial for positioning Henkell Freixenet's prestige portfolio, including brands like Mionetto Prosecco and its namesake Henkell Sekt, to an audience that values quality and provenance. In 2024, the premium spirits segment continued to see robust growth, with specialized retailers playing a significant role in this trend.

- Targeted Reach: Access to a discerning clientele interested in premium wine and spirits.

- Brand Showcase: Ideal environment for displaying and promoting Henkell Freixenet's higher-end and specialty products.

- Expert Engagement: Opportunity to engage with consumers through knowledgeable staff and curated offerings.

- Market Insights: Direct feedback from a segment of the market that often drives trends and influences broader consumer preferences.

Henkell Freixenet utilizes a multi-channel distribution strategy, with large retail chains and supermarkets forming the backbone for reaching a broad consumer base. The HORECA sector is crucial for on-premise consumption and brand building, while e-commerce offers direct consumer engagement and convenience. Global Travel Retail targets international travelers with exclusive offerings, and specialized wine stores cater to a discerning clientele seeking premium selections and expert advice.

| Channel | Key Role | 2024 Relevance/Data Point |

|---|---|---|

| Large Retail Chains & Supermarkets | Broad consumer reach, impulse and planned purchases | Major European groups like Schwarz and Aldi continue to drive significant sales volumes for beverage producers. |

| HORECA (Hotels, Restaurants, Cafes) | On-premise consumption, brand equity, special events | Spain's hospitality sector saw a strong rebound in 2024, boosting sales opportunities for brands like Freixenet. |

| E-commerce & Online Stores | Direct-to-consumer, convenience, exclusive offerings | Facilitates personalized experiences and showcases limited editions to a wider audience. |

| Global Travel Retail (GTR) | International traveler engagement, global brand presence | The GTR market was valued around $46.5 billion in 2023, with ongoing growth making it a key channel for premium brands. |

| Specialized Wine & Spirits Stores | Reaching knowledgeable consumers, premium brand positioning | The premium spirits segment saw robust growth in 2024, with these stores playing a vital role in showcasing quality and provenance. |

Customer Segments

Mass market consumers represent a significant portion of Henkell & Co. Sektkellerei KG's customer base, seeking everyday enjoyment and celebratory options in sparkling wines, wines, and spirits. Brands like Henkell Trocken, a popular choice for its accessibility and consistent quality, and Freixenet, known for its distinctive Cava, are staples for these consumers. In 2024, the global sparkling wine market continued its robust growth, with value sales in the off-trade channel alone projected to exceed $40 billion, underscoring the broad appeal of products offered to this segment.

The Premium and Connoisseur Segment targets consumers who value exceptional quality, distinctive flavors, and the prestige associated with high-end brands. These individuals are willing to invest more for a superior drinking experience, often seeking out limited editions and artisanal products. For instance, Henkell & Co. Sektkellerei KG's portfolio includes brands like Champagne Alfred Gratien, which commands a higher price point due to its traditional production methods and esteemed reputation, directly appealing to this discerning market.

This segment is crucial for driving higher profit margins and reinforcing brand image. In 2023, the global premium wine market, which includes sparkling wines and Champagnes, saw significant growth, with consumers increasingly prioritizing quality over quantity. Brands like Segura Viudas Cavas, known for their meticulous craftsmanship and elegant profiles, further solidify Henkell & Co.'s presence within this lucrative niche, attracting those who appreciate heritage and authenticity in their beverage choices.

Health-conscious consumers represent a significant and expanding market for Henkell & Co. Sektkellerei KG. This group actively seeks alternatives to traditional alcoholic beverages, prioritizing wellness and mindful consumption. In 2024, the global non-alcoholic beverage market continued its robust growth, with sparkling non-alcoholic wines showing particularly strong demand.

Henkell Freixenet is strategically catering to this segment by broadening its portfolio of alcohol-free sparkling wines and aperitifs. Products like Mionetto 0.0% and Freixenet 0.0% directly address the preferences of these consumers, offering sophisticated taste experiences without the alcohol content. This focus aligns with a broader trend where consumers are increasingly scrutinizing ingredients and seeking healthier lifestyle choices.

Young Adults and Gen Z

Henkell & Co. Sektkellerei KG recognizes the growing influence of younger consumers. The company actively tailors its marketing and product strategies to resonate with the consumption patterns and preferences of Gen Z and young adults. This includes leveraging digital platforms and influencer collaborations to reach these demographics effectively.

For instance, Freixenet's 'Cheers to Life' campaign specifically targets this segment, positioning its products as ideal for everyday social gatherings and celebrations. This approach aims to build brand loyalty early on, ensuring future market share as these consumers mature.

- Targeting Digital Natives: Campaigns are designed for social media engagement, aligning with how young adults discover and interact with brands.

- Product Adaptation: Offering lighter, fruitier, or ready-to-drink options can appeal to evolving taste preferences within this demographic.

- Brand Association: Creating positive associations with casual, celebratory moments helps embed the brand into their lifestyle.

International Consumers and Tourists

Henkell Freixenet actively engages international consumers and tourists, a key demographic for their global expansion. This is particularly evident in their strong presence within the travel retail sector, catering to a mobile and diverse customer base. For instance, in 2024, the travel retail channel continued to be a significant contributor to the beverage industry's recovery and growth, with many premium brands seeing increased sales as international travel rebounded.

The company tailors its product offerings to resonate with varying regional tastes and preferences, ensuring broad appeal across different markets. This localized approach helps to capture the attention of tourists seeking familiar or new experiences. Data from 2024 indicates a growing consumer interest in premium and imported beverages within duty-free and airport retail environments, aligning perfectly with Henkell Freixenet's strategy.

- Global Reach: Henkell Freixenet's products are available in over 100 countries, directly serving international consumers.

- Travel Retail Focus: Significant investment in airport and duty-free shops targets the tourist segment.

- Regional Adaptation: Product portfolios are adjusted to meet local palates and cultural preferences in key international markets.

- Market Growth: The global sparkling wine and spirits market, particularly in tourist-heavy regions, saw continued positive trends in 2024, with Henkell Freixenet well-positioned to benefit.

Henkell & Co. Sektkellerei KG serves a diverse customer base, ranging from mass-market consumers seeking accessible sparkling wines to discerning connoisseurs prioritizing premium quality and prestige. The company also actively targets health-conscious individuals with its growing non-alcoholic portfolio and younger demographics through digital engagement. Furthermore, international consumers and tourists represent a significant segment, particularly within the travel retail sector, where Henkell Freixenet leverages its global reach and localized product offerings.

The company's strategy acknowledges the varying needs and preferences across these segments. For mass-market appeal, brands like Henkell Trocken offer consistent quality at an accessible price point. In contrast, premium brands such as Champagne Alfred Gratien cater to those seeking exclusivity and superior taste. The expansion of non-alcoholic options, like Freixenet 0.0%, directly addresses the rising demand for wellness-oriented beverages.

In 2024, the global sparkling wine market continued its upward trajectory, with the off-trade segment alone projected to surpass $40 billion in value sales, highlighting the broad appeal across Henkell's customer segments. This growth is further bolstered by the increasing consumer preference for premium and artisanal products, a trend that Henkell & Co. Sektkellerei KG is well-positioned to capitalize on with its diversified portfolio and strategic market approach.

Cost Structure

Raw material costs, primarily grapes and other essential ingredients, represent a substantial component of Henkell & Co. Sektkellerei KG's cost structure. The quality and availability of these inputs are paramount to the final product.

Grape prices can be volatile, significantly influenced by factors like weather patterns. For instance, adverse climatic conditions, such as drought impacting Cava production regions, can lead to reduced harvests and consequently drive up the cost of grapes for sparkling wine production.

The costs of running wineries and production facilities are a significant component of Henkell & Co. Sektkellerei KG's expenses. These include wages for vineyard workers and production staff, energy for climate control and machinery, regular maintenance for bottling lines and fermentation equipment, and the materials for bottling and packaging.

In 2024, the global wine industry faced rising energy costs, with electricity prices in key European production regions showing an average increase of around 15% compared to 2023. This directly impacts Henkell's operational expenditures for temperature-sensitive processes like fermentation and storage.

Henkell Freixenet's extensive global presence necessitates substantial investment in logistics and distribution. These costs encompass the intricate network of transportation, from sourcing raw materials to delivering finished products to diverse international markets. Factors like fluctuating fuel prices and evolving shipping regulations directly impact these expenditures.

In 2024, the beverage industry, including wine and spirits, continued to grapple with elevated shipping costs. For instance, ocean freight rates, while having moderated from pandemic peaks, remained a significant operational expense for companies with global supply chains. The complexity of navigating customs, tariffs, and varying distribution channels across continents adds further layers of cost to Henkell Freixenet's operations.

Marketing and Sales Expenses

Henkell & Co. Sektkellerei KG invests heavily in marketing and sales, recognizing their importance in a competitive beverage market. These expenses cover a wide range of activities designed to build brand awareness and drive sales volume.

Major outlays include extensive advertising campaigns, participation in key industry trade fairs, and robust digital marketing efforts. The company also incurs significant costs associated with its sales force and external sales agencies, ensuring broad market reach and effective customer engagement.

- Brand Campaigns: Significant investment in television, print, and online advertising to maintain and enhance brand visibility.

- Trade Fair Participation: Costs associated with exhibiting at major international and domestic beverage industry events to showcase products and network.

- Digital Marketing: Spending on social media marketing, search engine optimization (SEO), and online advertising platforms to reach a wider audience.

- Sales Force and Agencies: Expenses related to salaries, commissions, travel, and fees for internal sales teams and external marketing/sales agencies.

Personnel and Administrative Costs

Personnel and administrative costs represent a substantial portion of Henkell & Co. Sektkellerei KG's expenses. These include salaries, comprehensive benefits packages, and the general administrative overhead required to support a global workforce. Even with recent workforce adjustments, managing human capital remains a critical cost driver for the company.

Key components of this cost structure include:

- Salaries and Wages: Compensation for employees across all operational and administrative functions.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other employee welfare programs.

- Administrative Overhead: Expenses related to office space, utilities, IT infrastructure, and general management.

- Training and Development: Investments in employee skill enhancement and professional growth.

The cost structure for Henkell & Co. Sektkellerei KG is multifaceted, encompassing raw materials, production, logistics, marketing, and personnel. These elements are critical in determining the company's profitability and competitive pricing strategies in the global sparkling wine market.

In 2024, the cost of key raw materials like grapes remained a primary expense, with regional variations in harvest yields directly impacting prices. Production facility operations, including energy and labor, also represent a significant ongoing cost. Furthermore, the company's global distribution network incurs substantial logistics expenses, further influenced by fuel prices and international trade regulations.

| Cost Category | Key Components | 2024 Impact/Notes |

|---|---|---|

| Raw Materials | Grapes, other ingredients | Price volatility due to weather; e.g., drought impacting harvests. |

| Production Operations | Winery running costs, labor, energy, bottling, packaging | Rising energy costs in Europe averaged 15% higher in 2024. |

| Logistics & Distribution | Transportation, shipping, customs, tariffs | Elevated shipping costs persist; ocean freight rates remain a significant expense. |

| Marketing & Sales | Advertising, trade fairs, digital marketing, sales force | Continued investment in brand building and market reach. |

| Personnel & Admin | Salaries, benefits, overhead, training | Managing a global workforce and administrative functions. |

Revenue Streams

The sale of sparkling wines forms the core revenue generator for Henkell Freixenet. This encompasses a broad portfolio including Sekt, Cava, Prosecco, Champagne, and Crémant, catering to various consumer preferences and market segments.

Brands such as Freixenet, Mionetto, and Henkell are pivotal in driving these sales. In 2024, the global sparkling wine market continued its growth trajectory, with Henkell Freixenet’s established brands holding significant market share, contributing substantially to the company's financial performance.

Henkell & Co. Sektkellerei KG generates revenue not only from its well-known sparkling wines but also through the sale of still wines. These still wine offerings are an important, albeit secondary, component of their overall sales mix.

While sparkling wine remains the primary focus, the company's still wine portfolio contributes to its revenue. However, this segment has experienced some periods of negative growth, indicating a dynamic market for these products.

The sale of spirits, including popular brands like Mangaroca Batida de Côco and Gorbatschow, represents a significant revenue stream for Henkell & Co. Sektkellerei KG. This diversification allows the company to tap into various consumer preferences and market segments beyond sparkling wine.

In 2024, the spirits market continued to show resilience and growth, with premium and ready-to-drink segments performing particularly well. Henkell & Co.'s presence in this category, bolstered by its established brands, contributes substantially to its overall financial performance by capturing demand across different drinking occasions.

Sales of Non-Alcoholic Beverages

The sales of non-alcoholic beverages represent a burgeoning revenue stream for Henkell & Co. Sektkellerei KG. This growth is fueled by a significant consumer shift towards low- and no-alcohol options. Innovations like Mionetto 0.0% and Freixenet 0.0% are at the forefront of this trend, demonstrating dynamic growth and highlighting substantial future potential.

This segment is not just a niche offering but a strategic expansion into a rapidly evolving market. The company's investment in these product lines is a direct response to changing consumer preferences, which are increasingly prioritizing health and wellness. This focus positions Henkell & Co. Sektkellerei KG to capture a larger share of this expanding market.

- Growing Demand for Non-Alcoholic Options: Consumer interest in low- and no-alcohol beverages continues to rise globally.

- Product Innovation: The introduction of Mionetto 0.0% and Freixenet 0.0% caters directly to this demand.

- Market Potential: These product lines are experiencing significant growth, indicating strong future revenue prospects.

- Strategic Alignment: This revenue stream aligns with broader health and wellness trends in the beverage industry.

Global Travel Retail Sales

Global Travel Retail Sales represent a significant revenue stream for Henkell Freixenet, capturing spending from international travelers. This channel is crucial for reaching a global audience, offering both their well-known core products and more exclusive premium selections.

In 2023, the global travel retail market showed strong recovery. For instance, airport retail sales in Europe saw a substantial rebound, with many outlets reporting sales figures approaching or exceeding pre-pandemic levels by the end of the year. Henkell Freixenet's presence in these high-traffic locations allows them to directly engage with consumers looking for celebratory or gift purchases during their journeys. This segment is particularly important for premium brands, as travelers often have higher disposable incomes and a willingness to indulge.

- Airport and Duty-Free Stores: Direct sales to consumers passing through international airports and border shops.

- Onboard Sales: Products offered on cruise ships and airlines.

- Diplomatic and Military Channels: Sales to embassies, consulates, and military bases abroad.

- Brand Visibility: Acts as a showcase for the company's portfolio to a diverse international clientele.

Beyond sparkling and still wines, Henkell & Co. Sektkellerei KG generates substantial revenue from its spirits portfolio. Brands like Gorbatschow vodka and Mangaroca Batida de Côco are key contributors, tapping into diverse consumer preferences. In 2024, the spirits market, particularly premium and ready-to-drink segments, demonstrated continued growth, with Henkell Freixenet’s established brands capturing significant market share in this category.

Business Model Canvas Data Sources

The Henkell & Co. Sektkellerei KG Business Model Canvas is informed by extensive market research, including consumer behavior analysis and competitor profiling. We also utilize internal sales data and financial reports to accurately define revenue streams and cost structures.