Henkel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkel Bundle

Henkel's robust brand portfolio and global reach present significant strengths, but understanding their specific vulnerabilities and untapped opportunities is crucial for strategic advantage. Our comprehensive SWOT analysis dives deep into these dynamics, offering a clear roadmap for navigating the competitive landscape.

Want the full story behind Henkel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Henkel Adhesive Technologies stands as the undisputed global leader in the adhesives market, a position that grants it a significant competitive advantage. This leadership is built on a comprehensive product range, profound industry knowledge, and strong, long-standing relationships with customers across numerous sectors.

The company's Adhesive Technologies division demonstrated robust performance, achieving sales of 5,475 million euros in the first half of 2024. This figure was bolstered by a 2.0 percent increase in organic sales, underscoring the unit's continued strength and market penetration.

Henkel benefits from a robust brand portfolio across its consumer-facing segments, now unified under the Consumer Brands division. This strong brand equity fosters significant market presence and cultivates deep customer loyalty, a key asset in competitive markets. The company's commitment to innovation is evident, with continuous investment in new product development that aligns with evolving consumer preferences and market dynamics.

The company's strategic focus on innovation is paying dividends, as demonstrated by the impressive performance of its top brands. In 2024, Henkel's leading consumer brands collectively achieved very strong organic growth. Notably, the Hair business within this segment experienced a substantial 6.9% organic growth, underscoring the success of its product development and marketing strategies in resonating with consumers.

Henkel showcased impressive financial resilience in 2024. The company achieved organic sales growth of 2.6%, reaching €21.6 billion, and saw a substantial 20.9% jump in adjusted operating profit to €3.1 billion. This strong showing, even amidst economic headwinds, highlights Henkel's adeptness in managing costs, refining its product offerings, and implementing effective pricing strategies.

Strategic Portfolio Management and Integration

Henkel's strategic portfolio management is a key strength, marked by the divestment of less profitable brands and targeted acquisitions in areas with higher growth and margins. This approach ensures a sharper focus on core competencies and future expansion opportunities.

The company's integration of its consumer goods businesses into a unified Consumer Brands unit is a significant achievement, exceeding initial expectations for speed and efficiency. This consolidation is projected to unlock substantial cost savings and enhance operational agility, directly contributing to improved profitability.

- Portfolio Optimization: Henkel has strategically divested non-core assets, sharpening its focus on high-margin, high-growth segments.

- Accelerated Integration: The merger of consumer businesses into the Consumer Brands unit is ahead of schedule, driving cost efficiencies.

- Profitability Boost: This strategic realignment is designed to enhance overall profitability and streamline operations for greater competitiveness.

Commitment to Sustainability and ESG

Henkel's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. The company has made substantial strides in reducing its environmental footprint, notably cutting CO2 emissions from production by 64% per ton of product compared to 2017 levels. This commitment resonates strongly with a growing segment of consumers and investors who prioritize eco-friendly practices, bolstering Henkel's brand image and long-term viability.

Furthermore, Henkel is actively increasing the use of recycled plastic in its packaging, with 89% of its packaging now being recyclable. This focus on circularity not only addresses environmental concerns but also positions Henkel favorably in a market increasingly demanding sustainable product solutions. The company's proactive approach to gender parity in leadership also contributes to its strong ESG profile.

- Reduced CO2 Emissions: 64% reduction per ton of product compared to 2017.

- Recyclable Packaging: 89% of packaging is now recyclable.

- ESG Appeal: Enhances reputation and attracts environmentally conscious consumers and investors.

- Gender Parity: Progress in promoting gender equality in leadership roles.

Henkel's Adhesive Technologies division is the global market leader, demonstrating strong performance with 5,475 million euros in sales for H1 2024, supported by 2.0% organic sales growth. The company also boasts a robust brand portfolio in its Consumer Brands segment, with leading brands achieving very strong organic growth in 2024, particularly the Hair business at 6.9%.

| Segment | H1 2024 Sales (million €) | H1 2024 Organic Growth (%) | 2024 Full Year Organic Sales Growth (%) |

|---|---|---|---|

| Adhesive Technologies | 5,475 | 2.0 | N/A |

| Consumer Brands (Overall) | N/A | N/A | N/A |

| Consumer Brands (Hair Business) | N/A | 6.9 | N/A |

What is included in the product

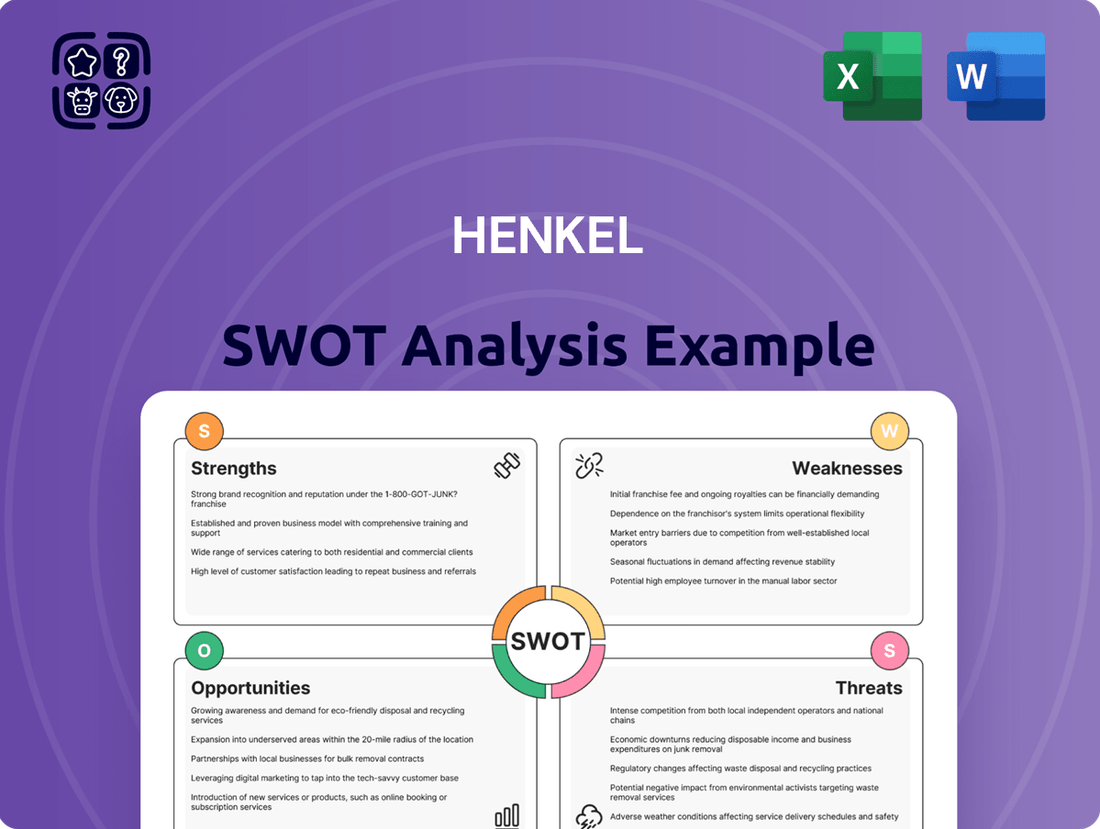

Analyzes Henkel’s competitive position through key internal and external factors, detailing its strengths in brand portfolio and market presence, weaknesses in innovation speed, opportunities in emerging markets and sustainability, and threats from intense competition and economic volatility.

Provides a clear, actionable framework to identify and address Henkel's strategic challenges and opportunities.

Weaknesses

Henkel's reliance on global markets makes it vulnerable to economic downturns. Geopolitical instability and rising inflation directly impact its operational costs, as seen with persistently strained supply chains and increased expenses throughout 2024, affecting raw material, labor, and logistics. These pressures can dampen both consumer and industrial demand, ultimately hitting sales and profit margins.

Henkel's Consumer Brands division saw a slight sales dip in 2024, with a more pronounced 3.5% organic decline in the first quarter of 2025. This downturn is largely attributed to softer demand for personal care and laundry items, specifically within the North American market.

The weakness in these specific product categories and geographic regions highlights a challenge for Henkel in sustaining uniform growth across its diverse consumer offerings and global footprint. North America, a significant market representing 28% of Henkel's 2024 revenue, experienced a 3.4% organic sales decrease in Q1 2025, underscoring the impact of these regional headwinds.

Henkel's recent growth trajectory shows a significant reliance on price increases, particularly within its Consumer Brands division. This strategy, while helpful in counteracting rising costs, poses a risk if consumers begin to resist higher prices or if competitors offer more compelling value propositions.

In the first quarter of 2025, Henkel reported that pricing remained a positive contributor to its Consumer Brands segment. However, this continued dependence on pricing for growth raises concerns about long-term sustainability and potential market share erosion in intensely competitive markets, underscoring the need for a stronger emphasis on volume-driven expansion through innovation.

Potential for Disappointing Market Expectations

Henkel's financial performance can sometimes fall short of analyst projections, leading to market disappointment. For instance, the company's Q4 2024 results and subsequent 2025 guidance did not meet the elevated expectations of many analysts, causing a noticeable dip in its stock price. This highlights a potential weakness where actual growth, especially within key segments like Adhesive Technologies and Consumer Brands, might not align with the aggressive growth rates anticipated by the market.

This disconnect can negatively impact investor sentiment and confidence. Analysts had projected stronger growth figures for both Adhesive Technologies and Consumer Brands in the fourth quarter of 2024 than what Henkel ultimately reported. Consequently, while the company may be achieving solid operational results, the perception of not meeting ambitious market forecasts can create a perception of underperformance.

- Q4 2024 Growth Disappointment: Henkel's reported growth in Q4 2024 was below analyst expectations.

- 2025 Guidance Impact: The company's outlook for 2025 also failed to impress the financial community.

- Stock Price Reaction: Disappointing results and guidance led to a significant decline in Henkel's share value.

- Analyst Expectations Gap: Specific business units, including Adhesive Technologies and Consumer Brands, saw growth rates lower than anticipated by analysts.

Complexity of Portfolio Optimization

While Henkel’s portfolio streamlining is a strategic advantage, the actual execution of divesting non-core assets and integrating new acquisitions presents significant complexity. This process demands considerable resources and meticulous planning to ensure smooth transitions and minimize operational disruptions.

The divestment of brands generating approximately €1 billion in sales, alongside the strategic exit from specific oral and skin care markets in North America and Europe, highlights the intricate nature of these portfolio adjustments. Success hinges on careful management to maintain market share and customer relationships during these shifts.

- Resource Intensity: Streamlining efforts, including divestitures and integrations, require substantial financial and human capital.

- Execution Risk: The successful exit from markets and divestment of brands, valued at around €1 billion in sales, carries inherent risks of disruption.

- Integration Challenges: Absorbing acquired businesses and brands into existing structures demands robust management to realize synergies and avoid brand dilution.

Henkel's reliance on price increases for growth, particularly in its Consumer Brands division, presents a significant weakness. This strategy, while boosting reported figures, risks alienating price-sensitive consumers and losing market share to competitors offering better value. The company's Q1 2025 results showed continued pricing contributions, but this dependence on price hikes rather than volume growth is unsustainable long-term.

The company's performance in Q4 2024 and its 2025 guidance missed analyst expectations, leading to a stock price dip. This disconnect between market anticipation and actual results, especially in Adhesive Technologies and Consumer Brands, can erode investor confidence and create a perception of underperformance, even if operational results are solid.

Henkel faces execution risks in its portfolio streamlining efforts, which involve divesting around €1 billion in sales and exiting specific markets. These complex transitions demand significant resources and meticulous management to avoid operational disruptions and maintain customer relationships.

The company's vulnerability to global economic downturns and geopolitical instability, as evidenced by strained supply chains and rising costs in 2024, directly impacts operational expenses and can dampen demand across its product lines.

Same Document Delivered

Henkel SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and guarantees you're getting the exact Henkel SWOT analysis you expect.

This is a real excerpt from the complete Henkel SWOT analysis document. Once purchased, you’ll receive the full, editable version, providing comprehensive insights.

You’re viewing a live preview of the actual Henkel SWOT analysis file. The complete version, detailing all strategic factors, becomes available after checkout.

Opportunities

Henkel can leverage the burgeoning consumer base in emerging markets, where rising disposable incomes are fueling demand for its adhesives, beauty care, and laundry & home care products. For instance, by 2025, the middle class in Asia is projected to reach 1.7 billion people, presenting a substantial opportunity for Henkel to expand its market share. Tailoring product portfolios and distribution strategies to local preferences will be key to unlocking this growth potential and driving significant revenue increases.

Accelerating digitalization and expanding e-commerce offers Henkel a significant opportunity to connect with more customers and boost engagement. This digital push can also refine operations and provide valuable insights into consumer preferences, ultimately streamlining supply chains.

Henkel's strategic focus on digital sales is key, aiming to increase the value derived from its online presence. For example, in 2024, the company continued to invest in its digital platforms to enhance customer experience and drive online revenue growth, building on the momentum from previous years where digital sales saw consistent year-over-year increases.

Henkel can bolster its market presence by strategically acquiring businesses that complement its existing product lines or by forging partnerships. This approach allows for accelerated entry into high-growth sectors and the adoption of cutting-edge technologies. For instance, their acquisition of Vidal Sassoon in China has already proven effective in solidifying Henkel's standing within the premium hair care market.

Innovation in Sustainable Solutions

Henkel can capitalize on the increasing demand for sustainable products by innovating in eco-friendly formulations, packaging, and manufacturing. This focus allows them to stand out in a competitive market.

Showcasing advancements like recyclable adhesives and CO2-reducing solutions, as seen at events like Labelexpo Europe 2025, demonstrates Henkel's commitment to sustainability and its potential to capture market share. This innovation aligns with growing consumer preferences and stricter environmental regulations.

- Market Growth: The global market for sustainable packaging is projected to reach $467.8 billion by 2027, according to Grand View Research, presenting a significant opportunity for Henkel's innovative solutions.

- Regulatory Tailwinds: Increasing government regulations worldwide promoting circular economy principles and reduced carbon emissions further bolster the demand for Henkel's eco-conscious product development.

- Brand Differentiation: By leading in sustainable innovation, Henkel can enhance its brand reputation and attract environmentally conscious consumers and business partners, potentially increasing sales and customer loyalty.

Growth in High-Value Industrial Applications

Henkel's Adhesive Technologies division is well-positioned to capitalize on the burgeoning demand for sophisticated bonding solutions in high-value industrial sectors. The company's strategic focus on areas like e-mobility and advanced automotive components presents a significant avenue for growth. By investing in cutting-edge research and development, Henkel aims to solidify its market position and secure long-term partnerships.

A prime example of this commitment is the opening of Henkel's advanced battery testing center in 2024. This facility is designed to accelerate the development of innovative adhesive solutions critical for the rapidly evolving electric vehicle market. Such investments are crucial for capturing market share in a sector projected for substantial expansion in the coming years.

The opportunity lies in leveraging these advanced capabilities to address complex challenges in:

- E-mobility: Developing specialized adhesives for battery pack assembly, thermal management, and structural integrity in electric vehicles, a market segment that saw significant investment and production increases in 2024.

- Integrated Automotive Components: Creating bonding solutions for lightweighting, advanced driver-assistance systems (ADAS) integration, and sophisticated interior/exterior assemblies.

- Aerospace and Electronics: Expanding the application of high-performance adhesives in demanding environments requiring extreme temperature resistance and structural reliability.

- Renewable Energy: Providing adhesive solutions for solar panel manufacturing and wind turbine component assembly, sectors experiencing robust growth and technological advancement.

Henkel's strategic expansion into emerging markets, particularly in Asia, presents a substantial growth avenue. By 2025, Asia's middle class is expected to number 1.7 billion, driving increased demand for Henkel's diverse product portfolio.

The company's commitment to digitalization and e-commerce, evident in its continued platform investments throughout 2024, offers a direct channel to engage a wider customer base and gather crucial consumer insights.

Strategic acquisitions and partnerships, such as the successful Vidal Sassoon acquisition in China, provide Henkel with opportunities to quickly enter high-growth segments and adopt new technologies.

Henkel's focus on sustainable innovation, exemplified by advancements in recyclable adhesives and CO2-reducing solutions showcased in 2025, positions it to capture market share amidst growing consumer and regulatory demand for eco-friendly products.

The Adhesive Technologies division is poised to benefit from the increasing demand for advanced bonding solutions in sectors like e-mobility, with investments in facilities like its 2024 battery testing center supporting growth in the electric vehicle market.

Threats

Henkel navigates fiercely competitive landscapes in both its industrial and consumer divisions, contending with formidable global and regional competitors. This rivalry often translates into significant pricing pressures and necessitates higher marketing investments, making it difficult to retain market share. For instance, in the consumer personal care segment, inflation-sensitive consumers are increasingly scrutinizing prices, impacting sales volumes for established brands.

Fluctuations in the prices of key raw materials, coupled with persistent global supply chain disruptions, represent a considerable threat to Henkel's financial performance. These external pressures can directly inflate production expenses and create uncertainty regarding the timely availability of critical inputs, necessitating ongoing strategic adjustments and robust sourcing strategies.

For instance, in 2024, Henkel, like many in the consumer goods sector, grappled with significant supply chain bottlenecks and escalating material costs, impacting its operational efficiency and profitability margins.

Henkel faces growing threats from increasingly stringent environmental regulations globally. For instance, the EU's proposed Packaging and Packaging Waste Regulation (PPWR) aims to mandate higher recycled content and reduce packaging waste, potentially increasing costs for raw materials and requiring significant investment in new packaging solutions. Failure to adapt to these evolving compliance requirements could lead to operational disruptions and financial penalties.

Currency Fluctuations and Geopolitical Instability

Henkel's global operations expose it to significant currency exchange rate volatility. When translating revenues earned in foreign currencies back into its reporting currency, unfavorable movements can lead to a reduction in reported sales and earnings. This was evident in the first half of 2024, where foreign exchange effects alone reduced Henkel's sales by a notable -1.9%.

Beyond currency, escalating geopolitical tensions and ongoing conflicts create a complex landscape of economic uncertainties. These broader instabilities can disrupt supply chains, impact consumer demand in affected regions, and generally create an unpredictable operating environment for a company with Henkel's international reach.

- Currency Headwinds: Foreign exchange rate fluctuations resulted in a -1.9% reduction in Henkel's sales during H1 2024.

- Geopolitical Risks: Global conflicts and political instability introduce significant economic uncertainties, potentially affecting market access and demand.

- Operational Disruptions: Geopolitical events can lead to supply chain interruptions and impact the ability to conduct business as usual in certain markets.

Shifting Consumer Preferences and Brand Loyalty

Consumer preferences in the FMCG sector are notoriously fickle, posing a significant threat to Henkel's established brands. Rapid shifts in demand can quickly impact sales for their Beauty Care and Laundry & Home Care divisions. For instance, weak US demand for personal care and laundry products was a contributing factor to a sales decline in Q1 2025, highlighting the vulnerability to changing consumer tastes.

Maintaining brand loyalty in this environment demands substantial and ongoing investment. Henkel must continuously innovate its product offerings and marketing strategies to stay relevant. This includes a deep understanding of evolving consumer needs and desires, which can range from sustainability concerns to ingredient preferences.

The challenge is amplified by the sheer pace of change. What resonates with consumers today might be obsolete tomorrow. This necessitates agile product development and marketing campaigns that can adapt quickly to emerging trends and competitive pressures.

Key considerations for Henkel include:

- Evolving demand: Monitoring and predicting shifts in consumer preferences for personal care and home care products.

- Brand relevance: Ensuring brands remain appealing through continuous innovation and effective marketing.

- Competitive landscape: Staying ahead of competitors who may be quicker to adapt to new consumer demands.

- Geographic variations: Addressing specific regional shifts in consumer behavior, such as the noted weakness in the US market.

Henkel faces significant threats from intense competition, particularly in its consumer goods segments, which can lead to price wars and higher marketing costs. Furthermore, the company is vulnerable to volatile raw material prices and ongoing global supply chain disruptions, as seen with cost pressures in early 2024. Increasingly strict environmental regulations, like the EU's PPWR, also pose a challenge by potentially increasing operational expenses and requiring substantial investment in new packaging solutions.

Currency exchange rate volatility remains a concern, with foreign exchange effects reducing Henkel's sales by -1.9% in H1 2024. Geopolitical instability adds another layer of risk, potentially disrupting supply chains and impacting demand in various markets. Shifts in consumer preferences, especially in the fast-moving consumer goods sector, necessitate continuous innovation and marketing efforts to maintain brand relevance and market share, with weak US demand for personal care products impacting sales in Q1 2025.

| Threat Category | Specific Example/Impact | Timeframe |

|---|---|---|

| Competitive Pressure | Pricing pressures and increased marketing investment needs | Ongoing |

| Supply Chain & Material Costs | Escalating material costs and supply chain bottlenecks | 2024 |

| Regulatory Changes | EU's PPWR mandating higher recycled content | Future Compliance |

| Currency Volatility | -1.9% sales reduction due to foreign exchange effects | H1 2024 |

| Consumer Preference Shifts | Weak US demand impacting personal care/laundry sales | Q1 2025 |

SWOT Analysis Data Sources

This Henkel SWOT analysis is built upon a foundation of credible data, including Henkel's official financial reports, comprehensive market research studies, and expert analyses of the consumer goods and adhesive technologies sectors.