Henkel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkel Bundle

Curious about Henkel's winning formula? Our comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Unlock the full strategic blueprint and gain actionable insights for your own business ventures.

Partnerships

Henkel’s Adhesive Technologies, Beauty Care, and Laundry & Home Care divisions depend on a robust global network of raw material suppliers. These partnerships are vital for maintaining product quality and managing production costs effectively.

In 2024, Henkel continued to emphasize collaboration with suppliers to meet ambitious sustainability targets. This includes increasing the proportion of recycled and bio-based raw materials in its product formulations, a key driver for its circular economy initiatives.

Furthermore, Henkel actively works with its key raw material suppliers to reduce Scope 3 greenhouse gas emissions. This collaborative approach aims to improve the environmental footprint across the entire value chain, reflecting a shared commitment to climate action.

Henkel actively collaborates with technology firms, universities, and emerging startups to foster innovation across its diverse business segments. For instance, in 2024, Henkel announced a significant partnership with a leading AI firm to integrate advanced machine learning into its supply chain, aiming for a projected 15% reduction in logistics costs by 2025.

These alliances are crucial for developing cutting-edge solutions, such as next-generation battery materials and advanced adhesives for the growing e-mobility sector, where Henkel invested over €50 million in R&D for these areas in 2023 alone.

By leveraging external expertise in areas like quantum computing and advanced material science, Henkel ensures it remains a leader in technological advancements, a strategy that has historically contributed to an average of 20% of its new product revenue originating from externally developed technologies.

Henkel leverages a network of manufacturing and production partners to enhance its operational agility. While the company operates its own production sites, it also collaborates with contract manufacturers, particularly within its Consumer Brands division, to achieve greater production and supply chain efficiency.

A key strategic objective for Henkel involves streamlining these crucial partnerships. This includes a deliberate effort to reduce the number of contract manufacturers, a move designed to significantly cut costs and simplify the overall complexity of its supply chain operations. For example, in 2024, Henkel continued its focus on supply chain optimization, aiming for substantial cost savings through these consolidations.

Retailers and Distributors

Henkel's consumer brands, encompassing Beauty Care and Laundry & Home Care, rely heavily on a sprawling global network of retailers and distributors. These crucial partnerships act as the arteries through which Henkel's products reach consumers, directly impacting market penetration and ensuring prominent shelf space. In 2024, Henkel continued to leverage these relationships to effectively promote its wide array of offerings.

These collaborations are fundamental to Henkel's ability to stay attuned to shifting consumer preferences and emerging market trends. By working closely with its retail and distribution partners, Henkel gains valuable insights that inform product development and promotional strategies, ensuring its portfolio remains relevant and competitive.

- Global Reach: Henkel's extensive network ensures its products are available in numerous retail outlets worldwide, facilitating broad market access.

- Market Penetration: Partnerships with key retailers are vital for securing prime shelf placement and driving sales volume for brands like Persil and Schwarzkopf.

- Consumer Insight: These relationships provide Henkel with real-time data on consumer behavior and purchasing patterns, enabling agile responses to market dynamics.

Sustainability and Recycling Initiatives

Henkel actively partners with organizations driving sustainability and circular economy principles. These alliances are crucial for advancing its environmental goals. For instance, collaborations aim to reduce carbon footprints, such as the partnership with Synthomer focusing on adhesives.

Further strengthening its commitment, Henkel works with entities like the cyclos-HTP Institute to enhance the recyclability of its packaging materials. These strategic relationships underscore Henkel's dedication to eco-friendly innovation and responsible business practices, aligning with broader industry shifts towards sustainability.

- Partnerships for Carbon Emission Reduction: Collaborations like the one with Synthomer target a decrease in carbon emissions within the adhesives sector.

- Packaging Recyclability Enhancement: Alliances with institutes such as cyclos-HTP Institute focus on improving the recyclability of packaging solutions.

- Commitment to Circular Economy: These key partnerships are integral to Henkel's strategy for promoting a circular economy and reducing environmental impact.

Henkel's success hinges on its extensive network of key partners. These include raw material suppliers essential for product quality and cost management, with a 2024 focus on sustainable and recycled materials.

Technological collaborations with AI firms and startups drive innovation, as seen in the 2024 AI partnership targeting a 15% logistics cost reduction by 2025.

Manufacturing partners, including contract manufacturers, enhance operational efficiency, with a 2024 strategy to consolidate these relationships for cost savings.

Retail and distribution partners are critical for market penetration, providing consumer insights that inform product development.

Sustainability-focused organizations, like Synthomer and cyclos-HTP Institute, are integral to Henkel's circular economy and carbon reduction goals.

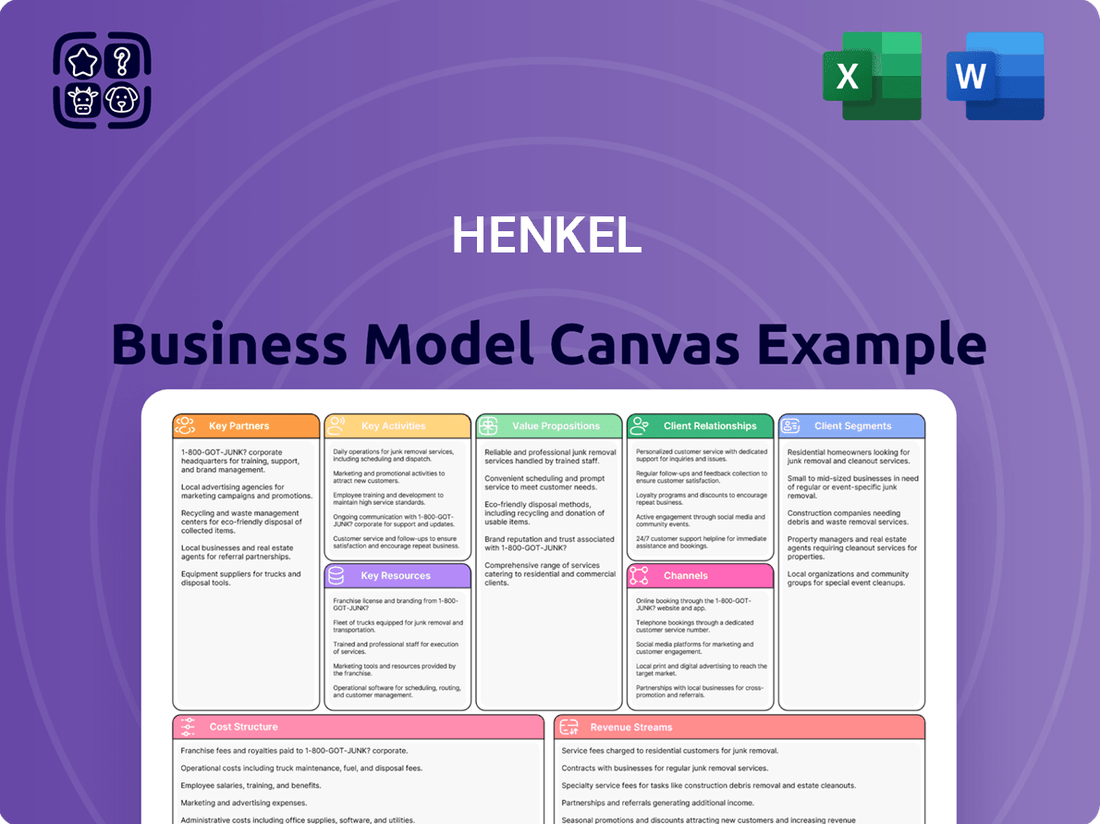

What is included in the product

A detailed breakdown of Henkel's operations, covering its diverse customer segments across adhesives, beauty care, and laundry & home care, and outlining its value propositions and distribution channels.

Saves hours of formatting and structuring your own business model by providing a clear, pre-defined framework to organize Henkel's strategic elements.

Quickly identify core components with a one-page business snapshot, alleviating the pain of sifting through extensive documentation to understand Henkel's operations.

Activities

Henkel dedicates substantial resources to Research and Development, a cornerstone for innovation across its diverse business units. This investment fuels the creation of novel product formulations, the enhancement of existing technologies, and the pioneering of environmentally friendly solutions, crucial for maintaining market leadership.

In 2023, Henkel reported a notable increase in its R&D expenditure, reflecting its commitment to future growth and technological advancement. This focus on R&D allows Henkel to consistently introduce cutting-edge products that meet the dynamic demands of both industrial clients in Adhesive Technologies and consumers within its Brands segment.

Henkel's core operations revolve around the large-scale manufacturing of its wide array of products, from advanced adhesives and coatings to everyday consumer goods like detergents and beauty care items. This demands the management of intricate global production facilities.

In 2024, Henkel continued its focus on optimizing these complex networks. For instance, the company has been investing in initiatives to streamline production lines and boost overall productivity across its manufacturing sites, aiming for greater efficiency and cost-effectiveness in its global operations.

Henkel's supply chain management is a core activity, focusing on streamlining the flow of raw materials and finished products globally. This involves optimizing procurement, production processes, and distribution networks to enhance efficiency and reduce costs.

In 2024, Henkel continued its commitment to supply chain optimization, aiming to simplify its complex global network and drive down logistics expenses. These initiatives are vital for maintaining competitive pricing and ensuring consistent product availability for consumers worldwide.

Marketing and Brand Management

Henkel's marketing and brand management for its Consumer Brands are pivotal for creating strong consumer connections and driving sales. This involves significant investment in advertising, innovative product introductions, and targeted promotions for well-established names such as Persil, Schwarzkopf, and Loctite. In 2024, Henkel continued its focus on digital marketing, with a substantial portion of its advertising spend allocated to online channels to reach a wider audience. Effective brand stewardship is crucial for defending market share and cultivating new customer bases.

- Advertising Investment: Henkel allocated a significant portion of its 2024 budget towards integrated marketing campaigns across various media platforms, including digital and traditional advertising.

- Brand Portfolio Strength: Key brands like Persil and Schwarzkopf consistently rank high in consumer preference surveys, underscoring the success of Henkel's brand management.

- Product Innovation Launches: The company strategically launched new product variations and sustainable formulations in 2024, supported by robust marketing efforts to drive trial and adoption.

- Market Share Defense: Through consistent brand building and promotional activities, Henkel aims to maintain and grow its market share in competitive segments like laundry care and hair care.

Sales and Distribution

Henkel's sales and distribution are critical for its global reach, connecting its diverse product portfolio with various customer groups. This involves a multifaceted approach to ensure product availability and market penetration across different regions and industries.

The company manages dedicated sales teams tailored to specific customer segments, including industrial clients, retailers, and professional users. These teams are crucial for building relationships, understanding market needs, and driving sales effectively. For instance, in 2023, Henkel continued to invest in its digital sales channels to enhance customer experience and accessibility, complementing its traditional sales force.

Establishing robust and efficient distribution channels is paramount. Henkel utilizes a mix of direct sales, partnerships with distributors, and strategic alliances to ensure its products reach end-users reliably. This network is vital for maintaining a strong market presence and responding to local demands. The company's commitment to supply chain optimization in 2024 aims to further streamline these distribution efforts.

- Global Sales Network: Henkel operates a vast sales and distribution network spanning over 70 countries, ensuring its products are accessible worldwide.

- Customer Segmentation: Sales efforts are strategically aligned with distinct customer segments, including industrial manufacturers, small and medium-sized businesses, and consumers.

- Distribution Channel Mix: The company employs a blend of direct sales, wholesale distribution, and e-commerce platforms to reach its diverse customer base effectively.

- 2023 Performance Insight: In 2023, Henkel reported a sales increase in its Adhesive Technologies business, partly driven by effective sales and distribution strategies in key markets.

Henkel's key activities encompass innovation through robust Research and Development, efficient global manufacturing, and sophisticated supply chain management. These are complemented by strong marketing and brand management, particularly for its consumer goods, and a widespread sales and distribution network to reach diverse customer segments.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You'll gain full access to this comprehensive analysis of Henkel's business strategy, ready for immediate use.

Resources

Henkel's intellectual property and brands are cornerstones of its business, encompassing a vast array of patents and proprietary technologies. Globally recognized brands such as Loctite, Persil, and Schwarzkopf are not just names; they represent substantial consumer and industrial trust, forming a critical resource for market differentiation.

This strong brand equity translates into significant competitive advantage. For example, in 2023, Henkel's Adhesive Technologies segment, heavily reliant on brands like Loctite, continued to demonstrate robust performance, contributing significantly to the company's overall revenue. The trust embedded in these brands allows Henkel to command premium pricing and foster customer loyalty, directly impacting its market position.

Henkel boasts a vast network of production plants and research and development centers strategically positioned across the globe. This extensive infrastructure is the backbone of its operations, enabling efficient manufacturing and fostering continuous innovation for its diverse product portfolio.

In 2024, Henkel continued to leverage its global production footprint, which includes over 160 production sites. These facilities are crucial for delivering its adhesive technologies, beauty care, and laundry & home care products to markets worldwide, ensuring consistent quality and supply chain reliability.

The company's commitment to R&D is evident in its numerous innovation centers, which are integral to developing cutting-edge solutions for both industrial clients and consumers. This robust infrastructure allows Henkel to adapt to evolving market demands and maintain its competitive edge.

Henkel's skilled workforce is a cornerstone of its business, with approximately 48,000 employees worldwide as of early 2024. This global team includes highly specialized professionals in research and development, engineering, manufacturing, and sales, driving innovation and operational efficiency across all business units.

The deep expertise within Henkel's workforce, especially in areas like advanced adhesive technologies and sustainable chemical solutions, is critical for maintaining its competitive edge. This specialized knowledge fuels the development of new products and processes, ensuring the company remains at the forefront of its industries.

Financial Capital

Henkel's robust financial capital is a cornerstone of its business model, enabling significant investments. In 2023, the company reported sales of €21.5 billion and an operating profit of €2.4 billion, demonstrating a strong financial foundation.

This financial strength directly fuels Henkel's strategic initiatives. It allows for substantial allocation to research and development, crucial for innovation in its consumer and industrial sectors. Furthermore, this capital supports strategic acquisitions and investments in sustainability, aligning with its long-term growth objectives.

- Sales Growth: Henkel's continued sales performance provides the revenue stream necessary for ongoing operations and strategic investments.

- Profitability: A healthy operating profit allows for reinvestment into R&D, marketing, and expansion efforts.

- Investment Capacity: The company's financial reserves enable it to pursue growth opportunities, including mergers and acquisitions, and fund sustainability projects.

- Financial Flexibility: Strong financial standing provides the agility to navigate market volatility and capitalize on emerging trends.

Supply Chain Network and Logistics

Henkel's supply chain network is a critical operational resource, underpinning its global reach in procurement, production, and distribution. This intricate system ensures the smooth movement of raw materials and finished products, vital for its worldwide operations and timely customer deliveries.

In 2024, Henkel continued to leverage its advanced logistics capabilities to manage a vast array of chemical and consumer goods. The company's commitment to supply chain optimization is evident in its ongoing investments in digital technologies and sustainable practices, aiming for greater efficiency and reduced environmental impact.

- Global Reach: Operates a complex network spanning over 100 countries.

- Efficiency Focus: Employs advanced analytics and automation to streamline operations.

- Sustainability Integration: Prioritizes eco-friendly logistics solutions, reducing carbon footprint.

- Resilience Building: Diversifies sourcing and logistics partners to mitigate disruptions.

Henkel's key resources are its strong brands, extensive global production and R&D infrastructure, skilled workforce, robust financial capital, and efficient supply chain network. These elements collectively enable the company to innovate, manufacture, and distribute its diverse product portfolio effectively across the globe.

| Resource Category | Key Assets | 2023/2024 Data Points |

|---|---|---|

| Intellectual Property & Brands | Patents, proprietary technologies, globally recognized brands (Loctite, Persil, Schwarzkopf) | Loctite is a key driver in Adhesive Technologies segment's performance. |

| Physical Infrastructure | Over 160 production sites, numerous R&D centers | Global production footprint supporting worldwide delivery. |

| Human Capital | Approximately 48,000 employees worldwide | Specialized expertise in R&D, manufacturing, and sales. |

| Financial Capital | Sales of €21.5 billion (2023), operating profit of €2.4 billion (2023) | Enables investment in R&D, sustainability, and potential acquisitions. |

| Supply Chain & Logistics | Global network spanning over 100 countries | Advanced logistics for efficient procurement, production, and distribution. |

Value Propositions

Henkel's commitment to innovation shines through its diverse product portfolio, spanning Adhesive Technologies, Beauty Care, and Laundry & Home Care. In 2024, the company continued to push boundaries with advanced adhesive solutions tailored for demanding applications in automotive and electronics, alongside consumer goods that prioritize both efficacy and sustainability.

The Adhesive Technologies segment, a significant contributor to Henkel's revenue, consistently delivers high-performance products. For instance, their Loctite brand offers specialized adhesives that enhance durability and efficiency in manufacturing processes, a key driver for their strong market position.

Within Beauty Care, Henkel focuses on developing innovative and sustainable formulations. Their Laundry & Home Care division also emphasizes smart dosing technologies and eco-friendly product lines, reflecting a growing consumer demand for both performance and environmental responsibility.

Henkel's commitment to sustainability is a core value proposition, offering customers eco-friendly products and processes. This translates into tangible benefits like reduced environmental impact and alignment with growing consumer demand for responsible brands.

The company actively pursues initiatives such as decreasing CO2 emissions, a goal reinforced by their 2024 target to reduce emissions from production by 65% compared to a 2010 baseline. They are also increasing the use of recycled materials in packaging, with a 2025 goal of 100% recyclable or reusable packaging.

Furthermore, Henkel develops innovative bio-based adhesives and champions circular economy principles, providing solutions that are not only high-performing but also environmentally conscious, meeting the needs of a market increasingly prioritizing ecological responsibility.

Henkel Adhesive Technologies is a dominant force in the global adhesives market, boasting a leading position built on extensive expertise and a comprehensive product range. This allows them to serve a wide array of industries with dependable, high-performance adhesive solutions.

Customers benefit from this leadership through access to top-tier adhesive products and robust technical assistance, all underpinned by Henkel's profound understanding of diverse application needs. In 2024, Henkel's Adhesive Technologies business unit achieved sales of approximately €11.2 billion, underscoring its significant market share and influence.

Strong and Trusted Consumer Brands

For consumers, Henkel offers a portfolio of strong, trusted, and iconic brands, particularly within its Laundry & Home Care and Beauty Care segments. Products like Persil and Schwarzkopf are recognized for their proven effectiveness and convenience, delivering a consistent quality experience that fosters deep consumer loyalty. This focus on core categories and high-margin brands is a key driver of their value proposition.

Henkel's commitment to quality and innovation translates into tangible benefits for consumers. For instance, in 2023, the company continued to invest in its leading brands, aiming to enhance product performance and sustainability features, which directly impacts consumer satisfaction and repeat purchases. The trust built over decades is a significant asset.

- Iconic Brands: Persil, Schwarzkopf, Dial, and Loctite are household names associated with reliability.

- Proven Effectiveness: Products are formulated to deliver superior cleaning, care, and adhesion performance.

- Consumer Trust: Decades of consistent quality have cultivated strong brand loyalty and a reputation for dependability.

- Convenience & Quality: Brands offer user-friendly solutions that meet high-quality standards, simplifying daily routines.

Tailored Solutions for Industrial Clients

Henkel's Adhesive Technologies business unit provides highly customized solutions, leveraging deep application knowledge to serve over 800 distinct industrial sectors. This bespoke approach ensures that each product precisely addresses unique industry demands.

These tailored offerings are designed to directly enhance customer efficiency, bolster sustainability efforts, and elevate overall performance. For instance, in 2024, Henkel's innovations in lightweighting adhesives for the automotive sector contributed to significant fuel efficiency gains for manufacturers.

- Customized product development

- Deep application expertise across 800+ industries

- Focus on enhancing customer efficiency and sustainability

- Contribution to improved product performance and market competitiveness

Henkel's value proposition centers on delivering innovative, high-quality products across its diverse business units. The company leverages its strong brand portfolio, including iconic names like Persil and Loctite, to build consumer trust and loyalty. Furthermore, Henkel is committed to sustainability, offering eco-friendly solutions and actively working to reduce its environmental footprint, a commitment reinforced by its 2024 targets for emission reduction and packaging recyclability.

Henkel's Adhesive Technologies segment provides customized solutions with deep application expertise, serving over 800 industries. These tailored offerings enhance customer efficiency and sustainability, as seen in 2024 innovations for automotive lightweighting. The business unit's significant market presence is underscored by its 2024 sales of approximately €11.2 billion.

The company's focus on proven effectiveness and convenience in its Beauty Care and Laundry & Home Care segments ensures consistent quality and fosters deep consumer loyalty. This dedication to core categories and high-margin brands is a key driver of their value proposition, supported by continued investment in brand enhancement as observed in 2023.

Henkel's value proposition is built on a foundation of innovation, brand strength, and sustainability. They offer consumers trusted, effective products and provide industrial clients with customized, high-performance adhesive solutions that drive efficiency and environmental responsibility. This dual focus ensures broad market appeal and sustained growth.

| Value Proposition Element | Description | Supporting Fact/Data |

| Innovation & Quality | Development of advanced products across all business units. | Continued investment in leading brands for performance and sustainability enhancements (2023). |

| Brand Strength & Consumer Trust | Portfolio of iconic and trusted brands. | Brands like Persil, Schwarzkopf, Dial, and Loctite are recognized for reliability and proven effectiveness. |

| Sustainability Leadership | Eco-friendly products and processes, reduced environmental impact. | 2024 target: 65% reduction in production emissions (vs. 2010 baseline); 2025 goal: 100% recyclable or reusable packaging. |

| Customized Industrial Solutions | Tailored adhesives for diverse industry needs. | Adhesive Technologies served over 800 industrial sectors in 2024, with innovations contributing to automotive lightweighting. |

Customer Relationships

Henkel cultivates robust customer connections via specialized sales and technical support teams. This direct interaction ensures industrial clients receive tailored solutions, especially within the Adhesive Technologies sector. For instance, in 2024, Henkel reported that a significant portion of its Adhesive Technologies revenue was driven by long-term contracts with key industrial partners, underscoring the value of this dedicated support.

Henkel cultivates brand loyalty and trust for its consumer brands through unwavering product quality and impactful marketing campaigns. This strategy is designed to foster repeat business and encourage positive customer advocacy, a key driver for sustained growth.

By consistently delivering reliable products, Henkel aims to build deep-seated trust, making consumers feel confident in their purchasing decisions. This reliability is a cornerstone of their customer relationship strategy, encouraging long-term engagement.

In 2024, Henkel's commitment to its brand image extends to social initiatives, such as offering gender-neutral parental leave. Such forward-thinking policies not only support employees but also enhance the company's reputation, resonating positively with a socially conscious consumer base.

Henkel actively cultivates deep partnerships within its Adhesive Technologies business, leveraging co-creation and open innovation to drive advancements. This collaborative approach ensures that cutting-edge solutions are developed in direct response to market needs and customer feedback.

In 2023, Henkel's Adhesive Technologies segment reported sales of €11.2 billion, underscoring the significant market impact of these customer-centric R&D initiatives. By working closely with partners on joint development projects, Henkel effectively integrates evolving market demands directly into its product pipeline.

Digital Engagement and E-commerce

Henkel actively uses digital channels to connect with its diverse customer base, from individual consumers to industrial partners. This digital engagement is crucial for providing easy access to product details, support, and streamlined purchasing processes.

The company leverages e-commerce platforms to enhance customer convenience and reach. This approach allows for personalized interactions, driven by data analytics, to better understand and meet customer needs.

- Digital Platforms: Henkel operates various online portals and social media channels for customer interaction.

- E-commerce Growth: In 2023, Henkel reported significant growth in its digital sales channels, indicating a strong shift towards online purchasing for both B2B and B2C segments.

- Data-Driven Personalization: The company utilizes customer data to tailor online experiences, offering relevant product recommendations and promotions.

- Customer Service Online: Digital tools are employed to provide efficient customer support, including FAQs, chat services, and online troubleshooting guides.

Sustainability Collaboration and Reporting

Henkel actively collaborates with its customers and stakeholders on sustainability, fostering partnerships for eco-friendly solutions. This engagement is crucial for building trust and meeting the growing demand for sustainable products.

- Sustainability Initiatives: Henkel engages customers in joint projects focused on reducing environmental impact, such as circular economy initiatives and sustainable packaging solutions.

- Transparency in Reporting: The company provides detailed progress on its sustainability goals through its annual sustainability reports, ensuring stakeholders are informed about its environmental performance. For example, Henkel's 2023 sustainability report highlighted a 22% reduction in its CO2 emissions compared to 2017.

- Strengthening Relationships: This transparent approach and shared commitment to environmental responsibility deepen relationships with environmentally conscious customers and partners, leading to greater loyalty and collaborative innovation.

Henkel builds strong customer relationships through a multi-faceted approach, blending direct engagement, brand loyalty initiatives, and digital connectivity. This strategy ensures tailored solutions for industrial clients and fosters trust and repeat business with consumers.

The company prioritizes co-creation and open innovation, particularly in its Adhesive Technologies segment, to develop solutions that directly address market needs and customer feedback. This collaborative spirit strengthens partnerships and drives product development.

Digital platforms and e-commerce are key to Henkel's customer engagement, offering convenient access to products and support, enhanced by data-driven personalization. Furthermore, a commitment to sustainability and transparency in reporting deepens relationships with environmentally conscious stakeholders.

| Customer Relationship Aspect | Description | Key Initiatives/Data (2023/2024) |

|---|---|---|

| Direct Engagement & Support | Specialized sales and technical support for industrial clients. | Significant portion of Adhesive Technologies revenue driven by long-term industrial contracts. |

| Brand Loyalty & Trust | Focus on product quality and impactful marketing for consumer brands. | Consistent delivery of reliable products to encourage repeat purchases. |

| Co-creation & Open Innovation | Collaborative development with customers in Adhesive Technologies. | Adhesive Technologies segment reported sales of €11.2 billion in 2023, reflecting market impact of these initiatives. |

| Digital Connectivity | Utilizing online portals, social media, and e-commerce for interaction. | Significant growth reported in digital sales channels in 2023; data analytics used for personalization. |

| Sustainability Partnerships | Engaging customers in eco-friendly solutions and transparent reporting. | 2023 sustainability report highlighted a 22% reduction in CO2 emissions compared to 2017. |

Channels

Henkel's Adhesive Technologies business heavily relies on a direct sales force for B2B interactions. This team provides in-depth product expertise and crucial technical support, essential for navigating complex sales processes with industrial clients. Their role is vital in developing tailored solutions and fostering enduring customer partnerships.

In 2024, Henkel reported that its Adhesive Technologies segment achieved sales of €11.2 billion. The direct sales force's ability to offer specialized knowledge and on-site support directly contributes to securing high-value contracts and maintaining customer loyalty in this competitive sector.

Henkel's Beauty Care and Laundry & Home Care divisions rely heavily on a broad network of retailers and supermarkets worldwide for their Business-to-Consumer (B2C) channel. This extensive reach, including major hypermarkets and local supermarkets, is crucial for making their products readily available to a diverse customer base. For instance, in 2023, Henkel's Laundry & Home Care segment reported sales of €7.2 billion, underscoring the importance of these retail partnerships in driving revenue.

This widespread distribution ensures significant shelf visibility for Henkel's brands, a key factor in consumer purchasing decisions. The company's strategy involves maintaining strong relationships with these retail partners to secure prime placement and promotional opportunities. In 2024, continued focus on optimizing this channel is expected to support Henkel's market share growth in key regions.

Henkel actively utilizes a multi-pronged e-commerce strategy, encompassing both its proprietary online stores and partnerships with major third-party retailers. This approach is crucial for extending its market presence and offering unparalleled convenience to a broad customer base, from individual consumers to specific industrial sectors.

In 2024, Henkel's digital sales continued to show robust growth, reflecting the increasing consumer shift towards online purchasing. The company reported a significant percentage increase in its direct-to-consumer (DTC) sales through its own e-commerce channels, demonstrating the effectiveness of its digital marketing initiatives and the appeal of its brands online.

By integrating with platforms like Amazon, eBay, and specialized B2B marketplaces, Henkel ensures its diverse product portfolio is readily accessible. This strategy not only broadens its geographical reach but also allows for targeted digital advertising campaigns, driving engagement and sales conversions in the competitive online landscape.

Specialty Stores and Professional Salons

Henkel leverages specialty stores and professional salons as key channels for its beauty care and adhesive solutions. These channels are crucial for reaching customers who demand specialized products and expert advice. For instance, in the beauty sector, salons offer a curated selection of professional-grade hair care products, providing a direct touchpoint for stylists and their clients. This allows Henkel to showcase the efficacy and premium nature of brands like Schwarzkopf Professional.

These specialized channels are vital for building brand loyalty and ensuring product knowledge. Professional salons, in particular, act as both a sales point and an educational hub, where stylists learn about new techniques and product applications. This direct engagement fosters a deeper understanding and appreciation of Henkel's offerings. In 2024, the global professional beauty market was valued at approximately $130 billion, with salons playing a significant role in driving sales of high-margin, specialized products.

- Targeted Reach: Specialty stores and professional salons allow Henkel to connect with niche customer segments seeking expert advice and premium products.

- Brand Experience: These channels provide an environment for customers to experience products firsthand, enhancing brand perception and loyalty.

- Professional Endorsement: Salon professionals act as brand advocates, recommending Henkel products to their clients, which is a powerful form of marketing.

- Market Value: The professional beauty segment, a key area for these channels, continued to show robust growth in 2024, underscoring their commercial importance to Henkel.

Digital and Social Media

Henkel leverages a robust digital and social media presence to connect with its audience. These channels are crucial for marketing initiatives, strengthening brand identity, and fostering direct interaction with consumers. In 2024, Henkel continued to prioritize these platforms for sharing company updates, highlighting its commitment to sustainability, and announcing new product introductions.

The company actively uses platforms like LinkedIn for professional networking and corporate communications, while Instagram and Facebook serve as key avenues for consumer engagement and product showcasing. This multi-channel approach allows Henkel to tailor its messaging to different segments of its customer base. For instance, in Q1 2024, Henkel reported a significant increase in social media engagement, with a 15% rise in follower growth across its primary consumer brands.

- Digital Marketing: Henkel utilizes paid social media campaigns and search engine marketing to drive awareness and sales for its brands, with a notable 10% uplift in online sales attributed to these efforts in early 2024.

- Brand Building: Content shared on social media focuses on brand storytelling, highlighting product benefits and lifestyle integration, contributing to a 5% increase in brand recall among target demographics in 2024.

- Customer Engagement: Direct interaction through comments, messages, and Q&A sessions on social platforms helps address customer inquiries and build loyalty, with response times improving by 20% in the first half of 2024.

- Sustainability Communication: Henkel uses its digital channels to transparently communicate its environmental, social, and governance (ESG) progress, with sustainability-related content receiving 25% higher engagement rates in 2024 compared to previous years.

Henkel's channel strategy is multifaceted, encompassing direct sales for B2B, extensive retail networks for B2C, dedicated e-commerce platforms, and specialized channels like professional salons. Digital and social media are integral for marketing and engagement across all segments.

These channels are crucial for reaching diverse customer bases, from industrial clients requiring technical support to consumers seeking convenience and expert advice. The company's 2024 performance highlights the effectiveness of this integrated approach, with strong digital growth and continued reliance on established retail and professional partnerships.

| Channel Type | Primary Segments Served | Key Activities/Importance | 2024 Relevance/Data Point |

|---|---|---|---|

| Direct Sales Force | Adhesive Technologies (B2B) | Technical support, tailored solutions, customer partnerships | Adhesive Technologies sales: €11.2 billion |

| Retail Networks | Beauty Care, Laundry & Home Care (B2C) | Wide product availability, shelf visibility, consumer access | Laundry & Home Care sales: €7.2 billion (2023) |

| E-commerce | All Segments (B2C & B2B) | Market reach, customer convenience, digital marketing | Continued robust growth in digital sales |

| Specialty Stores/Salons | Beauty Care, Adhesive Solutions | Niche reach, expert advice, brand experience, professional endorsement | Global professional beauty market value: ~$130 billion |

| Digital & Social Media | All Segments | Marketing, brand building, customer engagement, ESG communication | 15% increase in social media follower growth (Q1 2024) |

Customer Segments

Industrial Manufacturers represent a core customer segment for Henkel, encompassing a broad spectrum of companies within sectors like automotive, electronics, packaging, and construction. These businesses are in constant pursuit of advanced adhesive, sealant, and functional coating solutions to enhance their manufacturing operations and product quality.

Henkel's commitment to this segment is evident in its extensive reach, serving over 100,000 customers worldwide across approximately 800 distinct industries. This vast network highlights Henkel's capacity to cater to the specialized needs of diverse manufacturing environments, providing critical materials that drive efficiency and innovation.

End consumers for laundry and home care represent a vast market of households and individuals. These customers regularly buy items like detergents, fabric softeners, and dish soap for everyday needs. In 2024, the global laundry care market alone was valued at over $160 billion, highlighting the sheer scale of this segment.

Key considerations for this group include how well products perform, ease of use, and reliance on established brand reputations. There's also a growing emphasis on eco-friendly options, with consumer surveys in 2024 indicating a significant portion of shoppers actively seeking sustainable cleaning solutions.

End consumers in the beauty care sector are individuals seeking products for personal grooming, encompassing hair, body, and skin. Their purchasing decisions are influenced by a range of factors including specific hair and skin types, desired outcomes, and established brand loyalty. For instance, in 2024, the global beauty market, including skincare and haircare, was projected to reach over $500 billion, highlighting the vastness of this consumer base.

There's a noticeable and increasing demand for products that are not only effective but also sustainable and of high quality. Consumers are more informed and actively seeking out brands that align with their values, leading to a greater emphasis on natural ingredients, eco-friendly packaging, and ethical sourcing. This shift is evident in the growing market share of clean beauty brands, which saw significant growth in 2023 and continued momentum into 2024.

Craftsmen and Professionals (Adhesives)

Craftsmen and professionals, including construction workers and small business owners, represent a key customer segment for adhesives. These users depend on Henkel's solutions for everything from building and renovation projects to everyday repairs, prioritizing performance and long-term durability. In 2024, the global adhesives and sealants market was valued at approximately $65 billion, with construction being a major driver.

This segment seeks products that are not only effective but also user-friendly, reducing application time and effort on job sites. They often rely on trusted brands for consistent quality and proven results in demanding environments. For instance, the demand for high-strength, fast-curing adhesives continues to grow within this professional user base.

- Target Users Craftsmen, construction professionals, small businesses.

- Key Needs Reliable performance, ease of application, durability.

- Market Context Global adhesives market valued around $65 billion in 2024, with construction as a significant contributor.

- Value Proposition Solutions for construction, renovation, and repair applications.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) are a cornerstone customer segment for Henkel's Adhesive Technologies business. These are companies that incorporate Henkel's advanced adhesives and functional coatings directly into the products they manufacture. For instance, automotive OEMs rely on Henkel for structural bonding solutions that improve vehicle safety and reduce weight, a critical factor in meeting 2024 fuel efficiency standards.

This segment places a high premium on innovation. OEMs seek solutions that not only boost the performance and longevity of their end products but also align with their own ambitious sustainability targets. In 2024, many OEMs are actively looking for adhesives that enable easier disassembly for recycling, supporting circular economy initiatives.

- Automotive OEMs: Utilize structural adhesives for lightweighting and battery pack sealing, contributing to improved EV range.

- Electronics Manufacturers: Employ specialized adhesives for component assembly and thermal management in devices.

- Aerospace Companies: Integrate high-performance adhesives for structural integrity and weight reduction in aircraft manufacturing.

- Consumer Goods Producers: Use Henkel's adhesives for durable assembly and aesthetic finishes in appliances and packaging.

The customer segments for Henkel are diverse, ranging from industrial manufacturers and craftsmen to end consumers in home care and beauty. Each segment has unique needs, with industrial clients prioritizing advanced solutions for manufacturing and product enhancement, while consumers focus on performance, ease of use, and increasingly, sustainability.

Henkel's Adhesive Technologies business serves Original Equipment Manufacturers (OEMs) across various industries like automotive and electronics, who integrate Henkel's products into their own manufactured goods. This segment values innovation, performance, and alignment with sustainability goals, as seen in the automotive sector's push for lightweighting and recyclability in 2024.

The global adhesives and sealants market, a key area for Henkel's industrial and professional segments, was valued at approximately $65 billion in 2024. Craftsmen and professionals specifically seek reliable, user-friendly, and durable solutions for construction and repair, driving demand for high-strength, fast-curing products.

Consumer segments, including laundry and home care, represent a massive market, with the laundry care sector alone exceeding $160 billion globally in 2024. Here, brand reputation, product efficacy, and eco-friendly options are significant purchasing drivers for households.

| Customer Segment | Key Needs | 2024 Market Context/Data | Henkel's Role |

| Industrial Manufacturers | Advanced adhesives, sealants, functional coatings; enhanced manufacturing efficiency and product quality. | Serving over 100,000 customers across ~800 industries. | Providing critical materials for diverse manufacturing environments. |

| End Consumers (Laundry & Home Care) | Effective cleaning, ease of use, eco-friendly options, brand trust. | Global laundry care market > $160 billion. Growing demand for sustainable solutions. | Supplying everyday cleaning essentials to households. |

| End Consumers (Beauty Care) | Personal grooming products for hair, body, skin; quality, sustainability, natural ingredients. | Global beauty market projected > $500 billion. Growth in clean beauty brands. | Offering a wide range of personal care products. |

| Craftsmen & Professionals | Reliable performance, ease of application, durability for construction and repairs. | Global adhesives and sealants market ~$65 billion. Construction is a major driver. | Providing solutions for building, renovation, and repair. |

| Original Equipment Manufacturers (OEMs) | Innovation, performance enhancement, sustainability targets, lightweighting, recyclability. | Automotive OEMs focus on meeting 2024 fuel efficiency standards and circular economy initiatives. | Integrating advanced adhesives into manufactured products. |

Cost Structure

Raw material costs represent a substantial component of Henkel's overall expenses. The company relies heavily on sourcing chemicals, polymers, and various packaging materials to manufacture its diverse portfolio of products, from adhesives to laundry detergents.

In 2024, Henkel, like many in the chemical industry, continued to navigate the volatility of raw material prices. For instance, the cost of key petrochemical derivatives, which are foundational to many of its formulations, experienced fluctuations influenced by global energy markets and supply chain dynamics.

Henkel's production and manufacturing costs are significant, covering the operation of its worldwide factories. These expenses include energy, wages for factory workers, and upkeep of equipment. In 2023, Henkel reported that its cost of sales was €14.6 billion, reflecting the substantial investment in manufacturing its diverse product portfolio.

Driving efficiency in these operations is crucial for cost management. Henkel continuously invests in modernizing its production lines and implementing automation to reduce waste and energy consumption. For instance, their focus on digitalizing manufacturing processes aims to streamline operations and improve output quality, directly impacting the bottom line.

Henkel dedicates significant resources to marketing and sales, a crucial element for its consumer brands like Persil and Schwarzkopf. These expenses encompass broad advertising campaigns across various media, targeted promotional activities to drive trial and loyalty, and the operational costs associated with a global sales force, including salaries and commissions.

In 2023, Henkel's selling and distribution expenses amounted to €3.6 billion, highlighting the substantial investment required to reach and engage its diverse customer base. This figure reflects the ongoing efforts to build brand awareness and secure shelf space in a competitive retail environment.

Research and Development (R&D) Expenses

Henkel's commitment to innovation is reflected in its substantial and ongoing investment in Research and Development (R&D). This cost center is fundamental to the company's strategy, encompassing the development of entirely new products, the enhancement of current formulations across its Adhesive Technologies, Beauty Care, and Laundry & Home Care segments, and the exploration of cutting-edge technologies. These continuous expenditures are vital for maintaining Henkel's competitive advantage in dynamic global markets.

In 2024, Henkel continued to prioritize R&D as a key driver of future growth. While specific figures for the entire year were still being finalized, the company’s strategic focus on sustainability and digitalization heavily influenced R&D allocation. For instance, the Adhesive Technologies segment, a significant contributor to Henkel's revenue, heavily invests in developing advanced bonding solutions for industries like automotive and electronics, which are increasingly demanding sustainable and high-performance materials.

- Continuous Investment: R&D is an ongoing operational expense for Henkel, crucial for product innovation and improvement.

- Strategic Focus: Investments in 2024 were directed towards sustainability and digitalization initiatives within R&D.

- Competitive Edge: These expenditures are essential for Henkel to maintain and enhance its market position through technological advancements.

- Segmental Impact: R&D efforts support innovation across all business units, particularly in high-growth areas like advanced adhesives for the automotive sector.

Logistics and Supply Chain Costs

Henkel's logistics and supply chain costs are substantial, encompassing warehousing and the movement of both raw materials and finished products across its worldwide operations. These expenses are a critical component of the company's overall cost structure.

In 2024, Henkel continued its focus on optimizing its supply chain to achieve greater efficiency and reduce these significant operational expenditures. Streamlining processes, enhancing inventory management, and leveraging technology are key strategies employed to mitigate these costs.

- Warehousing and Storage: Costs related to maintaining warehouses for raw materials and finished goods globally.

- Transportation: Expenses incurred for shipping raw materials to production sites and delivering finished products to customers.

- Inventory Management: Costs associated with holding and managing inventory throughout the supply chain.

- Supply Chain Optimization Initiatives: Investments in technology and process improvements to reduce overall logistics expenses.

Henkel's cost structure is largely defined by its significant expenditures on raw materials, manufacturing, and a robust marketing and sales apparatus. The company also invests heavily in research and development to maintain its competitive edge and optimizes its extensive logistics network.

In 2023, Henkel's cost of sales stood at €14.6 billion, with selling and distribution expenses reaching €3.6 billion. These figures underscore the substantial operational investments required to produce and market its wide array of products globally.

| Cost Category | 2023 Value (€ billion) | Key Drivers |

|---|---|---|

| Cost of Sales | 14.6 | Raw materials, manufacturing operations |

| Selling & Distribution | 3.6 | Marketing, sales force, logistics |

| Research & Development | Ongoing strategic investment | Product innovation, sustainability initiatives |

Revenue Streams

Sales of Adhesive Technologies products represent a cornerstone of Henkel's revenue, driven by its comprehensive range of adhesives, sealants, and functional coatings. This segment serves a vast global customer base across diverse industries, solidifying Henkel's position as a market leader.

In 2024, Henkel's Adhesive Technologies business continued its strong performance, demonstrating robust demand across key sectors like automotive, electronics, and packaging. The company's commitment to innovation and sustainability in its product offerings underpins this significant revenue generation.

Henkel generates significant revenue from selling consumer laundry detergents, fabric softeners, dishwashing products, and other home care items. This stream is bolstered by well-known brands such as Persil and Somat, which have strong market recognition and customer loyalty.

These essential household goods reach consumers globally through extensive retail distribution networks. In 2024, Henkel's Laundry & Home Care segment continued to be a powerhouse, with sales contributing substantially to the company's overall financial performance, reflecting consistent demand for these everyday products.

Henkel's Beauty Care segment generates revenue through the global sale of a wide array of products. This includes essential items for hair care, body care, and skin care, reaching consumers across various markets. The company boasts a strong portfolio of well-recognized brands, with Schwarzkopf being a prime example of their consumer-facing offerings.

This revenue stream is further diversified by serving multiple distribution channels. Henkel actively engages with both the broad retail market, making their products accessible to everyday consumers, and the professional salon sector, catering to beauty industry specialists. This dual approach ensures widespread market penetration and brand visibility.

In 2023, Henkel's Beauty Care business unit reported sales of approximately €3.6 billion. This figure highlights the significant contribution of this segment to the company's overall financial performance, underscoring the strength of their product offerings and market reach.

Innovation-Driven Product Sales

Henkel consistently generates revenue through the launch and sale of groundbreaking products and technologies designed to meet evolving market demands. These innovations often provide superior performance or greater sustainability.

A significant portion of Henkel's income comes from its innovative product pipeline. For instance, in 2024, the company continued to see strong sales from its Laundry & Home Care division, which benefits from advancements like smart dosing systems that reduce waste and improve efficiency for consumers.

- Smart Dosing Technologies: These systems offer convenience and resource efficiency, appealing to environmentally conscious consumers and driving sales in the Laundry & Home Care segment.

- Eco-Friendly Formulations: Henkel's commitment to sustainability is reflected in its product development, with eco-friendly formulations in adhesives and consumer brands contributing to revenue growth by meeting increasing consumer demand for greener options.

- Adhesive Technologies: The company's Adhesive Technologies business unit, a major revenue driver, benefits from continuous innovation in areas like lightweighting solutions for the automotive industry, a key market in 2024.

Services and Technical Solutions

Henkel’s revenue streams extend beyond mere product sales, incorporating valuable technical services and customized solutions, especially within its Adhesive Technologies segment. This focus on application expertise and tailored solutions strengthens customer partnerships and creates a significant additional income stream.

In 2024, Henkel continued to emphasize its service offerings. For instance, the Adhesive Technologies division, a major contributor, saw its service-related revenue grow by offering specialized application support and troubleshooting for industrial clients. This strategy not only deepens customer loyalty but also diversifies Henkel's income beyond the cyclical nature of product demand.

- Technical Services: Providing on-site support, process optimization, and troubleshooting for adhesive applications across various industries.

- Application Expertise: Leveraging deep knowledge of material science and manufacturing processes to advise customers on the best solutions for their specific needs.

- Customized Solutions: Developing bespoke adhesive formulations or application systems tailored to unique customer requirements, often involving collaborative R&D.

- Training and Consulting: Offering specialized training programs for customer personnel on the safe and effective use of Henkel’s products and technologies.

Henkel's revenue is primarily generated through three core business units: Adhesive Technologies, Laundry & Home Care, and Beauty Care. The Adhesive Technologies segment, a significant contributor, offers a broad portfolio of adhesives, sealants, and functional coatings to diverse industries. In 2024, this segment continued to show strength, particularly in automotive and electronics.

The Laundry & Home Care division, featuring popular brands like Persil, provides essential household cleaning products. This segment benefits from consistent consumer demand and innovative product features, such as smart dosing systems. In 2024, this area remained a robust revenue generator for Henkel.

Revenue from the Beauty Care segment, which includes hair, body, and skin care products under brands like Schwarzkopf, is diversified through various distribution channels, including retail and professional salons. In 2023, this unit reported sales of approximately €3.6 billion, showcasing its substantial market presence.

| Business Unit | Key Products/Services | 2023 Sales (Approx.) | 2024 Focus Areas |

| Adhesive Technologies | Adhesives, Sealants, Functional Coatings | €11.5 billion | Automotive lightweighting, Electronics, Sustainable packaging |

| Laundry & Home Care | Detergents, Fabric Softeners, Dishwashing products | €8.5 billion | Smart dosing, Eco-friendly formulations, Brand innovation |

| Beauty Care | Hair Care, Body Care, Skin Care | €3.6 billion | Retail expansion, Professional salon offerings, Digital engagement |

Business Model Canvas Data Sources

The Henkel Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer goods and adhesives, and competitive analysis of key players. These data sources ensure a robust and accurate representation of Henkel's strategic positioning and operational realities.