Henkel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkel Bundle

Unlock the strategic potential of Henkel's product portfolio with a clear understanding of its BCG Matrix. See which brands are market leaders and which require a closer look. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your investments.

Stars

Adhesive Technologies: Mobility & Electronics is a standout performer for Henkel. This segment is experiencing robust organic sales growth, significantly boosted by the booming electric vehicle (EV) market, especially in China.

The strategic focus on e-mobility and advanced connectivity places this business squarely in a high-growth sector. This positioning suggests a strong trajectory for maintaining market leadership and capturing an increasing share of this dynamic market.

The Craftsmen, Construction & Professional segment within Henkel's Adhesive Technologies is a strong performer. It positively contributed to the organic sales growth of Adhesive Technologies in the first half of 2024, demonstrating robust market demand.

Strategic acquisitions in Maintenance, Repair, and Overhaul (MRO) solutions within this segment, such as the acquisition of a leading MRO provider in North America in early 2024, further reinforce its market position and growth prospects.

Schwarzkopf's Gliss hair care line experienced a significant relaunch in 2024, introducing advanced formulas designed to deliver stronger hair. This strategic move has paid off handsomely for Henkel.

The relaunch has driven impressive double-digit organic sales growth for Gliss. This success in the expanding hair care market positions Gliss as a strong performer, a true star within Henkel's Consumer Brands portfolio.

New Sustainable Adhesive Innovations (e.g., Aquence PS 3017 RE)

Henkel's commitment to sustainability is evident in its development of innovative adhesives like Aquence PS 3017 RE. This particular adhesive earned the FINAT Sustainability Award in 2024, underscoring its environmental benefits and market appeal.

The growing demand for recyclable packaging and reduced carbon footprints in the industry makes these advancements particularly significant. Henkel's focus on eco-friendly solutions like Aquence PS 3017 RE positions them favorably within this expanding market segment.

- Aquence PS 3017 RE: Winner of the FINAT Sustainability Award 2024.

- Addresses market demand for recyclability and CO2 reduction in packaging.

- Highlights Henkel's leadership in sustainable adhesive technology.

Smartwash Technology (Persil & Somat Smartwash)

Smartwash Technology, encompassing Persil and Somat Smartwash, is positioned as a potential star in Henkel's portfolio. The upcoming 2025 European launch of this AI-driven, cartridge-based detergent dosing system signifies a significant innovation with high-growth potential.

This technology directly addresses growing consumer demand for efficiency and sustainability in household chores, aiming to revolutionize the laundry and dish care sectors. For instance, Henkel reported a 5.1% organic sales growth in its Consumer Brands segment in the first quarter of 2024, indicating a strong market for its existing products, which Smartwash aims to build upon.

- Innovation Focus: AI-driven, cartridge-based detergent dosing system.

- Market Entry: Scheduled for Europe in 2025.

- Consumer Value: Addresses efficiency and sustainability needs.

- Industry Impact: Aims to transform laundry and dish care.

Henkel's Adhesive Technologies segment, particularly its Mobility & Electronics division, is a prime example of a Star. This area is experiencing substantial growth, fueled by the burgeoning electric vehicle market, especially in China. The segment's focus on e-mobility and advanced connectivity places it in a high-growth sector, indicating strong potential for continued market leadership.

The Gliss hair care line, following its 2024 relaunch with advanced formulas, is also performing exceptionally well, achieving impressive double-digit organic sales growth. This success positions Gliss as a clear Star within Henkel's Consumer Brands portfolio, capitalizing on the expanding hair care market.

Henkel's Smartwash Technology, set for a 2025 European launch, represents a significant innovation with high-growth potential, aiming to revolutionize laundry and dish care with its AI-driven system. This positions it as a promising Star, building on the 5.1% organic sales growth reported by the Consumer Brands segment in Q1 2024.

| Henkel Business Unit | BCG Category | Key Growth Drivers | Performance Indicators (2024 Data) |

|---|---|---|---|

| Adhesive Technologies: Mobility & Electronics | Star | Electric Vehicle Market Growth (China) | Robust organic sales growth |

| Consumer Brands: Gliss Hair Care | Star | Product Relaunch, Expanding Hair Care Market | Double-digit organic sales growth |

| Consumer Brands: Smartwash Technology (Upcoming) | Potential Star | AI Innovation, Sustainability Demand | Aims to build on 5.1% Q1 2024 Consumer Brands growth |

What is included in the product

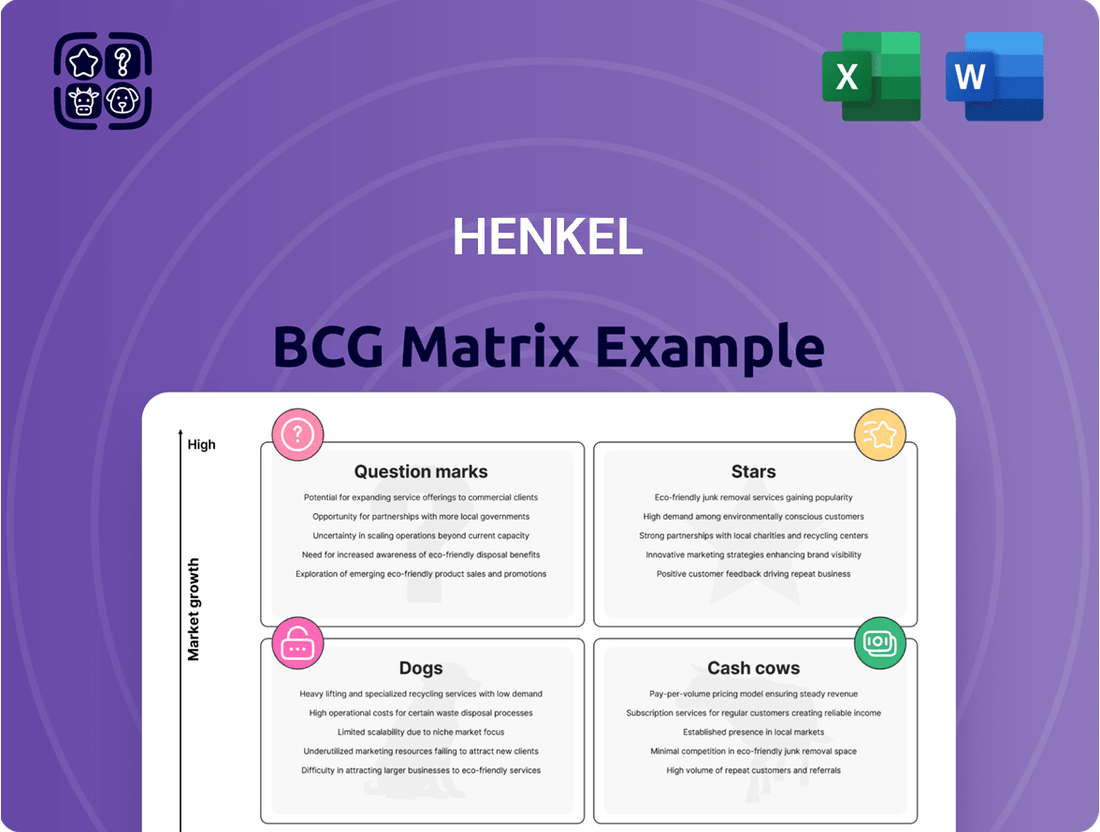

The Henkel BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework guides Henkel in making informed decisions about resource allocation, investment, and divestment for its diverse product portfolio.

The Henkel BCG Matrix provides a clear, visual overview of business unit performance, simplifying strategic decisions and relieving the pain of complex portfolio analysis.

Cash Cows

Henkel Adhesive Technologies stands as a prime example of a Cash Cow within the Henkel portfolio. As the undisputed global leader in the adhesives market, this business unit consistently delivers robust sales figures and impressive adjusted operating profit margins, underscoring its mature and highly profitable nature.

With a commanding market share, Henkel Adhesive Technologies generates substantial and reliable cash flow, which is crucial for funding other business units and strategic initiatives within the broader Henkel organization. For instance, in 2023, Henkel's Adhesive Technologies segment reported sales of €11.1 billion, highlighting its significant contribution to the group's overall revenue.

Persil, a cornerstone of Henkel's Laundry & Home Care segment, exemplifies a classic Cash Cow. Its robust market position, particularly in Europe where it consistently ranks among the top laundry brands, generates substantial and predictable revenue streams for Henkel. For instance, in 2023, Henkel's Laundry & Home Care division reported sales of €7.3 billion, with Persil being a significant contributor to this performance.

The brand benefits from a mature market where consumer loyalty and established distribution channels allow for efficient operations. This maturity means that while growth might be modest, the investment required to maintain its market share is also relatively low, leading to high profitability. This allows Henkel to reinvest profits into its growth-oriented brands.

Schwarzkopf, a cornerstone of Henkel's hair care division, continues to hold a dominant position in the global market. Its extensive product range and robust brand recognition consistently drive sales and profitability, even within the mature hair care segment.

In 2024, Henkel reported strong performance in its Beauty Care segment, where Schwarzkopf plays a pivotal role. The brand's ability to adapt to evolving consumer preferences, including a growing demand for sustainable and personalized hair solutions, underpins its enduring appeal and market leadership.

Core Brands within Consumer Brands Business Unit

Henkel's strategic focus on its top 10 consumer brands, accounting for over half of its consumer revenue, highlights these brands as powerful cash cows. These established brands command strong pricing power and boast impressive gross profit margins, contributing significantly to the company's financial stability and growth potential.

In 2024, Henkel's commitment to these core brands is evident in their sustained performance. For instance, brands like Persil and Schwarzkopf continue to demonstrate robust market share and profitability, reinforcing their status as key income drivers for the Consumer Brands business unit.

- Strong Market Position: Henkel's top 10 consumer brands hold leading positions in their respective categories, ensuring consistent demand.

- High Profitability: These brands typically achieve higher gross profit margins compared to the company average, directly boosting cash flow.

- Investment Focus: The company strategically invests in marketing and innovation for these cash cows to maintain their competitive edge and capitalize on their earnings potential.

- Contribution to Sales: In 2023, these brands collectively generated over 50% of the Consumer Brands business unit's sales, underscoring their importance.

Sustainable Packaging Solutions (across Consumer Brands)

Henkel's commitment to making consumer packaging 100% recyclable or reusable by 2025, coupled with increasing recycled plastic content, bolsters the enduring profitability and cost-effectiveness of its established product lines. These strategic moves are crucial for defending market share and retaining customer loyalty within its mature business segments.

For instance, in 2024, Henkel reported that 89% of its packaging was already recyclable, reusable, or compostable, demonstrating significant progress towards its ambitious goals. This focus on sustainability not only meets growing consumer demand for eco-friendly products but also drives operational efficiencies, such as reduced material costs through increased use of recycled content.

- Market Share Defense: Sustainable packaging initiatives help Henkel maintain its position in established markets by aligning with consumer preferences and regulatory trends.

- Cost Efficiency: Increased use of recycled materials can lead to lower raw material expenses over the long term, enhancing profitability.

- Consumer Loyalty: Demonstrating environmental responsibility fosters stronger brand loyalty among increasingly conscious consumers.

- Regulatory Compliance: Proactive adoption of sustainable practices ensures compliance with evolving environmental regulations, mitigating potential risks.

Cash Cows within Henkel, like Adhesive Technologies and brands such as Persil and Schwarzkopf, are mature businesses with dominant market positions. They generate substantial, reliable cash flow with relatively low investment needs, enabling Henkel to fund growth initiatives in other areas.

In 2023, Henkel's Adhesive Technologies generated €11.1 billion in sales, while Laundry & Home Care, boosted by Persil, brought in €7.3 billion. These segments, along with strong performers in Beauty Care like Schwarzkopf, represent key income drivers, with Henkel's top 10 consumer brands contributing over half of the Consumer Brands unit's sales in 2023.

These established brands benefit from high consumer loyalty and efficient operations, leading to strong profitability. Henkel's strategic focus on these brands, including investments in sustainability like 89% recyclable packaging reported in 2024, helps defend market share and maintain their cash-generating capabilities.

| Business Unit/Brand | 2023 Sales (EUR billions) | Key Characteristic | Contribution to Henkel |

|---|---|---|---|

| Adhesive Technologies | 11.1 | Global leader, mature, high profit margins | Major cash generator |

| Laundry & Home Care (incl. Persil) | 7.3 | Strong market position, established loyalty | Reliable revenue stream |

| Beauty Care (incl. Schwarzkopf) | N/A (Segment data) | Dominant global position, adapting to trends | Consistent profitability |

| Top 10 Consumer Brands | >50% of Consumer Brands sales | Leading categories, high gross margins | Financial stability, funding growth |

What You See Is What You Get

Henkel BCG Matrix

The Henkel BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be immediately available for your business planning needs. Rest assured, there are no watermarks or demo content; you're getting the complete, professionally crafted report ready for immediate application.

Dogs

Henkel's body care segment in North America and Europe has seen a downturn, signaling a weak position in these markets. This suggests both low market share and potentially sluggish growth, making them prime candidates for strategic review.

For instance, in 2024, the beauty care sector in Europe experienced a modest 2.5% growth, yet specific sub-segments like body care within Henkel's portfolio lagged significantly behind this average, indicating a competitive disadvantage.

Given this underperformance, Henkel might consider portfolio adjustments, such as divesting these underperforming assets or reallocating resources to more promising areas, to streamline its business operations and improve overall profitability.

Henkel's divestment of its North American retailer brands business in 2023, which generated approximately €200 million in sales, exemplifies a strategic move within the BCG Matrix. This action suggests these brands occupied a 'Dog' quadrant, characterized by low market share and limited growth potential, thereby freeing up capital and management focus for more promising ventures.

Henkel's consumer brands division experienced a slowdown in Q1 2025, with weak US demand specifically impacting laundry and home care products. This indicates that some of their North American laundry brands might be facing challenges, potentially characterized by a low market share and sluggish growth prospects within this segment.

Certain Legacy Brands impacted by Portfolio Optimization

Henkel's strategic portfolio optimization, initiated in 2022, has significantly impacted certain legacy brands. The company aimed to streamline its Consumer Brands division, a move that involved divesting or discontinuing brands with a combined value exceeding €1 billion. This strategic pruning targets products with weaker growth prospects and smaller market shares, aligning with the principles of portfolio management to focus resources on more promising areas.

The brands divested or discontinued were primarily those identified as underperforming within the Henkel BCG Matrix, likely categorized as 'Dogs'. These are brands that typically operate in mature or declining markets and hold a low market share. For instance, by the end of 2023, Henkel had completed the divestment of several non-core brands, freeing up capital and management attention for higher-potential businesses.

- Portfolio Streamlining: Henkel divested or discontinued over €1 billion worth of brands as part of its Consumer Brands optimization since 2022.

- Focus on Growth: This strategy targets legacy brands with low market share and limited growth potential, often classified as 'Dogs' in portfolio analysis.

- Financial Impact: The optimization aims to reallocate resources from underperforming assets to more profitable and growing segments of the business.

- Strategic Rationale: By shedding these legacy brands, Henkel enhances its overall competitiveness and financial flexibility.

Products affected by supply chain challenges and subdued consumer sentiment in North America

Henkel's consumer brands experienced a slowdown in sales, particularly in North America, due to weakened consumer spending and ongoing supply chain disruptions. This environment points to potential challenges for products within Henkel's portfolio that are sensitive to these macroeconomic headwinds, possibly indicating a position in the Dogs quadrant of the BCG matrix.

For instance, in 2024, the North American market saw a noticeable dip in discretionary spending across several consumer goods categories. This, combined with persistent logistics issues affecting product availability and cost, likely impacted sales volumes for certain Henkel products. The company's 2024 financial reports indicated that while Adhesive Technologies performed strongly, the Consumer Brands segment faced greater headwinds.

- North American Consumer Demand: Reports from early 2024 highlighted a contraction in consumer confidence in key North American markets, leading to reduced purchasing of non-essential household goods.

- Supply Chain Bottlenecks: Despite some improvements from previous years, transportation and raw material availability issues continued to affect product delivery times and costs for Henkel in 2024.

- Category Performance: Specific product lines within Henkel's laundry and home care or beauty care segments, particularly those with higher price points or less brand loyalty, may have underperformed due to these combined pressures.

Henkel's strategic pruning of its brand portfolio, which saw over €1 billion in brands divested or discontinued since 2022, primarily targets 'Dogs.' These are brands with low market share and limited growth prospects, often found in mature or declining markets.

For example, Henkel's divestment of its North American retailer brands business in 2023, generating around €200 million in sales, exemplifies this 'Dog' classification. This move frees up capital and management focus for more promising ventures.

The company's 2024 financial reports indicated that while Adhesive Technologies performed strongly, the Consumer Brands segment faced greater headwinds, with weak US demand impacting laundry and home care products, suggesting potential 'Dog' status for some of these brands.

These underperforming assets, characterized by low market share and sluggish growth, are prime candidates for divestment or discontinuation to streamline operations and improve overall profitability.

| Category | Market Share | Growth Rate | Strategic Implication |

|---|---|---|---|

| Body Care (NA/Europe) | Low | Sluggish | Divestment or Reallocation |

| Certain Laundry Brands (US) | Low | Weak | Portfolio Optimization |

| Divested Retailer Brands (NA) | Low | Limited | Completed Divestment |

Question Marks

New professional hair products acquired by Henkel, like Vidal Sassoon in China, are positioned as potential question marks in the BCG matrix. While Henkel's overall hair business demonstrated robust performance in Q1 2024, these new additions have an undefined market share within Henkel's broader portfolio.

Significant investment will be necessary to cultivate these products into stars, given their current status as emerging offerings. Their future success hinges on strategic market penetration and brand development initiatives.

Henkel is actively developing innovative bio-based polyurethane adhesives, targeting over 50% renewable carbon content by 2025, particularly for the consumer electronics sector. This positions them in a high-growth segment fueled by increasing demand for sustainable materials.

While these advanced adhesives represent a promising future for the industry, their current market penetration is still in its nascent stages. The company's investment in this area reflects a strategic move towards capturing future market share in environmentally conscious electronics manufacturing.

Henkel is pushing the boundaries of packaging sustainability with adhesive innovations designed for enhanced recyclability and significant CO2 reduction. These advancements are crucial for the burgeoning circular economy market, a sector experiencing rapid growth and increasing demand for eco-friendly solutions.

While Henkel is at the forefront of innovation in this expanding market, the widespread adoption and market penetration of these advanced adhesives are still in their formative stages. The global market for sustainable packaging solutions, including those enabled by circular economy principles, was valued at approximately $280 billion in 2023 and is projected to grow substantially in the coming years, with circular economy initiatives being a key driver.

Digital Applications and Data-Driven Innovations in Consumer Brands

Henkel is actively leveraging digital applications and data analytics to gain deeper, more immediate insights into consumer preferences and evolving market dynamics. This strategic focus aims to accelerate innovation cycles for its diverse brand portfolio.

These digital advancements are positioned as high-growth drivers, fundamentally reshaping how Henkel develops and markets its products. While the full market impact is still being assessed, early indicators suggest significant potential for enhanced consumer engagement and product relevance.

- Data-Driven Insights: Henkel utilizes advanced analytics to understand consumer behavior, leading to more targeted product development.

- Digital Innovation: Investments in digital platforms and tools are key to future growth and market responsiveness.

- Market Impact: The company is closely monitoring the effectiveness of its digital strategies in driving sales and brand loyalty.

- Consumer Focus: A core objective is to better anticipate and meet evolving consumer needs through technology.

Products aimed at 'Right to Repair' and device repairability

Henkel is actively developing adhesive solutions that directly support the 'Right to Repair' movement, enhancing device longevity and enabling easier repair, recycling, and redesign within the electronics industry. This strategic focus positions them in a rapidly expanding market driven by sustainability and a growing consumer desire for more repairable products.

These advanced adhesives are crucial for making electronic components more modular and accessible, thereby reducing electronic waste and extending product lifecycles. For instance, Henkel's LOCTITE brand offers specialized adhesives that allow for disassembly and reassembly without damaging sensitive components, a key requirement for repairability.

- Adhesive Technologies for Repair: Henkel's innovations in adhesives facilitate the disassembly and reassembly of electronic devices, crucial for repairability and extending product life.

- Sustainability Focus: The company's efforts align with the growing 'Right to Repair' movement, addressing consumer demand for more sustainable and repairable electronics.

- Market Growth: This segment represents a high-growth area for Henkel, capitalizing on increasing consumer and regulatory pressure for product longevity and reduced e-waste.

- Examples: LOCTITE's specialized adhesives are designed to withstand repeated disassembly cycles, making them ideal for repair-focused product designs.

Question marks in Henkel's portfolio represent products or business units with low market share in high-growth markets. These are often new ventures or products facing strong competition, requiring significant investment to gain traction.

Henkel's investment in innovative bio-based polyurethane adhesives, targeting over 50% renewable carbon content by 2025 for consumer electronics, exemplifies a potential question mark. While the segment is high-growth due to demand for sustainable materials, these advanced adhesives are in their early stages of market penetration.

Similarly, Henkel's adhesive innovations for enhanced recyclability and CO2 reduction in packaging, while crucial for the growing circular economy market, are also in their formative stages of widespread adoption. The global sustainable packaging market was valued at approximately $280 billion in 2023, indicating significant growth potential for these nascent technologies.

Henkel's strategic focus on digital applications and data analytics to accelerate innovation cycles also positions these advancements as question marks. While early indicators suggest significant potential for enhanced consumer engagement, their full market impact and market share are still being assessed.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.