Hellenic Petroleum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hellenic Petroleum Bundle

Political stability in Greece, fluctuating global oil prices, and the increasing adoption of renewable energy technologies are just a few of the critical external factors shaping Hellenic Petroleum's future. Understanding these dynamics is crucial for any serious investor or strategic planner. Our comprehensive PESTLE analysis delves deep into these influences, offering actionable intelligence.

Gain a strategic advantage by uncovering the intricate interplay of political, economic, social, technological, legal, and environmental forces impacting Hellenic Petroleum. This expert-crafted analysis provides the clarity you need to anticipate challenges and capitalize on opportunities. Don't miss out on vital market intelligence.

Unlock the full picture of Hellenic Petroleum's external environment with our meticulously researched PESTLE analysis. From regulatory shifts to evolving consumer preferences, we’ve covered it all. Equip yourself with the knowledge to make informed decisions and strengthen your market position. Purchase the complete report now.

Political factors

The stability of the Greek government directly impacts HELLENiQ ENERGY's operating environment through consistent energy policies and regulatory frameworks. A stable political climate, as seen in Greece into 2024, fosters long-term investment planning, particularly for large-scale projects in renewable energy and hydrocarbon exploration. Changes in government can lead to shifts in energy strategy, affecting subsidies or taxation, for instance, impacting HELLENiQ ENERGY's planned investments of over €4 billion in green energy by 2030. The current administration's commitment to the National Energy and Climate Plan (NECP) provides a predictable framework for the 2024-2025 period, supporting the company's diversification efforts. Such stability helps ensure the continuation of initiatives like Greece's ambition to reach 80% renewables in its electricity mix by 2030.

Ongoing territorial and jurisdictional disputes in the Eastern Mediterranean, particularly with Turkey, create an uncertain environment for HELLENiQ ENERGY's offshore hydrocarbon exploration. As of early 2025, these geopolitical tensions can significantly disrupt exploration and production schedules in areas like Block 2 south of Crete, impacting potential gas discoveries. Such instability increases political risk for the company's investments, potentially delaying projected revenue streams from new fields. Conversely, diplomatic resolutions, possibly seen in late 2024 or early 2025, could unlock significant reserves, potentially adding billions of cubic meters to Greece's estimated gas potential. This dynamic political landscape directly influences HELLENiQ's operational planning and long-term strategic outlook.

As an EU member, Greece must align its energy policies with directives like the Fit for 55 package, targeting a 55% emissions reduction by 2030, and the Corporate Sustainability Reporting Directive (CSRD), effective for large firms from January 2024. These mandate a shift towards renewables and stricter emissions targets, compelling HELLENiQ ENERGY to accelerate its green transition, with plans to reach 1 GW of RES capacity by 2030. The EU's push for energy independence also positions Greece as a potential regional energy hub. This creates opportunities for HELLENiQ ENERGY to expand its role in the evolving energy landscape.

Hydrocarbon Exploration Licensing and Regulation

The Greek government's stance on hydrocarbon exploration and the efficiency of its licensing process are critical political factors for HELLENiQ. Recent government actions, such as launching new international tenders for exploration blocks by early 2025, indicate a renewed interest in leveraging domestic resources to enhance energy security. This strategic shift aims to unlock potential offshore gas reserves, with estimates suggesting significant volumes. HELLENiQ's collaboration with international energy companies like ExxonMobil and Chevron in these tenders highlights the importance of a favorable and predictable regulatory environment for attracting crucial foreign investment and expertise.

- Greece launched new international tenders for hydrocarbon exploration blocks by early 2025.

- Potential offshore gas reserves are estimated to be substantial, driving government interest.

- HELLENiQ continues partnerships with ExxonMobil and Chevron in exploration efforts.

- A stable regulatory environment is crucial for attracting foreign investment in the sector.

Privatization and State Shareholding

The level of state ownership in HELLENiQ ENERGY significantly shapes its governance and strategic direction. As of early 2024, the Hellenic Republic Asset Development Fund (HRADF) holds approximately 35.5% of the company, influencing major corporate decisions. Any government privatization strategy, including potential sales of its remaining shares, could alter the company's capital structure and foster new strategic partnerships. Political decisions concerning the state’s continued shareholding will remain a critical factor in HELLENiQ ENERGY’s corporate evolution.

- HRADF holds about 35.5% of HELLENiQ ENERGY as of 2024.

- Government privatization plans could introduce new strategic investors.

- Potential share sales impact the company's capital structure and market valuation.

- Political stability directly influences investor confidence in state-owned assets.

Greek government stability and its commitment to the NECP provide a predictable framework for HELLENiQ ENERGY's diversification, including over €4 billion in green investments by 2030. EU directives like Fit for 55 and CSRD, effective January 2024, necessitate accelerating its transition to 1 GW RES capacity. Geopolitical tensions in the Eastern Mediterranean, while creating uncertainty for offshore exploration like Block 2, are balanced by new international tenders launched by early 2025 for potential gas reserves.

| Factor | Impact on HELLENiQ ENERGY | Key Data (2024/2025) |

|---|---|---|

| Government Stability | Predictable investment climate | €4B green investments by 2030 |

| EU Directives | Accelerated green transition | CSRD effective Jan 2024; 1 GW RES capacity by 2030 |

| Geopolitical Tensions | Offshore exploration uncertainty | New tenders by early 2025 for gas blocks |

What is included in the product

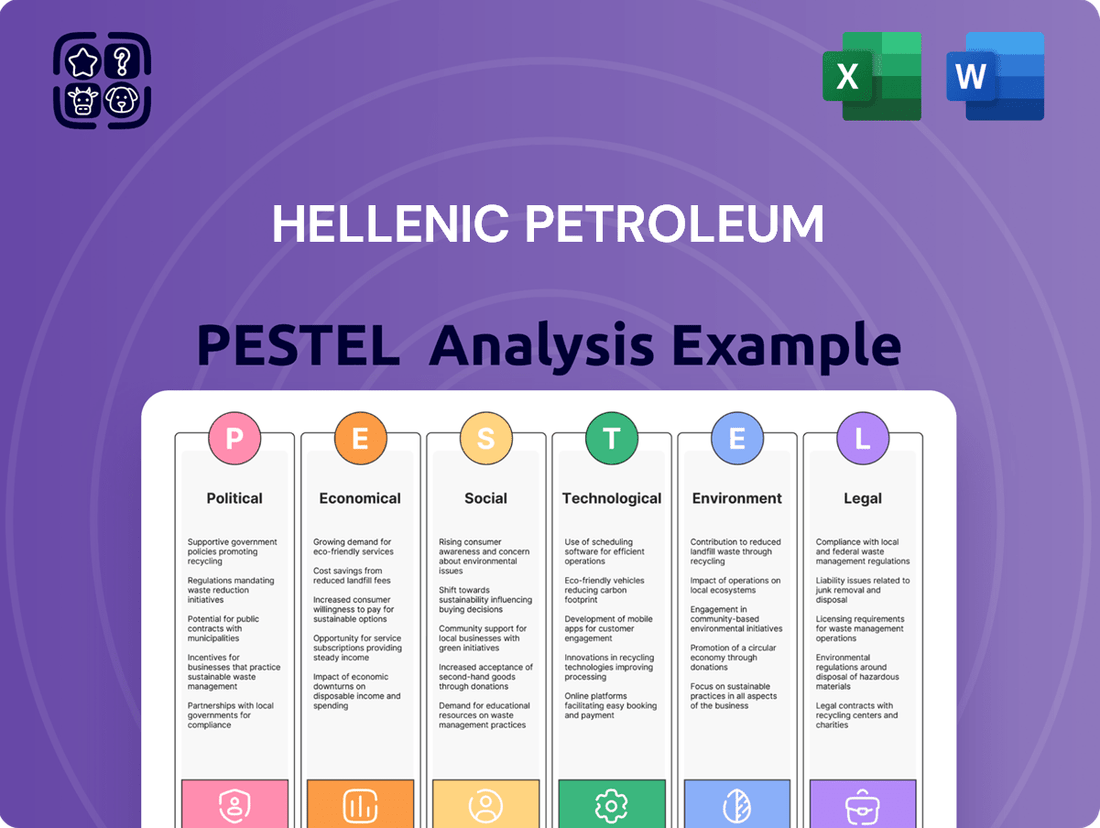

This Hellenic Petroleum PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic planning.

It provides a comprehensive overview of external forces, highlighting key trends and potential impacts relevant to Hellenic Petroleum's industry and geographic focus.

A PESTLE analysis of Hellenic Petroleum acts as a pain point reliever by providing a structured framework to anticipate and mitigate external threats and opportunities, thereby streamlining strategic decision-making.

This PESTLE analysis offers Hellenic Petroleum a clear path through complex external forces, transforming potential disruptions into manageable challenges and fostering proactive, resilient business strategies.

Economic factors

HELLENiQ ENERGY's profitability hinges on global crude oil prices and refining margins, which remain highly volatile, directly impacting its core refining business. Geopolitical events, such as ongoing conflicts or OPEC+ decisions, significantly influence supply and demand dynamics, affecting margins. The normalization of refining margins from the elevated levels seen in 2022 and early 2023 is expected to temper earnings and cash flow in 2024 and 2025. For instance, European refining margins, after peaking, are projected to stabilize, impacting HELLENiQ ENERGY's financial outlook.

The Greek economy's robust recovery significantly boosts HELLENiQ's domestic market. Greece's GDP is projected to grow by around 2.2% in 2024, driving increased private consumption and industrial activity. This growth fuels demand for transportation fuels and petroleum products. The country's emergence from its financial crisis and recent investment-grade credit ratings, like Fitch's upgrade in late 2023, enhance the overall business climate, supporting HELLENiQ's operational landscape.

Hellenic Petroleum's Vision 2025 strategy earmarks significant capital for renewable energy sources (RES), targeting 1 GW of installed capacity by 2025 and 2 GW by 2030. This economic shift is propelled by the ongoing decline in renewable technology costs, enhancing the long-term viability of green energy projects. Securing financing is crucial, as evidenced by the €766 million framework agreement signed in late 2023 with major banks to fund these large-scale RES initiatives. This strategic investment reflects a robust economic commitment to a diversified, lower-carbon portfolio.

Inflation and Operating Costs

Inflationary pressures significantly impact HelleniQ Energy's operating expenditures, affecting raw material costs, logistics, and labor. While the Harmonized Index of Consumer Prices (HICP) in Greece moderated to around 2.4% in April 2024, elevated price environments continue to challenge the profitability of refinery operations. The company must manage these costs effectively to maintain competitiveness, especially as its capex for the green transition, focusing on new capital-intensive technologies, remains substantial through 2025. Managing volatile crude oil prices, which hovered around $85 per barrel in mid-2024, is crucial for maintaining margins.

- Greece's HICP stood at approximately 2.4% in April 2024, impacting operational costs.

- Brent crude oil prices were around $85 per barrel in mid-2024, directly influencing raw material expenses.

- Logistics and labor costs continue to rise, pressuring refinery profitability.

- HelleniQ Energy's significant capital expenditure on new green technologies through 2025 demands stringent cost control.

Access to Capital and Financing Costs

HELLENiQ Energy’s ambitious transformation, encompassing refinery upgrades and renewable energy expansion, heavily relies on its access to diverse capital markets. Greece's improved credit rating to investment grade by agencies like S&P (BBB- stable outlook as of October 2023) significantly reduces borrowing costs for Greek entities, including HELLENiQ. The company's robust financial performance, with an adjusted EBITDA of approximately €1.2 billion in 2023, further enhances its creditworthiness. Successfully issuing new bonds, like its €500 million Eurobond in 2023, and refinancing existing debt are crucial for managing its net debt, which stood around €1.5 billion, ensuring a healthy balance sheet and funding future growth initiatives.

- Greece's credit rating uplifted to investment grade (e.g., S&P BBB-).

- HELLENiQ Energy's 2023 adjusted EBITDA reached approximately €1.2 billion.

- Net debt for HELLENiQ Energy stood around €1.5 billion in late 2023.

- Successful Eurobond issuance of €500 million in 2023.

HELLENiQ ENERGY's financial outlook for 2024-2025 is shaped by stabilizing refining margins and volatile crude oil prices, around $85 per barrel in mid-2024. Greece's projected 2.2% GDP growth in 2024 supports domestic demand, aided by its investment-grade status. The company's significant €766 million investment in renewables by 2025, targeting 1 GW, underscores its strategic economic pivot. Inflationary pressures, with Greek HICP at 2.4% in April 2024, continue to challenge operational costs.

| Economic Factor | 2024/2025 Outlook | Key Data Point |

|---|---|---|

| Refining Margins | Stabilizing from 2022-2023 highs | Impacts earnings and cash flow |

| Greek GDP Growth | Projected 2.2% in 2024 | Boosts domestic fuel demand |

| Renewable Investment | Targeting 1 GW by 2025 | €766 million financing secured |

| Inflation (Greece HICP) | Around 2.4% in April 2024 | Pressures operating expenditures |

| Crude Oil Price (Brent) | Around $85 per barrel (mid-2024) | Directly influences raw material costs |

Full Version Awaits

Hellenic Petroleum PESTLE Analysis

This preview showcases the comprehensive PESTLE analysis of Hellenic Petroleum, offering insights into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's operations.

The content and structure shown in the preview is the same document you’ll download after payment. You'll find a detailed examination of market trends, regulatory landscapes, and competitive pressures impacting the energy sector.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a robust framework for understanding Hellenic Petroleum's strategic positioning and potential growth avenues.

What you’re previewing here is the actual file—fully formatted and professionally structured. Dive into the critical elements that shape Hellenic Petroleum's business environment and future outlook.

Sociological factors

A significant societal shift towards environmental consciousness is driving increased demand for cleaner energy and sustainable products globally. This trend directly supports HELLENiQ Energy's strategic pivot towards renewable energy and lower-carbon fuels, with the company targeting over 1 GW of installed renewable capacity by 2025. Consumers and investors are increasingly prioritizing companies with strong ESG credentials; for instance, ESG funds saw continued inflows exceeding $100 billion in early 2024, influencing corporate strategy and brand reputation. This growing awareness pushes for reduced carbon footprints and sustainable operations across all sectors.

Public scrutiny of hydrocarbon exploration intensifies, particularly for HELLENiQ ENERGY in areas like the Ionian Sea, where environmental groups like Greenpeace Greece actively campaign against new drilling. This societal pressure frequently leads to project delays and increased regulatory hurdles, as seen with ongoing opposition to exploration blocks off Crete in 2024. Such challenges can significantly impact HELLENiQ's operational timelines and reputational standing. To maintain its social license, transparent communication and robust environmental management, aligning with its 2025 decarbonization goals, are crucial. Public sentiment heavily influences future energy policy and investment in Greece.

The gradual shift towards electric vehicles and evolving mobility patterns represents a significant sociological trend, directly impacting future demand for traditional fossil fuels. HELLENiQ Energy is proactively addressing this by investing in e-mobility infrastructure, including a network of over 300 EV charging points by early 2025, expanding its new energy portfolio. The pace of this transition is heavily influenced by government incentives, such as Greece's €8,000 subsidy for EV purchases through programs like Kinoumai Ilektrika 2, and the continuous development of public charging networks. Consumer preference and the increasing availability of affordable EV models also play a crucial role in accelerating this societal shift.

Local Community Engagement and Economic Impact

HELLENiQ Energy, as a significant industrial entity, profoundly impacts local communities, particularly around its refineries and burgeoning renewable energy sites. Its operations are vital for regional economic development, creating crucial local employment opportunities. For instance, the company's commitment to energy transition projects, including substantial investments in areas like Kozani, directly supports local economies and fosters positive community relations. This dedication to corporate social responsibility is integral to maintaining social license to operate.

- HELLENiQ Energy’s 2023 Corporate Social Responsibility report highlights over €12 million invested in social initiatives.

- The group's 2024-2025 energy transition plan includes significant local job creation in renewable energy projects.

- Investments in Kozani, part of their €4 billion green energy roadmap by 2030, are set to generate numerous local roles.

- Community engagement programs aim to enhance local infrastructure and educational opportunities.

Need for a Just Energy Transition

The energy transition away from fossil fuels presents significant social concerns regarding the future of the workforce in traditional energy sectors. Ensuring a 'just transition' is paramount, which necessitates comprehensive reskilling programs and the creation of new employment opportunities within the burgeoning green economy. HELLENiQ Energy, for instance, is actively diversifying, with targets to reach 1 GW of installed renewable energy capacity by 2025, demonstrating its commitment to new business lines.

- HELLENiQ Energy aims for 1 GW of installed renewable capacity by 2025, fostering new roles.

- The company is investing over €4 billion by 2030 in green energy and sustainable solutions.

- This strategic shift directly addresses workforce engagement and job security during the transition.

Societal demand for environmental sustainability and strong ESG credentials is rapidly increasing, impacting consumer and investor choices. Public scrutiny of hydrocarbon activities, particularly from groups like Greenpeace Greece, creates operational challenges and delays for HELLENiQ Energy. The shift towards electric vehicles, supported by government incentives, necessitates HELLENiQ's investment in new energy infrastructure. Maintaining social license also requires a focus on local community impact and a just workforce transition.

| Sociological Factor | Trend/Impact | 2024/2025 Data Point |

|---|---|---|

| Environmental Consciousness | Increased demand for clean energy; ESG focus | >$100B ESG fund inflows (early 2024) |

| Public Scrutiny | Opposition to hydrocarbon exploration | Greenpeace Greece campaigns (2024) |

| Evolving Mobility | Shift to Electric Vehicles (EVs) | 300+ EV charging points by early 2025 |

| Community & Workforce | Local impact, just transition | €12M in social initiatives (2023) |

Technological factors

Rapid innovation in solar, wind, and energy storage technologies is central to HELLENiQ's strategic shift, with utility-scale solar PV costs averaging below $30/MWh in 2024. The company is investing in cutting-edge photovoltaic parks and exploring offshore wind, targeting 1 GW of renewable capacity by 2025. Developing battery storage projects further diversifies their profitable renewables portfolio. The declining cost curve and increasing efficiency of these technologies make them increasingly competitive with traditional power sources.

HELLENiQ Energy is significantly investing in digitalizing and modernizing its refining operations, targeting enhanced efficiency and a reduced carbon footprint. This includes implementing advanced process controls and energy management systems across its facilities, aiming for a 25% energy consumption reduction by 2030, with significant progress expected in 2024-2025. Leveraging data analytics helps optimize performance and bolster safety protocols. These technological upgrades are vital for maintaining competitiveness in the core business as the energy transition accelerates.

HELLENiQ ENERGY is actively investing in emerging technologies like green hydrogen and advanced biofuels, aligning with its Vision 2025 strategy for decarbonization. These low-carbon fuels are crucial for reducing emissions in hard-to-abate sectors, including heavy industry and transportation. The company's collaboration with Neste, a global leader in sustainable aviation fuel (SAF), exemplifies its commitment to integrate new technologies. This partnership aims to expand SAF availability, with HELLENiQ ENERGY targeting a 50% reduction in Scope 1 and 2 emissions by 2030, leveraging such advancements.

Carbon Capture, Utilization, and Storage (CCUS)

Carbon Capture, Utilization, and Storage (CCUS) technologies offer HELLENiQ a crucial pathway to mitigate emissions from its existing hydrocarbon operations, aligning with broader decarbonization goals. Despite being in an evolving stage and facing significant economic hurdles, the potential to capture CO2 from industrial processes is a key component of the company's long-term environmental strategy. Greece is actively developing a legal and regulatory framework for CCUS, signaling future operational potential and investment opportunities, with an estimated €1.5 billion in public and private funding earmarked for green initiatives by 2025. HELLENiQ is exploring pilot projects, aiming to reduce its carbon footprint by a projected 25% by 2030 through such initiatives, alongside other green investments.

- HELLENiQ targets a 25% reduction in carbon footprint by 2030, partly through CCUS.

- Greece is developing a CCUS legal framework, supporting future projects.

- Estimated €1.5 billion in public and private funding is allocated for Greek green initiatives by 2025.

- CCUS provides a strategic opportunity for emissions mitigation in existing hydrocarbon operations.

Grid Infrastructure and Energy Storage

The expansion of renewable energy, crucial for HELLENiQ Energy, hinges on modernizing Greece's electricity grid and deploying large-scale energy storage solutions. HELLENiQ's strategic investments in battery storage projects, such as its planned 250 MW capacity by 2025, are vital for ensuring grid stability and maximizing the value of its intermittent renewable power generation. The company's success in the burgeoning renewables sector is directly tied to broader technological advancements in grid management and smart grid adoption across the nation.

- Greece's grid upgrades aim for 15 GW RES integration by 2030, supporting HELLENiQ's 1 GW RES target.

- Battery storage deployments are critical; HELLENiQ targets 250 MW by 2025, enhancing grid flexibility.

- Advanced grid management technologies are essential for absorbing HELLENiQ's growing renewable output.

- The Greek NECP (2024 revision) emphasizes significant investment in grid infrastructure for energy transition.

HELLENiQ Energy is rapidly investing in renewable technologies, targeting 1 GW of capacity by 2025 and 250 MW in battery storage. Digitalization initiatives in refining aim for significant energy consumption reduction by 2025. The company is also exploring green hydrogen and advanced biofuels, aligning with a 50% Scope 1 and 2 emissions reduction goal by 2030. Carbon Capture, Utilization, and Storage (CCUS) projects are being explored, supported by Greece's €1.5 billion green funding by 2025.

| Technology Area | 2024/2025 Target/Metric | Impact |

|---|---|---|

| Renewable Capacity | 1 GW by 2025 | Diversifies energy portfolio |

| Battery Storage | 250 MW by 2025 | Enhances grid stability |

| Refining Digitalization | Energy reduction progress | Boosts operational efficiency |

| Green Initiatives Funding | €1.5 billion (Greece) | Supports decarbonization projects |

Legal factors

Starting in 2024, HELLENiQ ENERGY must comply with the EU's Corporate Sustainability Reporting Directive (CSRD), which mandates detailed reporting on sustainability matters according to European Sustainability Reporting Standards (ESRS).

This directive significantly increases the scope and complexity of non-financial reporting for the company, requiring enhanced transparency regarding environmental and social impacts, risks, and opportunities.

This legal requirement directly reinforces the integration of crucial ESG factors into HELLENiQ ENERGY's corporate strategy and operational practices as of the 2024 fiscal year.

Greece's National Climate Law mandates a 55% reduction in emissions by 2030 and net-zero by 2050, profoundly impacting all economic sectors. This legislative framework directly compels HELLENiQ ENERGY, formerly Hellenic Petroleum, to align its strategic Vision 2025 with these national decarbonization goals. HELLENiQ ENERGY aims for a 40% reduction in its Scope 1 and 2 emissions by 2030 compared to 2019 levels. This includes significant investments in renewables and sustainable fuels to meet stringent regulatory requirements by mid-2025. The company's compliance is crucial for maintaining operational licenses and securing future financing within this evolving legal landscape.

The legal framework in Greece, encompassing licensing, auctions, and grid connection rules for renewable energy, significantly impacts HELLENiQ's RES business. Government updates to these regulations, common in 2024-2025, can directly influence project timelines and overall profitability. A stable and supportive legal environment is essential for HELLENiQ to achieve its ambitious renewable energy capacity targets, aiming for over 1 GW by 2025 and 2 GW by 2030.

Hydrocarbons Law and Exploration Rights

Greece's Hydrocarbons Law dictates all upstream activities for entities like HELLENiQ ENERGY, regulating prospection, exploration, and exploitation rights. Lease agreements with the state, such as those for offshore blocks in the Ionian Sea and off Crete, precisely define the operational terms and fiscal obligations. The legal process for granting new concessions remains pivotal, directly influencing the company's ability to expand its exploration portfolio and secure future reserves.

- Current concessions include exploration rights in key offshore blocks like Ionian and Southwest Crete.

- Regulatory frameworks are evolving, with Greece targeting increased domestic gas production by 2027.

- The company's investment in exploration reached approximately €30 million in 2023.

Solidarity Contribution and Energy Sector Taxation

The Greek government holds legal authority to impose special taxes on the energy sector, directly impacting Hellenic Petroleum (now HELLENiQ ENERGY). For instance, the extraordinary Solidarity Contribution on refining companies for 2024 profits is a potential measure, following similar levies from previous years. Such fiscal interventions, like the 2022 windfall tax that impacted energy firms, directly affect the company's financial planning and profitability outlook. The ongoing potential for new sector-specific taxes creates considerable legal and financial uncertainty for HELLENiQ ENERGY's operations.

- Greece's 2022 windfall tax on energy companies was 90% of excess profits.

- The EU Council Regulation (EU) 2022/1854 allowed Member States to implement a temporary solidarity contribution on windfall profits.

- HELLENiQ ENERGY reported significant profits, making it a target for such contributions.

- Future fiscal policies remain a key risk for 2025 financial projections.

HELLENiQ ENERGY navigates complex legal frameworks, including the EU CSRD from 2024 and Greece's National Climate Law mandating a 55% emissions cut by 2030.

Renewable energy regulations and the Hydrocarbons Law dictate project development and exploration rights, with new concessions influencing future reserves.

The potential for government-imposed special taxes, such as a Solidarity Contribution on 2024 profits, directly impacts profitability and financial outlook.

| Legal Area | Key Requirement/Impact | Target/Data (2024-2025) |

|---|---|---|

| CSRD Compliance | Enhanced sustainability reporting | Mandatory from 2024 fiscal year |

| National Climate Law | Emissions reduction targets | 40% Scope 1&2 reduction by 2030 |

| Renewable Energy Regulations | RES capacity targets | Over 1 GW by 2025, 2 GW by 2030 |

| Hydrocarbons Law | Exploration investment | Approx. €30M in 2023; new concessions pivotal |

| Taxation | Potential windfall taxes | Solidarity Contribution on 2024 profits possible |

Environmental factors

The foremost environmental driver for HELLENiQ ENERGY is the global imperative to tackle climate change by significantly reducing greenhouse gas emissions. This has directly led to the company's strategic transformation, moving from a conventional oil company towards an integrated energy group. HELLENiQ ENERGY is committed to an ambitious goal of cutting its carbon footprint by 50% by 2030. Furthermore, the company aims to achieve net-zero emissions across its operations by 2050, emphasizing its focus on low-carbon energy solutions and renewable energy investments, a key strategic pillar for 2024-2025.

HELLENiQ Energy is aggressively expanding its renewable energy portfolio, primarily through solar and wind power. The company is making substantial investments to reach over 1 GW of installed RES capacity by 2025/2026. This strategic shift targets 2 GW by 2030, significantly reducing its environmental footprint. This transition allows HELLENiQ to capitalize on the rapidly growing green energy market, aligning with global sustainability trends.

HELLENiQ is actively investing in the production and supply of more environmentally friendly fuels to address transportation sector emissions. This includes a strategic collaboration with Neste, which saw the first supply of Sustainable Aviation Fuel (SAF) in Greece in early 2024, targeting a significant reduction in aviation carbon footprint. Developing robust capabilities in biofuels and other renewable fuels is central to its 2025 strategy, aiming to reduce the carbon intensity of its product portfolio by 20% by 2030, aligning with evolving environmental regulations and market demands.

Operational Environmental Management

HELLENiQ ENERGY, formerly Hellenic Petroleum, prioritizes enhancing the environmental performance of its core refining operations. The company actively invests in energy efficiency projects and works to significantly reduce flaring across its facilities. These efforts are supported by robust environmental management systems designed to minimize pollution and waste generation, ensuring compliance with stringent EU environmental regulations. For instance, the company targets continued reductions in Scope 1 and 2 emissions, aligning with 2025 sustainability goals.

- HELLENiQ ENERGY aims for a 25% reduction in Scope 1 and 2 emissions by 2030, building on 2023 progress.

- Investments in renewable energy and green hydrogen initiatives are projected to exceed €4 billion by 2030.

- The company's environmental management systems are certified to ISO 14001, ensuring continuous improvement.

- Flaring intensity decreased by 20% in 2023 compared to 2022, demonstrating operational improvements.

Circular Economy and Waste Management

HELLENiQ Energy is increasingly integrating circular economy principles, aiming to produce fuels and chemicals from low-carbon and waste materials by 2025. This strategic shift reduces reliance on virgin fossil resources and minimizes the environmental footprint of its operations. The company's 2024 investment in advanced biofuels, targeting 150,000 tons of sustainable aviation fuel production annually, aligns with broader EU policy goals for a circular economy. This commitment supports the EU Green Deal's objective of achieving climate neutrality by 2050.

- By 2025, HELLENiQ aims for significant production from waste-derived feedstocks.

- The company's 2024 investments focus on sustainable aviation fuels.

HELLENiQ ENERGY is undergoing a significant strategic transformation driven by climate change imperatives, targeting a 50% carbon footprint reduction by 2030 and net-zero by 2050, with substantial investments in renewable energy. By 2025/2026, the company aims for over 1 GW of installed RES capacity, actively producing sustainable aviation fuels from 2024. Its core refining operations also prioritize environmental improvements through energy efficiency and reduced flaring, supported by ISO 14001 certified management systems.

| Environmental Metric | 2024/2025 Target/Status | Long-Term Goal |

|---|---|---|

| RES Capacity | >1 GW by 2025/2026 | 2 GW by 2030 |

| Carbon Footprint Reduction | Strategic transformation ongoing | 50% by 2030; Net-zero by 2050 |

| Sustainable Aviation Fuel (SAF) | First supply in Greece (early 2024) | 150,000 tons annually |

PESTLE Analysis Data Sources

Our Hellenic Petroleum PESTLE Analysis is built on a comprehensive foundation of data from official Greek government agencies, European Union regulatory bodies, and leading international energy organizations. This includes economic indicators, environmental policies, and technological advancements relevant to the energy sector.