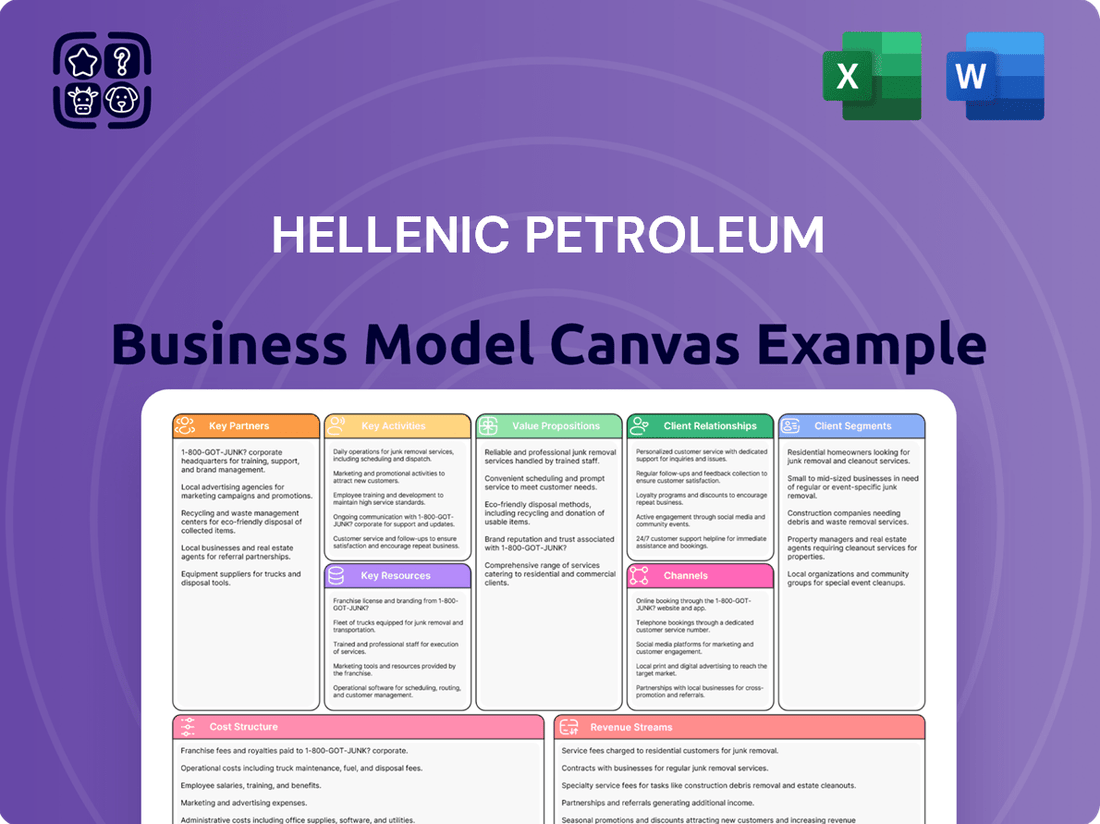

Hellenic Petroleum Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hellenic Petroleum Bundle

Unlock the full strategic blueprint behind Hellenic Petroleum's business model. This in-depth Business Model Canvas reveals how the company drives value through refining and energy, captures market share via a strong retail network, and stays ahead by investing in renewable energy. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a major energy player.

Dive deeper into Hellenic Petroleum’s real-world strategy with the complete Business Model Canvas. From its diverse value propositions in fuel and petrochemicals to its cost structure and revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

Want to see exactly how Hellenic Petroleum operates and scales its complex energy business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking your own energy ventures, strategic planning, or preparing investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Hellenic Petroleum’s success in a dynamic global market. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies in the oil, gas, and renewables sectors.

Transform your research into actionable insight with the full Business Model Canvas for Hellenic Petroleum. Whether you're validating a business idea in the energy sector or conducting a competitive analysis, this comprehensive template gives you all the strategic components, from key partners to customer relationships, in one place.

Partnerships

Hellenic Petroleum (HELLENiQ ENERGY) strategically secures long-term contracts with key national oil companies and major global producers to ensure a stable and cost-effective crude oil supply. These partnerships, crucial in 2024's volatile global market, mitigate supply chain disruptions and manage input costs for its refineries. For instance, maintaining diverse relationships with suppliers from regions like the Middle East and North Africa is vital. This diversification enhances energy security for the broader Southeast European region, supporting consistent operations.

HELLENiQ ENERGY, formerly Hellenic Petroleum, strategically forms joint ventures with major international energy firms to mitigate the substantial financial risks and intricate technical demands inherent in hydrocarbon exploration and production. These partnerships are crucial for accessing new, promising reserves and advanced technologies, significantly distributing the considerable capital expenditure, which can exceed hundreds of millions of euros for a single deepwater well. This collaborative model is particularly vital for the company's ongoing E&P activities in the high-potential yet complex Eastern Mediterranean region, where significant gas discoveries have been made, driving continued investment and resource sharing among partners.

HELLENiQ ENERGY, in its strategic pivot towards sustainability, collaborates with leading technology providers and engineering, procurement, and construction (EPC) contractors specializing in solar and wind power. These partnerships are crucial for developing and efficiently operating its expanding renewable energy portfolio. For instance, the company is targeting 1 GW of installed renewable capacity by 2025, with significant additions planned for 2024. Such collaborations ensure access to cutting-edge green technologies and essential project management expertise for assets like the 200 MW solar park in Kozani. This approach supports their ambitious energy transition goals.

Governmental and Regulatory Bodies

HELLENiQ ENERGY maintains crucial partnerships with the Greek government and European Union regulatory bodies, essential for operational licensing and environmental compliance. This collaboration secures vital exploration rights and operating permits. The relationship aligns the company's energy transition strategy with national goals and EU climate targets, such as those within the Fit for 55 package. Proactive engagement helps shape a supportive regulatory landscape, vital for navigating the 2024 energy policy shifts.

- Greek government engagement for domestic permits.

- EU Commission collaboration for regulatory alignment, e.g., REPowerEU.

- Ensuring compliance with EU Emissions Trading System (ETS) in 2024.

- Securing approvals for renewable energy projects, a key 2024 focus.

Logistics and Maritime Shipping Companies

Hellenic Petroleum relies heavily on a robust network of logistics and maritime shipping companies for the global transportation of crude oil to its refineries and the subsequent distribution of refined products. These partnerships are critical for maintaining a streamlined supply chain, ensuring timely delivery to both domestic and international markets. Optimizing these relationships is essential for effective cost control, especially given the volatility in global shipping rates. For instance, freight costs in 2024 have been influenced by ongoing geopolitical events, highlighting the importance of strategic alliances.

- Global crude oil transportation relies on specialized tanker fleets.

- Finished product distribution leverages extensive shipping networks for market reach.

- Partnerships are key to mitigating supply chain disruptions and cost fluctuations in 2024.

- Efficient logistics directly impacts operational expenditures and product competitiveness.

HELLENiQ ENERGY leverages key partnerships to secure its diverse energy supply and drive strategic growth. Collaborations with global crude oil producers and logistics firms ensure stable supply chains and cost management, particularly amid 2024's volatile shipping rates. Joint ventures with international energy companies facilitate hydrocarbon exploration and risk sharing, while alliances with technology providers accelerate renewable energy expansion, targeting 1 GW by 2025 with significant 2024 additions. Engagement with the Greek government and EU regulators secures crucial permits and ensures compliance with 2024 directives like the EU Emissions Trading System.

| Partnership Type | Key Benefit | 2024 Impact | ||

|---|---|---|---|---|

| Crude Suppliers | Stable supply, cost control | Mitigated supply chain disruptions | ||

| Renewables Tech/EPC | Green energy expansion | Achieving 1 GW target by 2025 | ||

| Government/EU Regulators | Licensing, compliance | Alignment with EU ETS, REPowerEU |

What is included in the product

This Business Model Canvas outlines Hellenic Petroleum's integrated approach to energy, focusing on refining, marketing, and petrochemicals, while also exploring renewable energy opportunities.

It details key partners, activities, and resources, emphasizing a commitment to operational efficiency and sustainable growth across diverse energy sectors.

The Hellenic Petroleum Business Model Canvas acts as a pain point reliever by offering a structured framework to identify and address operational inefficiencies within their complex energy value chain.

It streamlines communication and strategic alignment across diverse business units, alleviating the pain of siloed operations and fostering a more cohesive approach to market challenges.

Activities

Oil refining and processing is Hellenic Petroleum's core operational activity, transforming crude oil into essential products like gasoline, diesel, and jet fuel at its three major refineries. The focus remains on maximizing production efficiency and operational safety across these facilities. In 2024, the company continued significant investments, targeting cleaner fuels and reduced emissions. This modernization effort is crucial for meeting evolving environmental standards and maintaining product quality, ensuring a competitive edge.

HELLENiQ ENERGY robustly manages an extensive marketing and distribution network for its energy products across Southeast Europe.

This network includes over 1,700 EKO and BP branded retail service stations, primarily in Greece and the broader region as of late 2023.

Their activities encompass diverse sales channels such as wholesale, aviation, marine, and direct retail sales, ensuring broad market reach.

The strategic objective is to maintain a leading market share, reportedly around 30% in the Greek fuels market for 2024, and strengthen brand presence.

A pivotal activity for HelleniQ Energy involves the development, construction, and operation of renewable energy sources, primarily solar and wind parks. This strategic focus aligns with their 'Vision 2025' and 'Vision 2030' plans, driving a significant transformation towards a cleaner energy portfolio. Key actions include meticulous site selection, securing essential permits, and overseeing the efficient management of green energy production. As of 2024, HelleniQ Energy is actively expanding its RES portfolio, aiming for 1 GW of installed capacity by 2030, building on projects like the 204 MW solar park in Kozani.

Hydrocarbon Exploration and Production

Hellenic Petroleum, through its upstream segment, actively explores and produces oil and gas reserves both domestically and internationally. This critical activity aims to secure proprietary feedstock, reducing reliance on third-party suppliers and enhancing value capture across the energy chain. The process involves comprehensive geological surveys, advanced drilling operations, and meticulous field development. For instance, in 2024, the company continues its exploration efforts in Greece, notably in Block 2 and the Ioannina area, aiming to unlock significant domestic hydrocarbon potential.

- Strategic focus on E&P to ensure energy security and supply chain control.

- Ongoing exploration activities in promising Greek offshore and onshore blocks.

- Investment in geological surveys and drilling technology for resource identification.

- Efforts to maximize domestic hydrocarbon production, bolstering national energy independence.

Supply, Trading, and Optimization

Supply, Trading, and Optimization is a pivotal activity for HELLENiQ ENERGY, formerly Hellenic Petroleum, focusing on the strategic procurement of crude oil and feedstocks. This involves adept management of global supply chains to secure optimal raw material costs. The company's trading desk actively navigates international markets, seeking to leverage price volatility and logistical advantages for refined products like gasoline and diesel. This integrated approach directly enhances refining margins and overall profitability, as seen in the robust performance of its international sales channels.

- Maximizes refining margins by optimizing crude oil sourcing.

- Utilizes market intelligence to capitalize on price fluctuations in refined products.

- Ensures efficient distribution of products globally.

- Contributes significantly to the company's financial resilience in 2024.

Hellenic Petroleum's core activities encompass oil refining and extensive marketing through over 1,700 service stations, securing a 30% Greek market share in 2024. They are rapidly expanding renewable energy, targeting 1 GW of installed capacity by 2030, exemplified by the 204 MW Kozani solar park. Additionally, strategic oil and gas exploration in Greece, alongside sophisticated supply and trading operations, optimize crude sourcing and product distribution, bolstering financial performance in 2024.

| Key Activity | 2024 Status/Goal | Impact |

|---|---|---|

| Refining & Marketing | 30% Greek fuels market share | Ensures market leadership and product reach |

| Renewable Energy (RES) | Aiming for 1 GW by 2030 | Drives energy transition, diversifies portfolio |

| Exploration & Production | Ongoing Greek exploration (Block 2) | Secures feedstock, reduces import reliance |

What You See Is What You Get

Business Model Canvas

The Hellenic Petroleum Business Model Canvas you see here is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct preview of the final deliverable, showcasing the detailed strategic framework for Hellenic Petroleum. Once your transaction is complete, you'll gain full access to this exact document, ready for your analysis and application.

Resources

Hellenic Petroleum’s three integrated refineries, located in Aspropyrgos, Elefsina, and Thessaloniki, form its core physical assets and are crucial for value creation. These complexes represent significant production capacity, with a combined crude oil processing capacity exceeding 340,000 barrels per day as of 2024, making them strategically vital in the Mediterranean. Their scale and technological sophistication create a high barrier to entry for competitors. These facilities are central to the company's traditional energy sector operations, underpinning its market position.

Hellenic Petroleum, now HELLENiQ ENERGY, relies heavily on its skilled workforce, a critical human capital asset. Engineers, geoscientists, chemical experts, and energy traders possess the deep industry knowledge vital for complex operations. This expertise is crucial for managing the 15.2 million tons per annum refining capacity and advancing exploration and production projects. Retaining and developing this talent, especially as the company navigates its green energy transition, remains paramount for sustained success in 2024 and beyond.

HELLENiQ ENERGY's extensive retail and logistics network is a critical resource, encompassing over 1,700 service stations operating primarily under the EKO and BP brands across Greece and Southeast Europe. This vast infrastructure, complemented by significant storage facilities and pipelines, ensures direct access to end-customers for refined products. As of early 2024, this network remains a primary channel for fuel sales, driving significant revenue and facilitating efficient distribution. It also fosters crucial customer engagement, underpinning the company's market presence.

Exploration and Production Licenses

Exploration and production licenses are crucial intangible assets for Hellenic Petroleum, providing the legal rights to search for and extract hydrocarbons in specific onshore and offshore blocks. These licenses are fundamental, underpinning the company's long-term growth strategy in the upstream sector and representing a significant component of its asset base. For instance, in 2024, the company continues to hold interests in key exploration blocks, such as those offshore Crete and in Ioannina. This allows for potential future resource discovery and production, securing future revenue streams.

- Licenses enable access to hydrocarbon reserves.

- They are key for long-term upstream growth.

- Represent significant intangible asset value.

- Provide potential for future resource discovery.

Strong Financial Position and Access to Capital

Hellenic Petroleum, now HELLENiQ ENERGY, maintains a robust financial position and strong access to capital, critical for its strategic investments. This financial strength, underscored by its improved credit ratings like Fitch's BBB- in 2024, enables funding for significant capital expenditures. These include essential refinery upgrades and the expansion into renewable energy projects, aligning with its 2030 strategy to allocate around 50% of total capex to green energy initiatives. Access to international capital markets further ensures the necessary liquidity for these transformative projects and potential acquisitions, reducing the overall cost of capital.

- Improved credit ratings (e.g., Fitch BBB- in 2024) enhance borrowing terms.

- Significant capital expenditure is directed towards refinery upgrades.

- Around 50% of total capex by 2030 targets renewable energy projects.

- Access to international capital markets ensures liquidity for strategic growth.

HELLENiQ ENERGY’s core resources include its three integrated refineries, processing over 340,000 barrels per day as of 2024, and a skilled workforce essential for 15.2 million tons per annum refining capacity. Its extensive retail network, with over 1,700 service stations, ensures broad market access. Crucial exploration licenses and a strong financial position, evidenced by Fitch’s BBB- rating in 2024, underpin future growth and strategic investments, including a 50% capex allocation to green energy by 2030.

| Resource Category | Key Asset | 2024 Data Point |

|---|---|---|

| Physical Assets | Refining Capacity | >340,000 barrels/day |

| Human Capital | Refining Throughput | 15.2 million tons/annum |

| Retail Network | Service Stations | >1,700 stations |

| Financial Resources | Fitch Credit Rating | BBB- |

| Strategic Investment | Green Energy Capex Target | ~50% by 2030 |

Value Propositions

HELLENiQ ENERGY provides a stable and reliable supply of essential fuels and energy products, crucial for the energy security of Greece and Southeast Europe. This proposition is critical for transportation, industry, and households across the region. In 2024, the company continues to be a key supplier, safeguarding essential energy needs. It positions HELLENiQ ENERGY as a cornerstone of the regional economy, ensuring uninterrupted operations and stability. This reliable supply underpins the daily functioning of millions, from transport networks to industrial output.

Hellenic Petroleum, now HELLENiQ ENERGY, offers a compelling value proposition as a traditional energy leader actively pivoting towards a sustainable future.

This allows investors and partners to engage with the stability of conventional energy while tapping into the significant growth potential of renewables. The company aims for 1 GW of installed RES capacity by 2030, with a 2024 target of 600 MW, balancing risk and capturing future opportunities. This transition strategy includes over €4 billion in investments by 2030, with 50% allocated to green energy initiatives.

HELLENiQ ENERGY delivers fuels and petrochemicals meeting stringent European and international quality standards, ensuring top performance and environmental compliance for its B2B and B2C clients. This commitment to superior quality, evidenced by its significant investment in upgrading its refineries, such as over 200 million euros in environmental projects by 2024, positions it strongly. Adherence to EU directives, like Euro 6 standards for fuels, ensures product integrity and market competitiveness. This focus on certified excellence is a crucial differentiator in the dynamic energy market.

Regional Market Leadership and Scale Efficiency

HELLENiQ ENERGY leverages its dominant market position and extensive refining operations to offer competitive pricing and unparalleled supply chain efficiency. Customers, particularly wholesale and industrial clients, benefit from the reliability and cost-effectiveness derived from its large-scale infrastructure. This strategic advantage, reinforced by its significant regional presence, ensures consistent fuel supply across Greece and the wider Balkan region, enhancing client operational stability.

- HELLENiQ ENERGY maintains a leading market share in Greece's petroleum products, exceeding 60% in retail fuel sales for 2023.

- Their three refineries, with a total annual crude oil processing capacity of approximately 15.2 million tons, ensure scale efficiency.

- The company's extensive network includes over 1,700 service stations in Greece and the Balkans as of Q1 2024.

- This scale supports optimized logistics, reducing per-unit costs and offering competitive pricing to industrial and wholesale customers.

Integrated Value Chain Solutions

Hellenic Petroleum offers integrated energy solutions, managing its value chain from upstream exploration and production to refining and downstream retail. This comprehensive approach allows the company to deliver tailored energy products for diverse customer segments, including aviation, marine, and industrial clients. By controlling the entire process, Hellenic Petroleum ensures consistent quality and reliable supply, enhancing the customer experience. Its refining capacity, approximately 15.2 million tons annually across its three Greek refineries, underpins this integrated model. This integration supports market leadership, with the company holding a significant share in the Greek fuel market, estimated at over 30% in 2024.

- Upstream to Downstream Control: Manages the entire energy value chain, from crude oil exploration to refined product distribution.

- Tailored Solutions: Provides specific energy products for sectors like aviation, marine, and industrial clients.

- Quality and Supply Assurance: Integration ensures consistent product quality and reliable supply for customers.

- Market Positioning: Leveraging its integrated model, Hellenic Petroleum maintains a leading position in the Greek fuel market.

HELLENiQ ENERGY provides reliable, high-quality energy products, ensuring essential supply across Greece and Southeast Europe. It strategically combines its leading conventional energy operations with a significant pivot towards sustainable solutions, targeting 600 MW of renewable energy capacity by 2024. Leveraging its integrated value chain and extensive market presence, including over 1,700 service stations, the company offers competitive pricing and efficient supply chain solutions. This dual focus delivers stability and future growth potential for stakeholders.

| Value Proposition | Key Metric (2024) | Supporting Data |

|---|---|---|

| Reliable & Quality Supply | Environmental Investment | Over €200 million in environmental projects |

| Sustainable Transition | RES Capacity Target | 600 MW of installed RES capacity |

| Market Dominance & Efficiency | Retail Market Share (2023) | Exceeds 60% in Greek retail fuel sales |

| Integrated Solutions | Refining Capacity | Approximately 15.2 million tons annually |

Customer Relationships

HELLENiQ ENERGY, formerly Hellenic Petroleum, cultivates strong B2B relationships with industrial, aviation, and marine clients through long-term supply agreements. These contracts ensure crucial supply security and predictable pricing, vital for their operational planning, especially given the volatility seen in energy markets through 2024. Dedicated account managers provide specialized support and technical advice, fostering collaborative, partnership-based relationships. This approach helps secure a significant share of the Greek market, with the company maintaining a leading position in fuel supply.

HELLENiQ ENERGY engages its retail customers through robust loyalty programs at EKO and BP service stations, offering rewards, discounts, and personalized promotions. In 2024, the company continued to enhance these programs, leveraging digital apps and targeted marketing to improve customer experience. This strategy aims to foster strong brand loyalty and cultivate a community of repeat customers. Their focus on digital engagement has driven an increase in app usage among loyalty members.

A dedicated investor relations function for HELLENiQ ENERGY maintains an ongoing dialogue with shareholders and the financial community. This is achieved through transparent financial reporting, including their Q1 2024 financial results released in May 2024, which detail a strong operational performance. Regular investor roadshows and clear communication of the company's strategic initiatives, such as the energy transition roadmap, build trust. This proactive engagement fosters confidence in management and the company's future prospects within the market.

Automated and Digital Self-Service

HELLENiQ ENERGY provides robust digital platforms, enabling its B2B customers to seamlessly manage accounts, place orders, and track deliveries. This self-service model significantly enhances efficiency and convenience, streamlining the entire transaction process. It empowers clients with greater control over their energy procurement, aligning with modern digital demands.

- Digital portals facilitate 24/7 access for commercial clients.

- The system processes a high volume of orders, reducing manual intervention.

- Customer satisfaction metrics for digital tools are a key performance indicator for 2024.

- This approach supports HELLENiQ ENERGY's strategic focus on operational excellence.

Community and Stakeholder Engagement

HELLENiQ ENERGY actively builds robust relationships with local communities through dedicated corporate social responsibility initiatives and transparent communication. This proactive engagement, a cornerstone of their 2024 strategy, ensures a strong social license to operate, demonstrating their commitment as a responsible corporate citizen. Such deep-rooted community ties are crucial for the company's long-term operational sustainability and societal value creation.

- HELLENiQ ENERGY’s 2024 CSR budget continues significant investments in local communities.

- Their 2024 sustainability report highlights ongoing dialogue with stakeholders.

- Community programs foster local employment and infrastructure development.

- Building trust is key for their operational presence across Greece.

HELLENiQ ENERGY fosters diverse customer relationships, including B2B clients through long-term contracts and dedicated account managers, ensuring supply security. Retail customers are engaged via loyalty programs, with digital app usage increasing in 2024. Investor relations maintain transparency through Q1 2024 financial reporting and proactive engagement.

| Customer Segment | Key Relationship Approach | 2024 Focus/Data |

|---|---|---|

| B2B Clients | Partnership, Supply Agreements | Prioritizing stability amidst 2024 market volatility |

| Retail Customers | Loyalty Programs, Digital Engagement | Enhanced digital app usage in 2024 |

| Investors | Transparency, Proactive Dialogue | Q1 2024 financial results released May 2024 |

Channels

The primary channel for HELLENiQ ENERGY to reach end-consumers is its extensive branded service station network, primarily under the EKO and BP brands. These physical locations serve as the main point of sale for a wide range of products including gasoline, diesel, and convenience retail items. This channel is critical for ensuring high brand visibility across Greece and the wider region, offering direct market access to millions of daily commuters. With over 1,700 service stations in Greece and abroad as of early 2024, the network underpins direct sales and customer engagement, contributing significantly to retail fuel volumes.

A dedicated direct sales team within HELLENiQ ENERGY (formerly Hellenic Petroleum) directly manages relationships and negotiates contracts with large corporate, industrial, aviation, and marine sector clients. This channel is pivotal for high-volume, business-to-business transactions, requiring tailored solutions and pricing. For instance, in 2024, their commercial and industrial sales continued to represent a significant portion of overall refined product sales, emphasizing specialized service for key accounts. This direct engagement ensures precise fulfillment of energy needs for major customers.

Hellenic Petroleum leverages a robust wholesale distribution network, supplying fuel to independent service station owners, commercial fleet operators, and third-party distributors across its operational regions. This strategic channel significantly extends the company's market reach beyond its own branded retail outlets. It serves as a crucial volume driver, contributing substantially to overall sales figures. In 2024, this network continued to be pivotal for maintaining market share and operational efficiency.

International Trading and Cargo Sales

HELLENiQ ENERGY's trading division serves as a crucial channel, enabling the sale of surplus refined products into international markets through cargo shipments. This strategy allows the company to optimize its refinery output and effectively capitalize on global price differentials, a vital aspect for maximizing revenue streams. It is essential for balancing both supply and demand within the broader energy market. In 2024, maintaining robust international sales channels remains key for the company's financial resilience.

- International trading optimizes refinery capacity utilization.

- Cargo sales capitalize on global price arbitrage opportunities.

- This channel is critical for managing supply-demand imbalances.

- In Q1 2024, international sales remained a significant contributor to turnover.

Digital and Corporate Communication Platforms

HELLENiQ ENERGY, formerly Hellenic Petroleum, leverages its corporate website, investor relations portal, and official press releases as vital communication channels. These platforms are crucial for sharing financial results, such as the Q1 2024 Adjusted EBITDA of €279 million, strategic updates, and sustainability reports like the 2024 Sustainability Performance. This digital presence shapes public and financial market perception, ensuring transparency and investor engagement.

- Investor Relations Portal: Key for 2024 financial disclosures.

- Official Press Releases: Disseminate strategic initiatives.

- Corporate Website: Central hub for public information.

- Sustainability Reports: Detail 2024 ESG commitments.

HELLENiQ ENERGY leverages a robust multi-channel strategy. Its extensive retail network of over 1,700 branded service stations, including EKO and BP, is crucial for direct consumer access. Direct sales to major corporate clients and a strong wholesale distribution network secured significant 2024 volumes. International trading of refined products optimizes refinery output, contributing to Q1 2024 turnover. Digital platforms like its corporate website ensure market transparency.

| Channel Type | Primary Function | 2024 Impact/Data |

|---|---|---|

| Branded Retail | Direct Consumer Sales | 1,700+ stations (early 2024) |

| Direct & Wholesale | B2B & Bulk Distribution | Significant portion of refined product sales in 2024 |

| International Trading | Surplus Product Sales | Significant Q1 2024 turnover contribution |

Customer Segments

Retail Consumers and Motorists form a mass-market segment, comprising individual car owners and drivers who purchase fuel from Hellenic Petroleum's extensive EKO and BP service station network across Greece. This segment's purchasing decisions are significantly influenced by station location convenience, competitive pricing, and established brand loyalty. As of 2024, the company maintains a leading position in the Greek fuel market, with its retail network remaining a primary revenue driver. Fuel sales to this segment continue to underpin a substantial portion of the company’s domestic operations.

Industrial and commercial enterprises form a vital customer segment for Hellenic Petroleum, encompassing diverse operations from large manufacturing plants and construction companies to extensive logistics and transportation fleets across Greece.

These businesses consistently require substantial bulk deliveries of essential fuels like diesel, heating oil, and various lubricants to sustain their daily operations.

For these customers, reliability of supply is paramount, ensuring continuous operations without costly downtime, alongside competitive pricing to manage their significant operational expenses.

In 2024, the Greek industrial production index showed an increase, underscoring the ongoing demand for energy products from this segment.

They also highly value responsive and efficient service, which includes timely deliveries and technical support for their specialized needs.

The Aviation and Marine Industries form a critical B2B customer segment for Hellenic Petroleum, serving airlines with jet fuel and shipping companies with bunker fuel. This segment demands rigorous quality control and highly reliable supply at key transport hubs like Athens International Airport and major Greek ports, reflecting the essential nature of these operations. Contracts in this sector are typically long-term and high-volume, ensuring stable demand for specialized logistics. For instance, global aviation fuel demand was projected to increase by around 6% in 2024, while marine fuel consumption remains robust as shipping volumes continue to grow.

Power Generation and Utilities

The Power Generation and Utilities segment is increasingly vital as HELLENiQ ENERGY diversifies its portfolio, particularly towards cleaner energy sources. This segment primarily serves national electricity grid operators and other major utility companies. These entities purchase electricity and natural gas directly from HELLENiQ ENERGY’s power plants, including the 826 MW CCGT plant in Thessaloniki. The company aims for 600 MW of renewable capacity by 2025, underlining this strategic shift.

- Key customers include national grid operators and utility companies.

- Purchases cover electricity and natural gas.

- Strategic focus on cleaner energy, targeting 600 MW of renewables by 2025.

- HELLENiQ ENERGY’s power generation capacity includes the 826 MW CCGT plant.

Wholesale Fuel Resellers

Wholesale Fuel Resellers represent a vital B2B customer segment for HELLENiQ ENERGY, encompassing independent, unbranded service station owners and regional fuel distributors. These entities purchase petroleum products in bulk directly from HELLENiQ ENERGY, extending the company’s market reach significantly. They then resell these fuels, like gasoline and diesel, to their own diverse customer bases, ensuring broad distribution across various regions. This segment is crucial for volume sales and market presence, contributing to the broader Greek fuel market where HELLENiQ ENERGY maintains a substantial share, with refining capacity supporting domestic and international demand.

- HELLENiQ ENERGY’s refining output reached approximately 13.9 million tons in 2023, with a significant portion allocated to wholesale channels.

- The wholesale segment helps HELLENiQ ENERGY maintain a leading position in the Greek fuel market.

- Bulk sales to resellers streamline distribution and reduce direct retail operational overhead for the company.

- Market penetration through these partners is essential for reaching remote or niche geographical areas.

Hellenic Petroleum (HELLENiQ ENERGY) serves diverse segments, including retail consumers, leading the Greek fuel market in 2024. Key B2B clients include industrial enterprises, aviation and marine industries, and wholesale fuel resellers.

Industrial production index increases in 2024 drive demand for bulk fuels, while aviation fuel demand is projected to rise 6% in 2024. The company's 2023 refining output was approximately 13.9 million tons.

The power generation segment, serving grid operators, strategically focuses on cleaner energy, aiming for 600 MW of renewables by 2025.

| Segment | Key Product | 2024 Data |

|---|---|---|

| Retail Consumers | Fuel | Leading Greek market share |

| Industrial | Bulk Fuels | Industrial production increase |

| Aviation | Jet Fuel | 6% demand growth |

| Power Generation | Electricity | 600 MW renewables by 2025 |

| Wholesale | Petroleum Products | 13.9M tons refining (2023) |

Cost Structure

Crude oil and feedstock purchases represent the most significant cost driver for HELLENiQ ENERGY, encompassing the raw materials essential for its refining operations. This expense is highly volatile, directly influenced by fluctuating global commodity prices, such as Brent crude averaging around 83 USD per barrel in early 2024, and foreign exchange rates. Efficient sourcing strategies and robust hedging mechanisms are therefore critical for managing this substantial outlay, which typically constitutes a large majority of total operating costs for integrated refiners.

Capital Expenditures (CAPEX) on infrastructure represent a significant cost for Hellenic Petroleum, covering major investments crucial for its operations and strategic growth.

These outlays focus on maintaining and upgrading critical refinery infrastructure, ensuring operational efficiency and safety standards.

A substantial portion also funds new renewable energy projects, aligning with the company's energy transition goals.

For 2024, the company's investment plan underscores a continued commitment to these areas, with significant capital allocated towards strategic initiatives, including potential new exploration and production activities to secure future energy supplies.

These large, long-term investments are essential for sustaining market competitiveness and complying with evolving environmental regulations.

Operational Expenses (OPEX) for HelleniQ Energy's facilities encompass the crucial day-to-day costs of running its refineries and distribution networks. These include significant energy consumption for processing, ongoing maintenance of complex equipment, and the extensive logistics and distribution costs for products like fuels. Managing OPEX is paramount for maintaining healthy refining margins, especially with volatile energy prices seen in 2024. The company's focus on energy efficiency measures, such as those within their Vision 2025 strategy, is key to controlling these substantial operational expenditures and enhancing profitability.

Personnel and Employee Costs

Personnel and employee costs for Hellenic Petroleum represent a significant fixed cost, covering salaries, benefits, and training for its large, highly skilled workforce, from engineers to corporate staff. This investment in human capital is crucial for maintaining operational excellence and efficiency across its facilities. For 2024, the company continued to prioritize its workforce, with employee-related expenses being a substantial component of its operating costs, reflecting its role as a major employer in the region.

- Salaries, benefits, and training are key components.

- A significant fixed cost due to a large, skilled workforce.

- Essential for operational excellence and efficiency.

- Employee-related expenses are a major operating cost in 2024.

Environmental Compliance and Carbon Costs

Environmental compliance and carbon costs are pivotal for Hellenic Petroleum, encompassing expenses for adhering to regulations like waste management. The purchase of CO2 emission allowances under the EU Emissions Trading System (ETS) represents a significant and growing financial burden. As environmental regulations tighten, these costs are becoming increasingly material, influencing strategic planning and investment decisions for 2024 and beyond.

- EU ETS carbon prices have seen volatility, impacting operating costs.

- Increased investment in green technologies to mitigate future compliance burdens.

- The company's 2023 environmental provisions reflected rising regulatory demands.

- Strategic focus on decarbonization pathways to manage long-term carbon liabilities.

HELLENiQ ENERGY's cost structure is dominated by volatile crude oil purchases, with Brent averaging around 83 USD per barrel in early 2024. Significant capital expenditures in 2024 target infrastructure upgrades and renewable energy projects. Operational expenses, including energy consumption, and personnel costs are substantial. Environmental compliance and carbon costs, influenced by EU ETS, are increasingly material.

| Cost Area | 2024 Focus | Impact |

|---|---|---|

| Crude Purchases | Brent ~$83/bbl | Highly Volatile |

| CAPEX | Infrastructure/Renewables | Long-term Growth |

| OPEX/Personnel | Efficiency/Workforce | Ongoing Operations |

Revenue Streams

Hellenic Petroleum’s primary revenue stream comes from selling refined petroleum products, including gasoline, diesel, jet fuel, and heating oil, directly from its refining operations. This vital income is generated through both the robust domestic Greek market and substantial exports to international destinations. For instance, in Q1 2024, the Group’s sales volume reached approximately 3.4 million tons, highlighting the scale of these operations. This core activity remains the largest and most significant contributor to the company’s overall top-line performance.

Revenue from petrochemicals is a key stream for Hellenic Petroleum, generated through the sale of products like polypropylene and solvents, which are by-products of their refining operations. These essential chemical products are supplied to industrial clients for diverse uses, including plastics manufacturing and various other applications. This segment significantly diversifies the company's income, reducing reliance solely on fuel sales. In 2024, the petrochemical division is expected to continue its robust contribution, leveraging strong demand in key industrial sectors.

Electricity and natural gas sales represent a strategically vital and expanding revenue stream for HELLENiQ ENERGY, reflecting its commitment to the energy transition. This segment includes income from the company's thermal power plants and a growing contribution from renewable energy sources, such as its 204 MW solar park in Kozani, which commenced full operation in 2022. The group's power generation and natural gas activities reported an adjusted EBITDA of €119 million in 2023, showcasing significant growth. This diversification into electricity and gas trading, alongside supply, positions the company for new growth avenues in the evolving energy landscape, with expectations for continued positive contributions in 2024.

Income from Retail Network (Non-Fuel)

This revenue stream captures the sales of non-fuel products and services at HELLENiQ ENERGY's extensive EKO and BP service station network. It includes high-margin offerings like convenience store items, car washes, and diverse food services, significantly boosting the profitability of the retail channel. While individual 2024 non-fuel revenue figures are not yet fully disclosed, the company's strategic focus on diversifying retail offerings aims to enhance overall retail profitability, contributing to a substantial portion of the retail segment's gross profit. This diversification is a core element of their retail strategy, ensuring stability and higher margins beyond traditional fuel sales.

- In 2024, HELLENiQ ENERGY continued to expand its non-fuel offerings, reflecting a broader industry trend where non-fuel sales can account for 30-50% of a service station's gross profit.

- The convenience store segment, in particular, consistently delivers higher gross profit margins, often exceeding 25-30%, compared to the single-digit margins typical for fuel sales.

- Car wash services and food and beverage sales represent key growth areas, with increasing customer demand contributing to the overall strength of this revenue stream.

- This strategic emphasis on non-fuel income helps stabilize retail profitability, offsetting the volatility often seen in fuel prices and demand.

Trading and Supply Activities

Hellenic Petroleum, now HELLENiQ ENERGY, generates significant revenue and profit from its international trading arm. This segment actively capitalizes on arbitrage opportunities within global oil and refined products markets. Income also stems from optimizing logistics, carefully timing purchases and sales, and robustly managing price risk. Such strategic activity consistently enhances the group's overall profitability.

- HELLENiQ ENERGY reported an Adjusted EBITDA of €1,173 million for 2023, with refining and supply activities being a key contributor.

- The company's strategy emphasizes further internationalization and optimization of trading operations.

- Trading volumes for refined products continue to be a vital component of the business model.

- Risk management strategies, including hedging, are crucial for mitigating market volatility in trading.

HELLENiQ ENERGY diversifies its revenue through core refining and petrochemical sales, notably 3.4 million tons in Q1 2024 for refined products. Expanding into electricity and natural gas, including its 204 MW Kozani solar park, further bolsters income. Non-fuel sales at service stations, with convenience stores offering over 25% gross margins, enhance retail profitability. Additionally, strategic international trading generates significant revenue by leveraging global market opportunities.

| Revenue Stream | Key Contribution (2024 Focus) | 2024 Data Point |

|---|---|---|

| Refined Petroleum Products | Core sales (domestic & export) | Q1 2024 sales: ~3.4 million tons |

| Electricity & Natural Gas | Energy transition & diversification | 2023 Adj. EBITDA: €119 million |

| Non-Fuel Retail | High-margin retail diversification | Non-fuel sales: 30-50% of gross profit |

Business Model Canvas Data Sources

The Hellenic Petroleum Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic assessments of the energy sector. These diverse sources ensure the canvas accurately reflects the company's current operations and future strategies.