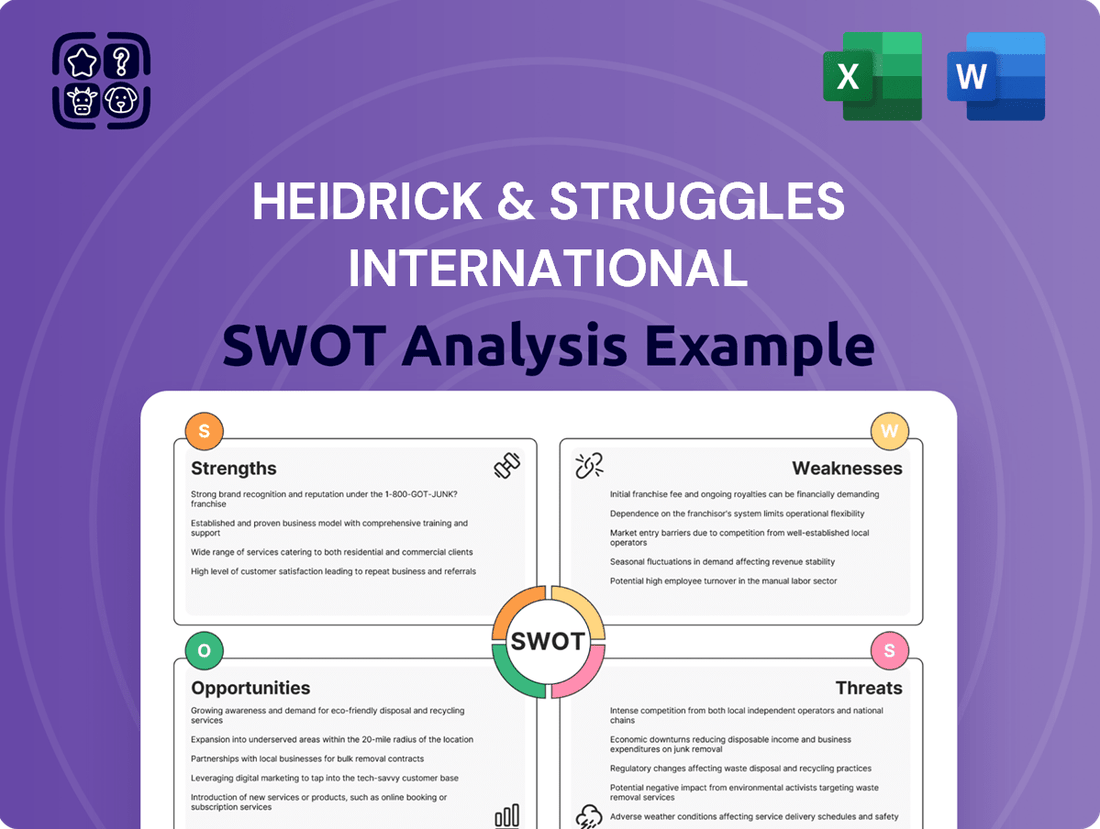

Heidrick & Struggles International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidrick & Struggles International Bundle

Heidrick & Struggles International, a leader in executive search and consulting, navigates a dynamic market. Their established brand and global reach are significant strengths, yet they face intense competition and evolving client demands. Understanding these internal capabilities and external pressures is crucial for strategic advantage.

Discover the complete picture behind Heidrick & Struggles' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Heidrick & Struggles has cultivated a robust global brand and a reputation for excellence over more than seven decades in executive search and leadership consulting. This enduring presence has fostered deep, trusted relationships with a significant portion of Fortune 1000 companies, ensuring a loyal client base. The firm's iconic brand is a key asset, consistently attracting high-caliber clients and top-tier consultant talent, reinforcing its market position into 2025. This strong brand equity is crucial for maintaining its competitive edge in a dynamic market.

Heidrick & Struggles has effectively diversified its revenue streams beyond traditional executive search. The firm's On-Demand Talent and Heidrick Consulting segments have demonstrated notable growth, with consulting revenue reaching approximately 26.5 million in Q1 2024, contributing significantly to overall financial resilience. This expansion reduces reliance on the cyclical executive search market. Such diversification provides a more stable business structure, allowing the firm to offer comprehensive, integrated talent solutions to its global clientele.

Heidrick & Struggles demonstrates robust financial strength, evidenced by a 7% year-over-year revenue increase in Q1 2025 and a 7% rise for the full year 2024. The company boasts a strong cash position of $325 million and a zero-debt balance sheet. This provides significant financial flexibility for strategic investments and shareholder returns. Such stability is crucial for navigating economic uncertainties and funding future growth initiatives.

Global Reach and Industry Expertise

Heidrick & Struggles demonstrates significant global reach, operating through offices across the Americas, Europe, Asia Pacific, and the Middle East. This extensive footprint supports its diverse international client base, addressing specific talent needs worldwide. The firm’s consultants possess deep expertise across critical sectors, including technology, financial services, healthcare, and industrial markets, enhancing their value proposition.

- Global presence spans over 25 countries, with more than 50 offices as of early 2025.

- Specialized expertise covers high-growth sectors like AI and renewable energy, crucial for 2024-2025 talent demands.

Growth in On-Demand Talent Segment

Heidrick & Struggles' On-Demand Talent segment represents a key strength, showing robust growth. In Q1 2025, this segment achieved a significant 12.4% revenue increase. This growth also translated into profitability, moving from a previous loss to a positive adjusted EBITDA. This performance highlights the increasing market demand for interim and project-based executive talent, a trend the company is well-positioned to leverage.

- Q1 2025 revenue increase: 12.4%

- Segment achieved positive adjusted EBITDA.

- Reflects strong market demand for interim talent.

Heidrick & Struggles leverages its robust global brand, cultivated over 70 years, to attract top clients and talent, maintaining a competitive edge. Diversified revenue streams, notably the On-Demand Talent segment which saw a 12.4% Q1 2025 revenue increase and positive adjusted EBITDA, enhance financial resilience. The firm’s strong financial position, including $325 million cash and zero debt, supports strategic investments and global reach across 25+ countries by early 2025.

| Metric | 2024 (Full Year) | Q1 2025 |

|---|---|---|

| Revenue Growth (YoY) | 7% | 7% |

| Cash Position | — | $325 million |

| Debt Balance | — | Zero |

| On-Demand Talent Revenue Growth (YoY) | — | 12.4% |

| Heidrick Consulting Revenue (Q1) | — | ~$26.5 million |

What is included in the product

Delivers a strategic overview of Heidrick & Struggles International’s internal and external business factors, identifying key growth drivers and market challenges.

Offers a clear, actionable roadmap to address Heidrick & Struggles' competitive challenges and leverage its market strengths.

Weaknesses

Heidrick & Struggles, like the broader executive search industry, remains highly susceptible to economic fluctuations. During periods of economic contraction, businesses typically curtail investments in new senior-level hires, directly impacting the firm's core executive search revenue. This inherent cyclicality can lead to notable volatility in the firm's financial performance. For instance, a projected slowdown in global GDP growth for 2025 could pressure demand for high-end talent acquisition services, potentially affecting Heidrick & Struggles' earnings outlook.

The Heidrick Consulting segment, while central to diversification, continues to face significant profitability hurdles. In Q1 2025, this segment reported an adjusted EBITDA loss of $3.5 million, highlighting the persistent challenge. Improving operational efficiency and enhancing margins are critical to reversing this trend. Achieving consistent profitability here is essential for the overall success and financial health of Heidrick & Struggles' diversification strategy.

Heidrick & Struggles faces a notable challenge with consultant retention, evidenced by an 18.4% consultant turnover rate reported for 2023. This high turnover can significantly increase recruitment and training expenditures for the firm. Moreover, it risks the loss of valuable client relationships and could potentially diminish service quality. Retaining top-performing consultants is critical for maintaining a competitive edge and ensuring consistent client satisfaction in the executive search market.

Relatively Small Market Capitalization

Heidrick & Struggles International, Inc. (NASDAQ: HSII) maintains a market capitalization significantly smaller than some major competitors in the broader human capital and consulting sector. As of late 2024, HSII's market cap hovers around $500 million, which can restrict its capacity for large-scale strategic acquisitions or substantial investments compared to rivals boasting multi-billion dollar valuations. This comparatively modest size also potentially increases its susceptibility to market volatility, making it more vulnerable to economic shifts or industry-specific downturns.

- HSII's market capitalization is approximately $500 million as of late 2024.

- Larger competitors may have market caps exceeding $5 billion, enabling greater acquisition flexibility.

- A smaller market cap can amplify the impact of market fluctuations on HSII's valuation.

Weakness in European Operations

Heidrick & Struggles has faced challenges in its European operations, notably a revenue decline in the region, which impacted overall performance in 2024. While other geographic segments demonstrated growth, underperformance in a significant market like Europe can hinder the firm's global expansion objectives. Addressing these regional headwinds, such as the reported 5.1% decline in European revenue for Q1 2024, is crucial for sustained profitability. This weakness contrasts with stronger results elsewhere, making European recovery a key focus.

- European revenue decreased by 5.1% in Q1 2024.

- This decline contrasts with growth in other global regions.

- Underperformance in Europe impacts the firm's consolidated financial results.

- Strategic initiatives are needed to revitalize the European market segment.

Heidrick & Struggles faces significant exposure to economic cyclicality, with potential 2025 global GDP slowdowns impacting core revenue. The Heidrick Consulting segment reported an adjusted EBITDA loss of $3.5 million in Q1 2025, highlighting persistent profitability challenges. High consultant turnover, at 18.4% in 2023, increases operational costs and risks client continuity. Additionally, a market cap of approximately $500 million (late 2024) limits strategic investments, while European revenue declined 5.1% in Q1 2024.

| Weakness Area | Key Metric (2024/2025) | Impact |

|---|---|---|

| Consulting Profitability | Q1 2025 Adj. EBITDA Loss: $3.5M | Hinders diversification strategy. |

| Consultant Retention | 2023 Turnover Rate: 18.4% | Increases costs, risks client ties. |

| European Operations | Q1 2024 Revenue Decline: 5.1% | Impacts global growth and profitability. |

What You See Is What You Get

Heidrick & Struggles International SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version. This comprehensive analysis delves into Heidrick & Struggles International's Strengths, Weaknesses, Opportunities, and Threats. You'll gain valuable insights into their market position and strategic outlook. This is the same document that will be provided upon purchase, ensuring transparency and professional quality.

Opportunities

The demand for leadership advisory services is significantly expanding beyond traditional executive search, presenting a robust opportunity for Heidrick & Struggles. Organizations are increasingly seeking external expertise for critical areas like succession planning, leadership effectiveness, and shaping organizational culture. This trend is evidenced by the global leadership consulting market projected to reach approximately $19 billion by 2025, demonstrating strong growth. This allows Heidrick & Struggles to further leverage its established reputation and expand its consulting and on-demand talent offerings, capturing a larger share of this evolving market.

Heidrick & Struggles can significantly expand its market presence by targeting high-growth sectors where executive talent demand is surging. The demand for leadership roles in artificial intelligence, cybersecurity, and health tech is projected to grow substantially through 2025, presenting new revenue streams. Focusing business development on these innovative industries allows Heidrick & Struggles to capitalize on emerging trends. Furthermore, the rise of specialized positions such as Chief Revenue Officer and Chief Customer Officer creates additional executive search opportunities, leveraging the firm's expertise in a dynamic market. This strategic focus aligns with the projected 15% annual growth in the global executive search market for these niche areas through 2025.

Leveraging AI and data analytics presents a significant opportunity for Heidrick & Struggles to innovate within the executive search sector. By integrating advanced algorithms, they can refine candidate sourcing, potentially reducing time-to-fill for senior roles by 20% by late 2024. This technology also enhances assessment accuracy, offering clients more precise, data-driven insights into leadership potential, moving beyond traditional methods. Such investments strengthen competitive advantage, as the global HR technology market is projected to reach $50 billion by 2025, with AI being a key growth driver.

Focus on Diversity, Equity, and Inclusion (DEI)

The increasing global emphasis on diversity, equity, and inclusion within corporate leadership presents a significant opportunity for Heidrick & Struggles. This trend fuels a growing market for specialized DEI consulting and executive search services. Heidrick & Struggles is well-positioned to assist clients in building more diverse and inclusive leadership teams, a service for which demand is rising, with the global DEI market projected to reach $15.4 billion by 2025.

- Global DEI consulting market continues strong growth into 2025.

- Companies prioritize diverse leadership to enhance performance and reputation.

- Heidrick & Struggles leverages expertise in executive search for DEI initiatives.

- Demand for inclusive leadership solutions drives new revenue streams.

Strategic Acquisitions

Heidrick & Struggles has a proven history of strategic acquisitions, enhancing its service capabilities and global footprint. With a robust balance sheet, reporting $243.6 million in cash and cash equivalents and no long-term debt as of Q1 2024, the firm is exceptionally well-positioned to pursue further growth through M&A. This financial strength allows for acquiring specialized boutique firms or innovative technology platforms, boosting its executive search and consulting offerings. Such moves could further diversify its revenue streams, building on its Q1 2024 net revenue of $174.6 million.

- Q1 2024 cash and cash equivalents: $243.6 million.

- No long-term debt reported as of Q1 2024.

- Potential targets include specialized boutique firms.

- Acquisitions could integrate new technology platforms.

Heidrick & Struggles can capitalize on the expanding $19 billion global leadership consulting market by 2025 and surging demand in high-growth sectors. Integrating AI and data analytics offers efficiency gains, potentially reducing time-to-fill by 20% by late 2024, within a $50 billion HR tech market by 2025. The firm's strong Q1 2024 cash position of $243.6 million enables strategic acquisitions, while the $15.4 billion global DEI market by 2025 presents further revenue streams.

| Opportunity Area | Key Metric (2024/2025) | Impact for Heidrick & Struggles |

|---|---|---|

| Expanding Leadership Advisory | Global Market: ~$19 billion by 2025 | Diversify beyond traditional search, capture market share. |

| High-Growth Sectors (AI, Health Tech) | Niche Executive Search Growth: 15% annually through 2025 | New revenue streams, capitalize on emerging talent needs. |

| AI & Data Analytics Integration | HR Tech Market: ~$50 billion by 2025; Time-to-fill reduction: 20% by late 2024 | Enhanced efficiency, improved assessment accuracy, competitive advantage. |

| Diversity, Equity, & Inclusion (DEI) | Global DEI Market: ~$15.4 billion by 2025 | Address rising client demand, specialized consulting services. |

| Strategic Acquisitions | Q1 2024 Cash & Equivalents: $243.6 million | Expand service capabilities, acquire innovative platforms, diversify revenue. |

Threats

The executive search and leadership consulting market faces intense competition, with numerous global firms and boutique agencies vying for market share. Key competitors for Heidrick & Struggles include Korn Ferry, Spencer Stuart, Russell Reynolds Associates, and Egon Zehnder. This fierce rivalry often puts significant pressure on pricing strategies and overall market share, impacting profitability. The global executive search market, estimated at around $18 billion in 2024, sees these major players constantly innovating to retain their competitive edge.

Global economic uncertainty, intensified by ongoing geopolitical conflicts and persistent inflation, significantly impacts client demand for Heidrick & Struggles' leadership advisory services. Companies often become more cautious with their executive search and consulting budgets during volatile periods, affecting revenue. For instance, the International Monetary Fund's April 2024 World Economic Outlook projected global growth at 3.2% for 2024 and 2025, highlighting continued economic fragility. This cautious spending environment could hinder Heidrick & Struggles' growth prospects, particularly if clients delay critical talent acquisition or strategic consulting projects.

The increasing development of in-house executive recruiting teams by large corporations presents a tangible threat to firms like Heidrick & Struggles. As of early 2024, approximately 40% of Fortune 500 companies have significantly expanded their internal talent acquisition functions, aiming to reduce reliance on external search firms for senior leadership roles. This strategic shift could diminish the addressable market for traditional executive search, potentially impacting Heidrick & Struggles’ revenue streams for certain client segments. Should this trend accelerate, with more companies following suit to control costs and enhance internal talent pipelines, it could fundamentally alter the landscape of high-level recruitment.

Disruption from Technology and New Business Models

The executive search industry faces significant disruption from emerging technologies and new business models, including advanced AI-powered recruitment platforms and flexible, subscription-based talent acquisition services. Heidrick & Struggles, despite investing in its digital capabilities like the Heidrick Navigator platform, must continuously innovate to prevent being outpaced by more agile or technologically advanced competitors. The global HR technology market is projected to reach approximately $40 billion by 2025, emphasizing the scale of this technological shift. This rapid evolution demands consistent adaptation to maintain market relevance and client value.

- The global HR technology market is estimated to approach $40 billion by 2025.

- AI-driven platforms are automating initial candidate screening, reducing manual effort.

- Flexible, subscription-based models are challenging traditional fee structures.

- Heidrick & Struggles' digital investments, such as Heidrick Navigator, are crucial for competitive positioning.

Talent Retention and Compensation Pressures

The competition for top consultant talent remains exceptionally fierce, particularly as the demand for specialized executive search services surged through late 2024 and into 2025. Attracting and retaining high-performing consultants necessitates competitive compensation packages, which saw average increases of 5-7% in the consulting sector in 2024, alongside a robust corporate culture. Failure to offer leading remuneration or a compelling work environment could lead to the loss of key talent to competitors, directly impacting client relationships and revenue generation, potentially affecting Heidrick & Struggles' projected 2025 growth.

- Consulting sector compensation rose 5-7% in 2024, escalating pressure.

- Talent loss directly impacts client retention and revenue streams.

- Fierce competition for elite executive search professionals persists into 2025.

Heidrick & Struggles faces intense competition and economic uncertainty, with global growth projected at 3.2% for 2024-2025. The rise of in-house recruiting, expanded by 40% of Fortune 500 firms, along with disruptive HR tech (a $40 billion market by 2025) and fierce talent competition, presents significant challenges.

| Threat | 2024 Data | 2025 Projection |

|---|---|---|

| Global Executive Search Market | ~$18 Billion | Continued Growth |

| Global Economic Growth | 3.2% (IMF) | 3.2% (IMF) |

| Fortune 500 In-house Recruiting | ~40% expansion | Potential increase |

| HR Technology Market | Significant Growth | ~$40 Billion |

| Consulting Compensation Rise | 5-7% | Ongoing Pressure |

SWOT Analysis Data Sources

This Heidrick & Struggles International SWOT analysis is built upon a foundation of robust data, including their latest financial filings, comprehensive market research reports, and insights from industry experts in executive search and leadership consulting.