Heidrick & Struggles International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidrick & Struggles International Bundle

Uncover the critical external forces shaping Heidrick & Struggles International's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, social shifts, technological advancements, evolving regulations, and environmental concerns create both opportunities and challenges for the executive search giant. Equip yourself with the strategic foresight needed to navigate this complex landscape and make informed decisions. Download the full PESTLE analysis now to gain actionable intelligence and secure your competitive advantage.

Political factors

Global political stability is a significant driver for Heidrick & Struggles, influencing international executive search and advisory services. For instance, the firm's reliance on cross-border talent mobility means that periods of heightened geopolitical tension, such as ongoing conflicts or regional instability in late 2024 and early 2025, can directly impede the movement of executives and the firm's ability to place candidates globally.

Evolving trade policies and the imposition of tariffs by major economies, including potential shifts in US-China trade relations anticipated through 2025, can impact client confidence. This, in turn, affects their willingness to invest in executive hiring and strategic business expansion, directly influencing demand for Heidrick & Struggles' services in cross-border markets.

Increased geopolitical tensions observed in various regions through 2024 have already led to a noticeable slowdown in international executive placements. This trend is expected to continue into 2025, prompting a strategic shift for firms like Heidrick & Struggles towards leveraging domestic talent pools and adapting search strategies to localized economic conditions.

Changes in labor laws and employment regulations worldwide present both hurdles and openings for Heidrick & Struggles. For instance, as of 2024, many nations are strengthening worker protections and mandating fairer hiring practices, which requires careful adherence to varying legal frameworks concerning recruitment, compensation, and employee rights.

Navigating this complex global landscape means Heidrick & Struggles must remain agile in adapting its services to comply with diverse legal requirements, from contract stipulations to data privacy laws impacting candidate sourcing.

Stricter regulations on hiring or firing, such as those seen in some European Union countries where employee termination processes are highly regulated, could directly influence the demand for executive search services. Companies facing more rigid employment laws might rely more heavily on expert guidance to ensure compliance during leadership transitions.

The evolving nature of remote work policies and gig economy regulations also adds another layer of complexity, impacting how Heidrick & Struggles advises clients on talent acquisition and workforce management strategies in 2024 and beyond.

Data privacy laws are becoming more intricate worldwide, impacting companies like Heidrick & Struggles that handle sensitive candidate and client information. Regulations such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) dictate how this data can be collected, stored, and processed. Staying compliant is essential not only to avoid hefty fines, which can reach up to 4% of global annual turnover for GDPR violations, but also to build and maintain the trust of clients and candidates.

These evolving regulations also present challenges for international operations. Restrictions on cross-border data transfers can make it more complex to conduct global executive searches, requiring careful navigation of differing legal frameworks to ensure data integrity and legal compliance across jurisdictions.

Government Spending and Economic Stimulus

Government fiscal policies play a significant role in shaping the economic landscape, directly impacting the demand for executive talent. For instance, substantial government spending on infrastructure projects, as seen in initiatives like the Bipartisan Infrastructure Law in the US, which allocated over $1 trillion in late 2021, can spur job creation and necessitate leadership roles in construction, engineering, and project management. Conversely, austerity measures or shifts in spending priorities can lead to contractions in certain sectors, influencing hiring trends for executive search firms like Heidrick & Struggles.

Economic stimulus packages are a key lever governments use to navigate economic downturns or foster growth. In response to economic challenges, many governments globally have implemented stimulus measures. For example, the European Union's NextGenerationEU recovery fund, with a budget of €806.9 billion, aims to boost sectors like digital transformation and green energy. Such initiatives can create a surge in demand for senior talent in these prioritized industries, benefiting executive search services.

Political support for specific industries can create significant growth opportunities and, by extension, boost the need for executive leadership. Government incentives for renewable energy, biotechnology, or advanced manufacturing can attract investment and foster expansion within these fields. This political backing often translates into increased hiring for C-suite positions and specialized senior roles, directly benefiting firms that recruit at this level.

- Government Spending: The US government's fiscal year 2024 budget proposal includes increased spending on national defense and technological innovation, signaling potential growth in executive roles within these sectors.

- Economic Stimulus: China's ongoing efforts to stimulate its domestic economy through tax cuts and increased infrastructure investment are expected to create demand for experienced managers and executives in manufacturing and technology sectors.

- Industry Support: The German government's commitment to supporting the automotive industry's transition to electric vehicles, backed by billions in subsidies and research funding, is driving demand for executives with expertise in sustainable technology and supply chain management.

Political Stability in Key Markets

Political stability is a cornerstone for business confidence, directly influencing Heidrick & Struggles' clients. For instance, upcoming elections or potential policy shifts in major economies like the United States or the European Union can inject significant uncertainty. This uncertainty often leads businesses to postpone or re-evaluate strategic hiring decisions, impacting the demand for executive search services. In 2024, several major economies are holding elections, creating a dynamic political landscape that necessitates careful monitoring by firms like Heidrick & Struggles.

A stable political climate encourages long-term investment and expansion, which are crucial drivers for the executive search and leadership consulting market. When governments provide clear regulatory frameworks and predictable economic policies, companies are more likely to invest in growth initiatives, including leadership development and executive recruitment. Conversely, political turmoil or unexpected policy changes can lead to a freeze in hiring or even the cancellation of ongoing search mandates. For example, a sudden imposition of trade barriers or changes in corporate governance laws in a key operating region could directly affect client spending on talent acquisition.

- Impact of Elections: Upcoming elections in countries representing significant portions of global GDP, such as the US and India in 2024, can create a wait-and-see attitude among corporate leaders regarding major hiring decisions.

- Policy Uncertainty: Shifts in government policy, such as changes in tax regulations or labor laws, can directly influence a company's willingness to invest in new leadership roles.

- Geopolitical Risk: Heightened geopolitical tensions or conflicts in regions where Heidrick & Struggles has a client base can disrupt business operations and delay strategic talent searches.

- Regulatory Environment: A stable and transparent regulatory environment fosters investor confidence, which in turn supports robust demand for executive talent acquisition services.

Government stability and policy predictability are paramount for Heidrick & Struggles, as clients often pause major hiring decisions during periods of political uncertainty. For instance, the significant number of elections scheduled globally in 2024, including in major economies like the United States and India, can lead to a cautious approach from businesses regarding executive recruitment.

Shifts in government fiscal policies directly influence corporate investment and, consequently, the demand for executive talent. For example, continued government investment in green technologies and digital infrastructure, as seen in the EU's NextGenerationEU fund totaling €806.9 billion, creates a need for specialized leadership in these growth sectors.

Government support for key industries, such as Germany's substantial backing for the automotive sector's transition to electric vehicles, directly fuels demand for executives with specific expertise. This targeted support can significantly boost hiring needs in those particular fields, impacting executive search firms.

| Factor | Impact on Heidrick & Struggles | Example/Data Point (2024-2025 Focus) |

|---|---|---|

| Political Stability & Elections | Influences client confidence and hiring decisions; uncertainty can lead to delayed searches. | Multiple major economies holding elections in 2024 (e.g., US, India) may cause a 'wait-and-see' approach for large-scale executive hiring. |

| Government Fiscal Policies | Government spending and stimulus packages can create demand for executives in specific sectors. | EU's NextGenerationEU fund (€806.9 billion) supports digital and green sectors, driving demand for leadership in these areas. |

| Industry Support & Regulation | Government incentives and regulations can foster growth and demand for specialized executive talent. | Germany's billions in subsidies for EV transition creates a need for executives with sustainable technology and supply chain expertise. |

What is included in the product

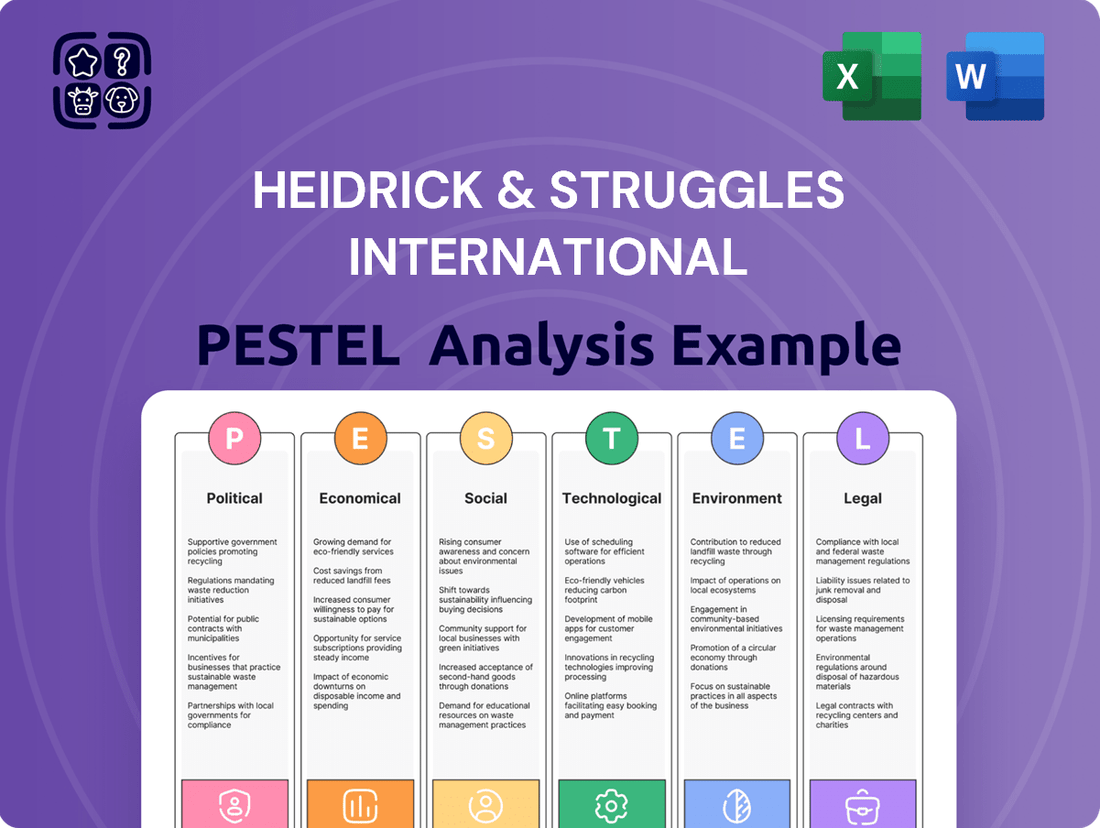

This PESTLE analysis of Heidrick & Struggles International examines how political, economic, social, technological, environmental, and legal factors impact its executive search and consulting business.

A PESTLE analysis of Heidrick & Struggles International provides a structured framework to anticipate and address external challenges, thereby alleviating the pain point of uncertainty in strategic decision-making.

Economic factors

Global economic growth directly impacts Heidrick & Struggles' business. When economies are expanding, companies tend to invest more in leadership roles and strategic growth initiatives, boosting demand for executive search services. For instance, a strong Q4 2024 saw many organizations actively seeking top-tier executives to capitalize on market opportunities.

Conversely, fears of recession or actual economic slowdowns can significantly curb hiring. In such environments, businesses often implement hiring freezes and reduce spending on advisory services, directly affecting the firm's revenue streams. The firm demonstrated resilience in Q1 2025, navigating a complex economic landscape with cautious optimism from clients.

The firm's performance is closely tied to the health of major economies like the US and Europe. A robust global GDP growth forecast for 2025, projected at around 3.1% by many institutions, suggests a generally favorable environment for leadership hiring. However, localized downturns or persistent inflation can still create headwinds.

Heidrick & Struggles' ability to adapt to shifting economic conditions is crucial. The firm has strategically diversified its service offerings, including consulting and digital solutions, to mitigate the impact of cyclical downturns in traditional executive search.

The availability of experienced leaders, particularly in high-demand fields like cybersecurity, significantly shapes Heidrick & Struggles' operational landscape. A scarcity of top-tier executives, as seen in the cybersecurity sector where a projected global shortage of 3.5 million professionals existed by early 2024, directly boosts the demand for specialized executive search firms.

Conversely, a more fluid executive talent pool might temper the immediate need for external recruitment, influencing the pricing and volume of Heidrick & Struggles' services. The ongoing demand for specialized skills, like those required in AI and data analytics, continues to present both challenges and opportunities for executive search firms in 2024 and into 2025.

High inflation, projected to remain above central bank targets throughout much of 2024 and into 2025, directly impacts Heidrick & Struggles by escalating operational expenses. This inflationary pressure also constrains client budgets, potentially reducing demand for executive compensation consulting and broader advisory services. For instance, if inflation pushes salary benchmarks higher, the cost of executive search may increase, while companies facing tighter margins might scale back on strategic hiring initiatives.

Rising interest rates, a trend observed globally as central banks combat inflation, create a more challenging environment for corporate investment. Higher borrowing costs can lead businesses to postpone expansion plans and hiring, including executive roles. This cautious sentiment directly affects Heidrick & Struggles, as a slowdown in corporate growth and investment typically correlates with a reduced need for executive search and talent advisory services.

The interplay of inflation and interest rates significantly shapes the profitability and growth trajectory for Heidrick & Struggles. Persistent inflation erodes purchasing power and increases business costs, while elevated interest rates dampen economic activity and investment. For example, if the Federal Reserve maintains its benchmark interest rate at 5.25%-5.50% through 2024, as widely anticipated, companies will continue to face higher financing costs, influencing their willingness to undertake significant executive recruitment or strategic projects.

Currency Fluctuations

Currency fluctuations present a significant economic factor for Heidrick & Struggles, a global executive search firm. As a company operating across numerous countries, its financial results are inherently tied to the varying exchange rates of different currencies. For instance, a strengthening U.S. dollar can impact the cost of their services for clients based in countries with weaker currencies, potentially affecting demand.

Conversely, when earnings from international operations are repatriated to the U.S., a strong dollar can diminish their value. This exposure necessitates continuous financial management to mitigate potential negative impacts. For example, in late 2023 and early 2024, the U.S. Dollar Index (DXY) showed some volatility, trading in the 100-107 range, which would have directly influenced Heidrick & Struggles' reported earnings from its non-U.S. operations.

- Revenue Impact: A stronger USD can make Heidrick & Struggles' services more expensive for international clients, potentially dampening demand in certain markets.

- Profitability Impact: Foreign earnings translated back into USD are reduced in value when the dollar is strong, affecting reported profitability.

- Risk Management: The company must actively manage currency exposure through hedging strategies or by diversifying its revenue streams across various currency zones to smooth out earnings volatility.

- 2024/2025 Outlook: Continued global economic uncertainty and differing monetary policies among major economies suggest ongoing currency volatility, requiring proactive financial strategies from Heidrick & Struggles.

Client Industry Health and Investment Trends

The health of the industries Heidrick & Struggles serves is a critical economic factor. For instance, robust growth in the technology sector, which saw global IT spending projected to reach $5 trillion in 2024, directly fuels demand for specialized executive talent in areas like AI and cybersecurity. Similarly, the financial services industry, a consistent client base, experienced a 7.5% increase in revenue for major banks in 2023, translating to a need for experienced leaders in risk management and digital transformation.

Investment trends also significantly shape the firm's opportunities. In 2024, venture capital funding in biotech and healthcare startups is expected to rebound, creating demand for C-suite executives with expertise in scaling innovative healthcare solutions. Conversely, shifts in investment towards sustainable energy and infrastructure also present new avenues for Heidrick & Struggles to place leaders experienced in navigating these evolving markets.

- Technology Sector Growth: Global IT spending reached an estimated $5 trillion in 2024, boosting demand for tech-focused executive search.

- Financial Services Revenue: Major financial institutions reported a 7.5% revenue increase in 2023, highlighting ongoing needs for leadership in finance.

- Healthcare Investment: Venture capital investment in healthcare and biotech is anticipated to grow in 2024, creating opportunities for specialized executive placements.

- Emerging Market Focus: Increasing investment in renewable energy and infrastructure creates a demand for executives with expertise in these transformative sectors.

Global economic growth directly impacts Heidrick & Struggles' business, with a strong Q4 2024 indicating increased company investment in leadership roles. Conversely, economic slowdowns and potential recessions can curb hiring, as seen in cautious client sentiment during Q1 2025. The firm's performance is closely tied to major economies, with a projected global GDP growth of around 3.1% for 2025 offering a generally favorable outlook, though localized downturns remain a risk.

| Economic Factor | Impact on Heidrick & Struggles | Supporting Data/Outlook |

|---|---|---|

| Global Economic Growth | Increased demand for executive search services during expansion; reduced demand during slowdowns. | Strong Q4 2024 performance; projected global GDP growth of ~3.1% for 2025. |

| Inflation and Interest Rates | Escalated operational costs and constrained client budgets due to inflation; dampened corporate investment due to rising interest rates. | Inflation projected above targets through 2024-2025; Federal Reserve rates anticipated at 5.25%-5.50% through 2024. |

| Currency Fluctuations | Affects service cost for international clients and value of repatriated foreign earnings. | U.S. Dollar Index (DXY) volatility in 100-107 range (late 2023-early 2024) impacted reported earnings. |

| Industry Health & Investment Trends | Demand for specialized talent in growing sectors like technology and healthcare; opportunities in evolving markets like renewable energy. | Global IT spending ~$5 trillion in 2024; venture capital in healthcare projected to rebound in 2024. |

Same Document Delivered

Heidrick & Struggles International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Heidrick & Struggles International delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the executive search industry. It provides critical insights into market dynamics, competitive landscapes, and potential growth opportunities. You'll gain a thorough understanding of the external forces shaping Heidrick & Struggles' strategic direction and operational decisions.

Sociological factors

Global demographic shifts are reshaping the executive talent landscape. In many developed nations, an aging workforce means a shrinking pool of experienced leaders, while other regions boast a burgeoning young, diverse talent base. For instance, by 2030, it's projected that nearly 25% of the workforce in countries like Japan and Italy will be over 65. Heidrick & Struggles must therefore refine its executive search methodologies to tap into these varied talent pools and guide clients in assembling age-diverse leadership teams.

The increasing demand for leaders adept at managing multi-generational workforces presents a significant opportunity. Companies are actively seeking executives who can bridge generational divides, foster collaboration among different age groups, and create inclusive environments. A 2024 survey by Deloitte indicated that 70% of organizations view managing a multi-generational workforce as a key strategic priority. This requires Heidrick & Struggles to identify and place leaders with strong intergenerational communication and management skills.

The shift towards hybrid and remote work models is fundamentally altering how companies attract and retain top talent, especially at the senior leadership level. Heidrick & Struggles must guide clients through this evolving landscape, recognizing that leaders who excel in flexible environments are now highly sought after.

Employee expectations for work-life balance have significantly increased. A 2024 survey indicated that over 70% of professionals consider work-life balance a top priority when evaluating job opportunities, directly influencing Heidrick & Struggles’ advice on employer branding and candidate sourcing.

The ability to foster a positive and productive culture in a hybrid setting is now a key differentiator for organizations. Heidrick & Struggles plays a crucial role in assessing leadership candidates for their adaptability and effectiveness in managing distributed teams, a capability that proved vital during the widespread adoption of remote work in 2020-2021.

Societal and corporate pressure to build diverse, equitable, and inclusive leadership teams is escalating, making it a core strategic priority for many businesses. Heidrick & Struggles, as a leader in executive search and advisory, is instrumental in assisting clients meet these demands by identifying diverse candidates and offering guidance on fostering inclusive leadership.

The focus on DEI is shifting from standalone initiatives to being an integral component of leadership strategy, with measurable business outcomes. For instance, a 2024 McKinsey report found that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability compared to those in the fourth quartile.

This trend directly impacts Heidrick & Struggles' service offerings, as clients increasingly seek expertise in sourcing and developing leadership that reflects broader societal demographics. The firm's ability to navigate complex talent landscapes and advise on cultural integration is thus a key differentiator in the current market.

Talent Mobility and Global Migration Patterns

The global appetite for international assignments among executives significantly shapes the talent pool available for cross-border roles. As of 2024, a survey by Cartus revealed that 56% of employees are open to relocation for a new job, a figure that fluctuates with economic conditions and personal circumstances, directly impacting firms like Heidrick & Struggles in sourcing candidates for international placements.

Immigration policies and evolving visa regulations worldwide present a dynamic landscape that can either facilitate or hinder global talent mobility. For instance, in 2024, several major economies have been refining their skilled worker visa programs, aiming to attract specific expertise while managing overall immigration levels, a critical factor for Heidrick & Struggles to navigate when advising clients on international talent acquisition.

Understanding these shifting global migration patterns is paramount for Heidrick & Struggles. The firm must remain informed about where talent is migrating and the barriers or enablers present. For example, the increasing movement of skilled professionals from Asia to Europe and North America in 2024 necessitates a nuanced understanding of regional talent dynamics to effectively serve clients seeking diverse executive leadership.

- Talent Pool Dynamics: Executive willingness to relocate internationally directly influences the availability of candidates for global assignments.

- Policy Impact: Immigration and visa regulations are critical determinants of cross-border talent mobility.

- Strategic Advice: Staying current on migration trends allows Heidrick & Struggles to offer informed international talent acquisition strategies.

- Regional Shifts: Observing talent movement, such as the growing migration of skilled workers from Asia in 2024, is key to understanding global talent markets.

Societal Expectations of Corporate Leadership

Societal expectations are increasingly shaping the demands placed on corporate leadership. There's a heightened focus on governance, ethics, and a company's overall social responsibility. This means clients and stakeholders are looking for leaders who not only possess strong business acumen but also demonstrate a clear commitment to ethical principles and making a positive societal impact.

Heidrick & Struggles must therefore evaluate potential candidates by considering their alignment with these evolving societal values. This includes assessing their ability to lead with a sense of purpose and their understanding of broader community and environmental concerns. A key aspect of this evaluation is the candidate's proficiency in Environmental, Social, and Governance (ESG) competencies.

- Growing Demand for Ethical Leadership: A 2024 report indicated that 78% of consumers consider a company's ethical behavior when making purchasing decisions, influencing their perception of leadership.

- Focus on ESG Competencies: Companies are actively seeking leaders with proven track records in implementing and advancing ESG strategies, recognizing their impact on long-term sustainability and reputation.

- Purpose-Driven Leadership: Surveys in late 2024 revealed that over 65% of employees believe their company's leadership should prioritize social and environmental impact alongside financial performance.

- Increased Scrutiny on Governance: Following high-profile corporate governance failures, regulators and investors are demanding greater transparency and accountability from senior management.

Societal expectations around diversity, equity, and inclusion (DEI) continue to drive demand for leaders who reflect broader demographics. A 2024 McKinsey report highlighted that companies with greater gender diversity on executive teams were 25% more likely to outperform financially. This trend necessitates Heidrick & Struggles' focus on identifying and placing diverse talent to meet client needs for inclusive leadership.

There's a growing emphasis on purpose-driven leadership and corporate social responsibility, with over 65% of employees in a late 2024 survey expecting leadership to prioritize social and environmental impact. Companies are actively seeking executives with strong ESG competencies, as demonstrated by the fact that 78% of consumers consider ethical behavior in purchasing decisions.

The willingness of executives to relocate internationally for assignments directly impacts the global talent pool. In 2024, 56% of employees expressed openness to relocation, a figure Heidrick & Struggles must consider when advising on cross-border talent acquisition strategies amidst evolving immigration policies.

Technological factors

Artificial intelligence and machine learning are rapidly reshaping executive search. AI tools are becoming instrumental in sourcing, screening, and assessing candidates, leading to more efficient and accurate recruitment processes. For instance, by mid-2025, it's projected that AI will automate up to 40% of current recruitment tasks, allowing firms like Heidrick & Struggles to focus on higher-value strategic advisory.

Heidrick & Struggles is actively integrating these digital advancements to refine candidate identification and evaluation. This technological adoption aims to provide clients with more data-driven insights for critical hiring decisions. However, the firm continues to stress that the nuanced understanding and relationship-building inherent in human interaction remain vital for successful executive placements.

The increasing sophistication of data analytics offers profound insights into talent pools, market dynamics, and leadership efficacy. Heidrick & Struggles can harness these advanced analytics to furnish clients with more data-backed counsel and pinpoint characteristics common to highly successful leaders.

Data-driven approaches are rapidly emerging as a key differentiator in the competitive executive search landscape. For instance, in 2024, the global big data analytics market was projected to reach over $300 billion, highlighting the pervasive adoption and value placed on data-driven decision-making across industries.

By integrating these analytical capabilities, Heidrick & Struggles can enhance its advisory services, offering clients a more precise understanding of leadership suitability and market talent availability. This allows for more strategic and effective talent acquisition, a critical factor in organizational success.

The continued evolution of digital platforms and remote work technologies is fundamentally reshaping executive search. Heidrick & Struggles can leverage these advancements to conduct searches on a global scale, unhindered by geographical constraints. For instance, the global collaboration software market was projected to reach $67.3 billion in 2024, highlighting the infrastructure supporting this shift.

These technological capabilities are not just about efficiency; they are essential for identifying leaders adept at navigating the complexities of hybrid and remote team management, a skill increasingly valued by clients. By embracing these tools, Heidrick & Struggles can enhance its competitive edge and broaden its client base, tapping into a wider pool of both talent and opportunities.

Cybersecurity Risks and Data Protection

Cybersecurity risks and data protection are critical for Heidrick & Struggles, given its role in managing highly sensitive client and candidate information. The escalating sophistication of cyber threats means the firm must consistently enhance its data protection capabilities and allocate resources to cybersecurity infrastructure. A significant data breach could irreparably harm Heidrick & Struggles' reputation and erode the trust of its clients.

The firm's commitment to cybersecurity is underscored by the growing demand for specialized cybersecurity executives, creating a distinct market niche where Heidrick & Struggles can leverage its expertise. For instance, in 2024, global spending on cybersecurity is projected to reach $267 billion, highlighting the increasing importance and investment in this area. This trend directly impacts Heidrick & Struggles by increasing the need for qualified cybersecurity leadership within client organizations and reinforcing the necessity for the firm's own robust security protocols.

- Cybersecurity Spending: Global cybersecurity spending is expected to exceed $267 billion in 2024, reflecting a significant market trend.

- Reputational Impact: A cybersecurity breach can lead to substantial reputational damage and loss of client confidence for firms like Heidrick & Struggles.

- Talent Demand: The demand for cybersecurity professionals, particularly at the executive level, is a key area of focus for executive search firms.

- Data Sensitivity: Heidrick & Struggles handles vast amounts of confidential client and candidate data, making robust data protection measures essential.

Automation of Administrative Tasks

The automation of routine administrative tasks within the recruitment lifecycle is significantly reshaping how firms like Heidrick & Struggles operate. By leveraging technology for functions such as interview scheduling and initial candidate communication, the company frees up its consultants. This allows them to dedicate more time to strategic advisory services and cultivating client relationships, thereby boosting overall operational efficiency.

This technological shift enables a more effective allocation of human capital, directing consultants towards higher-value activities that directly impact client success and revenue generation. For instance, AI-powered platforms can now sift through thousands of resumes in minutes, a task that previously consumed considerable consultant time. In 2024, it's estimated that recruitment automation tools could improve recruiter productivity by as much as 40%.

The benefits extend to enhanced candidate experience through faster response times and more organized processes. This automation also contributes to cost savings by reducing the manual effort required for administrative overhead. By embracing these advancements, Heidrick & Struggles can maintain a competitive edge in the fast-paced executive search market.

- Enhanced Consultant Focus: Automation handles scheduling and outreach, allowing consultants to prioritize strategic advisory and relationship building.

- Increased Operational Efficiency: Routine tasks are streamlined, leading to faster turnaround times and improved resource utilization.

- Higher Value Activities: Human resources are redirected to complex problem-solving and client engagement, areas where human expertise is indispensable.

- Improved Candidate Experience: Quicker communication and smoother processes contribute to a better experience for potential hires.

Technological advancements are fundamentally altering executive search, with AI and machine learning streamlining candidate sourcing and screening. By 2025, AI is expected to automate around 40% of recruitment tasks, enabling firms like Heidrick & Struggles to focus more on strategic client advisory.

The pervasive adoption of data analytics is providing deeper insights into talent pools and market trends, allowing for more data-driven counsel. The global big data analytics market, projected to exceed $300 billion in 2024, underscores the critical role of data in decision-making.

Furthermore, evolving digital platforms and remote work technologies are expanding the geographical reach of executive searches. The global collaboration software market's projected $67.3 billion valuation in 2024 highlights the infrastructure supporting this global talent access.

Heidrick & Struggles must navigate cybersecurity threats due to the sensitive data it handles, with global cybersecurity spending projected at $267 billion for 2024, emphasizing the critical need for robust data protection.

Legal factors

Heidrick & Struggles navigates a complex web of global employment and labor laws, from hiring and termination to non-discrimination and fair practices. In 2024, staying abreast of evolving regulations, such as those concerning remote work and worker classification, is paramount for operational efficiency and client advisory services. For instance, the US Department of Labor reported a 7% increase in wage and hour investigations in 2023, highlighting the growing scrutiny on fair compensation practices worldwide.

Heidrick & Struggles must navigate a complex web of data protection laws, including Europe's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), to safeguard the sensitive candidate and client information it processes. Failure to comply can lead to significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher.

The ongoing evolution of these privacy regulations necessitates a proactive and continuous legal review process to ensure ongoing adherence. For instance, the California Privacy Rights Act (CPRA), an amendment to CCPA, introduced new obligations and expanded consumer rights, which Heidrick & Struggles would need to integrate into its data handling practices.

Reputational damage stemming from data breaches or privacy violations can be substantial, impacting client trust and candidate willingness to share personal details. In 2023, data breaches continued to be a significant concern across industries, highlighting the critical importance of robust data security and privacy compliance for executive search firms.

Anti-discrimination and equal opportunity laws are paramount for Heidrick & Struggles, directly impacting their core business of executive search and talent assessment. These regulations, such as the Civil Rights Act of 1964 in the US and similar legislation globally, mandate fair treatment in employment, requiring the firm to design its methodologies to prevent bias. Failure to comply can lead to significant legal penalties and reputational damage, especially given the firm's role in shaping leadership diversity.

Ensuring compliance means Heidrick & Struggles must actively promote diversity, equity, and inclusion (DEI) within their client engagement processes and internal hiring. For instance, in 2023, reports indicated continued focus on diverse candidate slates, with many clients setting specific diversity targets for senior roles. The firm's ability to navigate these legal landscapes and demonstrate a commitment to DEI is crucial for maintaining trust and attracting both clients and top-tier talent, thereby safeguarding its operational integrity and market position.

Contract Law and Service Agreements

Heidrick & Struggles' operations are deeply rooted in contract law, particularly concerning service agreements with both clients and candidates. These contracts are crucial for defining the scope of services provided, fee structures, confidentiality obligations, and the handling of intellectual property. The firm's ability to secure and enforce these agreements underpins its revenue generation and client relationships.

Evolving contract law and heightened scrutiny of service agreements can introduce significant shifts in business terms and elevate legal risks. For instance, changes in data privacy regulations, such as updates to GDPR or CCPA, can necessitate revisions to confidentiality clauses and data handling practices within contracts. In 2024, the global legal landscape continues to emphasize stringent compliance, requiring firms like Heidrick & Struggles to adapt their standard agreements to meet new or revised legal standards across various operating regions.

Maintaining clarity and enforceability of these agreements across the diverse jurisdictions in which Heidrick & Struggles operates is a complex but vital undertaking. This involves navigating differing legal interpretations and enforcement mechanisms for contractual terms. The firm's legal teams must remain vigilant in ensuring that all service agreements are compliant with local laws and provide adequate protection for the company.

- Service Agreement Scope: Contracts clearly define deliverables, timelines, and responsibilities for both Heidrick & Struggles and its clients.

- Confidentiality and IP Protection: Robust clauses safeguard sensitive client and candidate information, as well as the firm's proprietary methodologies and data.

- Jurisdictional Compliance: Agreements are tailored to comply with the specific contract laws and regulatory requirements of each country of operation.

- Risk Mitigation: Well-drafted contracts are essential for minimizing legal disputes and ensuring predictable business operations.

Intellectual Property Rights

Heidrick & Struggles places significant emphasis on protecting its intellectual property, which includes proprietary assessment tools, unique methodologies, and confidential client insights. These assets are fundamental to maintaining the firm's competitive edge in the executive search and leadership consulting sectors. Safeguarding these through robust legal frameworks, particularly those concerning trademarks and copyrights, is paramount to preventing infringement and preserving the value of their specialized services.

The firm operates within a global landscape where intellectual property laws vary considerably. For instance, in 2024, ongoing legislative discussions in several key markets, including the United States and European Union, continue to refine the scope and enforcement of digital copyright and patent protections. This evolving legal environment directly impacts how Heidrick & Struggles can protect its digital assessment platforms and data analytics tools from unauthorized use or replication. The firm's ability to innovate and deliver unique solutions hinges on the strength and clarity of these legal protections.

Key aspects of intellectual property law relevant to Heidrick & Struggles include:

- Copyright Protection: Safeguarding written content, proprietary assessment instruments, and software code developed by the firm.

- Trademark Registration: Protecting brand names, logos, and service marks that differentiate Heidrick & Struggles in the market.

- Trade Secret Laws: Shielding confidential client data, internal processes, and unique methodologies that provide a competitive advantage.

- Enforcement Strategies: Actively monitoring for and pursuing legal action against any unauthorized use or infringement of its intellectual property.

Heidrick & Struggles operates under a strict legal framework governing employment, data privacy, and fair practices across its global operations. Compliance with evolving regulations, such as those concerning remote work and worker classification, remains a key focus in 2024, with agencies like the US Department of Labor increasing investigations into wage and hour practices, as evidenced by a 7% rise in such probes in 2023. The firm must also adhere to stringent data protection laws like GDPR and CCPA, where non-compliance can result in substantial fines, with GDPR penalties potentially reaching 4% of global annual revenue or €20 million.

Anti-discrimination and equal opportunity laws are foundational to Heidrick & Struggles' business model, necessitating fair treatment in all talent acquisition processes. The firm actively promotes diversity, equity, and inclusion (DEI), aligning with client demands for diverse candidate slates, a trend that saw significant emphasis in 2023 reports. Adherence to these legal mandates is crucial for maintaining client trust and attracting top talent, reinforcing the firm's market standing.

Environmental factors

Investor demand for ESG integration is a significant driver, with BlackRock CEO Larry Fink's 2024 letter emphasizing climate risk and sustainability as core to long-term value creation. This translates to a heightened need for leaders who can navigate complex environmental regulations and stakeholder expectations.

Heidrick & Struggles is seeing a surge in searches for executives skilled in ESG strategy and implementation. For instance, the firm reported a substantial increase in executive search assignments focused on sustainability roles in 2023, reflecting this market shift.

Companies are actively seeking leaders capable of embedding environmental stewardship and robust governance into their business models. This includes expertise in areas like carbon footprint reduction, supply chain sustainability, and ethical corporate practices.

The regulatory landscape is also evolving, with new disclosure requirements and climate-related legislation emerging globally. Leaders with foresight and adaptability in these areas are becoming increasingly valuable assets.

Clients increasingly scrutinize the corporate social responsibility (CSR) practices of their leadership advisory partners. Heidrick & Struggles’ commitment to ethical operations and tangible CSR initiatives directly impacts its brand perception and appeal to both clients and potential employees.

For instance, in 2023, Heidrick & Struggles reported a 15% increase in client inquiries specifically regarding their CSR and ESG (Environmental, Social, and Governance) strategies, highlighting a growing demand for partners who embody these principles.

Internally, the firm’s focus on sustainability, such as reducing its carbon footprint by 10% year-over-year through remote work policies and energy-efficient office spaces, reinforces its credibility in advising clients on similar fronts.

This dedication to responsible business practices is crucial for maintaining a competitive edge and attracting talent who prioritize working for organizations with a strong social conscience.

Climate change presents significant environmental factors impacting the industries Heidrick & Struggles serves. Evolving regulations and a global push towards sustainability are reshaping business models and, consequently, talent requirements. For instance, the burgeoning green economy is creating a substantial demand for leadership roles in renewable energy sectors and specialized fields like climate risk management and sustainable finance.

Heidrick & Struggles must remain highly adaptable to these shifting client needs. The firm’s ability to identify and place leaders who can navigate the complexities of the green transition is crucial. This includes expertise in areas such as carbon accounting, circular economy principles, and ESG (Environmental, Social, and Governance) integration.

The financial implications are also substantial. By 2024, the global sustainable investment market was projected to surpass $50 trillion, highlighting the economic imperative for companies to address climate change. This growth directly translates into a greater need for executive talent experienced in leading sustainable business transformations.

Resource Scarcity and Supply Chain Resilience

The increasing global concern over resource scarcity, particularly in critical materials like rare earth elements and certain metals essential for technology and green energy, directly impacts supply chain stability. For instance, the International Energy Agency's 2024 reports highlight potential supply bottlenecks for minerals like lithium and cobalt, crucial for electric vehicle batteries. This scarcity necessitates a strong focus on supply chain resilience, creating a demand for leadership adept at navigating these complexities.

Heidrick & Struggles must recognize and cultivate expertise in identifying leaders with proven track records in operational efficiency, robust risk management, and strategic sustainable sourcing. Companies are actively seeking executives who can build diversified supplier networks and implement circular economy principles to mitigate the risks associated with resource depletion. This translates to a growing need for leadership roles centered on supply chain optimization and sustainability integration.

- Demand for Supply Chain Expertise: Global supply chain disruptions, exacerbated by geopolitical events and climate impacts, have elevated the importance of resilient supply chains.

- Resource Scarcity Impact: Projections indicate growing demand for key minerals, with the World Bank's 2023 analysis forecasting a potential sixfold increase in demand for lithium and cobalt by 2050.

- Leadership Requirements: Companies are prioritizing leaders skilled in risk mitigation, operational agility, and sustainable procurement to manage these environmental pressures.

- Emerging Roles: Heidrick & Struggles should anticipate a rise in demand for Chief Supply Chain Officers and Heads of Sustainability with deep expertise in resource management and ethical sourcing.

Regulatory Pressure for Sustainability Reporting

Companies are facing growing demands for transparent sustainability reporting, covering areas like carbon emissions and diversity metrics. This regulatory shift necessitates executives who can expertly manage intricate reporting standards. For instance, in 2024, the SEC's proposed climate disclosure rules, though undergoing revisions, signaled a significant move towards standardized environmental reporting for public companies.

This evolving landscape creates a distinct need for leaders with specialized knowledge in sustainability reporting and regulatory compliance. Heidrick & Struggles is well-positioned to meet this demand by identifying and recruiting executives possessing these critical skills through its specialized executive search services.

- Increased Regulatory Scrutiny: Governments worldwide are implementing stricter rules for corporate environmental and social disclosures.

- Demand for ESG Expertise: Companies require leaders who can navigate and implement robust Environmental, Social, and Governance (ESG) reporting frameworks.

- Talent Gap: There's a notable shortage of executives with proven experience in sustainability reporting and compliance.

- Heidrick & Struggles' Role: The firm can leverage its network to source candidates with the necessary ESG leadership capabilities.

Investor demand for ESG integration is a significant driver, with BlackRock CEO Larry Fink's 2024 letter emphasizing climate risk and sustainability as core to long-term value creation. This translates to a heightened need for leaders who can navigate complex environmental regulations and stakeholder expectations.

Heidrick & Struggles is seeing a surge in searches for executives skilled in ESG strategy and implementation. For instance, the firm reported a substantial increase in executive search assignments focused on sustainability roles in 2023, reflecting this market shift.

Companies are actively seeking leaders capable of embedding environmental stewardship and robust governance into their business models. This includes expertise in areas like carbon footprint reduction, supply chain sustainability, and ethical corporate practices.

The regulatory landscape is also evolving, with new disclosure requirements and climate-related legislation emerging globally. Leaders with foresight and adaptability in these areas are becoming increasingly valuable assets.

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on a comprehensive blend of official government publications, reputable financial institutions, and leading market research firms. This approach ensures that every political, economic, social, technological, legal, and environmental insight is grounded in validated data.