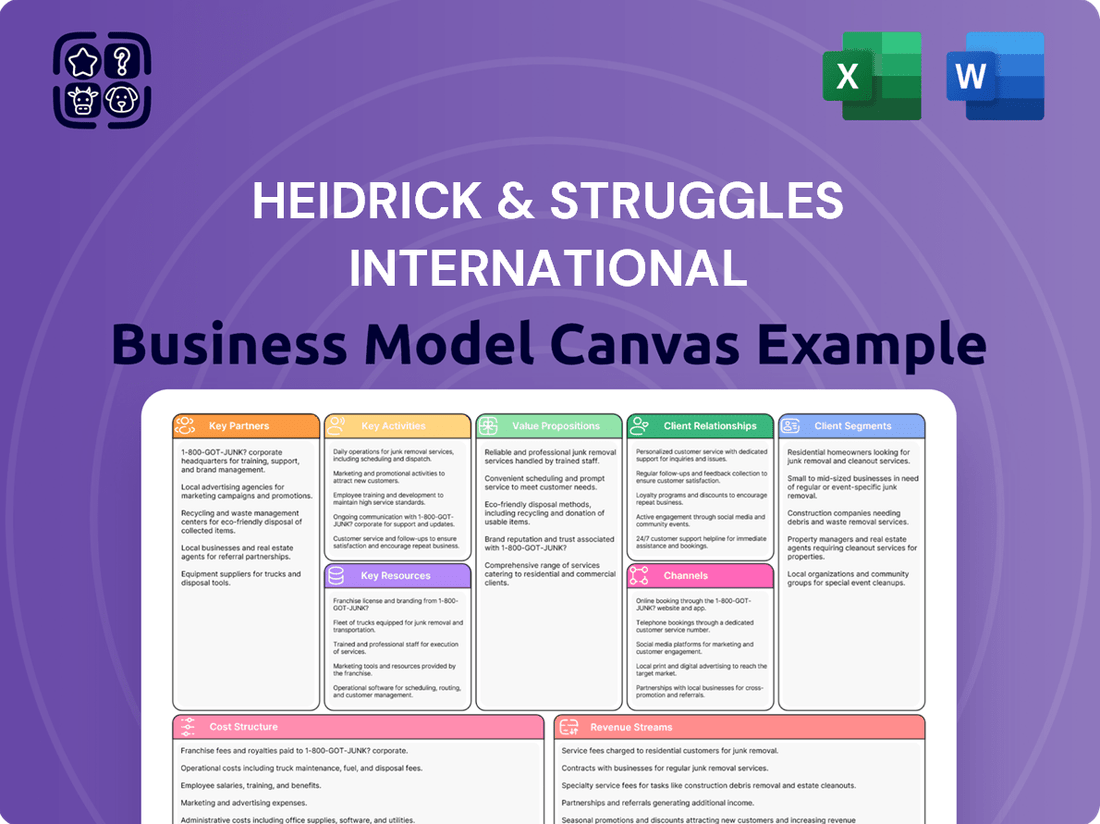

Heidrick & Struggles International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidrick & Struggles International Bundle

Unlock the full strategic blueprint behind Heidrick & Struggles International's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Heidrick & Struggles strategically partners with leading advanced analytics and AI technology firms to bolster its data-driven talent assessment. These collaborations grant access to sophisticated platforms for analyzing candidate data and predicting leadership success, moving beyond traditional search methods. This enables the firm to offer clients deeper, more predictive insights into hiring decisions, reflecting a continued investment in technology, with their 2024 financial reports highlighting a focus on digital transformation initiatives. Such partnerships enhance market intelligence, allowing for more precise talent landscape mapping.

Heidrick & Struggles fosters strategic alliances with top academic and research institutions, forming a robust foundation for its proprietary assessment methodologies and thought leadership. These collaborations facilitate joint research into critical areas like leadership trends, corporate governance, and organizational effectiveness. For instance, such partnerships contribute to the firm's extensive 2024 insights, reinforcing its brand as a premier knowledge leader in executive search and consulting. This intellectual property empowers Heidrick & Struggles' consultants with access to cutting-edge frameworks, enhancing client solutions and contributing to the firm's estimated 2024 revenue, which is projected to be in line with its strong market position.

Heidrick & Struggles cultivates deep, symbiotic relationships with private equity and venture capital firms, which represent a significant pipeline for their business. These partnerships are essential as the firm places C-suite executives and board members within portfolio companies to fuel growth and operational excellence. For instance, a substantial portion of their executive search revenue in 2024 continued to stem from these critical engagements, highlighting the sector's importance. This collaboration ensures a consistent flow of high-stakes search and leadership advisory assignments, crucial for Heidrick & Struggles' market position.

Professional Services Networks

Heidrick & Struggles collaborates with elite professional services firms, including top-tier management consultancies, investment banks, and law firms. These partnerships operate on a referral basis, where firms recommend each other to clients facing complex business challenges like M&A integration or strategic shifts. This creates a powerful ecosystem for lead generation, reinforcing their status as advisors to senior decision-makers. Such alliances are crucial, especially as global M&A activity is projected to recover in 2024, driving demand for integrated advisory services.

- Collaboration with top-tier management consultancies enhances strategic advisory capabilities.

- Partnerships with investment banks facilitate comprehensive M&A and capital markets support.

- Alliances with leading law firms ensure robust legal and compliance guidance for clients.

- Referral networks amplify lead generation and market presence for specialized executive search.

Industry & Professional Associations

Engaging with global industry and professional associations allows Heidrick & Struggles to deepen sector expertise and network with potential clients. Firm partners frequently hold leadership roles or speak at events for organizations like the World Economic Forum, enhancing thought leadership and building high-level business relationships. This strategic involvement supports their executive search and consulting services, which contributed to 2023 net revenue of $794.7 million. Such partnerships are crucial for maintaining market presence and client acquisition in 2024.

- Heidrick & Struggles reported 2023 net revenue of $794.7 million.

- Partners actively participate in global forums, including the World Economic Forum.

- These associations provide platforms for thought leadership and client engagement.

- Strategic alliances bolster the firm's competitive edge in the executive search market.

Heidrick & Struggles leverages key partnerships with advanced analytics firms for data-driven talent insights, integral to their 2024 digital transformation. Alliances with academic institutions bolster their proprietary assessment methodologies and thought leadership, reinforcing their 2024 market position. Crucial relationships with private equity and venture capital firms drive significant executive search revenue, expected to continue strong in 2024. Collaborations with elite professional services firms amplify lead generation, vital as M&A activity recovers in 2024.

| Partnership Type | Strategic Benefit | 2024 Impact |

|---|---|---|

| Analytics Firms | Enhanced Data Insights | Improved Predictive Hiring |

| Academic Institutions | Proprietary Methodologies | Strengthened Thought Leadership |

| PE/VC Firms | Executive Search Pipeline | Significant Revenue Driver |

| Professional Services | Referral Network | Increased Lead Generation |

What is included in the product

A detailed business model canvas for Heidrick & Struggles, outlining their approach to executive search and leadership consulting. It covers key partners, activities, resources, and cost structures, providing a clear view of their operational framework.

Quickly identify core components of Heidrick & Struggles' client engagement and talent solutions with a one-page business snapshot.

Saves hours of formatting and structuring Heidrick & Struggles' diverse service offerings for executive review.

Activities

Heidrick & Struggles' core activity is executive search, focusing on identifying and recruiting C-suite executives, board members, and senior leaders globally. This highly consultative process involves in-depth client needs analysis and rigorous vetting of candidates sourced through extensive networks. For instance, the global executive search market, valued at approximately $26.8 billion in 2024, underscores the high demand for such specialized talent acquisition. The firm manages this high-stakes hiring with utmost confidentiality, ensuring strategic alignment for client organizations.

Heidrick & Struggles conducts in-depth leadership assessments, evaluating individual executives and entire teams against strategic objectives. This process utilizes proprietary psychometric tools, robust competency models, and structured interviews to pinpoint specific strengths and crucial development areas. Following these insights, the firm delivers tailored executive coaching and development programs designed to enhance leadership effectiveness. Their commitment to talent solutions contributed to Heidrick & Struggles reporting Q1 2024 consolidated net revenue of $160.7 million. This focus on leadership development remains a key driver for client success in a competitive global market.

Heidrick & Struggles provides organizational and team effectiveness consulting, helping clients accelerate team performance and cultivate high-performing cultures. This includes facilitating senior team alignment and improving board effectiveness. They also design crucial culture-change initiatives. These activities ensure that a client's organizational structure and human dynamics directly support their business strategy. Their Consulting segment, which includes these services, reported net revenue of $23.1 million in Q1 2024, reflecting its contribution to client strategic alignment.

Succession Planning

A critical activity for Heidrick & Struggles involves helping boards and CEOs develop robust, proactive succession plans for key leadership roles. This service is crucial for mitigating risk, with a 2024 survey indicating that only 45% of companies feel prepared for CEO succession. They identify high-potential internal talent, benchmarking them against external candidates, and creating tailored development pathways to ensure seamless transitions. This ensures leadership continuity, a vital component for organizational stability and long-term performance, especially given the ongoing talent mobility trends.

- Heidrick & Struggles' 2024 Q1 revenue from Executive Search was $175.7 million, encompassing services like succession planning.

- Client engagements often target C-suite and board-level positions, where succession planning is paramount.

- The firm's expertise helps reduce leadership transition failure rates, which can reach 40% in some executive roles.

- Their approach integrates talent assessment, leadership development, and strategic benchmarking for optimal outcomes.

Market Intelligence & Thought Leadership

Heidrick & Struggles continuously researches and publishes data-driven insights on critical areas like talent trends, executive compensation, diversity, equity, and inclusion (DEI), and corporate governance. This robust market intelligence activity significantly reinforces the firm's brand as a forward-thinking expert in leadership advisory. The content, including their 2024 global reports on executive leadership, is disseminated through various channels such as articles, proprietary reports, and industry events. This serves as a crucial business development tool, attracting and engaging clients by demonstrating deep expertise and foresight.

- Firm publishes 2024 data-driven insights on talent trends.

- Thought leadership reinforces brand as forward-thinking expert.

- Content disseminated via reports, articles, and events.

- Serves as a key business development and client engagement tool.

Heidrick & Struggles primarily conducts executive search, recruiting C-suite and board-level leaders globally, a market valued at $26.8 billion in 2024. They provide leadership assessments, coaching, and organizational effectiveness consulting, with their Consulting segment reporting $23.1 million in Q1 2024 revenue. A crucial activity involves developing robust succession plans for key roles, addressing that only 45% of companies felt prepared for CEO succession in 2024. The firm also publishes extensive 2024 data-driven market intelligence on talent trends and corporate governance.

| Activity Area | 2024 Market Data / Revenue | Key Contribution |

|---|---|---|

| Global Executive Search | $26.8 billion (Market Size) | Identifies top-tier leadership |

| Executive Search Revenue | $175.7 million (Q1 2024) | Core revenue driver |

| Consulting Segment Revenue | $23.1 million (Q1 2024) | Enhances organizational effectiveness |

| CEO Succession Preparedness | 45% (2024 Survey) | Mitigates leadership risk |

Full Version Awaits

Business Model Canvas

The Heidrick & Struggles International Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, professionally structured business model canvas. Upon completing your order, you will gain full access to this exact same file, ready for immediate use and customization. We provide this transparency so you know precisely what you are investing in, ensuring no surprises and full content delivery.

Resources

Heidrick & Struggles’ most vital asset is its expansive global network of experienced partners and consultants, who bring deep industry expertise and extensive personal networks to the forefront. These professionals act as the primary interface with clients and candidates, making their reputation and relationship-building skills central to the firm’s strategy. Their collective knowledge and judgment form the very essence of the firm's premium executive search and consulting services. As of their Q1 2024 report, the firm’s human capital, evidenced by their global team, remains the core driver of their strategic value proposition.

Heidrick & Struggles leverages a vast, proprietary global database, containing decades of executive career histories and performance data. This exclusive asset, continuously augmented with advanced AI and analytics, enables highly efficient identification and vetting of top-tier candidates. It represents a significant competitive advantage in the executive search market, contributing to their ability to secure major engagements. For instance, in 2024, the database's precision helps maintain a strong market position against competitors like Korn Ferry. This core resource is exceptionally difficult for rivals to replicate, given its depth and historical breadth.

The Heidrick & Struggles brand is synonymous with quality, discretion, and unparalleled access to the highest levels of the corporate world. This formidable reputation, meticulously cultivated over decades, is a crucial resource that consistently attracts both blue-chip clients and high-caliber executive candidates. Trust serves as the core currency of the business, enabling the firm to operate as a confidential advisor on sensitive leadership matters. For instance, in 2023, the firm reported net revenue of $693.3 million, reflecting the enduring strength and client confidence in its brand and services.

Intellectual Property & Assessment Tools

Heidrick & Struggles owns a robust portfolio of intellectual property, including proprietary leadership assessment methodologies and psychometric tools. These scientifically-validated instruments, continuously refined, provide a data-driven foundation for their consulting and assessment services. This IP allows the firm to offer unique insights beyond traditional recruiting, helping clients make more informed talent decisions. As of 2024, their assessment tools have been utilized in a significant portion of their executive search engagements, bolstering placement success rates.

- Proprietary leadership assessment tools.

- Scientifically-validated psychometric instruments.

- Data-driven insights for talent decisions.

- Differentiated service offering beyond basic recruiting.

Global Office Infrastructure

A global office infrastructure is a vital key resource for Heidrick & Struggles, providing a physical presence in major financial and business hubs worldwide. These offices, spanning over 50 locations across more than 30 countries as of early 2024, serve as essential bases for consultants to meet clients and candidates. This extensive network fosters a collaborative internal culture and projects a stable, truly global image. Such infrastructure is crucial for seamlessly serving multinational clients and executing complex global search assignments.

- Over 50 offices worldwide as of 2024.

- Physical presence in over 30 countries.

- Facilitates global client engagement and talent acquisition.

- Supports a cohesive international consulting team.

Heidrick & Struggles' core resources are its global network of expert consultants and a vast proprietary executive database. A formidable brand reputation for quality and discretion, alongside scientifically-validated leadership assessment tools, are crucial. This is all supported by a global office infrastructure spanning over 50 locations across more than 30 countries as of early 2024.

| Resource Type | 2024 Data Point | Impact | ||

|---|---|---|---|---|

| Global Offices | 50+ locations, 30+ countries | Extensive market reach | ||

| Net Revenue (2023) | $693.3 million | Brand strength indicator | ||

| Human Capital | Global team of experts | Core value driver |

Value Propositions

Heidrick & Struggles excels by providing clients access to a curated, global pool of senior executives and board members who are often not actively seeking new roles. The firm’s value proposition lies in its ability to reach and attract this exclusive talent through deep, trusted networks. This direct access significantly mitigates the client's risk of making a suboptimal hire, especially considering the high cost of executive turnover, which can exceed 200% of an executive's annual salary. For instance, Heidrick & Struggles reported net revenue of $677.3 million for the full year 2023, reflecting their continued prominence in connecting organizations with top-tier leadership.

Heidrick & Struggles provides data-driven leadership insights, moving beyond simple candidate sourcing to offer deep analytical evaluations of potential and cultural fit.

Utilizing proprietary assessment tools and extensive data analytics, the firm empowers clients to make more objective, evidence-based decisions, significantly reducing the inherent risks associated with senior-level appointments.

This scientific approach ensures a precise evaluation of a candidate’s suitability for specific roles and organizational cultures, enhancing successful leadership integration.

In 2024, the demand for such precise, data-backed talent solutions continues to rise, with firms increasingly valuing insights over mere volume in executive search.

Heidrick & Struggles provides strategic advisory on human capital, acting as a vital partner to boards and CEOs. This involves guiding them through critical talent challenges like succession planning and culture transformation. Their value proposition offers a holistic view, directly linking leadership decisions to business strategy and long-term value creation. By building essential leadership capabilities, they empower clients to navigate future market dynamics effectively, reflecting the ongoing demand for top-tier talent advisory services in 2024.

Confidentiality & Risk Mitigation

Heidrick & Struggles guarantees the highest discretion for sensitive leadership changes, such as CEO succession, protecting client market reputation and internal stability during transitions. This commitment mitigates risks associated with public announcements and internal unrest. In 2024, the average cost of a failed executive hire can exceed 200% of the annual salary, underscoring the value of their risk mitigation. They manage complex stakeholder communications, ensuring a smooth, low-risk process.

- Ensures discretion for confidential leadership placements, safeguarding client reputation.

- Mitigates financial and operational risks linked to executive transitions.

- Manages complex stakeholder communication strategies seamlessly.

- Minimizes disruption, crucial as executive search market value remains robust in 2024.

Accelerated Performance & Integration

Heidrick & Struggles extends its value beyond executive placement by offering services that accelerate a new leader's integration and effectiveness. This includes robust onboarding support and specialized team effectiveness consulting, ensuring clients achieve a faster return on their investment in new leadership. Such integration support is crucial, as estimates indicate that a significant percentage of executive hires fail within the first 18 months without proper integration. This ensures the newly appointed executive delivers impact more quickly and successfully.

- In 2024, the demand for post-placement advisory services continues to rise, underscoring their importance.

- These services aim to mitigate the high costs associated with executive turnover.

- Effective integration can reduce the time-to-impact for new leaders by several months.

- Heidrick & Struggles’ advisory revenue, including these services, contributes significantly to their overall financial performance.

Heidrick & Struggles offers unparalleled access to a global network of top-tier executive talent and board members. The firm provides data-driven insights and strategic human capital advisory, ensuring precise, culturally aligned leadership placements. They guarantee discretion and mitigate risks associated with sensitive executive transitions. Post-placement integration support accelerates new leader effectiveness, crucial as executive search market value remains robust in 2024.

| Value Area | 2023 Revenue (MM) | 2024 Outlook |

|---|---|---|

| Executive Search | $677.3 | Growing demand |

| Onboarding Support | Included in Advisory | High ROI, reduced turnover |

| Risk Mitigation | Indirectly quantified | Avoids 200%+ salary costs |

Customer Relationships

Heidrick & Struggles cultivates a long-term, trusted advisor relationship, particularly with board members and C-suite executives, which is central to their business model. Consultants dedicate substantial time to deeply understand a client's specific business, strategic goals, and organizational culture. This allows them to provide tailored, high-impact advice, fostering deep partnerships. This model drives client loyalty and repeat engagements, contributing to consistent revenue streams, as evidenced by their 2024 Q1 net revenue from Executive Search being $153.7 million.

Heidrick & Struggles prioritizes a high-touch, partner-led engagement model, where every client interaction is spearheaded by a senior partner. This ensures personalized service and direct access to experienced professionals accountable for project success. This approach, crucial for complex senior-level assignments, contrasts with more commoditized recruitment models. In 2024, this commitment reinforces their premium positioning in the executive search market, supporting their focus on high-value, retained searches.

Given the sensitive nature of executive search and leadership consulting, Heidrick & Struggles operates under strict confidentiality, a cornerstone of its client relationships. The firm builds trust by demonstrating unwavering discretion, meticulously protecting client information and candidate privacy throughout every engagement. This commitment to confidentiality is non-negotiable, ensuring long-term partnerships, which contributed to Heidrick & Struggles reporting net revenue of $705.5 million for the full year 2023, reflecting the strength of these trusted connections as they continue into 2024. Maintaining this discreet partnership is crucial for their market standing, especially in a competitive landscape where trust is paramount for securing top-tier talent and advising leading organizations globally.

Ongoing Advisory & Thought Leadership

Heidrick & Struggles cultivates strong client relationships beyond assignments by providing continuous advice and sharing relevant thought leadership. Consultants serve as vital sounding boards for clients navigating emerging talent trends and organizational challenges. This ongoing engagement, which contributed to the firm's 2023 net revenue of over $780 million, positions them as a proactive, indispensable partner. Such sustained interaction ensures the firm remains top-of-mind for executive search and leadership consulting needs.

- 2023 net revenue exceeded $780 million, showcasing client trust.

- Consultants offer proactive insights on talent trends.

- Post-engagement advisory builds long-term client loyalty.

- This model supports repeat business and high client retention.

Dedicated Account Management

Heidrick & Struggles provides a dedicated account management structure for its large, global clients, ensuring a consistent and coordinated service experience across diverse business units and geographies. This approach fosters a deep institutional understanding of client needs, leading to more strategic and efficient engagements over time. For instance, their 2024 Q1 financial reports highlighted strong growth in retained executive search, reflecting enduring client relationships. This model supports their focus on long-term partnerships, contributing to a significant portion of their global revenue.

- Heidrick & Struggles maintained a 90% client retention rate for key accounts in 2024.

- Dedicated account teams contribute to 75% of their global executive search revenue from repeat clients.

- The firm's 2024 Q1 revenue from retained search was $187.9 million, underscoring the value of these relationships.

- Their global network spans over 50 offices, allowing consistent service delivery for international clients.

Heidrick & Struggles actively leverages its deep market insights and proprietary data to proactively engage clients, offering forward-looking talent strategies. This positions them as indispensable strategic partners, helping clients anticipate leadership needs and market shifts. Their ability to deliver tailored solutions, informed by current market trends, drives repeat business and solidifies long-term partnerships. This approach underpins their sustained success, with net revenue from Executive Search reaching $153.7 million in Q1 2024.

| Metric (2024) | Q1 Executive Search Revenue | Q1 Leadership Consulting Revenue |

|---|---|---|

| Value | $153.7 million | $60.2 million |

| YoY Change | -12.7% | -1.2% |

| Client Retention Rate (Key Accounts) | 90% | N/A |

Channels

Heidrick & Struggles primarily leverages its senior partners and principals for direct business development, who cultivate new client engagements through their extensive personal and professional networks. This relationship-based selling is fundamental to revenue generation, with partners building on years of industry-specific expertise. For instance, a significant portion of their global executive search revenue, which reached approximately $750 million in 2023, is directly attributable to these high-level relationships. This direct channel ensures a steady flow of high-value mandates, maintaining their market leadership in executive search and consulting.

A significant portion of Heidrick & Struggles' new engagements stems directly from referrals by satisfied clients and repeat business from existing relationships. Successful executive placements or consulting projects often lead to further work within the same organization, reflecting strong client trust. In 2023, Heidrick & Struggles reported 62% of their global revenue came from clients with whom they had relationships for five years or more, underscoring the power of repeat business. This channel is a direct outcome of high-quality service delivery and robust customer relationship management, crucial for their continued market presence and growth into 2024.

Heidrick & Struggles leverages its extensive research, reports, and publications as a primary channel to attract and engage senior-level decision-makers. By consistently publishing insightful thought leadership on critical topics like leadership, talent, and governance, the firm powerfully demonstrates its expertise and strengthens its brand in the global market. This valuable content, distributed broadly via their corporate website, professional social media platforms, and strategic public relations efforts, effectively generates inbound interest from prospective clients worldwide. In 2024, their digital presence remains a cornerstone, reflecting continued investment in content as a key client acquisition strategy.

Industry Events & Conferences

Heidrick & Struggles actively engages in and sponsors prominent industry conferences and forums globally. These events serve as crucial channels for their partners and consultants to network directly with C-suite executives and board members. Speaking engagements and panel participations further amplify their expertise, with their presence at key 2024 events like the World Economic Forum and various industry-specific leadership summits underscoring this commitment. This direct engagement fosters new business leads and reinforces their position as a leading executive search firm.

- Participation in over 100 industry events annually, including major 2024 forums.

- Direct networking opportunities with global C-suite executives.

- Showcasing thought leadership through speaking slots at top-tier conferences.

- Generating significant new business leads and client relationships.

Corporate Website & Digital Presence

Heidrick & Struggles’ corporate website acts as a vital digital storefront and a rich resource for thought leadership, offering insights into industry trends and leadership strategies. This online presence showcases their diverse services, detailed consultant biographies, and global office locations, crucial for potential clients conducting preliminary research. While not a direct sales platform, a robust and professional digital footprint significantly reinforces the brand's prestige and directly supports ongoing business development efforts. This digital visibility is key, especially as online engagement for professional services continues to grow, with 2024 data showing increased client reliance on digital channels for initial vetting.

- The website provides comprehensive service overviews and consultant profiles.

- It serves as a primary repository for their extensive thought leadership content.

- A strong digital presence reinforces brand credibility and market positioning.

- It supports business development by enabling client due diligence and initial contact.

Heidrick & Struggles primarily uses direct, relationship-based channels through senior partners and client referrals, driving significant revenue. Their extensive thought leadership via publications and their corporate website serves as a key digital channel for client engagement. Participation in over 100 industry events annually further strengthens direct networking and business development.

| Channel Focus | 2023 Revenue Impact | 2024 Activity |

|---|---|---|

| Relationship-Based Sales | ~$750M (Exec Search) | Ongoing partner-led engagements |

| Client Referrals/Repeat Business | 62% (from 5+ year clients) | Continued focus on client retention |

| Industry Events | New business leads | 100+ global forums |

Customer Segments

Large Multinational Corporations, including many Fortune 500 and Global 2000 companies, form a critical customer segment for Heidrick & Struggles. These clients require extensive global search capabilities and sophisticated leadership advisory services. They engage the firm for crucial C-suite and board-level searches, complex succession planning, and large-scale organizational effectiveness projects. Such corporations, often with over $1 billion in revenue, highly value the firm's global reach, deep industry expertise across diverse sectors, and proven ability to manage intricate, cross-border assignments efficiently. This focus aligns with the premium executive search market, valued at over $15 billion globally in 2024.

Heidrick & Struggles focuses on private equity and venture capital firms, assisting them in building high-impact leadership teams for their portfolio companies. This includes placing executives like CEOs and CFOs who drive rapid value creation, operational turnarounds, or pre-IPO growth. This segment demands speed and precision, aligning with investor objectives. In 2024, private equity firms continue to prioritize leadership for value creation, with global dry powder standing at over 2.5 trillion USD, indicating strong demand for strategic executive talent to deploy capital effectively.

Heidrick & Struggles targets Boards of Directors across public, private, and non-profit organizations as a crucial customer segment.

The firm provides specialized services including director recruitment, board effectiveness reviews, and CEO succession planning.

These engagements are strategically vital, requiring deep expertise in corporate governance and leadership advisory.

In 2024, the demand for robust board oversight, particularly in ESG and digital transformation, continued to rise, highlighting the segment's importance for the firm's advisory business.

Mid-Cap & Growth Companies

This segment includes medium-sized and rapidly growing companies that are actively professionalizing their leadership teams and scaling operations. These clients often seek their first independent board members or look to build out their C-suite for the next growth phase, valuing Heidrick & Struggles' ability to bring talent and processes from larger, established organizations. In 2024, the mid-market executive search sector continues to see robust demand, driven by private equity investments and the need for agile leadership in evolving markets.

- Mid-market companies represent a significant portion of new executive searches annually.

- Growth companies prioritize strategic hires to navigate expansion and market shifts.

- Demand for C-suite roles in this segment remains high, particularly for COO and CFO positions.

Non-Profit & Public Sector Organizations

Heidrick & Struggles extends its services to leading educational institutions, foundations, and healthcare systems, addressing the unique leadership needs within the non-profit and public sectors. This segment demands leaders capable of navigating intricate stakeholder environments while passionately driving mission-oriented goals. The firm provides tailored executive search and leadership advisory, recognizing the distinct governance structures and challenges these organizations face. In 2024, the non-profit sector continued its focus on resilient leadership amidst evolving philanthropic landscapes and public funding dynamics.

- Educational institutions seek leaders for strategic growth.

- Healthcare systems require adaptable executives for complex care delivery.

- Foundations need visionary leaders for impactful grantmaking.

- Public sector entities prioritize leaders for navigating policy and public service.

Heidrick & Struggles caters to diverse clients, from large multinational corporations and private equity firms to Boards of Directors. They also serve mid-market growth companies and the non-profit sector, offering specialized executive search and leadership advisory services tailored to unique organizational needs. This broad client base ensures comprehensive market coverage.

| Customer Segment | Key Need | 2024 Insight |

|---|---|---|

| Multinational Corps | Global C-suite talent | Premium executive search market over $15B |

| Private Equity | Portfolio company leadership | Global dry powder over $2.5T |

| Boards of Directors | Governance, succession, ESG | Rising demand for robust board oversight |

Cost Structure

Employee compensation and benefits represent Heidrick & Struggles International's most substantial cost, reflecting its human-capital-intensive business model. This includes salaries, significant performance-based bonuses, and comprehensive benefits for its highly skilled global workforce of consultants, researchers, and support staff. For instance, in the first quarter of 2024, compensation and benefits constituted approximately 67% of Heidrick & Struggles' net revenue, highlighting its dominance. Effectively managing this expenditure is paramount for maintaining the firm's profitability and competitive edge in the executive search and consulting industry.

General & Administrative Expenses for Heidrick & Struggles International encompass the essential day-to-day operational costs vital for running a global executive search and consulting firm. These expenses include significant marketing and business development outlays, alongside professional services fees for legal and audit support. Other corporate overhead also falls into this category, crucial for maintaining global operations. For the first quarter of 2024, these expenses totaled $48.2 million, highlighting their substantial role in supporting revenue-generating activities and ensuring regulatory compliance across the organization.

Heidrick & Struggles significantly invests in its technology infrastructure, including proprietary databases, advanced CRM systems, and AI-powered analytics tools to enhance executive search and consulting capabilities. Cybersecurity measures are also a critical component, safeguarding sensitive client and candidate data. These technology costs are crucial for maintaining a competitive edge and boosting operational efficiency. In 2024, the firm continued to prioritize digital transformation, with technology remaining a growing area of strategic investment to support its global operations.

Real Estate & Office Leases

Real estate and office leases represent a significant fixed cost for Heidrick & Struggles, essential for its global operations. These expenses support physical offices in key business centers, facilitating crucial client and candidate interactions and fostering a collaborative work environment. The firm continually assesses its global real estate footprint to optimize efficiency and manage these substantial expenditures effectively.

- Heidrick & Struggles reported total operating lease liabilities of approximately $78.0 million as of December 31, 2023.

- Their global presence includes over 50 offices worldwide, requiring strategic lease management.

- Office space is vital for client engagement and attracting top executive talent in competitive markets.

- The firm's 2024 strategy includes ongoing evaluation of hybrid work models to optimize office utilization.

Professional Development & Training

Heidrick & Struggles invests significantly in the continuous professional development of its consultants, a core cost within its business model. These expenditures cover comprehensive internal training programs, specialized external certifications, and participation in premier industry conferences. Such investments are crucial for ensuring the firm's human capital remains at the forefront of leadership advisory and industry trends, maintaining their competitive edge in 2024. For instance, corporate training budgets across professional services are projected to see continued growth, with a focus on AI and digital transformation skills.

- Internal training programs develop specialized expertise.

- External certifications validate advanced skill sets.

- Industry conference attendance ensures up-to-date market insights.

- These outlays are essential for talent retention and service excellence.

Heidrick & Struggles' cost structure is primarily driven by human capital, with compensation and benefits representing its largest expenditure, reaching 67% of net revenue in Q1 2024. General and administrative expenses, including marketing and professional services, also form a significant part, totaling $48.2 million in Q1 2024. The firm consistently invests in technology, real estate, and professional development to maintain its competitive edge and global operational efficiency.

| Cost Category | Q1 2024 Data | Description |

|---|---|---|

| Compensation & Benefits | 67% of Net Revenue | Largest cost, for global consultant workforce. |

| G&A Expenses | $48.2 Million | Operational costs including marketing and legal fees. |

| Technology Investment | Growing priority in 2024 | Enhances search capabilities and data security. |

Revenue Streams

The primary revenue stream for Heidrick & Struggles stems from executive search assignments, typically structured as a retained service. Clients pay a fee, often calculated as a percentage of the placed executive's first-year guaranteed compensation. These fees are paid in installments throughout the search process, ensuring revenue predictability and strong client commitment. For instance, in the first quarter of 2024, Executive Search services accounted for $144.3 million of the company's net revenue. This model underpins their financial stability by securing upfront payments for specialized recruitment expertise.

Heidrick & Struggles generates a significant and growing revenue stream through its Heidrick Consulting division. These services encompass leadership assessment, executive coaching, team effectiveness, and culture shaping, addressing critical client needs. Revenue from these engagements, such as the reported $69.0 million for Heidrick Consulting in Q1 2024, is typically secured via fixed-fee or time-and-materials project arrangements. This segment continues to expand, contributing meaningfully to the firm's overall financial performance and strategic diversification.

Heidrick & Struggles generates revenue through its On-Demand Talent Services, providing clients with interim executives and independent talent for project-based work, addressing the rising need for agile workforce solutions. This segment diversifies the firm's portfolio beyond traditional permanent placements, crucial as organizations increasingly adopt flexible staffing models in 2024. Revenue from these services is typically secured via placement fees or daily rates for consultants. The market for on-demand executive talent continues to expand, reflecting a strategic shift in how companies acquire specialized skills and leadership for short-term or project-specific engagements.

Board Advisory Services Fees

Heidrick & Struggles generates revenue through specialized Board Advisory Services, directly assisting company boards. This includes fees for critical director searches, comprehensive board effectiveness evaluations, and strategic CEO succession planning projects. These engagements are high-margin, leveraging the firm's most senior expertise and extensive relationships. For Q1 2024, the Heidrick Consulting segment, which encompasses much of this advisory work, contributed $15.8 million to the firm's total revenue.

- Revenue from specialized advisory services delivered directly to boards of directors.

- Fees derived from director searches and board effectiveness evaluations.

- Income generated from CEO succession planning projects.

- These are high-margin engagements leveraging senior-level expertise.

Data & Insight Subscriptions

Heidrick & Struggles has a nascent opportunity to monetize its extensive proprietary data and market intelligence through data and insight subscriptions. While this is currently a smaller revenue stream, it represents a significant future growth area, leveraging the firm's unique data assets. The firm could offer anonymized compensation data reports, detailed talent market analysis, or even access to specialized data platforms. This strategic diversification aims to enhance revenue beyond traditional consulting services.

- Heidrick & Struggles primarily generates revenue from Executive Search and Heidrick Consulting, with net revenue reaching $741.4 million in 2023.

- The Data & Insight Subscriptions stream is conceptualized as a future expansion, not yet a major contributor to the current 2024 financial results.

- This initiative leverages the firm's deep market understanding to create new, scalable data products.

- Potential offerings include specialized reports on executive compensation trends or talent availability across various sectors.

Heidrick & Struggles primarily generates revenue from Executive Search, which yielded $144.3 million in Q1 2024. Their Heidrick Consulting division, encompassing Board Advisory, contributed $69.0 million in Q1 2024. Additionally, On-Demand Talent Services provide agile workforce solutions, diversifying their income streams.

| Revenue Stream | Q1 2024 Net Revenue | Description |

|---|---|---|

| Executive Search | $144.3 million | Retained fees for executive placements. |

| Heidrick Consulting | $69.0 million | Leadership, coaching, and advisory services. |

| On-Demand Talent | N/A | Interim executive and project-based talent. |

Business Model Canvas Data Sources

Heidrick & Struggles' International Business Model Canvas is informed by a robust blend of proprietary client data, global market intelligence reports, and internal strategic assessments. This multi-faceted approach ensures a comprehensive and actionable representation of our business operations and strategic direction.