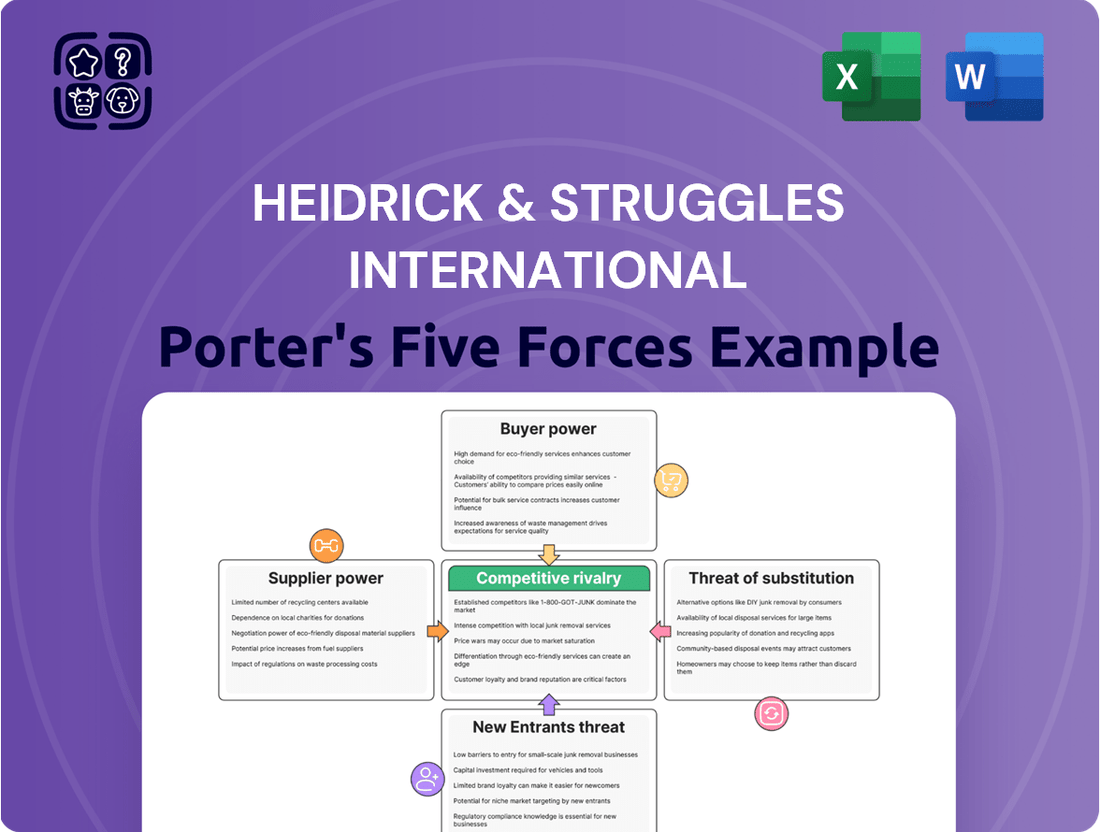

Heidrick & Struggles International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidrick & Struggles International Bundle

Heidrick & Struggles International operates in a competitive landscape shaped by powerful market forces, including the intensity of rivalry and the bargaining power of clients. Understanding these dynamics is crucial for navigating the executive search industry.

The threat of new entrants, while potentially moderate, is constantly influenced by the industry's need for established networks and reputation. Similarly, the threat of substitutes, such as in-house recruiting or AI-driven talent platforms, presents an evolving challenge.

Suppliers, primarily experienced consultants and researchers, hold significant influence due to the specialized knowledge they possess. This intricate interplay of forces significantly impacts Heidrick & Struggles International's strategic positioning and profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Heidrick & Struggles International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Heidrick & Struggles' core suppliers are its highly skilled executive search consultants, leadership assessors, and consulting professionals. The limited availability of individuals possessing extensive networks and deep industry-specific expertise grants these professionals substantial leverage.

The firm's success hinges on its ability to attract and retain this specialized talent, which often necessitates robust compensation packages, attractive benefits, and continuous professional growth opportunities to remain competitive in the talent market.

Providers of proprietary data and advanced technology, such as AI-driven talent intelligence platforms and sophisticated assessment tools, wield significant bargaining power over executive search firms like Heidrick & Struggles. As the industry increasingly leans on data analytics for candidate sourcing and evaluation, the uniqueness and integration costs of these specialized technologies can solidify supplier leverage. For instance, a platform offering unparalleled access to global executive data or a proprietary AI algorithm for candidate matching can command premium pricing and favorable terms.

For highly specialized or emerging leadership roles, such as AI ethics officers or chief sustainability officers, the available pool of qualified candidates and consulting expertise is exceptionally small. This scarcity significantly amplifies the bargaining power of the few professionals or boutique firms that possess these in-demand skills. Heidrick & Struggles, like its competitors, faces intense competition to secure this scarce talent, which is crucial for addressing the evolving needs of its clients in 2024.

Reputation and Brand of Key Professionals

The personal reputations and brand equity of senior consultants at Heidrick & Struggles are a critical component of their bargaining power. When a consultant possesses a strong individual following or an established history of successful placements, their ability to attract both clients and high-caliber candidates increases significantly.

This individual influence translates directly into leverage within the firm; a highly sought-after consultant can negotiate more favorable terms due to their direct impact on client acquisition and retention. For instance, the departure of a top-tier executive search professional with a robust network could lead to a substantial loss of revenue and damage existing client relationships.

In 2023, the executive search industry saw continued emphasis on specialized expertise. Firms like Heidrick & Struggles rely on their consultants' deep industry knowledge and personal connections to secure top talent for clients. The ability of these professionals to command higher fees or equity stakes is directly tied to their proven success and the unique value they bring, which is often built over many years.

- Reputation as leverage: A consultant's strong personal brand enhances their ability to attract clients and candidates, increasing their bargaining power.

- Revenue impact: The loss of a key professional with a significant following can directly affect the firm's revenue streams and client relationships.

- Industry trend: The executive search market in 2023 highlighted the value of specialized expertise and established networks, reinforcing the importance of individual consultant reputations.

High Switching Costs for Consultants

For experienced consultants, switching firms involves significant effort in transferring client relationships, rebuilding internal networks, and adapting to new operational procedures, which can increase their bargaining power. If a consultant does leave, Heidrick & Struggles incurs costs in replacing and onboarding new talent, a factor that can be substantial in a specialized field. In 2023, Heidrick & Struggles reported that their selling, general, and administrative expenses were $471.6 million, reflecting the operational costs associated with talent management and firm infrastructure.

Heidrick & Struggles' investment in consultant training and development further entrenches these professionals within the firm, fostering loyalty while simultaneously equipping them with specialized skills. This investment, however, also means that if a highly trained consultant departs, the firm has a vested interest in retaining them, as the cost of replicating that expertise is high. The firm’s focus on developing specialized talent, particularly in areas like digital transformation and ESG consulting, means these individuals possess unique skill sets that are difficult to replace quickly.

- High Switching Costs: Rebuilding client portfolios and internal networks creates a barrier for consultants seeking to move to competitor firms.

- Investment in Talent: Significant resources are allocated to training and development, increasing the firm's investment in each consultant.

- Specialized Expertise: Consultants with niche skills in high-demand areas possess greater leverage due to the scarcity of comparable talent.

- Onboarding Expenses: The cost of recruiting and integrating new consultants can be considerable, impacting the firm's profitability.

Heidrick & Struggles' suppliers are primarily its highly skilled executive search consultants and providers of specialized technology. The limited availability of individuals with extensive networks and deep industry expertise grants these professionals significant leverage, necessitating competitive compensation and development opportunities. For instance, in 2023, the firm's selling, general, and administrative expenses were $471.6 million, reflecting substantial investment in talent and operational infrastructure.

Technology providers, particularly those offering AI-driven talent intelligence and assessment tools, also wield considerable power. As data analytics becomes crucial for candidate sourcing and evaluation, the unique nature and integration costs of these platforms allow them to command premium pricing. The scarcity of specialized talent, especially in emerging fields like AI ethics or sustainability, further amplifies the bargaining power of consultants possessing these in-demand skills, a trend particularly pronounced in 2024.

| Supplier Type | Key Characteristics | Impact on Heidrick & Struggles | 2023 Relevance |

|---|---|---|---|

| Executive Search Consultants | Extensive networks, deep industry expertise, personal reputation | High leverage due to scarcity and revenue impact | Continued emphasis on specialized expertise and networks |

| Technology Providers (AI, Data Analytics) | Proprietary platforms, unique algorithms, integration costs | Ability to command premium pricing, critical for candidate sourcing | Increasing reliance on data analytics |

| Specialized Talent Pools | Niche skills in emerging fields (e.g., AI Ethics, ESG) | Significant leverage for individuals/boutiques possessing these skills | Crucial for addressing evolving client needs |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Heidrick & Struggles International's executive search and consulting services.

Understand the competitive landscape instantly with a visual breakdown of each force, pinpointing areas of strategic vulnerability.

Gain clarity on the most impactful competitive pressures, allowing for focused strategic responses rather than broad, unfocused efforts.

Customers Bargaining Power

Heidrick & Struggles' large corporate and private equity clients, often Fortune 500 entities, wield considerable bargaining power. These sophisticated buyers frequently engage multiple executive search firms, possess robust internal talent acquisition teams, and are adept at negotiating fees and service level agreements. Their substantial engagement sizes mean they can dictate terms, demanding measurable results and highly customized search methodologies.

The executive search market is populated by a number of prominent global firms, such as Korn Ferry, Spencer Stuart, and Russell Reynolds Associates, alongside a wide array of specialized boutique firms. This abundance of choice means clients can readily compare offerings and costs. For instance, in 2024, the total market for executive search services was estimated to be around $20 billion globally, with these top-tier firms holding a significant share but facing constant pressure from smaller, agile competitors.

With many firms vying for business, clients have substantial leverage to negotiate fees and demand tailored services. This competitive environment directly impacts pricing power, often leading to more favorable terms for the customer. The ability to easily switch providers or play firms against each other ensures that clients can secure competitive rates, typically ranging from 25% to 35% of the placed executive's first-year salary, depending on the firm and the seniority of the role.

Many large organizations boast robust in-house talent acquisition departments. These internal teams can manage a substantial portion of executive recruitment, acting as a direct substitute for external search firms.

This internal capacity significantly shifts the power dynamic, enabling clients to negotiate more favorable terms with external providers like Heidrick & Struggles. For instance, a company with a strong internal recruiting function might only engage an external firm for highly specialized or niche executive roles, thereby reducing their overall spend and increasing their leverage.

The presence of these sophisticated internal teams means that external firms must demonstrate clear value beyond basic candidate sourcing to win business. This often translates to a greater emphasis on market intelligence, diversity sourcing strategies, and advisory services.

In 2024, companies are increasingly investing in their internal HR technology and talent analytics, further strengthening their in-house capabilities. This trend puts pressure on executive search firms to continuously innovate and offer specialized expertise that cannot be easily replicated internally.

Price Sensitivity and Fee Structures

Clients are showing heightened price sensitivity, particularly regarding retained search fees, which often represent a substantial portion of a candidate's initial annual salary. For instance, in 2024, many executive search firms faced pressure to keep fees within a 20-30% range of first-year compensation, a direct reflection of this client demand.

The increasing transparency in fee structures, coupled with the availability of alternative billing models such as fixed fees or project-based arrangements, significantly influences client purchasing decisions. This shift compels firms like Heidrick & Struggles to articulate their value proposition beyond mere candidate placement, emphasizing strategic insights and market expertise.

- Client Price Sensitivity: Growing demand for cost-effective recruitment solutions.

- Fee Structure Options: Preference for fixed or project-based billing over traditional percentage models.

- Value Justification: Firms must demonstrate ROI beyond filling vacancies.

- Market Benchmarks: Average retained search fees in 2024 remained a key negotiation point.

Demand for Measurable Results and ROI

Clients are increasingly demanding concrete evidence of success from executive search and consulting firms. They are no longer satisfied with just a list of candidates; they want to see a clear return on investment (ROI) and measurable impact on their business. This focus on quantifiable outcomes significantly strengthens the bargaining power of customers.

For instance, many companies now tie a portion of consulting fees to achieving specific performance metrics, a trend that gained significant traction around 2024. This means firms like Heidrick & Struggles must demonstrate how their placements and advice translate into tangible improvements in leadership effectiveness, employee engagement, and ultimately, financial results. Firms that can effectively showcase this data-driven value proposition are better positioned, while those that cannot face greater pressure on pricing and terms.

- Demand for Data-Driven Insights: Clients expect firms to provide analytics on candidate performance and organizational impact.

- Focus on Measurable Outcomes: Success is increasingly defined by improvements in key performance indicators (KPIs) directly linked to the firm's engagement.

- Accountability for Performance: Clients can leverage the demand for results to negotiate fees and contract terms based on delivered value.

- Shift in Power Dynamics: The ability to prove ROI moves negotiation leverage towards the client.

The bargaining power of customers in the executive search market is significant, driven by the availability of numerous providers and the clients' own sophisticated procurement processes. Clients, particularly large corporations, can easily compare fees and services across multiple firms, leading to intense price competition. For instance, in 2024, the global executive search market, valued at approximately $20 billion, saw clients frequently leveraging this competitive landscape to negotiate fee structures, often pushing for rates between 20% and 30% of the placed executive's first-year salary.

Many clients also possess strong internal talent acquisition teams, reducing their reliance on external search firms and enhancing their negotiation leverage. This internal capacity allows them to handle a larger volume of recruitment, reserving external services for highly specialized or critical roles. Consequently, firms like Heidrick & Struggles must demonstrate superior value, such as in-depth market intelligence and diversity sourcing, to secure and retain business, further empowering clients in fee negotiations.

| Factor | Impact on Bargaining Power | 2024 Context |

|---|---|---|

| Provider Competition | High. Clients can choose from many firms. | Global market of ~$20 billion with numerous global and boutique firms. |

| Client's Internal Capabilities | Increases. Robust in-house teams reduce external reliance. | Companies investing in HR tech and talent analytics. |

| Fee Negotiation Leverage | Strong. Clients demand competitive pricing. | Typical fees range from 20-30% of first-year salary for retained searches. |

| Demand for Value-Added Services | Shifts focus to ROI and expertise. | Clients seek measurable impact, tying fees to performance metrics. |

Full Version Awaits

Heidrick & Struggles International Porter's Five Forces Analysis

This preview offers a comprehensive look at the Heidrick & Struggles International Porter's Five Forces analysis, showcasing the exact document you will receive immediately after purchase. The detailed breakdown of competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products is presented in its entirety, ensuring no surprises or missing sections. You are viewing the complete, professionally formatted analysis, ready for immediate download and application to your strategic planning needs. This is precisely the document that will be available to you upon payment, offering valuable insights into the executive search industry landscape. Rest assured, what you see is exactly what you get – a fully rendered strategic assessment.

Rivalry Among Competitors

The executive search landscape is dominated by a few giants, with Heidrick & Struggles International operating alongside formidable competitors like Korn Ferry, Spencer Stuart, and Russell Reynolds Associates. These established global players vie fiercely for premium executive placement contracts, relying on their widespread networks, strong brand equity, and deep industry expertise. This intense competition necessitates continuous innovation and differentiation to secure market share and attract top-tier clients.

The executive search landscape isn't just dominated by behemoths; a significant portion of the market is carved out by numerous boutique and specialized firms. These smaller entities thrive by concentrating on particular industries, specific functional areas like technology or finance, or even distinct geographic markets.

This niche specialization allows these firms to cultivate deep expertise and provide highly personalized client experiences. For instance, a boutique firm focusing solely on placing C-suite executives in biotech startups might offer a level of industry insight and network access that larger, more generalized firms struggle to match. This focused approach presents a competitive challenge to larger players by catering to clients who prioritize specialized knowledge.

In 2024, the continued growth of specialized recruitment sectors highlights this trend. For example, the demand for artificial intelligence and machine learning talent saw specialized search firms reporting a 25% increase in placement volume for AI-related roles compared to 2023. This demonstrates how focused expertise can translate into tangible market share and client acquisition.

Competitive rivalry within the executive search industry, including firms like Heidrick & Struggles, is significantly shaped by reputation and an established track record. Success in placing high-impact leaders is paramount, as it directly influences a firm's ability to secure new mandates. For instance, in 2023, executive search firms reported strong demand, with major players seeing revenue growth, underscoring the importance of a proven history of delivering results to win business.

Firms continuously invest in nurturing and strengthening client relationships, a vital component of their competitive edge. Demonstrating a history of successful placements, particularly for critical leadership roles, acts as a powerful differentiator. This focus on tangible outcomes, rather than just process, allows established firms to command premium fees and attract top-tier clients who prioritize reliability and proven success in their executive appointments.

Investment in Technology and Data Analytics

The recruitment industry is seeing intense competition driven by technological advancements, particularly in AI and data analytics. Firms are heavily investing in these areas to improve how they find, screen, and understand talent pools. This tech-driven approach is creating a significant differentiator, with companies that master these tools gaining a clear advantage.

For instance, in 2024, many recruitment firms are upgrading their platforms to leverage AI for resume screening and candidate matching, aiming to reduce time-to-hire by up to 30%. This investment in technology directly impacts competitive rivalry, as it allows for more efficient and precise talent acquisition, setting leaders apart.

- AI-powered sourcing tools are becoming standard, increasing the speed of candidate identification.

- Data analytics provides deeper market insights, enabling more strategic talent acquisition.

- Companies failing to invest in technology risk falling behind in efficiency and candidate experience.

- The cost of developing and implementing advanced recruitment technology is a significant barrier to entry for smaller firms.

Evolving Service Offerings

Competitive rivalry is heating up as firms like Heidrick & Struggles broaden their services beyond traditional executive search. They're now heavily involved in leadership assessment, talent management, and even organizational design. This expansion, seen across the industry, is a direct response to a desire for deeper client engagement and a larger slice of the human capital investment pie.

This diversification strategy intensifies competition not just in search, but across a wider spectrum of advisory services. For instance, in 2024, the global leadership consulting market saw significant growth, with specialized areas like talent analytics and succession planning becoming key battlegrounds. Firms are investing heavily in technology and expertise to offer integrated solutions.

- Expanded Service Portfolio: Companies are moving beyond core executive search to include leadership development, interim management, and diversity & inclusion consulting.

- Client Relationship Deepening: The goal is to become a more indispensable partner, capturing more of a client's total talent budget, which can represent a significant portion of operational spending.

- Increased Inter-Industry Competition: Traditional executive search firms now compete more directly with management consulting firms and specialized HR advisory businesses.

- Focus on Data and Analytics: Advanced talent analytics are becoming a crucial differentiator, offering clients deeper insights into their workforce capabilities.

Competitive rivalry within executive search is fierce, marked by a consolidation among large global players like Korn Ferry and Spencer Stuart, alongside a proliferation of specialized boutique firms. This dynamic intensifies the fight for high-value mandates, driving innovation in talent acquisition and client service. For Heidrick & Struggles, differentiation through deep industry expertise and robust global networks remains critical for market share.

In 2024, the competitive landscape is further shaped by technological advancements, particularly AI and data analytics, which are streamlining candidate sourcing and assessment. Firms investing in these tools, such as AI-powered screening platforms aiming for up to 30% faster time-to-hire, gain a significant edge. This technological arms race creates barriers for smaller firms and necessitates continuous investment from established players to maintain efficiency and candidate experience.

The industry's competitive intensity is also escalating as firms like Heidrick & Struggles expand service offerings beyond traditional executive search to include leadership assessment, talent management, and organizational design. This strategic diversification intensifies competition across broader human capital advisory services, with firms like Korn Ferry also broadening their scope. The 2024 growth in the leadership consulting market, particularly in talent analytics, highlights these expanding battlegrounds.

| Competitor | 2023 Revenue (USD Billions) | Key Service Expansion Areas | 2024 Focus |

|---|---|---|---|

| Korn Ferry | 2.8 | Talent Intelligence, Future of Work Solutions | Digital Transformation in Talent Acquisition |

| Spencer Stuart | Not Publicly Disclosed | Leadership Development, Board Advisory | Deepening Sector Specialization |

| Russell Reynolds Associates | Not Publicly Disclosed | Digital Transformation, ESG Leadership | AI Integration in Search Process |

| Heidrick & Struggles | 1.7 | Leadership Advisory, DEI Consulting | Data-Driven Talent Solutions |

SSubstitutes Threaten

Companies are increasingly building out their internal talent acquisition and HR departments. This trend allows them to manage executive and leadership hiring directly. As these internal teams mature and adopt sophisticated recruitment technologies, their capability to handle recruitment processes grows. This can diminish the reliance on external executive search firms, especially for roles that aren't exceptionally niche or complex.

For instance, in 2024, many large corporations expanded their HR tech budgets, with some allocating over 15% more than in the previous year to internal recruitment platforms and AI-driven sourcing tools. This investment enhances their ability to identify, screen, and engage candidates efficiently, presenting a viable substitute for traditional search firm services.

The threat of substitutes for traditional executive search is growing, particularly with the rise of interim management and fractional leadership. Organizations are increasingly turning to these flexible solutions to fill critical roles on a temporary or part-time basis. This offers immediate expertise without the long-term commitment of permanent hires, making it an attractive alternative during transitions or for specific project needs.

For instance, a significant portion of companies utilized interim executives in 2024 to address immediate skill gaps or manage critical projects. This trend is driven by the need for agility and cost-effectiveness, allowing businesses to access specialized talent precisely when and where it's needed. The market for interim professionals has seen robust growth, reflecting this shift in demand.

Professional networking platforms like LinkedIn have significantly altered the talent acquisition landscape. In 2024, LinkedIn boasted over 1 billion members globally, providing companies with direct access to a vast pool of potential candidates. This democratization of access means businesses can identify and engage with professionals without necessarily relying on traditional executive search firms for initial sourcing, especially for mid-level positions.

While these digital platforms offer a broad reach for candidate identification, they present a threat of substitution to executive search services. For instance, a company seeking to fill a senior engineering role might first leverage LinkedIn's extensive database and direct messaging capabilities to find suitable candidates, bypassing the need for an external search firm's initial outreach efforts. This can reduce the perceived value of traditional search for certain hiring needs.

General Management Consulting Firms

Major management consulting firms like McKinsey & Company, Bain & Company, and the Boston Consulting Group (BCG) present a significant threat of substitutes for Heidrick & Struggles' human capital and leadership advisory services. These firms, while primarily focused on broader strategic business challenges, increasingly offer specialized human capital and organizational design consulting. For instance, in 2024, many of these large consulting players have expanded their talent and organization practices, directly competing with executive search and leadership advisory firms on areas like talent strategy, workforce planning, and organizational effectiveness. Their deep client relationships and broad strategic insights allow them to integrate talent considerations into their overall business recommendations, positioning them as a comprehensive alternative for clients seeking strategic HR guidance.

The threat is amplified by their ability to offer integrated solutions that encompass both strategic business planning and the human capital required to execute it. This integrated approach can be particularly appealing to C-suite executives. For example, a firm advising on a major digital transformation might also offer services to ensure the right leadership and talent are in place to manage that change, directly encroaching on traditional leadership consulting domains. This overlap means clients may opt for a single, large consulting partner rather than engaging separate firms for strategy and human capital needs.

- Broad Strategic Capabilities: Large consulting firms offer holistic business strategy advice, often incorporating human capital as a key component.

- Talent and Organization Practices: Many have dedicated and growing practices focused on talent strategy, leadership development, and organizational design.

- Integrated Solution Delivery: They can provide end-to-end solutions, from business strategy to talent execution, appealing to clients seeking a single point of contact.

- Client Relationships: Existing deep relationships with C-suite executives across various industries facilitate the offering of these overlapping services.

Direct Sourcing and Talent Marketplaces

The increasing prevalence of direct sourcing models and specialized talent marketplaces presents a significant threat of substitutes for traditional executive search firms like Heidrick & Struggles. These platforms enable organizations to bypass intermediaries and directly connect with pre-qualified talent for contingent or project-based engagements.

For instance, platforms like Upwork and Fiverr, while not solely focused on executive roles, are expanding their offerings to include higher-level expertise, making them viable alternatives for certain leadership needs. In 2024, the gig economy continued its robust growth, with estimates suggesting that over 60 million Americans participated in some form of freelance work, highlighting the expanding talent pool accessible outside traditional recruitment channels.

This trend is particularly impactful for roles that do not require extensive, long-term commitment or highly specialized, hard-to-find niche skills. Companies can potentially achieve faster turnaround times and reduced costs by directly accessing a readily available pool of vetted professionals, thereby diminishing the perceived value of retained search services for these specific needs.

The threat is amplified as these platforms mature and incorporate more sophisticated vetting processes and AI-driven matching capabilities. This allows them to effectively compete on speed, cost, and increasingly, on the quality of talent presented, directly challenging the core value proposition of executive search for a growing segment of the market.

The rise of sophisticated internal HR departments and advanced recruitment technology presents a significant substitute. By investing in AI sourcing and robust platforms, companies can increasingly manage executive and leadership hiring internally, reducing reliance on external firms. This trend was evident in 2024 with many large corporations boosting their HR tech budgets by over 15% to enhance their in-house capabilities.

Direct sourcing through professional networking sites like LinkedIn, which had over 1 billion members globally in 2024, offers another powerful substitute. Companies can directly identify and engage with a vast talent pool, bypassing traditional search firm outreach for many roles. This democratization of access diminishes the perceived necessity of external recruiters for initial candidate sourcing.

Specialized talent marketplaces and the growing gig economy also offer viable alternatives, especially for contingent or project-based leadership needs. Platforms facilitating access to freelance executives provide faster, often more cost-effective solutions. The gig economy's continued expansion in 2024, with millions participating, underscores the availability of talent outside conventional channels.

Major management consulting firms are increasingly competing by offering integrated human capital and leadership advisory services alongside their core strategic consulting. In 2024, these firms expanded their talent practices, directly challenging executive search firms by providing holistic solutions that combine business strategy with talent execution, leveraging their deep client relationships.

Entrants Threaten

The executive search industry, especially for top-tier positions, presents substantial hurdles for newcomers. Building the necessary extensive personal networks, a demonstrable history of successful placements, and profound industry knowledge takes considerable time and effort. These are not easily acquired by new firms.

A new entrant would find it incredibly difficult to quickly replicate the intangible assets that established firms like Heidrick & Struggles possess, such as a strong reputation for discretion and the ability to deliver high-quality results. This makes it challenging for them to compete effectively for lucrative senior-level mandates.

For instance, building trust and a robust client base in this niche market can take years, requiring consistent delivery of value and maintaining confidentiality, which are critical for attracting both clients and candidates. The initial investment in talent and brand building is also substantial.

The threat of new entrants is tempered by the significant capital investment required in technology and global infrastructure. While not on the scale of heavy manufacturing, building a competitive executive search firm demands substantial outlays for advanced technology platforms, sophisticated research tools, and establishing a worldwide office network. This high upfront cost creates a considerable barrier for potential new players looking to challenge established entities like Heidrick & Struggles.

In the executive search landscape, where relationships are key, a firm's brand reputation and the trust it has cultivated are incredibly important. Clients, often entrusting firms with critical leadership placements, depend on a proven track record of successfully identifying and securing top-tier talent, alongside discreet advisory services.

New companies entering this space face a significant hurdle in establishing this essential trust and credibility. They would need substantial time and considerable financial investment to build a reputation that rivals established players.

For instance, while specific 2024 data on new entrant trust-building investment is still emerging, the executive search industry generally sees firms like Heidrick & Struggles investing millions annually in marketing, client development, and talent acquisition to maintain their brand image.

Talent Acquisition and Retention Challenges for New Firms

New executive search firms entering the market face a significant hurdle in attracting and retaining seasoned consultants. These experienced professionals often possess deep-rooted client relationships and extensive networks, which are crucial for success in this industry. For instance, in 2024, the demand for specialized executive recruiters remained high, with firms reporting increased competition for individuals with proven track records in niche sectors.

The competition for top talent is particularly intense, making it a substantial challenge for newcomers to assemble a highly capable and experienced team. This talent war means that established firms can leverage their brand reputation and existing compensation structures to retain their best people, thereby increasing the barrier to entry for new entrants. Reports from industry surveys in late 2023 indicated that over 60% of executive search firms cited talent acquisition as a primary strategic concern, highlighting the difficulty of luring away established talent.

- Talent Scarcity: Difficulty in finding consultants with established client portfolios.

- Retention Wars: Existing firms actively work to retain their top performers.

- High Acquisition Costs: Luring experienced talent often requires significant upfront investment and competitive compensation packages.

- Network Dependency: New firms struggle to build the essential client and candidate networks quickly.

Regulatory and Ethical Compliance

The executive search and human capital advisory industry is subject to a complex web of ethical guidelines and regulations. For instance, data privacy laws like GDPR in Europe and similar legislation elsewhere require strict adherence to how candidate information is handled, presenting a significant hurdle for newcomers. Navigating these compliance requirements, particularly concerning fair hiring practices and data protection, demands robust legal and compliance infrastructure that many new entrants may lack initially. This regulatory burden can act as a substantial barrier, deterring potential competitors who haven't invested in the necessary expertise and systems to operate legally and ethically.

New entrants must also contend with the cost and complexity of establishing compliance frameworks. Consider the financial implications: establishing a dedicated compliance department or outsourcing these functions can be a substantial upfront investment. For example, a company might need to spend hundreds of thousands of dollars annually on legal counsel and compliance software to ensure adherence to all relevant laws. This financial barrier, coupled with the need for specialized knowledge, makes it challenging for less capitalized firms to enter the market and compete effectively.

The industry's commitment to ethical conduct, often self-regulated through professional bodies, also imposes standards that new firms must meet. These standards cover areas like confidentiality, conflict of interest, and professional integrity. Building a reputation for ethical practice takes time and consistent effort, which can be difficult for new entrants to achieve quickly. Heidrick & Struggles, for example, emphasizes its adherence to ethical codes, setting a benchmark that new players must aspire to, thereby raising the barrier to entry.

- Regulatory Hurdles: Compliance with data privacy laws (e.g., GDPR, CCPA) and fair hiring regulations necessitates significant investment in legal and compliance infrastructure.

- Ethical Standards: Adherence to industry-wide ethical codes regarding confidentiality, conflicts of interest, and professional conduct is crucial for market acceptance.

- Investment Requirements: New entrants face substantial upfront costs for legal expertise, compliance software, and establishing internal control systems.

- Reputational Capital: Building trust and a reputation for ethical practice is a time-consuming process that can deter rapid market entry by new firms.

The threat of new entrants in the executive search sector is notably low due to the significant barriers to entry. Establishing the deep client relationships and extensive candidate networks essential for success requires years of dedicated effort and proven performance. This makes it exceptionally challenging for new firms to quickly gain traction and compete with established players like Heidrick & Struggles.

The industry's reliance on intangible assets, such as a strong reputation for discretion and consistent high-quality placements, further solidifies this barrier. New entrants struggle to replicate this trust capital, which is critical for securing lucrative senior-level mandates. For instance, in 2024, the demand for specialized executive recruiters with proven track records remained robust, intensifying competition for experienced talent.

Furthermore, substantial capital investment is necessary for technology, global infrastructure, and talent acquisition. Heidrick & Struggles, for example, invests millions annually in brand building and client development. This high upfront cost, coupled with the intense competition for seasoned consultants who possess established client portfolios, presents a formidable challenge for any new firm seeking to enter the market.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024 Estimates/Trends) |

|---|---|---|---|

| Network & Relationships | Building deep client and candidate networks takes considerable time. | Slow market penetration, difficulty securing mandates. | Time to build a substantial client base can exceed 3-5 years. |

| Reputation & Trust | Clients prioritize discretion and a proven track record. | Difficulty attracting high-value clients and candidates. | Brand building investment for top firms can be millions annually. |

| Talent Acquisition | Competition for experienced consultants with existing relationships is fierce. | High cost of hiring, challenges in team building. | Over 60% of firms cite talent acquisition as a primary strategic concern (late 2023 trend). |

| Capital Investment | Significant outlay for technology, global presence, and marketing. | High upfront costs deter less-capitalized entrants. | Estimated initial investment for a competitive global firm can run into millions of dollars. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data sources, including Heidrick & Struggles' proprietary market intelligence, public company filings, and reputable industry research reports. We also incorporate insights from macroeconomic data and expert interviews to provide a robust assessment of the competitive landscape.