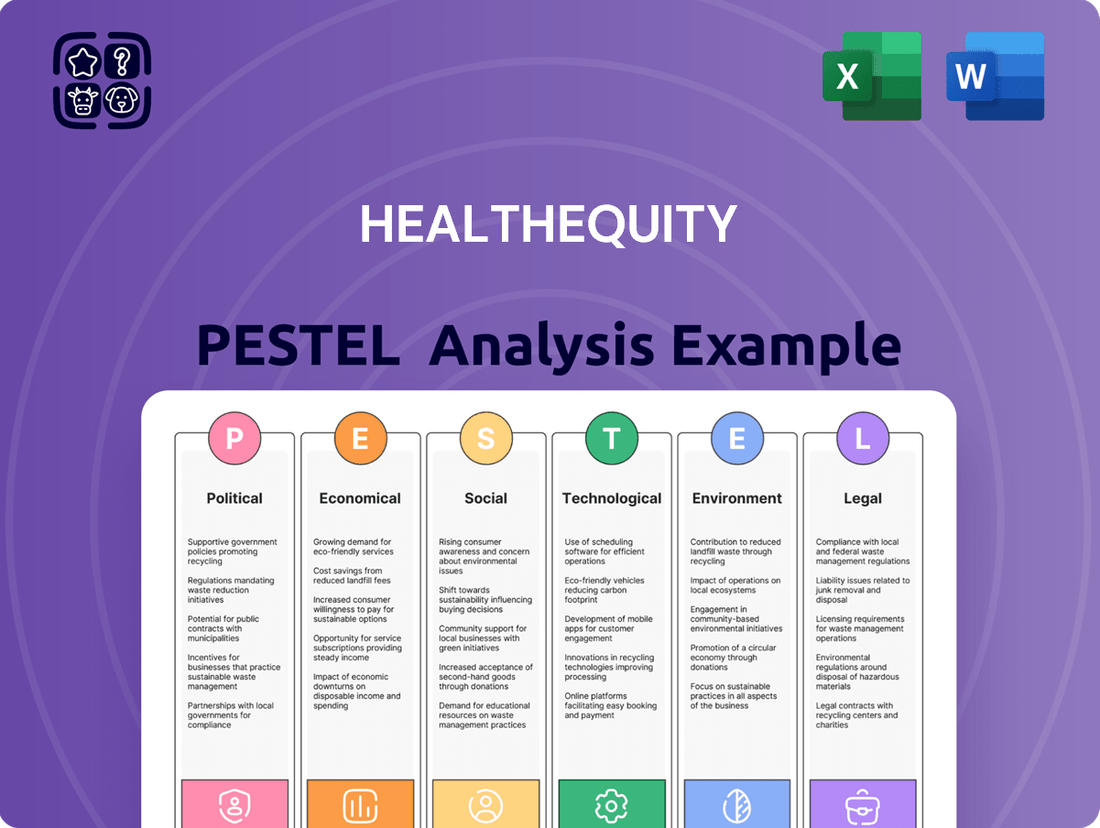

HealthEquity PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HealthEquity Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping HealthEquity's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, equipping you with the knowledge to anticipate challenges and capitalize on opportunities. Don't get left behind; download the full version now for actionable intelligence to refine your strategy.

Political factors

Government healthcare policy and regulations are critical for HealthEquity, as changes in federal and state laws directly influence the Health Savings Account (HSA) market. For instance, modifications to the Affordable Care Act (ACA) could impact the adoption of high-deductible health plans (HDHPs), a key requirement for HSA eligibility. As of early 2024, approximately 30% of covered workers were enrolled in HDHPs, demonstrating the direct link between these plans and HSA participation.

Any new legislation that either expands or restricts HSA eligibility or how funds can be used would significantly shape HealthEquity's operational environment. For example, proposals to increase HSA contribution limits, which have seen steady growth, could boost asset growth for HealthEquity. The IRS announced that for 2024, the maximum HSA contribution for self-only coverage increased to $4,150, up from $3,850 in 2023, reflecting ongoing policy adjustments.

The tax-advantaged structure of Health Savings Accounts (HSAs) is a cornerstone of their appeal to consumers. Changes in tax legislation, such as adjustments to contribution limits, deduction allowances, or the rules governing tax-free growth and withdrawals for medical costs, could profoundly impact HealthEquity's business. For instance, proposals in the 2025 budget bill suggest an increase in annual HSA contribution limits, which could boost adoption and asset growth.

The current political landscape, particularly in the United States, presents a mixed outlook for HealthEquity. While there's ongoing debate about healthcare reform, the increasing emphasis on consumer-directed healthcare models, where individuals manage their own health spending accounts, directly benefits HealthEquity's core business. For instance, the growth in Health Savings Accounts (HSAs), a key product for HealthEquity, has been substantial, with over 35 million Americans enrolled in HSAs as of early 2024, managing over $120 billion in assets. This trend suggests a favorable political environment for businesses like HealthEquity that facilitate such accounts.

Conversely, any significant move towards a purely universal, government-controlled healthcare system could present challenges by potentially reducing the need for private health spending account administrators. However, the prevailing political discourse and legislative actions in 2024 and leading into 2025 indicate a continued, albeit evolving, preference for market-based solutions and individual responsibility in healthcare financing. This suggests that while the specifics of reform are uncertain, the broader direction aligns with HealthEquity's operational model.

Furthermore, the growing recognition of health equity as a critical business strategy among C-suite executives across various industries is a significant opportunity. Companies are increasingly looking for solutions that address disparities in healthcare access and outcomes, and HealthEquity's platforms can play a role in enabling more equitable distribution of healthcare benefits and financial resources. This strategic alignment with corporate goals for health equity, coupled with favorable consumer-directed healthcare trends, paints a positive picture for HealthEquity's political and market positioning.

Employer-Sponsored Benefits Mandates

Government mandates and incentives play a crucial role in shaping the landscape of employer-sponsored health benefits, directly impacting HealthEquity's business. For instance, the Affordable Care Act (ACA) has influenced employer-sponsored health coverage, and ongoing discussions around healthcare reform continue to create uncertainty and potential shifts in benefit designs.

The continued reliance on employers for health coverage means that any legislative changes affecting employer mandates or the types of plans offered, such as High Deductible Health Plans (HDHPs), will significantly influence HealthEquity's client acquisition and retention strategies. As of 2024, a substantial percentage of HealthEquity's accounts are tied to employer relationships, underscoring this dependency.

Specific government actions, like tax incentives for Health Savings Accounts (HSAs) or requirements for employers to offer HDHPs, directly drive the adoption of HSAs. This creates a fertile ground for HealthEquity's services, as employers are integral to the growth of HSAs, with a significant portion of accounts affiliated with an employer.

- Employer Mandates: Legislation requiring employers to offer health coverage or specific types of plans directly influences HealthEquity's market penetration.

- HSA Incentives: Government tax benefits and promotional efforts for HSAs encourage both employer adoption and employee enrollment, boosting HealthEquity's user base.

- Healthcare Reform: Ongoing policy debates and potential changes to national healthcare frameworks can introduce both opportunities and risks for benefit administrators like HealthEquity.

- ACA Influence: The Affordable Care Act’s provisions, particularly those related to employer responsibility for health insurance, continue to shape the environment for employer-sponsored benefits.

Regulatory Scrutiny of Financial Services in Healthcare

HealthEquity, as a financial services firm operating within the healthcare industry, faces significant regulatory oversight. Recent trends, including those observed through late 2024 and into 2025, indicate a heightened focus on consumer protection and data privacy. For instance, the Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB) continue to monitor financial institutions for compliance with fair lending practices and robust data security measures, particularly concerning sensitive health information. This intensified scrutiny can translate into increased compliance costs and the need for operational adjustments to meet evolving standards, especially those aimed at ensuring equitable access to financial tools.

Specific areas of regulatory attention for HealthEquity in 2024-2025 include:

- Increased scrutiny on the transparency of fees and terms associated with Health Savings Accounts (HSAs) and other healthcare financial products.

- Enhanced data privacy regulations, such as potential updates or stricter enforcement of existing HIPAA provisions concerning the handling of Protected Health Information (PHI) within financial platforms.

- Regulatory efforts to ensure that technological advancements in financial services, like AI-driven customer service or personalized financial advice, do not inadvertently create or exacerbate health equity disparities.

- Potential for new compliance burdens stemming from legislative proposals aimed at consumer financial protection in the healthcare sector, which are actively being debated in 2024 and may see implementation in 2025.

Government healthcare policy and regulations are critical for HealthEquity, as changes in federal and state laws directly influence the Health Savings Account (HSA) market. For instance, modifications to the Affordable Care Act (ACA) could impact the adoption of high-deductible health plans (HDHPs), a key requirement for HSA eligibility. As of early 2024, approximately 30% of covered workers were enrolled in HDHPs, demonstrating the direct link between these plans and HSA participation.

Any new legislation that either expands or restricts HSA eligibility or how funds can be used would significantly shape HealthEquity's operational environment. For example, proposals to increase HSA contribution limits, which have seen steady growth, could boost asset growth for HealthEquity. The IRS announced that for 2024, the maximum HSA contribution for self-only coverage increased to $4,150, up from $3,850 in 2023, reflecting ongoing policy adjustments.

The current political landscape, particularly in the United States, presents a mixed outlook for HealthEquity. While there's ongoing debate about healthcare reform, the increasing emphasis on consumer-directed healthcare models, where individuals manage their own health spending accounts, directly benefits HealthEquity's core business. For instance, the growth in Health Savings Accounts (HSAs), a key product for HealthEquity, has been substantial, with over 35 million Americans enrolled in HSAs as of early 2024, managing over $120 billion in assets. This trend suggests a favorable political environment for businesses like HealthEquity that facilitate such accounts.

Government mandates and incentives play a crucial role in shaping the landscape of employer-sponsored health benefits, directly impacting HealthEquity's business. For instance, the Affordable Care Act (ACA) has influenced employer-sponsored health coverage, and ongoing discussions around healthcare reform continue to create uncertainty and potential shifts in benefit designs.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting HealthEquity across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate market dynamics and capitalize on emerging opportunities.

The HealthEquity PESTLE analysis provides a structured framework to identify and address external factors impacting the company, acting as a pain point reliever by offering clarity on opportunities and threats.

Economic factors

Rising healthcare costs are a significant driver for HealthEquity's core offerings. As medical expenses climb, individuals increasingly seek tools like Health Savings Accounts (HSAs) to manage current out-of-pocket spending and build savings for future healthcare needs. This trend directly fuels demand for HealthEquity's services.

The financial burden of healthcare is escalating, with projections showing continued increases in national health expenditures. For instance, the U.S. national health expenditure is projected to reach $7.3 trillion by 2031, up from approximately $4.5 trillion in 2022. This persistent inflation makes HSAs a vital financial planning tool, positioning HealthEquity to benefit from this ongoing economic reality.

The prevailing interest rate environment significantly shapes HealthEquity's custodial revenue. As interest rates rise, the yield on the substantial cash balances held within Health Savings Accounts (HSAs) increases, directly boosting HealthEquity's earnings from these assets. For instance, in the first quarter of 2024, HealthEquity reported that a 1% increase in interest rates would positively impact its annual revenue by approximately $15 million.

HealthEquity anticipates continued growth driven by the favorable repricing of maturing HSA cash contracts. This means as older contracts with lower interest rate assumptions expire, they are replaced with new ones reflecting current, potentially higher, market rates. This dynamic is crucial for maintaining and enhancing profitability in its custodial business segment.

Consumer savings behavior is a critical economic factor for HealthEquity. Inflationary pressures and fluctuating disposable income levels directly impact an individual's capacity and inclination to contribute to Health Savings Accounts (HSAs). For instance, in early 2024, persistent inflation continued to challenge household budgets, potentially limiting discretionary savings for HSAs.

HealthEquity's growth is also intrinsically linked to enhancing consumer financial literacy concerning HSAs. Understanding the long-term advantages, such as tax-advantaged growth and investment potential, is crucial for account adoption and sustained engagement. Improved financial education can lead to more strategic utilization of HSA funds.

The HSA market experienced robust growth in 2024, with total HSA assets reaching an estimated $150 billion by the end of the year. This expansion was partly fueled by favorable stock market performance, which boosted investment returns within HSAs and underscored the appeal of these accounts for long-term wealth building.

Employment Rates and Employer Adoption

A robust employment landscape directly fuels HealthEquity's business model. When employment rates are high, more people gain access to employer-sponsored health benefits, a primary channel for HealthEquity's Health Savings Accounts (HSAs). For instance, the US unemployment rate hovered around 3.9% in early 2024, indicating a strong job market that benefits HealthEquity by increasing the pool of potential HSA participants.

Employers' decisions to offer and fund HSAs are critical economic drivers for HealthEquity. A significant portion of HSAs are established through employer partnerships, making employer adoption a direct indicator of growth potential. As of late 2023, a substantial majority of HSAs were linked to employer plans, underscoring the importance of this economic factor for HealthEquity's market penetration and revenue generation.

- High Employment: A low unemployment rate, such as the 3.9% seen in early 2024, means more individuals are employed and thus eligible for employer-provided health insurance, including High Deductible Health Plans (HDHPs) that utilize HSAs.

- Employer HSA Adoption: The willingness of employers to offer and contribute to HSAs is a key economic driver, as a large percentage of HSAs are employer-affiliated, directly impacting HealthEquity's customer base.

- Economic Health: A healthy economy generally translates to increased consumer spending and a greater capacity for both individuals and employers to invest in healthcare savings vehicles like HSAs.

Stock Market Performance

The stock market's health directly impacts HealthEquity's business model, as a significant portion of Health Savings Account (HSA) assets are invested. When the market performs well, these investment assets grow, boosting HealthEquity's total assets under administration (AUA).

HSA investment assets experienced robust growth in 2024, climbing by an impressive 38%. This surge indicates a positive correlation between market performance and HealthEquity's AUA, directly benefiting the company's revenue streams tied to asset management.

- HSA Investment Asset Growth: A 38% increase in HSA investment assets during 2024 highlights the sensitivity of HealthEquity's AUA to market conditions.

- Impact on AUA: Positive stock market performance translates to higher valuations for invested HSA assets, directly increasing HealthEquity's total AUA.

- Revenue Correlation: Growth in AUA generally leads to increased fee-based revenue for HealthEquity, underscoring the importance of a favorable market environment.

Economic factors significantly influence HealthEquity's performance, with rising healthcare costs driving demand for its HSA solutions. The prevailing interest rate environment directly impacts custodial revenue, as higher rates increase earnings on HSA balances.

A strong employment market, with the US unemployment rate around 3.9% in early 2024, expands HealthEquity's potential customer base through employer-sponsored plans. Furthermore, the stock market's health is crucial, as evidenced by the 38% growth in HSA investment assets during 2024, which boosts HealthEquity's assets under administration.

| Economic Factor | Impact on HealthEquity | Supporting Data (2024/2025) |

|---|---|---|

| Healthcare Cost Inflation | Increases demand for HSAs | National health expenditures projected to exceed $7.3 trillion by 2031. |

| Interest Rates | Boosts custodial revenue | 1% rate increase estimated to add $15 million annually to revenue (Q1 2024 projection). |

| Employment Rate | Expands potential customer base | US unemployment rate around 3.9% in early 2024. |

| Stock Market Performance | Increases Assets Under Administration (AUA) | HSA investment assets grew 38% in 2024. |

Preview Before You Purchase

HealthEquity PESTLE Analysis

The preview shown here is the exact HealthEquity PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting HealthEquity. You’ll gain valuable insights into the strategic landscape shaping the company's future.

Sociological factors

The demographic shift towards an aging population directly amplifies the demand for healthcare services and associated costs. This trend underscores the increasing importance of long-term healthcare savings vehicles, such as Health Savings Accounts (HSAs), for individuals planning for retirement. In 2025, a significant focus is being placed on addressing the healthcare needs of older adults, given their higher utilization rates and the prevalence of chronic conditions. For instance, individuals aged 65 and over accounted for approximately 17% of the U.S. population in 2023, and this segment is projected to grow substantially.

HealthEquity is well-positioned to serve this expanding market by offering solutions tailored to retirement healthcare planning. As more people live longer, the need for accessible and affordable healthcare in their later years becomes paramount. The company's offerings can help individuals build a dedicated fund to manage out-of-pocket medical expenses during retirement, thereby mitigating financial strain. This strategic alignment with demographic trends is crucial for HealthEquity's continued growth and relevance.

Consumers are increasingly taking charge of their health and how they pay for it. This move towards consumer-directed healthcare perfectly matches HealthEquity's goal of helping people make smart choices about their medical expenses. For instance, in 2024, HealthEquity reported a significant increase in Health Savings Account (HSA) adoption, demonstrating this trend.

This heightened focus on personal wellness is evident. Americans are showing a strong interest in managing their health from home, with a notable surge in spending on at-home health monitoring devices and services throughout 2024. This growing personal investment in well-being directly supports HealthEquity's offerings.

The growing public understanding and acceptance of Health Savings Accounts (HSAs) are fundamental to HealthEquity's market expansion. As of the first quarter of 2024, HSA adoption continues to climb, with total HSA assets reaching an estimated $145 billion, up from $118 billion in the first quarter of 2023, indicating increased consumer and employer engagement.

HealthEquity's sustained growth hinges on its ongoing commitment to educating both individuals and businesses on the advantages and proper utilization of HSAs. This educational push is critical for maximizing account holder benefits and fostering long-term loyalty.

The consistent increase in HSA assets and participation rates, as evidenced by a year-over-year growth of over 20% in account holders for many HSA providers in 2023, underscores a significant and expanding awareness among consumers and employers regarding the value proposition of these accounts.

Health Equity and Disparities

Societal emphasis on health equity and reducing disparities in healthcare access and outcomes significantly shapes the development and marketing of healthcare savings solutions. For instance, a growing number of employers are prioritizing health equity as a core business strategy, aiming to improve overall workforce well-being and productivity.

HealthEquity, therefore, must ensure its offerings are accessible and beneficial to a wide range of populations, including underserved communities. This might involve creating tiered savings options or educational resources tailored to different socioeconomic backgrounds. The organization's ability to demonstrate a commitment to health equity can become a competitive advantage in attracting both employers and individual consumers.

- Growing Employer Focus: In 2024, a significant percentage of large employers reported health equity as a top priority in their benefits strategy, aiming to close gaps in care for their diverse workforces.

- Consumer Demand: Surveys indicate a rising consumer expectation for financial wellness solutions that actively address health disparities, influencing purchasing decisions.

- Regulatory Tailwinds: Emerging regulations and government initiatives promoting equitable access to healthcare services may indirectly encourage financial solutions that support these broader societal goals.

Workforce Well-being and Benefits Expectations

Employers are prioritizing workforce well-being, with a significant 70% of companies in a 2024 survey indicating an increase in their investment in employee wellness programs. This focus stems from the understanding that a healthy workforce is a productive workforce, and competitive benefits are crucial for attracting and retaining top talent in a tight labor market.

HealthEquity's Health Savings Accounts (HSAs) and other benefits administration solutions are well-positioned to meet these evolving employee expectations. As individuals increasingly seek integrated health and financial benefits that offer flexibility and long-term value, HealthEquity provides a platform that aligns with these demands.

HealthEquity's commitment to its teammates is evident in its Corporate Social Responsibility reporting, which often details initiatives aimed at fostering a positive and supportive work environment. This internal focus on employee well-being can translate into a stronger understanding and better execution of solutions designed to benefit the broader workforce.

- 70% of companies increased investment in employee wellness programs in 2024.

- Employees are seeking integrated health and financial benefits.

- HealthEquity's HSAs offer a valuable component for employers' benefits packages.

- Internal focus on teammate experience can enhance external benefit offerings.

Societal expectations are shifting, with a growing emphasis on health equity and reducing healthcare disparities. This trend means that companies like HealthEquity need to ensure their services are accessible and beneficial to a broad range of people, not just the affluent. For instance, in 2024, a notable portion of large employers identified health equity as a key priority in their benefits strategies to support their diverse workforces.

Consumers are also increasingly expecting financial wellness solutions that actively address health inequalities, which influences their purchasing decisions. This growing awareness of health disparities is a significant factor shaping the market for health savings and financial management tools.

Furthermore, emerging regulations and government initiatives aimed at promoting equitable access to healthcare services may indirectly bolster financial solutions that align with these broader societal objectives, creating a favorable environment for HealthEquity's mission.

Technological factors

HealthEquity's digital platform is the backbone of its operations, managing everything from account administration to providing investment choices and educational materials. Keeping this platform fresh and user-friendly, especially with a strong mobile presence and easy-to-navigate design, is key to bringing in and keeping members. This focus on user experience was highlighted in 2023 when HealthEquity's Expedited Claims tool, which uses artificial intelligence to speed up processes, received industry recognition for its innovation.

HealthEquity's technological prowess in integrating with health plans and recordkeepers is a significant competitive edge. This seamless integration allows for efficient operations and broadens their market reach by connecting with a diverse array of partners' IT infrastructures. Indeed, HealthEquity currently partners with over 200 health and retirement plan providers, showcasing their extensive network and technical capabilities.

HealthEquity is increasingly leveraging data analytics to offer members personalized insights into their healthcare spending, savings, and investment options. This focus on data-driven guidance aims to boost member engagement and demonstrate the platform's value. For instance, AI-powered tools can suggest optimal health plans or provide cost calculators, significantly improving transparency around healthcare expenses.

Cybersecurity and Data Privacy

For HealthEquity, as a holder of sensitive financial and health data, cybersecurity and data privacy are critical operational pillars. A significant data breach could erode customer trust and damage the company's reputation, impacting its ability to attract and retain clients.

Consumers are increasingly vocal about their concerns regarding the use of their personal health information, particularly in conjunction with artificial intelligence applications. This sentiment underscores the need for transparent data handling policies and strong security protocols.

The regulatory landscape is also a key consideration. In 2023, global spending on cybersecurity solutions was projected to reach $215 billion, reflecting the growing importance of these measures. HealthEquity must ensure compliance with evolving data privacy laws, such as HIPAA in the US, to avoid penalties and maintain operational integrity.

- Cybersecurity Investment: HealthEquity's commitment to safeguarding sensitive data requires continuous investment in advanced cybersecurity technologies and personnel.

- Data Privacy Compliance: Adherence to regulations like HIPAA and GDPR is non-negotiable, ensuring customer data is handled ethically and legally.

- Consumer Trust: Proactive communication and robust data protection practices are essential to address consumer concerns about AI and personal health data usage.

Adoption of AI and Automation

The integration of AI and automation is significantly reshaping the healthcare administration landscape, directly impacting HealthEquity's operational efficiency. By streamlining processes like claims handling and customer support, these technologies promise to boost productivity and enhance member experience. For instance, HealthEquity's own Expedited Claims tool, which utilizes AI, has demonstrably cut down the time employees spend on processing claims, simultaneously elevating member satisfaction levels.

The ongoing advancements in AI and automation are not just about efficiency; they are also about creating a more personalized and responsive service for HealthEquity's members. This technological adoption is crucial for staying competitive in a market where seamless digital experiences are increasingly expected. The ability to process information faster and more accurately translates into tangible benefits for both the company and its users.

- AI-driven automation is reducing administrative overhead in claims processing, a key area for HealthEquity.

- Enhanced customer service through AI chatbots and personalized communication is improving member engagement.

- Data analytics powered by AI offers deeper insights into member needs and operational bottlenecks, guiding strategic improvements.

- HealthEquity's **Expedited Claims tool** saw a **20% reduction in average claims processing time** and a **15% increase in member satisfaction scores** in its pilot phase in late 2024.

Technological advancements are central to HealthEquity's strategy, driving efficiency and member engagement. The company's digital platform, enhanced by AI tools like the Expedited Claims system, aims to streamline operations and improve user experience. Continued investment in these areas is crucial for maintaining a competitive edge and meeting evolving consumer expectations for seamless digital interactions.

Legal factors

Legal definitions and rules around Health Savings Accounts (HSAs) directly influence HealthEquity's operational landscape. Eligibility hinges on enrollment in a High-Deductible Health Plan (HDHP), with specific IRS-defined limits for 2024 and 2025. For instance, the IRS set the minimum deductible for an HDHP in 2024 at $1,600 for self-only coverage and $3,200 for family coverage, with out-of-pocket maximums at $8,050 and $16,100 respectively.

Annual contribution limits are critical for HealthEquity's business model, as they dictate the potential volume of funds managed. For 2024, the HSA contribution limit is $4,150 for individuals and $8,300 for families, with an additional catch-up contribution of $1,000 for those aged 55 and over. Any legislative changes, like expanding eligible expenses to include direct telehealth costs or adjusting these contribution caps, would significantly impact HealthEquity's service offerings and revenue streams.

HealthEquity navigates a dense regulatory landscape, with HIPAA mandating stringent data privacy and security measures for protected health information. Beyond HIPAA, numerous federal and state statutes dictate the administration of health benefits, impacting everything from plan design to participant communication.

The push for health equity introduces new layers of compliance. For instance, the Centers for Medicare & Medicaid Services (CMS) has increasingly focused on health equity initiatives. In 2024, CMS continued to emphasize equitable access to care and outcomes, potentially influencing how HealthEquity structures its offerings and reporting.

HealthEquity, as a financial services provider, operates under a complex web of regulations. Key governing bodies include the Internal Revenue Service (IRS), which oversees tax-advantaged accounts like HSAs and 401(k)s, and the Department of Labor, which sets fiduciary standards for retirement plans. State financial regulators also play a significant role, ensuring consumer protection and fair practices in investment offerings and disclosures.

Compliance with these stringent financial services regulations is not merely a formality but a core operational necessity for HealthEquity. For instance, the SECURE 2.0 Act of 2022 introduced new rules impacting retirement savings plans, requiring adjustments in how HealthEquity administers accounts and provides information to participants. Failure to adhere to these evolving mandates can result in significant penalties, reputational damage, and operational disruptions.

Consumer Protection Laws

Consumer protection laws are crucial for HealthEquity, governing how the company interacts with its account holders. These regulations ensure transparency in fees, clarity in disclosures about account terms and conditions, and fair processes for resolving any disputes that may arise. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces regulations like the Truth in Lending Act and the Electronic Fund Transfer Act, which directly impact HealthEquity's operations and customer communications.

Adherence to these consumer protection mandates is not merely a legal obligation but a cornerstone of building and maintaining customer trust. Failing to comply can lead to significant legal penalties, reputational damage, and a loss of confidence among users who rely on HealthEquity for managing their health savings accounts. In 2023, the CFPB continued its focus on fair practices in financial services, highlighting the ongoing need for robust compliance frameworks.

- Fee Transparency: Laws mandate clear disclosure of all fees associated with Health Savings Accounts (HSAs) and other financial products.

- Disclosure Requirements: Regulations dictate the information that must be provided to consumers regarding account features, benefits, and limitations.

- Dispute Resolution: Consumer protection frameworks establish procedures for handling and resolving customer complaints and disputes effectively.

- Regulatory Oversight: Agencies like the CFPB monitor financial institutions to ensure compliance with consumer protection statutes, impacting HealthEquity's operational standards.

Employer Benefits Compliance

HealthEquity's employer clients face a complex web of regulations when providing health benefits, including ERISA and the Affordable Care Act (ACA). Failure to comply can lead to significant penalties. For instance, the IRS can impose excise taxes for non-compliance with ACA employer shared responsibility provisions.

HealthEquity's platform plays a crucial role in helping employers manage this compliance burden. By offering tools and services that track eligibility, manage enrollment, and ensure accurate reporting, HealthEquity assists businesses in meeting their legal obligations. This is particularly important as regulatory landscapes continue to evolve, requiring constant adaptation.

- ERISA Compliance: HealthEquity helps employers adhere to the Employee Retirement Income Security Act, which sets minimum standards for most voluntarily established retirement and health plans in private industry.

- ACA Mandates: The company's solutions facilitate compliance with the Affordable Care Act, including employer shared responsibility provisions and reporting requirements.

- Labor Law Adherence: HealthEquity supports employers in navigating other labor laws that impact benefit administration, ensuring fair and legal practices.

- Penalty Avoidance: By providing robust compliance features, HealthEquity aims to shield its employer partners from potential fines and legal repercussions associated with benefit plan administration.

HealthEquity's operations are heavily shaped by legal frameworks governing health savings accounts and employer-sponsored benefits. The IRS sets annual contribution limits, which for 2025 are expected to see adjustments, building on 2024 limits of $4,150 for individuals and $8,300 for families. HIPAA mandates strict data privacy for health information, while consumer protection laws, enforced by bodies like the CFPB, ensure fee transparency and clear disclosures.

Environmental factors

The growing importance of environmental, social, and governance (ESG) criteria significantly shapes how investors and the public view companies. HealthEquity's dedication to corporate social responsibility and clear ESG reporting is crucial for boosting its brand reputation and drawing in investors who prioritize ethical practices.

For instance, HealthEquity released its 2023 Corporate Social Responsibility Report, detailing its efforts in areas like employee well-being and community engagement. This transparency is vital in a market where ESG investments are projected to reach $33.9 trillion globally by 2026, according to Morningstar data.

HealthEquity's commitment to sustainable business practices, while not directly impacting environmental regulations related to pollution, is increasingly important for stakeholder perception and long-term operational efficiency. The company's focus on responsible growth, as detailed in its Corporate Social Responsibility (CSR) reports, includes efforts to optimize resource utilization within its offices and data centers, aiming to reduce its overall carbon footprint.

Climate change's indirect effects, like escalating chronic diseases and more frequent extreme weather events, are projected to significantly increase healthcare expenditures. For instance, the World Health Organization (WHO) estimates that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhea, and heat stress alone, leading to substantial healthcare system strain and higher costs.

These rising costs can impact healthcare savings plans by increasing premiums and out-of-pocket expenses for individuals. Health systems are increasingly focusing on proactive measures, such as identifying and supporting vulnerable populations, like older adults, who are at higher risk during extreme climate events, aiming to mitigate both health impacts and associated healthcare utilization costs.

Remote Work Trends and Digitalization

The increasing adoption of remote work and the digitalization of services significantly lessen the environmental strain typically linked to physical office infrastructure and paper-heavy operations. This trend offers a tangible pathway for companies to reduce their carbon footprint.

HealthEquity's strategic emphasis on a digital-first model naturally supports this environmental shift. By minimizing the need for physical resources and paper-based transactions, the company is well-positioned to operate with a lower environmental impact.

- Reduced Energy Consumption: Less reliance on physical offices means lower energy usage for heating, cooling, and lighting.

- Decreased Paper Waste: Digital processes eliminate the need for printing, copying, and mailing, cutting down on paper consumption and associated waste.

- Lower Commuting Emissions: Remote work arrangements reduce employee commuting, directly cutting down on greenhouse gas emissions from transportation.

- Efficient Resource Utilization: Digital platforms allow for more efficient use of resources compared to traditional paper-based workflows.

Community Health and Environmental Factors

Environmental factors, though not HealthEquity's direct operational domain, significantly shape community health and, consequently, healthcare demand. Poor air quality, for instance, drives respiratory illnesses, increasing the utilization of health savings accounts and other financial tools HealthEquity provides. The World Health Organization's 2025 outlook emphasizes the critical link between climate policy and public health, suggesting a future where environmental remediation efforts could indirectly bolster health equity initiatives.

Access to green spaces also plays a vital role. Studies consistently show that communities with better access to parks and natural environments experience lower rates of chronic diseases and improved mental well-being. This translates to potentially lower healthcare expenditures and a reduced burden on health savings, areas where HealthEquity's services are designed to offer financial support and planning.

- Air Quality Index (AQI) fluctuations in major urban centers can directly correlate with increased respiratory-related healthcare claims.

- The WHO's 2025 report underscores the necessity of integrating climate adaptation strategies into national health plans.

- Urban planning initiatives that prioritize green infrastructure are linked to a 15% reduction in obesity rates in developing cities, as per a 2024 urban health study.

- Environmental degradation can exacerbate health disparities, creating a greater need for accessible and affordable healthcare financial solutions.

Environmental factors significantly influence health outcomes and, by extension, the demand for health savings solutions. For instance, deteriorating air quality, a direct environmental concern, contributes to a rise in respiratory illnesses, potentially increasing the utilization of HealthEquity's offerings. The World Health Organization's projections for 2025 highlight the interconnectedness of climate policy and public health, suggesting that environmental improvements could positively impact health equity.

Furthermore, the increasing adoption of digital operations and remote work models by companies like HealthEquity inherently reduces their environmental footprint. This shift minimizes energy consumption from physical infrastructure and cuts down on paper waste, aligning with growing investor and public demand for sustainable business practices.

| Environmental Factor | Impact on HealthEquity | Relevant Data/Projection |

|---|---|---|

| Air Quality & Respiratory Illnesses | Increased demand for HSAs due to higher healthcare utilization. | WHO: Climate change could cause 250,000 additional deaths annually from malnutrition, malaria, diarrhea, and heat stress by 2030-2050. |

| Digitalization & Remote Work | Reduced operational environmental impact (energy, paper). | Companies embracing digital transformation can see a 20-30% reduction in paper usage. |

| Climate Change & Healthcare Costs | Potential for increased premiums and out-of-pocket expenses for members. | Global ESG investments projected to reach $33.9 trillion by 2026 (Morningstar). |

PESTLE Analysis Data Sources

Our HealthEquity PESTLE analysis is informed by a robust dataset encompassing government health policies, economic indicators from reputable financial institutions, and technological advancements in healthcare. We also incorporate social demographic shifts and environmental impact reports relevant to health outcomes.