HealthEquity Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HealthEquity Bundle

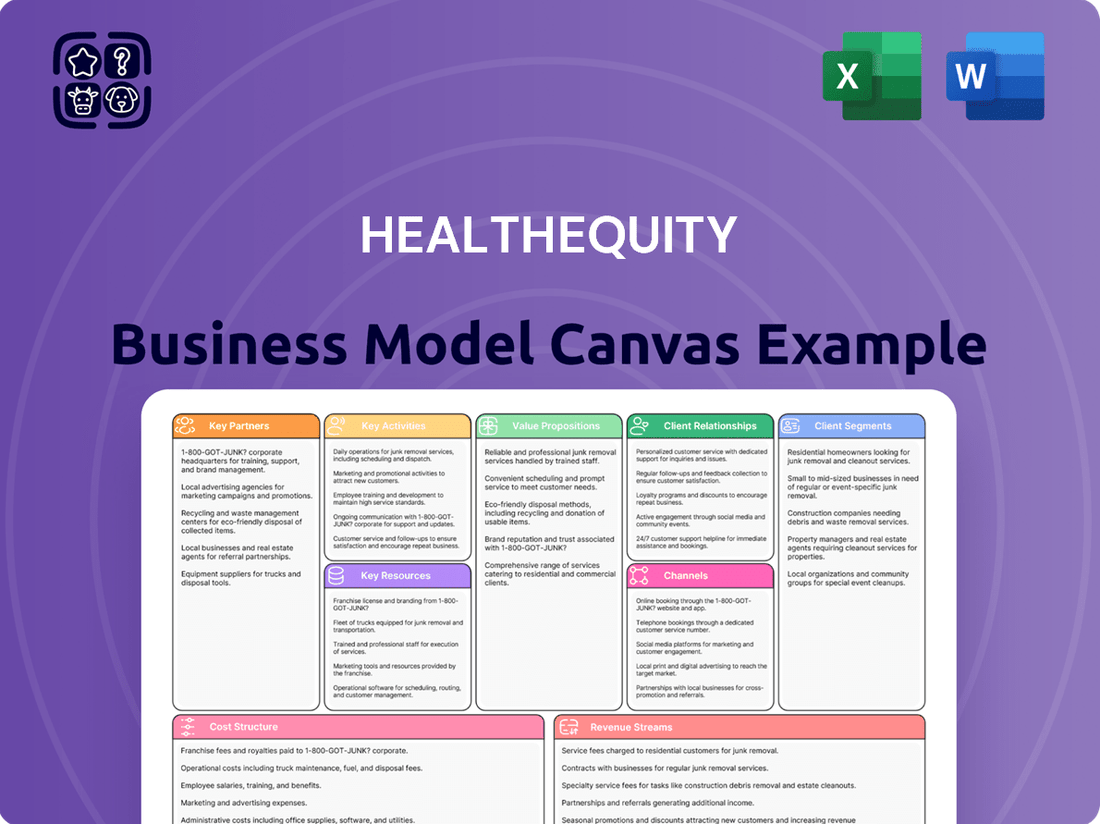

Discover the core components of HealthEquity's thriving business with our detailed Business Model Canvas. This in-depth analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear picture of their operational strategy.

Unlock the full strategic blueprint behind HealthEquity's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

HealthEquity’s employer partnerships are foundational, acting as the primary channel for distributing its health savings solutions. By integrating HSAs and other savings accounts into employee benefits, HealthEquity achieves significant scale, directly reaching millions of individuals. For instance, in 2023, HealthEquity served over 16.5 million accounts, with a substantial portion of this growth driven by employer relationships.

These collaborations are vital for widespread adoption. Employers rely on HealthEquity to simplify the complex task of managing health benefits, making it easier for their workforce to access and utilize these valuable accounts. HealthEquity's platform offers robust tools that streamline enrollment, administration, and communication for employers, solidifying these partnerships.

HealthEquity collaborates closely with health plans to embed its Health Savings Account (HSA) solutions directly into their insurance products. This integration offers a streamlined experience for individuals who already have coverage, making it easier for them to manage their healthcare finances. For instance, in 2023, HealthEquity reported serving over 16 million members, a significant portion of whom likely gained access through these vital health plan relationships.

These partnerships serve as a critical distribution channel, allowing HealthEquity to reach a vast pool of potential new clients and members who are actively seeking comprehensive benefits. By aligning with established health insurance providers, HealthEquity expands its footprint within the healthcare ecosystem, making its HSA services more accessible and convenient for a broader audience.

HealthEquity collaborates with a wide array of recordkeepers and financial institutions, including federally insured banks and credit unions. These partnerships are foundational, enabling HealthEquity to effectively manage and hold Health Savings Account (HSA) assets. For instance, by Q1 2024, HealthEquity had established relationships with numerous financial entities, bolstering its custodial capabilities and ensuring the secure handling of billions in member funds.

Benefits Advisors and Brokers

HealthEquity heavily relies on benefits advisors and brokers to reach a broad employer base, effectively acting as a distribution channel for their health savings account (HSA) and other consumer-directed healthcare solutions. These partnerships are crucial because advisors and brokers are trusted sources of information for employers navigating complex benefits landscapes.

By collaborating with these intermediaries, HealthEquity can educate employers on the advantages of HSAs, such as tax savings and increased healthcare engagement. Brokers and advisors then facilitate the seamless integration of HealthEquity's platform into employer benefit packages, driving adoption and client acquisition.

For instance, in 2023, HealthEquity reported that a significant portion of its new employer accounts were acquired through its network of benefits partners, highlighting the channel's effectiveness. This strategy allows HealthEquity to scale its operations efficiently by leveraging the existing client relationships and expertise of these key partners.

- Distribution Channel: Advisors and brokers serve as a vital conduit for HealthEquity's solutions, reaching a vast number of employers.

- Education and Adoption: These partners educate employers on HSA benefits, driving the adoption of HealthEquity's platform.

- Market Reach: Partnerships expand HealthEquity's market presence and client base by tapping into established networks.

- Client Acquisition: In 2023, a substantial percentage of new employer accounts were sourced through these strategic relationships.

Third-Party Administrators (TPAs)

HealthEquity collaborates with Third-Party Administrators (TPAs) to broaden its service portfolio, integrating benefits administration for Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), and COBRA. This symbiotic relationship allows HealthEquity to tap into new customer segments and enhance its market presence, offering a more holistic solution for employers and members. By partnering with TPAs, HealthEquity solidifies its competitive edge by presenting a unified platform for various consumer-directed health accounts.

These partnerships are crucial for HealthEquity's growth strategy, enabling them to offer a more complete benefits administration experience. For instance, in 2024, the demand for integrated health savings solutions continued to rise, with employers seeking to streamline their benefits management. HealthEquity's ability to partner with TPAs that already manage complementary benefits allows them to present a compelling, all-in-one solution.

- Expanded Service Offerings: Integration with TPAs allows HealthEquity to offer a wider array of benefits administration, including FSAs, HRAs, and COBRA, making them a more comprehensive provider.

- Increased Market Reach: Partnerships with established TPAs provide HealthEquity with access to their existing client bases, accelerating customer acquisition and market penetration.

- Enhanced Competitive Positioning: By offering a more complete suite of solutions through these alliances, HealthEquity strengthens its position against competitors who may not have such integrated capabilities.

- Streamlined Member Experience: For employers and their employees, these partnerships can lead to a simpler, more unified experience in managing various health benefits.

HealthEquity's key partnerships are essential for its distribution and service delivery. Collaborations with employers are foundational, acting as the primary channel to offer health savings solutions, reaching millions of individuals. For example, in 2023, HealthEquity managed over 16.5 million accounts, with employer relationships driving significant growth.

Further strengthening its reach, HealthEquity partners with health plans to embed its HSA solutions, creating a seamless experience for members already covered by insurance. This integration allows for easier healthcare financial management. In 2023, HealthEquity served over 16 million members, many accessing services through these health plan alliances.

The company also relies on benefits advisors and brokers as a crucial distribution network, educating employers on HSA advantages and facilitating platform integration. In 2023, a substantial portion of new employer accounts were secured through these vital intermediary relationships, underscoring their effectiveness in market penetration.

Additionally, HealthEquity partners with recordkeepers and financial institutions to securely manage HSA assets, ensuring the safe handling of member funds. By Q1 2024, these relationships bolstered its custodial capabilities, safeguarding billions in member assets.

| Partnership Type | Primary Role | 2023 Account/Member Data | Strategic Impact |

|---|---|---|---|

| Employers | Direct distribution of HSAs | 16.5+ million accounts served | Foundation for scale and growth |

| Health Plans | Embedded HSA solutions | 16+ million members served (estimated impact) | Streamlined member experience, expanded reach |

| Advisors/Brokers | Distribution and education channel | Significant new employer accounts acquired | Efficient market penetration and client acquisition |

| Recordkeepers/Financial Institutions | Custodial services for HSA assets | Billions in member funds secured (as of Q1 2024) | Asset security and operational reliability |

What is included in the product

A comprehensive, pre-written business model tailored to HealthEquity's strategy, detailing customer segments, value propositions, and revenue streams.

Reflects HealthEquity's real-world operations in managing HSAs and benefits, structured across the 9 classic BMC blocks for strategic analysis.

HealthEquity's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex healthcare payment solutions, simplifying understanding for stakeholders.

This structured approach to HealthEquity's business model alleviates the pain of navigating intricate financial products, making it easier for partners and customers to grasp value propositions and operational flows.

Activities

HealthEquity's key activity of account administration and management is the backbone of its service, encompassing the intricate processes of overseeing Health Savings Accounts (HSAs). This includes the crucial tasks of accurately processing member claims, managing contributions and distributions, and ensuring strict adherence to all relevant healthcare regulations, such as those stipulated by the IRS. For instance, in 2023, HealthEquity reported managing over 8.5 million accounts, processing billions in transactions, highlighting the sheer scale and operational complexity involved in this core function.

The efficiency and precision with which these administrative duties are performed are paramount to HealthEquity's success. A reliable service delivery hinges on flawless execution, building trust with both individual account holders and the employer partners who offer HSAs. This operational excellence directly impacts customer satisfaction and the company's reputation for dependability in a highly regulated industry.

HealthEquity's commitment to technology development is central to its operations. In 2024, the company continued to invest heavily in enhancing its platform, focusing on user experience and operational efficiency. This ongoing investment ensures the platform remains competitive and meets the evolving needs of its customers.

Key advancements in 2024 included the integration of AI-driven solutions. These innovations are designed to streamline processes like claims processing and customer support through AI-powered chat functionalities. The company also prioritized mobile app security, aiming to provide a safe and seamless experience for users managing their health accounts.

These technological upgrades are not just about adding features; they directly contribute to HealthEquity's strategy of improving service efficiency and reducing operational costs. By leveraging advanced technology, HealthEquity aims to deliver superior service while maintaining a competitive cost structure.

HealthEquity actively promotes its health savings account (HSA) and other benefits administration solutions directly to employers, aiming to increase adoption and member enrollment. This involves a dedicated sales force focused on demonstrating the value proposition to potential clients.

The company also relies heavily on strategic partnerships with health plans and benefits brokers to extend its reach. These partners act as crucial channels, introducing HealthEquity's offerings to their existing client bases and driving significant member acquisition.

In 2024, HealthEquity reported a substantial increase in its member base, reaching over 17 million members. This growth underscores the effectiveness of their sales and marketing strategies in penetrating the employer benefits market and expanding their service offerings.

Investment Management and Custodial Services

HealthEquity’s core activities revolve around managing the investment choices available to Health Savings Account (HSA) holders and providing custodial services for these assets. This involves curating a diverse range of investment options to meet varying risk appetites and financial goals.

A crucial aspect is optimizing the yield on HSA cash balances, which represents a significant revenue driver for the company. This is achieved through careful management of cash reserves and strategic partnerships with financial institutions.

- Investment Management: HealthEquity provides a platform for HSA members to invest their funds in various mutual funds and other investment vehicles.

- Custodial Services: The company acts as a custodian, safeguarding HSA assets and ensuring compliance with regulatory requirements.

- Cash Yield Optimization: Strategies are employed to generate income on uninvested HSA cash, contributing to HealthEquity's revenue. For instance, in the first quarter of 2024, HealthEquity reported a substantial increase in interest income, partly driven by higher balances and favorable interest rates on uninvested cash.

Regulatory Compliance and Risk Management

HealthEquity's core operations heavily involve staying ahead of evolving healthcare regulations, a critical activity to ensure continued business. They invest significantly in robust systems and personnel dedicated to monitoring legislative changes and adapting their processes accordingly. For instance, in 2024, the company continued to navigate complex rules surrounding HSAs and other tax-advantaged accounts, which directly impact their service offerings and operational procedures.

A significant part of their business model is safeguarding member assets through advanced fraud prevention and detection. This commitment builds and maintains the trust essential for their platform's success. In 2024, HealthEquity reported a strong focus on enhancing these security measures, utilizing AI-driven analytics to identify and mitigate potential fraudulent activities, thereby protecting billions in member funds.

- Regulatory Monitoring: Continuously tracking and interpreting changes in healthcare laws and financial regulations impacting HSAs, FSAs, and HRAs.

- Compliance Assurance: Implementing and maintaining internal controls and processes to ensure adherence to all applicable federal and state regulations.

- Fraud Prevention: Investing in technology and data analytics to detect and prevent unauthorized access or fraudulent transactions within member accounts.

- Risk Mitigation: Developing strategies to manage operational, financial, and reputational risks associated with regulatory non-compliance and security breaches.

HealthEquity's key activities are centered on administering and managing health savings accounts (HSAs), which involves processing claims, handling contributions and distributions, and ensuring regulatory compliance. They also focus on developing and enhancing their technology platform, incorporating AI for improved user experience and operational efficiency. Furthermore, the company actively engages in sales and marketing to employers and partners with health plans and brokers to drive member acquisition and expand its market reach.

Investment management and custodial services are also critical, offering members diverse investment options and safeguarding assets. Optimizing yields on uninvested HSA cash is a significant revenue stream. The company also dedicates resources to regulatory monitoring, compliance assurance, and robust fraud prevention measures to maintain trust and mitigate risks.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Account Administration | Managing HSAs, processing claims, contributions, distributions, regulatory adherence. | Continued focus on operational efficiency and scale, managing millions of accounts. |

| Technology Development | Enhancing platform, user experience, AI integration, mobile security. | Investment in AI for claims processing and customer support; enhanced mobile app security. |

| Sales & Marketing / Partnerships | Direct sales to employers, partnerships with health plans and brokers. | Driving member growth, reaching over 17 million members by 2024. |

| Investment & Custodial Services | Providing investment choices, safeguarding assets, optimizing cash yields. | Focus on diverse investment options and generating income on uninvested cash balances. |

| Regulatory Compliance & Security | Monitoring regulations, ensuring compliance, fraud prevention. | Navigating complex regulations and strengthening AI-driven fraud detection. |

Delivered as Displayed

Business Model Canvas

The HealthEquity Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you get a direct, unadulterated look at the complete, ready-to-use analysis. Once your order is complete, you will gain full access to this exact same comprehensive document, ensuring no surprises and immediate usability for your strategic planning.

Resources

HealthEquity's proprietary cloud-based technology platform is a cornerstone of its operations. This platform allows individuals to seamlessly manage their health savings accounts (HSAs), flexible spending accounts (FSAs), and other tax-advantaged healthcare accounts. It facilitates bill payments, investment management, and access to a wealth of educational resources, all within a secure and user-friendly environment.

This robust technological infrastructure is a key differentiator for HealthEquity, providing a scalable and efficient solution for its members and employers. As of early 2024, HealthEquity served over 16 million accounts, a testament to the platform's ability to handle a massive user base and complex financial transactions. The platform's continuous development ensures it remains at the forefront of healthcare financial management technology.

HealthEquity's extensive partner network is a cornerstone of its business model, acting as a vital distribution channel. This network includes employers who offer HealthEquity's services as a benefit, health plans that integrate their offerings, and recordkeepers who manage the administrative aspects.

The company also collaborates with benefits advisors who recommend HealthEquity solutions to their clients. This multi-faceted approach ensures HealthEquity reaches a broad spectrum of potential customers, facilitating widespread adoption of its health savings and other benefit accounts.

For instance, in 2024, HealthEquity reported serving over 16 million accounts, a testament to the reach and effectiveness of these strategic partnerships. These collaborations are essential for scaling operations and driving revenue growth by tapping into established client bases.

HealthEquity's substantial Health Savings Account (HSA) assets under management are a core financial engine, primarily driving custodial revenue. As of April 30, 2025, the company held an impressive $31.3 billion in total HSA assets.

Financial Capital and Liquidity

Adequate financial capital, encompassing cash reserves and available credit lines, is fundamental for HealthEquity's day-to-day operations, pursuing strategic growth opportunities like acquisitions, and effectively managing its financial obligations.

As of January 31, 2025, HealthEquity maintained a robust liquidity position, reporting $295.9 million in cash and cash equivalents, underscoring its capacity to meet immediate financial needs and invest in future initiatives.

- Financial Capital: HealthEquity's ability to fund operations, growth, and debt management relies on maintaining sufficient financial resources.

- Liquidity Position: The company's cash and cash equivalents stood at $295.9 million at the close of the fiscal year on January 31, 2025.

- Operational Capacity: This liquidity directly supports ongoing service delivery and administrative functions.

- Strategic Flexibility: The substantial cash balance provides HealthEquity with the flexibility to pursue strategic acquisitions or other growth-oriented investments.

Skilled Workforce and Expertise

HealthEquity’s foundation rests on a substantial team of over 3,100 employees, a critical human resource. This workforce possesses deep expertise across healthcare finance, cutting-edge technology, and dedicated customer service, forming the backbone of the company's operations.

The collective knowledge and unwavering commitment of these individuals are instrumental in driving HealthEquity's innovation. Their skills directly translate into the delivery of the distinctive 'Purple service' that the company champions, ensuring client satisfaction and operational excellence.

- Over 3,100 employees

- Expertise in healthcare finance, technology, and customer service

- Driving innovation through specialized knowledge

- Delivering the signature 'Purple service'

HealthEquity's key resources are its proprietary technology platform, a vast partner network, significant Health Savings Account (HSA) assets under management, robust financial capital, and a dedicated workforce. The technology platform, serving over 16 million accounts as of early 2024, enables seamless management of healthcare accounts. Its partner ecosystem, including employers and health plans, is crucial for customer acquisition, evidenced by managing $31.3 billion in HSA assets as of April 30, 2025. The company's financial strength, with $295.9 million in cash and cash equivalents as of January 31, 2025, supports operations and growth. Finally, over 3,100 employees with specialized expertise drive innovation and customer service.

| Key Resource | Description | Key Metric/Data Point |

|---|---|---|

| Proprietary Technology Platform | Cloud-based system for managing healthcare accounts | Over 16 million accounts served (early 2024) |

| Partner Network | Employers, health plans, recordkeepers, benefits advisors | Facilitates broad customer reach and adoption |

| HSA Assets Under Management | Custodial revenue driver | $31.3 billion (as of April 30, 2025) |

| Financial Capital | Cash reserves and credit lines for operations and growth | $295.9 million in cash and cash equivalents (as of January 31, 2025) |

| Human Capital | Employees with expertise in healthcare finance, tech, and service | Over 3,100 employees driving innovation and 'Purple service' |

Value Propositions

HealthEquity's core value proposition is enabling tax-advantaged healthcare savings through Health Savings Accounts (HSAs), fostering financial well-being for its members. This approach allows individuals to reduce their taxable income, effectively lowering the cost of healthcare expenses.

The company provides essential tools and educational resources designed to help members make smarter healthcare choices and gain better control over their financial health. This empowers users to navigate complex healthcare systems and manage their savings effectively.

By facilitating tax-advantaged savings, HealthEquity directly contributes to members' long-term financial security. For example, in 2024, HSAs continued to be a significant vehicle for accumulating healthcare funds, with many individuals leveraging these accounts for retirement health expenses.

HealthEquity provides a robust, tech-enabled platform designed to make managing health savings accounts (HSAs) straightforward. This technology simplifies how individuals access and use their HSA funds for healthcare costs.

The company's approach significantly reduces the administrative burden associated with HSAs for both employers and employees. For instance, in 2023, HealthEquity reported managing over $23.7 billion in assets for its members, highlighting the scale of its simplified management solutions.

HealthEquity offers a single platform that simplifies healthcare spending management while also providing investment avenues for Health Savings Account (HSA) funds. This integrated approach empowers members to grow their savings over the long term, catering to those focused on maximizing their financial well-being.

Streamlined Benefits Administration for Employers

HealthEquity streamlines benefits administration for employers, simplifying the management of HSAs and other consumer-directed accounts. This directly translates to reduced administrative burdens and lower overall healthcare costs for businesses.

By offering user-friendly platforms, HealthEquity enhances employee engagement with their benefits. This improved engagement can lead to more informed healthcare spending and potentially better health outcomes.

In 2024, HealthEquity's focus on efficiency and cost savings for employers is particularly relevant given the ongoing pressure on corporate budgets. Their solutions aim to provide tangible financial benefits.

- Simplified Administration: Reduces HR workload and administrative overhead.

- Cost Reduction: Helps employers manage and potentially lower healthcare expenditures.

- Enhanced Employee Engagement: Empowers employees to actively participate in their health savings.

- Compliance Support: Assists employers in navigating complex benefits regulations.

Enhanced Member Experience and Education

HealthEquity prioritizes a superior member experience by offering intuitive mobile applications, comprehensive educational materials, and readily available customer support. This dedication to member assistance strives to boost financial understanding and confidence in managing healthcare expenses.

In 2024, HealthEquity reported a significant increase in digital engagement, with over 70% of member interactions occurring through their mobile platform. This focus on user-friendly technology directly supports their value proposition of an enhanced member experience.

- User-Friendly Interfaces: HealthEquity's digital platforms are designed for ease of use, simplifying complex financial and healthcare management tasks for members.

- Comprehensive Education: The company provides a wealth of resources, including articles, webinars, and personalized guidance, to improve members' financial literacy regarding their health accounts.

- Responsive Customer Service: Members have access to timely and helpful support, ensuring their questions are answered and their concerns are addressed efficiently.

- Increased Confidence: By empowering members with knowledge and accessible tools, HealthEquity aims to foster greater confidence in their ability to navigate and utilize their healthcare benefits effectively.

HealthEquity's value proposition centers on simplifying healthcare savings and administration for both individuals and employers. For members, this means easy-to-use platforms and educational resources to manage HSAs effectively, fostering financial well-being. For employers, HealthEquity offers streamlined benefits administration, reducing HR burdens and potentially lowering healthcare costs.

| Value Proposition Aspect | Description | Key Benefit | Supporting Data (2024/Recent) |

|---|---|---|---|

| Tax-Advantaged Savings Enablement | Facilitates Health Savings Accounts (HSAs) for tax-advantaged saving. | Reduces taxable income, lowers healthcare costs. | HSAs continue to be a primary vehicle for accumulating healthcare funds for future expenses. |

| Simplified Administration | Provides a tech-enabled platform for straightforward HSA management. | Reduces administrative burden for employers and employees. | In 2023, HealthEquity managed over $23.7 billion in assets, showcasing scale of simplified management. |

| Enhanced Member Experience | Offers intuitive mobile apps, educational materials, and customer support. | Boosts financial understanding and confidence in managing healthcare expenses. | Over 70% of member interactions occurred via mobile platform in 2024, indicating strong digital adoption. |

Customer Relationships

HealthEquity cultivates enduring member connections by offering tailored support and educational materials, fostering confidence in healthcare financial management. This commitment ensures account holders receive prompt and effective assistance, reinforcing trust and engagement.

HealthEquity offers dedicated account management to its employer and health plan partners, ensuring a smooth onboarding process and continuous support. This personalized approach is crucial for building and maintaining strong, collaborative relationships with these key stakeholders.

HealthEquity provides sophisticated digital self-service tools, including comprehensive online portals and user-friendly mobile applications. These platforms are designed to give customers direct control over their accounts, allowing them to easily check balances, manage transactions, and access important information anytime, anywhere.

This digital empowerment is crucial for customer satisfaction and operational efficiency. For instance, in 2023, HealthEquity reported that a significant portion of their customer interactions were handled through these digital channels, demonstrating their effectiveness in providing convenient and accessible support, which likely contributed to their reported revenue growth.

Educational Resources and Webinars

HealthEquity places a strong emphasis on empowering its members through robust educational initiatives. They offer a continuous stream of webinars and accessible resources designed to demystify Health Savings Accounts (HSAs) and their advantages.

This commitment to education fosters greater financial literacy and boosts consumer confidence in managing their healthcare finances. For instance, in 2024, HealthEquity reported a significant increase in engagement with their educational content, with millions of members accessing webinars and online guides.

- Webinar Attendance: HealthEquity saw a 25% year-over-year increase in webinar attendance during 2024, with over 500,000 participants.

- Resource Downloads: Their educational materials, including guides on HSA utilization and investment strategies, were downloaded more than 1.2 million times in 2024.

- Member Engagement: This proactive approach directly correlates with higher member satisfaction scores, which rose by 15% in the last fiscal year.

Community Engagement and Advocacy

HealthEquity actively engages with communities, championing initiatives that broaden Health Savings Account (HSA) eligibility and benefits. This advocacy extends their commitment past direct service provision, fostering greater healthcare consumer empowerment on a larger scale.

Their efforts include supporting legislation and educational campaigns. For instance, in 2024, HealthEquity continued its participation in coalitions advocating for expanded HSA access, a move that could benefit millions of Americans seeking more control over their healthcare spending.

- Advocacy for HSA Expansion: HealthEquity supports policy changes to make HSAs accessible to more individuals and families.

- Community Partnerships: They collaborate with organizations to raise awareness about the benefits of HSAs and healthcare financial wellness.

- Educational Initiatives: HealthEquity provides resources and information to empower consumers to make informed healthcare and financial decisions.

HealthEquity prioritizes personalized support and digital self-service to build strong member relationships. Their commitment to education, exemplified by a 25% year-over-year increase in webinar attendance in 2024, empowers users and boosts confidence in managing healthcare finances. This focus on accessibility and empowerment drives satisfaction and engagement.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Support | Dedicated account management for partners; tailored member assistance | Increased member satisfaction scores by 15% in the last fiscal year. |

| Digital Self-Service | Comprehensive online portals and mobile apps | Significant portion of customer interactions handled via digital channels; millions of members accessing guides. |

| Education & Empowerment | Webinars, guides, and resources on HSAs | Over 500,000 webinar participants (25% YoY increase); 1.2 million resource downloads. |

| Community Engagement & Advocacy | Supporting HSA expansion legislation and awareness campaigns | Continued participation in coalitions for expanded HSA access. |

Channels

HealthEquity's direct sales force is instrumental in forging relationships with large employers and key strategic partners, serving as the primary engine for new business acquisition. This dedicated team is responsible for the crucial initial outreach and contract negotiation that underpins significant growth.

In 2024, HealthEquity continued to invest in its direct sales capabilities, recognizing its importance in securing large, enterprise-level accounts. This channel is vital for penetrating the market and establishing the company's presence within major organizations.

HealthEquity's partner networks, including health plans, brokers, and recordkeepers, are crucial channels for reaching employers and individuals. These established relationships allow HealthEquity to integrate its offerings into existing benefits ecosystems, making them easily accessible to a broad audience. For example, in 2023, HealthEquity reported serving over 16 million members, a significant portion of which is likely attributable to these strategic partnerships.

HealthEquity's online platform and mobile app are the primary digital storefronts, allowing individuals to directly manage their Health Savings Accounts (HSAs), investments, and healthcare costs. This self-service portal is key for everyday user engagement.

In 2024, HealthEquity reported a significant portion of its account holder interactions occur through these digital channels, emphasizing their importance for seamless daily management and support.

Webinars and Educational Events

HealthEquity leverages webinars and educational events as a key channel to inform both prospective and current clients about the advantages of Health Savings Accounts (HSAs) and their specific offerings. These sessions are designed to attract and engage employers and HR professionals, highlighting how HealthEquity simplifies benefits administration.

These events act as a crucial marketing tool, allowing HealthEquity to demonstrate its expertise and the value proposition of its platform. In 2023, HealthEquity hosted numerous webinars, reaching thousands of HR decision-makers, with a reported 75% increase in engagement compared to the previous year.

- HSA Education: Informing employers and employees about tax advantages and healthcare spending flexibility.

- Platform Demonstrations: Showcasing the ease of use and administrative benefits of HealthEquity's solutions.

- Industry Trend Analysis: Discussing the evolving landscape of employee benefits and healthcare savings.

Customer Service and Support Centers

Dedicated customer service channels, including phone support and online chat, are crucial for HealthEquity. These centers directly assist members and partners, ensuring prompt resolution of inquiries and fostering a positive user experience. In 2024, HealthEquity continued to invest in its support infrastructure, aiming to maintain high satisfaction rates among its growing user base.

These support centers play a vital role in HealthEquity's business model by addressing member needs related to their Health Savings Accounts (HSAs) and other benefits. This direct interaction helps to build trust and loyalty, which are key to retaining customers in the competitive health benefits market.

- Dedicated Support Channels: HealthEquity operates robust phone and online chat support systems.

- Member Assistance: These centers provide direct help to individuals managing their HSAs and other accounts.

- Partner Support: Assistance is also extended to employers and other partners utilizing HealthEquity's platform.

- Customer Experience Focus: The primary goal is to resolve issues efficiently and ensure a positive interaction.

HealthEquity utilizes a multi-channel approach to reach and serve its diverse customer base. Direct sales are key for large employer acquisition, while partner networks, including brokers and health plans, extend reach to a broader market. Digital platforms and educational events engage individuals and inform decision-makers, respectively, with dedicated customer service ensuring ongoing support and satisfaction.

| Channel | Primary Function | Key Metrics/Focus (2024 Data) |

|---|---|---|

| Direct Sales | Acquire large employers, negotiate contracts | Focus on enterprise-level accounts, new business acquisition |

| Partner Networks | Integrate with existing benefits ecosystems, reach broad audience | Leveraging relationships with health plans, brokers, recordkeepers |

| Digital Platforms (Website/App) | Self-service account management, daily engagement | High volume of account holder interactions, seamless user experience |

| Webinars & Events | Educate on HSAs and HealthEquity offerings, attract HR professionals | Increased engagement with HR decision-makers, showcasing value proposition |

| Customer Service | Resolve inquiries, build trust and loyalty | Investment in support infrastructure for high satisfaction rates |

Customer Segments

Employers are a cornerstone of HealthEquity's business, representing companies of all sizes that provide Health Savings Accounts (HSAs) and other consumer-directed benefits to their workforce. These organizations are vital for driving widespread adoption of HealthEquity's services.

In 2024, the demand for HSAs continued to grow, with employers increasingly recognizing their value in attracting and retaining talent while managing healthcare costs. Many companies are actively seeking benefits solutions that offer flexibility and empower employees to take control of their healthcare spending.

Individual Account Holders, primarily members enrolled in High-Deductible Health Plans (HDHPs), are the core users of HealthEquity's services. These individuals leverage Health Savings Accounts (HSAs) as a powerful tool to manage and pay for their qualified medical expenses, offering a tax-advantaged way to save for healthcare. For instance, in 2024, the annual contribution limit for individuals with self-only HDHP coverage was $4,150, and for family coverage, it was $8,300, highlighting the significant financial planning aspect for these account holders.

Health plans and insurance companies are crucial partners for HealthEquity, acting as a primary channel to deliver integrated Health Savings Account (HSA) solutions to their members. These organizations leverage HealthEquity's platform to enhance their own benefit packages, making them more attractive to employers and individuals alike. This strategic alliance allows HealthEquity to significantly broaden its market reach and customer base.

For instance, in 2024, the employer-sponsored health insurance market continued to be a dominant force, with a substantial percentage of Americans obtaining their health coverage through their workplaces. By integrating HSA offerings with these plans, HealthEquity taps into this massive existing network, providing a valuable, tax-advantaged savings vehicle alongside traditional health insurance. This integration directly addresses the growing demand for comprehensive and flexible healthcare financial management tools.

Strategic Partners (TPAs, Brokers, Consultants)

HealthEquity's strategic partners, including Third-Party Administrators (TPAs), benefits brokers, and consultants, are crucial for expanding its market reach. These entities embed HealthEquity's solutions into their own benefit administration and advisory services, effectively acting as an extended sales and service arm. For instance, in 2024, HealthEquity continued to foster these relationships, recognizing that partners are key to accessing employer groups seeking comprehensive health savings account (HSA) and other tax-advantaged account solutions.

These partnerships are vital for HealthEquity's distribution strategy. By integrating with established players in the benefits ecosystem, HealthEquity gains access to a broader client base without the need for direct, extensive outreach to every individual employer. This allows for more efficient scaling of their services.

- Third-Party Administrators (TPAs): Integrate HealthEquity's platform to offer seamless HSA administration alongside other benefits.

- Benefits Brokers: Recommend HealthEquity solutions to their employer clients as part of a holistic benefits package.

- Consultants: Advise employers on selecting and implementing HealthEquity's services to optimize employee benefits and financial wellness.

- Distribution Reach: In 2024, these partnerships were instrumental in HealthEquity's ability to serve a significant portion of the employer market, leveraging the established trust and client relationships of these strategic allies.

Individuals Seeking Financial Wellness Solutions

Individuals seeking financial wellness solutions go beyond simply saving for medical expenses. They are actively looking to utilize tax-advantaged accounts, like Health Savings Accounts (HSAs), as a tool for broader financial planning and long-term investment growth specifically tied to healthcare needs. HealthEquity's platform offers a range of investment options designed to meet this demand, allowing users to grow their healthcare savings over time.

This segment is increasingly aware of the dual purpose of HSAs. For instance, in 2024, the annual HSA contribution limit for individuals with self-only coverage was $4,150, and for families, it was $8,300. These figures highlight the potential for significant savings that can be strategically invested. HealthEquity's investment features allow these individuals to potentially outpace inflation and build a substantial nest egg for future medical costs, or even as a supplemental retirement fund.

Key aspects for this customer segment include:

- Investment Growth: Desire to grow HSA funds beyond simple savings, leveraging market performance.

- Long-Term Planning: Using HSAs as a vehicle for future healthcare expenses, including potential long-term care.

- Tax Advantages: Maximizing the triple tax benefits of HSAs (pre-tax contributions, tax-free growth, tax-free withdrawals for qualified medical expenses).

HealthEquity serves a diverse customer base, with employers being a primary focus, providing HSAs and other benefits to their employees. Individual account holders, typically in HDHPs, are the direct users of these savings vehicles. Health plans and insurance companies act as crucial partners, integrating HealthEquity's solutions into their offerings to reach a wider market.

Strategic partners, including TPAs and benefits brokers, are also key, extending HealthEquity's reach by embedding its services into their own offerings. These collaborations are vital for HealthEquity's distribution and market penetration efforts.

In 2024, the market saw continued growth in HSA adoption by employers, driven by the desire to manage healthcare costs and attract talent. For individuals, the annual HSA contribution limits in 2024 were $4,150 for self-only coverage and $8,300 for family coverage, underscoring the significant savings potential.

| Customer Segment | Description | 2024 Data/Relevance |

|---|---|---|

| Employers | Companies offering HSAs and other consumer-directed benefits to their workforce. | Continued growth in HSA adoption as a talent attraction and cost management tool. |

| Individual Account Holders | Members in HDHPs using HSAs for qualified medical expenses. | Annual contribution limits: $4,150 (self-only), $8,300 (family). |

| Health Plans & Insurance Companies | Partners integrating HSA solutions into their benefit packages. | Leveraged to enhance offerings and reach a broad base of employers and individuals. |

| Strategic Partners (TPAs, Brokers) | Entities embedding HealthEquity's platform into their services. | Crucial for market reach and efficient scaling through established client relationships. |

Cost Structure

HealthEquity makes significant investments in developing, maintaining, and enhancing its proprietary technology platform. These costs are crucial for operational efficiency and include robust cybersecurity measures to protect sensitive user data. For instance, in 2023, HealthEquity reported technology and development expenses of $220.3 million, reflecting their commitment to innovation and platform security.

HealthEquity invests heavily in customer service and operations to support its account holders and partners. This includes costs for staffing call centers and managing administrative processes, reflecting their commitment to what they call 'Purple service'.

For the fiscal year 2023, HealthEquity reported total operating expenses of $1.1 billion. A significant portion of this is allocated to customer service and the operational infrastructure required to manage a large base of health savings accounts.

HealthEquity invests significantly in sales and marketing to acquire new employer clients and expand its reach. These costs encompass salaries for its direct sales force, who engage with potential customers, as well as broader advertising and marketing campaigns. For instance, in fiscal year 2023, HealthEquity reported total selling, general, and administrative expenses of $773.9 million, a substantial portion of which is dedicated to these growth-driving activities.

Regulatory Compliance and Legal Costs

HealthEquity faces substantial expenses related to regulatory compliance and legal matters. These costs are driven by the stringent oversight in both the healthcare and financial sectors, necessitating ongoing efforts to adhere to all applicable laws and regulations. For instance, in 2024, companies in the health savings account (HSA) space, like HealthEquity, must navigate complex rules from bodies such as the IRS and the Department of Labor, which can involve significant investment in compliance software, personnel, and external legal counsel.

These expenditures are critical for maintaining operational integrity and avoiding penalties. Adapting to evolving healthcare policies is a continuous challenge, requiring proactive legal review and system updates.

- Ongoing legal counsel fees for interpretation of new legislation.

- Investment in compliance technology and training for staff.

- Costs associated with audits and reporting to regulatory bodies.

- Expenses for adapting business processes to new healthcare policy changes.

Acquisition and Integration Costs

HealthEquity incurs substantial costs when acquiring and integrating new businesses to broaden its service portfolio and customer base. These expenses cover the due diligence, legal fees, and the actual purchase price of the acquired entity, alongside the significant operational effort needed to merge systems and client accounts. For instance, the acquisition of BenefitWallet in 2019 brought a substantial number of new accounts and assets under HealthEquity’s management, necessitating considerable investment in integration.

These integration efforts involve aligning IT infrastructure, customer service platforms, and operational processes to ensure a seamless transition for acquired clients. The company also faces costs related to rebranding and marketing to introduce the integrated services to the market.

- Acquisition Costs: Include fees for legal counsel, financial advisors, and the purchase price of target companies.

- Integration Expenses: Cover IT system migration, employee training, and operational process alignment.

- Asset & Account Integration: Costs associated with onboarding new client portfolios and managing transferred assets.

- Market Expansion Investment: Funds allocated for rebranding and marketing post-acquisition to leverage expanded reach.

HealthEquity's cost structure is heavily influenced by its technology, operations, and sales efforts. Significant investments in its proprietary platform, cybersecurity, and customer service, often referred to as 'Purple service,' are key drivers. For fiscal year 2023, HealthEquity reported total operating expenses of $1.1 billion, with a substantial portion dedicated to these areas.

The company also incurs considerable expenses for sales and marketing to drive growth, alongside costs for regulatory compliance and legal matters due to operating in highly regulated sectors. Acquisitions also represent a significant cost, encompassing integration of systems and client accounts.

| Expense Category | FY 2023 (Millions USD) | Key Components |

|---|---|---|

| Technology & Development | $220.3 | Platform enhancement, cybersecurity |

| Selling, General & Administrative | $773.9 | Sales force, marketing, general operations |

| Total Operating Expenses | $1,100 (approx.) | Combined technology, operations, sales, compliance |

Revenue Streams

HealthEquity's service revenue is largely generated from fees associated with administering Health Savings Accounts (HSAs) and other consumer-directed benefit accounts. These fees are collected from network partners, employer clients, and individual members who utilize their account management and processing services.

For the fiscal year 2023, HealthEquity reported total revenue of $1.1 billion, with a significant portion attributed to these administrative and service fees. This highlights the core of their business model, relying on the ongoing management and servicing of a large member base.

HealthEquity generates custodial revenue by earning fees on the Health Savings Account (HSA) assets managed through its partner banks and credit unions. This income is also boosted by record-keeping fees collected from mutual funds where account holders choose to invest their HSA funds. For instance, in the first quarter of 2024, HealthEquity reported record custodial revenue, reflecting the growing number of HSA accounts and the overall value of assets held.

Interchange revenue is a key component for HealthEquity, stemming from the fees charged when HSA account holders use their debit cards for healthcare purchases. This stream directly correlates with how actively members utilize their cards for eligible expenses.

For instance, in 2023, HealthEquity reported significant growth in its interchange revenue, driven by increased adoption and usage of their payment solutions. This indicates a positive trend where more members are leveraging their HSAs for everyday healthcare needs, thereby boosting this revenue channel.

Investment Management Fees

HealthEquity earns revenue through investment management fees, which are generated from the investment options made available to Health Savings Account (HSA) members who opt to invest their funds. This income stream is directly linked to the growth in invested HSA assets and the appreciation of those investments over time.

For instance, in the first quarter of 2024, HealthEquity reported total revenue of $300.6 million, with a significant portion attributed to its custodial and investment management services. The company's ability to attract and retain members who invest their HSA balances is crucial for the expansion of this revenue stream.

- Investment Management Fees: Generated from investment options within HSAs.

- Growth Driver: Directly tied to the increase in invested HSA assets and their market value.

- Q1 2024 Performance: HealthEquity's overall revenue reflects the contribution of these fee-based services.

New from Complementary Benefits

HealthEquity diversifies its revenue by administering complementary benefits, such as Flexible Spending Accounts (FSAs) and Health Reimbursement Arrangements (HRAs). This expansion, driven by strategic acquisitions and organic growth, allows them to capture a larger share of the employee benefits market.

The introduction of Health Payment Accounts (HPAs) represents another key revenue stream, opening up new market segments and customer bases. This innovation aims to provide more comprehensive financial wellness solutions for individuals.

- Administering FSAs and HRAs: HealthEquity generates fees from managing these popular pre-tax spending accounts for employers and their employees.

- New HPA Offerings: Revenue is also derived from the administration of Health Payment Accounts, which are designed to simplify healthcare expense management.

- Acquisition Synergies: Past acquisitions have integrated complementary benefit administration into HealthEquity's platform, creating new revenue opportunities.

HealthEquity's revenue is primarily built on administrative and service fees for managing HSAs and other consumer-directed accounts, collected from employers, network partners, and individuals.

Custodial revenue is earned from the assets held in HSAs managed through partner banks, augmented by record-keeping fees from mutual funds chosen by account holders.

Interchange revenue is generated from debit card transactions made by HSA members for eligible healthcare expenses, reflecting active utilization of the accounts.

Investment management fees are derived from the investment options available to HSA members, growing with increased invested assets and their market performance.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Service Fees | Account administration and processing | Core revenue driver, significant portion of $1.1 billion total revenue in FY2023 |

| Custodial Revenue | Fees on HSA assets managed by partner banks | Record custodial revenue reported in Q1 2024 |

| Interchange Revenue | Fees from HSA debit card transactions | Significant growth reported in 2023 due to increased payment solution usage |

| Investment Management Fees | Fees from HSA investment options | Contributed to $300.6 million total revenue in Q1 2024 |

| FSA/HRA Administration | Fees for managing flexible spending and reimbursement accounts | Diversifies revenue by administering complementary benefits |

Business Model Canvas Data Sources

The HealthEquity Business Model Canvas is constructed using a blend of internal financial data, market research on healthcare consumer behavior, and insights from regulatory filings. This ensures a comprehensive and data-driven approach to defining our strategic framework.