HealthEquity Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HealthEquity Bundle

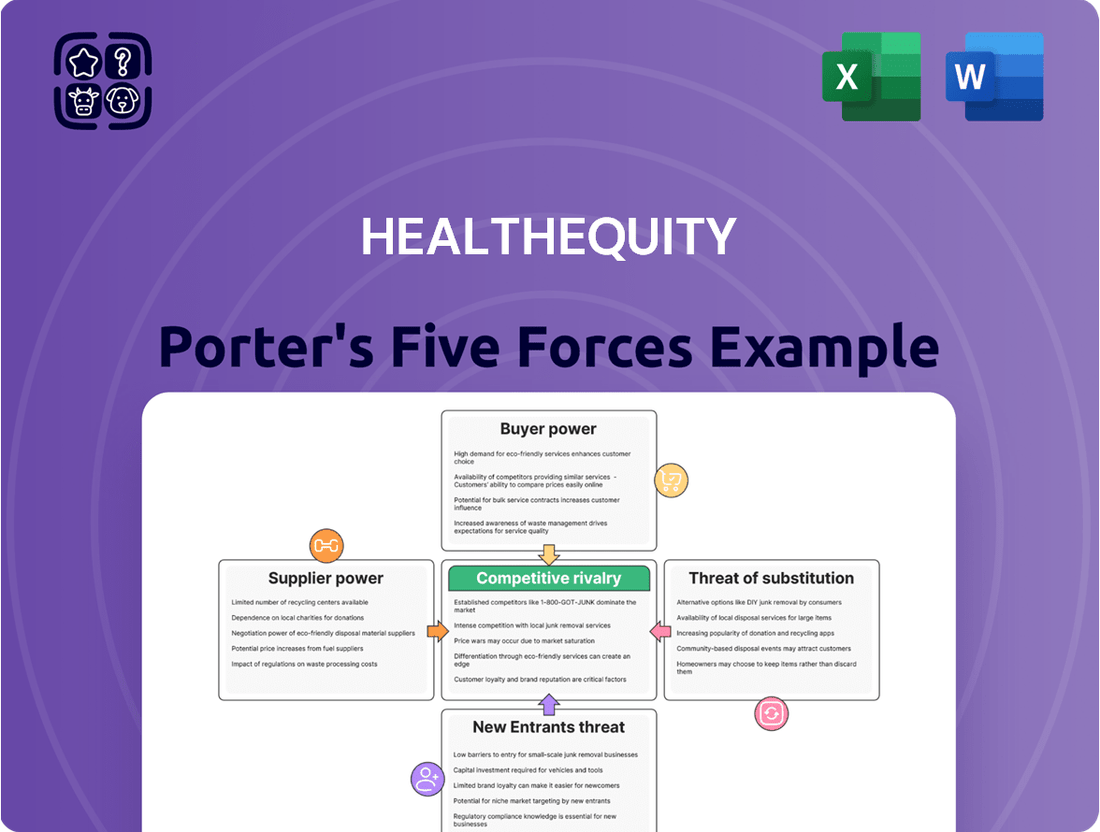

HealthEquity navigates a dynamic landscape shaped by intense buyer power from large employers and significant threats from potential new entrants offering innovative solutions. Understanding these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping HealthEquity’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for specialized financial technology and secure custodial services crucial for Health Savings Accounts (HSAs) can be quite concentrated. This concentration means a limited number of providers possess the necessary scale and regulatory expertise, granting them significant bargaining power over companies like HealthEquity.

HealthEquity's reliance on investment fund managers for its Health Savings Account (HSA) offerings is a significant factor in its supplier power analysis. The company provides a wide array of investment choices, meaning it must partner with external mutual fund providers and other investment product managers. The terms, performance, and fees associated with these underlying investments directly impact HealthEquity's competitiveness and customer appeal.

HealthEquity faces considerable supplier bargaining power due to high switching costs associated with its core technology platforms and custodial banking partners. Transitioning these critical systems is not only complex and expensive but also carries significant operational disruption, making it challenging for HealthEquity to change providers. For instance, in 2023, HealthEquity reported approximately $2.2 billion in revenue, highlighting the scale of operations tied to these foundational supplier relationships.

Differentiation of Supplier Services

When suppliers offer highly specialized or proprietary services, their bargaining power increases. For HealthEquity, this is evident in providers of unique data analytics or robust cybersecurity solutions crucial for managing vast financial accounts. These differentiated services are hard for HealthEquity to replicate internally or source from alternative providers, giving these suppliers leverage.

HealthEquity's reliance on advanced and secure platforms for managing millions of accounts and billions in assets underscores the importance of these specialized supplier services. For instance, in 2024, the healthcare technology sector saw significant investment in AI-driven analytics, with companies offering such niche capabilities commanding premium pricing due to their unique value proposition.

- Specialized Technology: Suppliers with proprietary platforms for health savings account (HSA) administration or unique investment management tools can dictate terms.

- Cybersecurity Prowess: Given the sensitive nature of financial and health data, providers of advanced, industry-leading cybersecurity solutions hold considerable sway.

- Data Analytics Capabilities: Firms offering sophisticated analytics for compliance, fraud detection, or customer insights in the healthcare finance space are highly valued.

Power of Distribution Partners (e.g., Benefits Advisors)

The bargaining power of distribution partners, such as benefits advisors and health plans, is a crucial factor for HealthEquity. These entities act as gatekeepers, influencing which Health Savings Account (HSA) providers employers choose. Their recommendations carry significant weight, directly impacting HealthEquity's customer acquisition and market penetration.

In 2024, the landscape of benefits administration continued to see consolidation, potentially increasing the leverage of larger health plans and benefits consulting firms. These partners can demand more favorable terms or integration capabilities from HSA providers like HealthEquity, impacting fee structures and service level agreements.

- Influence on Employer Decisions: Benefits advisors often guide employers through the complex decision-making process for selecting HSAs, making their endorsement vital for HealthEquity's business development.

- Network Reach: The extensive networks of major health insurance providers and large benefits consulting firms offer HealthEquity access to a broad employer base, but this access comes with the expectation of value and competitive pricing.

- Integration Demands: Distribution partners increasingly require seamless integration with their existing platforms, creating a barrier to entry for HSA providers who cannot meet these technical demands.

- Potential for Competition: If these distribution partners develop their own in-house HSA solutions or partner exclusively with competitors, HealthEquity's market share could be adversely affected.

HealthEquity's reliance on specialized technology providers, particularly for its core HSA administration platforms and investment management services, grants these suppliers significant bargaining power. The high switching costs associated with these critical systems, coupled with the specialized nature of services like advanced cybersecurity and data analytics, mean HealthEquity has limited alternatives. This leverage allows suppliers to negotiate favorable terms, impacting HealthEquity's operational costs and service delivery.

| Supplier Type | Reason for Bargaining Power | Impact on HealthEquity |

|---|---|---|

| Technology Platform Providers | Proprietary systems, high switching costs | Dictate terms for essential services, potential for increased fees |

| Investment Fund Managers | Essential for diverse investment offerings | Influence product selection, fees, and performance impacting customer appeal |

| Cybersecurity & Data Analytics Firms | Specialized, high-value services crucial for data protection | Command premium pricing due to unique capabilities and demand for security |

What is included in the product

This analysis dissects the competitive forces impacting HealthEquity, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes within the health savings account and benefits administration market.

HealthEquity's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures, perfect for quickly identifying and addressing potential market threats.

Customers Bargaining Power

HealthEquity's diverse customer base, including employers, health plans, and recordkeepers, faces a market brimming with HSA provider options. This abundance of choice directly fuels their bargaining power.

Competitors like Fidelity, Lively, WEX Benefits, and Optum Financial provide robust alternatives, offering similar services and features. This competitive landscape means customers can easily switch or negotiate terms, putting pressure on HealthEquity to remain competitive on pricing and service quality. For instance, as of early 2024, the HSA market has seen significant growth, with total assets in HSAs exceeding $100 billion, indicating a highly active and competitive environment where customer retention is paramount.

Employers switching HSA providers, while requiring some administrative effort, have seen the process become significantly more streamlined. This ease of transition, fueled by industry competition and technological improvements, directly enhances the bargaining power of these employer clients.

The ability for employers to readily switch HSA administrators puts considerable pressure on companies like HealthEquity to offer competitive pricing and superior service. For instance, in 2024, the HSA market continued to see new entrants and existing players enhancing their onboarding processes, making it even simpler for employers to migrate their accounts, thereby amplifying customer leverage.

Employers and health plans are keenly focused on managing costs and making their benefits attractive to employees. This means they scrutinize the fees and overall value offered by Health Savings Account (HSA) providers, making them powerful negotiators.

For instance, in 2024, many large employers reported that employee benefits costs were a significant concern, with some actively seeking to reduce administrative fees associated with programs like HSAs. This pressure directly translates into a demand for competitive pricing from HSA administrators.

Customer Size and Consolidation in Employer Market

The bargaining power of customers in the employer market significantly impacts HealthEquity. Large employers and national health plans command substantial volumes of accounts and assets. This scale grants them considerable leverage when negotiating crucial terms like service level agreements, pricing structures, and the need for customized solutions.

Further consolidation within this employer segment could amplify their collective bargaining power. For instance, if a major employer or a group of similar employers decides to pool their purchasing power, they can demand more favorable terms from service providers like HealthEquity.

- Significant Client Volumes: Large employers and national health plans represent a substantial portion of HealthEquity's client base, giving them considerable negotiating clout.

- Leverage in Negotiations: This scale allows these clients to influence service level agreements, pricing, and the customization of HealthEquity's offerings.

- Impact of Consolidation: Increased consolidation among large employers could further strengthen their collective bargaining power, potentially leading to more aggressive demands.

- Asset Management Scale: The significant assets managed by these large clients for their employees' health accounts provide an additional layer of leverage in their dealings with HealthEquity.

Access to Information and Benchmarking Tools

Customers today are incredibly well-informed, thanks to readily available industry reports, insights from consultants, and sophisticated benchmarking tools. This access allows them to precisely evaluate HealthEquity's services and pricing against those of its competitors.

This transparency in the market significantly boosts their ability to negotiate for the best possible solutions and terms. For instance, in 2024, the average consumer spent an estimated $500 annually on healthcare-related services, making informed decisions about their benefits providers even more critical.

- Informed Decision-Making: Customers can easily compare HealthEquity's features, fees, and customer satisfaction ratings with those of other health savings account administrators.

- Price Sensitivity: With clear visibility into market pricing, customers are more likely to push for competitive rates and favorable contract terms.

- Demand for Value: Well-informed customers expect not just basic services but also robust digital tools, educational resources, and responsive support, driving HealthEquity to continuously enhance its offerings.

- Competitive Landscape Awareness: Understanding the competitive offerings allows customers to leverage their knowledge to secure better deals and service levels.

HealthEquity's customers, particularly large employers and health plans, possess significant bargaining power due to the substantial volume of accounts and assets they represent. This scale allows them to negotiate favorable terms, impacting pricing and service level agreements. For instance, as of early 2024, the HSA market's growth to over $100 billion in assets underscores the financial clout these large clients wield, making them key influencers in contract negotiations.

The increasing ease of switching HSA providers, driven by industry competition and technological advancements, further amplifies customer leverage. Employers can more readily migrate their accounts, pressuring HealthEquity to maintain competitive pricing and superior service quality. In 2024, enhanced onboarding processes by competitors made client transitions simpler, directly increasing the bargaining power of employer clients.

Customers are well-informed about market offerings, enabling them to compare HealthEquity's services and pricing against competitors. This transparency fuels demands for competitive rates and better value, pushing HealthEquity to continuously improve its digital tools and support. The average consumer's annual healthcare spending in 2024, estimated around $500, highlights the importance of informed benefit provider selection.

Same Document Delivered

HealthEquity Porter's Five Forces Analysis

This preview showcases the comprehensive HealthEquity Porter's Five Forces Analysis, detailing the competitive landscape of the health savings account administrator. The document you see here is the exact, professionally crafted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

The Health Savings Account (HSA) market is intensely competitive, with numerous specialized administrators like Lively and WEX Benefits, alongside major financial institutions such as Fidelity and Bank of America, all actively seeking to capture market share. HealthEquity, as a prominent HSA custodian, directly contends with this broad spectrum of rivals, each offering distinct value propositions and targeting different customer segments.

While the Health Savings Account (HSA) market features numerous participants, a notable trend is the increasing concentration among the top players. By the end of 2023, the top five HSA providers collectively managed over 60% of all HSA assets, a significant increase from previous years. This consolidation intensifies the competitive rivalry among these leading firms, including HealthEquity, as they vie for market share in a maturing and consolidating landscape.

The Health Savings Account (HSA) market is booming, with assets and accounts seeing significant increases. This rapid expansion is largely due to greater public understanding of HSAs and more employers offering high-deductible health plans. For instance, the HSA market saw a 20% year-over-year growth in assets in 2023, reaching over $100 billion.

This strong growth environment naturally attracts and energizes competitors. Existing players are motivated to scale up their services and capture new customers, leading to a highly competitive landscape. New entrants are also drawn to the market's potential, further intensifying the rivalry as companies vie for market share.

Differentiation Through Technology and Service

Competitive rivalry in the health savings account (HSA) and benefits administration sector extends beyond mere pricing. Companies like HealthEquity differentiate themselves through advanced technology platforms, a diverse range of investment options, and superior customer service. The seamless integration of these services with employer payroll and benefits systems is a critical factor for retention and acquisition.

HealthEquity's strategic focus on innovation and cultivating key partnerships underscores its commitment to building a distinct competitive edge. This approach aims to provide employers and individuals with a holistic and user-friendly solution for managing their healthcare finances. For instance, in 2024, HealthEquity continued to enhance its digital tools, reporting a significant increase in user engagement with its mobile app, indicating successful platform differentiation.

- Platform Innovation: HealthEquity invests in user-friendly interfaces and robust backend systems to streamline account management and employee engagement.

- Investment Options: Offering a wider array of investment choices, from conservative mutual funds to more aggressive options, attracts and retains users seeking growth.

- Customer Support: Providing responsive and knowledgeable customer service is paramount, addressing user inquiries about account management, eligible expenses, and investment performance.

- Employer Integration: Seamless integration with employer HR and payroll systems simplifies administration for businesses and enhances the employee experience.

Importance of Employer Partnerships and Distribution Channels

The battle for employer partnerships is intense, as these relationships are key to HealthEquity's market reach. Securing and keeping strong ties with employers, alongside health plans and recordkeepers, is vital for expanding its presence and growing its business. This competition for strategic alliances underscores their critical role in the HealthEquity industry's competitive landscape.

HealthEquity's success hinges on its ability to cultivate and maintain robust relationships with employers. These partnerships are the primary conduits for distributing its Health Savings Account (HSA) solutions. In 2023, HealthEquity reported serving over 16 million accounts, a testament to the strength of its employer network.

- Employer Partnerships: HealthEquity's growth is directly linked to its ability to win and retain employer clients, who then offer its HSA products to their employees.

- Health Plan & Recordkeeper Alliances: Collaborations with health insurance providers and financial recordkeepers are essential for seamless integration and broader distribution of HSA services.

- Competitive Pressure: Rival firms actively compete for these same strategic partnerships, driving up the value and importance of each successful alliance.

- Market Penetration: Strong distribution channels through employers and partners are crucial for HealthEquity to penetrate new markets and increase its overall market share.

Competitive rivalry within the HSA market is fierce, with HealthEquity facing numerous specialized administrators and large financial institutions. This intense competition drives innovation in platform features, investment options, and customer service, as companies strive to differentiate themselves and capture market share.

The market's rapid growth, with a 20% year-over-year increase in assets in 2023 reaching over $100 billion, fuels this rivalry. Top providers now manage over 60% of HSA assets, intensifying competition among these leading firms.

HealthEquity's strategy involves differentiating through technology, diverse investment choices, and strong employer partnerships. In 2024, enhanced digital tools and user engagement on their mobile app demonstrate this focus on platform superiority.

| Competitor Type | Key Differentiators | Market Share Impact |

|---|---|---|

| Specialized Administrators (e.g., Lively, WEX Benefits) | Niche focus, user-friendly interfaces | Targeted customer segments, agile innovation |

| Major Financial Institutions (e.g., Fidelity, Bank of America) | Brand recognition, broad financial services | Leveraging existing customer base, cross-selling |

| Consolidated Top Providers | Scale, comprehensive benefit solutions | Dominating asset management, driving industry standards |

SSubstitutes Threaten

Flexible Spending Accounts (FSAs) present a significant threat of substitution for Health Savings Accounts (HSAs). FSAs are widely adopted by employers, offering tax-advantaged savings for healthcare costs. In 2023, approximately 88% of large employers offered FSAs, making them a readily available alternative for many individuals.

However, FSAs typically operate on a "use it or lose it" principle, with limited options for carrying over unused funds to the next year. This contrasts sharply with HSAs, which allow balances to accumulate indefinitely and can be invested for long-term growth, making HSAs a more attractive option for individuals focused on future healthcare needs and wealth building.

Health Reimbursement Arrangements (HRAs) present a notable substitute. These are employer-funded accounts designed to reimburse employees for eligible medical costs. For instance, in 2024, many employers continued to offer various HRA designs as part of their benefits packages, aiming to provide a degree of cost containment while offering employee choice within defined parameters.

A key distinction is that HRAs are employer-owned and typically not portable. This means employees generally cannot take their HRA funds with them if they leave the company, unlike Health Savings Accounts (HSAs). This lack of portability can limit an employee's ability to accumulate long-term savings specifically for healthcare needs.

Individuals may choose to save for healthcare expenses in traditional savings or brokerage accounts instead of HealthEquity's Health Savings Accounts (HSAs). These alternatives, however, do not offer the same tax advantages. For instance, in 2024, the maximum HSA contribution for self-only coverage was $4,150, and for family coverage, it was $8,300, with an additional $1,000 catch-up contribution for those aged 55 and over.

These conventional accounts lack the triple tax benefit of HSAs: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. This makes HSAs a more compelling option for long-term healthcare savings compared to general investment vehicles.

Employer-Sponsored Benefits and Direct Payment Programs

Employers may offer alternative health benefits or direct payment programs that diminish the reliance on Health Savings Accounts (HSAs). For instance, comprehensive traditional health insurance plans that cover a larger portion of medical costs upfront can reduce the perceived need for an HSA. In 2024, the average employer contribution to HSAs was reported to be around $1,200 for individuals and $2,400 for families, but these figures can vary significantly, and employers might shift these funds to other benefit structures.

The emergence of new payment solutions, such as Health Payment Accounts, also presents a substitute. These accounts might offer different features or a more streamlined approach to managing healthcare expenses, potentially drawing employee interest away from HSAs. As healthcare costs continue to be a significant concern for both employers and employees, the competitive landscape of benefit offerings is constantly evolving, with innovative solutions emerging to meet diverse needs.

- Alternative Employer Benefits: Some employers provide richer traditional health insurance plans or wellness programs that cover more out-of-pocket expenses, reducing the perceived value of an HSA.

- Direct Payment Programs: Certain providers or employers may offer direct payment or discount programs for specific services, bypassing the need for HSA funds.

- Emerging Payment Solutions: New financial products or health payment accounts could offer similar or superior benefits to HSAs, acting as direct substitutes.

- Employee Preference Shifts: Employee demand for simpler or more immediate healthcare cost solutions might lead them to favor alternatives over the long-term savings and investment potential of HSAs.

Evolving Healthcare Payment Models and Technology

The threat of substitutes for HealthEquity's core offerings, particularly Health Savings Accounts (HSAs), is growing due to evolving healthcare payment models and technology. Direct primary care (DPC) initiatives, for instance, offer predictable monthly fees for a defined set of services, potentially reducing the need for a separate savings vehicle like an HSA for some consumers. In 2023, the DPC market was valued at approximately $15 billion and is projected to grow significantly, indicating a rising alternative for healthcare access and payment.

Innovative health technology solutions that streamline out-of-pocket payments or offer integrated financial management for healthcare expenses also pose a threat. These might include advanced payment platforms or digital wallets specifically designed for medical bills. For example, some fintech companies are developing tools that allow for installment payments on medical debt, which could lessen the perceived necessity of accumulating funds in an HSA for unexpected costs.

These advancements can indirectly substitute for HSAs by simplifying the financial aspect of healthcare. If consumers find it easier to manage and pay for healthcare expenses through these new models or technologies, the unique benefits of HSAs, such as tax advantages for long-term savings and investment growth, might become less compelling for a segment of the market. This could impact HealthEquity's ability to attract and retain members who prioritize immediate payment convenience over long-term tax benefits.

Key substitute trends impacting HealthEquity include:

- Direct Primary Care (DPC) Growth: DPC models provide an alternative payment structure for routine healthcare, potentially bypassing the need for traditional insurance and associated savings accounts like HSAs.

- Fintech Innovations in Healthcare Payments: New financial technology solutions are emerging that offer simplified payment processing, installment plans, and integrated financial management for medical expenses.

- Digital Health Wallets: The development of specialized digital wallets for healthcare costs could streamline out-of-pocket payments, making them more manageable and less reliant on dedicated savings vehicles.

- Shifting Consumer Preferences: A growing consumer preference for convenience and predictable costs in healthcare may favor simpler payment solutions over complex savings and investment accounts.

The threat of substitutes for Health Savings Accounts (HSAs) is significant, as consumers have various ways to manage healthcare expenses. Flexible Spending Accounts (FSAs) are a common alternative, with around 88% of large employers offering them in 2023. However, their "use it or lose it" nature makes them less attractive for long-term savings compared to HSAs.

Health Reimbursement Arrangements (HRAs) are another substitute, employer-funded and designed for medical cost reimbursement. Unlike HSAs, HRAs are typically not portable, limiting long-term accumulation for individuals changing employers. Traditional savings and brokerage accounts also serve as substitutes, but they lack the crucial triple tax advantage offered by HSAs.

Emerging solutions like Direct Primary Care (DPC) and fintech innovations in healthcare payments are also gaining traction. DPC models offer predictable monthly fees for services, potentially reducing the need for HSA savings. By 2023, the DPC market was valued at approximately $15 billion, highlighting its growing presence as an alternative to traditional healthcare payment structures.

| Substitute Type | Key Features | 2023/2024 Data Point | Comparison to HSA |

|---|---|---|---|

| Flexible Spending Accounts (FSAs) | Tax-advantaged savings for healthcare costs | Offered by ~88% of large employers (2023) | "Use it or lose it" vs. HSA's rollover/investment |

| Health Reimbursement Arrangements (HRAs) | Employer-funded medical cost reimbursement | Commonly offered by employers (2024) | Employer-owned and generally not portable vs. HSA portability |

| Traditional Savings/Brokerage Accounts | General investment vehicles | N/A (general financial products) | Lack HSA's triple tax advantage (deductible contributions, tax-free growth, tax-free withdrawals) |

| Direct Primary Care (DPC) | Predictable monthly fees for defined services | Market valued at ~$15 billion (2023) | Alternative payment model for routine care, potentially reducing HSA need |

Entrants Threaten

Significant regulatory and compliance hurdles present a formidable barrier to entry in the Health Savings Account (HSA) market. New entrants must meticulously navigate a complex web of healthcare and financial regulations, including Internal Revenue Service (IRS) stipulations, Health Insurance Portability and Accountability Act (HIPAA) compliance, and various banking sector rules. These requirements demand substantial investment in specialized legal and compliance expertise, effectively deterring potential competitors.

The significant capital required to build sophisticated Health Savings Account (HSA) administration platforms, encompassing secure data handling, transaction processing, and investment options, acts as a substantial barrier. For instance, developing and maintaining the necessary technology infrastructure for a player like HealthEquity involves ongoing investment in cybersecurity, regulatory compliance, and user experience enhancements, which can easily run into tens of millions of dollars annually.

The Health Savings Account (HSA) market demands extensive employer and health plan partnerships for success. New entrants must navigate the complex landscape of establishing these crucial relationships, a significant hurdle when competing against established players like HealthEquity.

Building trust and integration with employers and health plans is a lengthy and resource-intensive process. For instance, in 2024, the average employer onboarding process for a new benefits administrator can take upwards of six months, requiring significant investment in sales, integration, and support infrastructure.

Incumbents like HealthEquity have spent years cultivating these deep-seated relationships, often with exclusive agreements or preferred vendor status. This existing network provides a substantial competitive advantage, making it difficult for newcomers to gain traction and access a broad customer base without similar established connections.

Brand Recognition and Trust in Financial Services

Building trust and brand recognition in financial services, especially for long-term savings like HSAs, is a significant investment in time and capital. New entrants face the challenge of overcoming established players' reputations and customer loyalty.

HealthEquity benefits from its established reputation and substantial customer base, creating a substantial barrier for any new company aiming to enter the market. This existing trust is a key differentiator.

- Established Brand Equity: HealthEquity's years of operation have fostered significant brand recognition, making it a trusted name for consumers seeking health savings accounts.

- Customer Acquisition Costs: New entrants must spend heavily to acquire customers, often through aggressive marketing and competitive pricing, to even begin challenging HealthEquity's market position.

- Regulatory Hurdles: The financial services sector is highly regulated, adding complexity and cost for new companies navigating compliance requirements to offer HSA products.

Economies of Scale and Experience Curve Advantages

Existing large providers like HealthEquity leverage significant economies of scale in administration, technology, and investment management. This allows them to offer competitive pricing while maintaining profitability. For instance, in 2024, the average cost per participant for Health Savings Account (HSA) administration for large providers was notably lower than for smaller, newer entrants. Newcomers would find it challenging to replicate these cost efficiencies early on, placing them at a distinct disadvantage.

The experience curve also plays a crucial role. As companies like HealthEquity process a higher volume of transactions and manage a larger asset base, they refine their operational processes and gain expertise. This leads to further cost reductions and service improvements over time. A new entrant would lack this accumulated experience, making it harder to compete on both cost and service quality from the outset.

- Economies of Scale: Large players benefit from lower per-unit costs in administration and technology.

- Experience Curve: Accumulated operational expertise leads to greater efficiency and cost savings.

- Pricing Pressure: New entrants face difficulty matching the competitive pricing of established firms.

- Initial Disadvantage: Start-ups struggle to overcome the cost and efficiency gaps inherent in their early stages.

The threat of new entrants into the Health Savings Account (HSA) market remains moderate. While the market offers growth potential, significant barriers exist, including stringent regulatory compliance, substantial capital requirements for technology infrastructure, and the need for extensive employer and health plan partnerships. Established players like HealthEquity have built strong brand recognition and customer loyalty, making it challenging for newcomers to gain immediate traction.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Compliance | Navigating IRS, HIPAA, and banking regulations. | High cost and complexity, requiring specialized expertise. |

| Capital Investment | Developing and maintaining secure administration platforms. | Significant upfront and ongoing investment in technology. |

| Partnerships | Securing employer and health plan relationships. | Time-consuming and resource-intensive, competing with incumbents. |

| Brand & Trust | Building reputation and customer loyalty. | Requires substantial marketing and time to establish credibility. |

| Economies of Scale | Leveraging size for cost efficiencies. | New entrants face higher per-unit costs initially. |

Porter's Five Forces Analysis Data Sources

Our HealthEquity Porter's Five Forces analysis is built upon a foundation of comprehensive data, including HealthEquity's SEC filings, investor presentations, and annual reports.

We supplement this with industry-specific market research from reputable firms and data from government health agencies to provide a thorough assessment of the competitive landscape.