Harvia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvia Bundle

Harvia's market position is strong, leveraging its brand reputation and innovative product development. However, understanding the full scope of its competitive landscape and potential market disruptions requires deeper analysis.

Want the full story behind Harvia's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Harvia stands as a recognized global leader in the sauna and spa industry, commanding an estimated 5% of the total sauna market and over 20% in the critical sauna heaters and components segment as of 2024. This dominant market standing is bolstered by a portfolio of strong brands, including the flagship Harvia and EOS, alongside respected regional names like Almost Heaven Saunas, ThermaSol, and Kirami. Their expansive distribution network, reaching roughly 90 countries, provides a substantial competitive edge.

Harvia boasts a broad product lineup, covering everything from electric and wood-burning heaters to complete sauna rooms and steam generators, serving both homes and businesses. This comprehensive offering ensures they can meet diverse customer needs within the wellness sector.

Innovation is a key strength, highlighted by the 2024 launch of the Kirami FinVision Sauna Zero, a solar-powered outdoor sauna. Furthermore, the Q1 2025 introduction of a wood-burning Cilindro heater variant saw significant market acceptance, demonstrating Harvia's ability to adapt and respond to consumer demand for sustainable and traditional heating solutions.

Looking ahead, Harvia is actively exploring cutting-edge technologies, including a notable collaboration with Toyota to develop hydrogen saunas. This forward-thinking approach positions them at the forefront of future wellness trends and sustainable energy applications in the spa industry.

Harvia has showcased impressive financial results, with revenues reaching EUR 175.2 million in 2024 and an adjusted operating profit of EUR 37.1 million, translating to a healthy 21.2% margin.

The company continued its upward trajectory into 2025, achieving record sales in the first quarter. Revenue surged by 22.7% to EUR 52.0 million, while profitability remained robust with an adjusted operating profit margin of 22.9%.

This consistent financial strength provides Harvia with the capacity to fund ongoing growth strategies and pursue important strategic opportunities.

Geographical Diversification and Growth in Key Markets

Harvia's strategic expansion into high-growth regions is a significant strength. In 2024, North America and the APAC & MEA regions demonstrated robust revenue increases of 42.8% and 51.8%, respectively. This geographical diversification is crucial for balancing performance, especially when facing headwinds in established markets like Northern Europe.

The company's focus on these key markets is clearly paying off. North America, in particular, was a dominant force in Harvia's revenue growth during the first quarter of 2025, accounting for more than 80% of the total uplift. This highlights the success of their market penetration strategies in these vital areas.

- North America Revenue Growth (2024): 42.8%

- APAC & MEA Revenue Growth (2024): 51.8%

- North America's Contribution to Q1 2025 Revenue Increase: Over 80%

Commitment to Sustainability and Responsible Practices

Harvia's commitment to sustainability is a significant strength, underscored by its formal 2022-2025 sustainability program. This program targets key areas like environmental impact, employee well-being, product innovation, and ethical conduct. For instance, in 2024, Harvia made strides by upgrading heating systems to more efficient heat pump technology and installing solar panels at its Muurame facility, demonstrating a tangible effort to reduce its operational footprint.

The company's focus on reducing its greenhouse gas emissions is also noteworthy. Harvia has set an ambitious goal to decrease its Scope 1 GHG emissions by 30%, a target that aligns with global climate action efforts. This dedication extends to their material sourcing, utilizing sustainably harvested wood and responsibly manufactured stainless steel, which resonates strongly with an increasingly environmentally aware consumer base.

Key sustainability initiatives and their impact include:

- Formal Sustainability Program: A comprehensive framework guiding actions from 2022 to 2025.

- Energy Efficiency Upgrades: Transitioning to heat pump technology and installing solar panels in 2024.

- GHG Emission Reduction Target: Aiming for a 30% reduction in Scope 1 GHG emissions.

- Sustainable Material Sourcing: Utilizing responsibly sourced wood and stainless steel.

Harvia's market leadership in the sauna and spa sector, particularly in heaters and components where it holds over 20% market share as of 2024, is a core strength. This is reinforced by a strong brand portfolio and an extensive distribution network spanning approximately 90 countries, ensuring broad market access. The company's comprehensive product range, from heaters to complete sauna solutions, caters to a wide array of customer needs in the growing wellness market.

Innovation is a consistent driver for Harvia, evidenced by the 2024 launch of the solar-powered Kirami FinVision Sauna Zero and the positive market reception of the wood-burning Cilindro heater variant in early 2025. Their forward-looking approach includes exploring hydrogen saunas through a collaboration with Toyota, positioning them for future sustainability trends.

Financially, Harvia demonstrates robust performance. 2024 revenues reached EUR 175.2 million with a healthy 21.2% adjusted operating profit margin. This momentum continued into Q1 2025, with sales increasing 22.7% to EUR 52.0 million and maintaining a strong 22.9% adjusted operating profit margin, providing ample resources for strategic growth.

Harvia's strategic expansion into high-growth regions is a key advantage. North America and APAC & MEA saw significant revenue increases of 42.8% and 51.8% respectively in 2024. North America alone contributed over 80% of Harvia's revenue growth in Q1 2025, underscoring the success of their market penetration strategies in these vital areas.

Sustainability is deeply integrated into Harvia's operations, guided by a 2022-2025 program. Initiatives like heat pump upgrades and solar panel installations in 2024, coupled with a target to reduce Scope 1 GHG emissions by 30%, demonstrate a commitment to environmental responsibility. Their use of sustainably sourced materials further appeals to eco-conscious consumers.

| Strength | Description | Key Data/Examples |

| Market Leadership | Dominant position in the global sauna and spa industry, especially in heaters and components. | Over 20% market share in sauna heaters and components (2024). Distribution in ~90 countries. |

| Brand Portfolio & Distribution | Strong portfolio of recognized brands and an extensive global distribution network. | Brands include Harvia, EOS, Almost Heaven Saunas, ThermaSol, Kirami. |

| Product Breadth | Comprehensive product offering catering to diverse residential and commercial needs. | Electric & wood heaters, complete sauna rooms, steam generators. |

| Innovation | Commitment to developing new and sustainable product solutions. | Kirami FinVision Sauna Zero (solar-powered, 2024), hydrogen sauna collaboration with Toyota. |

| Financial Performance | Consistent revenue growth and strong profitability. | 2024 Revenue: EUR 175.2M; Adj. Operating Profit: EUR 37.1M (21.2% margin). Q1 2025 Revenue: EUR 52.0M (22.7% growth); Adj. Operating Profit Margin: 22.9%. |

| Geographic Expansion | Successful penetration and growth in high-potential markets. | North America Revenue Growth (2024): 42.8%. APAC & MEA Revenue Growth (2024): 51.8%. North America drove >80% of Q1 2025 growth. |

| Sustainability Focus | Integration of environmental responsibility into business strategy and operations. | 2022-2025 Sustainability Program. GHG emission reduction targets. Solar panel installations (2024). |

What is included in the product

Delivers a strategic overview of Harvia’s internal and external business factors, highlighting its market strengths and potential threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into growth opportunities.

Weaknesses

Harvia's reliance on specific geographic markets presents a notable weakness. For instance, the company has faced headwinds in its core Northern European and Finnish markets. This is largely due to a slowdown in construction and housing sectors, coupled with dampened consumer confidence.

This regional vulnerability directly impacts Harvia's financial performance. In 2024 and the first quarter of 2025, the company observed a continued decline in sales within Finland. Such localized downturns can significantly offset positive performance in other regions, impacting overall revenue and profitability.

Harvia faces headwinds from global economic uncertainty and evolving trade policies, which can create short-term disruptions. While the company has strategically shifted about 70% of its North American production to local manufacturing to buffer against issues like U.S. tariffs, these external forces can still impact its financial performance and market positioning.

Harvia's production relies heavily on a steady flow of steel, electronic components, and wood. In 2024, the company continued to navigate the complexities of global logistics, where any significant disruption could directly affect manufacturing timelines and increase costs. For instance, fluctuations in lumber prices, a key input for sauna production, can directly squeeze profit margins.

The company's profitability is sensitive to price volatility in these essential materials. An increase in the cost of steel or semiconductors, for example, would necessitate either absorbing these higher costs, impacting earnings, or passing them on to consumers, potentially affecting demand. Harvia's 2024 financial reports likely detailed efforts to mitigate these supply chain risks through diversification of suppliers and strategic inventory management.

Profitability Pressure from Product Mix and Campaign Sales

Harvia's profitability faced pressure in late 2024 due to its product mix and sales strategies. The adjusted operating profit margin in Q4 2024 saw a dip, largely because of a significant volume of lower-margin campaign sales, especially in the North American market.

Further impacting earnings was an unfavorable shift in the product mix. Sauna rooms and steam saunas experienced faster growth compared to the higher-margin heating equipment, control units, and spare parts, which consequently put a strain on the company's earnings before interest and taxes (EBIT).

- Q4 2024 Adjusted Operating Profit Margin: Weakened by campaign sales.

- Geographic Impact: North America particularly affected by lower-margin sales.

- Product Mix Shift: Sauna rooms and steam saunas outpaced higher-margin items.

- EBIT Pressure: Resulting from the combined effects of campaign sales and product mix.

Potential for Intense Competition in Specific Product Segments

While Harvia holds a strong global position, the sauna and spa industry is quite fragmented. This means intense competition can arise in specific product categories or geographic areas. Some rivals might offer heaters, for instance, that achieve higher temperatures than Harvia's UL-listed models, potentially appealing to a niche segment of the market seeking extreme heat.

This competitive landscape means Harvia must continually innovate and differentiate its offerings to maintain its market share. The company's commitment to safety standards, like UL listings, is crucial, but it also means that in some performance metrics, like maximum achievable temperature, competitors might have an edge.

- Niche Competitors: Specialized players may offer products targeting specific customer needs, potentially outperforming Harvia in narrow segments.

- Regional Strength: Local brands can possess strong brand loyalty and distribution networks in their home markets.

- Performance Differentiation: Competitors' heaters exceeding Harvia's UL-listed temperature capabilities present a challenge for certain consumer preferences.

Harvia's profitability is susceptible to shifts in its product mix and sales strategies, as seen in late 2024. A significant volume of lower-margin campaign sales, particularly in North America, contributed to a dip in the adjusted operating profit margin during Q4 2024. Furthermore, an unfavorable shift occurred where sauna rooms and steam saunas grew faster than higher-margin items like heating equipment and spare parts, placing strain on EBIT.

The company's reliance on specific geographic markets, notably Northern Europe and Finland, poses a weakness. A construction and housing sector slowdown, coupled with reduced consumer confidence in these regions, impacted Harvia's performance. For example, sales in Finland continued to decline through Q1 2025, highlighting this regional vulnerability.

Harvia faces pressure from global economic uncertainty and evolving trade policies, which can cause short-term disruptions. Despite efforts to mitigate tariff impacts through increased North American production, external economic forces remain a concern.

The company's operations are dependent on key inputs like steel, electronic components, and wood, making it vulnerable to supply chain disruptions and price volatility. Fluctuations in lumber prices, for instance, directly affect profit margins, as seen in 2024's navigation of global logistics challenges.

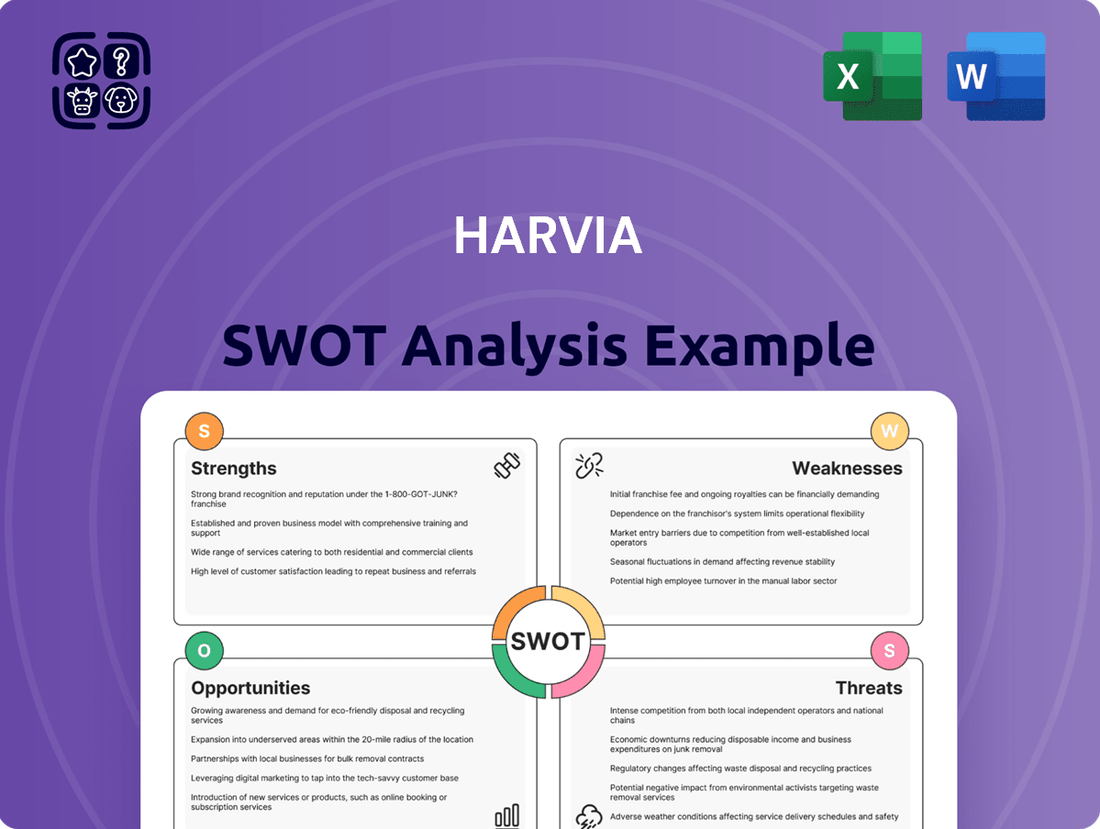

Preview Before You Purchase

Harvia SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of Harvia's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Harvia's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing actionable insights for Harvia's business development.

Opportunities

The escalating global focus on wellness and health directly benefits Harvia. As more people prioritize their well-being, the demand for saunas, known for their therapeutic effects, is on the rise. This growing health-conscious consumer base is actively seeking out products and experiences that contribute to a healthier lifestyle.

Furthermore, the boom in wellness tourism is a significant tailwind. Travelers are increasingly choosing destinations and activities that promote relaxation and rejuvenation, with sauna experiences often being a key component. This trend is expected to continue, providing Harvia with a substantial opportunity to expand its market reach.

The global wellness industry is a massive and rapidly expanding market, projected to surpass $8.5 trillion by 2027. This impressive growth underscores the strong consumer appetite for wellness-related services and products, directly translating into increased demand for Harvia's sauna and spa solutions.

Harvia is strategically targeting significant growth opportunities in key markets outside of Europe, including North America, Japan, China, and Australia. This geographic diversification aims to tap into the substantial untapped potential present in these large and attractive markets.

The company's performance in 2024 and the first quarter of 2025 demonstrates this potential, with strong growth recorded in both North America and the APAC & MEA (Asia-Pacific & Middle East/Africa) regions. For instance, Harvia's sales in the APAC region saw a notable increase of 17% in 2024 compared to the previous year, highlighting the growing demand for their wellness solutions.

Harvia's strategy actively targets industry consolidation, particularly within the steam and infrared sauna sectors. This approach aims to bolster market share and expand its product and service portfolio through strategic acquisitions.

The acquisition of U.S.-based steam solutions manufacturer ThermaSol in July 2024 exemplifies this strategy. This move significantly enhanced Harvia's presence in North America and broadened its expertise in digital steam solutions, creating a strong foundation for future expansion and cost efficiencies.

Innovation in Energy-Efficient and Digital Sauna Solutions

The market is increasingly favoring smart and sustainable sauna experiences, presenting a significant opportunity for Harvia. Consumers are actively seeking out eco-friendly materials and advanced digital controls for their wellness spaces. Harvia's commitment to developing energy-efficient technologies, like their solar-powered sauna concepts, and investigating novel heating systems such as hydrogen-based solutions, directly addresses this demand. This focus allows for strong product differentiation and the potential for expanded market reach.

Further investment in digital integration and smart home connectivity can unlock new customer demographics. By enhancing smart sauna systems, Harvia can tap into the growing smart home market, offering seamless integration with existing home automation platforms. This strategic move positions Harvia to capture a larger share of a market that values convenience and technological advancement in home wellness.

- Growing Demand for Smart Saunas: The global smart home market, which includes connected wellness devices, is projected to reach over $137 billion by 2025, indicating a strong consumer appetite for integrated technology.

- Eco-Conscious Consumerism: A significant portion of consumers, particularly in North America and Europe, are willing to pay a premium for sustainable products, a trend that benefits Harvia's energy-efficient innovations.

- Digital Transformation in Wellness: The wellness industry is increasingly leveraging digital platforms for personalized experiences, a trend Harvia can capitalize on with its smart sauna solutions.

Leveraging E-commerce and Direct-to-Consumer Channels

Harvia is actively enhancing its direct-to-consumer (DTC) and e-commerce platforms to better reach its market. This strategic move aims to capture a larger share of the market by directly engaging with customers and streamlining the sales process. By upgrading digital sales channels, Harvia can improve customer experience and brand perception.

Expanding e-commerce and direct marketing offers significant advantages. It allows Harvia to reach a wider customer base and foster stronger brand loyalty. Furthermore, bypassing intermediaries through DTC channels can lead to improved profit margins, as seen in the broader retail sector where DTC sales often command higher profitability.

- Increased Market Reach: E-commerce allows Harvia to connect with customers globally, transcending geographical limitations.

- Enhanced Customer Engagement: Direct marketing efforts and improved digital platforms facilitate deeper customer relationships and brand loyalty.

- Potential for Higher Margins: Reducing reliance on traditional retail partners through DTC sales can boost profitability.

- Data-Driven Insights: Digital channels provide valuable data on customer behavior, enabling more targeted marketing and product development.

Harvia is well-positioned to capitalize on the growing global wellness trend, with increasing consumer interest in health and well-being driving demand for sauna experiences. The company is also strategically expanding into new geographic markets like North America and Asia, showing strong growth in these regions, with APAC sales up 17% in 2024. Furthermore, Harvia's focus on smart and sustainable sauna technology, coupled with its direct-to-consumer (DTC) e-commerce strategy, presents significant opportunities for market share growth and enhanced customer engagement.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Global Wellness Market Growth | Increasing consumer focus on health and well-being drives demand for sauna and spa solutions. | Global wellness market projected to exceed $8.5 trillion by 2027. |

| Geographic Expansion | Targeting growth in key markets outside Europe, including North America and APAC. | APAC sales increased by 17% in 2024; strong growth in North America. |

| Smart & Sustainable Innovations | Meeting consumer demand for eco-friendly and digitally integrated wellness experiences. | Global smart home market to exceed $137 billion by 2025; consumers willing to pay a premium for sustainable products. |

| Direct-to-Consumer (DTC) & E-commerce | Enhancing digital sales channels to improve customer reach and engagement. | E-commerce allows for wider market access and potentially higher profit margins. |

Threats

While Harvia holds a strong position, the sauna and spa sector is inherently competitive, featuring a mix of established regional players and emerging global contenders. This crowded landscape, particularly in mature markets, often translates into significant pricing pressures and a dampening effect on overall growth rates.

The threat of intensified competition is a constant concern for Harvia. For instance, in 2023, the global sauna and spa market experienced moderate growth, but the presence of numerous smaller, agile competitors, especially in Europe, can erode market share. Aggressive pricing strategies from these rivals or innovative product launches from larger, diversified wellness companies could directly impact Harvia's profitability and its ability to maintain its leading edge.

Economic downturns, coupled with persistent inflation, pose a significant threat to Harvia's performance. As consumer confidence wanes, spending on non-essential items, such as saunas and spas, is likely to contract. For instance, in early 2024, many European economies experienced inflation rates above 5%, directly impacting disposable incomes and discretionary purchases.

Global supply chain vulnerabilities, exacerbated by potential industrial actions like strikes in key manufacturing regions or unforeseen geopolitical events, pose a significant threat to Harvia's operations. These disruptions can directly impact production schedules and the timely distribution of products, potentially leading to increased operational costs and extended lead times for customers.

Such disruptions can result in a reduced ability to meet market demand, directly affecting Harvia's revenue streams and overall profitability. For instance, the ongoing geopolitical tensions in Eastern Europe have already demonstrated the fragility of global logistics, with shipping costs and availability fluctuating significantly throughout 2024.

Regulatory Changes and Environmental Compliance Costs

Harvia faces increasing pressure from evolving environmental regulations globally. For instance, the European Union's Green Deal initiatives and stricter emissions standards in key markets could necessitate costly upgrades to manufacturing facilities and product designs to meet new sustainability benchmarks. These changes might impact production efficiency and require significant capital expenditure for compliance.

Adapting to these shifting regulatory landscapes presents a financial challenge. While Harvia has demonstrated a commitment to sustainability, the pace of regulatory change means ongoing investment is crucial. For example, new mandates on material sourcing or energy efficiency in production could add unforeseen costs, potentially affecting profit margins if not managed proactively.

- Increased Compliance Costs: Stringent environmental regulations in the EU and other major markets could raise manufacturing and R&D expenses.

- Investment in Sustainability: Adapting to evolving standards may require substantial capital investment in new technologies and processes.

- Potential for Fines: Non-compliance with new environmental directives could lead to significant penalties.

Fluctuations in Exchange Rates and Raw Material Prices

Harvia's global operations expose it to the significant threat of fluctuating exchange rates. For instance, a stronger Euro against other currencies could reduce the reported value of sales made in markets like the US or UK when translated back into its reporting currency. This can directly impact revenue figures and overall profitability, especially considering Harvia's presence in numerous international markets.

Furthermore, the company faces considerable risk from volatility in the prices of its essential raw materials. Steel, a primary component in sauna heaters and stoves, along with electronic components and wood, are subject to market forces that can cause sharp price increases. In 2024, the global steel price index showed an upward trend, averaging around 115 points compared to the 2020 baseline of 100, which directly pressures Harvia's production costs and can compress gross margins if these increases cannot be fully passed on to consumers.

- Currency Risk: Fluctuations in exchange rates can negatively impact Harvia's reported revenues and profits from international sales.

- Raw Material Costs: Volatility in prices for steel, electronic components, and wood directly affects production expenses.

- Margin Pressure: Rising raw material costs, as seen with steel prices in 2024, can lead to reduced gross margins if not effectively managed.

Harvia operates in a highly competitive market, facing pressure from both established players and agile new entrants, particularly in mature European regions. This intense competition can lead to pricing wars and limit overall market growth potential.

Economic volatility, including inflation and potential downturns, poses a significant risk as consumers may reduce discretionary spending on wellness products. For example, persistent inflation above 5% in many European economies in early 2024 directly impacts disposable income.

Supply chain disruptions, stemming from geopolitical events or industrial actions, can impede production and timely delivery, increasing costs and affecting customer satisfaction. Geopolitical tensions in Eastern Europe have already caused significant shipping cost fluctuations throughout 2024.

Evolving environmental regulations, such as the EU's Green Deal, may necessitate costly upgrades to manufacturing processes and product designs, impacting efficiency and requiring substantial capital investment for compliance.

| Threat Category | Specific Risk | Impact on Harvia | Supporting Data/Example |

| Competition | Intensified Rivalry | Market share erosion, pricing pressure | Numerous agile competitors in Europe |

| Economic Factors | Inflation & Downturns | Reduced consumer spending on non-essentials | European inflation >5% (early 2024) |

| Supply Chain | Disruptions & Logistics | Production delays, increased costs | Geopolitical impact on shipping costs (2024) |

| Regulatory | Environmental Standards | Increased compliance costs, capital expenditure | EU Green Deal initiatives |

SWOT Analysis Data Sources

This Harvia SWOT analysis is built upon a robust foundation of data, including the company's official financial reports, comprehensive market research, and insights from industry experts. These sources provide a well-rounded perspective on Harvia's internal capabilities and external market positioning.