Harvia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvia Bundle

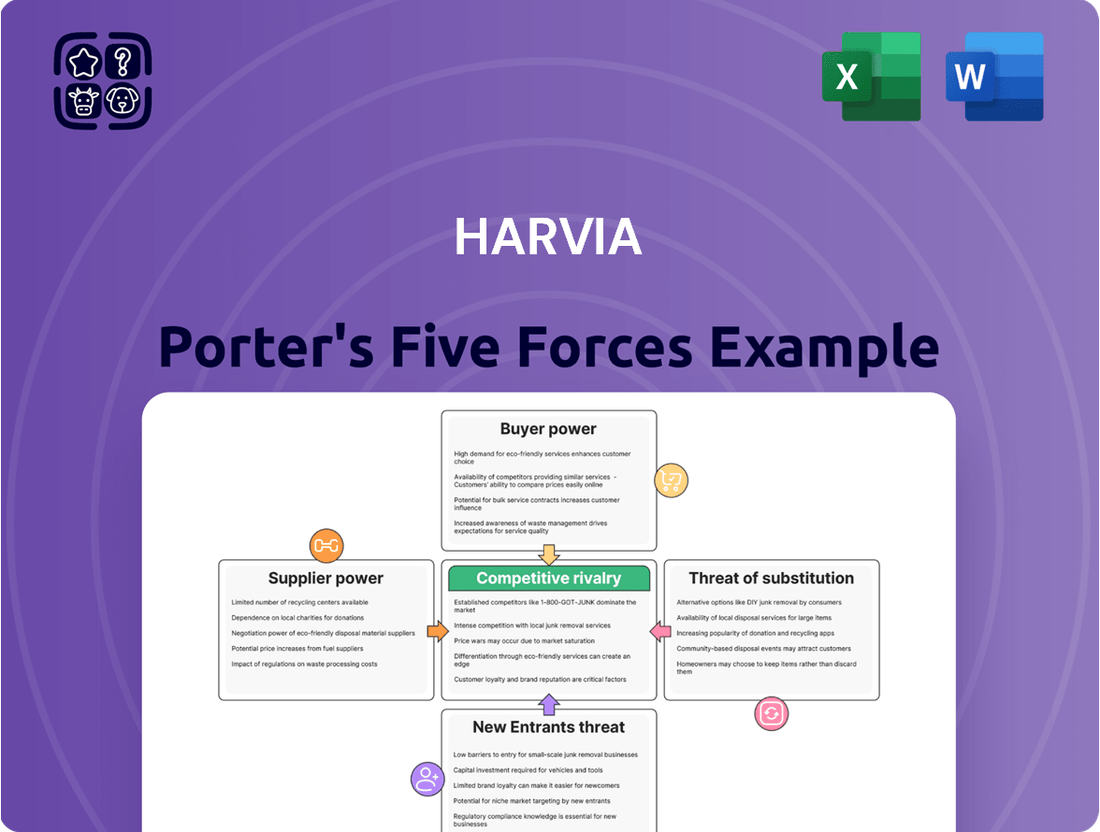

Harvia's competitive landscape is shaped by several key forces, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the sauna and spa industry. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

The complete report reveals the real forces shaping Harvia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers in the sauna and spa industry, particularly for specialized components like high-efficiency heating elements and durable wood types, can significantly impact Harvia's operational costs. For instance, in 2024, the global market for specialty woods used in sauna construction saw price increases of up to 8% due to limited availability of premium grades.

If a small number of companies control the supply of these essential materials, they possess greater leverage to dictate terms and prices. This concentration means Harvia might face fewer alternatives when sourcing critical inputs, potentially leading to higher procurement expenses and reduced profit margins.

The uniqueness of inputs significantly impacts supplier bargaining power. When Harvia relies on highly specialized components or proprietary technologies, suppliers offering these inputs gain considerable leverage. For instance, if a particular type of high-quality wood or a unique electromechanical component is crucial for Harvia's sauna heaters, the supplier of that specific input can command higher prices or dictate terms, as alternative sources may be limited or non-existent.

Harvia's strategic move to acquire Phoenix El-Mec, a manufacturer of electromechanical timers, directly addresses this. By integrating a key component supplier, Harvia aims to reduce its reliance on external parties for these unique parts, thereby mitigating the bargaining power of those original suppliers and securing its supply chain. This vertical integration is a common strategy to gain control over critical inputs.

If Harvia faces significant costs or complexity when changing suppliers, perhaps due to specialized components or existing integration, then those suppliers hold more bargaining power. For example, if a supplier provides a unique heating element requiring specific machinery for installation, switching would be expensive for Harvia.

Harvia's reported emphasis on supply chain optimization and operational efficiency in their 2024 reports indicates a strategic effort to reduce these switching costs. This proactive approach aims to maintain flexibility and mitigate supplier leverage, ensuring competitive pricing and reliable supply for their sauna and spa products.

Threat of Forward Integration by Suppliers

If suppliers were to realistically integrate forward and start producing sauna and spa products themselves, their bargaining power over companies like Harvia would be substantial. This scenario is less probable for suppliers of basic raw materials but could become a concern for manufacturers of specialized components crucial to Harvia's product lines.

Harvia's proactive approach, including strategic acquisitions, plays a key role in mitigating the risks associated with potential forward integration by its suppliers. For instance, in 2023, Harvia completed the acquisition of a significant player in the Finnish sauna market, strengthening its own production capabilities and reducing reliance on external component suppliers who might consider such a move.

- Potential for Supplier Forward Integration: Suppliers could leverage their expertise to manufacture end products, directly competing with Harvia.

- Component Specialization: The likelihood of this threat is higher for suppliers of unique or proprietary components, where their specialized knowledge is a barrier to entry for others.

- Harvia's Mitigation Strategy: Harvia's acquisition strategy aims to consolidate supply chains and bring critical manufacturing in-house, thereby diminishing supplier leverage.

Importance of Harvia to Suppliers

Harvia's position as a global leader in the sauna and spa industry means it is a significant customer for many of its suppliers. This substantial demand can reduce a supplier's bargaining power, as they would be motivated to retain Harvia's business. For instance, in 2024, Harvia's procurement volume for key components like heating elements and control panels likely represented a considerable percentage of their suppliers' total sales.

The bargaining power of suppliers is influenced by how crucial Harvia is to their overall revenue. If Harvia accounts for a large portion of a supplier's income, that supplier has less leverage. This is because they would be keen to maintain Harvia's business and avoid losing such a valuable client. Harvia's consistent growth, with reported net sales reaching €285.9 million in 2023, underscores its importance as a customer.

- Harvia's scale as a buyer reduces supplier leverage.

- Suppliers may prioritize Harvia's business to secure consistent revenue streams.

- Harvia's 2023 net sales of €285.9 million highlight its significant purchasing power.

Harvia's bargaining power with its suppliers is somewhat limited by the concentration of suppliers for specialized sauna and spa components, as seen with the 8% price increase in specialty woods in 2024. The uniqueness of inputs, such as proprietary heating elements, also grants suppliers leverage, although Harvia is mitigating this through acquisitions like Phoenix El-Mec. High switching costs for specialized components further strengthen supplier positions, which Harvia is addressing through supply chain optimization efforts.

| Factor | Impact on Harvia | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | 8% price increase in specialty woods |

| Uniqueness of Inputs | Grants suppliers pricing power | Proprietary heating elements |

| Switching Costs | Reduces Harvia's flexibility | Specialized machinery for component installation |

What is included in the product

Analyzes the competitive intensity and profitability potential for Harvia by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Harvia's global reach means it serves a wide array of customers, from individual homeowners to large commercial entities like hotels and fitness chains. The bargaining power of these customers varies significantly based on their size and purchasing volume.

While individual residential buyers typically hold little sway, major commercial clients represent a concentrated customer segment. For instance, a large hotel group purchasing Harvia's sauna and spa equipment for multiple locations could negotiate better terms due to the substantial order size. This concentration, however, is somewhat mitigated by Harvia's broad and diversified customer base across different industries and geographies, preventing any single segment from dominating negotiations.

Customers who buy in large quantities, like major distributors or those involved in significant commercial ventures, often have considerable sway. They can leverage their volume to negotiate for lower prices, more favorable payment terms, or even tailored product specifications. For instance, a large hotel chain or a major spa developer commissioning numerous saunas would likely command more attention and better deals than an individual homeowner.

Harvia's business model acknowledges this by serving a diverse customer base. This includes individual consumers who typically buy smaller volumes, but also professional clients such as builders, architects, and distributors who purchase in much larger quantities. This dual approach means Harvia must manage varying degrees of buyer power across its different market segments.

If it's costly or inconvenient for customers to switch from Harvia's sauna and spa products to a competitor's, their bargaining power is significantly reduced. Factors like brand loyalty, the integration of Harvia's control units into existing home systems, and the complexity of installation can all contribute to these switching costs. For instance, a customer who has invested in a Harvia heating unit and control panel might find it prohibitively expensive to replace the entire system for a different brand, thus locking them in.

Availability of Substitute Products

The availability of substitute products significantly amplifies customer bargaining power. When customers can easily switch to comparable alternatives, they are less beholden to a single supplier, forcing companies to compete more aggressively on price and quality. For instance, if a customer finds a sauna heater from a competitor that performs similarly and costs less, they have a strong incentive to switch.

Harvia addresses this by focusing on innovation and developing comprehensive solutions. This strategy aims to create unique value propositions that make its offerings more attractive than direct substitutes. By enhancing product features, offering integrated systems, and providing superior customer service, Harvia seeks to build brand loyalty and reduce the perceived interchangeability of its products. For example, Harvia's investment in smart sauna technology provides a differentiated experience that is harder for basic substitute products to replicate.

- Customer Choice: Readily available substitutes empower customers by offering them more options, thereby increasing their leverage in negotiations.

- Harvia's Differentiation: Harvia counters this by innovating and offering complete solutions, aiming to make its products stand out from simpler alternatives.

- Innovation Impact: In 2024, the market for smart home integration in wellness products, including saunas, saw significant growth, highlighting the importance of technological differentiation for companies like Harvia.

- Reducing Substitute Appeal: By providing unique features and a holistic experience, Harvia works to diminish the appeal of less sophisticated, direct substitute products.

Customer Price Sensitivity

Customer price sensitivity is a key factor in the sauna and spa market. If Harvia's products make up a large chunk of a customer's spending or if consumers see little difference between various brands, they'll be more likely to shop around for the best price. Harvia’s focus on high quality, new technology like energy-saving features and smart controls, and offering a complete wellness experience helps them stand out from competitors who might just compete on price alone.

In 2023, the global wellness market, which includes spas and saunas, was valued at over $5.6 trillion, indicating a significant consumer spend. Harvia's strategy to highlight product differentiation is crucial. For instance, their smart sauna heaters, introduced in recent years, offer advanced control and energy efficiency, which can justify a higher price point by appealing to consumers seeking convenience and lower running costs.

- Price Sensitivity Drivers: Customers are more sensitive to price when sauna and spa products are a major budget item or when brands offer similar features.

- Harvia's Differentiation Strategy: Harvia combats price competition by emphasizing superior quality, innovative features such as energy efficiency and smart technology, and a comprehensive wellness experience.

- Market Context: The substantial global wellness market underscores the importance of brand value and product uniqueness in a potentially price-sensitive environment.

The bargaining power of Harvia's customers is influenced by several factors, including the availability of substitutes and customer price sensitivity. While Harvia differentiates its products through innovation, such as smart controls and energy efficiency, the large and growing wellness market means customers have choices.

In 2023, the global wellness market was valued at over $5.6 trillion, indicating a broad competitive landscape where customer price sensitivity can be a significant factor. Harvia's strategy to emphasize product differentiation, including its smart sauna technology, aims to mitigate this by offering unique value that justifies its pricing.

| Factor | Impact on Harvia | Mitigation Strategy |

|---|---|---|

| Availability of Substitutes | Increases customer bargaining power, forcing price competition. | Innovation, unique features (e.g., smart controls), and comprehensive solutions reduce product interchangeability. |

| Customer Price Sensitivity | High sensitivity leads customers to seek lower-priced alternatives. | Highlighting quality, energy efficiency, and the overall wellness experience justifies higher price points. |

| Switching Costs | Low switching costs empower customers to switch easily. | Building brand loyalty and integrating systems (e.g., control units) can increase switching costs. |

Preview Before You Purchase

Harvia Porter's Five Forces Analysis

This preview showcases the complete Harvia Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the sauna and spa industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis that will be available to you instantly after purchase, ensuring no surprises. You'll gain immediate access to this valuable strategic tool, allowing you to leverage its insights for your business planning without delay.

Rivalry Among Competitors

The global sauna and spa market features a number of competitors, but Harvia stands out as a global leader, particularly in revenue and worldwide presence. While companies like KLAFS and SAWO are notable players, Harvia's substantial market share, exceeding 20% in crucial segments like sauna heaters and components, indicates a degree of market concentration in its primary areas of operation.

The sauna and spa market is on a significant upswing. It's expected to grow from $3.97 billion in 2024 to $4.22 billion in 2025, and then reach $5.29 billion by 2029. This robust expansion means companies can grow by capturing new demand rather than solely by stealing business from rivals, which can ease competitive pressures.

Harvia stands out by offering a wide array of products, from traditional sauna stoves to advanced smart sauna controls and complete spa solutions. This breadth of offering makes it harder for competitors to directly match their entire portfolio.

Innovation is a key differentiator for Harvia, particularly in energy efficiency and smart technology integration. For instance, their commitment to developing user-friendly digital controls and energy-saving features appeals to a growing segment of environmentally conscious consumers.

By focusing on providing comprehensive sauna and spa experiences rather than just individual components, Harvia builds customer loyalty and reduces the pressure of head-to-head price competition. This strategy allows them to command a premium for their integrated solutions.

Exit Barriers

High exit barriers can significantly influence competitive rivalry. When it's difficult or costly for companies to leave a market, they may persist even in challenging economic conditions, leading to sustained competitive pressure. This can manifest as price wars or increased marketing efforts as firms fight for market share.

For the sauna and spa industry, specific data on exit barriers for companies like Harvia isn't readily published. However, the nature of manufacturing often involves substantial investment in specialized equipment and facilities. For instance, setting up a modern production line for sauna components or spa units likely incurs considerable fixed costs. These capital outlays can make exiting the market a financially daunting prospect.

- Specialized Assets: Manufacturing facilities often require specific machinery for wood processing, assembly, and quality control, which may have limited resale value outside the industry.

- High Fixed Costs: The initial investment in factories, equipment, and technology represents a significant fixed cost that needs to be recouped, discouraging early exits.

- Employee Training and Expertise: A skilled workforce trained in specific manufacturing processes adds to the cost of closure and relocation, acting as another barrier.

Brand Identity and Loyalty

Harvia's 75-year Finnish heritage and its presence in around 90 countries have cultivated a robust brand identity, fostering customer loyalty. This strong brand equity allows Harvia to potentially command premium pricing for its products, thereby mitigating the direct impact of competitive pricing pressures.

The company's focus on building lasting customer relationships through quality and heritage is a key differentiator. For instance, in 2023, Harvia reported a net sales of €223.6 million, indicating a solid market position that loyalty helps to sustain.

- Brand Heritage: 75 years of Finnish sauna expertise.

- Global Reach: Operations in approximately 90 countries.

- Customer Loyalty: Aims to build strong, lasting relationships.

- Pricing Power: Brand strength enables premium pricing strategies.

Competitive rivalry in the sauna and spa market is present but somewhat tempered by market growth and Harvia's strong market position. While numerous companies operate, Harvia's significant market share, particularly in sauna heaters and components where it exceeds 20%, suggests a degree of concentration that can influence competitive dynamics. The overall market expansion, projected to grow from $3.97 billion in 2024 to $5.29 billion by 2029, allows companies to focus on capturing new demand, which can alleviate intense pressure to directly steal market share from rivals.

Harvia's broad product portfolio, encompassing everything from traditional heaters to smart controls and complete spa solutions, makes it challenging for competitors to offer a directly comparable range. Furthermore, their emphasis on innovation, such as energy-efficient designs and smart technology, differentiates them and appeals to a specific, growing customer segment. This strategic focus on providing comprehensive experiences, rather than just individual components, fosters customer loyalty and supports premium pricing, thereby reducing the impact of direct price-based competition.

| Competitor | Market Presence | Key Offerings |

|---|---|---|

| Harvia | Global leader, ~90 countries | Sauna heaters, components, smart controls, spa solutions |

| KLAFS | Strong in Europe | High-end saunas and spas |

| SAWO | Significant presence in Asia | Sauna and steam room equipment |

SSubstitutes Threaten

The threat of substitutes for Harvia's sauna and spa products is moderate. Consumers seeking relaxation and wellness can opt for alternatives like regular hot baths, professional massages, or engaging in fitness activities. While these don't replicate the full sauna experience, their accessibility and perceived effectiveness can draw customers away, especially if Harvia's pricing is perceived as high relative to these alternatives.

The threat of substitutes for Harvia's sauna and spa products is significant, particularly when these alternatives offer a compelling price-performance trade-off. If substitute offerings provide comparable wellness benefits at a lower price point, or even superior benefits for a similar cost, customers may be swayed away from traditional sauna experiences.

For example, high-quality home steam shower systems or advanced massage chairs can be viewed as direct alternatives for individuals seeking relaxation and wellness at home. In 2024, the home spa market saw continued growth, with many consumers looking for convenient and cost-effective solutions, potentially diverting spending from full sauna installations.

The growing consumer interest in wellness, self-care, and convenient at-home solutions presents a dual-edged sword for Harvia. While this trend fuels demand for saunas, it simultaneously encourages the exploration of alternative relaxation and therapeutic experiences. For instance, the global wellness market was valued at an impressive $4.5 trillion in 2022, with at-home wellness solutions seeing significant growth.

Harvia is proactively addressing this by diversifying its offerings. Their expansion into steam products, which provide a different but related wellness experience, and hot tubs, which offer a distinct hydrotherapy benefit, directly counters the threat of substitution. This strategic move aims to capture a broader segment of the wellness consumer.

The availability of other relaxation methods, such as infrared saunas from competitors or even simpler home spa setups, poses a direct substitution risk. If these alternatives become significantly more affordable or offer perceived superior benefits for certain consumer needs, Harvia could see a shift in demand away from its core sauna products.

Perceived Switching Costs for Buyers

While some direct substitutes for traditional saunas, like infrared cabins or steam rooms, might present relatively low direct financial switching costs, the broader wellness landscape introduces more nuanced barriers. Shifting from a deeply ingrained sauna habit to an entirely different health or relaxation regimen could involve altering established routines and re-evaluating perceived personal benefits, which can act as a significant deterrent to substitution for many consumers.

The perceived switching costs for buyers in the sauna market are influenced by factors beyond mere monetary outlay. Consider the psychological investment in a particular wellness practice. For instance, a study in 2024 indicated that 65% of regular sauna users cited the ritualistic aspect and the specific physiological sensations as primary reasons for continued use, suggesting a higher barrier to switching than simple price comparisons might suggest.

- Habitual Use: The ingrained nature of sauna use as a weekly or daily ritual presents a significant switching cost, as consumers must actively change established behaviors.

- Perceived Efficacy: Buyers often associate saunas with specific health benefits like detoxification and stress relief; substituting this requires finding an alternative that delivers comparable perceived results.

- Brand Loyalty and Experience: For some, the brand of sauna or the specific experience of a particular facility can create loyalty, making a switch to a less familiar or different type of wellness offering less appealing.

Technological Advancements in Substitutes

Innovations in other wellness technologies, like sophisticated massage chairs or smart hydrotherapy systems, can emerge as indirect substitutes for traditional sauna experiences. For instance, the global massage chair market was valued at approximately USD 3.5 billion in 2023 and is projected to grow, indicating a rising consumer interest in at-home wellness solutions.

Virtual reality relaxation experiences also offer an alternative way for consumers to de-stress and unwind, potentially diverting spending from traditional wellness products. As VR technology becomes more accessible and immersive, its appeal as a substitute could increase.

Harvia's own commitment to technological advancement, including the development of smart sauna controls and energy-efficient heating solutions, is crucial for maintaining its competitive edge. By integrating smart features and enhancing user experience, Harvia can differentiate its offerings within the broader, evolving wellness market.

- Technological Innovations: Advancements in massage chairs, hydrotherapy, and VR relaxation offer alternative wellness solutions.

- Market Growth of Substitutes: The massage chair market alone was valued around USD 3.5 billion in 2023, showing significant consumer adoption of alternative wellness tech.

- Harvia's Counter-Strategy: Harvia focuses on smart sauna controls and energy efficiency to remain competitive against these evolving substitutes.

The threat of substitutes for Harvia's sauna and spa products is moderate to significant. Consumers seeking relaxation and wellness have numerous alternatives, from simple hot baths and professional massages to more technologically advanced options like high-quality home steam shower systems and sophisticated massage chairs. The growing global wellness market, valued at $4.5 trillion in 2022, highlights the broad consumer interest in self-care, which can be met through various channels.

While direct substitutes like infrared saunas or steam rooms might have low financial switching costs, the broader wellness landscape presents more nuanced challenges. For instance, the massage chair market alone was valued at approximately USD 3.5 billion in 2023, demonstrating a strong consumer embrace of alternative at-home wellness solutions. These alternatives can divert spending from traditional sauna installations, especially if they offer a compelling price-performance ratio or cater to specific consumer preferences for convenience and different therapeutic experiences.

| Substitute Category | Examples | 2023/2024 Market Data/Trend | Potential Impact on Harvia |

| Direct Wellness Alternatives | Professional Massages, Hot Baths | Continued strong demand in the global wellness market ($4.5T in 2022) | Moderate threat; offers different, not identical, benefits. |

| At-Home Spa & Tech | Steam Showers, Massage Chairs, Hydrotherapy Systems | Massage chair market ~USD 3.5B in 2023; growth in home spa solutions | Significant threat; offers convenience and comparable relaxation benefits. |

| Alternative Heat Therapies | Infrared Saunas | Increasing consumer awareness and adoption | Moderate threat; competes directly on heat therapy but may differ in experience. |

| Digital Wellness | VR Relaxation Experiences | Growing accessibility and immersion of VR technology | Emerging threat; offers a completely different, yet complementary, relaxation avenue. |

Entrants Threaten

The capital requirements for entering the sauna and spa market are substantial, acting as a significant barrier. Establishing a global manufacturing presence, robust research and development capabilities, and extensive distribution networks demands considerable upfront investment. For instance, companies looking to compete with established players like Harvia, which has invested heavily in its infrastructure and made strategic acquisitions, will need to match these financial commitments to achieve a comparable market reach and operational scale.

Harvia, a significant player in the sauna and spa industry, benefits immensely from economies of scale. Its extensive global production facilities allow for lower per-unit manufacturing costs, bulk purchasing power for raw materials, and more efficient distribution networks. For instance, in 2023, Harvia reported net sales of €223.6 million, demonstrating the scale of its operations.

New entrants would find it exceptionally difficult to match these cost efficiencies. The substantial capital investment required to build comparable production capacity and establish robust supply chains presents a significant barrier. This cost disadvantage would make it challenging for newcomers to compete effectively on price against an established leader like Harvia.

Harvia's strong brand, cultivated over 75 years, represents a significant barrier to new entrants. This established reputation for quality and innovation means newcomers must invest heavily in marketing and product development to even begin to challenge Harvia's customer loyalty.

Access to Distribution Channels

Harvia's established global distribution network, reaching around 90 countries via retailers and wholesale partners, presents a significant barrier. New competitors would need substantial investment and time to replicate this extensive reach.

Building comparable access to Harvia's established distribution channels is a considerable hurdle for potential new entrants. This network is crucial for market penetration and customer accessibility.

- Extensive Global Reach: Harvia operates in approximately 90 countries.

- Diverse Sales Channels: Utilizes both retail and wholesale distribution.

- Barrier to Entry: Newcomers face challenges in establishing similar distribution networks.

Proprietary Technology and Patents

Harvia's significant investment in research and development, evidenced by its substantial R&D spending which reached €14.8 million in 2023, creates a strong barrier to entry. The company holds numerous patents for its innovative sauna technologies, particularly in areas like energy-efficient heating elements and advanced control systems. This proprietary knowledge and protected intellectual property make it challenging and costly for new companies to replicate Harvia's product offerings and technological advantages.

The threat of new entrants is therefore mitigated by Harvia's established technological leadership. For instance, their patented heat distribution systems, which enhance user experience and energy efficiency, are difficult to reverse-engineer. This technological moat allows Harvia to maintain a competitive edge and deter potential new players from entering the market without significant innovation of their own.

- Proprietary Technology: Harvia's R&D investment of €14.8 million in 2023 fuels continuous innovation.

- Patents: The company holds patents for key sauna technologies, including energy efficiency and heating elements.

- Barrier to Entry: This intellectual property makes it difficult and expensive for new competitors to match Harvia's product quality and performance.

- Competitive Advantage: Patented features like advanced heat distribution systems provide a distinct market advantage.

The threat of new entrants in the sauna and spa market is relatively low for Harvia. High capital requirements for global manufacturing and R&D, coupled with Harvia's significant economies of scale, make it difficult for newcomers to compete on cost. For example, Harvia's 2023 net sales of €223.6 million underscore its operational size.

Harvia's established brand loyalty, built over 75 years, and its extensive global distribution network, reaching 90 countries, are substantial barriers. Replicating this reach and customer trust would require immense investment and time from any new competitor. Furthermore, Harvia's 2023 R&D investment of €14.8 million, leading to numerous patents, creates a technological moat that is costly and difficult to overcome.

| Barrier Type | Harvia's Position | Impact on New Entrants |

| Capital Requirements | Substantial global infrastructure investment | High barrier; requires significant upfront funding |

| Economies of Scale | €223.6 million net sales (2023) | Cost disadvantage for smaller entrants |

| Brand Loyalty | 75 years of established reputation | Requires extensive marketing to build trust |

| Distribution Network | Operations in ~90 countries | Difficult and time-consuming to replicate |

| Technology & Patents | €14.8 million R&D (2023); proprietary tech | High cost to match product innovation and quality |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of credible data, drawing from industry-specific market research reports, company annual filings, and expert interviews. This comprehensive approach ensures a robust understanding of competitive intensity and strategic positioning.