Harvia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvia Bundle

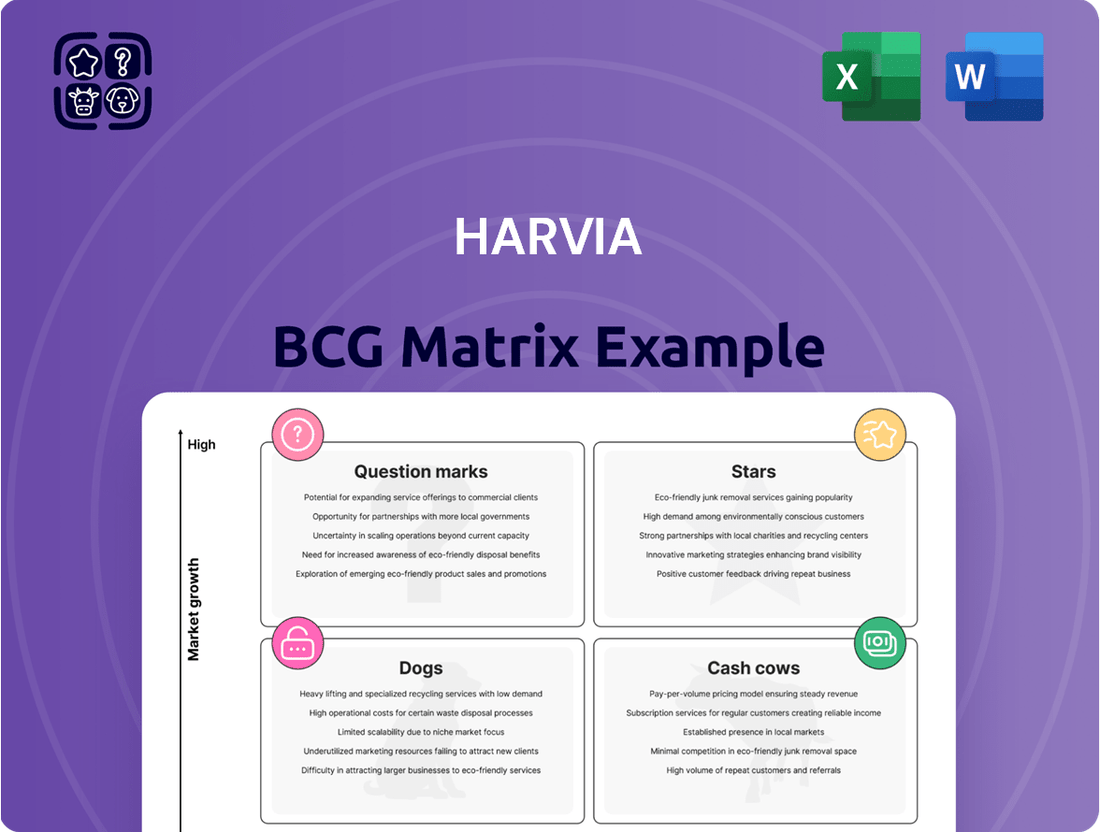

Curious about how this company's product portfolio stacks up? Our BCG Matrix preview offers a glimpse into its market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. For a comprehensive understanding and actionable strategies to optimize your investments and product lifecycle, purchase the full BCG Matrix report today.

Stars

North America is a key growth engine for Harvia. In 2024, the company saw nearly 40% organic revenue growth in this region, a substantial contribution to its global performance.

Harvia is actively investing in its North American presence, including expanding operations and establishing localized production capabilities to better serve this burgeoning market. The strategic acquisition of ThermaSol in 2024 significantly bolstered Harvia's market position and product offerings in the United States and Canada.

The acquisition of ThermaSol in July 2024 was a strategic move for Harvia, significantly enhancing its position in the premium steam solutions market. This acquisition directly supports Harvia's overarching goal of providing a comprehensive sauna experience and accelerating growth within its steam business segment. ThermaSol's strong brand recognition and deep expertise in the U.S. market offer a solid foundation for further expansion in this burgeoning category.

Harvia is making significant strides in its heating equipment division, the company's largest revenue generator. Innovations like the wood-burning Cilindro heater, launched in 2024 with a focus on modern design and efficient heating, highlight this commitment. These advancements, coupled with digital solutions and smart sauna systems, are designed to be major growth catalysts.

Comprehensive Sauna and Spa Experiences

Harvia's strategy focuses on offering comprehensive sauna and spa experiences, moving beyond just the sauna itself. This involves broadening their product range to include items like cold plunges and hot tubs, aiming to capture more of the burgeoning global wellness market. This expansion is key to their plan to increase product categories and deepen their market presence.

This holistic approach aligns with a significant market trend. For instance, the global wellness market was valued at approximately $4.5 trillion in 2022, with the spa segment alone contributing a substantial portion. Harvia's expansion into related wellness products positions them to capitalize on this growth, potentially increasing their revenue streams and market share in the coming years.

- Holistic Wellness Focus: Harvia is enhancing its offerings to provide a complete spa experience, not just traditional saunas.

- Market Expansion Strategy: By adding products like cold plunges and hot tubs, Harvia aims to capture a larger share of the growing global wellness market.

- Revenue Growth Potential: This strategy targets increased consumer spending in a high-growth sector, aiming to expand product categories and market penetration.

APAC & MEA Market Growth

The Asia-Pacific and Middle East & Africa regions are demonstrating robust performance for Harvia, driving significant market growth. In 2024, these areas saw impressive organic revenue increases of 51.8% for APAC and 42.8% for MEA.

Harvia is strategically focusing on high-growth potential markets within these regions, including Japan and Australia. This targeted development signifies substantial investment and a strong expectation for sustained high growth trajectories.

- APAC Revenue Growth: 51.8% in 2024.

- MEA Revenue Growth: 42.8% in 2024.

- Key Market Focus: Japan and Australia.

- Strategic Positioning: Emerging wellness markets driving star status.

Harvia's Stars are its high-growth markets, particularly North America and the Asia-Pacific/Middle East & Africa regions. These segments are characterized by significant revenue increases and strategic investments, positioning them as key drivers of future success and market leadership.

North America showed nearly 40% organic revenue growth in 2024, bolstered by strategic acquisitions like ThermaSol. The APAC and MEA regions also demonstrated exceptional performance, with 51.8% and 42.8% organic revenue growth respectively in 2024. Harvia's focus on these emerging markets, including Japan and Australia, underscores their potential to become dominant players.

| Region | 2024 Organic Revenue Growth | Key Strategic Initiatives |

|---|---|---|

| North America | ~40% | ThermaSol acquisition, expanded operations, localized production |

| Asia-Pacific (APAC) | 51.8% | Focus on Japan and Australia, emerging wellness markets |

| Middle East & Africa (MEA) | 42.8% | Focus on emerging wellness markets |

What is included in the product

The Harvia BCG Matrix categorizes business units based on market share and growth, guiding strategic decisions for investment and resource allocation.

Clear visual of business unit performance, simplifying strategic decisions.

Cash Cows

Traditional sauna heaters, both electric and wood-burning, represent Harvia's established Cash Cows. Harvia's significant market presence, holding over 20% of the global sauna heater and component market, underscores the maturity and stability of this segment.

In 2024, heating equipment alone accounted for more than half of Harvia's total revenue, highlighting the substantial market share and consistent demand for these core products. This strong performance in a mature market generates significant and reliable cash flow for the company.

Harvia's sauna rooms and interiors stand as a significant Cash Cow within the company's portfolio. This segment, encompassing both indoor and outdoor solutions, captured a substantial 26.7% of Harvia's total revenue in 2024.

The strong performance of these products is underpinned by Harvia's global leadership position and its well-established brand recognition. Leveraging extensive distribution networks, these offerings consistently contribute to the company's financial stability and profitability, demonstrating reliable cash generation.

The market for sauna components and accessories, encompassing items like control units, sauna stones, textiles, and scents, is a consistent revenue generator for Harvia. These products are frequently bought with or as add-ons to heaters and rooms, creating a reliable income flow.

Harvia holds a significant market share within this relatively stable segment due to its broad product range. In 2023, Harvia's accessories segment, which includes these components, represented a substantial portion of their net sales, demonstrating its importance as a cash cow. The demand for these complementary items remains robust, supported by the ongoing popularity of sauna culture.

Established European Markets

Harvia benefits from a robust presence in established European markets, particularly in Continental Europe. These regions represent a significant portion of the company's revenue, acting as a stable foundation for its operations. The company actively works to reinforce its standing in these mature markets, capitalizing on its established brand recognition and customer loyalty.

In 2024, Harvia's European sales continued to be a cornerstone of its business. For instance, the company reported strong performance in Germany and France, key Continental European markets where sauna culture is deeply ingrained. This stability allows Harvia to invest in innovation and expansion in other areas.

- Established European Markets: Harvia's strong foothold in Continental Europe provides a significant revenue stream.

- Brand Loyalty: Decades of presence have fostered strong brand recognition and customer loyalty in these core markets.

- Market Stability: Despite broader economic fluctuations, these established regions offer a reliable base for Harvia's sales.

- Revenue Contribution: Continental Europe consistently contributes a substantial percentage to Harvia's overall financial performance.

Residential Segment Products

The residential segment is a powerhouse for Harvia, commanding over 56% of the global sauna market share in 2023. This dominance is built on an extensive product portfolio designed specifically for private consumers, solidifying Harvia's position in this mature, high-volume market.

Harvia's offerings for private homes, including a diverse array of sauna types and complementary accessories, are consistent drivers of strong cash flow. This segment's stability and broad appeal make it a quintessential cash cow for the company.

- Market Dominance: Residential segment accounted for over 56% of the global sauna market in 2023.

- Product Breadth: Harvia offers a wide range of saunas and accessories for private customers.

- Cash Flow Generation: Products for residential use consistently produce robust cash flow.

Harvia's traditional sauna heaters, both electric and wood-burning, are its bedrock Cash Cows. With over 20% of the global market share, this segment's stability is undeniable.

In 2024, these heating solutions alone generated more than half of Harvia's total revenue, a testament to their consistent demand and profitability.

| Product Category | 2024 Revenue Contribution | Market Position |

| Traditional Sauna Heaters | >50% of Total Revenue | >20% Global Market Share |

| Sauna Rooms & Interiors | 26.7% of Total Revenue | Global Leadership |

| Components & Accessories | Significant Portion of Net Sales (2023) | Broad Product Range, Stable Demand |

Preview = Final Product

Harvia BCG Matrix

The Harvia BCG Matrix preview you see is the definitive document you will receive upon purchase, offering a comprehensive analysis ready for immediate strategic application. This isn't a sample; it's the complete, unwatermarked report, meticulously prepared by industry experts to provide actionable insights into your product portfolio. You can confidently expect the exact same professional-grade analysis and formatting, empowering you to make informed decisions without any further modifications. Once acquired, this Harvia BCG Matrix will be instantly accessible for your business planning, competitive strategy development, and investor presentations.

Dogs

Products catering to stagnant Northern European markets, especially Finland, are experiencing considerable strain. This is largely due to subdued construction and housing sector activity, coupled with a general dip in consumer confidence. For instance, Harvia's sales in these specific regional product categories have shown a consistent downward trend.

While Harvia maintains a strong global presence, these particular product lines dependent on Northern Europe are seeing declining sales. This situation suggests that future investments in these mature or declining markets might not offer the same attractive returns as those in more dynamic, high-growth areas.

Harvia's commitment to sustainability means older, less energy-efficient sauna models are likely candidates for the 'dogs' category. As consumer demand shifts towards eco-friendly options, these products may face declining sales and profitability. For instance, in 2024, the global market for energy-efficient appliances saw a notable surge, indicating a clear consumer preference that older Harvia models might not meet.

Niche products with limited appeal within Harvia's portfolio, such as highly specialized sauna accessories or unique spa components that haven't gained traction, would be classified as Dogs. These items likely contribute minimally to overall revenue, potentially even seeing a decline. For instance, if a specific, low-demand infrared panel model only accounted for 0.1% of Harvia's 2024 sales, it would fit this category.

Low-Demand Accessories or Components

Within Harvia's broader accessories business, certain items might fall into the low-demand category. These could be older models of sauna accessories or niche components that are no longer widely sought after. For instance, if a particular type of sauna heater accessory saw a significant decline in sales in 2023, perhaps due to the introduction of more energy-efficient models, it could be classified here. Such items might offer minimal profit or even incur costs without contributing to overall growth.

These underperforming accessories could be products that have been replaced by newer, more advanced versions, or they might serve a very specific, shrinking customer base. For example, a specialized steam generator part that has been superseded by a more versatile unit might represent a cash consumer. In 2023, Harvia's accessories segment as a whole performed well, but these specific items could be a drag on profitability.

- Low Sales Volume: Certain accessories might exhibit consistently low sales figures, indicating a lack of market interest or demand.

- Product Obsolescence: Items superseded by technological advancements or newer product lines often fall into this category.

- Niche Market Dependence: Accessories catering to very small or declining sub-segments of the sauna and spa market are prone to low demand.

- Potential Cash Consumption: These items may break even or consume cash due to inventory holding costs or minimal revenue generation without significant growth prospects.

Products Impacted by Local Economic Downturns

Products whose sales are disproportionately affected by local economic downturns and low consumer confidence in specific, non-strategic markets could be considered Dogs in the Harvia BCG Matrix. Harvia's business operations in certain European countries experienced challenging conditions in 2024, impacting sales of some product lines. These localized product performances might not contribute significantly to overall growth or profitability.

For instance, Harvia's sauna and spa products in regions like parts of Eastern Europe faced headwinds in 2024 due to persistent inflation and reduced discretionary spending. Consumer confidence indices in these areas remained subdued, leading to a decline in demand for premium home wellness solutions. This resulted in a negative growth rate for these specific product segments within Harvia's portfolio.

- Localized Market Weakness: Harvia's sales in some smaller European markets showed a decline in 2024, reflecting broader economic slowdowns in those specific countries.

- Low Consumer Confidence Impact: Reduced consumer confidence in these regions directly translated to lower demand for Harvia's products, particularly those considered non-essential.

- Contribution to Overall Performance: Products sold in these struggling local markets contributed minimally to Harvia's consolidated revenue growth in 2024, potentially dragging down overall company performance.

- Strategic Market Re-evaluation: The performance of these product lines necessitates a strategic review of Harvia's market focus and resource allocation in 2024 and beyond.

Products in the Dogs category, like older, less energy-efficient sauna models or niche accessories with declining demand, represent areas of low market share and low growth for Harvia. These items may consume resources without generating significant returns, potentially even incurring costs. For example, a specific low-demand infrared panel model that accounted for only 0.1% of Harvia's 2024 sales would fit this description.

Harvia's sales in certain Northern European markets, particularly Finland, have faced strain due to subdued construction activity and lower consumer confidence in 2024. This has led to declining sales for product lines heavily reliant on these mature or stagnant regions.

The performance of Harvia's products in some smaller European markets in 2024 was impacted by economic slowdowns and reduced discretionary spending, leading to minimal contribution to overall revenue growth.

Harvia's strategic review in 2024 likely includes assessing these underperforming product lines to optimize resource allocation and focus on higher-growth opportunities.

Question Marks

Infrared sauna solutions within Harvia's portfolio are positioned as potential Stars in the BCG matrix. While their current market share may be modest, the rapidly expanding global health and wellness market, particularly the growing interest in infrared therapy, signals substantial growth potential. This segment is a key focus for Harvia's expansion efforts.

The company is actively investing in the development and market penetration of its infrared sauna offerings. These investments, while currently cash-consuming, are strategically aimed at capturing a larger share of a high-growth market. By 2024, the global wellness market was valued at over $5.6 trillion, with infrared therapy a notable contributor to this growth, indicating a fertile ground for Harvia's ambitions.

The Hydrogen Sauna Concept represents a significant innovation for Harvia, positioning it as a potential future star in the BCG matrix. This groundbreaking co-development with Toyota, announced in June 2025, showcases Harvia's commitment to pioneering sustainable heating technologies.

Currently, this concept is in its nascent stages, meaning its market share is negligible. However, its potential within the burgeoning market for eco-friendly and technologically advanced heating solutions is substantial, suggesting a strong future growth trajectory.

Significant investment in research and development, alongside strategic efforts to drive market adoption, will be paramount for the Hydrogen Sauna Concept to transition from a promising idea to a market leader. Its success hinges on overcoming technological hurdles and consumer acceptance in the coming years.

The Kirami FinVision Zero, launched in 2024, is Harvia's pioneering solar-powered outdoor electric sauna. This innovative product positions itself as a potential Star within the BCG matrix, given its novelty and the growing demand for sustainable, eco-friendly solutions. Its current market share is likely modest, but the burgeoning interest in renewable energy for residential applications suggests substantial growth potential.

New Market Entries in Select APAC Countries (e.g., China)

While Japan and Australia are recognized as robust growth markets for Harvia, the company's strategic emphasis extends to other selected high-potential countries within the APAC and Middle East/Africa regions. China, for instance, represents a key area of active development, offering significant growth prospects for Harvia's sauna and spa solutions.

Harvia is actively cultivating its presence in these emerging markets, where it is still in the process of building substantial market share and enhancing brand recognition. This phase necessitates dedicated investment in developing and executing tailored strategies that acknowledge and adapt to the diverse cultural nuances present in these regions.

- China's Sauna Market Growth: The Chinese sauna and spa market is projected to experience significant expansion, driven by increasing disposable incomes and a growing wellness trend among its large population.

- Brand Building Investment: Harvia is allocating resources to marketing and distribution networks in China to build brand awareness and establish a strong foothold.

- Cultural Adaptation: Success in China requires understanding local consumer preferences and adapting product offerings and marketing messages accordingly.

- Market Share Development: Current market share in China is nascent, indicating substantial room for growth as Harvia executes its market entry strategy.

Integrated Smart Shower Components and Digital Controls

Harvia's acquisition of ThermaSol significantly bolstered its portfolio by integrating advanced digital control units and smart shower components. This strategic move aligns with Harvia's broader objective to enhance its digital capabilities across its entire product range, aiming to capitalize on the burgeoning smart home wellness market.

These smart shower solutions, while currently representing a smaller segment of Harvia's business, exhibit substantial growth potential. The company anticipates that continued investment in these high-potential offerings will be crucial for achieving widespread market adoption and solidifying its position in the evolving wellness technology landscape.

- Digital Integration: ThermaSol acquisition brought key digital control and smart shower technologies.

- Strategic Focus: Harvia is prioritizing digital enhancements across its product lines.

- Market Potential: Smart shower components represent a high-growth, albeit currently smaller, market segment for Harvia.

- Investment Needs: Further investment is required to drive widespread adoption of these smart wellness products.

Question Marks in Harvia's BCG matrix represent products or business units with low market share in a high-growth industry. These are typically new ventures or products that haven't yet gained significant traction but operate in markets with strong future potential. Harvia's focus on developing innovative, sustainable solutions places several of its offerings in this category, requiring careful consideration for future investment or divestment strategies.

The Hydrogen Sauna Concept, while promising, currently has a negligible market share, placing it firmly in the Question Mark quadrant. Similarly, the Kirami FinVision Zero, a new solar-powered sauna, also exhibits low market share in a high-growth sustainable solutions market. Harvia's strategic investments in China, where its market share is nascent, also fit the characteristics of a Question Mark, aiming to cultivate growth in a rapidly expanding market.

| Product/Segment | Market Share | Market Growth | BCG Quadrant | Strategic Implication |

| Hydrogen Sauna Concept | Negligible | High (Eco-friendly tech) | Question Mark | Invest for growth or divest |

| Kirami FinVision Zero | Low | High (Sustainable solutions) | Question Mark | Invest for growth or divest |

| China Operations | Nascent | High (Wellness market) | Question Mark | Invest for growth or divest |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.