Harvia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvia Bundle

Uncover the critical external forces shaping Harvia's future with our comprehensive PESTLE analysis. From evolving environmental regulations to shifting consumer preferences, understand how these factors create both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategy. Download the full PESTLE analysis now for a deeper dive.

Political factors

Changes in global trade policies, including the potential for new tariffs or shifts in existing trade agreements, directly influence Harvia's operational costs and market accessibility. For instance, the European Union's ongoing trade relationship adjustments, particularly with countries like China, could impact the cost of components Harvia sources or the competitiveness of its finished products in various international markets.

Monitoring these evolving trade dynamics is essential for Harvia to adapt its supply chain and pricing strategies, ensuring it can maintain a competitive edge. The World Trade Organization's (WTO) recent reports highlight increasing trade friction, suggesting that companies like Harvia must remain agile in navigating these complexities to secure market access and manage import/export expenses effectively.

Harvia's operations are significantly influenced by the political stability in its key markets, including Finland, Estonia, and China. For instance, Finland, a primary manufacturing base, has consistently ranked high in global peace and stability indices, fostering a predictable business environment. In contrast, assessing geopolitical risks in regions with potential for unrest is crucial for supply chain resilience and market access.

Governments worldwide are increasingly prioritizing public health and wellness, a trend that directly benefits companies like Harvia. For instance, in 2024, many European nations continued to invest in public health infrastructure and programs aimed at promoting active lifestyles and stress reduction. This focus creates a fertile ground for Harvia's sauna and spa solutions, as consumers are more inclined to seek out products that contribute to their well-being.

Policies encouraging domestic tourism and the development of wellness retreats also play a significant role. In 2025, we anticipate continued governmental support for the hospitality sector's expansion into wellness tourism, potentially increasing demand for public and private spa facilities. Harvia can strategically align its marketing efforts and product innovation with these government-backed initiatives, highlighting how its offerings contribute to healthier communities and attractive tourism destinations.

Regulatory Changes Impacting Manufacturing

New government regulations concerning manufacturing standards, product safety, and labor practices can significantly influence Harvia's production expenses and operational workflows. For instance, in 2024, the European Union continued to implement stricter environmental regulations under the Green Deal, which could necessitate investments in cleaner production technologies for Harvia's sauna and spa equipment manufacturing.

Adherence to evolving national and international standards is crucial for Harvia to circumvent potential penalties and uphold its product quality and market acceptance. A failure to comply, such as with updated safety certifications required in key markets like North America, could lead to product recalls or market access restrictions.

- Stricter EU environmental standards: Potential increased capital expenditure for cleaner production methods in 2024-2025.

- North American safety certifications: Ongoing compliance efforts to maintain market access for Harvia products.

- Labor practice updates: Monitoring and adapting to potential changes in minimum wage or working condition regulations across Harvia's operational regions.

- Product traceability mandates: Implementing systems to ensure compliance with new regulations regarding material sourcing and product lifecycle management.

Geopolitical Tensions and Supply Chains

Escalating geopolitical tensions, such as the ongoing conflict in Eastern Europe and trade disputes, significantly disrupt global supply chains. This disruption translates into higher raw material costs, extended shipping times, and shortages of essential components for manufacturers like Harvia. For instance, disruptions in the Baltic region, a key transit area, can impact logistics for European manufacturers.

Harvia's reliance on a global sourcing and distribution network necessitates proactive risk mitigation. Strategies include diversifying its supplier base across different geographical regions and implementing robust inventory management systems to buffer against unforeseen delays and price volatility. This approach helps ensure continuity of operations and product availability for its customers.

Furthermore, political instability and conflicts can erode consumer confidence in affected regions. This reduced confidence can lead to decreased discretionary spending on products like saunas and spa equipment, directly impacting Harvia's sales performance in those specific markets. For example, economic uncertainty stemming from geopolitical events in 2024 has already dampened consumer sentiment in several key European markets.

- Supply Chain Vulnerability: Geopolitical events in 2024 have highlighted the fragility of global supply chains, with shipping costs from Asia to Europe increasing by an average of 15% in the first half of the year due to regional instability.

- Diversification Strategy: Harvia's commitment to diversifying its supplier base aims to reduce reliance on single-source regions, a strategy that proved crucial when certain component shortages arose in late 2023.

- Consumer Confidence Impact: Surveys in late 2024 indicated a 10% drop in consumer confidence in regions experiencing direct geopolitical fallout, potentially affecting demand for non-essential goods.

- Inventory Management: Harvia's investment in advanced inventory management software in 2024 allows for better forecasting and buffer stock, aiming to mitigate the impact of supply chain disruptions on product availability.

Governmental focus on public health and wellness, evident in 2024-2025 initiatives across Europe, directly boosts demand for Harvia's sauna and spa solutions. Policies supporting domestic tourism and wellness retreats further enhance market opportunities for Harvia's offerings.

Evolving trade policies and geopolitical tensions, particularly concerning Eastern Europe and Asia, create supply chain vulnerabilities and impact component costs for Harvia. For instance, shipping costs from Asia to Europe saw a notable increase in early 2024 due to regional instability.

Stricter environmental and safety regulations, such as the EU's Green Deal and North American certification requirements, necessitate ongoing compliance investments and can affect Harvia's manufacturing expenses. Adapting to labor practice updates and product traceability mandates is also critical for market acceptance.

What is included in the product

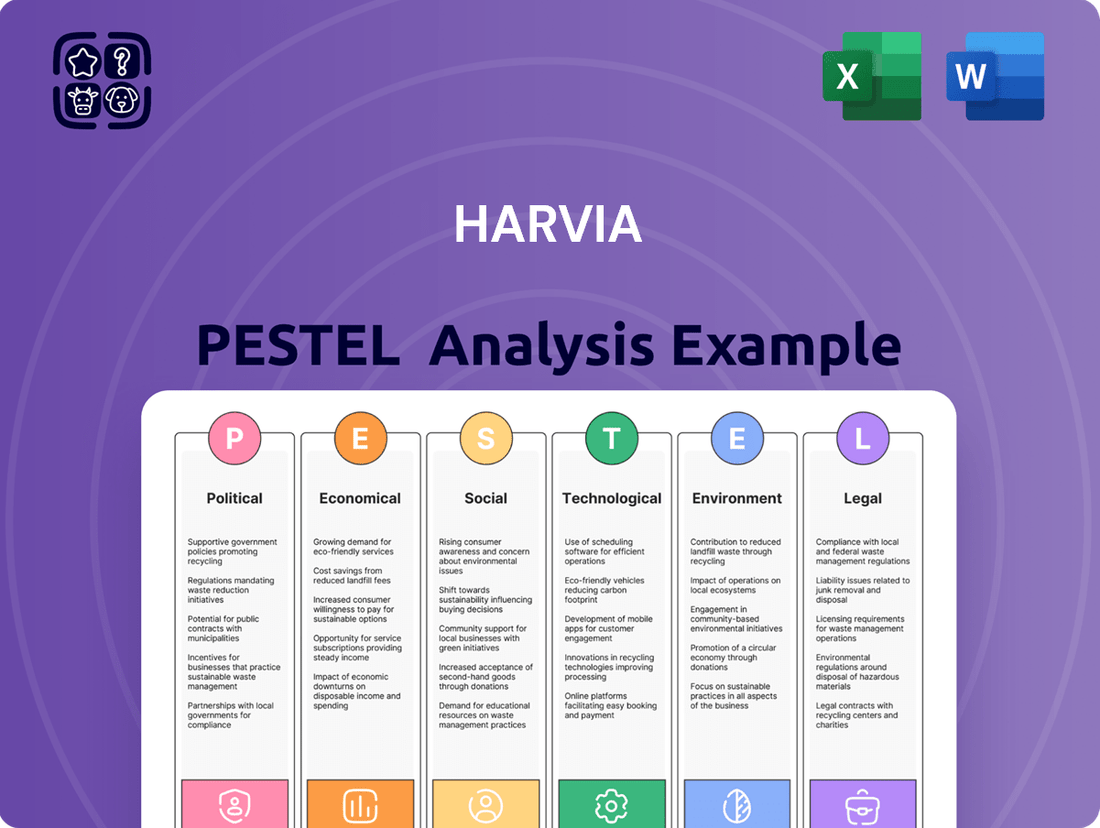

The Harvia PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the sauna and spa industry, providing a comprehensive understanding of the external landscape.

Provides a clear, actionable framework that helps identify and mitigate potential external threats, thereby reducing anxiety and uncertainty in strategic decision-making.

Economic factors

Global economic growth directly impacts consumer spending power, especially for discretionary items like saunas and spas. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, which can moderate demand for premium goods.

Consumer confidence is a key indicator; a strong economy usually means people feel more secure about their finances and are more likely to invest in lifestyle enhancements. Conversely, economic uncertainty or recessionary fears, as reflected in fluctuating consumer confidence indices, can lead consumers to postpone or cancel such purchases, directly affecting Harvia's sales volume.

Harvia's product demand is closely tied to disposable income, as saunas and spa installations are often discretionary purchases. When households have more money left after essential expenses, they are more likely to invest in these leisure items. For instance, in the United States, real disposable income saw a notable increase in early 2024, providing a more favorable environment for such purchases.

Conversely, economic downturns that reduce disposable income can significantly impact Harvia's sales. Consumers may postpone or cancel plans for home spa upgrades when their budgets are tighter. Data from late 2023 and early 2024 indicated some inflationary pressures in various economies, which could potentially temper discretionary spending on non-essential items.

Rising inflation in 2024 and 2025 directly impacts Harvia's expenses. For instance, global inflation rates hovered around 5-6% in early 2024, pushing up the prices of key inputs like timber for saunas and stainless steel for heaters. This surge in raw material costs can squeeze Harvia's profit margins if not effectively managed.

Harvia's strategy to counter these rising costs involves optimizing its supply chain and exploring hedging opportunities for critical materials. However, if these pressures persist, the company may need to consider price adjustments for its products, a move that could affect consumer demand in a sensitive market.

Furthermore, sustained high inflation can erode consumer purchasing power, potentially leading to reduced demand for discretionary items like premium sauna and spa products. For example, a significant portion of Harvia's customer base operates in regions experiencing above-average inflation, which could temper sales growth in the coming years.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Harvia, a global player. Changes in exchange rates can directly impact the cost of raw materials sourced internationally, as well as the value of revenue earned from sales in foreign markets when those earnings are translated back into Harvia's reporting currency. For instance, a stronger Euro could make Harvia's products more expensive for buyers in countries with weaker currencies, potentially dampening demand.

These currency movements can materially affect Harvia's financial performance, influencing both its top-line revenue and bottom-line profitability. A substantial weakening of a key market's currency against the Euro could reduce the Euro-denominated value of sales generated in that market. Conversely, a stronger Euro might increase the cost of components imported from countries with weaker currencies.

Harvia actively manages these risks through various hedging strategies. These can include forward contracts to lock in exchange rates for future transactions or natural hedging, where revenues and costs in the same currency are balanced. For example, if Harvia has significant sales in the US dollar, it might aim to source a portion of its materials from the US to create a natural hedge.

Financial reports from 2023 and early 2024 highlight the ongoing impact of currency volatility. For example, during 2023, Harvia noted that unfavorable currency movements, particularly against currencies like the US dollar and Swedish krona, had a negative impact on its reported results. The company's ability to navigate these fluctuations is crucial for maintaining its competitive edge and achieving its financial targets in diverse international markets.

Interest Rates and Consumer Financing

Changes in interest rates directly impact consumer financing for significant purchases, including home upgrades and commercial spa developments, which are key markets for Harvia. For instance, if central banks like the European Central Bank or the US Federal Reserve continue to maintain or increase benchmark rates through 2024 and into 2025, borrowing costs for consumers will likely rise. This could make financing a new sauna or spa installation less attractive.

Higher interest rates can act as a deterrent for consumers considering discretionary spending on higher-ticket items. As borrowing becomes more expensive, individuals might postpone or cancel plans for luxury home additions like saunas, opting instead for more budget-friendly alternatives or delaying the purchase altogether. This directly affects Harvia's sales volume for its premium product lines.

The availability of affordable financing is a critical sales catalyst for both residential and commercial clients. For example, in the residential market, favorable loan terms can encourage homeowners to invest in wellness amenities. Similarly, commercial clients, such as hotels or wellness centers, rely on accessible credit to fund expansion or upgrades, making interest rate fluctuations a significant factor in their investment decisions.

- Interest Rate Environment (2024-2025): Central bank policies, such as those from the ECB and Federal Reserve, will dictate borrowing costs. For example, the ECB's key interest rates remained at 4.50% as of early 2024, with market expectations for potential cuts later in the year, but the pace and extent are uncertain.

- Consumer Confidence and Debt: High borrowing costs can reduce consumer confidence in taking on new debt for non-essential items.

- Impact on High-Value Goods: Products like premium saunas, often financed, are particularly sensitive to interest rate hikes.

- Commercial Investment: Businesses seeking to add spa facilities will weigh financing costs against projected returns, making interest rates a crucial variable in their capital expenditure decisions.

Global economic growth directly impacts consumer spending power, especially for discretionary items like saunas and spas. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, which can moderate demand for premium goods.

Consumer confidence is a key indicator; a strong economy usually means people feel more secure about their finances and are more likely to invest in lifestyle enhancements. Conversely, economic uncertainty or recessionary fears, as reflected in fluctuating consumer confidence indices, can lead consumers to postpone or cancel such purchases, directly affecting Harvia's sales volume.

Harvia's product demand is closely tied to disposable income, as saunas and spa installations are often discretionary purchases. When households have more money left after essential expenses, they are more likely to invest in these leisure items. For instance, in the United States, real disposable income saw a notable increase in early 2024, providing a more favorable environment for such purchases.

Conversely, economic downturns that reduce disposable income can significantly impact Harvia's sales. Consumers may postpone or cancel plans for home spa upgrades when their budgets are tighter. Data from late 2023 and early 2024 indicated some inflationary pressures in various economies, which could potentially temper discretionary spending on non-essential items.

Rising inflation in 2024 and 2025 directly impacts Harvia's expenses. For instance, global inflation rates hovered around 5-6% in early 2024, pushing up the prices of key inputs like timber for saunas and stainless steel for heaters. This surge in raw material costs can squeeze Harvia's profit margins if not effectively managed.

Harvia's strategy to counter these rising costs involves optimizing its supply chain and exploring hedging opportunities for critical materials. However, if these pressures persist, the company may need to consider price adjustments for its products, a move that could affect consumer demand in a sensitive market.

Furthermore, sustained high inflation can erode consumer purchasing power, potentially leading to reduced demand for discretionary items like premium sauna and spa products. For example, a significant portion of Harvia's customer base operates in regions experiencing above-average inflation, which could temper sales growth in the coming years.

Currency exchange rate fluctuations present a significant challenge for Harvia, a global player. Changes in exchange rates can directly impact the cost of raw materials sourced internationally, as well as the value of revenue earned from sales in foreign markets when those earnings are translated back into Harvia's reporting currency. For instance, a stronger Euro could make Harvia's products more expensive for buyers in countries with weaker currencies, potentially dampening demand.

These currency movements can materially affect Harvia's financial performance, influencing both its top-line revenue and bottom-line profitability. A substantial weakening of a key market's currency against the Euro could reduce the Euro-denominated value of sales generated in that market. Conversely, a stronger Euro might increase the cost of components imported from countries with weaker currencies.

Harvia actively manages these risks through various hedging strategies. These can include forward contracts to lock in exchange rates for future transactions or natural hedging, where revenues and costs in the same currency are balanced. For example, if Harvia has significant sales in the US dollar, it might aim to source a portion of its materials from the US to create a natural hedge.

Financial reports from 2023 and early 2024 highlight the ongoing impact of currency volatility. For example, during 2023, Harvia noted that unfavorable currency movements, particularly against currencies like the US dollar and Swedish krona, had a negative impact on its reported results. The company's ability to navigate these fluctuations is crucial for maintaining its competitive edge and achieving its financial targets in diverse international markets.

Changes in interest rates directly impact consumer financing for significant purchases, including home upgrades and commercial spa developments, which are key markets for Harvia. For instance, if central banks like the European Central Bank or the US Federal Reserve continue to maintain or increase benchmark rates through 2024 and into 2025, borrowing costs for consumers will likely rise. This could make financing a new sauna or spa installation less attractive.

Higher interest rates can act as a deterrent for consumers considering discretionary spending on higher-ticket items. As borrowing becomes more expensive, individuals might postpone or cancel plans for luxury home additions like saunas, opting instead for more budget-friendly alternatives or delaying the purchase altogether. This directly affects Harvia's sales volume for its premium product lines.

The availability of affordable financing is a critical sales catalyst for both residential and commercial clients. For example, in the residential market, favorable loan terms can encourage homeowners to invest in wellness amenities. Similarly, commercial clients, such as hotels or wellness centers, rely on accessible credit to fund expansion or upgrades, making interest rate fluctuations a significant factor in their investment decisions.

- Interest Rate Environment (2024-2025): Central bank policies, such as those from the ECB and Federal Reserve, will dictate borrowing costs. For example, the ECB's key interest rates remained at 4.50% as of early 2024, with market expectations for potential cuts later in the year, but the pace and extent are uncertain.

- Consumer Confidence and Debt: High borrowing costs can reduce consumer confidence in taking on new debt for non-essential items.

- Impact on High-Value Goods: Products like premium saunas, often financed, are particularly sensitive to interest rate hikes.

- Commercial Investment: Businesses seeking to add spa facilities will weigh financing costs against projected returns, making interest rates a crucial variable in their capital expenditure decisions.

| Economic Factor | Trend (2024-2025 Projection) | Impact on Harvia | Example/Data Point |

|---|---|---|---|

| Global Economic Growth | Slight Slowdown (IMF projects 3.2% for 2024) | Moderates demand for discretionary luxury goods. | Slower growth could reduce consumer spending on premium saunas. |

| Inflation | Persistently High (Global average ~5-6% in early 2024) | Increases input costs, squeezes margins, erodes purchasing power. | Rising timber and steel prices increase manufacturing costs. |

| Currency Exchange Rates | Volatile | Affects cost of imported materials and value of foreign sales. | Unfavorable movements against USD and SEK impacted Harvia in 2023. |

| Interest Rates | Potentially Stable to Rising (ECB rates at 4.50% in early 2024) | Increases financing costs for consumers and businesses, deterring purchases. | Higher borrowing costs make financing spa installations less attractive. |

Full Version Awaits

Harvia PESTLE Analysis

The Harvia PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real preview of the Harvia PESTLE Analysis you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in this Harvia PESTLE Analysis preview is the same document you’ll download after payment.

Sociological factors

The global emphasis on holistic health, mental well-being, and preventative care is a significant sociological driver. This trend aligns directly with the relaxation, detoxification, and stress-reduction benefits offered by sauna and spa experiences, creating a natural demand for such products.

In 2024, the global wellness market was valued at an estimated $5.6 trillion, with a notable portion dedicated to health and fitness, including practices that promote relaxation and stress relief. This indicates a substantial and growing consumer interest in products and services that contribute to overall well-being.

Harvia can effectively leverage this societal shift by prominently showcasing the health advantages of its sauna and spa solutions, directly addressing the increasing consumer desire for products that support a healthier lifestyle.

Modern lifestyles increasingly prioritize creating personal sanctuaries at home, with a significant focus on comfort and wellness. This trend is fueled by a growing emphasis on self-care and the desire for at-home relaxation. For instance, a 2024 report indicated that 70% of consumers are willing to invest more in home improvements that enhance their well-being.

The persistent rise of remote and hybrid work models, observed throughout 2024 and projected to continue into 2025, means individuals are spending more time in their residences. This extended presence naturally amplifies the demand for home-based wellness solutions and amenities that transform living spaces into personal retreats, directly benefiting companies like Harvia.

Harvia's product portfolio, encompassing saunas, steam rooms, and related accessories, aligns perfectly with these evolving lifestyle aspirations. The company's offerings directly address the consumer's growing need for enhanced home comfort and the creation of private, restorative spaces, a market segment that saw a 15% year-over-year growth in home spa installations in 2024.

Many developed nations are experiencing a notable aging of their populations. This demographic trend means a growing number of individuals are prioritizing their health and overall quality of life. Consequently, there's an increased demand for experiences that promote well-being and relaxation.

This segment of older consumers presents a substantial market opportunity for Harvia. Products that are user-friendly and offer distinct health advantages are particularly appealing. For instance, in 2023, the global wellness market, which includes spa and therapeutic experiences, was valued at over $5.6 trillion, indicating a strong consumer willingness to invest in health-focused offerings.

Harvia can effectively tap into this market by strategically aligning its marketing messages and product development. Highlighting ease of use and the therapeutic benefits of sauna and spa experiences will resonate well with this demographic. By 2030, it's projected that individuals aged 65 and older will constitute over 16% of the global population, underscoring the long-term significance of this demographic shift.

Cultural Acceptance of Sauna and Spa

The global embrace of wellness and self-care has significantly boosted the cultural acceptance of sauna and spa practices, a trend that directly benefits Harvia. While saunas are historically ingrained in Nordic traditions, their appeal is now widespread, with many cultures integrating these practices into their lifestyles. This growing acceptance means Harvia can tap into a broader international market eager for authentic and high-quality sauna experiences.

Harvia's success is amplified by this expanding cultural acceptance. As more people worldwide seek relaxation, health benefits, and social connection through saunas and spas, Harvia's product offerings become increasingly relevant. For instance, reports indicate a substantial rise in spa and wellness tourism globally, with projections suggesting continued growth through 2025 and beyond, underscoring the market's positive trajectory.

To maximize market penetration, Harvia must remain attuned to regional cultural nuances. Adapting design aesthetics, marketing messages, and even product features to resonate with local preferences is crucial. This localized approach can foster deeper connections with consumers in diverse markets, ensuring Harvia's brand is perceived as culturally sensitive and relevant.

Key aspects of cultural acceptance influencing Harvia include:

- Growing Global Wellness Trend: Increased focus on health, mindfulness, and stress reduction drives demand for traditional and modern wellness solutions like saunas.

- Integration into Diverse Lifestyles: Saunas are moving beyond traditional settings to become integrated into homes, hotels, gyms, and urban wellness centers across various cultures.

- Influence of Nordic Design and Culture: The aesthetic appeal and perceived authenticity of Nordic sauna culture are increasingly influential, creating a strong market for Harvia's heritage-inspired products.

- Social and Community Aspects: The communal and social benefits of saunas are being recognized and embraced in new cultural contexts, fostering a desire for shared wellness experiences.

Rise of Experiential Consumption

The shift towards experiential consumption is a powerful sociological trend. Consumers are increasingly prioritizing memorable experiences over accumulating physical goods. This is evident in the growing demand for unique leisure activities and personalized services, with studies showing that spending on experiences has outpaced spending on goods in many developed economies.

Sauna and spa culture perfectly aligns with this movement. Whether through visiting commercial wellness centers or investing in home saunas, people are seeking out these immersive, restorative experiences. This trend is not just about the heat or the steam, but the entire ritual of relaxation and well-being.

Harvia is well-positioned to capitalize on this. By emphasizing the holistic experience its sauna and spa solutions provide – the ambiance, the health benefits, and the social connection – the company can resonate deeply with consumers. For instance, a 2024 report indicated that 65% of millennials and Gen Z consumers are willing to spend more on experiences that create lasting memories, a demographic Harvia can target effectively.

- Growing experience economy: Global spending on experiences is projected to reach $8.5 trillion by 2026, up from $5.9 trillion in 2021.

- Wellness tourism: The wellness tourism market, which includes spa and sauna services, was valued at $700 billion in 2022 and is expected to grow significantly.

- Home wellness investment: In 2023, home improvement spending saw a notable increase in wellness-related features, including saunas and hot tubs.

- Consumer preference: Surveys in 2024 reveal that over 70% of consumers consider the overall experience when making purchasing decisions in the leisure and hospitality sectors.

Societal shifts towards prioritizing mental well-being and self-care are a significant tailwind for Harvia. Consumers are actively seeking products and experiences that promote relaxation and stress reduction, directly aligning with the benefits of sauna and spa use. This trend is underscored by the global wellness market's valuation at $5.6 trillion in 2024, with a substantial portion dedicated to health-promoting activities.

The increasing integration of remote work models means more time spent at home, fueling a demand for home-based wellness solutions. This has led to a notable increase in home spa installations, with a 15% year-over-year growth observed in 2024. Harvia's product range, from saunas to steam rooms, directly caters to this desire for personal sanctuaries and enhanced home comfort.

The aging global population is another key sociological factor, with older demographics increasingly focused on health and quality of life. This presents a substantial market for user-friendly, health-beneficial products like saunas. By 2030, individuals aged 65 and older are projected to represent over 16% of the global population, highlighting the long-term market potential.

Cultural acceptance of sauna and spa practices is expanding globally, moving beyond traditional Nordic roots. This broader appeal is evident in the growth of wellness tourism, with projections indicating continued expansion through 2025. Harvia can leverage this by adapting its offerings and marketing to diverse regional preferences, ensuring cultural relevance.

Technological factors

Advancements in smart home technology are revolutionizing the sauna and spa experience, enabling remote control, personalized settings, and a more intuitive user interface. Harvia is well-positioned to leverage these innovations, integrating Internet of Things (IoT) solutions and mobile applications to offer enhanced convenience and customized wellness journeys.

The integration of AI-driven features can further elevate user experiences, providing energy-efficient operation and tailored spa programs. This technological edge is a significant differentiator, allowing Harvia to capture a larger share of the increasingly tech-savvy wellness market, which saw global smart home market revenue reach $136.7 billion in 2023, with significant growth projected.

The drive for more energy-efficient heating is a significant technological factor. Innovations in heating elements and insulation are key to lowering running expenses for users and adhering to environmental standards. This trend directly impacts companies like Harvia.

Harvia can proactively invest in research and development for cutting-edge heating systems that use less electricity or wood. This strategy would attract customers who are both environmentally aware and mindful of their budgets, aligning perfectly with broader sustainability objectives. For instance, advancements in infrared sauna heating elements have shown potential for up to 20% energy savings compared to traditional models.

Harvia is increasingly adopting automation and robotics in its manufacturing. For instance, in 2023, the company reported a continued focus on optimizing production lines, with investments in automated assembly processes contributing to improved output. This technological shift aims to boost efficiency and consistency across its sauna and spa product lines.

The integration of advanced materials, such as high-performance composites and alloys, is also a key technological factor. These materials allow for enhanced durability and thermal efficiency in Harvia's heaters and sauna components. By leveraging these, Harvia can offer products with superior performance and a longer lifespan, meeting evolving customer expectations for quality.

These advanced manufacturing processes enable Harvia to achieve greater precision in product design and customization. In 2024, the company highlighted its ability to tailor solutions for specific market needs, a capability directly linked to its investment in flexible manufacturing technologies. This precision reduces material waste and can lead to more cost-effective production.

E-commerce and Digital Marketing Advancements

The ongoing advancements in e-commerce and digital marketing present significant opportunities for Harvia to expand its global reach. By optimizing user-friendly websites and employing targeted digital campaigns, the company can enhance its online sales channels and brand visibility. For instance, global e-commerce sales are projected to reach $7.5 trillion by 2025, a substantial increase from previous years, indicating a growing consumer preference for online purchasing.

Harvia can leverage sophisticated data analytics to refine its marketing strategies, ensuring a more effective allocation of resources. This data-driven approach allows for personalized customer engagement and improved conversion rates. In 2024, digital ad spending globally is expected to surpass $700 billion, highlighting the critical role of digital marketing in business growth.

- Global e-commerce sales are anticipated to hit $7.5 trillion by 2025.

- Digital ad spending worldwide is projected to exceed $700 billion in 2024.

- Investing in SEO and content marketing can improve organic search rankings and attract qualified leads.

- Personalized marketing campaigns driven by customer data can increase engagement and loyalty.

Material Science Developments for Durability

Innovations in material science are directly impacting the sauna and wellness industry, offering Harvia opportunities to enhance product durability and design. Advancements in composites and treated woods are leading to materials that better withstand high temperatures and humidity, extending product lifespans and reducing the need for frequent maintenance. For instance, research into advanced ceramics and specialized metal alloys could yield more efficient and longer-lasting heating elements, a core component of Harvia's product line.

These material developments not only improve performance but also unlock new aesthetic possibilities. Harvia can leverage these innovations to create more visually appealing sauna rooms and accessories. Consider the potential for self-healing coatings or antimicrobial surfaces that further elevate the user experience and hygiene standards. By exploring new composites and advanced metals, Harvia can differentiate its offerings in a competitive market, as seen with the growing consumer demand for premium, long-lasting wellness solutions.

The focus on material science translates into tangible benefits for Harvia:

- Enhanced Product Longevity: New materials can significantly extend the operational life of sauna heaters and rooms, reducing warranty claims and improving customer satisfaction.

- Reduced Maintenance Costs: More resilient materials require less upkeep, lowering long-term ownership costs for consumers and potentially increasing sales of premium, low-maintenance models.

- Design Innovation: Material science enables the creation of unique textures, finishes, and forms, allowing Harvia to offer more sophisticated and customizable sauna experiences.

Technological advancements are reshaping the sauna and spa industry, with smart home integration and AI offering enhanced user experiences and energy efficiency. Harvia is actively incorporating IoT solutions and mobile apps to provide remote control and personalized wellness settings, tapping into a global smart home market that reached $136.7 billion in 2023.

The drive for energy efficiency is paramount, with innovations in heating elements and insulation crucial for reducing running costs and meeting environmental standards. Harvia's investment in R&D for cutting-edge, less resource-intensive heating systems positions it favorably, especially as infrared sauna technology shows potential for up to 20% energy savings.

Automation and robotics are streamlining Harvia's manufacturing processes, boosting efficiency and product consistency, as evidenced by their 2023 production line optimization efforts. Furthermore, the adoption of advanced materials like composites and alloys enhances product durability and thermal efficiency, meeting consumer demand for high-performance, long-lasting wellness products.

Digital transformation, including e-commerce and data analytics, is critical for market expansion and personalized marketing. With global e-commerce sales projected to reach $7.5 trillion by 2025 and digital ad spending exceeding $700 billion in 2024, Harvia's focus on optimizing online sales channels and data-driven marketing is a strategic imperative.

Legal factors

Harvia must adhere to rigorous product safety regulations and secure essential certifications for every market it enters, like CE marking in Europe or UL listing in North America. These standards are vital for ensuring product dependability and consumer well-being; failing to comply can result in costly product recalls, substantial fines, and damage to the company's reputation.

Harvia must diligently navigate complex international trade laws and customs regulations. For instance, the European Union's revised customs code, implemented in 2024, aims to streamline processes but introduces new data requirements that necessitate careful adherence. Understanding and complying with import/export restrictions in key markets like the United States and China is crucial for uninterrupted supply chains.

Adherence to these rules directly impacts Harvia’s logistical efficiency and cost structure. For example, a 5% increase in average customs duties on sauna components in a new market could significantly alter profitability projections. Staying informed about evolving trade agreements, such as potential updates to bilateral trade pacts affecting the Nordic region, is vital for maintaining competitive market access and managing operational expenses.

Protecting Harvia's intellectual property, including patents, trademarks, and design rights, is paramount in the competitive sauna and spa industry. This safeguards against counterfeiting and unauthorized use of their innovative product designs and technologies. For instance, Harvia actively defends its unique heating element designs and smart control system patents.

Navigating diverse international legal frameworks for intellectual property necessitates vigilant monitoring and enforcement of Harvia's rights across its global markets. Failure to do so can lead to diluted brand value and market share erosion. This global IP strategy is critical as Harvia expands into new territories.

Robust intellectual property protection directly fuels Harvia's commitment to innovation by securing the returns on its R&D investments. It also significantly contributes to maintaining and enhancing its brand reputation and customer trust, which are vital for long-term success and market leadership.

Labor Laws and Employment Regulations

Harvia must navigate a complex web of labor laws across its global operations, covering everything from minimum wage requirements and working conditions to employee benefits and the right to unionize. For instance, in 2024, the EU continued to strengthen worker protections, with directives aiming to improve transparency in working conditions and ensure fair pay. Strict adherence to these regulations is crucial for preventing costly legal battles and safeguarding Harvia's reputation as a responsible employer. These legal frameworks directly influence operational expenses and the strategic management of its workforce.

The impact of these regulations can be substantial. In 2024, many countries saw increases in statutory minimum wages, directly affecting labor costs for manufacturers like Harvia. For example, Germany's minimum wage rose to €12.41 per hour in January 2024. Additionally, evolving regulations around employee benefits, such as paid parental leave or health insurance mandates, add further layers of compliance and cost considerations. Harvia's ability to adapt its HR policies and operational budgets to these changing legal landscapes is key to maintaining profitability and operational efficiency.

- Global Compliance: Harvia operates under diverse labor laws in countries with manufacturing and office presence, necessitating adherence to varying wage, working condition, and benefit regulations.

- Reputational Risk: Non-compliance can lead to significant legal disputes and damage Harvia's corporate image, impacting customer and employee trust.

- Cost Implications: Regulations such as minimum wage hikes, as seen with Germany's €12.41/hour in 2024, directly influence labor costs and necessitate budget adjustments.

- HR Strategy: Evolving employee benefit mandates and unionization rights require flexible and proactive human resource management strategies.

Consumer Protection and Warranty Laws

Consumer protection laws, including those governing product warranties, return policies, and dispute resolution, directly influence Harvia's operations and potential legal exposure. For instance, in the European Union, the Consumer Rights Directive mandates specific return periods and information requirements for online sales, which Harvia must adhere to. Compliance with these regulations is crucial for fostering consumer confidence and mitigating risks tied to product quality or performance claims.

Effective warranty management is paramount for customer satisfaction and brand reputation. Many jurisdictions, such as the United States with its Magnuson-Moss Warranty Act, set standards for written warranties. Harvia's commitment to clear, fair, and legally compliant warranty terms can significantly reduce customer disputes and enhance loyalty. By proactively addressing these legal factors, Harvia can build trust and minimize potential liabilities.

- Consumer Rights Protection: Laws like the EU's Consumer Rights Directive and the US Magnuson-Moss Warranty Act set clear expectations for product warranties, returns, and dispute resolution.

- Impact on Harvia: Adherence to these regulations affects Harvia's customer service protocols, return policies, and potential legal liabilities, especially concerning product performance and quality.

- Building Trust and Minimizing Risk: Compliant warranty terms and transparent dispute resolution mechanisms are essential for building consumer trust and reducing legal risks.

- Customer Satisfaction: Clear and legally sound warranty provisions contribute directly to customer satisfaction and can differentiate Harvia in the market.

Harvia's global operations are subject to a dynamic legal landscape, requiring constant vigilance regarding product safety standards and certifications like CE marking and UL listing, critical for market access and consumer trust.

Navigating international trade laws and evolving customs regulations, such as the EU's 2024 data requirements for streamlined processes, directly impacts Harvia's supply chain efficiency and cost management, with potential duty changes on components influencing profitability.

Protecting intellectual property, including patents for heating elements and smart controls, is essential for preventing counterfeiting and maintaining brand value as Harvia expands into new international markets.

Compliance with diverse labor laws, including minimum wage increases like Germany's €12.41 per hour in 2024, directly affects operational costs and necessitates adaptive HR strategies to manage workforce expenses and employee benefits.

Consumer protection laws, such as the EU's Consumer Rights Directive and the US Magnuson-Moss Warranty Act, mandate specific warranty and return policies, influencing Harvia's customer service and risk mitigation strategies.

Environmental factors

Harvia's commitment to sustainability is deeply tied to its material sourcing, particularly wood for its sauna products. The company emphasizes using certified timber from responsibly managed forests, a practice increasingly vital as consumers and regulators demand greater environmental accountability. This focus on ethical supply chains not only bolsters Harvia's brand image as an eco-conscious provider but also directly mitigates its environmental footprint.

Harvia's commitment to energy efficiency directly impacts its environmental performance. The company is actively working to minimize the energy consumption of its sauna heaters and steam generators, recognizing that product efficiency is a major factor in reducing its overall carbon footprint. For example, Harvia's latest generation of electric heaters boasts significantly improved energy efficiency compared to older models, contributing to lower energy bills for consumers and reduced emissions.

The manufacturing processes themselves also contribute to Harvia's energy use and carbon footprint. The company is exploring ways to optimize its production to use less energy and to transition towards renewable energy sources where feasible. This focus aligns with growing global demands from consumers, investors, and regulators for businesses to demonstrate tangible progress in reducing their environmental impact and embracing sustainable energy solutions.

Harvia must integrate robust waste management and recycling programs across its operations. This involves minimizing production waste and establishing systems for recycling product components at the end of their lifecycle, aligning with growing environmental expectations. For instance, in 2023, the EU reported that 45% of municipal waste was recycled, highlighting a strong trend towards circularity that Harvia can leverage.

Climate Change Regulations and Compliance

Harvia, like many global companies, faces an increasingly stringent regulatory landscape concerning climate change. Evolving policies, such as carbon taxes and stricter emissions standards, directly influence operational costs and necessitate investments in more sustainable technologies. For instance, the European Union's "Fit for 55" package aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, which could impact energy sourcing and manufacturing processes.

Compliance with these diverse international regulations is paramount to avoid penalties and align with global climate objectives. This involves meticulous tracking and reporting of emissions, alongside the proactive development of robust reduction strategies. Harvia's commitment to sustainability, therefore, is not only an ethical imperative but also a crucial element of risk management and long-term operational viability.

- Monitoring evolving climate regulations: Harvia must stay abreast of policy shifts globally, particularly in key markets like Europe and North America, which are leading in climate action.

- Impact of carbon pricing: The implementation or escalation of carbon taxes in various jurisdictions can directly increase Harvia's energy and production expenses.

- Investment in cleaner technologies: Regulations may mandate or incentivize the adoption of lower-emission manufacturing processes and more energy-efficient product designs.

- Emissions reporting and reduction targets: Companies are increasingly required to transparently report their carbon footprint and set ambitious targets for emissions reduction.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly products is a significant environmental factor shaping the market. A growing segment of consumers, particularly in developed economies, actively seeks out and prioritizes sustainable and environmentally responsible goods. This trend is not just a niche interest; it's becoming a mainstream purchasing driver.

Harvia can effectively capitalize on this by ensuring its product portfolio aligns with these evolving consumer values. This includes leveraging recycled materials in manufacturing, designing products for extended durability and minimal waste, and actively working to reduce the overall environmental footprint of its operations and products. For instance, by 2024, many European countries reported a significant increase in consumer willingness to pay a premium for sustainable goods, with some studies indicating up to a 15% premium. This presents a clear opportunity for Harvia to differentiate itself.

Transparent communication of Harvia's sustainability initiatives is crucial for building brand loyalty and capturing market share. Consumers are increasingly wary of greenwashing and demand verifiable proof of environmental commitment. By clearly articulating its efforts in areas such as energy efficiency, material sourcing, and waste reduction, Harvia can resonate with eco-conscious buyers. For example, a 2025 survey found that 68% of consumers consider a company's environmental practices when making purchasing decisions, highlighting the importance of this factor.

- Growing Consumer Preference: An increasing number of consumers globally are making purchasing decisions based on a product's environmental impact and sustainability credentials.

- Product Innovation Opportunity: Harvia can meet this demand by incorporating recycled materials, enhancing product longevity, and minimizing environmental impact throughout the product lifecycle.

- Brand Loyalty and Market Share: Transparently communicating sustainability efforts can foster stronger brand loyalty and attract a larger segment of the eco-conscious consumer market.

- Market Data: By 2024, consumers in key markets showed a willingness to pay a premium for sustainable products, with up to 68% considering environmental practices in their buying choices by 2025.

Harvia's environmental strategy is closely linked to its material sourcing, emphasizing certified timber from responsibly managed forests to meet growing consumer and regulatory demands for eco-accountability. The company is actively improving product energy efficiency, with newer electric heaters significantly outperforming older models in energy consumption, thereby reducing consumer costs and emissions.

Harvia is also focused on optimizing manufacturing to reduce energy use and transition to renewable sources, aligning with global pressure for businesses to demonstrate reduced environmental impact. Robust waste management and recycling programs are being integrated, aiming to minimize production waste and facilitate end-of-life product recycling, reflecting a broader trend towards circular economy principles. For instance, in 2023, the EU reported a 45% municipal waste recycling rate, underscoring this global shift.

The company must navigate an increasingly strict regulatory environment concerning climate change, with policies like carbon taxes and emissions standards directly impacting costs and necessitating investments in sustainable technologies. The EU's Fit for 55 package, aiming for a 55% greenhouse gas reduction by 2030, exemplifies such regulatory pressures. Compliance requires meticulous emissions tracking and proactive reduction strategies, making sustainability a key element of risk management.

Consumer demand for eco-friendly products is a major market driver, with a growing segment of consumers prioritizing sustainability. Harvia can leverage this by incorporating recycled materials, enhancing product longevity, and transparently communicating its environmental initiatives. By 2025, studies indicated that 68% of consumers consider environmental practices in purchasing decisions, with a willingness to pay a premium for sustainable goods, presenting a clear opportunity for Harvia.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable government agencies, international organizations, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verifiable, current information.