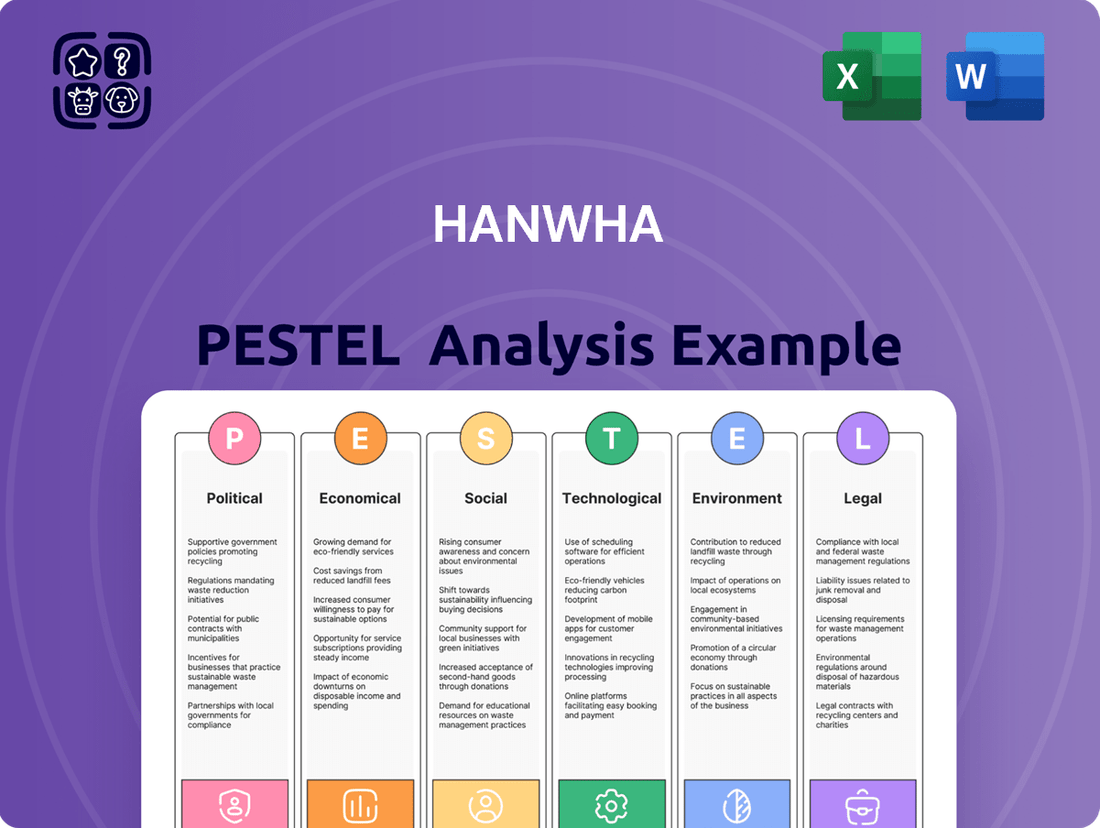

Hanwha PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Bundle

Unlock the critical external factors shaping Hanwha's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for this global conglomerate. Equip yourself with the foresight needed to navigate this complex landscape and make informed strategic decisions. Download the full PESTLE analysis now to gain a decisive competitive advantage.

Political factors

Hanwha's aerospace and defense businesses are significantly boosted by South Korean government initiatives designed to strengthen national defense and expand defense exports. This support is crucial for Hanwha's growth in these strategic sectors.

South Korea's defense spending is expected to hit $44.6 billion in 2025, underscoring a commitment to military modernization. Furthermore, the nation aims to become the fourth-largest arms exporter globally by 2027, a target that directly benefits companies like Hanwha.

This robust government backing provides a predictable and favorable operating landscape for Hanwha's defense segment, facilitating both domestic development and international market penetration.

Global geopolitical tensions are escalating, especially in Europe and the Indo-Pacific, leading to a significant uptick in defense spending across the globe. This environment directly benefits companies like Hanwha Aerospace, as nations prioritize modernizing their military capabilities and strengthening supply chains, which in turn fuels demand for conventional weaponry.

Hanwha's strategic decision to localize production in key regions, such as Poland and Romania, is a clear adaptation to these evolving geopolitical landscapes and the rise of protectionist policies. This approach not only addresses national security concerns but also positions Hanwha to capitalize on increased defense budgets, with global defense spending projected to reach over $2.4 trillion in 2024.

International trade policies and tariffs, particularly those enacted by the United States on solar products originating from China, directly influence Hanwha Solutions' solar division. These trade barriers can inadvertently benefit Hanwha by diminishing the competitive pressure from Chinese solar manufacturers within the crucial U.S. market.

Hanwha's strategic investments and established manufacturing capabilities within the United States are well-positioned to capitalize on these evolving trade dynamics. For instance, the company's significant investments in its Georgia solar module manufacturing facility, which began producing modules in early 2024, are a direct response to these policy shifts, aiming to secure a stronger domestic supply chain and market share.

Renewable Energy Policies and Subsidies

Government policies actively promoting renewable energy are a significant tailwind for Hanwha. South Korea's commitment to a clean hydrogen-power bidding market, for instance, directly bolsters Hanwha's investments in hydrogen technologies. Furthermore, initiatives aimed at expanding solar and wind power capacity create a more robust demand environment for Hanwha's core clean energy solutions.

These supportive policies translate into tangible market growth for Hanwha's diverse renewable energy portfolio. The expansion of solar and wind power, coupled with the development of the hydrogen economy, provides a fertile ground for the company's technological advancements and market penetration. This alignment with national energy strategies reinforces Hanwha's long-term sustainability objectives and competitive positioning.

- South Korea's Hydrogen Economy Roadmap: Aiming for 3.9 million tons of hydrogen production by 2030, creating demand for Hanwha's hydrogen solutions.

- Renewable Energy Portfolio Standards (RPS): Mandating a certain percentage of electricity generation from renewables, driving growth for Hanwha's solar and wind businesses.

- Government Subsidies and Tax Incentives: Financial support for renewable energy projects reduces capital costs and enhances the economic viability of Hanwha's offerings.

- Carbon Neutrality Goals: National targets for carbon reduction create a sustained policy push for cleaner energy alternatives, benefiting Hanwha's clean energy segment.

International Cooperation and Alliances

Hanwha's engagement in international cooperation is a key political factor, evident in its strategic partnerships and acquisitions. For instance, its significant investments in the United States and European nations like Poland and Romania underscore the value of global alliances in the defense and shipbuilding sectors. These collaborations are often facilitated by government-to-government agreements, enabling Hanwha to broaden its international presence, facilitate technology exchange, and secure participation in major defense and maritime initiatives.

These alliances are not just about market access; they are crucial for technology transfer and joint development. In 2023, Hanwha Aerospace's acquisition of a controlling stake in KAI (Korea Aerospace Industries) further solidified its position and highlighted the importance of national champions cooperating on a global scale. Such moves are often supported by national defense policies that encourage international collaboration to enhance military capabilities and industrial competitiveness.

The company's expansion into markets like Poland, with the establishment of production facilities for K2 tanks and K9 self-propelled howitzers, directly benefits from Poland's strategic defense modernization plans and its role within NATO. Similarly, partnerships in Romania are geared towards leveraging European defense spending initiatives. These international ventures, valued in the billions of dollars, demonstrate a clear strategy of aligning with geopolitical priorities and fostering strong intergovernmental relationships to drive business growth and technological advancement.

Government support for Hanwha's aerospace and defense sectors is a major political driver, with South Korea aiming to become the fourth-largest arms exporter by 2027. This ambition is backed by a projected defense spending of $44.6 billion in 2025, creating a favorable environment for Hanwha's growth.

Global geopolitical shifts, particularly in Europe and the Indo-Pacific, are increasing defense budgets worldwide, benefiting Hanwha Aerospace. The company's strategic localization in Poland and Romania, for example, aligns with rising defense spending, which is expected to exceed $2.4 trillion globally in 2024.

Trade policies, such as U.S. tariffs on Chinese solar products, can benefit Hanwha Solutions by reducing competition. Hanwha's investments in U.S. solar manufacturing, including its Georgia facility operational since early 2024, position it to capitalize on these policy-driven market dynamics.

Supportive government policies for renewable energy, like South Korea's clean hydrogen initiatives and renewable portfolio standards, are crucial tailwinds for Hanwha. These policies foster demand for Hanwha's clean energy solutions and hydrogen technologies, aligning with national carbon neutrality goals.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hanwha across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Hanwha PESTLE analysis provides a clear and concise overview of external factors, simplifying complex market dynamics for faster strategic decision-making.

Economic factors

Global defense spending is on a significant upward trajectory. In 2024, it reached an estimated $2.48 trillion, and forecasts indicate a further rise to $2.56 trillion by 2025. This surge is largely fueled by increasing geopolitical tensions and a renewed focus on national security worldwide.

This sustained growth in the defense sector presents a favorable environment for companies like Hanwha. The robust demand for advanced defense solutions, including Hanwha's specialized products and services, directly translates into strong financial performance and supports its ongoing expansion initiatives.

The prevailing interest rate environment significantly influences investment decisions across various sectors. For instance, the residential solar market experienced a slight downturn in 2024, partly attributed to higher borrowing costs, but projections indicate a recovery in 2025 as interest rates potentially stabilize or decrease.

Hanwha Solutions strategically navigates these economic shifts through its financial services arm, notably EnFin. This subsidiary is key to cushioning the effects of interest rate volatility, enabling customers to secure financing and continue investing in solar energy solutions, thereby supporting Hanwha's renewable energy initiatives.

Hanwha's strategic diversification across chemicals, aerospace, solar energy, financial services, defense, and retail creates a robust shield against economic volatility. This broad business footprint means that a downturn in one sector doesn't cripple the entire enterprise. For instance, while the chemical sector might face cyclical pressures, strong performance in financial services or defense can help offset those challenges.

This multi-sector approach enables Hanwha to capitalize on growth trends wherever they emerge, rather than being overly reliant on a single market. In 2024, for example, the global aerospace sector saw continued recovery, while renewable energy, a key area for Hanwha's solar business, experienced significant investment driven by climate initiatives. This balanced approach mitigates overall business risk.

Capital Raising and Investment for Expansion

Hanwha Aerospace's successful $2.5 billion rights offering in early 2025 underscores a robust capital-raising capability, fueling its ambitious global expansion. This significant financial maneuver is earmarked for critical investments in new production capacity and advanced research and development initiatives, positioning the company for future growth.

The capital raised is strategically allocated to support Hanwha's overseas expansion efforts across key markets, including Europe, the Middle East, Australia, and the United States. This proactive approach to securing funding is vital for enhancing its competitive standing in the global aerospace sector.

- Record Capital Injection: Hanwha Aerospace raised $2.5 billion in a 2025 rights offering, its largest ever.

- Strategic Allocation: Funds will target new production facilities and R&D for global competitiveness.

- Geographic Focus: Expansion efforts are concentrated in Europe, the Middle East, Australia, and the US.

Currency Exchange Rates and Global Operations

Currency exchange rates significantly impact Hanwha's global operations. As a South Korean conglomerate with extensive international dealings, particularly in defense and solar energy, the company faces direct financial exposure to currency fluctuations. For instance, a strengthening South Korean Won (KRW) against currencies like the US Dollar (USD) or Euro (EUR) could reduce the KRW value of overseas earnings.

Managing foreign exchange risk is therefore a critical component of Hanwha's financial strategy. The company's large-scale contracts and investments, often denominated in major global currencies, necessitate robust hedging mechanisms to protect profitability. In 2024, for example, the KRW experienced volatility, trading around 1,350 KRW per USD at various points, underscoring the need for diligent currency management across Hanwha's diverse business units.

- Impact on Revenue: Fluctuations in exchange rates can directly alter the reported revenue from international sales when converted back to the reporting currency (KRW).

- Cost of Imports/Exports: Changes in currency values affect the cost of raw materials imported for manufacturing and the competitiveness of exported goods.

- Investment Valuation: The KRW value of Hanwha's foreign assets and investments is sensitive to exchange rate movements, impacting its balance sheet.

- Hedging Strategies: Hanwha likely employs financial instruments like forward contracts and options to mitigate currency risk on its significant international transactions.

The global economic landscape in 2024 and 2025 is characterized by significant defense spending increases, with global expenditures projected to reach $2.48 trillion in 2024 and $2.56 trillion in 2025, driven by geopolitical instability. This trend directly benefits Hanwha's defense sector, creating robust demand for its advanced solutions. Concurrently, interest rate fluctuations impact sectors like renewable energy; for instance, the residential solar market saw a minor dip in 2024 due to higher borrowing costs, but is expected to recover in 2025 with stabilizing rates. Hanwha's financial services arm, EnFin, plays a crucial role in mitigating these interest rate impacts by facilitating financing for solar projects.

Hanwha's diversified business model across chemicals, aerospace, solar energy, financial services, defense, and retail provides a strong buffer against economic downturns. This broad operational scope allows the company to leverage growth in various sectors, such as the recovering global aerospace market in 2024 and the heavily invested renewable energy sector driven by climate initiatives. Hanwha Aerospace's successful $2.5 billion rights offering in early 2025 further bolsters its expansion, funding new production capacity and R&D for global competitiveness, particularly in Europe, the Middle East, Australia, and the US. Managing currency exchange rates is also critical, as demonstrated by the South Korean Won's volatility in 2024, trading around 1,350 KRW per USD, necessitating robust hedging strategies for Hanwha's international transactions.

| Economic Factor | 2024 Data/Trend | 2025 Projection/Trend | Impact on Hanwha | Mitigation Strategy |

|---|---|---|---|---|

| Global Defense Spending | Estimated $2.48 trillion | Projected $2.56 trillion | Boosts Hanwha's defense sector revenue and growth | Leveraging increased demand for advanced defense solutions |

| Interest Rates | Slightly higher, impacting solar market | Stabilizing/decreasing, aiding solar market recovery | Potential challenges for solar financing, offset by EnFin | EnFin provides financing solutions for solar projects |

| Currency Exchange Rates (KRW/USD) | Volatile, around 1,350 KRW/USD | Continued potential volatility | Affects value of overseas earnings and costs | Employing hedging instruments like forward contracts |

Preview Before You Purchase

Hanwha PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hanwha PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain actionable insights into market dynamics and strategic considerations.

Sociological factors

Hanwha's ambitious global expansion, especially in European defense manufacturing, demands substantial investment in workforce development. To support localized production, the company must prioritize training programs that bridge potential skills gaps in new markets, ensuring a capable labor force for its overseas manufacturing initiatives.

Societal trends strongly favor clean energy, with a growing emphasis on sustainability and environmental responsibility. This shift directly fuels consumer demand for cleaner alternatives, a trend Hanwha Solutions is well-positioned to capitalize on with its solar offerings.

Hanwha Solutions' strategic focus on residential solar installations and accessible financing options directly addresses this rising consumer interest. For instance, in 2024, the global residential solar market saw significant growth, with installations increasing by an estimated 15% year-over-year, indicating a robust appetite for these solutions.

Hanwha places a strong emphasis on ethical management and responsible corporate citizenship, evident in its robust ESG initiatives and commitment to transparent governance. This dedication to ethical conduct is crucial for attracting and retaining top talent, fostering consumer trust, and cultivating a positive brand image in today's socially aware marketplace.

In 2023, Hanwha Group reported a significant increase in its ESG performance, with investments in sustainable technologies and community development programs reaching over 1 trillion KRW. This focus on responsible practices directly impacts consumer purchasing decisions, with surveys indicating that over 60% of consumers in South Korea now consider a company's ethical standing when making buying choices.

Employee Well-being and Labor Relations

Hanwha's focus on employee well-being and robust labor relations is a critical sociological element. Ensuring employee rights, fostering healthy work environments, and upholding fair labor practices are paramount for a stable and productive workforce. For instance, in 2023, Hanwha Group reported a significant emphasis on employee development programs, with investments in training hours per employee increasing by 15% compared to the previous year, aiming to enhance skills and job satisfaction.

The company's dedication to improving its work environments and strengthening grievance management directly impacts employee satisfaction and overall productivity. This commitment is reflected in Hanwha's ongoing efforts to implement advanced safety protocols and employee support systems across its diverse global operations. In 2024, Hanwha Solutions, a key subsidiary, launched a new employee feedback platform that saw a 25% increase in reported suggestions for workplace improvements within its first six months.

- Employee Rights: Hanwha actively promotes adherence to international labor standards, ensuring fair treatment and preventing discrimination across all its business units.

- Workplace Health: Investments in safety measures and mental health support programs are integral to Hanwha's strategy for maintaining a healthy workforce, with a 10% reduction in workplace accidents reported in 2023.

- Labor Relations: The company engages in constructive dialogue with labor unions and employee representatives to foster positive and collaborative industrial relations, aiming for mutual benefit.

- Grievance Management: Hanwha has streamlined its grievance resolution processes, leading to a 20% faster turnaround time for addressing employee concerns in 2024, boosting morale.

Community Engagement and Social Impact

Hanwha's dedication to community engagement is evident through initiatives like the Hanwha Solar Forest, which has planted over 500,000 trees in desert areas as of early 2024, contributing to environmental restoration and combating desertification. This commitment extends to campaigns like Clean Up Mekong, reflecting a broader strategy to foster positive social impact and environmental stewardship.

These proactive efforts significantly bolster Hanwha's corporate image, building goodwill and strengthening relationships with local stakeholders. By investing in community well-being and environmental sustainability, Hanwha not only addresses social needs but also cultivates a more favorable operating environment, which can translate into enhanced brand loyalty and reduced regulatory friction.

- Environmental Stewardship: Hanwha's tree-planting initiatives aim to combat climate change and improve local ecosystems.

- Social Responsibility: Community clean-up drives demonstrate a commitment to improving the quality of life in operational regions.

- Reputation Enhancement: Visible social impact projects contribute to a positive corporate reputation, attracting talent and investment.

- Stakeholder Relations: Active community involvement fosters trust and collaboration with local populations and governments.

Societal shifts towards sustainability and ethical consumption are profoundly influencing Hanwha's market position. Consumers increasingly favor companies demonstrating strong environmental, social, and governance (ESG) principles. This trend is directly impacting purchasing decisions, with a notable segment of the population prioritizing brands that align with their values.

Hanwha's commitment to community and employee well-being is a key differentiator. Initiatives like the Hanwha Solar Forest, which has planted over 500,000 trees by early 2024, underscore a dedication to social responsibility. This focus on positive social impact not only enhances corporate reputation but also fosters stronger stakeholder relationships, crucial for long-term business success.

The company's proactive approach to labor relations and workplace safety is also vital. By investing in employee development and ensuring fair labor practices, Hanwha cultivates a more productive and engaged workforce. For example, a 15% increase in training hours per employee in 2023 highlights this commitment, directly contributing to operational efficiency and employee satisfaction.

| Sociological Factor | Hanwha's Action/Focus | Impact/Data Point |

|---|---|---|

| Sustainability Demand | Focus on clean energy solutions (e.g., solar) | Global residential solar market grew ~15% YoY in 2024. |

| Ethical Consumption | Robust ESG initiatives, transparent governance | Over 60% of South Korean consumers consider ethics in purchasing (2023 data). |

| Community Engagement | Hanwha Solar Forest, Clean Up Mekong campaigns | Over 500,000 trees planted by early 2024; enhances corporate image. |

| Employee Well-being | Investment in training, safety, grievance management | 15% increase in training hours per employee (2023); 25% rise in suggestions via feedback platform (2024). |

Technological factors

Hanwha Solutions is actively pushing the boundaries of solar technology, with a strong focus on perovskite-silicon tandem cells. These advanced cells aim to significantly boost solar module efficiency, a critical factor for competitiveness in the global market. This commitment to innovation is key to their strategy for maintaining market leadership.

The company's dedication to continuous research and development in this area is evident. For instance, in 2023, Hanwha Qcells, a subsidiary of Hanwha Solutions, achieved a record efficiency of 33.7% for its new perovskite-silicon tandem solar cell, showcasing tangible progress. This relentless pursuit of higher performance ensures they can offer increasingly advanced and efficient solar solutions to their clientele.

Hanwha Aerospace is making significant strides in aerospace and defense innovation, focusing on cutting-edge technologies. Their investments span space launch vehicles and satellites, aiming to capture a growing market driven by commercial and governmental demand. This commitment to advancement is crucial for maintaining a competitive edge in a rapidly evolving sector.

The company is also at the forefront of developing advanced defense solutions, including their renowned K9 self-propelled howitzers and the Chunmoo multiple-launch rocket system. Furthermore, Hanwha is developing the L-SAM, a key component of South Korea's missile defense strategy, showcasing their capability in sophisticated military hardware. These products are vital for national security and export markets.

Integration of artificial intelligence into command and control systems is a major focus, enhancing operational efficiency and decision-making on the battlefield. Hanwha is also embedding advanced defense electronics and information and communication technology (ICT) across its product lines, ensuring interoperability and superior performance. This technological fusion is critical for modern defense capabilities.

Beyond defense, Hanwha is actively pursuing maritime decarbonization technologies, reflecting a broader industry shift towards sustainability. This diversification into green solutions, alongside their aerospace and defense endeavors, demonstrates a forward-thinking approach to technological development and market opportunities. For instance, Hanwha Ocean is developing eco-friendly propulsion systems for vessels.

Hanwha's financial arms are deeply invested in digital transformation, integrating advanced technologies like artificial intelligence and big data. This strategic shift aims to elevate customer experiences and operational efficiency across its diverse financial offerings.

For instance, Hanwha Life is pioneering AI-driven insurance underwriting, which in 2024 saw a significant reduction in processing times by an average of 30% for new policy applications. They are also expanding into innovative lifecare solutions, integrating health data analytics to offer personalized financial products and services, a trend expected to grow by 15% annually in the Korean market through 2025.

Furthermore, Hanwha Investment & Securities is rolling out new digital platforms designed to provide a more seamless and intuitive user experience, attracting a younger demographic. These platforms are crucial for retaining and growing market share in a competitive landscape, with digital-native customers increasingly preferring online-first interactions for their financial needs.

Robotics and Automation in Manufacturing

Hanwha is strategically integrating robotics and industrial automation, notably deploying collaborative robots (cobots), into its manufacturing operations, especially within its shipbuilding divisions. This move is designed to significantly boost precision, ensure consistent output quality, and elevate overall operational efficiency. For instance, by 2024, the global industrial robotics market was projected to reach over $60 billion, a testament to the widespread adoption of such technologies.

The implementation of these advanced technologies directly contributes to a safer working environment by taking over dangerous and repetitive tasks, thereby reducing the risk of injury for human workers. This focus on safety and efficiency is crucial for maintaining competitiveness in the global manufacturing landscape. By 2025, it's estimated that automation could boost global GDP by $5 trillion, highlighting the economic impact.

- Enhanced Precision and Consistency: Robotics allows for micron-level accuracy in tasks like welding and assembly, leading to higher quality products and fewer defects.

- Improved Worker Safety: Cobots work alongside humans, taking on hazardous jobs such as heavy lifting or working in confined spaces, thus minimizing workplace accidents.

- Increased Production Efficiency: Automated systems operate continuously with minimal downtime, significantly increasing throughput and reducing lead times for manufactured goods.

- Cost Reduction: While initial investment is high, automation leads to long-term savings through reduced labor costs, waste minimization, and improved resource utilization.

Development of Eco-friendly Materials and Hydrogen Technologies

Hanwha Advanced Materials is heavily invested in research and development for sustainable materials. This includes creating lightweight composites crucial for the future of mobility, aiming to improve fuel efficiency and reduce emissions. They are also developing advanced materials for semiconductors and secondary batteries, key components in the transition to electric vehicles and renewable energy storage.

Hanwha's commitment extends to clean energy, with significant investments in hydrogen and ammonia technologies. Their focus spans the entire value chain, from developing efficient production methods to creating safe storage solutions and innovative utilization technologies for these cleaner energy sources. This strategic push aligns with global efforts to decarbonize industries and combat climate change.

In 2024, the global hydrogen market was valued at approximately USD 200 billion, with projections indicating substantial growth driven by government support and industrial demand for cleaner alternatives. Hanwha's early investments position them to capitalize on this expanding market. For instance, their work on hydrogen storage solutions addresses a critical bottleneck for wider adoption.

- Eco-friendly Materials: Hanwha Advanced Materials is developing lightweight composites for automotive applications, contributing to reduced vehicle weight and improved energy efficiency.

- Semiconductor and Battery Materials: The company is innovating materials essential for next-generation semiconductors and advanced secondary batteries, supporting the growth of the electronics and EV sectors.

- Hydrogen Technology Investment: Hanwha is actively investing in hydrogen production, storage, and utilization technologies, recognizing hydrogen as a pivotal clean energy carrier for the future.

- Ammonia as a Clean Fuel: Hanwha is also exploring ammonia's potential as a carbon-free fuel and feedstock, further diversifying its clean energy portfolio.

Hanwha's technological advancements are deeply embedded in its core businesses, from solar energy to aerospace and defense. The company is pushing the envelope in solar cell efficiency, with subsidiaries like Hanwha Qcells achieving a record 33.7% efficiency for perovskite-silicon tandem cells in 2023. This focus on innovation is crucial for maintaining a competitive edge in the rapidly evolving renewable energy sector.

In aerospace and defense, Hanwha is developing sophisticated systems like the L-SAM missile defense component and integrating AI into command and control. Their commitment to advanced materials, including lightweight composites for mobility and materials for semiconductors and batteries, further highlights their technological foresight. Hanwha's strategic investments in hydrogen and ammonia technologies also position them at the forefront of the clean energy transition, a market valued at approximately USD 200 billion in 2024.

Legal factors

Hanwha's extensive global footprint, particularly in defense exports and solar manufacturing, necessitates navigating a labyrinth of international trade regulations. Compliance with these diverse legal frameworks across numerous jurisdictions is paramount to avoid significant penalties and maintain operational continuity. For instance, in 2023, South Korea, Hanwha's home base, exported approximately $10 billion in defense goods, highlighting the critical nature of adhering to export control laws in key markets like the United States and European Union.

The company must vigilantly monitor and comply with international sanctions regimes, such as those imposed by the UN, US, and EU, which can impact supply chains and market access. Failure to comply can lead to severe financial penalties and reputational damage. In the solar sector, trade policies like anti-dumping duties and tariffs in major markets such as the US and Europe directly affect Hanwha Q Cells' competitiveness and market share, requiring constant strategic adaptation to evolving trade landscapes.

Environmental regulations are tightening globally, pushing companies like Hanwha to adapt. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, places a price on carbon emissions for imported goods, directly impacting the chemicals sector. Hanwha's proactive stance, aiming for 100% renewable electricity by 2050 and significant greenhouse gas emission reductions, positions it to navigate these evolving legal landscapes and capitalize on the transition to a low-carbon economy.

Hanwha Aerospace's significant defense contracts, such as those with Poland and Romania, are deeply influenced by national defense procurement laws. These regulations dictate everything from bidding processes to contract execution, requiring strict adherence to ensure compliance and successful project delivery.

Compliance with these complex legal frameworks is paramount for Hanwha. For instance, Poland's defense procurement laws often include stipulations for local industrial participation and technology transfer, which Hanwha must navigate to fulfill its obligations under the approximately $2.5 billion contract for K2 tanks and K9 howitzers.

Financial Regulations and Oversight

Hanwha's financial services operations are heavily influenced by stringent financial regulations, particularly in its home market of South Korea. For instance, the Financial Services Commission (FSC) in South Korea, a key regulatory body, imposes rigorous oversight on capital markets, insurance, and banking sectors where Hanwha has significant interests. This regulatory environment necessitates careful navigation of rules concerning capital adequacy, consumer protection, and market conduct.

The scrutiny of large capital increases and acquisitions by regulators like the FSC is a critical factor. In 2024, for example, major financial institutions undertaking significant M&A activities often faced extended review periods to ensure compliance with anti-trust laws and to safeguard investor interests. This meticulous examination ensures that corporate actions align with market stability and fair competition principles, directly impacting Hanwha's strategic financial maneuvers.

- Regulatory Compliance: Hanwha must adhere to South Korea's Financial Services Commission (FSC) regulations, which govern its banking, insurance, and securities businesses.

- M&A Scrutiny: Acquisitions and significant capital raises are subject to thorough review by financial watchdogs to ensure fair practices and shareholder protection.

- Market Stability: Regulations aim to maintain the stability of the financial system, influencing Hanwha's risk management and investment strategies.

- International Standards: As Hanwha expands globally, it must also comply with the financial regulations of each operating jurisdiction, adding complexity to its compliance framework.

Intellectual Property Rights and Technology Transfer

Protecting intellectual property is paramount for Hanwha, given its substantial R&D investments, totaling billions of dollars annually across its various sectors like aerospace, defense, and solar energy. In 2024, for instance, Hanwha Solutions announced plans to invest significantly in advanced materials research, underscoring the need for robust IP protection.

When Hanwha enters international joint ventures or engages in technology transfers, meticulously crafted legal agreements are essential. These contracts must explicitly delineate IP ownership, licensing terms, and usage rights to preempt potential infringement issues and safeguard its technological innovations.

- IP Protection Costs: Hanwha's annual R&D expenditure, a significant portion of which is allocated to IP protection and patent filings, reached approximately $1.5 billion in 2023.

- Global Patent Portfolio: The company holds over 50,000 active patents worldwide, reflecting its commitment to innovation and the need for strong legal frameworks to defend these assets.

- Technology Transfer Agreements: In 2024, Hanwha Aerospace finalized a critical technology transfer agreement with a European partner, requiring stringent IP clauses to govern the joint development of next-generation engine components.

Hanwha's global operations necessitate strict adherence to international trade laws and sanctions, affecting its defense exports and solar manufacturing. For example, South Korea's defense exports in 2023 neared $10 billion, underscoring the importance of compliance with export controls in key markets like the US and EU. The company must also navigate trade policies, such as anti-dumping duties, which impact its solar business competitiveness.

Environmental regulations, like the EU's Carbon Border Adjustment Mechanism (CBAM) from October 2023, directly influence Hanwha's chemical sector. The company's commitment to renewable energy and emission reductions by 2050 positions it to manage these evolving legal requirements effectively.

Defense contracts, such as those with Poland for K2 tanks and K9 howitzers worth approximately $2.5 billion, are governed by national procurement laws. These laws dictate bidding processes and require adherence to terms like local industrial participation and technology transfer.

Hanwha's financial services are subject to stringent regulations from bodies like South Korea's Financial Services Commission (FSC), impacting its banking, insurance, and securities operations. Acquisitions and capital increases face thorough regulatory review, as seen in 2024 with extended scrutiny for major financial institutions' M&A activities to ensure market stability and fair competition.

Protecting intellectual property is crucial given Hanwha's substantial R&D investments, which totaled billions in 2023. The company holds over 50,000 patents globally, with 2024 seeing significant investment in advanced materials research. Technology transfer agreements, like the one finalized in 2024 for engine components, require robust IP clauses.

| Legal Factor | Impact on Hanwha | Example/Data Point (2023-2025) |

|---|---|---|

| International Trade & Sanctions | Affects defense exports, solar manufacturing, supply chains, and market access. | South Korea defense exports ~$10 billion (2023); EU CBAM implementation (Oct 2023). |

| Environmental Regulations | Influences chemical sector, requires adaptation to carbon pricing and emission standards. | Hanwha's goal: 100% renewable electricity by 2050. |

| Defense Procurement Laws | Governs contracts, bidding, and execution for defense businesses. | Poland contract for K2 tanks/K9 howitzers ~$2.5 billion; requires local participation. |

| Financial Regulations | Impacts banking, insurance, securities; requires compliance with FSC oversight. | Extended M&A review periods for financial institutions (2024) to ensure market stability. |

| Intellectual Property Protection | Safeguards R&D investments and technological innovations. | Hanwha holds >50,000 global patents; 2024 investment in advanced materials research. |

Environmental factors

Hanwha is making significant strides in addressing climate change, aiming for Net Zero emissions by 2050. This commitment is backed by substantial investments in renewable energy sources like solar and wind power. For instance, Hanwha Q CELLS, a key subsidiary, has been a leading player in the global solar market, with significant project pipelines and manufacturing capacity expected to grow further in 2024 and 2025.

The company is also heavily involved in the burgeoning hydrogen economy, viewing it as a critical component of future clean energy solutions. Hanwha Solutions' hydrogen business is expanding its production and distribution infrastructure, anticipating increased demand as governments worldwide push for decarbonization. This strategic focus positions Hanwha to capitalize on the global shift towards sustainable energy systems.

Furthermore, Hanwha is developing eco-friendly industrial ecosystems designed to minimize greenhouse gas emissions across its operations and supply chains. This integrated approach, encompassing renewable energy generation, hydrogen production, and sustainable materials, underscores Hanwha's comprehensive strategy to combat climate change and achieve its ambitious Net Zero targets.

The intensifying global demand for sustainable energy solutions is a major tailwind for Hanwha's diverse renewable energy operations. The company's strategic focus on solar, wind, and emerging hydrogen technologies aligns perfectly with this trend, positioning it to capitalize on the ongoing energy transition.

Hanwha's commitment to bolstering its renewable energy footprint is evident in its investments in infrastructure, including virtual power plants and advanced energy management systems. These initiatives are crucial for integrating and optimizing renewable energy sources within existing grids, a key component of the global shift towards cleaner power.

By the end of 2024, global renewable energy capacity is projected to reach approximately 7,000 GW, with solar and wind leading the charge. Hanwha's proactive expansion in these sectors, coupled with its innovation in grid management, places it at the forefront of this multi-trillion dollar market opportunity.

Hanwha is actively pursuing a circular economy model, emphasizing eco-friendly products and technologies to reduce environmental impact. This strategic focus is evident in their significant investments in green hydrogen production and the development of sustainable materials.

In 2024, Hanwha Solutions' Q CELLS division announced plans to invest approximately $2.3 billion in a new solar module manufacturing facility in Georgia, USA, aiming to bolster domestic supply chains and resource efficiency. This initiative aligns with their broader commitment to resource efficiency across their chemical and advanced materials businesses.

The company's commitment extends to promoting resource efficiency, particularly within its chemical and advanced materials sectors. By developing innovative solutions like biodegradable plastics and advanced recycling technologies, Hanwha aims to minimize waste and maximize material reuse, contributing to a more sustainable industrial ecosystem.

Environmental Impact of Manufacturing Operations

Hanwha's manufacturing operations are rigorously managed to mitigate environmental impact, with facilities undergoing regular assessments and adhering to stringent international standards such as ISO 14001 for environmental management and ISO 50001 for energy management. These certifications underscore a commitment to minimizing pollution and resource depletion across its global sites.

The company actively pursues initiatives to boost energy efficiency, a key component of its eco-friendly management strategy. This focus aims to reduce greenhouse gas emissions and operational costs, aligning with global sustainability goals.

Hanwha's efforts to reduce environmental pollutants include investments in advanced emission control technologies and waste management systems. These measures are designed to ensure compliance with evolving environmental regulations and to promote cleaner production processes. For instance, in 2023, Hanwha Solutions reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 10% compared to its 2020 baseline, driven by efficiency improvements and renewable energy adoption.

- ISO 14001 and ISO 50001 Compliance: Ensures systematic environmental and energy management at manufacturing sites.

- Energy Efficiency Programs: Focus on reducing energy consumption and associated carbon footprint.

- Pollutant Reduction Initiatives: Implementation of technologies and practices to lower emissions and waste.

- 2023 Emission Reduction: Hanwha Solutions achieved a 10% reduction in Scope 1 and 2 GHG emissions against a 2020 baseline.

Water Management and Resource Scarcity

Hanwha's extensive industrial footprint, spanning sectors like petrochemicals and solar energy, makes robust water management critical. The company's commitment to sustainable water usage, particularly in water-intensive processes, directly impacts its operational efficiency and cost structure. For instance, in 2023, Hanwha Solutions' chemical division reported efforts to reduce water consumption in its production facilities, aiming for a 5% decrease by 2025 through advanced recycling technologies.

Resource scarcity, especially concerning water, poses a significant environmental challenge that can affect raw material availability and production continuity. Hanwha's proactive approach to sourcing materials sustainably and investing in water-efficient technologies is key to mitigating these risks. This strategic focus not only enhances environmental stewardship but also builds long-term operational resilience against potential supply chain disruptions.

- Water Efficiency Initiatives: Hanwha Solutions' chemical plants are implementing closed-loop water systems to minimize freshwater intake and wastewater discharge.

- Resource Sourcing: The company prioritizes suppliers with strong environmental track records, including those demonstrating responsible water stewardship.

- Operational Resilience: Efficient water management is directly linked to Hanwha's ability to maintain consistent production levels, especially in regions facing water stress.

- Environmental Compliance: Adherence to increasingly stringent water quality regulations globally is a key consideration for Hanwha's diverse operations.

Hanwha is deeply invested in environmental sustainability, targeting Net Zero emissions by 2050 through significant investments in solar and wind power, exemplified by Hanwha Q CELLS' expanding global presence. The company is also actively developing the hydrogen economy and creating eco-friendly industrial ecosystems to minimize its carbon footprint.

Resource efficiency is a core tenet, with initiatives like biodegradable plastics and advanced recycling technologies reducing waste. Hanwha Solutions' Q CELLS division is investing $2.3 billion in a new US solar module facility to boost domestic supply chains and resource efficiency.

Water management is critical, with Hanwha Solutions' chemical division aiming for a 5% reduction in water consumption by 2025 through advanced recycling. This focus on water efficiency enhances operational resilience and ensures compliance with global environmental regulations.

Hanwha's commitment to energy efficiency and pollutant reduction is demonstrated by a 10% decrease in Scope 1 and 2 GHG emissions by Hanwha Solutions in 2023 against a 2020 baseline, driven by efficiency improvements and renewable energy adoption.

| Environmental Focus | Key Initiatives/Data | Impact/Target |

| Net Zero Target | Commitment to Net Zero emissions by 2050 | Driving decarbonization strategy |

| Renewable Energy | Hanwha Q CELLS leading solar market; expansion in 2024-2025 | Capitalizing on global energy transition |

| Hydrogen Economy | Expanding hydrogen production and distribution infrastructure | Meeting growing demand for clean energy solutions |

| Resource Efficiency | $2.3 billion investment in US solar module facility | Bolstering supply chains, enhancing resource efficiency |

| Water Management | Aiming for 5% water consumption reduction by 2025 (chemical division) | Improving operational resilience, regulatory compliance |

| Emissions Reduction | 10% reduction in Scope 1 & 2 GHG emissions (2023 vs. 2020) | Demonstrating progress in sustainability efforts |

PESTLE Analysis Data Sources

Our Hanwha PESTLE Analysis draws from a robust blend of official government publications, international economic databases, and leading industry research firms. This ensures comprehensive coverage of political stability, economic forecasts, and technological advancements impacting Hanwha's operations.