Hanwha Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Bundle

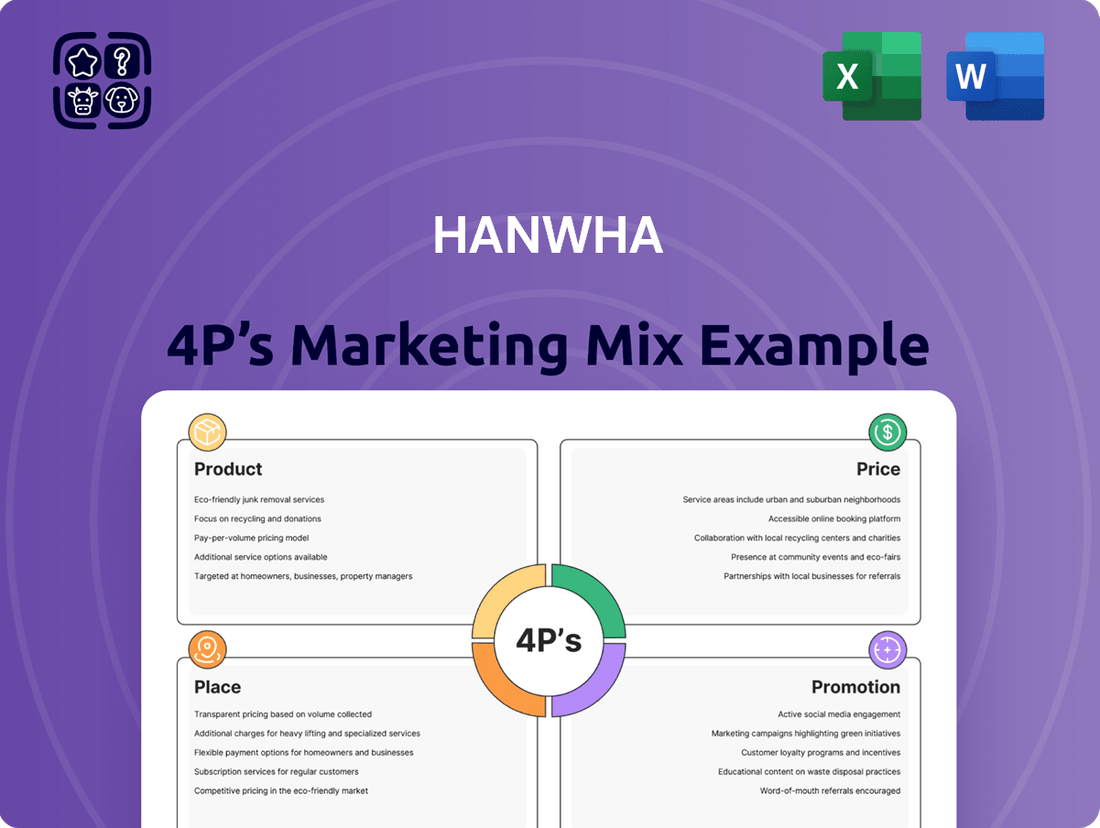

Hanwha's marketing strategy is a masterclass in aligning Product, Price, Place, and Promotion to achieve market dominance. Discover how their innovative product development, competitive pricing, strategic distribution, and impactful promotional campaigns create a cohesive and powerful market presence.

Unlock the full potential of Hanwha's marketing blueprint with our comprehensive 4Ps analysis. This ready-to-use, editable report provides actionable insights into each element, perfect for students, professionals, and consultants seeking strategic advantage.

Product

Hanwha's product strategy is defined by its extensive diversification, offering a broad spectrum of industrial goods and advanced solutions. This includes critical components for the aerospace sector, cutting-edge materials and chemicals, and integrated solar energy systems, demonstrating their reach across numerous global industries.

In 2024, Hanwha Solutions, a key subsidiary, reported significant growth in its solar division, contributing substantially to the company's overall revenue. This expansion highlights the strategic importance of their renewable energy offerings in a rapidly evolving market.

Hanwha's Advanced Defense Systems are a cornerstone of its product portfolio, showcasing significant global competitiveness. Key offerings include the K9 Self-Propelled Howitzer, which has seen substantial international adoption, and advanced air defense solutions like the L-SAM. These systems are not only technologically superior but also highly sought after, evidenced by Hanwha's robust export performance in the defense sector.

Hanwha's product strategy in clean energy is comprehensive, encompassing everything from advanced solar components like high-efficiency solar cells and modules to the complete lifecycle of large-scale solar power plants, including construction and ongoing operation. This broad offering positions them as a one-stop shop for solar solutions.

Beyond solar, Hanwha is actively diversifying its clean energy portfolio. They are making significant investments and advancements in emerging sectors such as hydrogen, ammonia, and wind power, aiming to capture growth opportunities across the entire clean energy value chain.

In 2024, Hanwha Q CELLS, a key subsidiary, reported a significant increase in solar module shipments, exceeding 12 GW globally. This growth underscores the strong demand for their solar products and their expanding market reach.

The company's commitment to innovation is evident in their continuous development of next-generation solar technologies, including perovskite solar cells, with pilot production expected to commence in late 2025, targeting efficiency gains beyond current silicon-based technologies.

Financial Services and Digital Solutions

Hanwha's financial services arm extends far beyond its industrial roots, encompassing a broad spectrum of offerings. These include insurance, robust asset management capabilities, and comprehensive securities services. This diversification provides multiple revenue streams and caters to a wide range of customer needs.

The company is making significant strides in digital finance, recognizing its transformative potential. Hanwha is strategically investing in cutting-edge technologies such as artificial intelligence and big data analytics. These investments are geared towards developing innovative financial solutions and significantly improving customer accessibility and experience.

- Digital Transformation Investment: Hanwha is channeling resources into AI and big data to create smarter financial products.

- Customer Accessibility: The focus on digital solutions aims to make financial services more convenient and readily available.

- Diversified Financial Portfolio: Hanwha offers insurance, asset management, and securities, serving a broad client base.

Cutting-Edge ICT and Space Technologies

Hanwha's product portfolio is significantly bolstered by its cutting-edge Information and Communication Technologies (ICT) and its forward-looking investments in space technologies. This dual focus positions the company at the forefront of innovation in critical defense and civilian sectors.

Within ICT, Hanwha offers advanced capabilities in radar, electro-optics, and avionics, essential components for modern defense systems and sophisticated industrial applications. These technologies are crucial for enhanced situational awareness and operational efficiency.

The company's commitment to space extends to developing foundational technologies for space launch vehicles and Earth observation systems. This strategic expansion into space leverages satellite-based communication systems, catering to a growing global demand for connectivity and data services.

Hanwha's strategic investments in these high-growth areas are evident. For instance, Hanwha Systems reported a significant increase in its order backlog for defense and ICT sectors in early 2024, reflecting strong market demand for its advanced solutions. The company is also actively pursuing partnerships and research initiatives to solidify its position in the burgeoning space economy, aiming to capitalize on the projected multi-trillion dollar global space market by 2040.

- Advanced Radar and Electro-Optics: Enhancing defense capabilities with superior detection and targeting systems.

- Avionics and Satellite Communications: Providing integrated solutions for aerospace and global connectivity.

- Space Launch Vehicle Technology: Developing core components for next-generation space access.

- Earth Observation Systems: Contributing to critical data collection and analysis for environmental and security applications.

Hanwha's product strategy is characterized by its deep diversification across key industrial and technological sectors. The company offers a comprehensive suite of solutions, ranging from advanced aerospace components and cutting-edge chemicals to integrated solar energy systems and sophisticated defense platforms. This broad product base demonstrates Hanwha's commitment to innovation and its ability to serve multiple high-growth global markets.

In 2024, Hanwha Q CELLS, a significant contributor to the group's solar energy division, reported a substantial increase in global solar module shipments, exceeding 12 GW. This performance highlights the strong market demand for Hanwha's renewable energy products and its expanding international footprint in this crucial sector.

The company's defense segment is a major strength, featuring products like the K9 Self-Propelled Howitzer, which has achieved significant international sales, and advanced air defense systems such as the L-SAM. These offerings underscore Hanwha's technological prowess and its competitive position in the global defense industry.

| Product Category | Key Offerings | 2024/2025 Data/Highlights |

|---|---|---|

| Solar Energy | High-efficiency solar cells, modules, solar power plant construction and operation | Hanwha Q CELLS exceeded 12 GW in solar module shipments globally in 2024; investing in perovskite solar cell technology with pilot production expected late 2025. |

| Advanced Defense Systems | K9 Self-Propelled Howitzer, L-SAM air defense system | Strong global adoption and export performance; significant order backlog growth reported in early 2024 for defense and ICT sectors. |

| ICT & Space Technologies | Radar, electro-optics, avionics, space launch vehicle technology, Earth observation systems | Hanwha Systems reported significant order backlog growth in early 2024; actively pursuing partnerships to capitalize on the projected multi-trillion dollar global space market by 2040. |

What is included in the product

This analysis offers a comprehensive examination of Hanwha's marketing strategies, delving into its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a detailed understanding of Hanwha's market positioning, providing a solid foundation for competitive benchmarking and strategic planning.

Simplifies complex marketing strategies by clearly outlining Hanwha's Product, Price, Place, and Promotion, alleviating the pain of information overload.

Offers a clear, actionable framework to identify and address potential market challenges, relieving the stress of strategic uncertainty.

Place

Hanwha's strategic placement of manufacturing and R&D facilities across key global markets, including South Korea, the U.S., Germany, Malaysia, and China, underpins its production efficiency and localized innovation capabilities. This distributed network allows for agile responses to regional market demands and fosters collaborative development across diverse technological landscapes.

Hanwha actively broadens its global footprint through strategic alliances and acquisitions. A prime example is their investment in overseas defense production facilities, enhancing their ability to serve international markets directly. For instance, Hanwha's acquisition of a stake in the U.S. defense contractor KAI in 2023, valued at approximately $200 million, underscores this strategy, aiming to bolster its position in the lucrative North American defense sector.

These strategic moves are crucial for establishing a localized presence and ensuring efficient production and service delivery. By acquiring shipyards in key regions, such as the U.S. market, Hanwha can better meet regional demand and navigate regulatory landscapes. This approach not only strengthens their competitive edge but also allows for tailored solutions and faster response times for their global clientele.

Hanwha's strategy for industrial and defense products heavily relies on direct sales and business-to-business (B2B) channels. This means they engage directly with key clients like governments, major corporations, and project developers. This direct approach is crucial for managing the intricate negotiations and customized solutions often required in these sectors.

For instance, Hanwha Defense Solutions secured a significant contract in early 2024 for its K9 self-propelled howitzers with Poland, a prime example of a direct B2B transaction with a government entity. This direct engagement allows Hanwha to understand and meet the specific technical and logistical demands of such large-scale defense procurements, ensuring tailored solutions are delivered effectively.

Financial Services Network and Digital Platforms

Hanwha's financial services leverage a dual approach, combining traditional physical financial centers in South Korea with a robust expansion of digital platforms and mobile applications. This strategy aims to cater to diverse customer preferences and enhance accessibility. By 2024, Hanwha Life Insurance reported a significant portion of its new business sales originating from digital channels, reflecting the growing importance of online engagement.

The company's strategic push into global financial markets, notably in the U.S. and Southeast Asia, further diversifies its distribution network. This international presence allows Hanwha to tap into new customer bases and revenue streams, adapting its service delivery to varied market demands. Hanwha Investment & Securities has been actively expanding its overseas operations, with a focus on digital brokerage services.

- Digital Penetration: Hanwha Life Insurance saw a notable increase in digital channel sales for new business in 2024, underscoring the shift in customer behavior.

- Global Reach: Expansion into the U.S. and Southeast Asia broadens Hanwha's financial service distribution, particularly through digital offerings.

- Investment Focus: Hanwha Investment & Securities is prioritizing digital brokerage expansion in international markets to capture global investor interest.

- Customer Engagement: The blend of physical and digital channels aims to provide a comprehensive and convenient experience for all clients.

Integrated Supply Chain and Logistics

Hanwha's commitment to an integrated supply chain is central to its marketing strategy, ensuring products reach customers efficiently. This involves meticulous inventory management and sophisticated logistics to support its wide product range. For instance, Hanwha Q CELLS has been actively developing its integrated solar value chain in North America.

This North American expansion includes significant investments in manufacturing capabilities. By 2024, Hanwha Q CELLS announced plans to invest over $2.5 billion in expanding its solar module and cell production capacity in the United States. This strategic move aims to bolster supply chain resilience and meet growing demand for renewable energy solutions.

- Integrated Solar Value Chain: Hanwha Q CELLS is building a comprehensive solar manufacturing ecosystem in North America, from polysilicon to finished modules.

- Investment in US Manufacturing: Over $2.5 billion committed by 2024 to establish and expand US-based solar production facilities.

- Logistics Optimization: Focus on efficient transportation and warehousing to ensure timely product delivery across diverse markets.

- Value Chain Management: Overseeing all stages from raw material sourcing to final product distribution for enhanced control and reliability.

Hanwha's place strategy is characterized by a global yet localized approach. This involves establishing manufacturing and R&D hubs in key regions like South Korea, the U.S., Germany, Malaysia, and China, enabling agile responses to diverse market needs. Strategic acquisitions and partnerships, such as the 2023 investment in U.S. defense contractor KAI for approximately $200 million, bolster their international presence and production capabilities.

For industrial and defense products, Hanwha prioritizes direct sales and B2B channels, exemplified by the early 2024 contract for K9 howitzers with Poland. In financial services, a hybrid model combining physical centers in South Korea with expanding digital platforms and mobile applications caters to varied customer preferences, with digital channels contributing significantly to new business sales by 2024.

Hanwha Q CELLS is actively building an integrated solar value chain in North America, committing over $2.5 billion by 2024 to expand U.S. solar production. This focus on localized manufacturing and efficient logistics ensures supply chain resilience and timely product delivery across global markets.

| Strategic Location | Key Activities | Recent Investment/Deal (Approx.) | Market Focus |

|---|---|---|---|

| South Korea | Manufacturing, R&D, Financial Centers | N/A | Domestic, Global Hub |

| U.S. | Manufacturing (Solar, Defense), R&D, Financial Expansion | $2.5B+ (Solar Production, 2024), $200M (KAI Stake, 2023) | North America (Defense, Renewables, Finance) |

| Germany | Manufacturing, R&D | N/A | Europe |

| Malaysia | Manufacturing | N/A | Asia |

| China | Manufacturing | N/A | Asia |

Same Document Delivered

Hanwha 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hanwha 4P's Marketing Mix Analysis covers all essential elements, ready for your immediate use. You're viewing the exact version of the analysis you'll receive, fully complete and prepared to inform your strategic decisions.

Promotion

Hanwha's strategic presence at global exhibitions like IDEX (International Defence Exhibition & Conference) is a cornerstone of its 'Promotion' strategy. These events serve as vital platforms for showcasing cutting-edge defense technologies, such as advanced artillery systems and unmanned aerial vehicles. For instance, at IDEX 2023, Hanwha showcased its K9 Thunder self-propelled howitzer and the Chunmoo multi-rocket launcher, attracting significant international interest.

Participation in these high-profile industry gatherings is instrumental in building brand visibility and directly engaging with a global clientele. It provides an unparalleled opportunity to demonstrate product capabilities, gather market intelligence, and solidify existing relationships while forging new ones with potential partners and defense ministries. This direct interaction is crucial for understanding evolving market demands and positioning Hanwha's offerings effectively in the competitive international defense landscape.

Hanwha's commitment to sustainability is clearly demonstrated through its annual sustainability reports, which detail its progress in Environmental, Social, and Governance (ESG) initiatives. These reports serve as a transparent communication channel, showcasing the company's dedication to environmental stewardship, social responsibility, and robust governance practices. For instance, Hanwha Solutions reported a significant increase in its renewable energy capacity in 2023, contributing to its environmental goals.

This focus on ESG not only bolsters Hanwha's corporate image but also cultivates essential stakeholder trust and loyalty. By openly sharing their performance metrics, such as a reported 15% reduction in carbon emissions intensity across key operations in 2024, Hanwha aligns its business strategy with long-term value creation and responsible corporate citizenship.

Hanwha leverages strategic communications and public relations to highlight its technological innovations and business successes. This involves disseminating information through press releases and corporate profiles to bolster its brand image and industry standing.

In 2024, Hanwha’s commitment to transparency and stakeholder engagement was evident in its numerous media interactions, aiming to build trust and enhance its reputation as a leader in diverse sectors like aerospace and renewable energy.

Investor Relations and Financial Disclosures

Hanwha Group prioritizes robust investor relations, ensuring stakeholders receive clear and timely financial disclosures. This commitment is evident through regular earnings presentations, comprehensive annual reports, and active participation in investor conferences. For instance, Hanwha Solutions reported a significant increase in its operating profit for the first quarter of 2024, reaching KRW 278.3 billion, up from KRW 144.5 billion in the same period of 2023, showcasing the transparency of their financial reporting.

This dedication to transparency fosters investor confidence by providing the necessary data for informed decision-making. Hanwha's proactive approach in sharing financial performance, including key metrics like revenue growth and profitability trends, helps build trust and manage market expectations effectively. The company's investor relations efforts are crucial in communicating its strategic direction and financial health to a diverse range of stakeholders.

Key aspects of Hanwha's investor relations and financial disclosures include:

- Timely Dissemination of Financial Results: Hanwha consistently releases quarterly and annual financial reports, adhering to regulatory requirements and providing early access to key performance indicators. For example, in 2023, Hanwha Aerospace achieved record-high consolidated revenue of KRW 10.5 trillion, a fact readily available to investors.

- Investor Engagement Platforms: The company actively engages with investors through various channels, including earnings calls, investor days, and dedicated investor relations websites, facilitating direct communication and feedback.

- Strategic Communication: Beyond raw numbers, Hanwha communicates its long-term vision, growth strategies, and commitment to sustainability, offering a holistic view of the company's value proposition.

- Transparency in Reporting: Hanwha's financial disclosures are designed for clarity and accuracy, enabling investors to conduct thorough due diligence and understand the company's financial standing and future prospects.

Digital Marketing and Online Presence

Hanwha actively cultivates its digital marketing and online presence to engage a wide array of stakeholders, from individual investors to business leaders. Their corporate website likely serves as a central hub, detailing their extensive portfolio and innovations across various sectors. This digital footprint is crucial for disseminating information and attracting a global audience interested in their diverse business activities.

The company's commitment to digital finance underscores a significant investment in online platforms and services. This strategic focus ensures accessibility and engagement for customers and partners seeking financial solutions. For instance, Hanwha Investment & Securities reported a 10.2% increase in its digital customer base in early 2024, highlighting the growing importance of their online channels.

- Corporate Website: A primary channel for showcasing Hanwha's diverse business units, from aerospace and defense to renewable energy and finance.

- Digital Finance Platforms: Essential for customer engagement and service delivery in their financial services segments, with user acquisition showing steady growth.

- Social Media Engagement: Likely used to build brand awareness and communicate corporate news, targeting a broad demographic including financially-literate individuals.

- Content Marketing: Disseminating insights and updates through online channels to inform and attract potential investors and business partners.

Hanwha's promotional efforts extend to robust digital marketing, utilizing its corporate website and social media to showcase its diverse business units and innovations. This online presence is crucial for attracting a global audience and disseminating information about their advancements in aerospace, defense, and renewable energy.

The company's investment in digital finance platforms is also a key promotional tool, enhancing customer engagement and service delivery within its financial services segments. Hanwha Investment & Securities, for example, saw a 10.2% increase in its digital customer base in early 2024, underscoring the growing importance of these channels.

Hanwha's promotional strategy includes active participation in global exhibitions like IDEX, where it showcases advanced defense technologies such as the K9 Thunder howitzer. This direct engagement builds brand visibility and fosters relationships with international clients and defense ministries.

Furthermore, Hanwha prioritizes transparent investor relations, providing timely financial disclosures and engaging through earnings calls and investor conferences. Hanwha Aerospace's record-high consolidated revenue of KRW 10.5 trillion in 2023 exemplifies this commitment to clear financial communication.

| Promotional Activity | Key Channels/Examples | Impact/Data Point |

|---|---|---|

| Global Exhibitions | IDEX (International Defence Exhibition & Conference) | Showcased K9 Thunder and Chunmoo; attracted international interest. |

| Digital Marketing | Corporate Website, Social Media | Central hub for showcasing diverse portfolio; attracting global audience. |

| Digital Finance Platforms | Hanwha Investment & Securities | 10.2% increase in digital customer base (early 2024). |

| Investor Relations | Earnings Presentations, Investor Conferences | Hanwha Aerospace: KRW 10.5 trillion consolidated revenue (2023). |

Price

Hanwha's value-based pricing for advanced technologies in sectors like aerospace and clean energy centers on the substantial long-term benefits and strategic advantages their solutions provide. This strategy acknowledges the significant upfront investment but emphasizes the superior performance, efficiency, and reduced operational costs customers will experience. For instance, Hanwha's aerospace division might price components based on their contribution to fuel efficiency and extended aircraft lifespan, a value proposition far exceeding the initial cost.

In the clean energy market, Hanwha Q CELLS, a major solar panel manufacturer, employs value-based pricing by highlighting the high energy yield and durability of their products. Their advanced solar modules, often featuring technologies like PERC or TOPCon, are priced to reflect their ability to generate more electricity over a longer operational period, offering a compelling return on investment for commercial and residential customers. In 2024, the global solar energy market continued its robust growth, with Hanwha Q CELLS consistently ranking among the top suppliers, underscoring the market's acceptance of their value-driven pricing for high-performance solar solutions.

In mature and highly competitive sectors, like specialized chemicals, Hanwha strategically positions its offerings by providing premium products at prices that are competitive. This approach is crucial for retaining its leading market position.

For instance, in the global petrochemical market, where price sensitivity is high, Hanwha's focus is on optimizing production costs to ensure its products remain attractive. This involves leveraging economies of scale and advanced manufacturing processes to achieve cost efficiencies, as seen in its petrochemical segment which reported significant revenue in 2023.

Hanwha's pricing strategy in these established markets is a delicate act of balancing cost-effectiveness with the inherent value and quality of its products. The company aims to deliver superior performance and reliability, justifying its price point and fostering customer loyalty in a crowded marketplace.

Hanwha frequently utilizes long-term contracts and project-based pricing for its significant undertakings in sectors like defense, solar energy, and infrastructure. These arrangements are structured to cover comprehensive Engineering, Procurement, and Construction (EPC) phases, alongside crucial post-completion support services.

For instance, in the solar sector, Hanwha Qcells secured a significant deal in late 2023 to supply solar modules for a major U.S. project, reflecting the long-term commitment inherent in such large-scale infrastructure pricing. Similarly, defense contracts, often spanning years, involve intricate pricing that factors in research, development, and sustained operational readiness.

Strategic Investment and Financing Options

Hanwha's strategic investment and financing options are crucial for market penetration, particularly in sectors like solar energy. By offering installment financing, they lower the barrier to entry for customers, making their solutions more attainable. This approach is supported by their continued investment in R&D and advanced manufacturing capabilities. For instance, Hanwha Q CELLS announced significant investments in its U.S. solar manufacturing facilities in 2023 and 2024, aiming to boost production and reduce costs. This aligns with their goal to make renewable energy more economically viable for a broader customer base.

These financing and investment strategies are designed to stimulate demand and secure long-term market leadership. By reducing the upfront cost of solar installations through financing, Hanwha can capture a larger market share. Furthermore, strategic investments in technology and production capacity, such as the expansion of their polysilicon production in South Korea, directly contribute to cost efficiencies that can be passed on to consumers or reinvested in further innovation.

- Financial Accessibility: Offering installment plans for solar solutions increases adoption rates by managing upfront costs for consumers.

- Technological Advancement: Hanwha invests heavily in research and development to enhance solar panel efficiency and manufacturing processes.

- Cost Reduction Initiatives: Strategic investments in new facilities, like those in the U.S. and South Korea, aim to lower production costs and improve competitiveness.

- Market Expansion: These financial and investment strategies are key to expanding Hanwha's presence in the global renewable energy market.

Market Demand and Economic Conditions Influence

Hanwha's pricing decisions are deeply intertwined with market dynamics, including fluctuating demand and competitor pricing strategies. For instance, in the competitive solar energy sector, Hanwha Q CELLS has adjusted its module pricing in response to global supply chain shifts and demand surges seen in 2024, particularly in regions like Europe and North America.

Broader economic conditions significantly shape Hanwha's pricing flexibility. During periods of economic growth, the company might leverage higher pricing on its advanced materials or defense systems, reflecting increased purchasing power. Conversely, during economic downturns, such as the global economic slowdown anticipated for late 2024 and early 2025, Hanwha may implement more competitive pricing to maintain market share across its diverse business segments, from petrochemicals to aerospace.

Hanwha's extensive and varied product portfolio provides a strategic advantage in pricing. This diversification allows the company to implement distinct pricing strategies across different business units and geographical markets. For example, pricing for construction materials in a developing Asian market might differ significantly from pricing for advanced electronics in a mature European market, enabling Hanwha to optimize revenue and market penetration globally.

- Market Demand: Hanwha's solar module prices have seen volatility, with average selling prices (ASPs) for high-efficiency modules fluctuating throughout 2024 based on demand in key markets like the US and EU.

- Competitor Pricing: In the petrochemical sector, Hanwha Solutions' pricing for products like PVC is benchmarked against major global producers, with price adjustments occurring monthly based on market supply and demand.

- Economic Conditions: Global inflation trends and interest rate hikes in 2024 have influenced the cost of capital for Hanwha's large-scale projects, indirectly impacting pricing strategies for its infrastructure and energy solutions.

- Portfolio Flexibility: Hanwha's ability to adapt pricing is evident in its aerospace division, where custom solutions for defense contracts are priced based on project scope and technological complexity, differing from the standardized pricing of its consumer electronics.

Hanwha's pricing strategy is a dynamic blend of value-based, competitive, and project-specific approaches, tailored to its diverse business segments. In high-growth areas like solar, value-based pricing emphasizes long-term energy yields and durability, as seen with Hanwha Q CELLS. For mature markets, competitive pricing, supported by cost efficiencies from economies of scale in petrochemicals, ensures market position. Long-term contracts are common for large-scale projects in defense and infrastructure, incorporating comprehensive service packages.

| Business Segment | Pricing Strategy Focus | Key Data/Examples (2024/2025) |

|---|---|---|

| Aerospace | Value-based (performance, efficiency) | Pricing based on contribution to fuel efficiency and aircraft lifespan. |

| Clean Energy (Solar) | Value-based (energy yield, durability) | Hanwha Q CELLS ranked top supplier globally in 2024; module prices adjusted based on US/EU demand surges. |

| Petrochemicals | Competitive (cost-driven) | PVC pricing benchmarked against global producers, adjusted monthly; focus on optimizing production costs. |

| Defense/Infrastructure | Project-based (long-term contracts) | Contracts span years, factoring in R&D and operational readiness; e.g., US solar project supply in late 2023. |

4P's Marketing Mix Analysis Data Sources

Our Hanwha 4P's Marketing Mix Analysis is built upon a foundation of verified, up-to-date information, encompassing company actions, pricing models, distribution strategies, and promotional campaigns. We meticulously reference credible public filings, investor presentations, Hanwha's official brand websites, comprehensive industry reports, and detailed competitive benchmarks.