Hanwha Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Bundle

Uncover the strategic positioning of Hanwha's product portfolio with our comprehensive BCG Matrix analysis. See at a glance which products are poised for growth, which are generating stable returns, and which might be underperforming. This essential tool will illuminate your path to optimizing resource allocation and driving future success.

Ready to transform your understanding of Hanwha's market performance? Purchase the full BCG Matrix report for an in-depth breakdown of each product's quadrant placement, complete with actionable insights and strategic recommendations. Don't miss out on the clarity you need to make informed decisions and gain a competitive edge.

Stars

Hanwha Aerospace stands out as a strong performer within the Hanwha group, exhibiting substantial growth and market dominance, especially in defense exports. Its impressive trajectory is highlighted by a record 11.24 trillion won ($7.7 billion) in sales for 2024, a first for any South Korean defense company.

This achievement underscores the global demand for Hanwha's advanced defense systems, such as the K9 self-propelled howitzer and Chunmoo multiple rocket launcher. Significantly, for the first time, the company's export sales have outpaced its domestic sales, reflecting its expanding international footprint and competitive edge in the global defense market.

Hanwha Ocean is experiencing a significant surge in the LNG carrier sector, positioning it as a strong contender in the market. The company's financial performance saw a notable improvement in 2024, a testament to its strategic focus on the expanding LNG carrier demand, fueled by the global transition towards cleaner energy sources.

The acquisition of Philly Shipyard in the United States has further solidified Hanwha Ocean's competitive edge. This strategic move places the company in a prime position to capture lucrative, high-margin LNG carrier orders, which are expected to be a major driver of its revenue and operating profit growth, particularly noted in Q1 2025 figures.

Hanwha Q Cells shines brightly in the U.S. solar module market, particularly within the residential and commercial sectors. As of Q1 2023, the company commanded an impressive market share exceeding 35% in both these key areas. This strong performance underscores its established presence and customer trust.

The company's commitment to the U.S. market is further solidified by substantial investments. A notable example is the 3.2 trillion won (approximately $2.3 billion) facility being developed in Cartersville, Georgia. This strategic expansion is designed to create a fully integrated local solar value chain by 2025, enhancing production capabilities and supply chain resilience.

This robust market position, coupled with significant capital deployment for local manufacturing, firmly places Hanwha Q Cells as a star performer. Its strategic moves are well-aligned with the accelerating growth and demand within the renewable energy sector, particularly solar power.

Advanced Defense Solutions (Hanwha Systems)

Hanwha Systems, a significant player in Hanwha's defense and aerospace portfolio, is distinguished by its advanced defense electronics and information and communication technology (ICT) capabilities. In 2024, the company demonstrated robust financial performance, achieving a notable 19% year-over-year revenue increase. This growth was fueled by a healthy expansion in both its domestic sales channels and its international export markets.

The company’s strategic emphasis on developing and deploying cutting-edge technologies is a key driver of its market standing. This includes significant advancements in areas such as radar systems, electro-optical equipment, and sophisticated maritime platforms. Furthermore, Hanwha Systems' involvement in the acquisition of Philly Shipyard underscores its commitment to expanding its footprint in the high-growth defense sector, positioning it as a star performer within the BCG matrix.

- Hanwha Systems' 2024 revenue growth: 19% year-over-year.

- Key technology areas: Radar, electro-optics, maritime systems.

- Strategic expansion: Acquisition of Philly Shipyard.

- Market positioning: Strong performer in a high-growth defense market.

Video Surveillance Solutions (Hanwha Vision)

Hanwha Vision is a leading global provider of vision solutions, significantly advancing international video surveillance through its integration of AI and cloud technologies. The company is well-positioned for substantial growth, projecting a robust expansion in the video surveillance market driven by the burgeoning AI ecosystem and the escalating demand for cloud-based systems, with expectations for 2025 to be a pivotal year.

Its strategic emphasis on AI-powered cameras and tailored industry solutions firmly establishes Hanwha Vision as a star performer in a rapidly evolving technological landscape. This focus allows them to capitalize on key market trends and deliver innovative products.

- Market Position: Global leader in vision solutions, leveraging AI and cloud.

- Growth Drivers: Expansion of AI ecosystem and demand for cloud-based surveillance.

- Key Offerings: AI-powered cameras and industry-specific solutions.

- Future Outlook: Anticipated significant growth in the video surveillance market.

Hanwha Aerospace, Hanwha Ocean, Hanwha Q Cells, Hanwha Systems, and Hanwha Vision are all demonstrating star-like performance within the Hanwha group, characterized by strong growth, market leadership, and strategic investments. These companies are capitalizing on significant global trends, from defense modernization to renewable energy and advanced surveillance technologies.

Hanwha Aerospace achieved a record 11.24 trillion won ($7.7 billion) in sales for 2024, a first for a South Korean defense company, with exports surpassing domestic sales. Hanwha Ocean is seeing a surge in LNG carrier orders, boosted by its acquisition of Philly Shipyard. Hanwha Q Cells holds over 35% market share in the U.S. residential and commercial solar sectors and is investing $2.3 billion in a Georgia facility. Hanwha Systems saw 19% revenue growth in 2024, driven by defense electronics and ICT. Hanwha Vision is a leader in AI-powered video surveillance, anticipating substantial market expansion.

| Company | Key Performance Indicator | 2024/Recent Data | Strategic Focus |

|---|---|---|---|

| Hanwha Aerospace | Total Sales | 11.24 trillion won ($7.7 billion) | Global defense exports, advanced systems |

| Hanwha Ocean | Sector Growth | Significant surge in LNG carriers | LNG carrier demand, Philly Shipyard acquisition |

| Hanwha Q Cells | U.S. Market Share | >35% (Residential/Commercial Solar) | U.S. solar market, integrated value chain investment |

| Hanwha Systems | Revenue Growth | 19% year-over-year | Defense electronics, ICT, AI integration |

| Hanwha Vision | Market Position | Global leader in vision solutions | AI and cloud in video surveillance |

What is included in the product

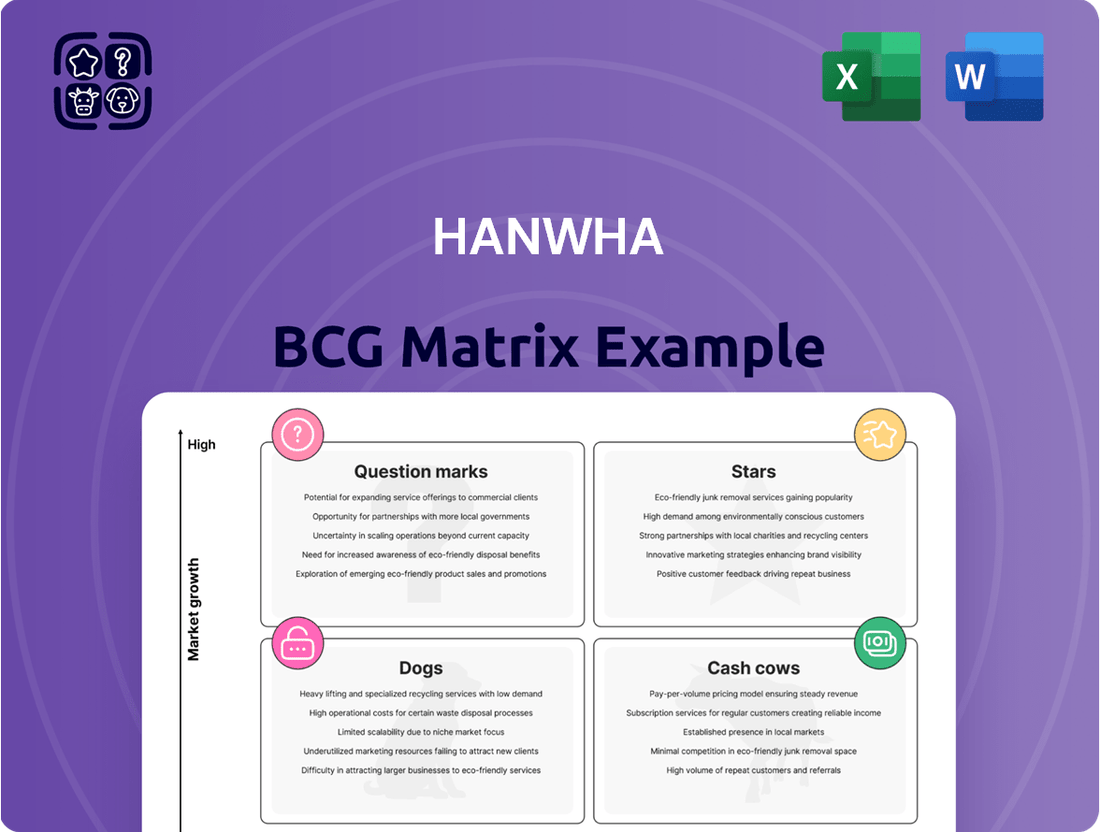

Hanwha's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides Hanwha in making informed decisions about resource allocation, investment, and divestment for each segment.

The Hanwha BCG Matrix offers a clear, one-page overview, relieving the pain of complex business unit analysis.

Cash Cows

Hanwha's traditional chemicals and materials division, a cornerstone of its operations, navigates a mature market with tempered growth expectations. This segment is a reliable generator of consistent cash flow, a vital resource for funding the company's expansion into more dynamic, high-potential sectors.

Despite facing anticipated operating losses in 2024, this foundational business unit continues to be an integral component of Hanwha's overall strategic structure, underpinning its diversified portfolio.

Hanwha's financial services, notably Hanwha Life and Hanwha General Insurance, are firmly established in South Korea's insurance market. These businesses are mature, consistently generating substantial cash flow from premiums and investment activities.

In 2023, Hanwha Life reported total assets of 146.3 trillion KRW, showcasing its significant scale. This segment acts as a stable cash generator, providing crucial financial stability for the broader Hanwha Group.

The consistent earnings from these financial entities allow them to be leveraged, effectively 'milked' to support investments in other growth areas within the Hanwha conglomerate.

Hanwha Ocean's conventional shipbuilding, excluding LNG carriers, likely falls into the Cash Cow quadrant of the BCG Matrix. While the company is heavily invested in the high-growth LNG carrier market, its established operations in other vessel types generate consistent revenue and cash flow.

These traditional shipbuilding activities benefit from existing infrastructure and experienced workforces, contributing to stable profitability. In 2023, Hanwha Ocean secured orders for various conventional vessels, including container ships and tankers, demonstrating ongoing demand and a steady market presence.

Retail and Leisure Industries

Hanwha's retail and leisure segments are positioned as Cash Cows within its business portfolio. These sectors generally operate in mature markets, characterized by stable, predictable demand rather than high growth. This stability allows them to generate consistent revenue streams and reliable cash flow for the conglomerate.

While not requiring substantial capital for aggressive expansion, these businesses offer a steady return on investment. For instance, in 2024, the South Korean retail sector saw a modest growth of around 3-4%, driven by domestic consumption, providing a solid foundation for Hanwha's operations in this area. The leisure industry, recovering post-pandemic, also showed resilience, with domestic travel and entertainment spending contributing positively.

- Stable Revenue Generation: Retail and leisure businesses provide a consistent income stream, acting as a reliable source of funds for the group.

- Mature Market Operations: Operating in established markets allows for predictable demand and less volatile revenue compared to high-growth sectors.

- Lower Capital Intensity: Expansion in these areas typically requires less capital investment, leading to a more efficient use of resources and steady returns.

- Contribution to Overall Stability: These segments help balance the portfolio by offering stability and dependable cash flow, supporting investment in other, more dynamic business units.

Legacy Defense Products (Hanwha Aerospace)

Within Hanwha Aerospace's portfolio, legacy defense products can be considered cash cows. While the K9 howitzer and Chunmoo launcher are currently experiencing high demand and are classified as Stars, older or less technologically advanced defense systems, despite their profitability, represent mature segments. These established products benefit from existing market share and require minimal investment in innovation compared to cutting-edge defense technologies.

These cash cow products generate consistent revenue with lower operational and developmental costs, allowing Hanwha Aerospace to allocate resources to its growth-oriented Star products. For instance, while specific figures for individual legacy products aren't publicly detailed, the broader defense sector in South Korea saw significant growth. In 2023, South Korea's defense exports reached a record high, exceeding USD 10 billion, indicating a robust market for established and reliable defense equipment.

- Mature Market Position: Legacy products benefit from long-standing customer relationships and established supply chains.

- Low Investment Needs: Reduced R&D expenditure allows for higher profit margins.

- Consistent Revenue Generation: These products contribute stable cash flow to the company.

- Support for Star Products: Profits from cash cows can fund the development and expansion of newer, high-growth products.

Hanwha's traditional chemicals and materials division, a cornerstone of its operations, navigates a mature market with tempered growth expectations. This segment is a reliable generator of consistent cash flow, a vital resource for funding the company's expansion into more dynamic, high-potential sectors.

Hanwha's financial services, notably Hanwha Life and Hanwha General Insurance, are firmly established in South Korea's insurance market. These businesses are mature, consistently generating substantial cash flow from premiums and investment activities. In 2023, Hanwha Life reported total assets of 146.3 trillion KRW, showcasing its significant scale.

Hanwha's retail and leisure segments are positioned as Cash Cows within its business portfolio. These sectors generally operate in mature markets, characterized by stable, predictable demand rather than high growth, allowing them to generate consistent revenue streams. For instance, in 2024, the South Korean retail sector saw a modest growth of around 3-4%, driven by domestic consumption.

Within Hanwha Aerospace's portfolio, legacy defense products can be considered cash cows. These established products benefit from existing market share and require minimal investment in innovation compared to cutting-edge defense technologies, generating consistent revenue with lower operational and developmental costs. In 2023, South Korea's defense exports exceeded USD 10 billion.

What You See Is What You Get

Hanwha BCG Matrix

The Hanwha BCG Matrix preview you see is the definitive document you will receive upon purchase, ensuring complete transparency and immediate utility. This comprehensive analysis, meticulously crafted, will be delivered to you without any watermarks or altered content, ready for immediate application in your strategic planning. You are viewing the exact, fully formatted report that will be yours to download, empowering your decision-making processes with actionable insights. Rest assured, the professional design and in-depth analysis presented here are precisely what you will acquire, enabling you to confidently present your findings and drive business growth.

Dogs

Certain areas within Hanwha Solutions' chemical business may be considered Dogs, particularly those grappling with fierce market competition, shrinking consumer interest, or substantial overcapacity. These segments often require significant investment but yield minimal returns, acting as a drag on overall performance.

The chemical division of Hanwha Solutions has encountered financial headwinds, with projections indicating an operating loss for the entirety of 2024. This financial strain points to specific sub-segments that are likely underperforming, consuming valuable resources without generating adequate profits.

Outdated manufacturing technologies at Hanwha Momentum, particularly those not embracing AI and advanced automation, represent potential Dogs in the BCG framework. These legacy systems might require significant capital for upkeep or modernization, diverting funds from more promising growth areas. For instance, if a substantial portion of their production lines still relies on manual processes rather than robotic automation, it could lead to higher labor costs and lower output efficiency compared to competitors. In 2023, the global manufacturing automation market was valued at approximately $300 billion, highlighting the industry's shift towards more advanced solutions.

Hanwha, a major South Korean conglomerate, likely manages several smaller ventures that don't align with its core strategic focus or possess a significant market presence. These non-core, low-market share businesses often operate in mature or declining industries, presenting limited opportunities for substantial growth. For instance, a legacy manufacturing unit within a diversified group might fall into this category, requiring capital investment but yielding minimal returns compared to more strategic investments.

These types of ventures can become a drag on overall performance, tying up valuable capital and management attention that could be better allocated to high-growth areas. Divesting such businesses can free up resources, allowing Hanwha to concentrate on its more promising segments, such as its advanced materials or renewable energy divisions, which are crucial for future expansion. In 2023, Hanwha Solutions’ solar business, Q CELLS, reported significant revenue growth, highlighting the importance of focusing on strategic, high-potential areas.

Certain Legacy Financial Products

Within Hanwha's broad financial offerings, certain legacy products may exhibit characteristics of "Dogs" in the BCG matrix. These are typically offerings with low market share and low growth prospects. For instance, older insurance policies with declining customer interest or traditional savings accounts facing stiff competition from digital platforms could fall into this category. These products often require significant ongoing investment in maintenance, compliance, and customer support, yet contribute minimally to overall revenue growth.

The challenge with these legacy products lies in their potential to drain resources that could be better allocated to more promising ventures. For example, a legacy mutual fund with dwindling assets under management might still necessitate active management and regulatory oversight. In 2024, financial institutions globally are increasingly scrutinizing such underperforming assets, looking to streamline operations and focus on high-potential areas. Hanwha, like its peers, likely evaluates these products based on their return on equity and the cost of capital required for their continued operation.

Consider the following potential "Dog" characteristics for legacy financial products at Hanwha:

- Low Market Share: Products with a declining customer base or niche appeal that fails to expand.

- Low Growth Rate: Offerings in mature or shrinking markets where expansion is unlikely.

- High Maintenance Costs: Products requiring significant operational, IT, or compliance expenditure relative to their revenue generation.

- Limited Strategic Value: Items that do not offer cross-selling opportunities or contribute to broader strategic goals.

Divested or Downsized Operations

Divested or downsized operations represent Hanwha's 'Dogs' in the BCG Matrix. These are business units that have shown poor performance, characterized by low market share and minimal growth prospects. Hanwha's strategic decisions to exit or reduce investment in these areas reflect a focus on optimizing its overall portfolio.

For example, Hanwha Corporation's move to divest its offshore wind turbine and industrial plant businesses to Hanwha Ocean exemplifies this strategy. This action signals a recognition that these segments were not meeting performance expectations or aligning with Hanwha's future growth objectives.

- Low Market Share: These divested or downsized operations typically held a small percentage of their respective markets.

- Low Growth Potential: The industries or segments in which these operations participated were not experiencing significant expansion.

- Strategic Realignment: Divestment allows Hanwha to reallocate resources to more promising business areas.

- Performance Issues: Poor financial returns or a lack of competitive advantage often drives the decision to divest.

Certain legacy products within Hanwha's financial services portfolio may be categorized as Dogs. These offerings, characterized by low market share and minimal growth potential, often require substantial ongoing investment for maintenance and compliance. For instance, older insurance policies with declining customer interest or traditional savings accounts facing intense competition from digital alternatives could fit this description. In 2023, the financial sector saw a significant push towards digital transformation, further marginalizing traditional, underperforming products.

These "Dog" segments can hinder overall performance by diverting capital and management focus from more promising ventures. Hanwha, like many large conglomerates, continually evaluates its product lines to ensure resources are allocated effectively. The company's strategic objective is to streamline its offerings, concentrating on areas with higher growth and profitability potential, such as its advanced materials and renewable energy divisions.

Hanwha Solutions' chemical business has specific segments that could be considered Dogs, particularly those facing intense competition, declining consumer demand, or overcapacity. These areas often demand significant investment but generate limited returns, negatively impacting the company's overall financial health. Projections indicated an operating loss for Hanwha Solutions' chemical division in 2024, underscoring the challenges faced by some of its chemical product lines.

Outdated manufacturing technologies, especially those not incorporating AI and advanced automation, can also be classified as Dogs within Hanwha Momentum. Legacy systems requiring substantial capital for upkeep or modernization divert funds from more growth-oriented areas. The global manufacturing automation market, valued at approximately $300 billion in 2023, highlights the industry's rapid shift towards advanced solutions, leaving less automated facilities at a competitive disadvantage.

Hanwha's strategic divestment of certain business units, such as its offshore wind turbine and industrial plant businesses to Hanwha Ocean, exemplifies the management of "Dogs." These divested operations typically held low market share in slow-growing industries, indicating poor performance and a lack of strategic alignment with Hanwha's future objectives. This strategic realignment allows Hanwha to reallocate resources to more promising business areas, optimizing its overall portfolio.

| Business Segment | BCG Category (Potential) | Key Characteristics | Financial Performance Indicator (2024 Projection) | Market Context |

|---|---|---|---|---|

| Legacy Financial Products | Dog | Low market share, low growth rate, high maintenance costs | Minimal revenue contribution | Mature market, increasing digital competition |

| Certain Chemical Segments | Dog | Intense competition, declining demand, overcapacity | Projected operating loss | Highly competitive global market |

| Outdated Manufacturing Tech (Hanwha Momentum) | Dog | Low efficiency, high upkeep costs, lack of automation | Diverts capital from growth areas | Industry trend towards AI and automation |

| Divested/Downsized Operations (e.g., Offshore Wind) | Dog | Low market share, low growth potential, poor returns | N/A (divested) | Strategic realignment, focus on core strengths |

Question Marks

Hanwha Solutions is strategically expanding into hydrogen and ammonia, aligning with global decarbonization efforts and its own carbon neutrality goals. These sectors represent significant growth potential, fueled by the ongoing energy transition, though Hanwha's current market penetration in these emerging areas is still being established.

The company's substantial investments in these clean energy ventures are crucial for building a robust market presence and transitioning them into future high-performing 'Stars' within its portfolio. For instance, in 2024, Hanwha Q CELLS, a key part of Hanwha Solutions, announced plans to invest heavily in green hydrogen production facilities, signaling a serious commitment to this developing market.

Hanwha is aggressively positioning itself in the burgeoning space sector, focusing on launch vehicles, satellite technology, and satellite communications with the ambition of becoming a global leader in comprehensive space solutions. This segment represents a high-growth, nascent market where Hanwha's current market share and established footprint are still developing.

Significant research and development expenditure, alongside substantial capital investment, are critical for Hanwha to secure a leading position in this dynamic and evolving industry. For instance, Hanwha Aerospace's investment in satellite technology is a key component of this strategy, aiming to capture a significant portion of the projected global satellite market, which is expected to reach hundreds of billions of dollars in the coming decade.

Hanwha Robotics is positioned within the dynamic and rapidly growing sector of AI-driven automation. This market is experiencing significant expansion, fueled by increasing demand for intelligent and efficient robotic solutions across various industries.

Given that this is a relatively nascent venture for Hanwha, its current market share and competitive positioning likely place it in the Question Mark quadrant of the BCG Matrix. This classification suggests a high-growth market but with an uncertain competitive advantage, necessitating substantial investment to foster growth and establish a stronger market presence.

Next-Generation Battery Machinery (Hanwha Momentum)

Hanwha Momentum represents Hanwha Group's strategic entry into the burgeoning secondary battery machinery sector, a move designed to capitalize on the rapid expansion of the electric vehicle (EV) and energy storage system (ESS) markets. The global battery market is projected to reach over $300 billion by 2027, with machinery being a critical component of this growth.

While the market opportunity is significant, Hanwha Momentum is a nascent player in this highly specialized field. Its current market share is minimal, necessitating considerable investment in research, development, and manufacturing capabilities to establish a competitive position against established machinery providers.

- Market Growth: The secondary battery market, driven by EVs and ESS, is experiencing exponential growth, creating substantial demand for advanced manufacturing equipment.

- New Entrant Status: Hanwha Momentum is a new business unit, meaning it has yet to build significant market share or brand recognition in the battery machinery segment.

- Investment Needs: Achieving leadership in this capital-intensive industry will require substantial ongoing investment to scale production, innovate technology, and secure key clients.

- Competitive Landscape: The sector is competitive, with established players holding significant technological and market advantages that Hanwha Momentum must overcome.

Urban Air Mobility (UAM) (Hanwha Systems)

Hanwha Systems is actively investing in Urban Air Mobility (UAM), positioning itself for the future of transportation. This venture into UAM, often involving electric vertical takeoff and landing (eVTOL) aircraft, represents a significant strategic move into a nascent but potentially lucrative market. The company's efforts are focused on the early stages of development, acknowledging the substantial capital and technological advancements required before widespread commercial adoption.

The UAM sector, while promising, is characterized by high risk and uncertainty. Hanwha Systems' current market share in this domain is negligible, reflecting its early-stage involvement. The company is likely channeling considerable resources into research and development to address complex challenges, including battery technology, air traffic management, and regulatory approvals.

- Market Potential: The global UAM market is projected to reach hundreds of billions of dollars by 2040, with eVTOLs playing a key role.

- Investment Needs: Significant capital is required for R&D, infrastructure, and certification processes, making UAM a capital-intensive endeavor.

- Technological Hurdles: Advancements in battery density, autonomous flight systems, and noise reduction are critical for UAM's viability.

- Regulatory Landscape: Establishing safety standards and air traffic control systems for UAM operations is a major ongoing challenge.

Hanwha Robotics, a newer venture for the group, operates in the rapidly expanding field of AI-driven automation. This sector is experiencing substantial growth, driven by the increasing demand for intelligent robotic solutions across diverse industries.

As an emerging business, Hanwha Robotics likely holds a small market share, placing it in the Question Mark category. This suggests a high-growth market with an uncertain competitive position, requiring significant investment to foster development and establish a stronger foothold.

Hanwha Momentum is strategically entering the secondary battery machinery market, aiming to capitalize on the booming electric vehicle and energy storage sectors. The global battery market is projected to exceed $300 billion by 2027, with machinery being a vital component of this expansion.

Despite the immense market opportunity, Hanwha Momentum is a new entrant in this specialized industry. Its current market share is minimal, necessitating substantial investment in R&D and manufacturing to compete effectively with established players.

Hanwha Systems is investing in Urban Air Mobility (UAM), targeting the future of transportation with eVTOL aircraft. This represents a strategic move into a nascent but potentially high-reward market, though significant capital and technological advancements are needed for widespread adoption.

The UAM sector is characterized by high risk and uncertainty, with Hanwha Systems holding a negligible market share due to its early-stage involvement. The company is dedicating considerable resources to R&D to overcome challenges in battery technology, autonomous flight, and regulatory approvals.

| Business Unit | Market Growth | Market Share | Investment Needs | BCG Quadrant |

|---|---|---|---|---|

| Hanwha Robotics | High | Low | High | Question Mark |

| Hanwha Momentum | High | Low | High | Question Mark |

| Hanwha Systems (UAM) | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, integrating financial performance, industry growth rates, and competitor analysis to provide strategic clarity.