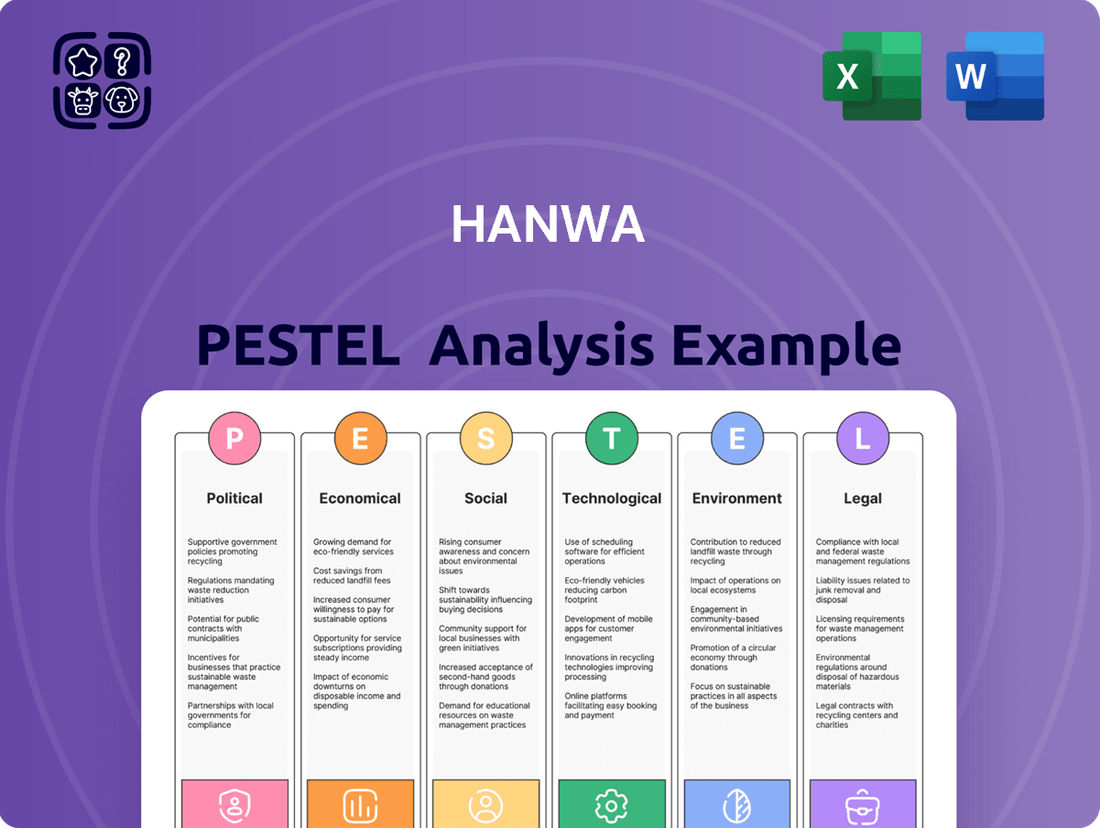

Hanwa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwa Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Hanwa's trajectory. This PESTLE analysis delivers actionable intelligence to inform your strategic decisions and competitive advantage. Purchase the full report for a comprehensive understanding and to unlock Hanwa's future opportunities.

Political factors

Changes in global trade policies and tariffs significantly influence Hanwa's operations across its diverse sectors. For instance, the imposition of new tariffs on steel imports, as seen in various trade disputes throughout 2024, can directly increase Hanwa's procurement costs or reduce its competitiveness in export markets. Similarly, shifts in agricultural trade agreements can impact the landed cost of food products, affecting Hanwa's distribution margins.

Geopolitical tensions, such as those impacting East Asian trade routes in late 2024 and early 2025, create supply chain vulnerabilities. These disruptions can lead to increased logistics expenses and delays, directly affecting Hanwa's profitability in its metals and chemicals divisions. The company's ability to navigate these volatile trade environments by diversifying sourcing and markets remains crucial for maintaining stable operations and competitive pricing strategies.

Geopolitical instability, such as the ongoing conflicts in Eastern Europe and the Middle East, directly impacts global trade routes and commodity prices. For Hanwa, a major player in international trade, disruptions in these regions can escalate shipping costs and create significant delays in sourcing raw materials and delivering finished goods. For instance, the Red Sea shipping crisis in late 2023 and early 2024 led to a surge in insurance premiums and rerouting, adding substantial costs for companies reliant on these transit points.

Government regulations significantly influence Hanwa's global operations. For instance, in 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) began its transitional phase, impacting the import costs of carbon-intensive goods, potentially affecting Hanwa's steel and chemical businesses. Compliance with these diverse international trade and product standards is a constant operational necessity.

Subsidies can reshape market landscapes for Hanwa. In 2024, the US Inflation Reduction Act continued to offer incentives for green hydrogen and battery production, creating potential avenues for Hanwa's advanced materials division, while also intensifying competition from subsidized players in other regions.

International Sanctions and Embargoes

International sanctions and embargoes pose a significant political risk for Hanwa, a global trading intermediary. The imposition of such measures on countries or entities can directly restrict Hanwa's trading activities, necessitating strict compliance to avoid severe legal penalties. For instance, the ongoing sanctions against Russia, which intensified following the 2022 invasion of Ukraine, have significantly altered global trade flows, impacting various sectors including commodities and manufacturing, areas where Hanwa might operate.

Navigating these complex sanction regimes requires Hanwa to exercise extreme diligence. This can lead to limitations in market access, forcing the company to seek alternative suppliers and customers to maintain its operations. The U.S. Treasury Department's Office of Foreign Assets Control (OFAC) regularly updates its lists of sanctioned individuals and entities, requiring constant monitoring and adaptation by global businesses like Hanwa. Failure to comply can result in substantial fines, reputational damage, and even loss of operating licenses.

- Sanction Compliance Costs: Businesses often incur significant costs associated with implementing and maintaining robust compliance programs to adhere to international sanctions.

- Market Access Limitations: Sanctions can block access to lucrative markets, forcing companies to redirect trade to less profitable regions or find new partners.

- Supply Chain Disruptions: Embargoes can disrupt established supply chains, requiring companies to identify and vet new suppliers, potentially increasing lead times and costs.

- Geopolitical Instability: The broader geopolitical landscape, marked by increasing trade disputes and the potential for new sanctions, creates an environment of uncertainty for global intermediaries like Hanwa.

Bilateral and Multilateral Trade Agreements

The landscape of international trade for Hanwa, a key player in the global commodity market, is significantly shaped by bilateral and multilateral trade agreements. The formation or dissolution of these pacts directly impacts the ease and cost of Hanwa's cross-border transactions.

These agreements often serve to lower tariffs, simplify customs, and grant preferential market access, which can be a boon for Hanwa's intermediary operations. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes major economies like Japan and Canada, can facilitate smoother trade flows for commodities Hanwa handles.

Conversely, the breakdown or absence of such agreements can introduce complexities and increase operational costs. The ongoing trade tensions and renegotiations of existing agreements, such as those involving the United States and China, create uncertainty and potential disruptions for global supply chains that Hanwa navigates.

- Impact of Trade Agreements: Trade agreements directly influence Hanwa's international trade costs and efficiency.

- Benefits of Pacts: Agreements like CPTPP can reduce tariffs and streamline customs, aiding Hanwa's intermediary role.

- Risks of Disruption: Trade disputes and the absence of agreements can complicate trade flows and increase operational complexities for Hanwa.

- Global Trade Dynamics: Hanwa must adapt to evolving trade policies, such as the US-China trade dynamics, which affect commodity movements.

Government regulations and trade policies remain critical for Hanwa's global operations, influencing everything from import costs to market access. For example, the EU's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in 2024, directly impacts the cost of carbon-intensive goods, potentially affecting Hanwa's steel and chemical sectors. Similarly, the US Inflation Reduction Act's incentives for green technologies in 2024 could create new opportunities but also intensify competition from subsidized players in markets Hanwa serves.

What is included in the product

The Hanwa PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company.

It provides actionable insights into how these external forces create both strategic opportunities and potential risks for Hanwa's operations and future growth.

Provides a clear, actionable summary of external factors, enabling strategic decision-making and mitigating the pain of uncertainty.

Economic factors

The global economy's trajectory is a critical factor for Hanwa, as its trading activities in steel, non-ferrous metals, food, and chemicals are directly tied to overall economic health. A strong global economy, characterized by robust industrial output and consumer spending, typically translates into higher demand and favorable pricing for Hanwa's diverse commodity portfolio.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.3% in 2023, indicating a generally positive but moderating environment. This growth underpins demand for industrial metals and construction materials, benefiting Hanwa's core businesses.

However, recession risks loom. Geopolitical tensions and persistent inflation could dampen consumer confidence and business investment, leading to reduced demand and increased price volatility for Hanwa’s traded goods. The potential for slower growth in major economies like China and the Eurozone in 2025 presents a significant headwind.

Fluctuations in commodity prices, such as steel, copper, and petrochemicals, directly influence Hanwa's financial performance. For instance, the average price of copper, a key commodity for Hanwa, saw significant swings in 2024, impacting inventory valuations and trading margins. These price movements are critical for Hanwa, given its role as a major intermediary managing substantial inventory volumes.

Hanwa's business model, which involves trading large quantities of commodities, makes it particularly vulnerable to sudden price shifts. For example, a sharp decline in crude oil prices in early 2025 could directly reduce the value of Hanwa's petrochemical holdings. This inherent susceptibility underscores the necessity of robust risk management.

To navigate this volatility, Hanwa relies heavily on sophisticated risk management techniques, particularly hedging strategies. By employing futures and options contracts, Hanwa aims to lock in prices for future transactions, thereby mitigating the financial impact of adverse price movements. This proactive approach is essential for maintaining stable profitability in a volatile market.

Currency exchange rate fluctuations present a significant challenge for Hanwa, given its global operations. For instance, the Japanese Yen's strength against other major currencies can increase the cost of imported raw materials and components, directly impacting Hanwa's cost of goods sold. Conversely, a weaker yen can make Hanwa's exports more competitive but reduce the repatriated value of earnings from overseas subsidiaries.

In 2024, the yen experienced volatility, trading around 150-160 against the US dollar for much of the year. This fluctuation directly influences Hanwa's financial results, as sales in USD-denominated markets translate into fewer yen when repatriated. Managing these currency exposures through hedging strategies is crucial for Hanwa to mitigate potential losses and ensure stable profitability.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Hanwa, potentially increasing operational expenses across the board. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, indicating broader inflationary pressures that could affect raw material costs, transportation, and labor.

Higher interest rates, stemming from central bank efforts to curb inflation, directly impact Hanwa's financing costs. The Federal Reserve's benchmark interest rate, held steady in the 5.25%-5.50% range through mid-2024, makes securing capital for trade finance and new investments more expensive.

- Increased Operational Costs: Inflationary pressures, as seen in the 3.4% US CPI in April 2024, can escalate expenses for logistics, materials, and wages for Hanwa.

- Higher Borrowing Expenses: The Federal Reserve's sustained interest rate of 5.25%-5.50% through mid-2024 increases the cost of capital for trade finance and development projects.

- Impact on Capital Availability: Elevated interest rates can reduce the overall availability of capital for essential business activities like supply chain management and resource acquisition.

- Need for Financial Resilience: Hanwa must implement robust financial planning to navigate these macroeconomic headwinds and maintain operational stability.

Supply Chain Disruptions and Logistics Costs

Economic shocks, like the energy price surges seen in 2023 and ongoing labor market tightness, directly impact global supply chains. These events can significantly increase logistics costs, affecting Hanwa's operational expenses and delivery timelines. For instance, the cost of ocean freight, a critical component of global logistics, saw significant volatility throughout 2023 and into early 2024, with some routes experiencing cost increases of over 50% compared to pre-pandemic levels.

Hanwa, as a supply chain management provider, faces direct exposure to these disruptions. Delays and increased operational expenses can erode profit margins and negatively affect customer satisfaction. The International Monetary Fund (IMF) has highlighted that persistent supply chain bottlenecks contributed to elevated inflation rates globally in 2023, underscoring the broad economic impact.

- Increased Freight Costs: The average cost of shipping a 40-foot container globally remained elevated in early 2024, with rates fluctuating significantly based on demand and geopolitical factors.

- Labor Shortages Impact: Many sectors, including warehousing and transportation, experienced persistent labor shortages throughout 2023, driving up wage costs and impacting service efficiency.

- Infrastructure Bottlenecks: Congestion at major ports and limited inland transportation capacity continued to be a challenge in 2023, leading to longer transit times and higher demurrage charges.

- Diversification Benefits: Companies that diversified their sourcing and logistics partners demonstrated greater resilience, mitigating the impact of localized disruptions and cost escalations.

Economic growth globally is projected to moderate, with the IMF forecasting 3.2% in 2024. This growth supports demand for Hanwa's commodities, but risks from inflation and geopolitical tensions could slow consumption and investment in 2025.

Commodity price volatility, seen in copper's swings in 2024, directly impacts Hanwa's trading margins and inventory values. Currency fluctuations, like the Yen trading between 150-160 against the USD in 2024, also affect Hanwa's profitability on international sales and imports.

Inflationary pressures, evidenced by the US CPI at 3.4% year-over-year in April 2024, increase Hanwa's operational costs. Higher interest rates, with the Federal Reserve holding rates at 5.25%-5.50% through mid-2024, also raise Hanwa's borrowing expenses for trade finance and investments.

Supply chain disruptions, including elevated ocean freight costs in early 2024 and labor shortages in warehousing and transport through 2023, continue to impact Hanwa's logistics and operational efficiency.

| Economic Factor | 2024/2025 Data Point | Impact on Hanwa |

|---|---|---|

| Global GDP Growth Forecast | IMF: 3.2% (2024) | Supports demand for commodities, but moderation poses a risk. |

| Key Commodity Price Trend | Copper price volatility (2024) | Affects trading margins and inventory valuation. |

| Currency Exchange Rate | USD/JPY: ~150-160 (2024) | Impacts profitability of international sales and import costs. |

| Inflation Rate (US CPI) | 3.4% year-over-year (April 2024) | Increases operational expenses for materials, logistics, and labor. |

| Interest Rate (Federal Funds Rate) | 5.25%-5.50% (through mid-2024) | Raises cost of capital for trade finance and investments. |

Same Document Delivered

Hanwa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This Hanwa PESTLE Analysis provides a comprehensive overview of the external factors influencing the company. It details Political, Economic, Social, Technological, Legal, and Environmental considerations, offering valuable insights for strategic planning.

You'll gain a deep understanding of the opportunities and threats Hanwa faces in its operating environment, enabling informed decision-making.

Sociological factors

Consumer preferences are rapidly shifting towards sustainability and ethical sourcing, directly impacting Hanwa's chemical and food trading businesses. For instance, a 2024 Nielsen report indicated that 60% of global consumers are willing to pay more for products from sustainable brands, a trend that necessitates Hanwa's adaptation in its supply chain and product offerings to align with these values.

This evolution demands Hanwa to actively adjust its sourcing strategies and supplier selection criteria to meet growing market expectations for healthier and responsibly produced goods. Failing to adapt could lead to a decline in demand for certain chemicals or food products that do not meet these new benchmarks, impacting overall sales volumes and market share.

Furthermore, understanding the nuanced regional variations in these consumer trends is crucial for Hanwa’s market relevance and strategic planning. For example, while demand for plant-based alternatives surged by 15% in Europe in 2024, the growth in Asia was closer to 8%, highlighting the need for tailored approaches to product portfolios and marketing efforts.

Global workforce demographics are shifting, with many developed nations, including key markets for Hanwa's partners, experiencing aging populations. This trend, seen in countries like Japan where the median age was around 48.6 years in 2023, can lead to labor shortages and increased labor costs. Conversely, emerging economies often boast a younger, growing workforce, presenting different opportunities and challenges for talent acquisition and management.

Labor trends are also evolving rapidly. The increasing adoption of remote work models, for instance, can impact Hanwa's operational flexibility and its need for physical office space or collaborative hubs. Furthermore, persistent skill shortages in crucial areas like logistics and digital expertise, coupled with a growing demand for better work-life balance, are forcing companies to rethink their recruitment and retention strategies to remain competitive in attracting and keeping top talent.

Societal expectations for corporate social responsibility (CSR) are growing, pushing companies like Hanwa to focus on ethical sourcing, fair labor, and community involvement. These efforts directly shape Hanwa's public image and how stakeholders view the company. For instance, in 2024, consumer surveys indicated that over 70% of global consumers consider a company's CSR performance when making purchasing decisions, a significant increase from previous years.

Maintaining high CSR standards throughout Hanwa's extensive global supply chains is vital for building and keeping trust with customers, investors, and regulators. This means being open about operations and actively participating in sustainable initiatives. Hanwa's 2025 sustainability report highlighted a 15% reduction in carbon emissions across its key manufacturing sites, demonstrating a commitment to environmental stewardship that resonates with increasingly eco-conscious investors.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with projections indicating that by 2050, 68% of the world's population will reside in urban areas. This trend directly fuels demand for construction materials, including steel, a core product for Hanwa. The expansion of cities necessitates robust infrastructure, from transportation networks to utilities, impacting Hanwa's logistics and supply chain efficiency.

The development of new urban centers, particularly in emerging economies, presents significant opportunities for Hanwa. These projects often require tailored supply chain solutions to meet the specific needs of rapidly growing regions. For instance, the sheer scale of infrastructure investment planned in Asia, with significant portions dedicated to urban development, presents a substantial market for steel products.

However, the flip side of urbanization is the challenge posed by underdeveloped infrastructure in certain areas. Hanwa's trading activities rely heavily on efficient logistics, and regions with poor road networks, limited port facilities, or unreliable rail systems can create significant operational hurdles and increase costs.

- Urban Population Growth: Expected to reach 68% globally by 2050, driving demand for construction materials.

- Infrastructure Investment: Significant global investment in urban infrastructure, particularly in Asia, creates market opportunities.

- Logistical Challenges: Inadequate infrastructure in developing urban areas can impede Hanwa's trading operations and increase costs.

Health and Safety Standards and Awareness

Societal expectations for robust health and safety standards are increasingly influencing Hanwa's global operations. This heightened awareness directly impacts how Hanwa manages its diverse product portfolio, from chemicals to food and metals, demanding rigorous adherence to international regulations. For instance, the International Labour Organization (ILO) reported in 2024 that workplace safety incidents continue to be a significant concern across various industries, underscoring the need for proactive measures.

Hanwa's commitment to responsible sourcing and handling is crucial for maintaining consumer trust and regulatory compliance. Ensuring safe storage and transportation across its extensive supply chain, particularly for sensitive goods like food and chemicals, mitigates risks and protects both employees and end-users. The World Health Organization (WHO) has consistently highlighted the importance of stringent food safety standards, with global foodborne illnesses affecting millions annually, making compliance a critical business imperative.

- Increased scrutiny on chemical handling: Stricter regulations, like those in the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), necessitate detailed safety data and risk assessments for chemicals Hanwa trades.

- Food safety protocols: Compliance with standards such as HACCP (Hazard Analysis and Critical Control Points) is essential for Hanwa's food division, aiming to prevent contamination and ensure product integrity.

- Worker safety in logistics: Hanwa must invest in training and equipment to ensure the safety of personnel involved in the handling and transportation of metals and other industrial materials, aligning with global best practices for occupational health.

- Consumer demand for transparency: Growing consumer awareness translates into a demand for transparency regarding product safety and ethical sourcing, pushing companies like Hanwa to demonstrate robust health and safety management systems.

Societal expectations for corporate social responsibility (CSR) are a significant driver for Hanwa, influencing its public image and stakeholder perceptions. A 2024 survey revealed that over 70% of consumers consider a company's CSR performance in their purchasing decisions, highlighting the direct link between ethical practices and market success.

Hanwa's commitment to CSR, demonstrated by its 2025 sustainability report detailing a 15% reduction in carbon emissions, is crucial for building trust. This focus on ethical sourcing and community involvement is increasingly becoming a benchmark for investors and regulators alike.

The growing demand for transparency in product safety and ethical sourcing compels Hanwa to showcase robust health and safety management systems across its operations.

Increased scrutiny on chemical handling, exemplified by EU regulations like REACH, necessitates detailed safety data and risk assessments for Hanwa's chemical trading. Similarly, adherence to food safety standards like HACCP is vital for Hanwa's food division to prevent contamination and ensure product integrity.

| Societal Factor | Impact on Hanwa | Supporting Data/Trend |

|---|---|---|

| Corporate Social Responsibility (CSR) | Shapes public image, stakeholder trust, and purchasing decisions. | 70% of consumers consider CSR in purchasing (2024). |

| Health & Safety Standards | Drives rigorous adherence to regulations for chemicals and food. | EU REACH regulations for chemical handling; HACCP for food safety. |

| Consumer Transparency Demands | Requires demonstration of robust safety and ethical sourcing practices. | Growing consumer awareness about product origins and safety. |

Technological factors

The digitalization of supply chains, fueled by technologies like blockchain, IoT, and AI, is a significant technological driver impacting global trade. These advancements offer unprecedented visibility, tracking, and optimization capabilities. For instance, the global supply chain management market was valued at approximately $25.5 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards digital integration.

Hanwa can harness these digital tools to streamline its logistics operations, leading to improved efficiency and cost reductions. Enhanced transparency through real-time tracking and data analytics can also build greater trust with partners and customers. Companies that invest in these digital transformations, such as implementing AI-powered demand forecasting, are better positioned to navigate market volatility and maintain a competitive advantage.

Hanwa can leverage advanced data analytics and AI to gain a competitive edge. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the significant investment and potential in this sector. By analyzing vast datasets, Hanwa can refine commodity price forecasting, improving its purchasing and sales strategies across its diverse product lines, from steel to chemicals.

The application of predictive analytics is crucial for optimizing inventory management, a key concern for a company with extensive supply chains. In 2025, businesses are increasingly relying on AI-driven forecasting to reduce holding costs and prevent stockouts. This technology can also pinpoint emerging trading opportunities, allowing Hanwa to proactively adapt to market shifts and enhance its risk management capabilities, especially in volatile commodity markets.

The global B2B e-commerce market is experiencing significant growth, projected to reach $35.3 trillion by 2027, up from $27.7 trillion in 2022. Hanwa can leverage this trend by developing or integrating digital platforms to streamline its commodity trading, from initial orders to final payments, thereby enhancing its operational efficiency and market reach.

Digital trade facilitation tools are crucial for navigating complex international transactions. For instance, platforms offering automated customs clearance and digital payment solutions can significantly reduce lead times and costs. Hanwa's investment in robust digital infrastructure and advanced cybersecurity measures is essential to capitalize on these advancements and mitigate associated risks in its global operations.

Automation and Robotics in Warehousing and Ports

The increasing adoption of automation and robotics in warehousing and ports is a major technological driver. These advancements are revolutionizing how goods are handled, leading to faster, more accurate, and cost-effective operations. For Hanwa, a global trading and investment company dealing with diverse products like steel, metals, food, and chemicals, this presents a significant opportunity to optimize its supply chain.

By integrating robotics and automation into its logistics hubs and ports, Hanwa can expect substantial benefits. These include a reduction in labor costs, a decrease in handling errors, and a notable acceleration in delivery times. Such improvements are crucial for maintaining competitiveness in Hanwa's varied product sectors.

- Robotic Process Automation (RPA) adoption in logistics is projected to grow significantly, with the global market expected to reach USD 10.7 billion by 2028, up from USD 1.5 billion in 2021.

- Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) are becoming standard in modern warehouses, with industry reports indicating a substantial increase in their deployment for material handling.

- Ports are also embracing automation, with initiatives like automated container terminals aiming to boost throughput. For instance, the Port of Rotterdam has seen efficiency gains through automated systems.

Innovations in Material Science and Production

Innovations in material science and production are reshaping global commodity markets, a key area for Hanwa. For instance, breakthroughs in lightweight, high-strength alloys could reduce demand for traditional steel, impacting Hanwa's ferrous metal trading. Similarly, advancements in sustainable chemical processes, like bio-based plastics, may offer new trading opportunities while potentially diminishing reliance on petrochemicals.

Hanwa needs to actively track these technological shifts to maintain a competitive edge. The development of novel food preservation methods, such as advanced modified atmosphere packaging, could alter global trade flows for perishable goods, creating both challenges and prospects for Hanwa's foodstuff division. By staying abreast of these material science advancements, Hanwa can strategically adapt its portfolio, identify nascent markets, and proactively invest in resources that align with future material demands.

- New Alloys: Advancements in aluminum-lithium alloys, for example, are seeing increased adoption in aerospace, potentially impacting demand for traditional aluminum and titanium.

- Sustainable Chemicals: The global market for bio-plastics is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, presenting new trading avenues.

- Food Preservation: Innovations in high-pressure processing (HPP) and pulsed electric fields (PEF) are extending the shelf life of food products, potentially altering supply chain dynamics and demand for certain agricultural commodities.

Technological advancements are fundamentally reshaping global trade and investment, areas critical to Hanwa's operations. The increasing integration of AI and data analytics, for instance, offers powerful tools for forecasting commodity prices and optimizing supply chains, with the global AI market projected to exceed $200 billion in 2024. Furthermore, the digitalization of trade, evidenced by the B2B e-commerce market's projected growth to $35.3 trillion by 2027, enables more efficient transactions and broader market access.

Automation and robotics are revolutionizing logistics, with significant growth expected in Robotic Process Automation (RPA) in logistics, reaching an estimated USD 10.7 billion by 2028. This trend, alongside the increasing deployment of AGVs and AMRs in warehouses and automated systems in ports, promises reduced costs and faster handling times for Hanwa's diverse product portfolio.

Innovations in material science are also creating new dynamics. Advancements in alloys and sustainable chemicals, with the bio-plastics market expected to grow at over 15% CAGR, present both opportunities and challenges for Hanwa's commodity trading. Similarly, new food preservation technologies are altering supply chain dynamics for agricultural products.

| Technology Area | 2024/2025 Projection/Data | Impact on Hanwa |

| AI & Data Analytics | Global AI market > $200 billion (2024) | Improved commodity forecasting, supply chain optimization |

| Digital Trade Platforms | B2B E-commerce market to reach $35.3 trillion by 2027 | Streamlined commodity trading, enhanced market reach |

| Automation & Robotics | RPA in logistics market USD 10.7 billion by 2028 | Reduced logistics costs, faster handling, fewer errors |

| Material Science | Bio-plastics market CAGR > 15% | New trading opportunities, potential shifts in demand for traditional materials |

Legal factors

Hanwa navigates a labyrinth of international trade laws and customs regulations across its global operations. For instance, the World Trade Organization (WTO) agreements, which many of Hanwa’s operating countries are signatories to, set foundational rules for international commerce. Failure to adhere to these, such as incorrect tariff classifications or documentation errors, can lead to significant fines, with customs penalties often amounting to substantial percentages of the goods' value.

Staying compliant with import/export restrictions is paramount for Hanwa’s supply chain efficiency. In 2024, for example, many nations have tightened controls on certain raw materials and finished goods due to geopolitical shifts. A single customs violation could result in lengthy delays, costing Hanwa millions in lost revenue and impacting production schedules. Proactive monitoring of these evolving legal landscapes is therefore a core operational necessity.

As a global trading company, Hanwa's operations across diverse industries necessitate strict adherence to antitrust and competition laws worldwide. These regulations are designed to foster fair market practices and prevent monopolistic behavior, directly influencing Hanwa's strategies for market share expansion, potential mergers, acquisitions, and strategic alliances.

Failure to comply with these laws can result in substantial financial penalties and severe reputational harm. For instance, the European Union's competition authorities have historically imposed significant fines on companies for anti-competitive practices, with some penalties reaching billions of euros, underscoring the financial risks involved.

Environmental regulations are becoming stricter globally, impacting industries like chemicals and metals where Hanwa operates. For instance, in 2024, the EU's Carbon Border Adjustment Mechanism (CBAM) began its transitional phase, requiring reporting on embedded emissions for certain imported goods, which will affect Hanwa's material sourcing and potentially its export competitiveness.

Hanwa must navigate a complex web of compliance, from managing hazardous waste in its chemical divisions to ensuring sustainable resource extraction in its metals segment. Failure to adhere to these evolving sustainability standards, such as those related to water usage or emissions, could lead to significant legal penalties and operational disruptions, as seen with fines levied against other industrial players for non-compliance.

Labor Laws and Employment Regulations

Hanwha's global operations necessitate strict adherence to a patchwork of international labor laws. These regulations cover everything from minimum wage requirements and working hour limits to ensuring safe working conditions and upholding human rights across its diverse workforce. For instance, in 2024, many nations are strengthening their regulations around fair wages and benefits, impacting Hanwha's operational costs and compliance strategies.

Failure to comply can lead to significant penalties, labor disputes, and reputational damage. Hanwha's commitment to ethical business practices means it must conduct thorough due diligence not only on its own employment policies but also on the labor practices of its suppliers and partners worldwide. This includes verifying compliance with international labor standards and local regulations, which is becoming increasingly scrutinized by consumers and investors alike.

- Global Compliance: Hanwha must navigate varying labor laws in over 100 countries where it operates, covering wages, working hours, and employee rights.

- Ethical Sourcing: The company is increasingly expected to ensure its supply chain partners also adhere to fair labor practices, a trend amplified by heightened consumer awareness in 2024.

- Risk Mitigation: Non-compliance can result in fines, legal challenges, and significant damage to Hanwha's brand reputation, impacting investor confidence.

- Employee Welfare: Upholding robust labor standards is critical for attracting and retaining talent, a key competitive advantage in the current economic climate.

Product Liability and Safety Standards

Hanwa, operating as a crucial intermediary in the trade of goods like food and chemicals, faces significant legal responsibilities under product liability laws and stringent safety standards. These regulations are in place to protect consumers and ensure the integrity of the supply chain.

To effectively navigate these legal landscapes and minimize risks, Hanwa must rigorously verify that all traded products adhere to the specific safety and quality regulations of their respective destination markets. This due diligence is not just about compliance; it's fundamental to safeguarding consumer well-being and preserving the company's reputation.

- Supplier Compliance: Hanwa's commitment to product safety necessitates thorough due diligence on its suppliers to confirm their adherence to all relevant safety and quality certifications.

- Regulatory Adherence: For instance, in 2024, the European Union continued to enforce strict regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), impacting chemical traders and requiring comprehensive safety data sheets for imported substances.

- Food Safety Standards: Similarly, global food safety initiatives, such as those overseen by the Codex Alimentarius Commission, set benchmarks that Hanwa must meet to ensure the safety of the food products it facilitates.

- Liability Mitigation: Failure to comply can result in substantial fines, product recalls, and damage to brand equity, underscoring the critical importance of proactive risk management in this area.

Hanwa's global operations are heavily influenced by intellectual property (IP) laws, particularly concerning its technology and branding. Protecting patents, trademarks, and copyrights is crucial for maintaining its competitive edge in sectors like advanced materials and renewable energy. For example, in 2024, the World Intellectual Property Organization (WIPO) reported a continued increase in international patent filings, highlighting the growing importance of IP protection across industries.

Navigating differing IP regimes across jurisdictions presents a significant challenge, requiring robust strategies to prevent infringement and secure its innovations. Failure to adequately protect its IP could lead to significant financial losses and erosion of market position, especially as competitors actively seek to leverage technological advancements.

Data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and similar laws enacted globally, are increasingly impacting Hanwa's handling of customer and operational data. Compliance is essential to avoid substantial fines and maintain trust.

In 2024, the focus on cybersecurity and data protection continues to intensify, with stricter enforcement and evolving requirements for data breach notifications. Hanwa must invest in robust data governance frameworks and employee training to ensure adherence to these critical legal mandates.

Environmental factors

Global efforts to combat climate change are intensifying, with an increasing number of countries implementing stricter regulations. These include carbon pricing mechanisms, emissions trading schemes (ETS), and mandates for greater renewable energy adoption. For instance, the European Union's Emissions Trading System (EU ETS) saw the average carbon price reach €93.72 per tonne of CO2 in 2023, a significant increase from previous years, directly impacting industries with substantial carbon footprints.

Hanwa, like many global corporations, faces direct consequences from these regulations. Higher operational costs due to carbon taxes or the need to purchase allowances within ETS are a significant consideration. Furthermore, the company must meticulously evaluate and reduce emissions not only from its own facilities but also across its entire supply chain, including logistics and production partners, to ensure compliance with evolving environmental standards and avoid penalties.

Growing concerns over resource depletion, especially for critical metals and staple food commodities, are compelling Hanwa to prioritize sustainable sourcing and resource efficiency. For instance, the International Energy Agency (IEA) projected in 2024 that demand for key minerals like lithium and cobalt, essential for batteries, will continue to surge, potentially creating supply chain vulnerabilities.

Hanwa's strategy must therefore involve a deeper exploration of recycled materials and a commitment to promoting responsible mining and agricultural practices. This proactive approach is vital for ensuring long-term supply stability and mitigating risks associated with resource scarcity, a trend that is only expected to intensify in the coming years.

The global momentum towards a circular economy, focusing on reducing, reusing, and recycling waste, directly influences Hanwa's operational strategies, particularly within its steel and non-ferrous metals sectors. This shift necessitates a re-evaluation of material sourcing and waste stream management.

Hanwa is positioned to play a significant role by fostering the trade of recycled materials and championing more efficient resource use across its extensive supply chain. For instance, the global market for recycled metals is projected to grow substantially, with the stainless steel recycling market alone expected to reach over $30 billion by 2027, presenting a clear opportunity for Hanwa.

Successfully navigating this transition requires strategic investments in advanced infrastructure for material recovery and the cultivation of robust partnerships with recycling facilities and technology providers. This commitment to circularity can enhance Hanwa's resource efficiency and potentially unlock new revenue streams from secondary materials.

Biodiversity Loss and Ecosystem Protection

Growing concerns over biodiversity loss and ecosystem degradation directly impact Hanwha's sourcing, especially in agriculture and resource extraction. The company must actively ensure its supply chains avoid contributing to deforestation and habitat destruction, aligning with global conservation goals.

Hanwha's commitment to sustainability necessitates rigorous environmental impact assessments and collaboration with certified sustainable producers. For instance, the global cost of ecosystem degradation was estimated at over $15 trillion annually in recent years, highlighting the economic imperative of protection.

- Supply Chain Scrutiny: Hanwha needs to trace its raw materials to ensure they are not linked to illegal logging or unsustainable land use practices.

- Certification Standards: Partnering with producers who hold certifications like the Roundtable on Sustainable Palm Oil (RSPO) or Forest Stewardship Council (FSC) demonstrates a commitment to responsible sourcing.

- Ecosystem Services Valuation: Understanding the economic value of intact ecosystems can inform strategic decisions and investments in conservation initiatives.

- Regulatory Compliance: Staying abreast of evolving international regulations concerning biodiversity and environmental protection is crucial for maintaining operational integrity.

Water Scarcity and Water Quality Management

Water scarcity is becoming a significant challenge globally, with regions vital to agriculture and industry facing increasing stress. This directly impacts companies like Hanwa, whose food and chemical segments rely heavily on consistent water availability. For instance, by 2025, projections suggest that over two-thirds of the world's population could face water shortages, a stark reality for agricultural sourcing.

Hanwa must actively manage its water footprint, integrating water efficiency into its sourcing strategies and encouraging similar practices throughout its supply chain. This proactive approach is essential for mitigating risks associated with water-stressed areas. The company's commitment to sustainability in 2024, as highlighted in its latest environmental report, emphasizes investments in water-saving technologies for its manufacturing facilities.

Responsible wastewater management and the prevention of water pollution are also paramount environmental considerations. Ensuring that discharged water meets stringent quality standards protects ecosystems and community health, a crucial aspect of corporate social responsibility. Hanwa's ongoing efforts in 2024 included upgrading wastewater treatment plants at several key production sites, demonstrating a tangible commitment to this environmental factor.

- Global Water Stress: By 2025, an estimated 5.2 billion people could experience water scarcity, impacting agricultural yields crucial for Hanwa's food division.

- Industrial Impact: Water-intensive chemical production processes are vulnerable to supply disruptions due to scarcity, potentially affecting Hanwa's chemical segment output.

- Supply Chain Resilience: Hanwa's 2024 sustainability initiatives focused on mapping water risks across its supply chain to ensure business continuity.

- Wastewater Management: Hanwa invested approximately $15 million in 2024 to enhance wastewater treatment capabilities at its major processing plants.

Intensifying global climate action, marked by stricter regulations like carbon pricing and emissions trading, directly impacts Hanwa's operational costs and necessitates a comprehensive approach to emissions reduction across its entire value chain. The EU ETS carbon price averaging €93.72 per tonne in 2023 exemplifies this financial pressure.

Resource depletion concerns, particularly for critical minerals and agricultural commodities, are driving Hanwa to prioritize sustainable sourcing and efficiency. The IEA's 2024 projection of surging demand for battery minerals like lithium and cobalt highlights potential supply chain vulnerabilities.

The growing momentum towards a circular economy is reshaping Hanwa's strategies, especially in metals, encouraging greater use of recycled materials. The stainless steel recycling market alone is expected to exceed $30 billion by 2027, presenting a significant opportunity.

Biodiversity loss and ecosystem degradation demand that Hanwa ensures its supply chains avoid deforestation and habitat destruction, aligning with global conservation goals where the cost of ecosystem degradation is estimated at over $15 trillion annually.

PESTLE Analysis Data Sources

Our Hanwa PESTLE analysis is built on a robust foundation of data from reputable sources including government publications, international economic organizations, and leading industry research firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant.