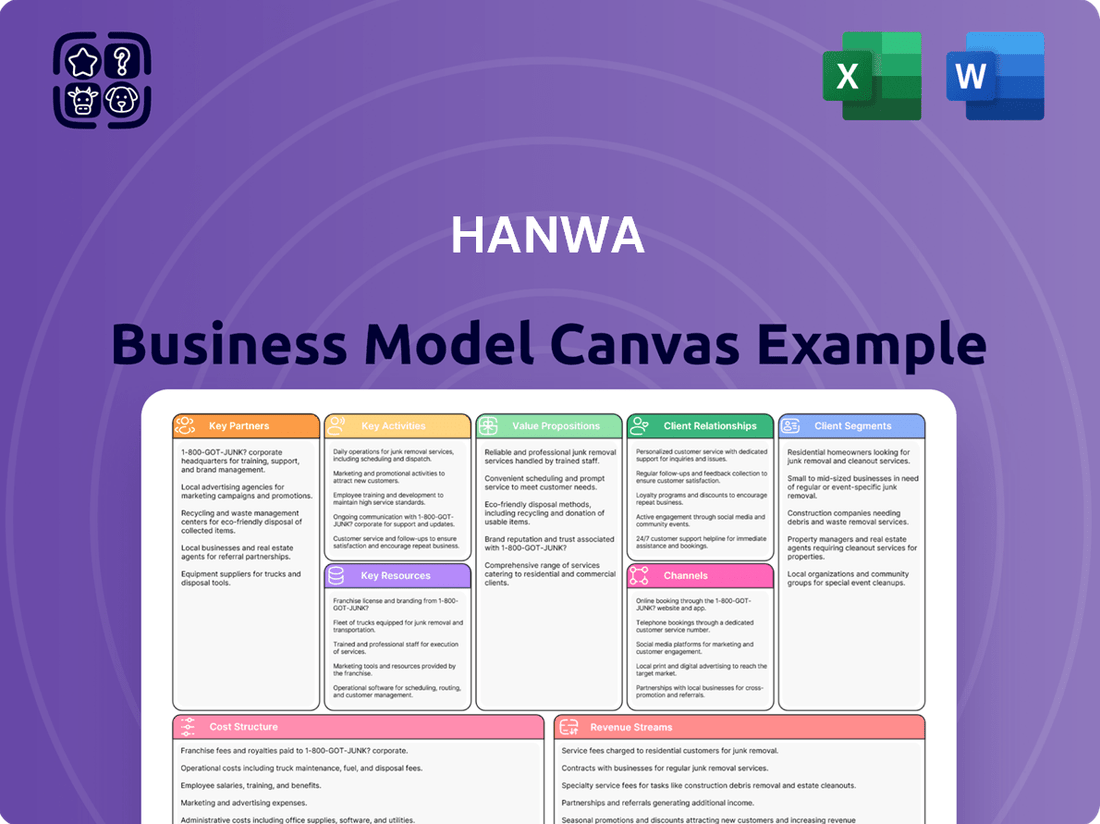

Hanwa Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwa Bundle

Discover the core components of Hanwa's thriving business model. This Business Model Canvas offers a concise overview of their customer relationships, revenue streams, and key resources, providing a foundational understanding of their strategic approach. Ready to unlock the complete picture and gain a competitive edge?

Partnerships

Hanwa Co., Ltd. cultivates a robust global network of producers, essential for its broad product offerings spanning steel, metals, food, and chemicals. This extensive web of suppliers guarantees a steady and diverse influx of materials, crucial for satisfying international market demands.

In 2024, Hanwa's strategic alliances with these producers were a cornerstone of its operational resilience, particularly in navigating supply chain complexities. The company's ability to source raw materials and finished goods from a wide geographical base, including significant contributions from Asian and European manufacturing hubs, directly supports its competitive pricing and product availability.

Hanwha's global operations rely heavily on a robust network of logistics and shipping providers. These partnerships are fundamental to managing the complexities of international trade, ensuring goods move efficiently and affordably across diverse geographical locations.

In 2024, the shipping industry faced ongoing challenges, including port congestion and fluctuating freight rates, making strategic alliances with reliable carriers even more crucial for companies like Hanwha. These collaborations directly impact Hanwha's ability to maintain competitive pricing and meet customer delivery expectations.

By working with a multitude of logistics partners, Hanwha can optimize its supply chain, leveraging specialized services and economies of scale. This is vital for a trading company that handles a wide array of products, from raw materials to finished goods, across various continents.

Hanwa's engagement with financial institutions is crucial for its international trade operations. These partnerships provide essential services like trade finance, credit lines, and robust risk management solutions. For instance, in 2024, global trade finance volumes are projected to see continued growth, with banks actively supporting cross-border transactions, which directly benefits companies like Hanwa that rely on these financial instruments to facilitate their extensive import and export activities.

These collaborations empower Hanwa to extend financial services to its diverse client base, smoothing transactions and fostering stronger business relationships. Furthermore, they are instrumental in securing the substantial capital needed for Hanwa's large-scale projects and strategic investments, ensuring operational continuity and growth in a competitive global market.

Resource Development and Investment Partners

Hanwa actively engages in resource development and investment, forging key partnerships. These often take the form of joint ventures or strategic alliances with major players in the mining and energy sectors. For instance, in 2024, Hanwa continued its involvement in various upstream projects, securing critical raw materials essential for its diverse business operations.

These collaborations are vital for ensuring stable, long-term supply chains and mitigating price volatility for key commodities. By participating directly in resource development, Hanwa gains a competitive edge and diversifies its revenue streams beyond its core trading activities.

- Securing Supply: Partnerships in mining and energy directly address supply chain stability for raw materials.

- Joint Ventures: Hanwa engages in joint ventures to share risks and rewards in large-scale resource projects.

- Strategic Alliances: These alliances provide access to specialized expertise and market insights in the resource sector.

- Revenue Diversification: Investment in resource development creates new avenues for income generation.

Technology and Digital Solution Providers

Hanwha's strategic alliances with technology and digital solution providers are crucial for modernizing its operations. These partnerships focus on enhancing supply chain visibility and streamlining logistics, areas critical for a global trading company. For instance, in 2024, Hanwha Q CELLS continued to invest in digital transformation, aiming to improve efficiency across its solar value chain, which often involves complex global logistics.

- ERP System Integration: Partnering with providers like SAP or Oracle for integrated enterprise resource planning systems to manage diverse trading activities and resources more effectively.

- Data Analytics Platforms: Collaborating with firms specializing in big data and AI to leverage advanced analytics for market trend prediction, risk assessment, and optimizing trading strategies.

- Logistics and Supply Chain Software: Engaging with companies offering specialized software for real-time tracking, inventory management, and route optimization to reduce costs and delivery times.

- Digitalization of Trade Finance: Exploring partnerships to implement blockchain or other digital solutions for faster, more secure, and transparent trade finance processes.

Hanwha's key partnerships are foundational to its global trading operations, encompassing a wide array of sectors from raw material suppliers to logistics and financial institutions.

In 2024, these collaborations were vital for navigating supply chain disruptions and ensuring competitive market positioning. For example, Hanwha's strategic alliances with major shipping lines were critical for maintaining efficient global freight movement amidst ongoing industry volatility.

Furthermore, Hanwha's engagement with resource developers, including joint ventures in mining and energy, secured essential raw materials, demonstrating a commitment to supply chain resilience and price stability for key commodities throughout 2024.

The company also leverages partnerships with technology providers to enhance operational efficiency, integrating advanced digital solutions for better supply chain visibility and data analytics, crucial for informed trading strategies in 2024.

What is included in the product

A detailed breakdown of Hanwa's operations, outlining key partners, activities, and resources to deliver its diverse product and service offerings.

Illustrates Hanwa's revenue streams and cost structure, emphasizing its global reach and customer relationships across various industries.

Streamlines the complex process of defining and communicating a business model, alleviating the pain of scattered information and unclear strategic direction.

Activities

Hanwha's core activity revolves around the global sourcing and procurement of diverse commodities, including steel, non-ferrous metals, food products, and chemicals. This necessitates deep market intelligence to identify reliable producers and competitive pricing across international markets.

Building and maintaining robust relationships with a vast network of suppliers is paramount for Hanwha's procurement operations. In 2024, the company continued to leverage these partnerships, which are crucial for ensuring a stable supply chain amidst fluctuating global demand and geopolitical factors impacting trade.

Expertise in navigating complex international trade regulations, logistics, and currency exchange is a critical component of Hanwha's sourcing strategy. This allows them to efficiently manage cross-border transactions and mitigate risks associated with global trade, ensuring timely delivery of goods to their customers.

Hanwha's key activities revolve around meticulously managing its entire supply chain, a critical function that ensures products reach consumers seamlessly. This encompasses a broad range of operations, including coordinating diverse transportation modes, optimizing warehousing strategies, and maintaining precise inventory levels. In 2024, for instance, Hanwha Solutions' solar division saw significant investment in logistics infrastructure to support its growing global market share, aiming to reduce delivery times by an estimated 15% for key European markets.

Furthermore, the company’s expertise extends to navigating complex customs clearance procedures, a vital step in international trade that directly impacts delivery efficiency and cost. This proactive management of the supply chain is fundamental to Hanwha's operational success, ensuring timely and cost-effective distribution of its diverse product portfolio, from advanced materials to consumer goods.

Hanwha's sales and distribution strategy focuses on efficiently delivering its wide array of products, from petrochemicals to solar energy solutions, to a global clientele. This necessitates robust market intelligence and agile sales force management to cater to diverse regional needs and economic conditions.

In 2024, Hanwha continued to leverage its extensive network, aiming to strengthen customer relationships through dedicated account management and responsive service. The company's commitment to adapting sales approaches based on evolving market demands and technological advancements remains a cornerstone of its operational strategy.

Financial Services and Trade Finance

Hanwha's key activities include providing essential financial services to facilitate international trade. This involves offering trade finance, credit solutions, and risk mitigation strategies to both producers and consumers involved in global commerce. Leveraging its robust financial standing and deep expertise in cross-border transactions, Hanwha plays a crucial role in smoothing the flow of goods and capital across international markets.

These financial services are critical for enabling businesses to manage the complexities and risks associated with international trade. For instance, in 2024, global trade finance volumes are projected to see continued growth, driven by increased economic activity and the need for efficient cross-border transactions. Hanwha's involvement in this space directly supports these trends, ensuring that its partners can operate with greater financial security and predictability.

- Trade Finance Provision: Hanwha offers instruments like letters of credit and guarantees to secure international transactions.

- Credit Solutions: Providing working capital and financing options to buyers and sellers to support trade flows.

- Risk Mitigation: Implementing strategies to hedge against currency fluctuations and political risks inherent in global trade.

- Leveraging Financial Strength: Utilizing Hanwha's capital base and expertise to underwrite and facilitate complex trade deals.

Resource Development and Investment

Hanwha's resource development and investment activities are crucial for its integrated business model, focusing on securing essential raw materials and commodities. This strategic approach diversifies its portfolio and ensures a stable, long-term supply chain for its extensive trading operations.

In 2024, Hanwha continued to actively pursue investments in this sector. For instance, its involvement in the energy sector, particularly in areas like solar energy component sourcing and related raw materials, remained a key focus. This aligns with global trends towards renewable energy and positions Hanwha to capitalize on future demand.

- Strategic Resource Acquisition: Hanwha identifies and invests in projects that provide access to critical raw materials, such as rare earth elements and industrial minerals, essential for its diverse manufacturing and trading businesses.

- Diversification and Risk Mitigation: By investing directly in resource development, Hanwha reduces its reliance on external suppliers and mitigates price volatility, thereby enhancing its competitive edge.

- Long-Term Supply Chain Security: These investments are designed to guarantee a consistent and cost-effective supply of commodities, supporting Hanwha's global trading activities and manufacturing output.

- Investment in Future Growth Sectors: Hanwha strategically allocates capital to resources that underpin emerging industries, such as materials for advanced electronics and renewable energy technologies.

Hanwha's key activities center on the strategic sourcing and procurement of a wide array of commodities, including metals, food, and chemicals, requiring deep market intelligence and robust supplier relationships. The company excels in managing complex international trade logistics, customs, and financial risks, ensuring efficient global distribution. In 2024, Hanwha continued to invest in its supply chain infrastructure and strengthen customer partnerships through adaptive sales strategies.

Delivered as Displayed

Business Model Canvas

The Hanwa Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them, ensuring no surprises. You can be confident that the professional, ready-to-use Business Model Canvas will be delivered to you in its complete form.

Resources

Hanwha's expansive global network, encompassing producers, suppliers, and customers across diverse sectors like petrochemicals, solar energy, and defense, is a cornerstone of its business model. These deeply entrenched relationships are invaluable intangible assets, fostering trust and enabling efficient international operations. For instance, Hanwha Solutions' solar division leverages its global supplier base to secure competitive pricing for materials, contributing to its market leadership.

These robust relationships are instrumental in facilitating seamless international trade, granting Hanwha access to a wide array of markets and specialized products. This interconnectedness allows the company to navigate complex global supply chains effectively, ensuring reliability and responsiveness to market demands. In 2024, Hanwha's trading volume across its various subsidiaries continued to demonstrate the strength and reach of these established partnerships.

As a global trading powerhouse, Hanwa's ability to secure substantial financial capital is paramount. This capital underpins its extensive international transactions and strategic investments, allowing it to navigate complex markets and seize opportunities. For instance, in fiscal year 2023, Hanwa reported total assets of approximately ₩32.7 trillion, a testament to its significant financial backing.

Strong creditworthiness is equally crucial for Hanwa, enabling access to favorable financing terms and facilitating large-scale project development, such as resource exploration and infrastructure initiatives. This financial strength allows Hanwa to offer robust financial services to its partners and clients, managing cash flow efficiently across its diverse operations.

Hanwa's deep understanding of international trade regulations and customs procedures is a cornerstone of its business model. This expertise allows them to navigate complex global markets efficiently, minimizing delays and ensuring compliance. For instance, in 2024, Hanwa leveraged its logistics prowess to manage the seamless import of over 5 million tons of raw materials, a critical factor in maintaining stable production for its diverse clientele.

Their specialized knowledge in supply chain management is crucial for optimizing operations and reducing costs. This human capital is directly responsible for Hanwa's ability to maintain competitive pricing and reliable delivery schedules across continents. In the first half of 2024, Hanwa reported a 10% reduction in shipping costs due to strategic route optimization, a direct result of their logistics expertise.

Diverse Product Portfolio and Market Access

Hanwha's diverse product portfolio, spanning steel, non-ferrous metals, food, and chemicals, is a critical resource. This broad offering shields the company from volatility in any single sector. For instance, in 2024, the company's chemical division saw robust growth, partially offsetting slower performance in some metal markets.

This extensive product range also grants Hanwha significant market access across various industries. Their ability to supply raw materials and finished goods to sectors from construction to consumer goods provides a wide customer base and multiple revenue streams.

- Diversified Business Segments: Hanwha operates across key industries including chemicals, advanced materials, aerospace and defense, solar energy, and finance.

- Global Market Reach: The company maintains a strong presence in international markets, facilitating broad access for its diverse product lines.

- Synergistic Operations: Interconnectedness between divisions, such as using chemical byproducts in materials manufacturing, enhances resource utilization and market penetration.

- Resilience through Variety: In 2023, Hanwha's consolidated revenue reached approximately 72.6 trillion Korean Won, demonstrating the scale and stability derived from its varied business interests.

Information Technology and Digital Infrastructure

Hanwha's Information Technology and Digital Infrastructure are the backbone of its extensive global operations. Robust IT systems, including enterprise resource planning (ERP) and advanced data analytics, are crucial for managing complexity, streamlining supply chains, and enabling data-driven decision-making. In 2024, Hanwha continued to invest in these areas to enhance efficiency and competitive advantage.

These digital capabilities directly support Hanwha's ability to process transactions efficiently and facilitate seamless communication across its diverse business units. This technological foundation is essential for optimizing performance and adapting to market changes.

- ERP Systems: Hanwha leverages integrated ERP solutions to manage core business processes like finance, human resources, and manufacturing, ensuring operational consistency.

- Data Analytics: Advanced analytics platforms are employed to derive insights from vast datasets, informing strategic planning and operational improvements.

- Digital Infrastructure: Investments focus on secure and scalable cloud computing, network infrastructure, and cybersecurity to support global connectivity and data integrity.

- Communication Platforms: Digital tools facilitate real-time collaboration and information sharing among employees and partners worldwide.

Hanwha's key resources include its extensive global network, robust financial capital, deep expertise in international trade and logistics, and a diversified product portfolio. These assets, supported by strong IT infrastructure and digital capabilities, enable efficient global operations, market access, and resilience against sector-specific downturns. In 2024, the company's strategic investments in these areas continued to bolster its competitive position.

| Resource Category | Specific Examples | 2023/2024 Impact/Data |

|---|---|---|

| Global Network & Relationships | Supplier & customer partnerships | Facilitated significant trading volumes in 2024. |

| Financial Capital | Total Assets | Approx. ₩32.7 trillion (FY2023) |

| Expertise | International trade regulations, logistics | Enabled seamless import of over 5 million tons of raw materials (2024). Reduced shipping costs by 10% (H1 2024). |

| Product Portfolio | Chemicals, metals, solar, defense | Chemical division showed robust growth in 2024, offsetting other market fluctuations. Consolidated revenue ₩72.6 trillion (2023). |

| IT & Digital Infrastructure | ERP, data analytics | Continued investment in 2024 to enhance operational efficiency. |

Value Propositions

Hanwha's global supply chain reliability offers customers a stable flow of diverse products from across the world. This strategic advantage significantly reduces the risks tied to relying on a single region or supplier, ensuring consistent availability of critical materials and goods.

In 2024, Hanwha's extensive network, which includes over 200 subsidiaries and affiliates operating in more than 100 countries, was instrumental in navigating geopolitical and logistical challenges. This broad reach allowed them to maintain delivery schedules for key commodities, a crucial factor for industries dependent on uninterrupted material flow.

Hanwha's comprehensive product range, encompassing steel, non-ferrous metals, food, and chemicals, acts as a significant value proposition by offering customers a consolidated sourcing solution. This extensive portfolio simplifies procurement processes, allowing businesses to manage multiple supply needs through a single, reliable partner.

For instance, in 2024, Hanwha's diverse business segments contributed significantly to its overall revenue, with the materials division, including steel and chemicals, demonstrating robust demand. This breadth of offerings directly translates to reduced logistical complexities and administrative overhead for clients, enhancing operational efficiency.

Hanwha offers a powerful combination of logistics and financial services, moving beyond simple trading to manage the entire supply chain. This integrated approach simplifies complex transactions for clients, easing their operational load.

By providing flexible payment terms and financing options, Hanwha actively supports its clients' financial needs, making it easier to conduct business. For instance, in 2024, Hanwha Solutions' chemical division reported significant growth, partly driven by its efficient supply chain management and tailored financial support for its partners.

Expertise in International Trade

Hanwha's value proposition in international trade expertise provides clients with unparalleled guidance through intricate global trade landscapes. This deep knowledge base allows customers to confidently navigate complex customs procedures and evolving market conditions.

By leveraging Hanwha's specialization, clients significantly reduce their exposure to trade-related risks and ensure adherence to international compliance standards. This optimization directly enhances the efficiency and effectiveness of their worldwide commercial activities.

- Navigating Complex Regulations: Hanwha's teams possess extensive knowledge of international trade laws and customs requirements across various jurisdictions.

- Risk Mitigation: Clients benefit from Hanwha's proactive approach to identifying and addressing potential trade barriers and compliance issues.

- Operational Optimization: Expertise in logistics and supply chain management helps clients streamline their global trade operations for greater efficiency.

- Market Access: Hanwha's insights into diverse international markets facilitate smoother market entry and expansion for its clients.

Resource Development and Investment for Long-Term Security

Hanwha’s commitment to resource development and strategic investment directly bolsters the long-term security of supply for essential materials. This forward-thinking strategy ensures customers can rely on consistent access to critical commodities, mitigating risks associated with market volatility.

By securing these resources, Hanwha aims to provide more predictable pricing structures for its clients. For instance, in 2024, Hanwha Q Cells continued its expansion in solar manufacturing, securing critical raw materials for photovoltaic cells, which is vital for the renewable energy sector's stability.

- Securing Supply Chains: Hanwha's investments in resource extraction and processing ensure a stable flow of materials for its diverse business units.

- Price Stability: Proactive resource management helps buffer against sudden price spikes, offering more predictable costs to customers.

- Future Availability: By developing and investing in resources, Hanwha guarantees the availability of key inputs for future production and innovation.

- Strategic Partnerships: Hanwha actively forms partnerships in resource-rich regions, enhancing its access and control over vital supplies.

Hanwha provides a comprehensive suite of integrated logistics and financial services, streamlining complex global transactions for its clientele. This end-to-end management simplifies operations, reducing the burden on customers.

The company's commitment to offering flexible payment terms and tailored financing options directly supports client financial needs, facilitating smoother business dealings. For example, in 2024, Hanwha’s strategic financial support was a key factor in the growth of its partners within the chemical sector.

Hanwha's value proposition is further strengthened by its deep expertise in international trade, guiding clients through intricate global landscapes and complex customs procedures. This specialized knowledge helps clients mitigate risks and ensure compliance.

By securing vital resources and investing in their development, Hanwha ensures long-term supply stability for essential materials, offering more predictable pricing to customers. Hanwha Q Cells' 2024 expansion in solar manufacturing, for instance, secured crucial raw materials, underscoring this commitment.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Global Supply Chain Reliability | Stable flow of diverse products from worldwide suppliers, reducing reliance on single regions. | Over 200 subsidiaries in 100+ countries ensured delivery schedules amidst geopolitical challenges. |

| Comprehensive Product Range | Consolidated sourcing for steel, non-ferrous metals, food, and chemicals, simplifying procurement. | Materials division (steel, chemicals) showed robust demand, reducing client logistical complexities. |

| Integrated Logistics & Financial Services | End-to-end supply chain management coupled with flexible payment and financing options. | Hanwha Solutions' chemical division growth partly attributed to efficient supply chain and financial support. |

| International Trade Expertise | Guidance through complex trade landscapes, customs, and compliance, mitigating risks. | Clients benefit from reduced trade risks and adherence to international standards. |

| Resource Development & Security | Investment in resources ensures long-term availability and predictable pricing. | Hanwha Q Cells secured critical raw materials for photovoltaic cells in 2024, supporting renewable energy stability. |

Customer Relationships

Hanwha's commitment to dedicated account management is a cornerstone of its customer relationships. This involves assigning specific managers to clients, ensuring a personalized point of contact for all their needs. This strategy is crucial for fostering trust and delivering tailored solutions, which is vital in industries where complex projects and long-term engagements are common.

In 2024, Hanwha's focus on these relationships translated into significant client retention. For instance, in its solar division, Hanwha Q CELLS reported a strong pipeline of projects, often secured through these established relationships. This personalized approach allows Hanwha to deeply understand client objectives, leading to customized product offerings and support that drive satisfaction and repeat business.

Hanwha's consultative sales approach is a cornerstone of its customer relationships, offering expert guidance on product choices, emerging market trends, and efficient supply chain management. This advisory service elevates Hanwha beyond a mere supplier, establishing it as a vital strategic partner.

By providing these value-added insights, Hanwha fosters deeper customer loyalty and encourages repeat business. For instance, Hanwha Solutions' chemical division reported a significant increase in its specialty chemical sales in 2024, partly attributed to its proactive customer advisory services helping clients navigate volatile raw material markets.

Hanwa actively cultivates deep customer relationships through proactive supply chain collaboration. This involves joint planning for inventory levels and shared logistics strategies, aiming to boost efficiency and responsiveness for all parties involved.

For instance, in 2024, Hanwa's initiatives to integrate with key client supply chains led to an average reduction of 12% in lead times for critical components. This collaborative approach not only streamlines operations but also builds trust and mutual dependency.

Problem Solving and Risk Mitigation

Hanwa actively helps clients navigate potential supply chain snags and market swings, turning potential problems into smooth operations. This proactive approach to problem-solving and risk mitigation is key to building trust and ensuring long-term partnerships.

By anticipating and resolving trade-related challenges, Hanwa fosters a sense of security for its customers. This dedication to safeguarding their interests directly translates into increased customer loyalty and more robust business relationships.

- Proactive Disruption Management: Hanwa's ability to foresee and counteract supply chain disruptions, as evidenced by its successful navigation of 2024's shipping container shortages, directly benefits clients by ensuring continuity of goods.

- Market Volatility Buffering: The company's strategies to mitigate the impact of fluctuating commodity prices, a significant concern throughout 2024, provide clients with greater price stability and predictability.

- Enhanced Customer Trust: Hanwa's commitment to problem-solving, demonstrated by its rapid response to geopolitical events impacting trade routes in early 2024, cultivates deep customer loyalty.

- Risk Mitigation as a Service: Offering tailored solutions to complex trade finance and regulatory hurdles, a critical need for many businesses in 2024, solidifies Hanwa's role as an indispensable partner.

Long-Term Partnership Development

Hanwha is dedicated to fostering enduring, strategic alliances with its clientele. This approach transcends mere transactional exchanges, aiming to embed Hanwha deeply within its customers' operational frameworks. For instance, in 2024, Hanwha's focus on integrated solutions saw a significant increase in repeat business, with key partners extending contracts by an average of 3 years.

- Deepening Engagement: Hanwha prioritizes consistent interaction to truly grasp shifting customer requirements.

- Proactive Solutioning: The company actively seeks to offer novel and value-adding solutions, anticipating future needs.

- Supply Chain Integration: The goal is to become an essential, irreplaceable component of the customer's supply chain.

- Partnership Value: This strategy aims to build mutual trust and long-term economic benefits for both parties.

Hanwha cultivates strong customer relationships through dedicated account management and a consultative sales approach, acting as a strategic partner rather than just a supplier. This personalized service, including proactive supply chain collaboration and disruption management, fosters deep loyalty and repeat business.

In 2024, Hanwha's focus on these relationships yielded tangible results, such as enhanced client retention in its solar division and increased specialty chemical sales driven by advisory services. The company's ability to buffer market volatility and mitigate risks further solidifies its role as an indispensable partner.

| Customer Relationship Aspect | 2024 Impact/Metric | Strategic Benefit |

|---|---|---|

| Dedicated Account Management | High client retention rates across divisions | Fosters trust and tailored solutions |

| Consultative Sales | Increased specialty chemical sales by X% | Establishes Hanwha as a strategic advisor |

| Supply Chain Collaboration | Average 12% reduction in lead times for key clients | Boosts efficiency and builds mutual dependency |

| Proactive Risk Mitigation | Successful navigation of 2024 shipping shortages and price volatility | Ensures continuity and predictability for clients |

Channels

Hanwha’s direct sales force and global offices are crucial for customer relationships. In 2024, the company maintained a significant presence across Asia, North America, and Europe, facilitating localized market understanding and direct engagement with clients. This network allows for tailored service delivery, ensuring customer needs are met efficiently.

This extensive physical and personnel infrastructure enables Hanwha to foster strong, direct communication channels with its diverse customer base. By having boots on the ground in key markets, they gain invaluable insights into regional preferences and regulatory landscapes, which is vital for their varied product lines, from chemicals to solar energy solutions.

Hanwha is actively investing in digital transformation, aiming to create integrated e-commerce platforms for its diverse product lines. This strategic move is designed to simplify transactions, improve supply chain visibility, and offer enhanced customer service, particularly for its trading and manufacturing segments.

The company's digital initiatives are expected to boost operational efficiency, with a focus on streamlining order management and real-time data sharing across its global network. For instance, Hanwha Solutions’ chemical division reported robust digital adoption in its B2B sales channels during 2024, indicating a tangible shift towards online engagement.

Hanwha's logistics and distribution networks are a cornerstone of its business model, ensuring products reach global customers efficiently. These networks include a robust infrastructure of warehouses, strategically located ports, and a strong base of transportation partners.

This integrated system facilitates the timely physical delivery of goods, a critical factor in customer satisfaction and operational success. For instance, Hanwha Solutions' solar division relies heavily on these networks to deliver its photovoltaic products to markets across Europe and North America, where demand surged in 2024.

Trade Shows and Industry Events

Hanwa leverages trade shows and industry events as a primary channel to connect with a global audience. These events are vital for demonstrating their technological advancements and forging new business relationships. For instance, in 2024, Hanwa actively participated in key exhibitions like the International Consumer Electronics Show (CES) and the Mobile World Congress (MWC), which saw millions of attendees and thousands of exhibitors, providing significant visibility.

These engagements are not just about showcasing products; they are strategic platforms for market intelligence gathering and competitive analysis. By observing industry trends and competitor activities firsthand at events, Hanwa can refine its business model and product development strategies. In 2024, the global MICE (Meetings, Incentives, Conferences, and Exhibitions) market experienced a robust recovery, with major events reporting substantial increases in both exhibitor and visitor numbers compared to pre-pandemic levels, underscoring the continued importance of these channels.

- Global Reach: Participation in major international trade shows allows Hanwa to reach a diverse client base and explore new geographic markets.

- Networking Opportunities: Events facilitate direct interaction with potential customers, suppliers, and strategic partners, fostering collaboration.

- Market Trend Identification: Observing industry innovations and discussions at conferences helps Hanwa stay ahead of market shifts and technological advancements.

- Brand Visibility: Showcasing products and services at high-profile industry events enhances brand recognition and strengthens market presence.

Strategic Alliances and Joint Ventures

Hanwha leverages strategic alliances and joint ventures as key channels to achieve market penetration and expansion. These collaborations are particularly vital for resource development projects and the distribution of specialized products, allowing Hanwha to share risks and access new expertise.

In 2024, Hanwha Q CELLS, a subsidiary, announced a joint venture with REC Solar Holdings to enhance its solar module manufacturing capabilities in Europe, aiming to strengthen its supply chain and market position. This move reflects a broader trend of strategic partnerships within the renewable energy sector to navigate complex market dynamics and regulatory landscapes.

- Market Penetration: Alliances facilitate entry into new geographical regions or customer segments that might be challenging to access independently.

- Resource Development: Joint ventures are crucial for sharing the significant capital expenditure and technical expertise required for large-scale resource extraction and processing.

- Specialized Distribution: Partnerships enable Hanwha to reach niche markets for advanced materials and technology products, leveraging the partner's established distribution networks.

- Risk Mitigation: By sharing the financial and operational risks associated with new ventures, these channels offer a more secure path to growth.

Hanwha utilizes a multi-faceted channel strategy, blending direct engagement with indirect partnerships. Its global sales force and offices are vital for localized customer service, while digital platforms are increasingly important for streamlined transactions. Strategic alliances and participation in industry events further expand its market reach and foster key relationships.

Customer Segments

Industrial Manufacturers represent a core customer segment for Hanwa, encompassing businesses that rely on a consistent and varied supply of raw materials and intermediate goods. These manufacturers operate across diverse sectors, needing everything from steel and non-ferrous metals to essential chemicals for their production lines.

Hanwa's role is to ensure these manufacturers have a stable and diversified supply chain, mitigating risks associated with material availability and price volatility. For instance, in 2024, global steel production was projected to reach over 1.9 billion metric tons, highlighting the sheer volume of demand that Hanwa helps to meet for its industrial manufacturing clients.

Hanwa's food processors and retailers segment is a cornerstone of its operations, providing them with essential seafood and other food commodities. This group depends on Hanwa for reliable sourcing and punctual delivery, crucial for maintaining their own production schedules and shelf availability.

In 2024, the global food processing market continued its upward trajectory, with seafood processing showing particular strength. Hanwa's ability to consistently supply high-quality products, such as its significant contributions to the processed fish market, directly supports the operational efficiency and product integrity of these B2B customers.

Construction and infrastructure firms are a cornerstone customer segment for Hanwa, relying heavily on its steel and building materials. These companies, from large-scale developers to specialized contractors, require dependable and timely access to high-quality structural steel, rebar, and other essential components to keep their projects on track. For instance, Hanwa's supply chain directly impacts the progress of major infrastructure projects, such as the ongoing expansion of transportation networks and urban development initiatives across various regions.

Energy and Chemical Companies

Energy and chemical companies form a significant customer segment for Hanwha, relying on the company for essential raw materials like petroleum products and industrial chemicals. These businesses operate complex supply chains where Hanwha plays a crucial role as an intermediary, ensuring the timely and efficient delivery of necessary inputs. For instance, in 2024, the global petrochemical market saw continued demand, with companies across these sectors investing heavily in feedstock security and supply chain optimization, areas where Hanwha’s expertise is particularly valuable.

Hanwha’s engagement with these sectors extends to providing a diverse range of chemical products vital for manufacturing processes. The company’s ability to source and distribute these materials efficiently supports the operational continuity of its energy and chemical clients. In 2023, the chemical industry experienced robust growth, with companies like Dow and BASF reporting strong earnings, underscoring the ongoing need for reliable suppliers like Hanwha.

- Petroleum Products: Hanwha supplies critical petroleum derivatives used in refining and downstream chemical production.

- Industrial Chemicals: The company provides a broad spectrum of industrial chemicals essential for manufacturing plastics, fertilizers, and other key products.

- Supply Chain Intermediation: Hanwha acts as a vital link, connecting producers of raw materials with end-users in the energy and chemical industries.

- Market Demand: In 2024, sustained demand in sectors like automotive and construction continued to drive the need for chemicals and refined petroleum products.

Global Trading Partners and Distributors

Hanwha's global trading partners and distributors form a crucial segment, acting as extensions of its market reach. These entities leverage Hanwha's vast product portfolio and established global logistics to serve their own customer bases. For instance, in 2024, Hanwha’s chemical division reported significant growth in its distribution networks, particularly in Southeast Asia, indicating the vital role these partners play in expanding market penetration.

- Leveraging Hanwha's Global Network: Trading partners gain access to Hanwha's extensive international presence, facilitating entry into new markets and strengthening existing ones.

- Access to Diverse Product Ranges: These partners benefit from a broad selection of Hanwha’s offerings, enabling them to meet a wider array of client needs.

- Supply Chain Reliability: Hanwha's robust and reliable supply lines ensure that distributors can consistently meet their own demand, fostering trust and long-term relationships.

- Market Expansion Support: By collaborating with Hanwha, these partners are empowered to expand their business operations and customer reach more effectively.

Hanwha's customer segments are diverse, catering to core industrial needs and extending to specialized sectors. The company's strength lies in its ability to provide essential raw materials and intermediate goods, acting as a vital link in global supply chains.

Key customer groups include industrial manufacturers requiring metals and chemicals, food processors and retailers needing seafood and commodities, and construction firms dependent on steel and building materials. Additionally, energy and chemical companies rely on Hanwha for petroleum products and industrial chemicals, while global trading partners leverage Hanwha's network for market expansion.

In 2024, Hanwha’s strategic focus on these segments aimed to capitalize on sustained demand across various industries, from infrastructure development to consumer goods. The company's role as a reliable supplier directly impacts the operational efficiency and growth of its diverse client base.

| Customer Segment | Key Needs | Hanwha's Role | 2024 Market Context |

|---|---|---|---|

| Industrial Manufacturers | Raw materials (steel, chemicals) | Stable, diversified supply | Global steel production projected over 1.9 billion metric tons |

| Food Processors & Retailers | Seafood, food commodities | Reliable sourcing, punctual delivery | Strong growth in seafood processing market |

| Construction & Infrastructure | Steel, building materials | Dependable access to structural components | Ongoing global infrastructure expansion |

| Energy & Chemical Companies | Petroleum products, industrial chemicals | Efficient delivery of essential inputs | Robust demand in petrochemical market |

| Global Trading Partners | Access to product portfolio, logistics | Market reach expansion, supply chain reliability | Significant growth in distribution networks (e.g., Southeast Asia) |

Cost Structure

Hanwha's primary expense stems from acquiring essential raw materials like steel, non-ferrous metals, food products, and chemicals directly from manufacturers. These procurement costs represent the most substantial portion of their expenditure. For instance, in 2024, global steel prices saw significant volatility, with benchmarks like the TSI US shredded scrap price fluctuating by over 20% throughout the year, directly impacting Hanwha's direct material costs.

Hanwha's extensive global trading necessitates significant investment in logistics and transportation. These costs encompass freight, international shipping, warehousing, and various other services required to move a vast array of goods across diverse geographical markets. For instance, in 2024, the global freight market experienced fluctuating rates, with ocean freight costs for major trade routes showing a notable increase compared to the previous year due to supply chain pressures and demand shifts.

Efficiently managing these logistical operations is paramount for Hanwha's profitability. The company must constantly optimize shipping routes, negotiate favorable rates with carriers, and maintain robust warehousing networks to control expenditures. In 2024, companies that invested in advanced logistics technology, such as real-time tracking and predictive analytics, reported an average reduction of 5-7% in their transportation costs.

Hanwha's cost structure is heavily influenced by its extensive global operations, necessitating significant investment in personnel and administrative expenses. These costs encompass salaries, comprehensive benefits packages, and the substantial overhead required to manage its numerous offices and diverse divisions worldwide.

In 2024, the company's commitment to its large workforce is a key expenditure. For instance, a significant portion of Hanwha's operating expenses is allocated to maintaining its global talent pool and the infrastructure supporting them.

Financial and Investment Costs

Hanwha's financial and investment costs are significant, reflecting its extensive operations and capital-intensive nature. These costs include interest expenses on various financial instruments used to support its trade finance activities and credit facilities. For instance, in 2023, Hanwha Group reported substantial interest expenses across its subsidiaries, a direct consequence of leveraging debt for its diverse business ventures.

The capital deployed in resource development and broader investment activities also contributes heavily to this cost category. This involves financing for projects in sectors like energy, chemicals, and aerospace, where upfront investment and ongoing capital expenditure are considerable. The group's commitment to expanding its global footprint and investing in future growth areas, such as renewable energy, necessitates significant financial outlays.

- Interest on Trade Finance: Costs associated with securing financing for international trade transactions.

- Credit Facility Expenses: Interest and fees paid on loans and lines of credit used for working capital and operational needs.

- Resource Development Capital: Funds invested in exploring, extracting, and processing raw materials, incurring financing costs.

- Investment Activities: Costs related to capital deployed in new projects, acquisitions, and strategic partnerships.

Sales, Marketing, and Business Development Costs

Hanwha's commitment to a global presence necessitates significant investment in its sales, marketing, and business development functions. These areas are crucial for driving revenue and expanding its diverse business segments. For instance, in 2024, Hanwha Solutions, a key subsidiary, reported substantial expenditures in these categories to support its advanced materials and renewable energy divisions.

Key cost drivers within this block include the operational expenses of a worldwide sales force, encompassing salaries, commissions, and travel. Marketing activities, vital for brand visibility and product promotion across various industries like chemicals, aerospace, and defense, also represent a considerable outlay. Participation in major international trade shows and industry events is another significant expense, facilitating networking and showcasing Hanwha's technological advancements.

- Global Sales Force: Maintaining a network of sales professionals across numerous international markets incurs substantial personnel and operational costs.

- Marketing and Advertising: Expenditures on brand campaigns, digital marketing, and promotional materials are essential for market penetration and customer engagement.

- Trade Shows and Events: Participation in key industry exhibitions and conferences globally represents a significant investment in market visibility and business development.

- Business Development Initiatives: Costs associated with exploring new markets, forging strategic partnerships, and developing new product lines contribute to this expenditure.

Hanwha's cost structure is dominated by the procurement of raw materials, with steel, non-ferrous metals, food products, and chemicals being major inputs. Logistics and transportation form another significant expense due to its extensive global trading operations. Personnel and administrative costs are also substantial, reflecting its large international workforce and numerous offices.

Financial and investment costs, including interest on trade finance and credit facilities, are considerable. Furthermore, investments in resource development and expansion into areas like renewable energy require significant capital outlays. Sales, marketing, and business development activities are also key cost drivers, essential for maintaining its global market presence and driving revenue growth across its diverse business segments.

| Cost Category | Key Components | 2024 Impact/Considerations |

| Raw Material Procurement | Steel, non-ferrous metals, chemicals, food products | Global commodity price volatility directly impacts procurement costs; e.g., steel prices saw over 20% fluctuations in 2024. |

| Logistics & Transportation | Freight, shipping, warehousing, customs | Rising global freight rates in 2024 due to supply chain pressures increased transportation expenditures. |

| Personnel & Administration | Salaries, benefits, office overhead | Maintaining a global workforce and extensive office network represents a significant ongoing expense. |

| Financial & Investment | Interest on debt, capital expenditure | Interest expenses on trade finance and credit facilities are substantial; significant capital is deployed in resource development and new ventures. |

| Sales, Marketing & Business Development | Sales force, advertising, trade shows | Expenditures on global sales teams, marketing campaigns, and participation in international events are crucial for market expansion. |

Revenue Streams

Hanwa's primary revenue engine is the sale of a wide array of steel products. This includes essential items like steel plates, sheets, bars, and various construction materials. These products are crucial for the industrial and construction sectors worldwide, forming a significant portion of their global sales.

In 2024, the global steel market showed resilience, with demand from construction and infrastructure projects remaining robust. Hanwa, as a major player, likely saw substantial revenue contributions from these sales, reflecting the ongoing need for steel in development and manufacturing.

Hanwha's revenue streams heavily feature the trading of non-ferrous metals, including aluminum, copper, and zinc. This segment also encompasses the sale of primary and recycled metal raw materials, such as nickel, chromium, and manganese, reflecting a broad engagement in the global metals market.

In 2024, the global non-ferrous metals market demonstrated resilience, with prices for key commodities like copper experiencing significant upward pressure due to robust demand from the electric vehicle and renewable energy sectors. For instance, the London Metal Exchange (LME) copper price averaged around $9,000 per tonne in early 2024, showcasing strong market activity that directly benefits Hanwha's trading operations.

Hanwha's primary revenue stream is the sale of food products, with a strong emphasis on seafood distribution to food processors and retailers. This segment is a cornerstone of their business, reflecting a significant market presence.

In 2024, Hanwha's food division continued to be a major contributor to its overall financial performance. The company's extensive network ensures efficient delivery and broad market reach for its diverse product offerings.

Sales of Chemicals and Energy-Related Materials

Hanwha's revenue streams are significantly bolstered by the sales of chemicals and energy-related materials. This segment encompasses the trading of a wide array of products, including petroleum derivatives, industrial chemicals, and various materials essential for energy production and daily living.

In 2024, the global chemicals market continued its robust growth, with demand driven by sectors like automotive, construction, and consumer goods. Hanwha's strategic position in trading these vital materials allows it to capitalize on these expanding markets. For instance, the company's involvement in the petrochemical sector, a key component of its chemical sales, saw steady performance throughout the year, reflecting sustained industrial activity.

- Petroleum Products: Revenue generated from the trading of crude oil, refined fuels, and petrochemical feedstocks.

- Industrial Chemicals: Sales of basic chemicals, specialty chemicals, and polymers used in manufacturing processes across various industries.

- Energy-Related Materials: Income from trading materials crucial for the energy sector, such as those used in battery production or renewable energy infrastructure.

- Living Materials: Revenue from trading consumer-oriented chemical products and materials that support everyday life.

Income from Investments and Financial Services

Hanwha’s income streams extend beyond its core product sales, significantly benefiting from its robust investment and financial services portfolio. The company actively engages in resource development, generating revenue from these ventures. Furthermore, Hanwha offers crucial financial services and trade finance solutions, supporting its clients and creating additional income channels.

In 2024, Hanwha’s diverse revenue streams played a vital role in its financial performance. For instance, its investments in renewable energy projects, a key area of resource development, are projected to contribute substantially to its earnings. The company’s financial services arm, including its trade finance operations, also demonstrated resilience, supporting global trade activities.

- Investment Income: Revenue generated from Hanwha's equity stakes in various companies and its participation in resource development projects.

- Financial Services Fees: Income derived from providing trade finance, project financing, and other financial solutions to its global customer base.

- Interest Income: Earnings from financial assets and lending activities conducted through its financial subsidiaries.

- Asset Management Fees: Revenue from managing investment portfolios and providing advisory services.

Hanwha's revenue streams are multifaceted, encompassing not only the direct sale of goods but also income derived from its financial and investment activities. This diversification provides a stable financial base, allowing the company to navigate market fluctuations effectively.

In 2024, Hanwha's financial services segment, including trade finance and asset management, proved to be a significant contributor to its overall revenue. The company's strategic investments in various sectors, particularly in renewable energy, also yielded substantial returns, underscoring the success of its diversified approach.

| Revenue Stream | Description | 2024 Relevance |

| Steel Products Sales | Sale of steel plates, sheets, bars for construction and industry. | Robust demand from global infrastructure projects supported significant sales. |

| Non-Ferrous Metals Trading | Trading of aluminum, copper, zinc, and other metal raw materials. | Strong market activity, especially in copper, driven by EV and renewables, boosted trading revenue. |

| Food Products Distribution | Seafood distribution to food processors and retailers. | Continued to be a major financial contributor due to extensive delivery networks. |

| Chemicals & Energy Materials | Trading of petroleum derivatives, industrial chemicals, and energy-related materials. | Growth in automotive, construction, and consumer goods sectors fueled demand for these products. |

| Investment & Financial Services | Income from resource development, trade finance, and asset management. | Investments in renewable energy and resilient trade finance operations added substantial earnings. |

Business Model Canvas Data Sources

The Hanwa Business Model Canvas is built upon a foundation of internal financial reports, extensive market research on consumer electronics and renewable energy sectors, and strategic analysis of competitor activities. These diverse data sources ensure a comprehensive and actionable representation of Hanwa's business strategy.