Hanwa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwa Bundle

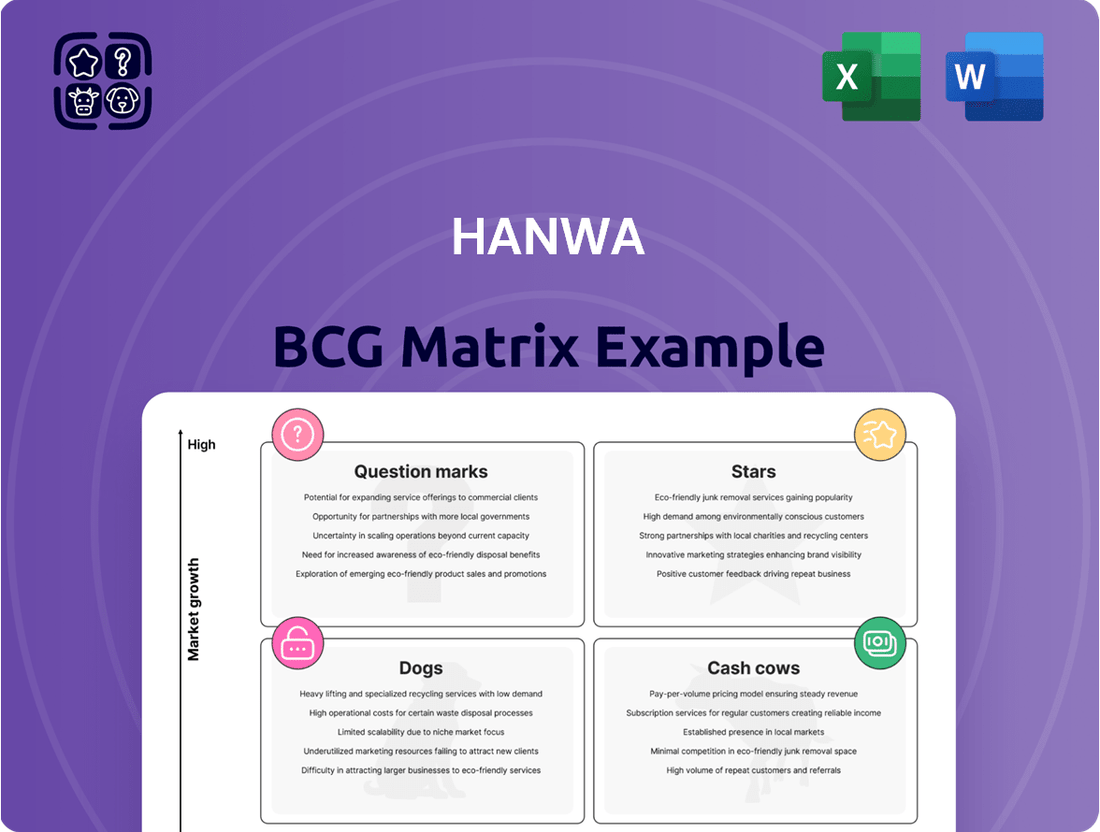

The Hanwa BCG Matrix offers a powerful framework to understand a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This strategic tool helps identify where to invest, divest, or nurture your offerings.

This preview highlights the core of the Hanwa BCG Matrix, but to truly unlock its potential for your business, you need the complete picture. Purchase the full report for detailed quadrant analysis, actionable insights, and a clear roadmap to optimize your product strategy and drive profitable growth.

Stars

Clean Energy Solutions represents a star in Hanwha's BCG Matrix, reflecting significant investment in solar, wind, and hydrogen technologies. Hanwha has committed to 100% renewable electricity usage by 2050, a move that taps into the robust global demand for sustainable energy. This strategic focus positions them advantageously in a rapidly expanding sector.

Hanwha is heavily investing in next-generation solar technology, specifically perovskite-silicon tandem cells. This innovation aims to boost solar module efficiency, a critical factor in the high-growth renewable energy market. By focusing on these advanced materials, Hanwha is positioning itself for a significant competitive advantage.

Hanwha Ocean, the shipbuilding arm of Hanwha Group, is experiencing a significant boost in its operating profit, largely thanks to a strong influx of LNG carrier contracts. This sector is anticipated to see substantial growth, with projections indicating a significant expansion by the year 2030.

The company's strategic approach, including key acquisitions and a dedicated focus on developing dual-fuel ships, places it in a favorable position within this high-demand market. For instance, Hanwha Ocean secured orders for multiple LNG carriers throughout 2023 and early 2024, contributing to a robust order backlog.

Overseas Sales Subsidiaries Expansion

Hanwha's strategic expansion of its overseas sales subsidiaries is a key driver of its growth, as evidenced by new transactions in China. This move signifies successful market penetration and a growing international footprint.

The company is also seeing significant scrap transaction expansion in Southeast Asia. This diversification of sales channels is contributing to increased overall sales and profitability for Hanwha.

- China Market Penetration: Hanwha secured new transactions in China, demonstrating effective entry and expansion within this crucial market.

- Southeast Asia Scrap Growth: Expansion of scrap transactions in Southeast Asia is bolstering Hanwha's revenue streams and operational reach.

- Profitability Impact: These international sales initiatives are directly contributing to improved sales figures and enhanced profits for the conglomerate.

Resource Development and Investment

Hanwha's resource development and investment activities are positioned as a Star within the BCG framework. This is due to the escalating global demand for essential raw materials, presenting a significant opportunity for substantial returns from well-executed resource projects.

This segment offers Hanwha crucial strategic depth and diversification, mitigating risks across its broader portfolio. For instance, in 2024, the global mining market was valued at approximately $2.5 trillion, with projections indicating continued growth driven by electrification and infrastructure development.

- Strategic Importance: Resource development provides Hanwha with direct access to critical inputs, enhancing supply chain resilience.

- Market Growth Potential: The increasing need for metals like lithium and copper, essential for batteries and renewable energy infrastructure, fuels this segment's growth.

- Investment Returns: Successful resource extraction and investment ventures can yield high profit margins, contributing significantly to overall profitability.

- Diversification Benefit: This sector offers a hedge against volatility in other business areas, broadening Hanwha's revenue streams.

Hanwha's Clean Energy Solutions, encompassing solar, wind, and hydrogen, is a clear Star. With a commitment to 100% renewable electricity by 2050 and advancements in perovskite-silicon tandem cells, they are well-positioned in a rapidly expanding market. Hanwha Ocean's success with LNG carrier contracts, driven by strong demand and strategic dual-fuel ship development, also marks it as a Star, with significant order backlogs continuing into 2024.

| Business Segment | BCG Classification | Key Drivers | Supporting Data/Facts |

| Clean Energy Solutions | Star | Global demand for renewables, advanced solar tech (perovskite-silicon tandem cells) | Hanwha's 2050 100% renewable electricity commitment; significant investment in next-gen solar |

| Hanwha Ocean | Star | High demand for LNG carriers, strategic dual-fuel ship development | Strong influx of LNG carrier contracts in 2023-2024; robust order backlog |

What is included in the product

The Hanwa BCG Matrix categorizes business units by market share and growth, offering strategic guidance.

It identifies Stars, Cash Cows, Question Marks, and Dogs to inform investment and divestment decisions.

Hanwa BCG Matrix offers a clear, visual overview of your portfolio, simplifying complex strategic decisions.

Cash Cows

Hanwa's domestic construction steel sector is a prime example of a Cash Cow. Despite a general slowdown in steel transactions, this segment continues to be highly profitable, indicating a mature market where Hanwa holds a dominant position.

The consistent cash flow generated here requires minimal promotional spending, largely due to Hanwa's deep-rooted relationships within the industry. For instance, in 2024, the domestic construction steel market, while facing headwinds, saw Hanwa's segment contribute significantly to overall profitability, demonstrating its stable revenue-generating capacity.

Hanwa's Food Products Division, especially its seafood segment focusing on prawns and crab, is a prime example of a Cash Cow. This division commands leading market shares across multiple categories, demonstrating a strong and established position within its industry.

The division's performance in 2024 has been particularly robust, with significant increases in both sales and profits. This growth is largely attributed to favorable market conditions, specifically higher market prices for seafood products, which directly benefit Hanwa's profitability.

The stability and leadership Hanwa enjoys in this mature market translate into substantial and consistent cash flow generation. This reliable income stream is crucial for funding other business ventures within Hanwa's broader portfolio.

Hanwa's non-ferrous metals recycling operations, focusing on aluminum, copper, and nickel, represent a strong Cash Cow in its portfolio. The steady market prices for copper and aluminum, in particular, have been a significant driver of profitability for this segment.

This business unit boasts a high market share within a mature recycling market. Established and efficient recycling processes contribute to its ability to generate consistent and reliable cash flow, a hallmark of a Cash Cow.

For instance, the global aluminum recycling market was valued at approximately USD 60 billion in 2023 and is projected to grow steadily. Similarly, the copper recycling market, a key focus for Hanwa, is robust, with prices for copper cathode averaging around $8,500 per metric ton in early 2024, supporting strong revenue generation.

Petroleum and Chemicals Trading

Hanwha's Petroleum and Chemicals trading segment is a prime example of a Cash Cow within its business portfolio. The segment has experienced a notable upswing in performance, driven by robust growth in transaction volumes for bunker oil products. This increased activity, coupled with higher unit prices for chemical products, has directly translated into enhanced sales and profitability for Hanwha.

This performance indicates a mature and stable trading environment where Hanwha effectively capitalizes on its existing strengths. The company's established supply chain infrastructure and strong market presence are key enablers of this success. For instance, in 2024, Hanwha's chemical division reported significant contributions to overall revenue, reflecting the strong demand and pricing power in this sector.

- Increased Transaction Volume: Higher demand for bunker oil products fuels revenue growth.

- Higher Unit Prices: Favorable pricing in chemical products boosts profit margins.

- Established Infrastructure: Hanwha leverages its existing supply chain and market reach.

- Stable Market Position: The segment benefits from a mature and predictable trading landscape.

Metal Raw Materials (Nickel, Chromium, Manganese)

Hanwa's Metal Raw Materials segment, encompassing nickel, chromium, and manganese, is a strong performer within its BCG matrix, characterized by high market share and stable demand across diverse industrial sectors.

This business unit generates consistent cash flow through its trading activities, even amidst some price volatility in these essential commodities. For instance, global nickel demand was projected to reach approximately 3.2 million metric tons in 2024, underscoring its critical role.

The reliable nature of this segment positions it as a cash cow for Hanwa, contributing significantly to overall profitability and providing the financial flexibility needed to invest in other business areas.

Key aspects of this segment include:

- Dominant Market Position: Hanwa holds a substantial share in the trading of nickel, chromium, and manganese.

- Consistent Demand: These metals are vital for industries such as stainless steel production, battery manufacturing, and alloy creation.

- Stable Revenue Generation: The core trading operations ensure a steady inflow of cash, acting as a reliable profit center.

- Resilience to Market Fluctuations: While prices can vary, the fundamental demand for these raw materials provides a buffer against significant downturns.

Hanwa's domestic construction steel sector is a prime example of a Cash Cow. Despite a general slowdown in steel transactions, this segment continues to be highly profitable, indicating a mature market where Hanwa holds a dominant position.

The consistent cash flow generated here requires minimal promotional spending, largely due to Hanwa's deep-rooted relationships within the industry. For instance, in 2024, the domestic construction steel market, while facing headwinds, saw Hanwa's segment contribute significantly to overall profitability, demonstrating its stable revenue-generating capacity.

Hanwa's Food Products Division, especially its seafood segment focusing on prawns and crab, is a prime example of a Cash Cow. This division commands leading market shares across multiple categories, demonstrating a strong and established position within its industry.

The division's performance in 2024 has been particularly robust, with significant increases in both sales and profits. This growth is largely attributed to favorable market conditions, specifically higher market prices for seafood products, which directly benefit Hanwa's profitability.

What You See Is What You Get

Hanwa BCG Matrix

The preview you are currently viewing is the exact Hanwa BCG Matrix report you will receive immediately after your purchase. This comprehensive document, free from watermarks or demo content, is fully formatted and ready for immediate strategic application within your business.

Dogs

The Metal Raw Materials segment, specifically tied to SAMANCOR Holdings, is currently positioned as a potential Dog within the BCG framework. This is due to a notable decrease in earnings originating from SAMANCOR, signaling a challenging market environment or a shrinking share within this particular sector.

This business unit demands considerable financial input but is not generating substantial returns, a classic characteristic of a Dog. For instance, in 2024, the ferrochrome market, a key area for SAMANCOR, saw fluctuating prices and demand, impacting profitability.

The sustained underperformance suggests that this investment may be consuming capital without a clear path to significant growth or market leadership.

Hanwa's lumber business, categorized as a Dog in the BCG matrix, is characterized by declining sales and profits. This downturn is primarily driven by a significant drop in lumber prices, a trend that has persisted through 2024.

The market for lumber is experiencing low growth, and within this sluggish environment, Hanwa's market share is also low. Consequently, the business faces challenges in generating substantial returns, making it a prime candidate for the Dog quadrant.

Hanwa's machinery business experienced a sales boost from a new subsidiary, but profits took a hit. This downturn was primarily due to a reduction in large-scale projects, signaling a challenging market for such endeavors.

The decline in large project volume suggests a low-growth environment for this segment within the machinery sector. Coupled with Hanwa's potentially limited market share in this specific niche, it positions this business area as a potential 'Dog' in the BCG matrix.

For context, the global construction machinery market, which heavily influences large project demand, saw moderate growth in 2024, with projections indicating continued, albeit slower, expansion. This backdrop makes Hanwa's profit dip in large projects particularly noteworthy.

Certain Overseas Subsidiaries (Impacted by US Tariffs)

Certain overseas subsidiaries, directly impacted by US tariffs, are likely facing a challenging environment. These operations might be categorized as Dogs within the BCG matrix, signifying low market share and low growth prospects in their affected regions or product lines. For instance, if a subsidiary primarily exports goods subject to a 25% US tariff, its profitability will inevitably shrink, potentially turning it into a cash trap, draining resources without generating significant returns.

The impact of these tariffs can be substantial. For example, in 2024, many companies reported that tariffs added millions to their cost of goods sold. This directly affects the bottom line, pushing these subsidiaries into a weaker competitive position. Their ability to invest in growth or even maintain current operations becomes compromised.

- Reduced Profitability: US tariffs directly increase the cost of goods for these overseas subsidiaries, leading to lower profit margins.

- Low Growth Prospects: The tariff-affected markets may offer limited growth opportunities due to increased prices and potential trade friction.

- Cash Trap Potential: Operations that are unable to pass on increased costs or find alternative markets risk becoming cash traps, consuming capital without generating adequate returns.

- Strategic Re-evaluation Needed: Companies must assess whether to divest, restructure, or seek alternative markets for these subsidiaries to mitigate losses.

Segments with Decreasing Transaction Volume and Lower Market Prices

These are the Dogs in the Hanwa BCG Matrix. They are characterized by declining transaction volumes and falling market prices. This typically signifies a low-growth market where Hanwa's market share is likely also low, meaning these segments are not contributing significantly to overall sales or profitability.

For instance, if a particular electronics component Hanwa produces has seen its global demand shrink by 15% year-over-year, and its average selling price has dropped by 10% in 2024, it would likely fall into this category. This situation implies capital is being tied up in assets or operations that yield minimal returns, potentially draining resources that could be better allocated elsewhere.

- Declining Demand: Segments experiencing reduced customer purchases.

- Price Erosion: Market prices for these products are falling, impacting revenue.

- Low Growth Environment: These represent markets with little to no expansion potential.

- Resource Drain: Capital invested here offers poor returns, hindering overall financial health.

The Dog segments within Hanwa's BCG matrix represent business units with low market share in low-growth industries. These areas consume resources without generating significant returns, often due to declining demand or intense price competition. For instance, Hanwa's ferrochrome operations, tied to SAMANCOR, faced fluctuating prices and demand in 2024, impacting profitability and signaling a potential Dog status.

Similarly, the lumber business, grappling with a significant drop in lumber prices throughout 2024 and low market growth, also fits the Dog profile. These segments require careful strategic consideration, as they may represent a drain on capital with limited prospects for future growth or market leadership.

Question Marks

Hanwa's July 2025 investment in a Thai tire pyrolysis recycling venture positions it as a Question Mark within the BCG matrix. This sector aligns with the burgeoning circular economy and sustainability trends, indicating future potential.

While the global tire recycling market is projected to reach USD 12.4 billion by 2027, with a CAGR of 5.2%, specific data for Thailand's pyrolysis segment remains nascent. This lack of established market share and current profitability makes the venture's future performance uncertain, characteristic of a Question Mark.

Hanwha's investment in cultured meat places it squarely in the Question Mark category of the BCG matrix. This innovative sector, while holding immense future potential, is characterized by substantial research and development costs and an unproven market demand.

The global cultured meat market is projected to reach $10 billion by 2030, indicating a significant growth trajectory. However, current market share for cultured meat remains negligible, reflecting the early stage of development and the significant hurdles to widespread adoption, such as scaling production and regulatory approvals.

Hanwha's commitment to this area signifies a strategic bet on a disruptive technology. While the potential rewards are high, the inherent risks associated with pioneering a new food category mean that success is far from guaranteed, necessitating careful management and continued investment.

Hanwha's strategic investments in climate tech position them in a sector brimming with potential, yet also marked by nascent technologies and intense competition. These ventures, while promising for long-term growth, currently occupy a position of question marks within the BCG matrix.

The inherent uncertainty surrounding market share and precise financial returns for these emerging climate technologies means they are not yet established stars or cash cows. For instance, the global climate tech market was projected to reach $1.5 trillion by 2027, according to some analyses, highlighting the scale of opportunity but also the early stage of many individual investments.

Smart Green Industrial Complex Projects

Hanwha's engagement in smart green industrial complex projects positions them in a sector experiencing significant expansion due to global urbanization and a strong push for sustainability. These projects, which often integrate advanced technologies for energy efficiency and environmental management, are seen as future growth engines.

While the market for such complexes is expanding, Hanwha's specific market share within this niche is still establishing itself. The profitability of these complex, multi-faceted projects can also vary, reflecting the evolving nature of the technology and regulatory landscape.

- High Growth Potential: The global smart city market, which encompasses smart industrial complexes, is projected to reach $1.5 trillion by 2025, indicating substantial opportunity.

- Sustainability Focus: These projects align with increasing investor and government demand for environmentally responsible infrastructure.

- Technological Integration: Success hinges on the effective deployment of IoT, AI, and renewable energy solutions, areas where Hanwha is actively investing.

- Developing Market Share: Hanwha's competitive standing in this nascent but rapidly growing segment is still being solidified through project execution and strategic partnerships.

Space Industry Value Chain Development

Hanwha is actively constructing a comprehensive value chain within the burgeoning space industry, focusing on critical technologies for future endeavors such as space launch vehicles and satellite development. This strategic move positions them in a high-growth, innovative sector, though their current market share and the commercial success of these nascent ventures are still developing.

The global space economy is projected to reach $1.1 trillion by 2030, according to Bank of America, highlighting the significant growth potential Hanwha is targeting.

- Space Launch Vehicles: Hanwha's investment in launch capabilities is crucial for independent access to space, a foundational element for any space-faring nation or commercial entity.

- Satellite Development: Developing proprietary satellite technology allows Hanwha to control key aspects of its space-based services, from communication to Earth observation.

- Early Stage Ventures: While the market is expanding, Hanwha's commercial viability and market share in these specific segments are still in the formative stages, indicating a high-risk, high-reward profile.

- Technological Advancement: The emphasis on core technology development is a strategic imperative to secure a competitive edge in a rapidly evolving and technologically intensive industry.

Question Marks represent business units or investments with low market share in high-growth industries. Hanwha's ventures in cultured meat and climate tech exemplify this, characterized by significant R&D investment and unproven market demand.

These segments, while holding substantial future potential, face challenges like scaling production and regulatory hurdles, leading to uncertain profitability and market penetration. The global cultured meat market, projected to reach $10 billion by 2030, still has negligible current market share.

Hanwha's strategic bet on these disruptive technologies, like space launch vehicles and smart green industrial complexes, positions them for high rewards but also entails considerable risk. The global space economy is expected to reach $1.1 trillion by 2030, but Hanwha's specific market share in this nascent sector is still developing.

| Business Unit/Investment | Industry Growth Rate | Market Share | Profitability | BCG Category |

|---|---|---|---|---|

| Thai Tire Pyrolysis Venture | High (Global Tire Recycling Market: USD 12.4 billion by 2027, 5.2% CAGR) | Low/Nascent | Uncertain/Low | Question Mark |

| Cultured Meat | High (Projected to reach $10 billion by 2030) | Negligible | Low/Negative | Question Mark |

| Climate Tech | High (Global market projected to reach $1.5 trillion by 2027) | Developing | Variable/Uncertain | Question Mark |

| Smart Green Industrial Complexes | High (Smart City Market: $1.5 trillion by 2025) | Establishing | Evolving | Question Mark |

| Space Industry Ventures | High (Global Space Economy: $1.1 trillion by 2030) | Nascent | High Risk/Uncertain | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market share reports, industry growth rates, and competitor analysis, to provide a clear strategic overview.