Hanwa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwa Bundle

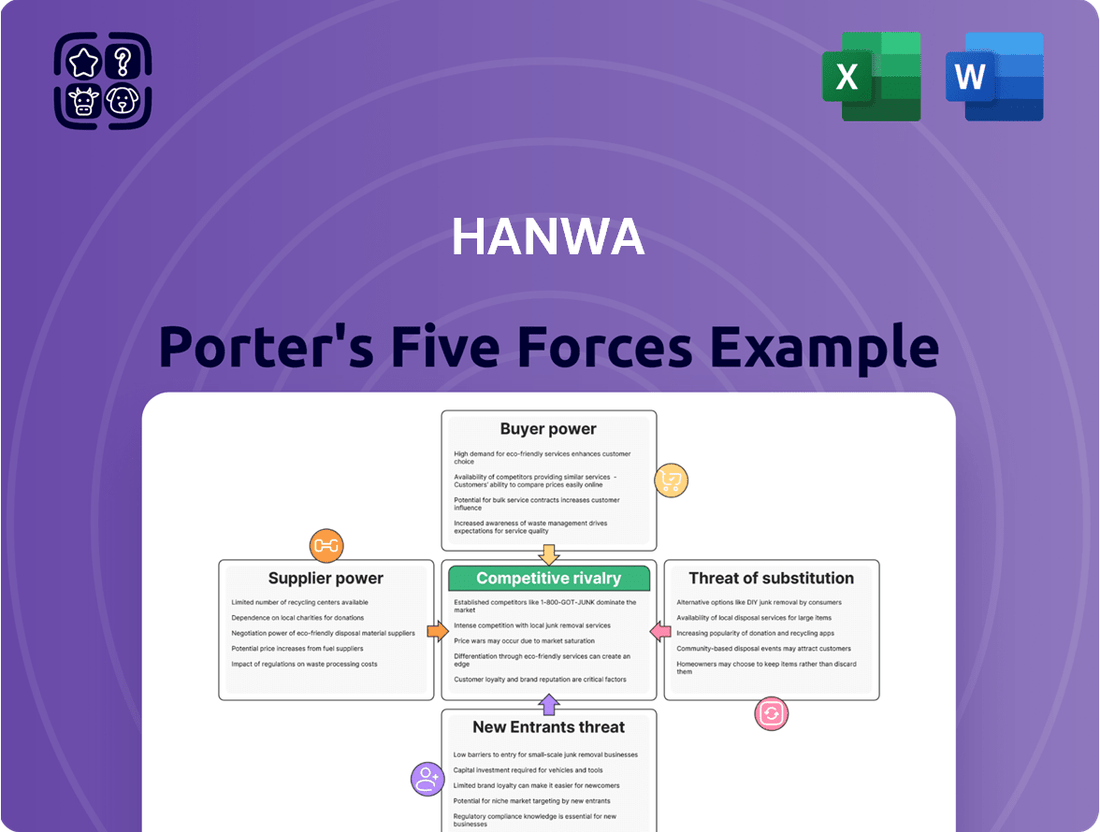

Hanwa's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business operating within or looking to enter Hanwa's market.

This brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hanwa’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hanwa's diverse sourcing across industries like steel, non-ferrous metals, food, and chemicals generally dilutes supplier power. This broad supplier base allows Hanwa to switch between providers, limiting the leverage of any single entity. For instance, in 2024, Hanwa's procurement of raw materials for its steel division likely involved hundreds of suppliers, meaning no single supplier controlled a significant portion of their supply chain.

However, situations with high supplier concentration can emerge for specialized components or unique food ingredients. In such cases, a limited number of suppliers for a critical input could grant them increased bargaining power. If Hanwa relies on a single, patented chemical for a specific product line, that supplier would hold considerable sway over pricing and terms.

For Hanwa, the costs of switching suppliers differ significantly across its diverse product lines. In categories like basic commodities, where products are standardized, Hanwa can readily switch suppliers if pricing or terms become unfavorable, indicating low switching costs and thus less supplier power.

However, for specialized inputs such as advanced chemical compounds or specific metal alloys, Hanwa faces higher switching costs. These can arise from the need for rigorous quality assurance revalidation, the expense of reconfiguring logistics, and the time required to build new, trusted relationships with alternative suppliers, thereby strengthening the bargaining power of incumbent suppliers in these niche markets.

Hanwha's suppliers offer a spectrum of products, from readily available commodities to highly specialized items. When suppliers provide unique or proprietary materials, such as specific alloys or advanced chemical compounds, their leverage over Hanwha grows substantially. For instance, if a supplier holds patents on a critical component essential for Hanwha's advanced materials division, their ability to dictate terms is amplified.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Hanwa's trading and distribution operations is generally low. This is primarily due to the highly specialized nature of general trading companies and the extensive global networks they maintain, which are difficult for manufacturers to replicate. For example, as of 2024, Hanwa’s diverse portfolio spans chemicals, metals, machinery, and energy, requiring intricate logistics and financial expertise that most raw material producers do not possess.

Most of Hanwa's suppliers are focused on their core manufacturing activities. The significant barriers to entry for them include the complexities of managing global trade flows, sophisticated logistics, and the provision of financial services integral to trading operations. These barriers effectively deter suppliers from venturing into Hanwa's established trading and distribution channels.

- Low Forward Integration Threat: Suppliers typically lack the expertise and infrastructure for global trading and distribution.

- Specialized Nature of Trading: Hanwa's business model requires complex logistics, financial services, and a vast network.

- Supplier Focus on Production: Most suppliers concentrate on manufacturing rather than engaging in trading activities.

- Barriers to Entry: The high cost and complexity of global trade deter suppliers from forward integration.

Importance of Hanwa to Suppliers

Hanwa's significance to its suppliers is a mixed bag, influencing its bargaining power. For smaller, niche manufacturers, Hanwa can be a critical sales channel, potentially accounting for a substantial percentage of their revenue. This dependence grants Hanwa considerable leverage in negotiations.

Conversely, larger, more diversified suppliers may view Hanwa as just one of many avenues to market. In such cases, Hanwa's bargaining power is diminished as these suppliers have alternative distribution options.

Hanwa's extensive global network and its capability to introduce suppliers to varied international markets can also be a significant draw. This value proposition can strengthen supplier relationships and, in some instances, offset Hanwa's leverage, particularly when access to new or lucrative markets is paramount for the supplier.

- Supplier Dependence: Hanwa's importance to a supplier directly impacts its bargaining power. For instance, if a specialized component manufacturer relies on Hanwa for over 30% of its annual sales, Hanwa gains significant leverage.

- Market Access Value: Hanwa's ability to open doors to emerging markets, such as its expansion into Southeast Asia in 2024, can make it an attractive partner, potentially reducing supplier price sensitivity.

- Diversification of Suppliers: Hanwa's own diversification across various product lines and geographies means it is not overly reliant on any single supplier, which generally strengthens its position.

Hanwa's broad sourcing across numerous industries generally limits individual supplier power due to the ability to switch providers. However, reliance on specialized or patented inputs can grant significant leverage to a few suppliers. High switching costs for critical components, like advanced alloys, also bolster supplier influence.

The threat of supplier forward integration into Hanwa's trading operations is minimal, as manufacturers typically lack the expertise in global logistics and finance that Hanwa possesses. This is evident in Hanwa's 2024 operations, which managed complex international trade across diverse sectors.

Supplier dependence on Hanwa for sales, particularly for niche manufacturers, provides Hanwa with considerable bargaining power. Conversely, Hanwa's value in providing market access, especially to emerging regions as seen in its 2024 Southeast Asian initiatives, can mitigate this power by making Hanwa an attractive partner.

| Factor | Impact on Hanwa's Supplier Bargaining Power | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | Low overall, but high for specialized inputs | Hundreds of steel suppliers vs. a single patent holder for a critical chemical |

| Switching Costs | Low for commodities, high for specialized items | Easy switching for basic metals; complex revalidation for advanced materials |

| Supplier Forward Integration Threat | Very Low | Manufacturers lack Hanwa's global trade and finance infrastructure |

| Supplier Dependence on Hanwa | Varies; high for niche suppliers | Hanwa can be a critical sales channel for small component makers |

| Hanwa's Market Access Value | Can reduce supplier price sensitivity | Hanwa's network opening new markets for suppliers |

What is included in the product

This analysis meticulously examines the five competitive forces shaping Hanwa's industry, assessing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Effortlessly identify and quantify competitive pressures with pre-built templates, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Hanwha's diverse global customer base, spanning numerous industries and geographical regions, generally limits the bargaining power of individual customers. This broad reach means no single customer typically accounts for a significant portion of Hanwha's overall sales, thus diffusing their leverage.

However, customer concentration can become a factor for specific large-scale industrial clients or major retail partners who procure substantial volumes of particular Hanwha products. For instance, a large construction project requiring significant steel tonnage or a major supermarket chain ordering bulk food supplies could grant these key accounts enhanced negotiation power.

Hanwha's customers face varying switching costs depending on the nature of the products and services they procure. For basic commodities, where alternatives are readily available, customers can often switch suppliers with minimal disruption or expense. This low switching cost empowers them to negotiate more favorable terms.

However, when customers engage with Hanwha for more complex offerings, such as integrated supply chain solutions or highly customized product specifications, the barriers to switching increase significantly. These specialized services often involve deep integration into the customer's operations, making a transition to a competitor both costly and time-consuming.

For instance, a customer relying on Hanwha's specialized logistics for managing the global distribution of their sensitive electronic components would incur substantial costs in reconfiguring their supply chain, retraining personnel, and potentially facing production delays if they were to switch. This complexity inherently reduces the bargaining power of such customers.

Customers often have multiple avenues to acquire goods, ranging from direct dealings with manufacturers to engaging with competing trading firms or even establishing their own sourcing departments. This wide array of choices, particularly for standardized commodities, significantly amplifies customer leverage.

The presence of numerous substitute products and services directly empowers customers. For instance, in 2024, the global trade volume in many basic commodities saw increased competition among suppliers, giving buyers more options and thus more power to negotiate favorable terms.

Hanwa's strategic advantage lies in its ability to provide more than just product supply. By offering integrated supply chain management and robust financial solutions, Hanwa distinguishes itself from competitors who solely focus on product provision, thereby mitigating some of the customer bargaining power derived from simple product availability.

Customers' Price Sensitivity

Customers' price sensitivity is a key factor in understanding their bargaining power. When a product represents a significant portion of a customer's expenses, they are naturally more inclined to seek lower prices. For commodity-like products, where differentiation is minimal, price becomes the primary competitive battleground.

However, this sensitivity can shift dramatically when quality, reliability, or specialized features are critical. For instance, in the semiconductor industry, where precision and consistent performance are non-negotiable, buyers may prioritize a trusted supplier like Hanwa over a slightly cheaper, less dependable alternative. This allows Hanwa to potentially secure better margins by emphasizing value beyond just the price tag.

Consider the automotive sector, a major consumer of steel and advanced materials. While cost is always a consideration, a delay in crucial component delivery or a slight defect in material quality can halt an entire production line, costing millions. In 2024, supply chain disruptions continued to highlight the importance of reliability for many manufacturers, potentially reducing their willingness to switch suppliers solely on price.

- Price Sensitivity Drivers: Customers are more sensitive to price when the product is a large part of their costs and when many alternatives exist.

- Commodity vs. Specialized Products: For commodities, price is paramount; for specialized items where quality and reliability are key, customers are less price-sensitive.

- Hanwa's Margin Potential: By focusing on quality and reliability, Hanwa can potentially achieve better profit margins, especially in markets where these factors outweigh price alone.

- 2024 Market Context: Ongoing supply chain concerns in 2024 underscored the value of dependable suppliers, potentially lessening price-driven customer behavior for critical inputs.

Threat of Backward Integration by Customers

The threat of customers integrating backward to become their own trading companies is generally low for Hanwa's broad customer base. This is because establishing such operations demands substantial capital investment, specialized trading expertise, and a robust global network, which most customers lack.

However, extremely large multinational corporations, particularly those with significant purchasing power and a need for direct control over supply chains for high-volume commodities, could potentially develop their own procurement channels. This represents a limited, but present, threat to Hanwa's trading business model.

- Low Threat Overall: The complexity and cost of replicating Hanwa's global trading infrastructure makes backward integration a significant barrier for most customers.

- Potential for Large Corporations: Very large, resource-rich companies might explore direct sourcing for key inputs, especially if seeking cost efficiencies or greater supply chain visibility.

- Focus on Specific Inputs: This threat is more likely to manifest for customers dealing with standardized, high-volume raw materials rather than niche or specialized products.

Hanwha's broad customer base generally dilutes individual customer bargaining power, as no single entity typically dominates sales volume. However, large-scale industrial clients and major retail partners who purchase significant quantities of specific Hanwha products can exert considerable negotiation leverage, particularly for commodity items with low switching costs.

Customers are more likely to negotiate aggressively when a product represents a substantial portion of their expenses and when numerous alternatives exist. For example, in 2024, increased competition in global commodity markets empowered buyers to seek more favorable terms, especially for standardized goods where price sensitivity is high. Conversely, for specialized products where quality and reliability are paramount, such as advanced materials for the automotive sector, customers may prioritize dependable suppliers like Hanwha, reducing their price-driven bargaining power.

| Factor | Impact on Hanwha | Example Scenario |

|---|---|---|

| Customer Concentration | Moderate to High for Key Accounts | A large construction firm requiring substantial steel orders for a major project. |

| Switching Costs | Low for Commodities, High for Specialized Solutions | Easy to switch for basic chemicals; difficult for integrated logistics services. |

| Availability of Substitutes | High for Commodities, Low for Differentiated Products | Numerous steel suppliers versus limited providers of advanced battery materials. |

| Price Sensitivity | High for Commodities, Lower for Value-Added Services | Automotive manufacturers negotiating steel prices versus semiconductor firms prioritizing chip reliability. |

Preview the Actual Deliverable

Hanwa Porter's Five Forces Analysis

This preview showcases the complete Hanwa Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises. You can confidently acquire this detailed report, knowing it's the exact resource you need for strategic decision-making.

Rivalry Among Competitors

The general trading industry is packed with competitors, both big global players and smaller, specialized firms. Think of other major Japanese trading houses like Marubeni Corporation, Mitsubishi Corporation, and Mitsui & Co., which are all significant rivals. This sheer volume and variety of companies vying for market share fuels very strong competition.

The global trade environment in 2024 saw a robust expansion, with trade volumes reaching new heights. However, as we look towards 2025, geopolitical tensions and shifting trade policies are introducing a degree of uncertainty. This dynamic environment, while offering opportunities, also means that the traditional trading business might experience moderate overall growth, thereby intensifying the rivalry among established companies vying for market share.

Hanwha's diverse product portfolio, spanning steel, non-ferrous metals, food, and chemicals, is a key differentiator. This broad offering allows them to serve multiple industries and customer needs, reducing reliance on any single product category.

Beyond core products, Hanwha distinguishes itself through integrated supply chain management, logistics, and financial services. These value-added offerings create a more comprehensive solution for clients, moving beyond simple product transactions and fostering deeper customer relationships.

While some of Hanwha's core products might face commoditization, the emphasis on these integrated services aims to mitigate direct price-based competition. For instance, in 2023, Hanwha Solutions reported a significant portion of its revenue derived from its advanced materials and energy solutions segments, showcasing the success of its differentiated strategy.

Exit Barriers

Exit barriers for general trading companies like Hanwha are substantial, stemming from heavy investments in established global distribution networks and long-term supply agreements. These commitments make it difficult and costly to simply walk away from existing operations or contracts, thereby keeping players engaged and intensifying competition.

Hanwha's diversified business model, spanning sectors such as steel, chemicals, and food, further elevates its exit barriers. Disentangling operations within one segment could trigger ripple effects across its integrated value chains, making strategic divestment a complex undertaking rather than a clean break. This interconnectedness encourages continued participation in various markets, fueling ongoing rivalry.

For instance, in 2024, Hanwha Solutions reported significant investments in its solar energy division, a key component of its diversified portfolio. Exiting such a capital-intensive and strategically important area would involve considerable financial penalties and reputational damage, reinforcing the high exit barriers.

- High Capital Investment: General trading firms often have extensive physical assets and infrastructure globally, representing a significant sunk cost.

- Long-Term Contracts: Commitments with suppliers and customers create ongoing obligations that are costly to terminate prematurely.

- Brand Reputation and Relationships: Exiting markets can damage established brand equity and sever crucial business relationships built over years.

- Specialized Expertise: The unique knowledge and skills developed for specific trading environments are hard to redeploy or sell, increasing the cost of exit.

Strategic Stakes

Japanese general trading companies, including Hanwa, operate with a long-term perspective, prioritizing market share maintenance and diversification into resource development and investment. This inherent strategic vision elevates the stakes in competitive rivalries.

Hanwa's commitment to its Medium-Term Business Plan 2025, which emphasizes strengthening its corporate foundation and enhancing profitability, underscores the significant strategic importance placed on its competitive standing. This focus signals a drive to solidify its market position and pursue growth opportunities.

- Strategic Imperative: Japanese trading houses like Hanwa pursue long-term market share and expansion, making competitive positioning a core strategic goal.

- Profitability Focus: Hanwa's Medium-Term Business Plan 2025 highlights a drive to improve profitability, indicating a heightened focus on competitive advantage.

- Market Dynamics: The industry's nature necessitates continuous effort to maintain and grow market share, fueling intense rivalry.

The competitive rivalry within the general trading industry is intense, driven by a large number of global and specialized players. Hanwha faces formidable competition from major Japanese trading houses like Mitsubishi Corporation and Mitsui & Co., all vying for market share in a dynamic global trade environment. In 2024, while global trade saw expansion, geopolitical shifts in 2025 are expected to moderate growth, thereby intensifying the competition for existing market share.

| Rival | 2023 Revenue (USD Billion) | Key Business Areas |

|---|---|---|

| Mitsubishi Corporation | 162.6 | Natural Gas, Industrial Materials, Chemicals, Food Industry, Consumer Industry, Power Solutions, Urban Development |

| Mitsui & Co. | 103.9 | Mineral & Metal Resources, Energy, Chemicals, Machinery & Infrastructure, Lifestyle, Innovation & Corporate Development |

| Marubeni Corporation | 67.9 | Food & Agri Business, Forest Products, Consumer Products & Real Estate, ICT & Real Estate Business, Energy & Metals, Power, Infrastructure & Mobility, Agri-Business, Chemicals, Forest Products, etc. |

SSubstitutes Threaten

End-users, especially large manufacturers and retailers, are increasingly exploring direct procurement from producers, bypassing intermediaries like Hanwa. This trend is particularly pronounced for high-volume, standardized commodities where cost savings are a primary driver. For instance, in 2024, major automotive manufacturers have been reported to be negotiating directly with steel producers for significant portions of their raw material needs, aiming to reduce per-unit costs by as much as 3-5% compared to traditional trading channels.

The threat of substitutes in the metals and chemicals sectors is significant, particularly as new materials and technologies emerge. For instance, the automotive industry's push for lighter vehicles could see increased adoption of advanced composites and high-strength plastics, potentially reducing demand for traditional steel and aluminum. In 2024, the global advanced composites market was valued at approximately $22.5 billion and is projected to grow substantially, indicating a direct challenge to established material suppliers.

The increasing digitalization and transparency in global supply chains, coupled with the growth of B2B e-commerce, presents a significant threat of substitutes by potentially disintermediating traditional players. For instance, platforms connecting manufacturers directly with buyers could bypass established distribution networks, impacting Hanwa's existing business model. This shift necessitates Hanwa's proactive adaptation to digital solutions.

Changes in Consumer Preferences

Shifts in consumer preferences represent a significant threat from substitutes, particularly within the food sector. For instance, a growing demand for locally sourced, organic, or plant-based food items could directly reduce the market share for globally traded food commodities that Hanwa might be involved with. This trend is accelerating; by 2024, the global plant-based food market was projected to reach over $74 billion, indicating a substantial move away from traditional products.

Hanwa's strategic diversification across various food categories acts as a crucial buffer against this threat. By not relying on a single food commodity, the company can better absorb the impact of a specific consumer trend. For example, if demand for conventional beef declines due to plant-based alternatives, Hanwa's presence in dairy, grains, or processed foods could offset these losses. This broad portfolio allows for adaptability in a dynamic market.

The increasing awareness of sustainability and health is a primary driver behind these preference shifts. Consumers are more informed and are actively seeking products that align with their values. This can manifest as a preference for foods with lower carbon footprints or those perceived as healthier. For example, a 2024 survey indicated that over 60% of consumers consider sustainability when making food purchases, directly impacting the appeal of conventional, globally traded goods.

- Consumer Shift: Growing preference for local, organic, and plant-based foods directly challenges demand for globally traded food commodities.

- Market Growth: The global plant-based food market was projected to exceed $74 billion by 2024, highlighting a significant substitute trend.

- Hanwa's Mitigation: Diversification across multiple food categories helps reduce reliance on any single product line susceptible to changing tastes.

- Sustainability Influence: Over 60% of consumers in 2024 considered sustainability in food choices, impacting the viability of traditional, less eco-friendly options.

In-house Logistics and Financial Capabilities of Customers

Large customers, particularly those with substantial financial backing and operational scale, pose a threat by developing their own in-house logistics, financing, and risk management capabilities. This allows them to reduce their dependence on third-party providers like Hanwa. For instance, major corporations in sectors like retail or manufacturing, which often have dedicated supply chain divisions, might find it more cost-effective to manage these functions internally, especially if they can achieve economies of scale. This trend is particularly pronounced among sophisticated, well-capitalized clients who can justify the upfront investment in infrastructure and expertise.

This threat is amplified when customers possess significant negotiating power. For example, a large automotive manufacturer might leverage its purchasing volume to demand lower service fees from logistics providers or even bring certain logistics functions in-house to gain greater control and potentially reduce costs. In 2024, many large enterprises are re-evaluating their supply chain strategies, prioritizing resilience and cost optimization, which can accelerate the adoption of in-house solutions for critical functions.

- Customer Self-Sufficiency: Sophisticated and financially strong clients can internalize logistics, financing, and risk management, decreasing reliance on Hanwa.

- Cost-Benefit Analysis: For large-volume customers, the investment in in-house capabilities can yield long-term cost savings and operational control.

- Market Trends: In 2024, a focus on supply chain resilience and cost efficiency encourages larger businesses to explore bringing core logistics and financial services in-house.

The threat of substitutes for Hanwa is multifaceted, stemming from evolving consumer preferences and technological advancements. In the food sector, a notable shift towards locally sourced, organic, and plant-based alternatives directly challenges demand for globally traded commodities. This trend is accelerating, with the global plant-based food market projected to exceed $74 billion by 2024. Furthermore, over 60% of consumers in 2024 considered sustainability when making food purchases, impacting the appeal of traditional options. Hanwa's diversification across various food categories helps mitigate this risk by reducing reliance on any single product line susceptible to changing tastes.

Beyond food, new materials and technologies present substitutes in sectors like metals and chemicals. The automotive industry's pursuit of lighter vehicles is driving increased adoption of advanced composites and high-strength plastics, potentially reducing demand for steel and aluminum. The global advanced composites market was valued at approximately $22.5 billion in 2024, indicating a direct challenge to established material suppliers.

Digitalization and e-commerce platforms also pose a threat by disintermediating traditional players. By connecting manufacturers directly with buyers, these platforms can bypass established distribution networks, necessitating Hanwa's adaptation to digital solutions. Additionally, large, financially capable customers are increasingly developing in-house logistics, financing, and risk management capabilities, reducing their dependence on third-party providers like Hanwa. This trend, driven by a focus on resilience and cost efficiency in 2024, allows these clients to potentially achieve greater control and cost savings.

| Threat Category | Example | 2024 Data Point | Impact on Hanwa | Mitigation Strategy |

| Consumer Preferences (Food) | Plant-based alternatives | Global plant-based food market projected >$74 billion | Reduced demand for traditional commodities | Portfolio diversification |

| Material Substitution (Metals/Chemicals) | Advanced composites in automotive | Global advanced composites market ~$22.5 billion | Decreased demand for steel/aluminum | Focus on high-value materials |

| Digital Disintermediation | B2B e-commerce platforms | N/A (growing trend) | Bypassing distribution networks | Investment in digital solutions |

| Customer In-housing | Logistics/financing internalization | Focus on resilience & cost efficiency | Reduced reliance on third parties | Value-added services, strategic partnerships |

Entrants Threaten

Entering the general trading industry at Hanwha's global scale, which spans steel, metals, food, and chemicals, demands immense capital. This is necessary to manage extensive inventory, sophisticated logistics networks, international office infrastructure, and vital financial services. For instance, establishing a comparable global footprint in 2024 would likely necessitate billions of dollars in initial investment.

These significant upfront capital requirements serve as a formidable barrier, effectively deterring potential new competitors from entering the market and challenging established players like Hanwha.

Established general trading companies, such as Hanwa, possess significant advantages through economies of scale. Their sheer volume of transactions allows for reduced per-unit costs in procurement, logistics, and even hedging against market risks. For instance, Hanwa's extensive global network in 2024 facilitated bulk purchasing power, driving down acquisition costs for raw materials and finished goods.

Furthermore, economies of scope play a crucial role in deterring new entrants. Hanwa leverages its established infrastructure and deep market knowledge across diverse product lines, from steel and chemicals to food and machinery. This ability to cross-sell and bundle services, supported by a robust existing network, creates a formidable barrier for newcomers attempting to match either cost efficiency or service comprehensiveness.

Hanwha's entrenched position in distribution channels and supplier networks presents a formidable barrier to new entrants. For instance, in 2024, Hanwha's chemical division reported strong performance, underscoring the value of its established supply chain. Newcomers would struggle to replicate decades of built trust and logistical efficiency, making it difficult to secure both raw materials and market access.

Brand Identity and Customer Loyalty

While brand identity might seem more critical in consumer markets, Hanwha's reputation for reliability and trust in the business-to-business trading arena is a significant deterrent to new entrants. Its established track record in managing intricate international trade deals fosters strong customer loyalty, acting as a formidable barrier.

This loyalty is built on years of consistent performance and the ability to navigate complex global supply chains. For instance, Hanwha's deep relationships with suppliers and buyers, cultivated over decades, are not easily replicated by newcomers. In 2023, Hanwha Solutions reported a robust performance, indicating the continued strength of its market position and brand equity.

- Brand Strength: Hanwha's long-standing reputation for dependability in international trade is a key factor.

- Customer Loyalty: Established relationships and a history of successful transactions create a loyal customer base.

- Barrier to Entry: The trust and reliability associated with the Hanwha brand make it difficult for new, unproven companies to gain traction.

- Market Position: Hanwha's consistent performance, exemplified by its financial results in 2023, reinforces its brand value.

Government Policy and Regulations

Government policies and regulations significantly impact the threat of new entrants in international trade. Navigating complex rules, tariffs, and regional variations demands substantial expertise and compliance infrastructure, creating a formidable barrier for newcomers. For instance, in 2024, the World Trade Organization (WTO) reported ongoing discussions and potential adjustments to trade facilitation agreements, which could further increase the compliance burden for businesses entering new markets.

The imposition of tariffs and quotas, often used to protect domestic industries, directly raises the cost of entry for foreign competitors. These measures can make it economically unfeasible for new players to compete with established firms that have already absorbed or adapted to existing trade policies. Global trade imbalances and the introduction of new tariffs in 2024, such as those discussed between major economic blocs, add layers of market uncertainty, deterring potential entrants who require predictable operating environments.

- Tariff Barriers: Increased import duties directly inflate product costs, making it harder for new entrants to offer competitive pricing.

- Regulatory Compliance: The need to adhere to diverse product standards, labeling requirements, and import/export licenses requires significant investment in legal and operational expertise.

- Trade Agreements: While trade agreements can lower barriers, their complexity and the need for specific certifications can still pose challenges for new market participants.

- Geopolitical Factors: Evolving trade relationships and potential sanctions can create sudden and significant risks for new entrants unfamiliar with the political landscape.

The threat of new entrants for Hanwha's general trading business is significantly mitigated by substantial capital requirements, estimated to be in the billions of dollars for establishing a comparable global footprint in 2024. This high barrier, driven by the need for extensive inventory, logistics, and financial services, deters most potential competitors. Economies of scale and scope further solidify Hanwha's position, allowing for reduced per-unit costs and leveraging existing infrastructure across diverse product lines, making it difficult for newcomers to match cost efficiency or service breadth.

Porter's Five Forces Analysis Data Sources

Our Hanwa Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Hanwa's official investor relations disclosures, industry-specific market research reports, and macroeconomic data from reputable financial institutions.