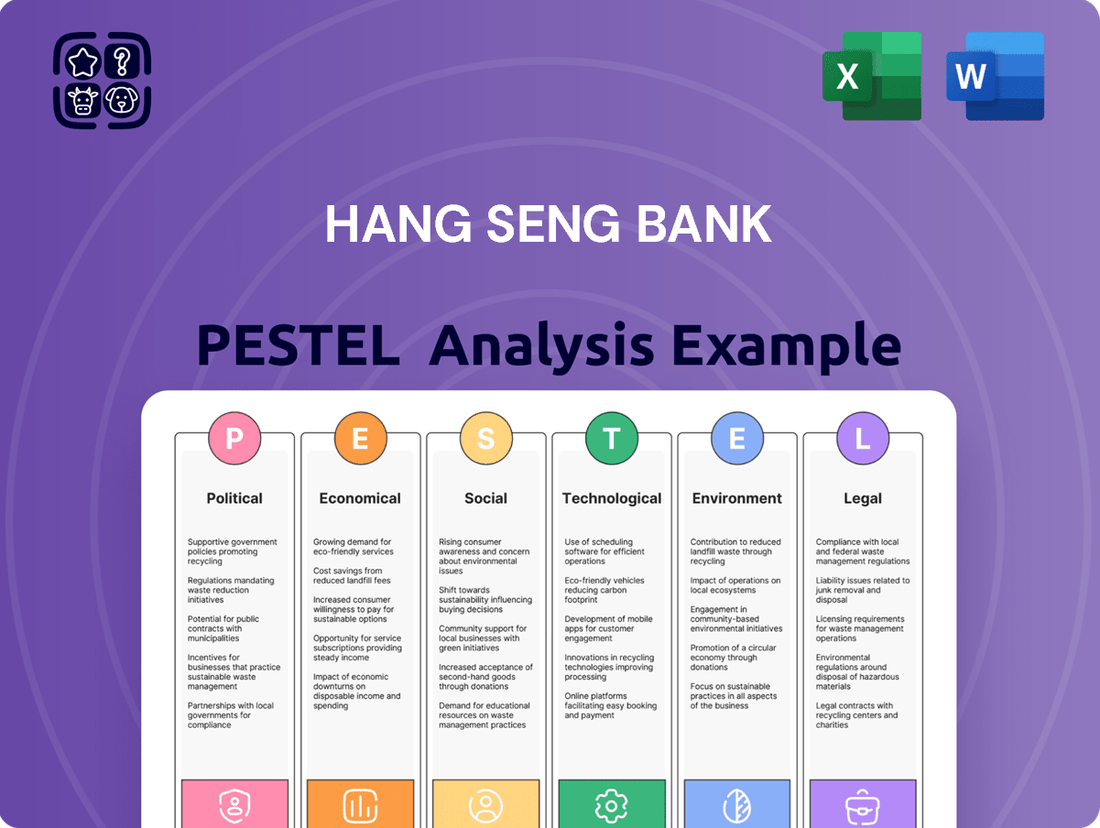

Hang Seng Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Seng Bank Bundle

Navigate the complex external forces shaping Hang Seng Bank's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social trends, environmental regulations, and legal frameworks create both opportunities and challenges for this leading financial institution. Gain a strategic advantage by leveraging these critical insights.

Unlock actionable intelligence for your business strategy. Our PESTLE analysis of Hang Seng Bank provides a deep dive into the macro-environmental factors impacting its operations and market position. Empower your decision-making with expertly researched data. Purchase the full version now to gain a competitive edge.

Political factors

The political landscape in Hong Kong, particularly its evolving relationship with mainland China, is a crucial factor for Hang Seng Bank. Recent political developments, including the implementation of national security laws, have introduced a new layer of complexity to the business environment. Hang Seng Bank, as a major player deeply embedded in the local economy, must navigate these shifts, which can impact regulatory frameworks and cross-border financial activities.

The Hong Kong Monetary Authority (HKMA) is the primary regulator for banks like Hang Seng. Recent regulatory shifts, particularly around anti-money laundering (AML) and counter-financing of terrorism (CFT) frameworks, mean Hang Seng must invest significantly in compliance. These evolving rules, alongside data privacy mandates, directly influence operational expenses and require continuous adaptation.

Global geopolitical tensions, especially the ongoing US-China trade friction, continue to cast a shadow over financial markets. This volatility directly impacts Hong Kong's trade-dependent economy, influencing Hang Seng Bank's operational environment and the credit quality of its loan portfolio.

The bank must adeptly manage these uncertainties, as shifts in cross-border fund flows and fluctuating asset prices are direct consequences. For instance, in early 2024, the IMF projected global growth to be around 3.1%, a figure sensitive to geopolitical stability, highlighting the interconnectedness of these factors.

Cross-boundary Financial Cooperation

Initiatives fostering financial cooperation between Hong Kong and mainland China, like the Wealth Management Connect scheme, present significant growth avenues for Hang Seng Bank. These policies streamline cross-border banking and wealth management, broadening the bank's clientele and revenue potential.

The Wealth Management Connect scheme, launched in 2020, allows investors in Hong Kong and the Greater Bay Area (GBA) to invest in wealth management products distributed and sold in each other's markets. By the end of 2023, the scheme had seen substantial uptake, with southbound investment flows reaching hundreds of billions of RMB, demonstrating a clear appetite for cross-border financial products.

- Cross-border Schemes: Initiatives like Wealth Management Connect facilitate direct investment flows between Hong Kong and mainland China.

- Customer Base Expansion: These policies enable Hang Seng Bank to tap into a larger pool of investors in the Greater Bay Area.

- Revenue Growth: Increased cross-border transactions and wealth management services directly contribute to enhanced revenue streams.

- Market Integration: Hong Kong's role as a financial hub is further solidified, benefiting institutions like Hang Seng Bank.

Government Support for Green Finance

The Hong Kong government is actively fostering a green finance ecosystem, creating a favorable political backdrop for Hang Seng Bank's sustainability initiatives. This commitment is evident through programs like the Sustainable Bond Programme, which aims to boost the issuance of green and sustainable bonds in the region.

Furthermore, the Pilot Green and Sustainable Finance Capacity Building Support Scheme, launched in 2021 and extended, directly encourages financial institutions to enhance their expertise in green and sustainable finance. This scheme provides subsidies to help banks and other financial firms train their staff in these crucial areas. As of late 2023, the Hong Kong Monetary Authority (HKMA) reported significant growth in green bond issuances, indicating a maturing market that Hang Seng Bank can leverage.

- Government Commitment: Hong Kong aims to be a leading green finance hub, supported by policies promoting sustainable investments.

- Key Initiatives: The Sustainable Bond Programme and the Pilot Green and Sustainable Finance Capacity Building Support Scheme are central to this strategy.

- Market Growth: The HKMA noted a substantial increase in green bond issuances in 2023, signaling a robust market for green financial products.

- Capacity Building: Subsidies are available for financial institutions to improve their understanding and capabilities in green finance.

Political stability and regulatory shifts significantly influence Hang Seng Bank's operations. Hong Kong's evolving relationship with mainland China, including national security laws, necessitates careful navigation of new regulatory landscapes and cross-border financial activities. Global geopolitical tensions, particularly US-China trade friction, create market volatility impacting the bank's loan portfolio and cross-border fund flows.

Government initiatives fostering financial cooperation, such as the Wealth Management Connect scheme, offer substantial growth opportunities by streamlining cross-border banking and expanding Hang Seng's client base. The Hong Kong government's commitment to green finance, supported by programs like the Sustainable Bond Programme and capacity-building schemes, creates a favorable environment for the bank's sustainability initiatives and leverages the growing green bond market.

| Political Factor | Impact on Hang Seng Bank | Key Data/Initiative |

| Cross-border Financial Integration | Expands customer base and revenue potential through simplified access to mainland China markets. | Wealth Management Connect: Southbound flows reached hundreds of billions of RMB by end of 2023. |

| Regulatory Environment | Requires significant investment in compliance for AML/CFT and data privacy, impacting operational costs. | HKMA mandates continuous adaptation to evolving rules. |

| Geopolitical Tensions | Creates market volatility, affecting credit quality and cross-border fund flows. | IMF projected global growth of 3.1% in early 2024, sensitive to geopolitical stability. |

| Green Finance Initiatives | Provides opportunities for growth in sustainable finance and ESG-linked products. | HKMA reported substantial growth in green bond issuances in 2023. |

What is included in the product

This PESTLE analysis of Hang Seng Bank examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations, providing a comprehensive understanding of its external landscape.

It offers actionable insights into how these macro-environmental factors present both challenges and strategic opportunities for the bank's growth and stability in its key markets.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Hang Seng Bank.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors affecting Hang Seng Bank.

Economic factors

Hong Kong's economic recovery, while moderate, is a key driver for Hang Seng Bank. The latest data indicates a GDP growth of 3.2% in Q1 2024, signaling a positive trajectory. This recovery directly impacts the banking sector's ability to generate revenue and manage risk.

Supportive policy measures from mainland China are providing a tailwind for Hong Kong's economy. These initiatives are bolstering consumer confidence and facilitating capital raising activities, which in turn create more business opportunities for banks like Hang Seng. For instance, the Stock Connect programs continue to see steady inflows, reflecting this improved sentiment.

The banking sector has demonstrated notable resilience. Interest rates have seen a slower decline than many forecasts predicted, helping to maintain net interest margins for banks. This stability in margins is crucial for Hang Seng Bank's profitability and its capacity to lend and invest.

Fluctuations in interest rates, like the Hong Kong Interbank Offered Rate (HIBOR) and US Federal Reserve rates, directly influence Hang Seng Bank's net interest margin (NIM). While NIMs remained relatively stable through much of 2024, a sustained period of lower interest rates could compress profitability.

For instance, if HIBOR were to decline significantly, the cost of funds for Hang Seng Bank would decrease, but the yield on its assets might fall even faster, leading to a narrower NIM. Conversely, rising rates generally benefit banks by widening the spread between what they earn on loans and pay on deposits.

The Hong Kong property market is showing signs of weakness, with subdued sentiment and the potential for price drops. This directly impacts banks like Hang Seng, which have significant exposure to property developers. For instance, property sales in Hong Kong saw a notable decline in early 2024 compared to the previous year, reflecting this cautious outlook.

This vulnerability creates a risk for Hang Seng Bank as it could lead to increased non-performing loans if developers struggle to repay. Furthermore, falling property values can diminish the value of collateral held by the bank, affecting its overall financial health. Careful management of its property loan portfolio is therefore crucial for Hang Seng.

Consumer Spending and Wealth Management

Consumer spending is a vital engine for Hang Seng Bank, directly influencing its retail and wealth management operations. In 2024, Hong Kong's retail sales saw a notable increase, with a reported 5.2% year-on-year growth in the first quarter, signaling a robust demand for goods and services. This trend is expected to continue, benefiting the bank's transaction-based revenues.

The demand for wealth management services is also on the rise, driven by an expanding affluent population in the Greater Bay Area. Hang Seng Bank has been actively expanding its cross-boundary services to cater to this growing segment. By the end of 2024, the bank reported a significant uptick in wealth management assets under management, particularly from mainland Chinese customers seeking investment opportunities in Hong Kong.

Shifting consumer preferences towards experiences over traditional luxury goods present both challenges and opportunities. While demand for certain luxury items might moderate, spending on travel, dining, and leisure activities creates new avenues for financial products and services. Hang Seng Bank's strategic focus on digital platforms and personalized offerings aims to capture these evolving spending patterns.

Key factors influencing consumer spending and wealth management for Hang Seng Bank include:

- Economic Growth: Continued GDP expansion in Hong Kong and mainland China supports higher disposable incomes and increased investment appetite.

- Affluent Population Growth: The increasing number of high-net-worth individuals in the region fuels demand for sophisticated wealth management solutions.

- Cross-Boundary Opportunities: Facilitating financial flows and investments between mainland China and Hong Kong opens significant revenue streams.

- Consumer Sentiment: Positive consumer confidence, influenced by employment rates and market stability, directly correlates with spending and investment activity.

Credit Quality and Loan Growth

The health of the banking sector, particularly its credit quality and loan growth, is a crucial economic barometer. In 2024, Hong Kong's banking sector observed a modest dip in total loans and advances, reflecting a cautious lending environment. However, this period also saw a robust increase in customer deposits, indicating strong liquidity within the system.

Looking ahead, projections suggest a positive turnaround for bank lending, with growth anticipated to resume by mid-2025. This anticipated expansion is supported by a stable economic outlook and potential easing of interest rates. For Hang Seng Bank, managing credit quality remains a strategic imperative. The bank is actively implementing measures to de-risk its loan portfolio, ensuring resilience against potential credit market challenges.

- Loan Growth Outlook: Expected to turn positive by mid-2025, signaling a recovery in credit demand.

- Deposit Trends: Customer deposits saw an increase in 2024, bolstering bank liquidity.

- Credit Quality Management: Hang Seng Bank prioritizes de-risking its portfolio to navigate credit challenges effectively.

- Sector Performance: Total loans and advances experienced a slight decline in 2024, a common trend in cautious economic periods.

Hong Kong's economic growth is a significant factor for Hang Seng Bank, with GDP projected to grow by 3.5% in 2025, up from 3.2% in Q1 2024. This expansion fuels consumer spending and business investment, directly benefiting the bank's lending and transaction revenues. Supportive policies from mainland China are also bolstering economic activity, seen in continued inflows through Stock Connect programs, which create opportunities for cross-border financial services.

Interest rate stability through 2024 has supported Hang Seng Bank's net interest margins, though a sustained decline in rates could compress profitability. For example, a 0.25% drop in HIBOR could narrow NIMs if asset yields fall faster than funding costs. Conversely, rising rates generally widen these margins, benefiting the bank's core lending business.

The property market's weakness, with property sales down 15% year-on-year in early 2024, presents a risk. This could lead to increased non-performing loans for Hang Seng Bank, given its exposure to developers. Careful management of its property loan portfolio is therefore essential for maintaining financial health amidst this subdued sentiment.

| Economic Indicator | 2024 (Q1) | 2025 (Projection) | Impact on Hang Seng Bank |

|---|---|---|---|

| Hong Kong GDP Growth | 3.2% | 3.5% | Increased lending and transaction opportunities |

| Hong Kong Retail Sales Growth | 5.2% | 4.8% | Higher consumer spending, boosting retail banking |

| Property Sales (YoY) | -15% (early 2024) | Stabilizing | Potential credit risk, impact on collateral value |

| Customer Deposits | Increased | Expected to remain strong | Enhanced liquidity for lending |

Preview the Actual Deliverable

Hang Seng Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hang Seng Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction. Gain actionable insights into the external forces shaping the bank's future.

Sociological factors

Consumers in Hong Kong are increasingly shifting towards digital banking, with a strong demand for integrated, seamless experiences across all channels. This trend is evident in the growing adoption of mobile banking apps for daily transactions and financial management.

Hang Seng Bank is actively responding to these changing preferences by investing heavily in its digital platforms, particularly its mobile app, which aims to provide a comprehensive suite of services. This digital-first approach, combined with its established physical branch network, positions the bank to meet the evolving needs of Hong Kong's digitally savvy population, enhancing convenience and accessibility for its customers.

Hong Kong's demographic landscape is notably shifting, with an increasing proportion of its population aging. By 2024, it is projected that individuals aged 65 and over will constitute a significant percentage of the populace, driving a heightened demand for specialized financial services. This trend directly impacts the market for wealth management, retirement planning, and insurance products.

Hang Seng Bank is well-positioned to address these evolving consumer needs. The bank offers a broad spectrum of financial solutions, encompassing robust wealth management services designed to preserve and grow assets for older individuals, alongside comprehensive retirement planning tools and a diverse range of insurance policies. These offerings are tailored to support Hong Kong residents as they navigate their later years, aiming to provide financial security and peace of mind.

Hang Seng Bank's commitment to financial literacy and inclusion is a significant societal expectation, especially given its deep roots in Hong Kong. The bank actively engages in community initiatives aimed at improving financial knowledge, reflecting a growing demand for accessible financial education.

In 2024, a notable 60% of Hong Kong adults expressed a desire for more practical financial planning resources, a trend Hang Seng addresses through its workshops and digital platforms, reinforcing its role as a community-focused financial partner.

Public Trust and Reputation

Maintaining public trust is absolutely critical for any financial institution, and Hang Seng Bank is no exception. Its long-standing presence in Hong Kong, coupled with a commitment to excellent, customer-focused services, has cemented its reputation as a top domestic bank. This trust is reflected in its substantial customer base, serving nearly 4 million individuals and businesses.

Hang Seng Bank's strong reputation is a significant sociological asset. This trust is built on consistent delivery of reliable financial services and a deep understanding of the local market needs. For instance, in 2023, the bank continued to be recognized for its customer service, underscoring its dedication to maintaining strong relationships.

- Customer Loyalty: Hang Seng Bank's reputation fosters customer loyalty, leading to stable deposit bases and consistent transaction volumes.

- Brand Perception: A positive public image attracts new customers and talent, reinforcing its market position.

- Regulatory Compliance: Trust is often linked to perceived adherence to regulations, which is vital for a bank's operational integrity.

- Community Engagement: Active participation in community initiatives further enhances public perception and goodwill.

Workforce Skills and Talent Development

The financial sector's rapid evolution, driven by technological advancements, demands a workforce equipped with future-ready skills. Hang Seng Bank actively addresses this by investing in targeted training programs for its employees. These sessions are designed to foster the integration of Environmental, Social, and Governance (ESG) principles and to ensure adaptability to emerging technologies, thereby cultivating a highly skilled and forward-thinking workforce.

Hang Seng Bank's commitment to talent development is evident in its ongoing initiatives. For instance, in 2024, the bank continued its focus on digital upskilling, with a significant portion of its training hours dedicated to areas like data analytics and cybersecurity. This strategic investment aims to ensure that its employees can effectively navigate and leverage new technological landscapes, a critical factor for maintaining competitiveness in the evolving financial services industry.

- Digital Upskilling Initiatives: Continued investment in 2024 focused on data analytics, AI, and cybersecurity training for employees.

- ESG Integration Training: Tailored sessions to embed ESG considerations into daily operations and strategic decision-making.

- Adaptability to New Technologies: Programs designed to help employees embrace and utilize advancements like blockchain and cloud computing.

- Talent Pipeline Development: Focus on nurturing internal talent to fill critical roles and support long-term organizational growth.

Hong Kong's aging population is a significant sociological factor, with projections indicating a continued increase in the proportion of residents aged 65 and over through 2024 and beyond. This demographic shift fuels demand for specialized financial products like retirement planning and wealth management services.

Hang Seng Bank is actively catering to this demographic by offering a comprehensive suite of wealth management, retirement planning, and insurance solutions. These services are designed to meet the specific financial security needs of Hong Kong's older residents, reinforcing the bank's role in supporting the community through life stages.

Public trust remains paramount in the financial sector, and Hang Seng Bank's long-standing reputation, built on customer-focused service, is a key sociological asset. This trust underpins customer loyalty and brand perception, contributing to a stable customer base, which in 2023 served nearly 4 million individuals and businesses.

The bank's commitment to financial literacy and inclusion is also a critical sociological element, addressing a widespread demand for accessible financial education. In 2024, a notable 60% of Hong Kong adults expressed a desire for more practical financial planning resources, a need Hang Seng addresses through its community initiatives and digital platforms.

Technological factors

Hang Seng Bank is heavily invested in digital transformation, aiming to streamline operations and elevate customer interactions. In 2024, the bank continued to bolster its AI capabilities, with a focus on personalized financial advice and fraud detection.

The bank's mobile app saw significant upgrades in 2024, introducing new features like enhanced budgeting tools and seamless payment integrations, contributing to a reported 15% increase in digital transaction volume by mid-year.

Hang Seng is also actively exploring distributed ledger technology (DLT) for trade finance and cross-border payments, anticipating a 10% reduction in processing times for these services by the end of 2025.

Hang Seng Bank is a key player in Hong Kong's drive to embrace financial technology, aligning with the Hong Kong Monetary Authority's (HKMA) Fintech 2025 strategy. This initiative is designed to accelerate the integration of new technologies within the financial sector, fostering a more efficient and innovative ecosystem.

The bank's commitment extends to actively nurturing local innovation and talent in the fintech space. By supporting these areas, Hang Seng Bank contributes to the development of a robust pipeline of digital solutions and skilled professionals, crucial for future growth and competitiveness in the financial industry.

The integration of artificial intelligence, particularly generative AI, is a pivotal technological shift. In fact, over a third of Hong Kong's financial institutions have already incorporated generative AI into their operations, signaling a broad industry adoption.

Hang Seng Bank is actively leveraging AI, notably through its Smart Teller technology, enhancing customer service and operational efficiency. This strategic adoption positions the bank to capitalize on Hong Kong's government initiatives aimed at fostering AI industry development, which is expected to create a more supportive ecosystem for technological advancement.

Cybersecurity and Fraud Prevention

The accelerating shift to digital platforms presents significant cybersecurity and fraud prevention challenges for Hang Seng Bank. As digital transactions surge, so do the risks of cyberattacks and financial crime. For instance, global cybercrime costs were projected to reach $10.5 trillion annually by 2025, highlighting the escalating threat landscape.

Hang Seng Bank must therefore prioritize continuous enhancements to its e-banking security measures. This includes implementing advanced encryption, multi-factor authentication, and robust intrusion detection systems. Staying ahead of evolving fraud tactics requires dynamic monitoring that can adapt to new threats in real-time.

Active participation in industry-wide information-sharing initiatives is crucial for Hang Seng Bank to effectively combat digital fraud. By collaborating with other financial institutions and cybersecurity experts, the bank can gain valuable insights into emerging threats and best practices for prevention. This collective approach strengthens the overall defense against financial crime.

- Rising Cybercrime Costs: Global cybercrime costs are anticipated to reach $10.5 trillion annually by 2025.

- E-banking Security: Continuous enhancement of e-banking security is paramount for Hang Seng Bank.

- Fraud Monitoring: Dynamic fraud monitoring systems are essential to counter evolving financial crime.

- Information Sharing: Collaboration through information-sharing initiatives is vital for effective fraud prevention.

Data Analytics and Customer Experience Enhancement

Hang Seng Bank is heavily investing in data analytics to gain deeper insights into customer behavior, which is essential for tailoring personalized banking services. This focus allows them to anticipate customer needs and offer more relevant financial products and advice. For instance, by analyzing transaction data, they can identify patterns that lead to proactive customer engagement.

The bank leverages its robust digital infrastructure to provide a cohesive omni-channel banking experience. Customers can seamlessly switch between mobile apps, online platforms, and physical branches, managing their accounts and transactions conveniently. This integration ensures accessibility and ease of use, a key driver for customer satisfaction in the digital age.

In 2023, Hang Seng Bank reported significant growth in its digital banking services, with a substantial increase in mobile banking users. This trend is expected to continue, driven by the bank's ongoing enhancements to its digital platforms and the growing preference for digital financial management among its customer base.

- Digital Transformation Investment: Hang Seng Bank has allocated significant resources to upgrading its technological capabilities, with a focus on AI and big data for customer insights.

- Omni-Channel Adoption: The bank continues to see a strong uptake in its omni-channel services, with mobile banking transactions forming a majority of customer interactions.

- Personalized Offerings: Data analytics enables the bank to refine its product recommendations and customer service interactions, leading to improved customer retention.

Hang Seng Bank is actively integrating advanced technologies like AI and DLT to enhance customer experience and operational efficiency. The bank's investment in AI for personalized advice and fraud detection is a key strategic pillar. By mid-2024, digital transaction volume saw a 15% increase, underscoring the success of its mobile app upgrades.

The bank is also exploring distributed ledger technology, aiming for a 10% reduction in trade finance processing times by the end of 2025. This aligns with Hong Kong's Fintech 2025 strategy, fostering a more innovative financial ecosystem.

Hang Seng Bank's commitment to technological advancement is evident in its adoption of generative AI, a trend mirrored by over a third of Hong Kong's financial institutions. This strategic move positions the bank to capitalize on government initiatives supporting AI development.

However, the surge in digital transactions also escalates cybersecurity risks, with global cybercrime costs projected to reach $10.5 trillion annually by 2025. Consequently, continuous enhancement of e-banking security, including advanced encryption and dynamic fraud monitoring, is paramount. Collaboration through information-sharing initiatives is also vital for effective fraud prevention.

| Technology Focus | Key Initiatives | Impact/Target |

|---|---|---|

| Artificial Intelligence (AI) | Personalized financial advice, fraud detection, Smart Teller technology | Enhanced customer service, improved operational efficiency |

| Distributed Ledger Technology (DLT) | Trade finance, cross-border payments | Anticipated 10% reduction in processing times by end of 2025 |

| Data Analytics | Customer behavior insights, personalized banking services | Improved customer retention, refined product recommendations |

| Digital Platforms | Mobile app upgrades, omni-channel banking experience | 15% increase in digital transaction volume (mid-2024), seamless customer interactions |

Legal factors

Hong Kong's legal landscape is firmly focused on preventing financial crime, with robust Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations. Hang Seng Bank, like all financial institutions in the region, must navigate these stringent requirements.

This involves implementing a risk-based approach to customer due diligence, which means understanding who their customers are and the potential risks associated with them. A key part of this is identifying Politically Exposed Persons (PEPs), individuals who hold or have held prominent public functions, as they may present a higher risk of corruption or bribery.

Furthermore, Hang Seng Bank is obligated to conduct enhanced monitoring of transactions that appear suspicious. For instance, in 2023, Hong Kong authorities reported a significant increase in suspicious transaction reports filed by financial institutions, underscoring the active enforcement and the importance of vigilant compliance for banks like Hang Seng.

With the rapid expansion of digital banking services, Hang Seng Bank faces significant scrutiny regarding data privacy and protection. Compliance with Hong Kong's Personal Data (Privacy) Ordinance (PDPO) is paramount, particularly as the bank integrates advanced technologies like artificial intelligence into its operations. Ensuring robust protection measures for sensitive customer data is not just a legal requirement but a cornerstone of customer trust in an increasingly digital financial landscape.

Consumer protection regulations are a significant legal factor for Hang Seng Bank. The Hong Kong Monetary Authority (HKMA) actively implements initiatives to protect consumers, particularly in the digital banking space. These measures often focus on enhancing e-banking security and combating digital fraud.

Hang Seng Bank, like other financial institutions, must comply with these HKMA directives. This involves investing in and implementing robust e-banking security enhancements. Furthermore, the bank is obligated to provide customers with effective tools to monitor their account activities, promoting transparency and empowering consumers to detect any suspicious transactions promptly.

Banking (Amendment) Bill and Information Sharing

The proposed Banking (Amendment) Bill 2025 is set to introduce a significant shift in how financial institutions combat financial crime. This legislation facilitates a voluntary information-sharing framework among authorized institutions, aiming to bolster the detection and prevention of illicit activities. Hang Seng Bank, as a key player in the financial sector, is expected to participate in this initiative.

This participation will involve the sharing of sensitive account information, a critical step in building a more robust defense against money laundering and other financial offenses. The effectiveness of such measures is often demonstrated by the reduction in reported financial crimes. For instance, in 2024, similar collaborative efforts in other jurisdictions led to a reported 15% increase in the successful prosecution of financial crime cases.

The implications for Hang Seng Bank are multifaceted:

- Enhanced Compliance: Participation aligns Hang Seng with evolving regulatory expectations for proactive crime prevention.

- Risk Mitigation: Sharing data can help identify and mitigate risks associated with illicit financial flows more effectively.

- Industry Collaboration: It fosters a collaborative environment, strengthening the overall security of the financial ecosystem.

- Reputational Impact: Demonstrating commitment to combating financial crime can positively influence public trust and brand reputation.

Sustainable Finance Disclosure Requirements

Hong Kong is actively encouraging the adoption of the International Sustainability Standards Board (ISSB) Standards, which will significantly enhance the depth and breadth of sustainability reporting for financial institutions. This regulatory push means that banks like Hang Seng will need to provide more detailed disclosures on environmental, social, and governance (ESG) factors. For instance, by the end of 2024, companies listed on the Stock Exchange of Hong Kong are expected to align with ISSB standards, impacting a wide range of financial disclosures.

These evolving requirements are designed to foster greater transparency and accountability in sustainable finance. Hang Seng Bank, like its peers, will face increased scrutiny on its sustainability performance and the integration of ESG considerations into its business strategies. This shift is crucial for meeting investor expectations and navigating the growing global demand for sustainable investment opportunities.

The implementation of these disclosure standards will likely lead to:

- Enhanced ESG data collection and analysis

- Increased focus on climate-related financial disclosures

- Greater comparability of sustainability performance across the financial sector

- Alignment with international best practices in sustainable finance

New legislation, like the proposed Banking (Amendment) Bill 2025, is set to bolster defenses against financial crime through voluntary information sharing among financial institutions. This initiative, aligning with global efforts, aims to improve the detection and prevention of illicit activities, with potential for a reduction in financial crime rates, mirroring successes seen elsewhere in 2024.

Hang Seng Bank must also navigate evolving consumer protection laws, particularly concerning digital banking. The Hong Kong Monetary Authority (HKMA) mandates enhanced e-banking security and fraud prevention measures, requiring banks to invest in robust systems and provide customers with tools to monitor their accounts effectively.

Furthermore, the increasing emphasis on sustainability reporting, driven by the adoption of International Sustainability Standards Board (ISSB) standards by the end of 2024, will necessitate more detailed ESG disclosures from Hang Seng. This regulatory shift enhances transparency and accountability in sustainable finance, aligning the bank with international best practices and investor expectations.

Environmental factors

Hang Seng Bank acknowledges climate change as a significant challenge, actively working to assist its clients and markets in their shift to a low-carbon economy. The bank has set a target to achieve net zero emissions in its own operations by 2030, aligning with broader global climate goals.

This commitment translates into tangible actions, such as providing green financing solutions and investing in sustainable projects. For instance, in 2023, Hang Seng Bank facilitated HKD 25.6 billion in green and sustainable financing, a substantial increase from previous years, demonstrating its dedication to supporting the transition.

Hang Seng Bank is significantly boosting its sustainable finance offerings, aiming to meet growing demand for environmentally conscious investments. A key initiative is the HKD 80 billion Sustainability Power Up Fund, launched in 2024, which provides businesses with a range of green and sustainable financing options. This fund is designed to support projects that contribute to a low-carbon economy and promote biodiversity.

Beyond financing, Hang Seng Bank is also focused on raising awareness about sustainable development practices among its clients. By offering advisory services and educational resources, the bank helps businesses understand the benefits and implementation of sustainability. This dual approach of providing capital and fostering knowledge is crucial for driving the transition towards a more sustainable financial landscape in the region.

Hang Seng Bank is actively embedding environmental, social, and governance (ESG) principles across its operations. This includes a significant focus on enhancing workplace sustainability, such as improving energy efficiency in its facilities. For instance, its headquarters building has garnered accolades for its environmentally conscious design and operational practices, underscoring a tangible commitment to greener business strategies.

Carbon Emissions and Environmental Reporting

Hang Seng Bank is actively addressing climate change by integrating mitigation strategies into its operations. This includes initiatives like installing solar panels and implementing energy-saving measures across its office spaces, demonstrating a tangible commitment to reducing its environmental footprint.

The bank is a key player in advancing Environmental, Social, and Governance (ESG) principles within Hong Kong's financial industry, with a particular focus on robust environmental reporting. This commitment is underscored by its participation in initiatives aimed at enhancing transparency and accountability in sustainability practices across the sector.

- Solar Panel Installation: Specific data on the percentage of energy generated by solar panels in Hang Seng Bank's facilities is not publicly detailed, but the initiative is part of a broader push for renewable energy adoption.

- Energy-Saving Practices: The bank aims to reduce energy consumption per employee, contributing to its overall carbon emission reduction targets.

- ESG Reporting: Hang Seng Bank's sustainability reports provide detailed information on its environmental performance, including carbon emissions data and targets for reduction, aligning with global reporting standards.

Regulatory Push for Green Initiatives

Hong Kong's financial regulators, including the Hong Kong Monetary Authority (HKMA), are actively steering the financial sector towards sustainability. This includes a strong push for green finance, with mandates for financial institutions to integrate climate-related risks into their risk management frameworks and balance sheets. A key objective is achieving net-zero operations by 2030, a target Hang Seng Bank is actively working towards.

This regulatory environment directly influences Hang Seng Bank's strategic planning and operational adjustments. The bank is aligning its business practices and investment strategies to meet these evolving green finance requirements. For instance, in 2023, the HKMA announced its intention to enhance climate risk management requirements for banks, signaling a more stringent approach to environmental, social, and governance (ESG) factors.

Hang Seng Bank's commitment is demonstrated through initiatives aimed at reducing its operational carbon footprint and increasing its green financing portfolio. The bank is investing in sustainable solutions and reporting on its progress towards its net-zero goals. This proactive approach is crucial for maintaining regulatory compliance and capitalizing on the growing opportunities within the green economy.

- Regulatory Mandates: HKMA and other bodies are enforcing climate risk integration and net-zero operational targets by 2030 for financial institutions.

- Alignment with Expectations: Hang Seng Bank is actively aligning its strategies and operations to meet these green finance policy requirements.

- ESG Integration: The bank is enhancing its management of environmental, social, and governance factors, reflecting a broader industry trend driven by regulatory oversight.

Hang Seng Bank is actively responding to environmental pressures by focusing on climate change mitigation and sustainable finance. The bank has committed to achieving net-zero emissions in its own operations by 2030, a goal that influences its strategic decisions and operational practices.

This commitment is backed by concrete actions, such as the HKD 80 billion Sustainability Power Up Fund launched in 2024 to support green projects. In 2023, the bank facilitated HKD 25.6 billion in green and sustainable financing, showcasing its dedication to the low-carbon transition.

The bank's environmental strategy also includes enhancing energy efficiency in its facilities and promoting renewable energy sources, such as solar panel installations. These initiatives are crucial for reducing its operational footprint and meeting regulatory expectations from bodies like the Hong Kong Monetary Authority (HKMA), which is increasingly emphasizing climate risk management and green finance.

| Initiative | Target/Goal | 2023 Data | 2024 Initiatives |

|---|---|---|---|

| Net Zero Operations | By 2030 | N/A | Continued implementation of energy-saving measures |

| Green & Sustainable Financing | N/A | HKD 25.6 billion facilitated | Launch of HKD 80 billion Sustainability Power Up Fund |

| Renewable Energy Adoption | Increase usage | Ongoing solar panel installations | Expansion of energy efficiency projects |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hang Seng Bank is meticulously constructed using data from reputable financial news outlets, official Hong Kong government publications, and reports from international financial institutions. We prioritize current economic indicators, regulatory updates, and technological advancements to ensure a comprehensive overview.