Hang Seng Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Seng Bank Bundle

Hang Seng Bank operates in a dynamic financial landscape, facing intense competition and evolving customer expectations. Understanding the power of buyers, the threat of new entrants, and the influence of substitutes is crucial for navigating this market.

The complete report reveals the real forces shaping Hang Seng Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The banking sector's growing dependence on sophisticated technology, such as AI and cybersecurity, grants specialized tech providers considerable influence. Hang Seng Bank's significant investments in digital transformation, including the adoption of generative AI and distributed ledger technology (DLT), underscore the critical role of these suppliers.

As of early 2024, the global fintech market was projected to reach $33.5 trillion by 2030, highlighting the immense value placed on technological innovation within finance. Hang Seng's commitment to digital services and operational efficiency means that high-quality, secure, and integrated software and hardware are paramount.

This reliance can translate into increased supplier power, particularly for providers offering niche, cutting-edge solutions essential for maintaining a competitive edge and ensuring robust cybersecurity in an evolving digital landscape.

The demand for skilled professionals in FinTech, AI, data science, and cybersecurity is exceptionally high in Hong Kong's competitive financial sector. Hang Seng Bank, like its peers, faces intense competition to attract and retain this specialized talent, which is crucial for its digital transformation and innovation efforts. In 2023, Hong Kong's financial services sector saw a significant increase in demand for AI and data analytics roles, with some specialized positions experiencing salary growth of up to 20% year-on-year, underscoring the heightened bargaining power of these human capital suppliers.

Regulatory bodies, such as the Hong Kong Monetary Authority (HKMA), wield substantial influence, acting as powerful de facto suppliers by dictating compliance standards. Banks like Hang Seng must invest in legal, compliance, and technology solutions to meet these evolving requirements, particularly in areas like financial crime prevention and digital asset regulation. This creates a strong demand for specialized RegTech providers.

Interbank and Payment Network Providers

Hang Seng Bank's operations are deeply intertwined with interbank and payment network providers. These entities, often monopolistic or oligopolistic in nature, facilitate essential transactions, including cross-border payments and clearing services. The reliance on these established networks grants them significant leverage.

The bargaining power of interbank and payment network providers stems from the critical nature of their services and the high costs associated with switching. For instance, participation in SWIFT, a global financial messaging network, involves substantial integration and ongoing operational expenses, making it difficult for banks like Hang Seng to easily change providers. The development of central bank digital currencies (CBDCs) and cross-border payment initiatives, such as Project mBridge, indicates a shift towards potentially more diversified but still controlled payment infrastructures, underscoring the evolving landscape of this supplier power.

- High Switching Costs: Banks face significant technical and operational hurdles when changing interbank and payment network providers, leading to high switching costs.

- Network Effects: The value of payment networks increases with the number of participants, creating strong network effects that solidify the position of incumbent providers.

- Essential Infrastructure: These networks are fundamental to banking operations, providing little room for negotiation on essential services.

- Limited Competition: In many regions, a few dominant players or government-backed initiatives control critical payment infrastructure, limiting competitive pressures.

Data Providers and Information Services

Data providers and information services wield significant bargaining power over Hang Seng Bank. Access to high-quality financial data, market intelligence, and risk assessment tools is absolutely critical for the bank's daily operations, its wealth management services, and its ability to effectively mitigate risks. In 2024, the demand for sophisticated data analytics and AI-driven insights continues to grow, making specialized data sources even more valuable.

Providers offering unique or proprietary data sets, particularly those that are difficult to replicate, can command higher prices. This is further amplified by the increasing reliance on data-driven decision-making across all banking functions, from lending to investment strategies. For instance, specialized market data platforms often have subscription fees that reflect the depth and exclusivity of their offerings, impacting Hang Seng's operational costs.

- Criticality of Data: High-quality financial data is essential for Hang Seng's core functions.

- Proprietary Information: Providers with unique data sets have increased leverage.

- AI Integration: The push for AI adoption in banking elevates the importance of advanced data suppliers.

- Market Intelligence: Reliable market intelligence is key for competitive advantage and risk management.

Hang Seng Bank's reliance on technology suppliers, particularly in AI and cybersecurity, grants these providers significant bargaining power. The bank's substantial investments in digital transformation, including generative AI and DLT, highlight the critical need for specialized tech solutions. This dependence is amplified by the high demand for FinTech talent, with specialized roles in Hong Kong seeing salary increases of up to 20% year-on-year in 2023, indicating the leverage these human capital suppliers possess.

Furthermore, interbank and payment network providers, often operating as monopolies or oligopolies, hold considerable sway due to the essential nature of their services and high switching costs. Participation in networks like SWIFT involves significant integration expenses, making it challenging for banks to change providers. The evolving landscape of payments, including CBDCs and initiatives like Project mBridge, suggests a future with potentially diversified but still controlled payment infrastructures.

Data providers also exert strong influence, as access to high-quality financial data and market intelligence is crucial for Hang Seng's operations and risk management. The increasing integration of AI in banking further elevates the value of advanced data suppliers, especially those offering unique or proprietary datasets that are difficult to replicate. This creates a scenario where specialized data sources can command premium pricing, impacting the bank's operational costs.

| Supplier Type | Key Dependencies | Supplier Power Factors | Impact on Hang Seng | 2024 Data Point |

| Technology (AI, Cybersecurity) | Digital transformation, operational efficiency | Specialized solutions, high demand for talent | Increased costs, potential for innovation | Global fintech market projected to reach $33.5 trillion by 2030 |

| Interbank/Payment Networks | Transaction processing, cross-border payments | High switching costs, network effects, essential infrastructure | Limited negotiation leverage, operational dependency | SWIFT integration costs can be substantial |

| Data Providers | Risk assessment, wealth management, decision-making | Proprietary data, AI integration demand, market intelligence criticality | Higher data acquisition costs, reliance on external insights | Demand for AI and data analytics roles surged in 2023 |

What is included in the product

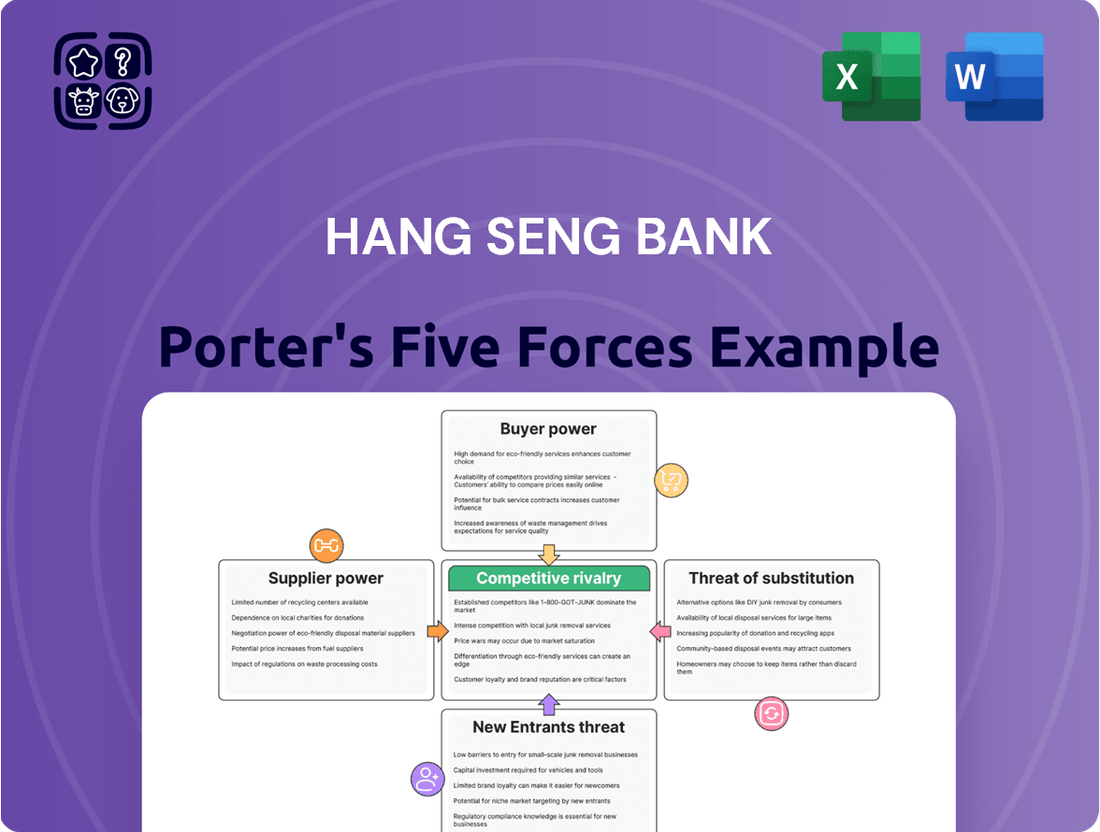

This analysis dissects the competitive forces impacting Hang Seng Bank, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the Hong Kong banking sector.

Visualize competitive intensity with a dynamic five forces dashboard, allowing Hang Seng Bank to pinpoint and address key strategic pressures.

Customers Bargaining Power

Individual retail customers in Hong Kong wield growing bargaining power, fueled by a highly competitive banking sector. With numerous traditional and emerging virtual banks vying for market share, customers have a wealth of choices. This intensified competition means banks must continuously innovate, as seen in Hang Seng's 'Future Banking 2.0' initiative, to retain and attract clients by offering superior digital experiences and personalized services.

The ease with which customers can switch financial institutions further amplifies their influence. Attractive promotional offers and enhanced digital platforms from competitors, especially virtual banks, empower retail customers to demand more favorable terms, better interest rates, and more convenient banking solutions. For instance, the rapid adoption of digital banking services in Hong Kong, with a significant portion of the population actively using mobile banking apps, underscores this trend.

Large corporate clients, especially those with significant financial dealings and international requirements, wield considerable bargaining power. They frequently seek customized financial packages, better interest rates, and lower fees for their corporate and commercial banking needs. Hang Seng Bank's engagement with these clients means it must offer competitive terms to keep them.

Wealth management clients, particularly high-net-worth individuals, wield significant bargaining power. Their substantial assets, often in the millions, mean banks are highly motivated to retain their business. These clients also have access to a global array of financial institutions, providing them with numerous alternatives if they are unsatisfied with Hang Seng Bank's offerings.

Hang Seng Bank's strategic focus on wealth management, highlighted by its 'Wealth Master' platform, underscores the importance of this client segment. In 2023, the bank reported a notable increase in its wealth management client base, indicating a competitive landscape where client retention is paramount. These clients expect tailored advice, competitive returns, and unique investment products, forcing banks to continually innovate and improve service quality to meet these demands.

Digital-Savvy Customers and Virtual Bank Users

The increasing digital savviness of Hong Kong consumers, coupled with the proliferation of virtual banks, significantly bolsters customer bargaining power. These digitally-oriented users actively seek convenience, seamless digital access, and attractive online promotions, making them more inclined to switch providers if their expectations aren't met. By the end of 2023, Hong Kong's virtual banks had attracted a substantial customer base, with some reporting over 1 million accounts, indicating a strong shift towards digital channels.

This trend puts pressure on established players like Hang Seng Bank to continuously enhance their digital offerings and customer experience. Virtual banks, unburdened by extensive physical branch networks, can often pass on cost savings through more competitive rates and lower fees. For instance, data from the Hong Kong Monetary Authority (HKMA) in early 2024 showed that virtual banks were indeed offering competitive interest rates on savings accounts, directly influencing customer choices.

- Digital Adoption: A significant portion of Hong Kong's banking population actively uses mobile banking apps, with adoption rates exceeding 70% for many demographics by late 2023.

- Virtual Bank Growth: As of mid-2024, virtual banks collectively hold a growing share of the retail deposit market, demonstrating their increasing appeal to tech-savvy customers.

- Switching Behavior: Customers prioritizing digital experience and promotional offers are more likely to switch banks, especially when virtual alternatives provide superior user interfaces and value propositions.

- SME Engagement: Small and Medium Enterprises (SMEs) are particularly responsive to the streamlined digital onboarding and transaction capabilities offered by virtual banks, further amplifying customer power in this segment.

Customers with Access to Diverse Financial Products

Customers today can access a much wider range of financial products than ever before. Beyond traditional bank accounts and loans, they have options like digital investment platforms, specialized insurance providers, and various alternative financing solutions. This broad availability means customers can pick and choose the best provider for each specific financial need.

For Hang Seng Bank, this presents a challenge. While the bank strives to offer a comprehensive suite of services, the existence of specialized firms for each niche allows customers to "unbundle" their financial requirements. For instance, a customer might use a dedicated robo-advisor for investments and a separate fintech firm for a specific loan, bypassing the bank for those services. This ability to cherry-pick increases customer bargaining power significantly.

The proliferation of these diverse financial products means customers are less tied to a single institution. In 2024, the growth of fintech and neobanks has further intensified this trend. For example, the global fintech market was projected to reach over $300 billion in 2024, highlighting the vast array of alternative options available to consumers.

- Increased Choice: Customers can select providers based on best-in-class offerings for each financial product, rather than relying on a single bank for all needs.

- Unbundling of Services: Financial needs, such as investments, insurance, and credit, can be met by specialized providers, weakening the all-encompassing relationship with a traditional bank.

- Competitive Pressure: The availability of diverse and often digitally-native financial products forces traditional banks like Hang Seng to compete more aggressively on price, features, and customer experience.

- Data Accessibility: Customers have greater access to comparative data and reviews, empowering them to make more informed decisions and negotiate better terms.

The bargaining power of customers for Hang Seng Bank is significantly influenced by the competitive landscape in Hong Kong's banking sector, particularly the rise of virtual banks. Customers, both retail and corporate, benefit from increased choice and the ease of switching, forcing banks to offer competitive rates and superior digital experiences to retain them.

| Customer Segment | Key Bargaining Factors | Impact on Hang Seng Bank |

| Retail Customers | Digital convenience, promotional offers, competitive interest rates | Pressure to enhance digital platforms and pricing strategies; retention focus |

| Corporate Clients | Customized packages, preferential rates, lower fees | Need for tailored solutions and competitive pricing to secure business |

| Wealth Management Clients | Global access to institutions, tailored advice, competitive returns | Requirement for premium service, sophisticated investment products, and client retention efforts |

Same Document Delivered

Hang Seng Bank Porter's Five Forces Analysis

This preview provides a comprehensive Porter's Five Forces analysis of Hang Seng Bank, detailing the competitive landscape and strategic implications for the institution. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering no surprises or placeholders. You are looking at the actual, professionally written document, and upon completion of your purchase, you will gain instant access to this precise file for your strategic planning needs.

Rivalry Among Competitors

Hang Seng Bank operates in a fiercely competitive Hong Kong market, facing off against formidable local rivals such as HSBC, its parent company, and Standard Chartered. These established institutions, along with other international banks, leverage vast branch networks and deep customer loyalty, creating significant pressure across retail, corporate, and wealth management sectors.

The competitive landscape for Hang Seng Bank is significantly shaped by virtual banks and FinTech companies. Since 2020, Hong Kong has welcomed eight new virtual banks, directly intensifying competition, especially in digital offerings and the small and medium-sized enterprise (SME) sector. These new entrants are steadily growing their depositor base and venturing into wealth management, even while many are still working towards profitability.

Beyond the virtual banks, the broader FinTech ecosystem in Hong Kong, boasting over 1,100 companies, presents a constant source of innovation. These firms introduce novel solutions and disruptive business models that challenge the established services of traditional banks like Hang Seng.

Banks are increasingly moving beyond traditional lending, actively diversifying their income sources. This includes a strong push into wealth management, insurance, and various investment products. Hang Seng Bank's performance in 2024, with a notable 26% rise in non-interest income, clearly illustrates this strategic shift.

This broad diversification means competition isn't just about loan rates anymore. Banks are now vying for customers across a wider array of financial services, from investment advice to insurance policies. This intensifies rivalry as institutions aim to become a one-stop shop for all financial needs, making it harder for any single bank to dominate a specific niche.

Digital Transformation and Innovation Race

The banking sector in Hong Kong is experiencing a heightened competitive rivalry driven by rapid digital transformation. Banks are heavily investing in technologies such as Artificial Intelligence (AI) and Distributed Ledger Technology (DLT) to enhance their digital offerings.

Hang Seng Bank, like its peers, is prioritizing these technological advancements to boost operational efficiency, elevate customer experiences, and strengthen risk management frameworks. This focus fuels an intense race to innovate and deliver cutting-edge digital services, with significant capital being deployed to maintain a competitive edge.

- Accelerated Digital Investment: In 2024, Hong Kong banks collectively committed billions to digital transformation initiatives, with AI and cloud computing being key focus areas.

- Customer Experience Focus: A significant portion of these investments aims to personalize customer interactions and streamline digital onboarding processes, a critical battleground for market share.

- Innovation as a Differentiator: Banks are actively exploring new digital products and services, such as advanced mobile banking features and integrated financial management tools, to attract and retain customers.

Regulatory Environment and Market Conditions

The regulatory environment, driven by initiatives like the Hong Kong Monetary Authority's (HKMA) FinTech 2025 strategy, actively shapes competition by setting innovation benchmarks and compliance requirements. This ongoing supervision fosters a dynamic landscape where banks must continually adapt to new technological standards and customer expectations.

Macroeconomic conditions, including interest rate shifts and the stability of the property market, significantly influence Hang Seng Bank's competitive position. For instance, rising interest rates in 2023-2024, while potentially boosting net interest margins, also increase the risk of loan defaults, forcing banks to compete more fiercely for quality borrowers and stable income streams.

- Regulatory Influence: HKMA's FinTech 2025 strategy encourages digital transformation, intensifying rivalry among banks to offer advanced digital services.

- Interest Rate Impact: Fluctuations in interest rates directly affect lending profitability, driving competition for deposits and loans, especially in a rising rate environment.

- Property Market Sensitivity: A cooling property market, a key sector for Hong Kong banks, can reduce lending volumes and increase credit risk, heightening competition for alternative revenue sources.

Hang Seng Bank faces intense rivalry from established local and international banks, as well as a growing wave of virtual banks and FinTech innovators in Hong Kong. This competition spans all banking segments, from retail to corporate and wealth management, pushing incumbents to accelerate digital investment and diversify income streams beyond traditional lending.

The push for digital dominance is a key battleground, with banks like Hang Seng investing heavily in AI and DLT to enhance customer experience and operational efficiency. This digital race is further fueled by regulatory initiatives encouraging innovation, creating a dynamic environment where staying ahead technologically is crucial for market share.

Macroeconomic factors, such as fluctuating interest rates and the health of the property market, also intensify competition by impacting lending profitability and credit risk. Banks are therefore compelled to compete more aggressively for stable income and quality borrowers amidst these economic shifts.

| Competitive Factor | Key Players | Impact on Hang Seng Bank | 2024 Trend/Data |

| Established Banks | HSBC, Standard Chartered | Strong brand loyalty, extensive networks | Continued focus on customer retention and digital service enhancement. |

| Virtual Banks | Livi, MOX, WeLab Bank | Disruptive digital offerings, focus on SMEs | Growing depositor base, increasing competition in digital lending and wealth management. |

| FinTech Ecosystem | Over 1,100 firms | Innovative solutions, new business models | Driving demand for advanced digital banking features and integrated financial tools. |

| Digital Transformation | AI, DLT, Cloud Computing | Need for significant investment to maintain competitiveness | Banks collectively invested billions in 2024; Hang Seng's non-interest income rose 26% in 2024, indicating diversification efforts. |

SSubstitutes Threaten

Alternative lending platforms and peer-to-peer (P2P) lending represent a significant threat of substitutes for traditional banking services like those offered by Hang Seng Bank. The growth of FinTech has fueled these platforms, providing individuals and businesses with credit options beyond conventional banks, often with quicker approvals and more adaptable terms, especially for smaller or overlooked loan segments. By mid-2024, the global P2P lending market was projected to reach over $150 billion, highlighting its substantial presence.

The rise of digital payment solutions and e-wallets like AlipayHK presents a significant threat of substitution for Hang Seng Bank. These platforms offer seamless alternatives to traditional banking methods for everyday transactions, often enhanced with loyalty programs and integrated services.

By providing convenient mobile payment options, these fintech solutions can diminish customer reliance on conventional bank accounts for a growing number of financial activities. This trend is particularly evident in Hong Kong, where mobile payment adoption has surged, with transaction volumes in the mobile payment sector reaching billions of Hong Kong dollars annually in recent years, indicating a substantial shift in consumer behavior.

Direct investment platforms and robo-advisors present a significant threat by offering lower-cost, more accessible alternatives for wealth management. These services allow individuals to invest directly or receive automated advice, bypassing traditional banking channels. For instance, in 2023, the global robo-advisor market was valued at approximately $2.5 billion and is projected to grow substantially, indicating a strong shift towards these digital solutions.

Cryptocurrencies and Decentralized Finance (DeFi)

The rise of cryptocurrencies and decentralized finance (DeFi) presents a significant threat by offering alternative avenues for financial services. These technologies can bypass traditional banking intermediaries for functions like cross-border payments, lending, and investment management.

While regulatory frameworks are still developing, Hong Kong's embrace of virtual assets and tokenization, as seen in Hong Kong Monetary Authority (HKMA) initiatives, signals a growing potential for these digital assets to substitute certain banking services. For instance, by mid-2024, the total market capitalization of cryptocurrencies, though volatile, remained in the trillions of US dollars, indicating substantial capital flow outside traditional systems.

- Cross-border Transactions: Cryptocurrencies can facilitate faster and potentially cheaper international money transfers compared to traditional bank wires.

- Lending and Borrowing: DeFi platforms allow users to lend and borrow assets directly from each other, often with higher yields or lower interest rates than banks.

- Asset Management: Tokenized assets and decentralized exchanges offer new ways to manage and trade investments, diversifying away from traditional brokerage services.

In-house Corporate Finance Departments and Treasury Operations

Large corporations increasingly leverage in-house treasury operations and direct access to capital markets, diminishing their need for traditional corporate banking services. For instance, by mid-2024, many multinational corporations were observed to be issuing commercial paper directly to manage short-term liquidity, bypassing bank lending facilities. This trend suggests that internal financial management capabilities can serve as a significant substitute for external banking relationships.

The ability of a company to manage its own foreign exchange hedging or to secure syndicated loans directly from institutional investors, rather than through a commercial bank intermediary, represents a direct substitution threat. This is particularly evident as many firms build sophisticated internal treasury functions capable of handling complex financial transactions. For example, in 2023, the volume of corporate bonds issued globally, bypassing bank underwriting in many cases, reached record levels, highlighting this shift.

- Internal Treasury Management: Corporations can handle functions like cash management, payments, and liquidity planning internally, reducing reliance on banks.

- Direct Capital Market Access: Companies can issue debt or equity directly to investors, substituting for bank loans and advisory services.

- Fintech Solutions: Specialized financial technology firms offer services that can replace certain traditional banking functions, such as payment processing or trade finance.

- In-house Expertise: The growth of in-house financial expertise allows corporations to undertake more complex financial activities themselves.

The threat of substitutes for Hang Seng Bank is multifaceted, stemming from FinTech innovations and evolving corporate financial strategies. Alternative lending, digital payments, and direct investment platforms offer convenience and cost efficiencies that challenge traditional banking models. By mid-2024, the global P2P lending market was projected to exceed $150 billion, and mobile payment transaction volumes in Hong Kong alone reached billions of dollars annually, underscoring the significant shift in consumer behavior away from conventional banking services.

Furthermore, the increasing sophistication of corporate treasury functions and direct access to capital markets reduce the reliance on banks for services like liquidity management and corporate finance. In 2023, global corporate bond issuance hit record levels, often bypassing traditional bank underwriting, indicating a strong substitution effect.

| Substitute Area | Key Characteristics | Impact on Banks | Example Data (Mid-2024 Projection/2023 Actual) |

|---|---|---|---|

| FinTech Lending & P2P | Faster approvals, adaptable terms, niche market focus | Reduced loan origination, competition for retail and SME credit | Global P2P lending market projected >$150 billion |

| Digital Payments & E-wallets | Seamless transactions, loyalty programs, integrated services | Decreased reliance on traditional accounts for daily transactions, potential loss of transaction fees | Hong Kong mobile payment transactions in billions HKD annually |

| Robo-Advisors & Direct Investing | Lower costs, accessibility, automated advice | Competition for wealth management and investment advisory services | Global robo-advisor market valued at ~$2.5 billion (2023) |

| Cryptocurrencies & DeFi | Decentralized transactions, alternative lending/borrowing | Potential disintermediation of cross-border payments, lending, and asset management | Global crypto market cap in trillions USD (volatile) |

| In-house Corporate Finance | Direct capital market access, internal treasury management | Reduced demand for corporate loans, trade finance, and treasury services | Record global corporate bond issuance (2023) |

Entrants Threaten

The threat of new entrants into Hong Kong's banking sector, particularly for established players like Hang Seng Bank, is significantly dampened by substantial regulatory hurdles. The Hong Kong Monetary Authority (HKMA) mandates rigorous licensing procedures and robust capital adequacy ratios, creating a high cost of entry. These stringent requirements act as a formidable barrier, deterring potential new competitors from establishing a foothold in the market.

Further reinforcing this barrier, the HKMA has indicated a cautious approach towards issuing additional virtual bank licenses, suggesting no immediate strong justification for expanding the number of new digital-only banks. This stance effectively limits the pipeline of potential new entrants, thereby reducing the competitive pressure on incumbent institutions like Hang Seng Bank.

Launching a new bank, like Hang Seng Bank, demands immense capital. Think billions for cutting-edge tech, secure networks, and a broad branch presence. For instance, in 2023, major banks globally continued investing heavily in digital transformation, with figures often exceeding hundreds of millions of dollars annually. This high barrier to entry significantly deters potential new competitors.

Existing institutions, including Hang Seng Bank, enjoy significant economies of scale. They leverage vast customer bases and established operational efficiencies to lower per-unit costs. This makes it incredibly difficult for newcomers to match pricing and service levels from the outset, effectively limiting the threat of new entrants in the banking sector.

Hang Seng Bank, like other established institutions, benefits from decades of building strong brand recognition and customer trust, fostering a sense of security that new entrants struggle to replicate. In 2024, while virtual banks in Hong Kong saw user growth, a significant portion of primary banking relationships remained with traditional players, highlighting the enduring power of established trust.

Technological Investment and Digital Infrastructure

The threat of new entrants for Hang Seng Bank, particularly concerning technological investment and digital infrastructure, is tempered by the substantial capital required. Established banks like Hang Seng are already making significant, ongoing investments in advanced digital infrastructure, robust cybersecurity measures, and sophisticated AI capabilities. For instance, in 2023, major global banks allocated billions to technology upgrades, a trend expected to continue. This creates a high barrier to entry, as new players must not only match but potentially exceed these existing technological investments to offer truly competitive digital banking services.

New entrants face the challenge of replicating the sophisticated digital ecosystems and AI-driven customer experiences that incumbents have painstakingly built.

- High Capital Outlay: Significant investment in cutting-edge digital infrastructure, cloud computing, and AI is a major deterrent for potential new competitors.

- Cybersecurity Demands: Meeting stringent cybersecurity standards and protecting vast amounts of sensitive customer data requires substantial ongoing expenditure and expertise.

- Incumbent Technological Advancement: Established banks are continuously upgrading their systems, making it difficult for newcomers to achieve parity in technological sophistication and service delivery.

Talent Acquisition and Retention

The threat of new entrants in the banking sector, particularly concerning talent acquisition and retention, remains a significant challenge for new players in Hong Kong. The demand for skilled FinTech and banking professionals is exceptionally high, fueling intense competition for experienced individuals. Established institutions like Hang Seng Bank often possess the advantage of offering robust compensation packages and clear career progression paths, making it difficult for newcomers to attract and retain top talent. This talent war can significantly impede a new entrant's ability to build a competent and competitive workforce.

In 2024, the FinTech sector in Hong Kong continued to experience a talent shortage, with an estimated 15% gap between available jobs and qualified candidates, according to industry reports. Established banks, including Hang Seng, are known for their comprehensive employee benefits and structured training programs, which are critical draws for professionals seeking stability and growth. For instance, Hang Seng Bank's investment in digital transformation initiatives in 2023-2024 has been accompanied by targeted recruitment drives and retention bonuses, underscoring the premium placed on skilled personnel.

- High Demand for FinTech Talent: Hong Kong's financial services industry faces a persistent shortage of professionals with expertise in areas like AI, blockchain, and cybersecurity.

- Established Banks' Advantage: Institutions like Hang Seng Bank leverage their strong brand reputation, competitive salaries, and extensive training programs to attract and retain skilled employees.

- Retention Challenges for New Entrants: New banking or FinTech firms struggle to match the career development opportunities and long-term incentives offered by incumbents, leading to higher employee turnover.

- Impact on Operational Capacity: The difficulty in acquiring and retaining talent can directly impact a new entrant's ability to innovate, scale operations, and compete effectively in the market.

The threat of new entrants for Hang Seng Bank is considerably low due to stringent regulatory requirements and high capital investment needed to establish a banking operation in Hong Kong. The Hong Kong Monetary Authority's strict licensing and capital adequacy rules create significant barriers. For example, in 2023, the cost of establishing robust digital infrastructure and meeting cybersecurity standards ran into hundreds of millions of dollars for existing banks, a sum prohibitive for most newcomers.

Established players like Hang Seng Bank also benefit from significant economies of scale, strong brand loyalty, and established customer trust, which are difficult and costly for new entrants to replicate. In 2024, while virtual banks gained traction, primary banking relationships remained largely with traditional institutions, underscoring the enduring power of incumbency.

The intense competition for skilled talent, particularly in FinTech, further elevates the barrier to entry. Established banks offer competitive compensation and career paths, making it challenging for new firms to attract and retain essential personnel. This talent gap, estimated at 15% in Hong Kong's FinTech sector in 2024, directly impacts a new entrant's operational capacity and innovation potential.

Porter's Five Forces Analysis Data Sources

Our analysis of Hang Seng Bank's competitive landscape is built upon a foundation of reliable data, including the bank's annual reports, investor presentations, and official press releases. We also incorporate insights from reputable financial news outlets and industry-specific publications to capture market dynamics and strategic developments.