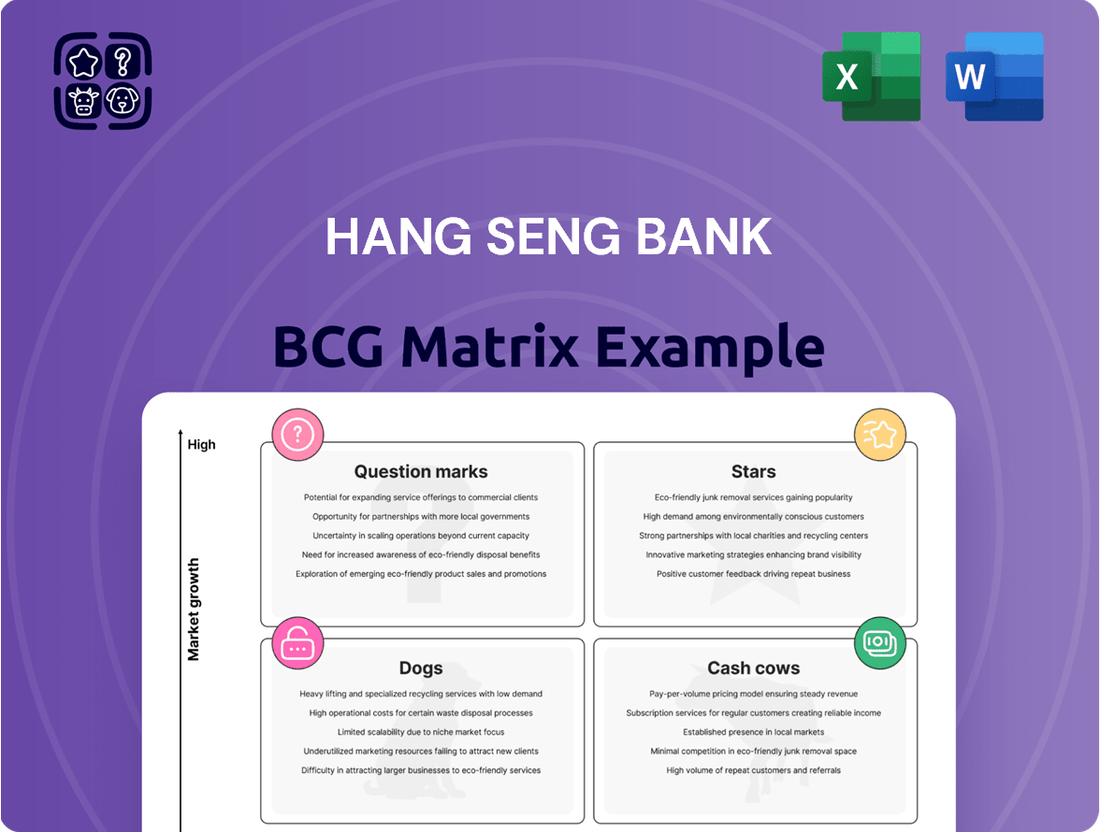

Hang Seng Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Seng Bank Bundle

Curious about Hang Seng Bank's strategic positioning? This glimpse into their BCG Matrix highlights key areas, but to truly understand their market dominance and growth potential, you need the full picture. Discover which of their offerings are Stars, Cash Cows, Dogs, or Question Marks, and unlock actionable insights.

Dive deeper into Hang Seng Bank's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hang Seng Bank is aggressively expanding its cross-boundary wealth management offerings in the Greater Bay Area (GBA). This strategic push is already yielding significant results, with new account openings for retail customers in mainland China experiencing an impressive 81% year-on-year surge in 2024.

The bank has established nine dedicated cross-boundary Wealth Management Centres across key GBA cities, underscoring its commitment to this dynamic and high-growth region. This expansion is a critical component of Hang Seng Bank's strategy to boost non-interest income and broaden its customer base.

Hang Seng Bank is aggressively pursuing digital banking innovation, evidenced by its award-winning mobile app and a significant focus on enhancing customer digital engagement. This commitment to digital advancement is a key driver of its growth.

The bank's leadership in digital finance was recognized with the Hong Kong Domestic Digital Payment Initiative of the Year award at the ABF Wholesale Banking Awards 2024. This accolade underscores its successful implementation of innovative digital payment solutions.

Continued strategic investments in AI-driven services and broader digital transformation initiatives are designed to boost operational efficiency and secure Hang Seng Bank's competitive position in the evolving financial landscape.

Hang Seng Bank's investment services experienced a robust 28% surge in income during 2024, a testament to its expanding market presence. This growth outpaces the overall wealth management sector's 20% year-on-year income increase, highlighting the bank's strong competitive position within a flourishing market segment.

Life Insurance Business Expansion

Hang Seng Bank's life insurance segment is a clear star in its BCG matrix. The bank achieved a remarkable 80% growth in new business premiums in 2024, propelling it to become the second-largest life insurer by this metric. This expansion is further underscored by a 17% increase in life insurance income year-over-year, signaling robust market penetration and strong revenue generation in a dynamic sector.

- Market Leadership: Hang Seng Bank is now the second-largest life insurer based on new business premiums.

- Exceptional Growth: The bank experienced an impressive 80% growth in new business premiums in 2024.

- Revenue Surge: Life insurance income saw a significant 17% increase compared to the prior year.

- Strategic Momentum: This performance indicates a rapidly expanding presence and high market share in the life insurance market.

Affluent Customer Base Growth

Hang Seng Bank experienced a remarkable surge in its affluent customer base during 2024. The bank saw a significant 75% increase in new-to-bank affluent customers, demonstrating its success in attracting high-net-worth individuals. This growth was observed across both Hong Kong and mainland China, highlighting the bank's expanding reach in key wealth management markets.

Overall affluent customer numbers also climbed by a healthy 15% in 2024. This expansion within a valuable customer segment points to Hang Seng Bank's robust competitive positioning in wealth management. The bank's ability to attract and retain affluent clients suggests a strong foundation for future growth in its premium banking services.

- Affluent Customer Growth (2024): 75% increase in new-to-bank affluent customers.

- Overall Affluent Customer Increase (2024): 15% rise in total affluent customer numbers.

- Geographic Reach: Growth observed in both Hong Kong and mainland China.

- Strategic Implication: Strong competitive advantage in wealth management services.

Hang Seng Bank's life insurance segment is a clear star, demonstrating exceptional performance and market penetration. The bank achieved an impressive 80% growth in new business premiums in 2024, a figure that propelled it to become the second-largest life insurer by this metric. This robust expansion is further reflected in a 17% year-over-year increase in life insurance income, underscoring its strong revenue generation and market share in this dynamic sector.

| Segment | 2024 Growth (New Business Premiums) | 2024 Growth (Life Insurance Income) | Market Position |

|---|---|---|---|

| Life Insurance | 80% | 17% | 2nd Largest (by new business premiums) |

What is included in the product

The Hang Seng Bank BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Hang Seng Bank BCG Matrix offers a clear overview of business units, relieving the pain of strategic uncertainty by highlighting Stars and Cash Cows for focused investment.

Cash Cows

Hang Seng Bank's retail banking operations in Hong Kong are a quintessential Cash Cow. With nearly 4 million customers and over 250 service outlets, the bank commands a dominant position in its home market. This extensive reach ensures a consistent inflow of deposits and a steady stream of revenue from traditional banking services, reflecting its mature and highly profitable status.

Hang Seng Bank's traditional commercial banking services represent a significant Cash Cow. The bank's deep roots and established presence in Hong Kong have secured a robust market share, ensuring a steady stream of revenue from these core offerings. This stability is further underscored by their recognition as the 'Hong Kong Power Brand in Commercial Banking' at the Power Brand Awards 2024, a testament to their enduring strength and customer trust in this segment.

Hang Seng Bank's core deposit base is a true Cash Cow, demonstrating impressive growth and stability. Customer deposits surged by HK$86 billion, or 7%, to HK$1,267 billion by the end of 2023. This substantial and growing funding source provides the bank with a reliable foundation for its operations.

This robust deposit base is crucial for Hang Seng Bank's financial health. It ensures strong liquidity, enabling the bank to confidently support its lending activities and generate consistent net interest income, even with a slight compression in its net interest margin.

Mortgage and Lending Portfolio (Excluding problem CRE loans)

Hang Seng Bank's mortgage and lending portfolio, excluding problematic commercial real estate loans, likely functions as a Cash Cow within its BCG Matrix. This segment benefits from Hong Kong's mature lending market, where Hang Seng holds a significant share.

These established loan books generate steady interest income, underpinning the bank's profitability. For instance, Hong Kong's mortgage market saw continued activity through 2024, with banks like Hang Seng benefiting from consistent demand.

- Stable Interest Income: Mature mortgage and lending portfolios provide predictable interest revenue streams.

- High Market Share: Hang Seng's established presence in Hong Kong's lending market allows it to capture a substantial portion of this stable business.

- Profitability Driver: These portfolios are key contributors to the bank's overall financial health and earnings.

- Prudent Management: Effective risk management within these portfolios ensures sustained profitability and minimizes potential losses.

Payment and Transaction Services

Hang Seng Bank's payment and transaction services are a cornerstone of its business, serving both individuals and corporations. These offerings, which include a robust ATM network and a variety of digital payment solutions, are mature but highly reliable. They consistently generate stable fee income, which is crucial for maintaining customer loyalty in a well-developed market.

In 2024, Hang Seng Bank continued to leverage its strong presence in Hong Kong's payment ecosystem. For instance, the bank reported significant transaction volumes through its digital platforms. As of the first half of 2024, Hang Seng's mobile banking app saw a substantial increase in daily active users, reflecting the growing adoption of digital payment methods. This steady revenue stream from transaction fees solidifies its position as a Cash Cow.

- Steady Fee Income: Transaction fees from a high volume of daily payments contribute consistently to Hang Seng's revenue.

- Customer Retention: Essential services like ATM access and digital payments help retain existing customers, even in a competitive landscape.

- Market Maturity: The payment services sector in Hong Kong is mature, meaning growth is slower, but the established customer base ensures predictable earnings.

- Digital Integration: Continued investment in digital payment solutions ensures these services remain relevant and efficient for users.

Hang Seng Bank's wealth management services in Hong Kong represent a mature Cash Cow. The bank's established reputation and extensive client base allow it to generate consistent fee-based income from managing assets. This segment benefits from Hong Kong's status as a global financial hub, with a significant portion of high-net-worth individuals seeking such services.

In the first half of 2024, Hang Seng Bank reported a notable increase in wealth management deposits, reflecting sustained client confidence and engagement. This growth in managed assets directly translates into higher fee income, reinforcing the Cash Cow status of this division due to its stable and predictable revenue generation within a mature market.

| Segment | BCG Category | Key Characteristics | 2024 Data/Context |

| Retail Banking (HK) | Cash Cow | Dominant market share, large customer base, stable revenue from deposits and traditional services. | Nearly 4 million customers, over 250 service outlets. |

| Commercial Banking (HK) | Cash Cow | Strong market share, established presence, consistent revenue from core offerings. | Recognized as 'Hong Kong Power Brand in Commercial Banking' at Power Brand Awards 2024. |

| Core Deposit Base | Cash Cow | Substantial and growing funding source, ensures liquidity and net interest income. | Deposits grew by HK$86 billion (7%) to HK$1,267 billion by end of 2023. |

| Mortgage & Lending (excl. CRE) | Cash Cow | Steady interest income from mature loan books in a stable market. | Continued activity in HK mortgage market through 2024. |

| Payment & Transaction Services | Cash Cow | Reliable fee income from high transaction volumes, customer retention. | Increased daily active users on mobile banking app in H1 2024. |

| Wealth Management | Cash Cow | Consistent fee-based income from asset management, strong client base. | Notable increase in wealth management deposits in H1 2024. |

What You’re Viewing Is Included

Hang Seng Bank BCG Matrix

The Hang Seng Bank BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase, ensuring complete transparency and immediate usability for your strategic planning needs.

This preview accurately represents the final Hang Seng Bank BCG Matrix document, meticulously prepared with comprehensive analysis and ready for immediate download and application within your business strategy framework.

What you see here is the actual Hang Seng Bank BCG Matrix report, a professional and insightful tool that will be delivered to you upon purchase, allowing for instant integration into your decision-making processes.

The Hang Seng Bank BCG Matrix presented in this preview is the exact same high-quality document you will acquire after purchase, offering a clear and actionable roadmap for evaluating the bank's business units.

Dogs

Hang Seng Bank has been strategically reducing its exposure to mainland China's commercial real estate sector. By the end of 2024, these loans represented approximately 2% of the bank's total loan portfolio.

This move reflects the segment's recent performance, marked by elevated credit costs and a rise in impaired loans. Such trends suggest a market characterized by limited growth potential and subdued profitability for the bank.

Legacy IT systems at Hang Seng Bank, if not actively undergoing upgrades or replacement, can be categorized as dogs in the BCG matrix. These systems often incur substantial maintenance costs, estimated to be significantly higher than modern cloud-based solutions, and struggle to integrate with new, agile digital services. For instance, in 2023, many traditional banks reported that a considerable portion of their IT budget was allocated to maintaining these older infrastructures, diverting funds that could be used for innovation.

Physical branches in areas experiencing demographic shifts or reduced customer visits are increasingly becoming a challenge for banks like Hang Seng. These locations, often in declining urban or suburban zones, face shrinking customer bases, directly impacting their revenue generation potential. For instance, a report from the Bank for International Settlements in early 2024 highlighted a consistent trend of declining branch usage in many developed economies, with some regions seeing a 10-15% year-over-year drop in in-person transactions.

If these underperforming branches aren't strategically reimagined, perhaps as specialized advisory hubs or integrated digital service centers, they risk becoming significant drains on operational resources. The ongoing costs associated with maintaining these physical spaces, from rent to staffing, can far outweigh the limited returns they generate in low-growth markets. This situation positions them as potential cash traps within the bank's portfolio, demanding careful consideration for their future role or potential divestment.

Outdated or Niche Investment Products with Low Uptake

Certain structured products or older legacy funds that haven't been updated to reflect current market demands or investor preferences can fall into the dog category for Hang Seng Bank. These offerings might have low sales volumes because they are either too complex for the average investor or target a very specific, shrinking niche.

For instance, if a particular bond fund focused on a declining industry saw only a fractional percentage of new investment in 2024, it would be a prime example. Such products consume resources for compliance and customer support without contributing meaningfully to revenue or customer engagement.

- Low Customer Uptake: Products with consistently minimal new investments, perhaps less than 0.5% of total new product sales in a given quarter.

- Stagnant Market Segments: Investments tied to industries or asset classes experiencing prolonged downturns or lack of innovation.

- Resource Drain: These products require ongoing marketing and maintenance despite negligible returns or market share gains.

- Example: A specific foreign exchange option product with limited hedging utility that saw less than HKD 10 million in new notional value traded in the first half of 2024.

Certain Non-Core, Non-Strategic Business Lines

Certain non-core, non-strategic business lines within Hang Seng Bank could be categorized as Dogs in the BCG Matrix. These might be niche services or minor operations that don't align with the bank's main focus on wealth management, retail, and corporate banking.

If these segments exhibit both low market share and limited growth potential, they fit the profile of a Dog. Such units might be candidates for divestment or restructuring to free up resources for more promising areas of the business.

For instance, if Hang Seng Bank had a small, underperforming digital payment solution with minimal user adoption in a saturated market, it would likely be considered a Dog. In 2024, the bank reported a net interest margin of 1.47%, indicating a focus on core lending activities where efficiency is paramount.

- Low Market Share: These business lines typically hold a small percentage of their respective markets.

- Limited Growth Prospects: The potential for expansion or increased revenue generation is minimal.

- Resource Drain: They often require ongoing investment without generating significant returns.

- Divestment Potential: Consideration for sale or closure to optimize the bank's portfolio.

Dogs within Hang Seng Bank's portfolio represent offerings with low market share and limited growth potential, often consuming resources without generating substantial returns. Examples include legacy IT systems, underperforming physical branches in declining areas, and outdated financial products that fail to attract new investment. These segments, characterized by stagnation and high maintenance costs, are prime candidates for divestment or strategic restructuring to reallocate capital towards more promising ventures.

| Category | Description | 2024 Data/Observation |

| Legacy IT Systems | Outdated infrastructure with high maintenance costs and poor integration capabilities. | Significant portion of IT budgets in 2023 allocated to maintaining older systems, diverting funds from innovation. |

| Underperforming Branches | Physical locations in areas with declining foot traffic and customer bases. | 10-15% year-over-year drop in in-person transactions in some regions, impacting revenue generation. |

| Outdated Financial Products | Products with low sales volumes and limited investor appeal due to complexity or targeting shrinking niches. | A specific foreign exchange option product saw less than HKD 10 million in new notional value traded in H1 2024. |

| Non-Core Business Lines | Niche services or minor operations not aligned with the bank's core strategic focus. | Small, underperforming digital payment solutions with minimal user adoption in saturated markets. |

Question Marks

Hang Seng Bank is actively exploring the potential of central bank digital currencies like the e-HKD, alongside integrating advanced AI-driven services into its offerings. These emerging technologies represent high-growth sectors with considerable future promise, but their current market penetration and revenue generation capabilities are still in nascent stages. This positions them as question marks within the BCG matrix, necessitating substantial investment to nurture their development and eventual market success.

Hang Seng Bank is actively building its sustainable finance offerings, including green and sustainable loans, and the Hang Seng Carbon Academy, specifically targeting SMEs. This focus addresses a rapidly expanding market for environmentally and socially conscious businesses.

While the bank is investing in this growth area, its current market share within the SME sustainable finance niche is still in its nascent stages. This presents an opportunity for Hang Seng to capture a larger portion of this developing market through continued strategic investment and tailored product development.

While the Greater Bay Area (GBA) is a strategic priority, Hang Seng Bank's expansion into other major mainland Chinese cities presents a significant, albeit less established, growth opportunity. This broader reach targets both retail and corporate clients in high-potential economic hubs, requiring continued investment to build market share.

In 2024, China's economic landscape continues to offer substantial potential beyond the GBA, with key cities outside the region experiencing robust growth in various sectors. Hang Seng Bank's strategy involves leveraging its existing strengths to capture a larger share of this diverse market, focusing on integrated digital banking solutions and tailored corporate services.

New Digital-Only Financial Products/Platforms

Hang Seng Bank's new digital-only financial products, such as the Global Money+ service and Prestige Multi-currency Debit Card, are positioned as question marks in the BCG matrix. These offerings represent investments in a high-growth digital sector, reflecting the bank's strategy to innovate and capture emerging market opportunities. The continuous introduction of compelling digital features signals a commitment to development, aiming to attract a tech-savvy customer base.

While these products showcase potential, their market share and widespread adoption are still in their nascent stages. For instance, the Global Money+ service, launched in late 2023, is still building its user base for international transfers. Similarly, the Prestige Multi-currency Debit Card, introduced to cater to the growing demand for seamless cross-border transactions, is in the process of establishing its presence in a competitive market.

- High Growth Potential: The digital finance sector is experiencing rapid expansion, offering significant opportunities for new product adoption.

- Early Stage Adoption: Newer digital products like Global Money+ and the Prestige Multi-currency Debit Card are still building market traction and customer familiarity.

- Investment Focus: Hang Seng Bank is actively investing in these digital innovations to secure future market share in a rapidly evolving financial landscape.

Strategic Partnerships for Fintech Innovation

Hang Seng Bank actively engages with innovation ecosystem partners, including academic institutions and startups, to foster fintech advancements. A prime example is the Hang Seng x CityUHK HK Tech 300 Innovation Programme, which signifies a strategic investment in ventures with substantial growth potential.

While the direct impact on market share from these collaborations is still unfolding, the bank's commitment to nurturing emerging technologies positions it for future gains. This approach aligns with a strategy of investing in promising, albeit currently less established, areas of fintech innovation.

- Focus on high-growth potential: Partnerships like the HK Tech 300 program target startups and academic projects with significant future upside.

- Investment in innovation ecosystem: Collaborations with universities and startups are key to accessing cutting-edge fintech ideas.

- Market share impact pending: The direct financial returns and market share gains from these specific partnerships are still in the early stages of realization.

- Strategic positioning: These efforts are designed to build a pipeline of future fintech capabilities and market opportunities.

Hang Seng Bank's exploration of central bank digital currencies (CBDCs) like the e-HKD and its integration of AI-driven services represent significant investments in high-growth, yet currently unproven, sectors. These initiatives are classified as question marks due to their nascent market penetration and revenue generation capabilities, requiring substantial capital to foster development and achieve future market success. For example, while AI adoption in banking is projected to grow substantially, the specific revenue streams from Hang Seng's AI initiatives are still being established.

Hang Seng Bank's new digital-only financial products, such as the Global Money+ service and Prestige Multi-currency Debit Card, are also considered question marks. These offerings are strategic investments in the high-growth digital finance sector, aiming to attract tech-savvy customers. While Global Money+ launched in late 2023 and the Prestige Multi-currency Debit Card was introduced to cater to cross-border transaction demand, their market share and widespread adoption are still in early stages, with ongoing efforts to build user bases and establish market presence.

BCG Matrix Data Sources

Our Hang Seng Bank BCG Matrix is informed by comprehensive financial disclosures, detailed market share data, and industry-specific growth forecasts to ensure accurate strategic positioning.