Hang Seng Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Seng Bank Bundle

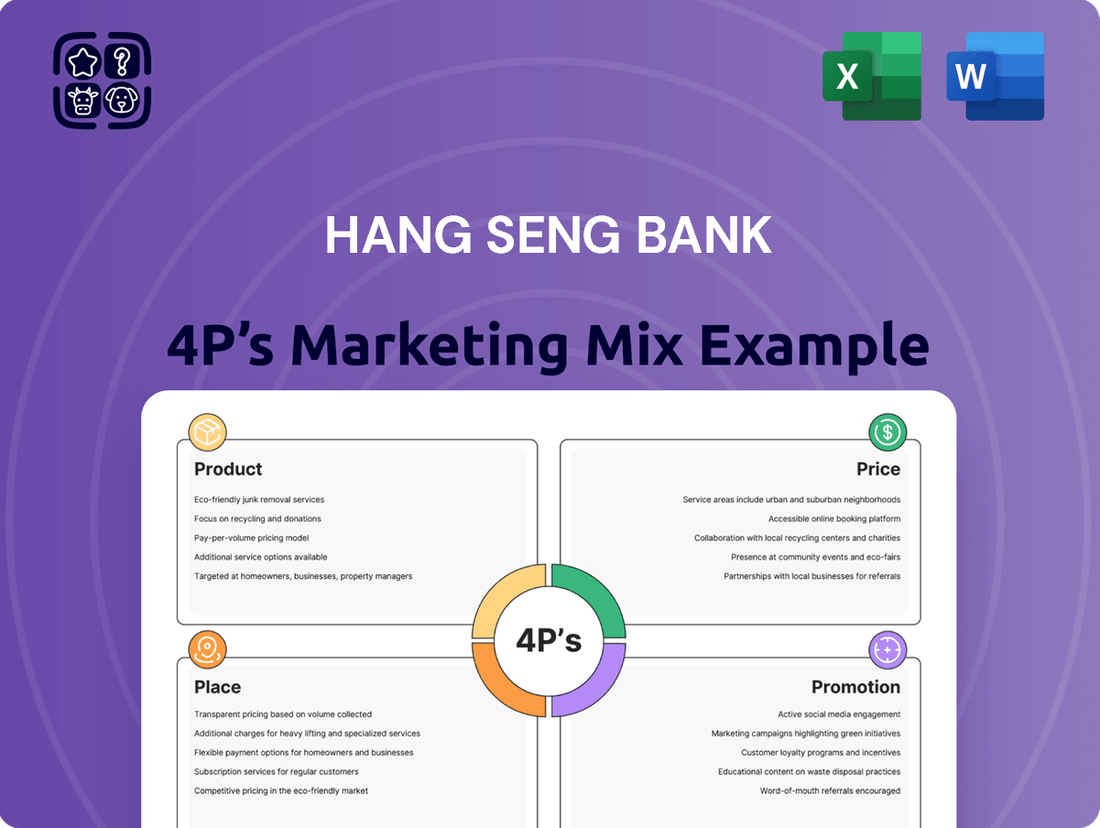

Hang Seng Bank's marketing prowess is built on a robust 4Ps foundation, from its diverse product portfolio catering to various customer segments to its strategic pricing that balances competitiveness with value. Their extensive distribution network ensures accessibility, while targeted promotions drive engagement.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Hang Seng Bank's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Hang Seng Bank's Product strategy is defined by its extensive range of financial services catering to a wide array of customers. This includes everything from everyday banking needs for individuals to specialized corporate and commercial banking solutions. Their offerings span retail banking, wealth management, insurance, and investment services, solidifying their role as a one-stop financial hub.

In 2024, Hang Seng Bank continued to emphasize its digital transformation, with mobile banking transactions seeing significant growth. The bank reported a substantial increase in its customer base for wealth management services, reflecting a growing demand for investment and advisory products. This expansion in product breadth and digital accessibility underscores their commitment to meeting evolving customer needs.

Hang Seng Bank is significantly boosting its digital banking capabilities, evidenced by its investment in an award-winning mobile app and the integration of AI-powered tools like Smart Teller. This focus on innovation aims to elevate customer experience and streamline internal operations, a key aspect of their product strategy.

The bank is actively participating in digital currency initiatives, including the e-HKD pilot program. This exploration into Central Bank Digital Currencies (CBDCs) demonstrates a forward-thinking approach to modernizing financial transactions, enhancing efficiency and transparency in fund management.

Hang Seng Bank offers a robust suite of wealth management and investment solutions, catering to diverse investor needs. This includes accessible investment products, a notable selection of Exchange Traded Funds (ETFs) tracking key global markets such as China, Japan, and the United States, and personalized savings plans designed to foster long-term financial growth.

The bank's commitment to customer experience is evident in its 'Wealth Master' platform, which has garnered recognition for its user-friendly and customer-centric design. This platform aims to simplify investment management and provide clients with the tools and information needed to make informed decisions.

As of early 2024, Hang Seng Bank continued to emphasize digital innovation in wealth management, aligning with broader market trends. The bank reported a significant increase in digital adoption for investment services, reflecting a growing preference among customers for convenient online and mobile banking solutions.

Retail and Personal Banking Solutions

For individual customers, Hang Seng Bank's retail and personal banking solutions focus on convenience and value. They offer everyday banking services with attractive features designed to appeal to a broad customer base. For instance, their commitment to $0 fees on many services and the availability of 24/7 Live Chat support directly address common customer pain points.

Hang Seng also enhances its payroll offerings through programs like PayDay+, aiming to attract and retain customers by providing additional benefits tied to their salary deposits. This proactive approach to payroll services demonstrates a clear strategy to capture a significant share of the retail banking market by integrating essential financial needs with added advantages.

Further strengthening their personal banking proposition, Hang Seng provides advanced account services. These include features such as multi-currency debit cards, which are invaluable for customers who travel or conduct international transactions. Additionally, their mobile app facilitates fee-free local foreign currency transfers, simplifying cross-border financial management.

- Everyday Banking: Features like $0 fees and 24/7 Live Chat support cater to daily customer needs.

- Payroll Enhancements: Programs like PayDay+ offer added value for customers receiving their salaries through Hang Seng.

- Global Accessibility: Multi-currency debit cards and fee-free local foreign currency transfers via the mobile app support international financial activities.

Commercial and Corporate Banking Offerings

Hang Seng Bank provides a comprehensive suite of commercial and corporate banking services designed to support businesses of all sizes. This includes specialized offerings in commercial banking, corporate banking, and sophisticated treasury services to manage financial operations effectively.

The bank also focuses on cross-boundary banking solutions, particularly for customers with interests in mainland China, facilitating smoother international transactions. In 2024, Hang Seng Bank continued its commitment to innovation, notably through its Index Innovation Lab, aiming to accelerate digital transformation and promote green development among Small and Medium-sized Enterprises (SMEs).

- Commercial and Corporate Banking: Tailored financial solutions for business growth.

- Treasury Services: Advanced tools for cash management and financial risk mitigation.

- Cross-Boundary Solutions: Facilitating business between Hong Kong and mainland China.

- SME Digital Transformation: Initiatives through the Index Innovation Lab to boost SME competitiveness.

Hang Seng Bank's product strategy is multifaceted, encompassing retail, wealth management, and corporate banking. In 2024, digital offerings saw significant expansion, with mobile banking transactions increasing substantially. The bank also reported robust growth in its wealth management customer base, highlighting demand for investment and advisory services.

Key product enhancements include the award-winning mobile app and AI-powered tools like Smart Teller, aimed at improving customer experience. Hang Seng is also actively exploring Central Bank Digital Currencies (CBDCs) through the e-HKD pilot program, signaling a commitment to modernizing financial transactions.

For individual customers, the bank offers everyday banking with features like $0 fees and 24/7 Live Chat. Payroll programs such as PayDay+ and advanced account services like multi-currency debit cards further enhance their retail proposition, supporting both local and international financial activities.

In the commercial and corporate sectors, Hang Seng provides tailored solutions, treasury services, and cross-boundary banking. Initiatives like the Index Innovation Lab are driving digital transformation and green development for SMEs, demonstrating a forward-looking approach to business support.

| Product Area | Key Offerings | 2024/2025 Focus/Data | Customer Segment |

|---|---|---|---|

| Retail Banking | Everyday banking, payroll services, multi-currency debit cards | $0 fees on many services, 24/7 Live Chat, PayDay+ program | Individuals, Families |

| Wealth Management | Investment products, ETFs, savings plans, advisory services | Significant customer base growth, digital adoption increase, Wealth Master platform | Affluent Individuals, Investors |

| Corporate & Commercial Banking | Commercial banking, corporate banking, treasury services, cross-boundary solutions | Index Innovation Lab for SME digital transformation and green development | SMEs, Large Corporations, Businesses with China exposure |

| Digital Innovation | Mobile banking, AI tools, digital currency exploration | Award-winning mobile app, Smart Teller, e-HKD pilot program participation | All Customer Segments |

What is included in the product

This analysis provides a comprehensive overview of Hang Seng Bank's marketing strategies, examining its Product offerings, Pricing models, Place of distribution, and Promotion tactics.

It offers a deep dive into how Hang Seng Bank positions itself in the market, ideal for understanding their customer engagement and competitive advantages.

This Hang Seng Bank 4Ps analysis simplifies complex marketing strategies, acting as a clear roadmap to address customer pain points and enhance service delivery.

It provides a concise, actionable framework for identifying and resolving customer friction, making it ideal for quick strategic reviews and problem-solving sessions.

Place

Hang Seng Bank boasts an extensive physical presence in Hong Kong, operating over 250 service outlets. This network includes both traditional branches and self-service banking centers, ensuring broad customer accessibility throughout the territory.

This widespread network facilitates an omni-channel banking experience, allowing customers to seamlessly manage their financial needs through in-person interactions. As of early 2024, Hang Seng Bank continues to leverage this robust physical infrastructure to serve its diverse customer base.

Hang Seng Bank's strategic presence in mainland China is primarily managed through its wholly-owned subsidiary, Hang Seng Bank (China) Limited. This allows for a focused approach to serving a key growth market.

The bank maintains a network of outlets in nearly 20 major cities across mainland China, facilitating direct customer engagement. This extensive reach is crucial for catering to both local customers and those with cross-border financial requirements, especially given the increasing economic ties between mainland China and Hong Kong.

As of the first half of 2024, Hang Seng Bank reported a notable increase in its customer base in mainland China, driven by demand for wealth management and cross-border transaction services. The bank's investment in digital channels further supports this growing customer segment, enhancing accessibility and convenience.

Hang Seng Bank has heavily invested in its digital and mobile presence, recognizing their crucial role in customer access and engagement. Their award-winning mobile banking app provides a comprehensive platform for a wide range of financial transactions, allowing customers to bank conveniently on the go.

This robust digital infrastructure is a cornerstone of their distribution strategy, ensuring accessibility and efficiency for their customer base. For instance, in 2023, Hang Seng reported a significant increase in mobile banking transactions, highlighting the growing reliance on these channels for everyday banking needs.

Omni-channel Customer Experience

Hang Seng Bank is dedicated to offering a smooth, omni-channel customer journey, unifying its physical branches with its robust digital and mobile banking services. This strategy allows customers the flexibility to engage with the bank through their preferred channels for all their financial requirements.

This integrated approach means a customer can start a transaction on the mobile app, continue it at a branch, and finalize it online, all without interruption. By 2024, Hang Seng reported a significant uptick in digital engagement, with over 70% of customer transactions occurring through its digital platforms, highlighting the success of its omni-channel push.

- Digital Adoption: Over 70% of Hang Seng Bank transactions were conducted via digital channels in 2024.

- Seamless Integration: Customers can initiate and complete banking tasks across mobile, online, and physical branch touchpoints.

- Customer Preference: The bank caters to diverse customer needs by offering multiple interaction points.

- Enhanced Accessibility: This omni-channel strategy ensures banking services are accessible anytime, anywhere, and through any preferred device or location.

Cross-border Connectivity and Services

Hang Seng Bank excels in cross-border connectivity, offering integrated banking solutions that bridge Hong Kong and mainland China. This focus is crucial for individuals and businesses operating across these key economic zones.

The bank facilitates seamless remittance services, a vital component for many individuals sending money home or managing family finances across borders. Furthermore, its cross-boundary wealth management services cater to a growing segment of customers seeking to invest and manage their assets across both Hong Kong and mainland China. This strategic offering directly addresses the financial complexities faced by those with dual-region interests.

- Remittance Efficiency: Hang Seng Bank reported a significant increase in cross-border transaction volumes, with digital remittance channels seeing a 25% year-on-year growth in 2024, primarily driven by transfers between Hong Kong and mainland China.

- Wealth Management Growth: The bank's cross-boundary wealth management platform saw assets under management increase by 18% in the first half of 2025, reflecting strong customer adoption for investment solutions spanning both markets.

- Customer Base Expansion: By Q3 2025, Hang Seng Bank had onboarded over 50,000 new customers specifically utilizing its cross-border banking features, highlighting the demand for such integrated services.

- Digital Integration: The bank continues to invest in its digital infrastructure, aiming to reduce transaction times for cross-border payments by an additional 15% by the end of 2025.

Hang Seng Bank's physical presence is a key element, with over 250 outlets in Hong Kong, including branches and self-service centers, ensuring widespread accessibility. This network supports an omni-channel experience, allowing customers to interact through their preferred methods. The bank also maintains a significant footprint in mainland China, with outlets in nearly 20 major cities, facilitating cross-border financial needs.

The bank's digital strategy is robust, with its mobile app handling a significant portion of transactions. In 2023, mobile banking transactions saw a substantial increase, underscoring its importance. By 2024, over 70% of Hang Seng Bank's customer transactions occurred via digital platforms, demonstrating a successful shift towards digital engagement.

| Channel | 2024 Transaction Share | Key Feature |

| Physical Branches | ~25% | In-person service, complex transactions |

| Mobile App | ~55% | Convenience, everyday banking, payments |

| Online Banking | ~15% | Account management, detailed information |

| Self-Service Machines | ~5% | Cash deposits/withdrawals, basic inquiries |

Preview the Actual Deliverable

Hang Seng Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hang Seng Bank 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You can be confident that the insights and information presented are exactly what you'll gain access to.

Promotion

Hang Seng Bank leverages fully integrated marketing campaigns, weaving together outdoor, digital, and social media channels. This approach ensures a consistent message reaches its diverse customer base wherever they are. For instance, in 2024, their digital ad spend saw a significant increase, reflecting a strategic pivot towards online engagement.

These campaigns frequently feature a dynamic mix of celebrity endorsers and popular online influencers. This strategy aims to boost relatability and drive deeper engagement, particularly with younger demographics. In Q1 2025, campaigns featuring popular Hong Kong artists saw an average engagement rate increase of 15% across social platforms.

Hang Seng Bank is actively engaging Hong Kong's youth, specifically the 18-35 demographic, through targeted campaigns like 'Plan Smart For Every Dollar!'. This initiative speaks directly to the younger generation's financial aspirations and challenges.

The bank's approach focuses on empowering this age group with practical financial management tools and knowledge, delivered in a style that resonates with their unique perspectives and communication preferences. This is crucial for building long-term banking relationships.

By understanding the financial landscape for young adults, which includes navigating student loans and early investment decisions, Hang Seng Bank aims to be a trusted partner in their financial journey. For instance, in 2024, a significant portion of Hong Kong's youth are actively seeking digital solutions for saving and investing.

Hang Seng Bank prioritizes public relations and community engagement, notably through its support for families in transitional housing. In 2024, the bank provided financial education to over 5,000 individuals and developed personalized savings plans, aiming to foster financial resilience.

Furthermore, Hang Seng Bank actively combats financial fraud with innovative campaigns. Their 2025 anti-fraud initiative, featuring popular Cantopop artists, reached an estimated 10 million people across Hong Kong, significantly boosting public awareness of common scam tactics.

Wealth Management and Lifestyle s

Hang Seng Bank's promotional efforts actively target wealth management, often integrating this with lifestyle aspirations. Their 'Little Great Stories' campaign, for instance, moves beyond traditional affluent portrayals to highlight the significance of family moments, thereby enhancing their wealth management offering. These initiatives frequently bundle investment and insurance products to provide comprehensive solutions.

The bank's strategy aims to resonate on an emotional level, connecting financial planning with personal well-being and life milestones. This approach is designed to attract a broader audience, including younger affluent individuals who prioritize experiences and family values. By linking wealth management to lifestyle, Hang Seng positions itself as a partner in achieving life goals, not just a financial institution.

- Campaign Focus: 'Little Great Stories' emphasizes family and life moments to promote wealth management.

- Product Integration: Campaigns commonly combine investment and insurance products for holistic financial planning.

- Target Audience Appeal: The strategy aims to connect with individuals who value lifestyle and family alongside financial growth.

- Market Positioning: Hang Seng seeks to be perceived as a lifestyle partner, facilitating the achievement of personal and financial objectives.

Digital Content and Gamification

Hang Seng Bank is actively employing digital content and gamification to enhance customer engagement, particularly with younger demographics. They produce entertaining content, such as humorous films, designed to make exploring financial products and improving financial well-being more appealing. This approach aims to create a more interactive and less intimidating experience for users.

The bank integrates interactive elements directly into their mobile application. Features like lucky draws and in-app missions are implemented to encourage users to delve deeper into the bank's various offerings and to promote a proactive approach to personal finance management. This strategy leverages the popularity of gamified experiences to drive user interaction.

Specifically for younger audiences, Hang Seng Bank utilizes gamification techniques to impart crucial financial knowledge. This educational approach makes learning about personal finance more accessible and enjoyable, fostering better financial literacy from an early age. For instance, their "Money Hero" campaign in 2024 provided interactive modules and challenges designed to educate users on budgeting and saving.

- Digital Engagement: Humorous films and interactive elements like lucky draws and missions in the mobile app encourage exploration of Hang Seng's offerings.

- Financial Well-being Focus: Content and gamified features aim to help users improve their personal financial health and knowledge.

- Youth Financial Literacy: Gamification is employed to educate younger segments on financial concepts, making learning more interactive and effective.

- Mobile App Integration: Key engagement strategies, including missions and draws, are embedded within the bank's mobile platform for seamless user experience.

Hang Seng Bank's promotional strategy is a multi-faceted approach, blending traditional and digital channels with a strong emphasis on targeted campaigns. Their 2024 digital ad spend saw a notable increase, signaling a commitment to online engagement, while campaigns featuring popular artists in early 2025 boosted social media engagement by an average of 15%.

The bank actively targets younger demographics, aged 18-35, with initiatives like 'Plan Smart For Every Dollar!', focusing on practical financial management tools and relatable content. This demographic shows a strong preference for digital solutions for saving and investing in 2024.

Community engagement and anti-fraud efforts are also key promotional pillars. In 2024, Hang Seng provided financial education to over 5,000 individuals, and their 2025 anti-fraud campaign, reaching an estimated 10 million people, significantly raised public awareness.

Furthermore, Hang Seng integrates wealth management with lifestyle aspirations through campaigns like 'Little Great Stories,' aiming to resonate emotionally and position the bank as a partner in achieving life goals.

| Promotional Activity | Key Focus | Target Audience | 2024/2025 Data Point |

|---|---|---|---|

| Digital Campaigns | Online Engagement | Broad Customer Base | Increased Digital Ad Spend in 2024 |

| Influencer/Celebrity Endorsements | Relatability & Engagement | Younger Demographics | 15% Engagement Rate Increase (Q1 2025) |

| Youth-Focused Initiatives | Financial Literacy & Tools | 18-35 Age Group | High demand for digital saving/investing solutions (2024) |

| Community & PR | Financial Education & Fraud Prevention | General Public & Vulnerable Groups | 5,000+ educated in 2024; 10M reached by anti-fraud campaign (2025) |

| Wealth Management Promotion | Lifestyle Integration | Affluent & Aspiring Individuals | 'Little Great Stories' campaign linking finance to life moments |

Price

Hang Seng Bank positions its pricing to be both competitive and accessible, carefully balancing the perceived value of its banking products with its established market standing. This strategy ensures that its offerings remain attractive to a broad customer base.

As of July 2025, Hang Seng Bank's prime rate in Hong Kong was set at 5.25%. This benchmark rate influences the cost of various loan products, reflecting the bank's approach to managing interest income and customer affordability in the current economic climate.

Hang Seng Bank actively uses fee waivers and promotions as a key element of its marketing mix, especially to attract and retain its Preferred and Prestige Banking clients. These incentives aim to reduce the cost barrier for essential banking services and international transactions.

For instance, the bank provides $0 fees on everyday banking for younger customers, a move designed to cultivate long-term relationships from an early age. This aligns with a broader strategy of making banking more accessible and affordable for specific demographic segments.

Furthermore, Hang Seng Bank waives fees for local foreign currency transfers conducted through its mobile app, enhancing convenience and cost savings for users. The Global Money+ service also offers fee-free overseas transfers to more than 50 countries, demonstrating a commitment to facilitating international financial activities for its customers.

Hang Seng Bank champions transparent fee structures, offering comprehensive tariff guides for personal and commercial banking. These guides clearly detail charges for services such as cheque handling, account maintenance, and remittances, ensuring customers fully grasp associated costs.

Dynamic Pricing based on Market Conditions

Hang Seng Bank employs dynamic pricing, adjusting its offerings based on a keen eye on the market. This means their interest rates for loans and savings accounts aren't static; they move with the broader economic landscape and what competitors are doing. For instance, in response to the Hong Kong Monetary Authority's (HKMA) rate hikes in 2023, which saw the benchmark interest rate increase, Hang Seng Bank adjusted its own prime lending rates accordingly to remain competitive and manage its balance sheet effectively.

The bank's pricing strategy is heavily influenced by external forces. Competitor pricing plays a significant role, ensuring Hang Seng Bank remains attractive in a crowded financial services market. Market demand for specific products, like mortgages or personal loans, also dictates how aggressively they price these services. Furthermore, overall economic conditions, including inflation and the prevailing interest rate environment, are critical inputs into their pricing decisions.

Recent adjustments highlight this dynamic approach. For example, in late 2023 and early 2024, following the HKMA's continued monetary tightening, Hang Seng Bank, like many other local banks, made adjustments to its savings account interest rates and mortgage pricing.

- Competitor Analysis: Regularly monitors and adapts rates to match or beat competitor offerings in Hong Kong's banking sector.

- Market Demand: Adjusts pricing on products like mortgages and personal loans based on current customer demand and economic activity.

- Interest Rate Environment: Responds to changes in the Hong Kong dollar's base rate, influenced by the US Federal Reserve, by adjusting its prime rates and deposit rates. For example, following HKMA rate hikes in 2023, Hang Seng Bank adjusted its prime rates.

- Economic Conditions: Incorporates broader economic factors such as inflation and GDP growth into its pricing models to ensure profitability and market relevance.

Value-Added Services and Bundling

Hang Seng Bank enhances customer value by bundling diverse financial products within its wealth management services, integrating investment and insurance options. This strategy aims to provide a more comprehensive and attractive offering, thereby increasing the perceived value for its clients.

The bank also focuses on providing elevated benefits for its payroll services, exemplified by offerings like PayDay+. This initiative is designed to deliver superior value to customers who utilize Hang Seng for their payroll needs, fostering greater loyalty and engagement.

- Integrated Wealth Management: Bundling investment and insurance products within wealth management services to boost perceived value.

- Enhanced Payroll Offers: Providing additional benefits like PayDay+ for payroll customers to increase overall value proposition.

- Customer Retention: These bundled services and enhanced offers are key drivers for retaining and attracting customers in a competitive banking landscape.

Hang Seng Bank's pricing strategy is a dynamic response to market conditions, aiming for both competitiveness and value. The bank actively uses fee waivers and promotions, particularly for its Preferred and Prestige Banking clients, to lower cost barriers for essential services and international transactions. For instance, $0 fees on everyday banking for younger customers cultivate early relationships, while fee-free local foreign currency transfers and Global Money+ overseas transfers demonstrate a commitment to cost-effective international banking.

| Pricing Tactic | Description | Example/Data Point (as of July 2025) |

|---|---|---|

| Prime Rate | Benchmark rate influencing loan costs. | 5.25% |

| Fee Waivers/Promotions | Incentives to attract and retain customers. | $0 fees on everyday banking for younger customers; fee-free local foreign currency transfers. |

| Bundled Services | Integrating financial products to enhance perceived value. | Wealth management services including investment and insurance. |

| Dynamic Pricing | Adjusting rates based on market and competitor activity. | Adjustments to savings account and mortgage pricing in response to HKMA rate hikes (late 2023/early 2024). |

4P's Marketing Mix Analysis Data Sources

Our Hang Seng Bank 4P's Marketing Mix Analysis is built upon a foundation of publicly available data. We meticulously review official company reports, investor relations materials, and the bank's own website to understand their product offerings, pricing strategies, distribution channels, and promotional activities.