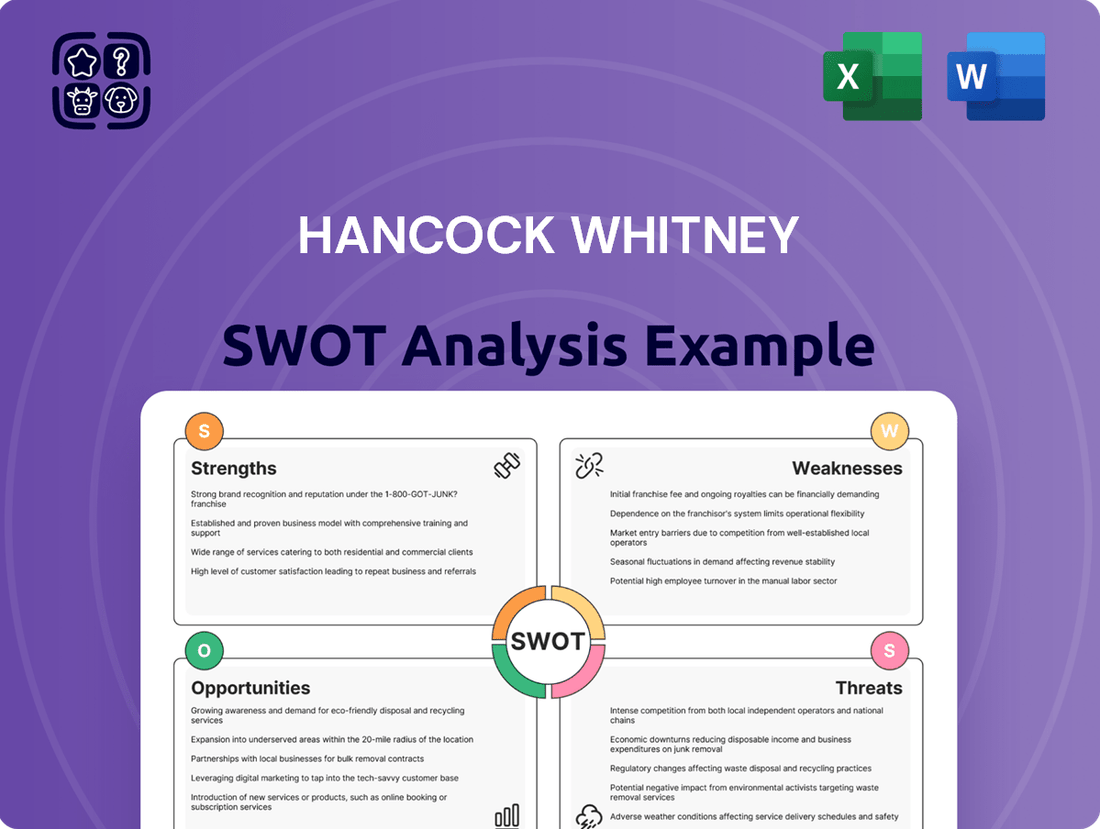

Hancock Whitney SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hancock Whitney Bundle

Hancock Whitney's robust market presence and strong customer loyalty are key strengths, but emerging digital competitors pose a significant threat. Understanding these dynamics is crucial for navigating the evolving financial landscape.

Want the full story behind Hancock Whitney's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hancock Whitney boasts a robust regional footprint, operating around 275 financial centers across key Gulf Coast states like Louisiana, Mississippi, Alabama, Florida, and Texas as of 2024. This extensive network fosters deep community engagement and a nuanced understanding of local market dynamics, which in turn cultivates strong, lasting customer relationships.

The bank's brand recognition is significantly bolstered by its long-standing history, originating in 1899. This heritage translates into a perception of stability and trustworthiness within its core operating regions, giving it a competitive edge.

Hancock Whitney's strength lies in its diverse revenue streams, offering a broad spectrum of financial products and services. These include core deposit and lending, alongside specialized areas like online banking, private banking, trust services, and investment management. The company also provides select insurance products, further broadening its income base.

This diversification across commercial banking, consumer banking, and wealth management is crucial. It significantly mitigates the risk of over-reliance on any single income source. For instance, as of Q1 2024, net interest income, a core banking revenue, was complemented by substantial non-interest income from fees and commissions across its various service lines, demonstrating this balanced approach.

Hancock Whitney has shown a positive trend in its financial results, with profitability on the rise. Net income per diluted share reached $5.28 in 2024, an increase from $4.50 in the prior year, and adjusted pre-provision net revenue also saw growth, underscoring operational improvements.

The bank's capital position remains a significant strength. As of the first quarter of 2025, its Common Equity Tier 1 (CET1) ratio was estimated at a healthy 14.51%, complemented by a Tangible Common Equity (TCE) ratio of 10.01%. These figures highlight a solid financial foundation and ample capacity to absorb potential risks.

Commitment to Shareholder Returns

Hancock Whitney demonstrates a strong commitment to rewarding its shareholders, evidenced by a long-standing practice of returning value. The company has maintained an unbroken streak of quarterly dividend payments since 1967, showcasing a stable and reliable income stream for investors.

This dedication to shareholder returns was further amplified in 2024 and 2025. Specifically, the Board of Directors approved a significant 33% increase in the quarterly dividend in April 2024, with another increase following in January 2025. Such consistent and growing dividend payouts reflect the company's financial robustness and its confidence in sustained future profitability.

- Consistent Dividend Payments: Uninterrupted quarterly dividends since 1967.

- Significant Dividend Increases: 33% increase approved in April 2024, with further growth in January 2025.

- Investor Confidence: Signals financial health and positive outlook to the market.

Strategic Initiatives for Growth

Hancock Whitney is actively pursuing strategic initiatives aimed at boosting its market standing and profitability. A key focus is the repositioning of its balance sheet, a move designed to expand its net interest margin. This strategy is crucial for improving overall financial performance in the current economic climate.

The bank is also prioritizing full-relationship loans, which typically involve a deeper engagement with customers and can lead to more stable, profitable business. This approach aims to build stronger, long-term customer loyalty and capture more of their financial needs.

Strategic acquisitions are another cornerstone of Hancock Whitney's growth plan. The acquisition of Sabal Trust Company, for instance, significantly bolsters its private wealth management services. This expansion is particularly targeted at high-growth regions such as Florida and Texas, where the demand for such services is robust.

- Balance Sheet Repositioning: Focused on expanding net interest margin.

- Loan Strategy: Emphasis on full-relationship loans for deeper customer engagement.

- Acquisition of Sabal Trust Company: Enhancing private wealth management capabilities.

- Geographic Expansion: Targeting high-growth markets like Florida and Texas.

Hancock Whitney's extensive regional presence, with approximately 275 financial centers across the Gulf Coast states as of 2024, fuels deep community ties and a keen understanding of local markets. This strong foundation, coupled with a brand reputation built on over a century of operation since 1899, instills trust and stability. The bank's diverse revenue streams, encompassing lending, deposits, wealth management, and specialized services, create a resilient financial model. This diversification is evident in its balanced income generation, where net interest income is consistently supported by robust non-interest income from fees and commissions.

The bank's financial health is underscored by its growing profitability, with net income per diluted share rising to $5.28 in 2024. Furthermore, Hancock Whitney maintains a robust capital position, evidenced by a Common Equity Tier 1 ratio of 14.51% and a Tangible Common Equity ratio of 10.01% as of Q1 2025, providing a solid buffer against potential risks.

Hancock Whitney's commitment to shareholder value is a key strength, marked by an unbroken history of quarterly dividend payments since 1967. This commitment was further demonstrated by a substantial 33% dividend increase in April 2024 and another in January 2025, signaling confidence in sustained profitability and financial strength.

| Metric | 2023 | 2024 | Q1 2025 |

| Net Income Per Diluted Share | $4.50 | $5.28 | N/A |

| CET1 Ratio | 14.2% | 14.4% | 14.51% |

| TCE Ratio | 9.8% | 9.9% | 10.01% |

What is included in the product

Analyzes Hancock Whitney’s competitive position through key internal and external factors, highlighting its strengths in regional presence and customer relationships while acknowledging challenges in digital transformation and market competition.

Offers a clear, actionable framework for identifying and addressing Hancock Whitney's strategic challenges and opportunities.

Weaknesses

Hancock Whitney's primary concentration within six Gulf Coast states, while a strategic advantage in those markets, also presents a significant weakness. This limited geographic footprint means the bank is more vulnerable to regional economic slowdowns or adverse events like natural disasters, which can disproportionately impact its financial performance compared to more geographically diversified institutions.

Hancock Whitney, like many financial institutions, faces inherent risks tied to interest rate volatility. While the Federal Reserve's anticipated rate cuts in 2025 could potentially lower funding costs and boost net interest margins (NIM), unforeseen policy shifts or a sustained inverted yield curve present a significant challenge.

For instance, if rates fall faster than anticipated, it could compress the spread between what the bank earns on loans and what it pays on deposits, impacting profitability. Conversely, if rates remain elevated longer than expected, it could increase borrowing costs for customers, potentially slowing loan growth and increasing credit risk.

Hancock Whitney faces a significant challenge from larger national banks that possess substantially greater financial resources and broader market reach. These larger institutions can often leverage economies of scale to offer more competitive pricing and a wider array of services, putting pressure on Hancock Whitney's market share.

The rise of agile fintech companies presents another formidable competitive threat. These firms frequently innovate rapidly, offering streamlined digital platforms and highly specialized financial solutions that appeal to evolving customer preferences, potentially siphoning off key customer segments that value convenience and cutting-edge technology.

For instance, in the first quarter of 2024, the banking sector continued to see significant digital adoption, with fintechs leading many of these advancements. While specific market share data for Hancock Whitney versus fintechs is complex to isolate, the overall trend indicates a growing preference for digital-first banking experiences, a space where fintechs often excel with lower overheads and focused product development.

Potential for Loan and Deposit Volatility

Hancock Whitney faces a potential weakness in the volatility of its loan and deposit balances. While the bank has experienced periods of growth, there have also been instances of sequential declines. For example, in the first quarter of 2025, both loans and deposits saw a decrease compared to the previous quarter.

This fluctuation highlights the challenges in managing deposit costs and sustaining consistent loan growth, especially within a dynamic economic landscape and a highly competitive banking sector.

- Loan Portfolio Fluctuations: Sequential declines in loans, as seen in Q1 2025, can impact revenue generation and asset growth strategies.

- Deposit Stability Concerns: Managing deposit costs and maintaining a stable, low-cost deposit base is crucial, and volatility here can pressure net interest margins.

- Economic Sensitivity: The bank's performance in loan and deposit growth is inherently linked to broader economic conditions and interest rate environments, creating inherent volatility.

Normalizing Credit Quality Metrics

Hancock Whitney's credit quality metrics, though generally sound, are showing signs of normalization. This is evidenced by slight increases in criticized commercial and non-accrual loans observed during certain reporting periods in late 2023 and early 2024. For instance, the bank reported a modest rise in non-performing assets in its Q4 2023 results.

While the bank maintains a strong allowance for credit losses, a potential economic downturn or stress in specific asset classes, such as commercial real estate, could pressure these figures. The ongoing adjustments in the CRE market, particularly for office properties, present a sector-specific vulnerability that warrants close monitoring for Hancock Whitney.

- Normalizing Trends: Observed upticks in criticized and non-accrual loans in recent periods.

- Economic Sensitivity: Potential for increased loan losses amid a broader economic slowdown.

- Sector Vulnerabilities: Specific risks associated with sectors like commercial real estate require attention.

- Allowance Adequacy: While the allowance for credit losses is robust, it faces testing from emerging credit concerns.

Hancock Whitney's concentrated geographic footprint along the Gulf Coast makes it susceptible to regional economic downturns and localized events, potentially impacting performance more severely than diversified competitors. For example, a significant hurricane in its core operating states could disrupt business and increase loan losses.

Same Document Delivered

Hancock Whitney SWOT Analysis

The preview you see is the actual Hancock Whitney SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This ensures you're getting exactly what you expect, a comprehensive and well-structured report.

Opportunities

Hancock Whitney has a significant opportunity to deepen its penetration in high-growth states like Texas and Florida, which are key components of its current operational footprint. These regions consistently demonstrate robust economic expansion and population influx, creating a fertile ground for banking services.

The bank is actively capitalizing on this by strategically opening new branches and recruiting experienced banking professionals. This expansion directly targets an increase in market share and a corresponding uplift in revenue streams, building on the bank's established presence.

For instance, in 2023, Texas saw a population growth of over 400,000 people, and Florida experienced a similar surge, highlighting the demand for financial services. This demographic shift presents a clear avenue for Hancock Whitney to acquire new customers and expand its loan and deposit portfolios.

Hancock Whitney can capitalize on the accelerating digital transformation within the banking sector. By enhancing its digital platforms and embracing AI and automation, the bank can create a more seamless and personalized customer experience, a key differentiator in today's market.

Strategic collaborations with fintech firms offer a pathway to introduce cutting-edge financial products and services, attracting a younger, digitally-oriented demographic. For instance, as of Q1 2024, the banking industry saw a 15% year-over-year increase in digital transaction volume, highlighting the growing customer preference for online channels.

The regional banking landscape is poised for increased merger and acquisition activity in 2025, fueled by potential regulatory easing and appealing asset valuations. Hancock Whitney, benefiting from its robust capital reserves, is well-positioned to pursue strategic acquisitions of smaller institutions or niche financial service firms. This approach could effectively broaden its market presence, grow its customer segments, and enhance its overall service portfolio.

Potential for Net Interest Margin Expansion with Rate Cuts

Hancock Whitney is positioned to potentially see its net interest margin (NIM) expand as the Federal Reserve is anticipated to implement interest rate cuts in 2025. This outlook is supported by the expectation that as certificates of deposit mature, they will be refinanced at lower prevailing rates, thereby reducing the bank's overall cost of funds. Coupled with a continued focus on diligent asset-liability management strategies, these factors are expected to contribute positively to the bank's profitability in the coming year.

Key drivers for this anticipated NIM expansion include:

- Lower Deposit Costs: As interest rates decline, the cost of funding for Hancock Whitney is expected to decrease, particularly on its certificate of deposit portfolio.

- Disciplined Asset-Liability Management: Proactive management of the bank's assets and liabilities will be crucial in capitalizing on the changing rate environment.

- Potential for Improved Profitability: The combination of reduced funding costs and effective balance sheet management could lead to a healthier net interest margin.

Growth in Wealth Management and Fee Income

Hancock Whitney's wealth management division and other fee-based revenue streams represent a significant avenue for expansion. The company's strategic acquisition of Sabal Trust Company in 2023, for instance, was a clear move to bolster its wealth management capabilities and revenue. This focus is expected to pay off as asset valuations and broader capital markets activity continue to trend upwards, potentially boosting non-interest income for the bank.

Several factors contribute to this positive outlook:

- Acquisition Strategy: The Sabal Trust acquisition directly targets the growth of wealth management revenue.

- Market Conditions: Rising asset valuations and increased capital markets activity are favorable tailwinds for fee-based income.

- Diversification of Revenue: Expanding fee income helps diversify the bank's revenue streams beyond traditional net interest income.

Hancock Whitney's strategic focus on high-growth markets like Texas and Florida, which saw significant population increases in 2023, presents a prime opportunity for expanding its customer base and loan portfolios. The bank is also leveraging digital transformation, with industry-wide digital transaction volumes rising 15% year-over-year in Q1 2024, to enhance customer experience and attract a younger demographic through fintech collaborations.

Furthermore, the anticipated interest rate cuts in 2025 could boost Hancock Whitney's net interest margin as deposit costs decrease, provided effective asset-liability management is maintained. The bank's acquisition of Sabal Trust Company in 2023 also positions it to capitalize on growth in wealth management and fee-based income, supported by favorable market conditions for asset valuations.

| Opportunity Area | Supporting Data/Trend | Potential Impact |

|---|---|---|

| Geographic Expansion | Texas & Florida population growth (2023) | Increased market share, loan & deposit growth |

| Digital Transformation | 15% YoY rise in digital transactions (Q1 2024) | Enhanced customer experience, new customer acquisition |

| Interest Rate Environment | Anticipated Fed rate cuts (2025) | Potential Net Interest Margin (NIM) expansion |

| Wealth Management Growth | Sabal Trust acquisition (2023), rising asset valuations | Diversified revenue, increased fee income |

Threats

A general deceleration in economic growth, particularly noticeable with moderating consumer spending and potentially weaker employment conditions anticipated in 2025, could significantly dampen loan demand. This macroeconomic environment poses a substantial threat to Hancock Whitney's asset quality and overall profitability.

The risk of recession increases the likelihood of higher credit delinquencies across the bank's diverse loan portfolios. For instance, if GDP growth, which was projected to be around 1.8% for the US in late 2024, slows further or turns negative in 2025, it directly impacts borrowers' ability to repay loans.

Hancock Whitney, like many regional banks, faces potential headwinds from its commercial real estate (CRE) portfolio, especially within the office sector. As of early 2024, the office CRE market continues to grapple with elevated vacancy rates and shifting tenant demands, posing a risk of increased loan losses.

Banks in the $10 billion to $100 billion asset range, which includes Hancock Whitney, tend to have a more significant CRE loan exposure relative to their risk-based capital. This heightened exposure means that any downturn in the CRE market could disproportionately impact their financial stability.

Hancock Whitney, like many financial institutions, operates in an environment of increasing regulatory oversight. New regulations, particularly around data privacy and consumer protection, are becoming more common and stringent. For instance, in 2024, the banking sector continued to grapple with the implementation of various consumer protection rules aimed at enhancing transparency and fairness in financial products.

These evolving compliance demands translate directly into higher operational expenses for Hancock Whitney. Significant investments are often necessary for technology upgrades, staff training, and robust internal controls to meet these requirements, potentially impacting the bank's bottom line and requiring careful resource allocation to maintain profitability.

Intensified Competition from Digital-First Players

The financial landscape is increasingly shaped by digital-first competitors, presenting a significant challenge. These fintech firms often offer superior customer experiences, characterized by speed and efficiency, which can attract customers seeking seamless digital interactions. For instance, the digital banking sector saw substantial growth, with neobanks acquiring millions of customers rapidly by 2024, highlighting this shift. Hancock Whitney must therefore invest considerably in its digital capabilities to remain competitive.

This intensified competition necessitates a strategic response. Traditional banks like Hancock Whitney face pressure to modernize their platforms and services to match the agility and user-friendliness of fintech offerings. Failing to adapt could lead to a gradual erosion of market share as customers migrate to more digitally adept providers. By Q1 2025, many regional banks reported increased spending on technology upgrades to counter this trend.

- Fintechs' Agile Development: Digital-first players can innovate and deploy new features much faster than traditional institutions.

- Customer Experience Focus: Fintechs prioritize intuitive design and user-friendly interfaces, setting new customer expectations.

- Cost Efficiencies: Digital-native models often have lower overheads, allowing them to offer more competitive pricing or better rates.

- Data Analytics Prowess: Fintechs leverage data analytics to personalize offerings and improve customer targeting, a capability traditional banks are working to replicate.

Cybersecurity Risks and Data Breaches

As financial services increasingly rely on digital platforms, the threat of cyberattacks and data breaches grows significantly. For a financial institution like Hancock Whitney, a successful cyberattack could lead to substantial financial losses, severe reputational damage, and a critical erosion of customer trust.

These risks are amplified by the evolving sophistication of cyber threats. For instance, the financial services sector consistently reports high average costs associated with data breaches. In 2023, IBM's Cost of a Data Breach Report indicated that financial services experienced the highest average cost of a breach at $5.90 million, underscoring the potential financial impact.

- Increased Attack Surface: Growing reliance on digital channels expands the potential entry points for cyber threats.

- Financial Repercussions: Data breaches can result in direct financial losses through theft, recovery costs, and regulatory fines.

- Reputational Damage: A breach can severely damage customer confidence and the institution's standing in the market.

- Operational Disruption: Cyberattacks can halt critical business operations, impacting service delivery.

Economic slowdowns and potential recessions in 2025 pose a significant threat, increasing the risk of loan defaults and impacting Hancock Whitney's profitability, especially if GDP growth continues to decelerate. The bank's exposure to the commercial real estate sector, particularly offices, remains a concern due to elevated vacancy rates and shifting tenant needs, which could lead to higher loan losses.

Increased regulatory scrutiny and compliance costs, especially concerning data privacy and consumer protection, demand ongoing investment in technology and internal controls, potentially impacting the bottom line. Furthermore, intense competition from agile fintech companies, which excel in customer experience and cost efficiencies, necessitates substantial digital transformation efforts to retain market share.

The growing sophistication of cyber threats presents a substantial risk, with the financial services sector experiencing high average costs for data breaches, as evidenced by reports from 2023. A successful cyberattack could result in significant financial losses, severe reputational damage, and a critical erosion of customer trust.

| Threat Category | Specific Risk | Potential Impact | Data Point/Context |

|---|---|---|---|

| Economic Slowdown | Increased loan delinquencies | Reduced profitability, higher credit losses | US GDP growth projected around 1.8% late 2024; further deceleration in 2025 could increase defaults. |

| Commercial Real Estate (CRE) | CRE loan losses (office sector) | Impact on asset quality and capital ratios | Office CRE market facing elevated vacancies as of early 2024. |

| Regulatory Environment | Higher compliance costs | Increased operational expenses, reduced net income | Ongoing implementation of stringent consumer protection rules in 2024. |

| Competitive Landscape | Erosion of market share to fintechs | Loss of customers and revenue | Neobanks acquired millions of customers rapidly by 2024; regional banks increased tech spending by Q1 2025. |

| Cybersecurity | Data breaches and financial losses | Reputational damage, operational disruption, direct financial costs | Financial services sector had highest average data breach cost at $5.90 million in 2023. |

SWOT Analysis Data Sources

This Hancock Whitney SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and accurate strategic overview.