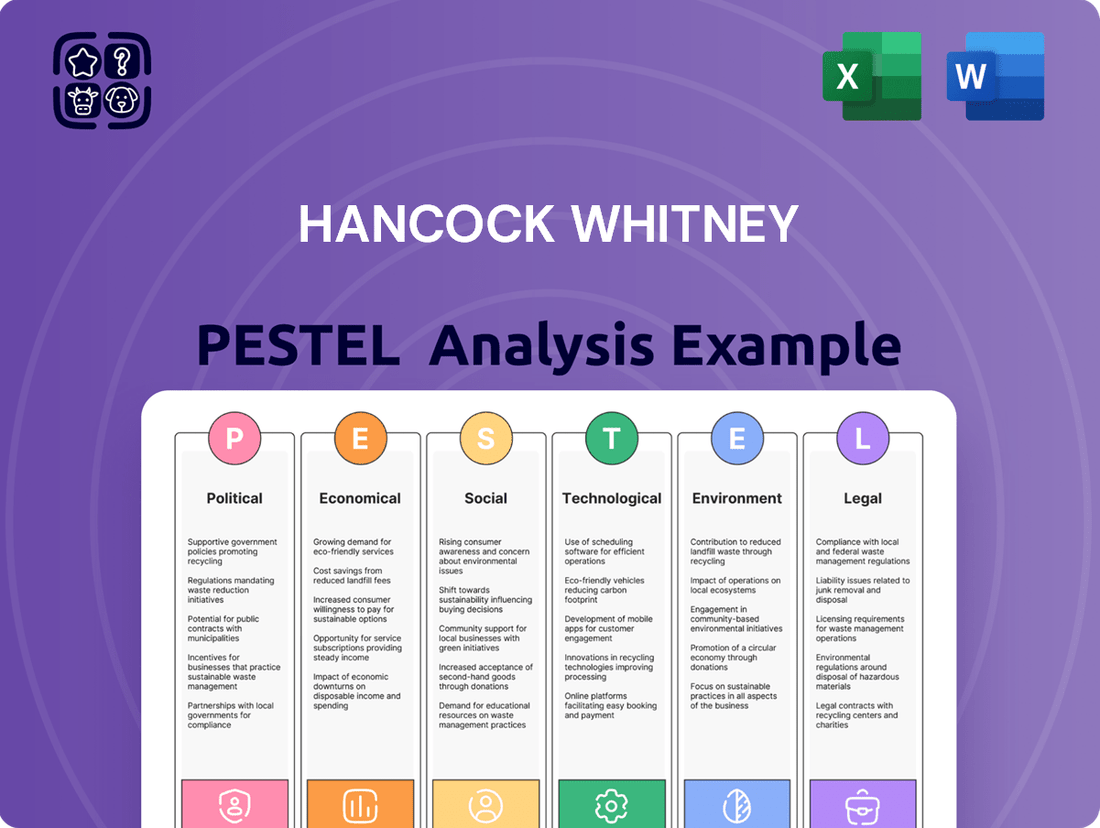

Hancock Whitney PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hancock Whitney Bundle

Uncover the critical political, economic, and technological forces shaping Hancock Whitney's strategic landscape. Our meticulously researched PESTLE analysis provides a clear roadmap to understanding these external influences, empowering you to anticipate market shifts and capitalize on opportunities. Get the full version now to gain a decisive competitive advantage.

Political factors

Governmental monetary policy, particularly changes in the Federal Reserve's interest rate decisions, directly impacts Hancock Whitney's profitability. When the Fed eases rates, as anticipated with potential cuts in late 2024 and throughout 2025, it can affect the bank's net interest margin by influencing both the cost of deposits and the yields on loans.

Hancock Whitney projects a modest but steady increase in its net interest margin for 2025. This forecast is contingent on the Federal Reserve implementing three 25 basis point rate reductions, specifically in July, September, and December of 2025.

The banking sector operates under a strict regulatory framework, and shifts in legislation directly impact Hancock Whitney's business and financial performance. For instance, the Consumer Financial Protection Bureau's (CFPB) Personal Financial Data Rights Rule, set to take effect April 1, 2027, for institutions of Hancock Whitney's size, mandates greater data sharing with consumers and third parties, necessitating significant compliance adjustments.

This evolving regulatory landscape, heightened by recent bank failures, demands robust adaptation. Hancock Whitney must continuously refine its compliance strategies to navigate new rules and maintain operational integrity. The CFPB's initiative, aimed at fostering competition and transparency, will require substantial investment in systems and processes to meet data access and security requirements.

Changes in federal and state tax laws directly impact Hancock Whitney's profitability and strategic investment choices. For instance, shifts in corporate tax rates or the introduction of new tax incentives can alter the attractiveness of various business ventures and capital allocation strategies.

The company's capacity to leverage new tax credits for specific projects is often contingent on the prevailing tax policies and the competitive landscape for those credits. Hancock Whitney's financial statements, such as its 2023 annual report, detail its net deferred tax asset and its involvement in investments designed to utilize tax credits, underscoring the significance of these political factors.

Political Stability and Geopolitical Events

Hancock Whitney's operational focus on the U.S. Gulf South means its political risk is largely tied to domestic policy and the stability of those specific states. While major geopolitical shifts like potential regime change in China or trade disputes, such as ongoing tariff impacts, are monitored for their broader economic implications, they don't directly translate into operational disruptions for Hancock Whitney in the same way they might for a global bank. The bank's economic outlooks incorporate these wider events as they influence national and regional economic conditions, which in turn affect lending and investment environments.

The banking sector's performance is inherently linked to the political climate, influencing regulatory frameworks, interest rate policies, and consumer confidence. For Hancock Whitney, this translates to how state-level economic development initiatives or changes in federal banking regulations might impact its business. For instance, shifts in fiscal policy or government spending in its core operating regions could affect local business growth and, by extension, loan demand and credit quality.

While specific numbers on the direct impact of foreign geopolitical events on Hancock Whitney's regional operations are not typically disclosed, the bank's financial reporting and investor communications often allude to the consideration of macroeconomic factors. These factors are influenced by political stability and global events. For example, the Federal Reserve's monetary policy decisions, which are shaped by economic conditions influenced by both domestic and international politics, directly affect the bank's net interest margin. In Q1 2024, the Federal Reserve maintained its benchmark interest rate, a decision influenced by a complex interplay of economic data and political considerations.

Key political factors impacting Hancock Whitney include:

- Domestic Regulatory Environment: Changes in banking regulations at the federal and state levels can significantly alter compliance costs and operational flexibility.

- State and Local Economic Policies: Initiatives promoting business growth, infrastructure development, or tax incentives in the Gulf South states can directly influence the bank's lending opportunities and the financial health of its clients.

- Broader Geopolitical Stability: While not a primary operational risk, global events that impact U.S. economic growth, inflation, or interest rates are factored into the bank's strategic planning and risk management.

Government Spending and Infrastructure Projects

Government spending on infrastructure, such as transportation and energy projects, can significantly boost economic activity within Hancock Whitney's core markets. For instance, in 2024, the U.S. Department of Transportation announced billions in funding for infrastructure improvements, directly benefiting regions where Hancock Whitney operates. This increased economic activity translates into higher demand for commercial loans and mortgages, creating new avenues for business growth.

Hancock Whitney's strategic focus on commercial and industrial lending, coupled with its expansion into dynamic markets like Texas, positions it to capitalize on these government-driven economic expansions. Texas, in particular, has seen substantial investment in infrastructure projects, with state and federal funding allocated for highway upgrades and utility modernization throughout 2024 and projected into 2025. These developments are expected to foster a more robust business environment, increasing the need for banking services.

- Increased Loan Demand: Infrastructure spending fuels business expansion, leading to greater demand for commercial and industrial loans from banks like Hancock Whitney.

- Market Expansion: Initiatives in high-growth markets such as Texas, which is a key focus for Hancock Whitney, are particularly sensitive to infrastructure investment.

- Economic Stimulus: Government investment in projects like the Bipartisan Infrastructure Law's allocation of $550 billion for infrastructure over five years (starting in 2022) provides a sustained economic tailwind.

- New Business Opportunities: The ripple effect of infrastructure projects creates opportunities for businesses that Hancock Whitney serves, thereby enhancing its own business prospects.

Government policies, particularly monetary and fiscal actions, significantly shape Hancock Whitney's operating environment. Anticipated Federal Reserve rate cuts in late 2024 and throughout 2025 could influence net interest margins, while federal and state tax law changes directly impact profitability and investment strategies.

Regulatory shifts are paramount, with new rules like the CFPB's Personal Financial Data Rights Rule (effective April 1, 2027) requiring significant compliance investments. Government spending on infrastructure projects, such as the Bipartisan Infrastructure Law's $550 billion allocation, stimulates economic activity in Hancock Whitney's core Gulf South markets, boosting loan demand and creating new business opportunities, especially in growth markets like Texas.

| Political Factor | Impact on Hancock Whitney | 2024/2025 Relevance |

|---|---|---|

| Monetary Policy (Fed Rates) | Affects Net Interest Margin (NIM) | Potential rate cuts in late 2024/2025 influencing NIM. |

| Regulatory Environment (CFPB Rule) | Increases compliance costs and operational changes | Rule effective April 1, 2027, requiring preparation. |

| Fiscal Policy (Infrastructure Spending) | Drives economic growth and loan demand | Bipartisan Infrastructure Law ($550B) supports Gulf South markets and Texas expansion. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Hancock Whitney across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key trends and their implications for the bank's operations and future growth.

The Hancock Whitney PESTLE Analysis offers a structured approach to understanding external forces, thereby alleviating the pain of uncertainty and enabling more informed strategic decision-making.

Economic factors

The prevailing interest rate environment, largely shaped by the Federal Reserve, significantly impacts Hancock Whitney's financial performance. In the first quarter of 2025, the company saw its net interest margin improve, a trend driven by lower deposit rates and more favorable yields on its securities portfolio.

Looking ahead to the remainder of 2025, Hancock Whitney anticipates further benefits from a declining cost of deposits as promotional pricing is scaled back. This strategic adjustment is projected to bolster net interest income throughout the year.

Inflationary pressures are a significant concern for Hancock Whitney, directly influencing its noninterest expenses. For 2024, the bank projects an increase in these expenses due to inflation, though it expects the growth rate to moderate compared to 2023. This careful monitoring of inflation is crucial for managing operational costs effectively.

Employment trends also play a vital role, impacting both loan demand and the overall credit quality of the bank's portfolio. Hancock Whitney's asset management team actively analyzes these economic indicators, viewing them as key highlights for their 2025 outlook. Strong employment typically correlates with higher loan demand and improved borrower repayment capabilities.

Loan and deposit growth are fundamental to Hancock Whitney's performance, directly reflecting the broader economic climate. In the first quarter of 2025, the bank experienced a sequential decline in both loan and deposit volumes.

Despite this Q1 dip, management anticipates a turnaround, projecting low-single-digit growth for both loans and deposits by the end of 2025. This optimism is particularly tied to expectations of easing interest rates in the latter half of the year, which should stimulate loan demand and, consequently, deposit inflows.

Regional Economic Performance

Hancock Whitney's financial health is intrinsically linked to the economic performance of the Gulf Coast region, its primary operational theater. For instance, in Q1 2024, the company reported strong net interest income growth, partly fueled by the economic expansion in these states.

The company is strategically targeting high-growth markets, notably Texas and Florida, to capitalize on their robust economic potential. Texas's GDP growth outpaced the national average in 2023, and Florida's economy continues to see significant population influx, driving demand for financial services.

The acquisition of Sabal Trust Company in late 2023 is a key move to bolster Hancock Whitney's wealth management services, particularly within the thriving Florida market. This expansion is expected to enhance fee income streams and client acquisition in a state projected to see continued economic and population growth through 2025.

- Gulf Coast Economic Vitality: Hancock Whitney's performance is directly influenced by the economic health of states like Mississippi, Alabama, Louisiana, Florida, and Texas.

- Texas Growth: Texas's economic expansion, with a projected GDP growth of 2.5% in 2024, presents significant opportunities for Hancock Whitney.

- Florida Expansion: The acquisition of Sabal Trust Company aims to capture Florida's growing wealth management market, a state expecting continued population and economic growth.

Consumer Spending and Business Investment

Consumer spending is a significant driver for Hancock Whitney, directly influencing demand for banking products like loans and deposit accounts. As of early 2024, consumer spending showed resilience, with retail sales increasing by 0.6% in January 2024, indicating continued economic activity. This trend is crucial for the bank's revenue streams.

Business investment levels also play a vital role, reflecting confidence in the economic outlook and impacting corporate banking services. While business investment saw some fluctuations in late 2023, projections for 2024 suggest a gradual improvement, potentially boosting demand for commercial lending and other financial solutions. Hancock Whitney's asset management team actively tracks these investment trends.

- Consumer spending growth: Retail sales saw a 0.6% increase in January 2024, signaling robust consumer activity.

- Business investment outlook: Projections indicate a gradual improvement in business investment for 2024.

- Impact on banking: Both consumer spending and business investment directly affect demand for Hancock Whitney's loan and deposit products.

- Monitoring trends: Hancock Whitney's asset management team closely monitors these economic indicators.

Economic factors significantly shape Hancock Whitney's operational landscape and strategic planning. The prevailing interest rate environment, influenced by the Federal Reserve, directly impacts the bank's net interest margin. In Q1 2025, Hancock Whitney experienced improved net interest margins, partly due to lower deposit costs and better yields on its securities. Looking ahead, the bank anticipates further benefits from decreasing deposit rates throughout 2025, projecting a boost to net interest income. Inflation remains a key concern, with projected increases in non-interest expenses for 2024, though at a slower pace than the prior year.

Consumer spending and business investment are critical drivers for loan and deposit growth. Resilient consumer spending, evidenced by a 0.6% rise in retail sales in January 2024, supports demand for banking products. While business investment saw some volatility in late 2023, 2024 projections indicate a gradual recovery, which could spur commercial lending. Hancock Whitney's performance is also closely tied to the economic vitality of the Gulf Coast region. The bank is strategically expanding into high-growth markets like Texas, which saw its GDP growth outpace the national average in 2023, and Florida, benefiting from population influx and economic expansion.

| Economic Indicator | Hancock Whitney Impact | Recent Data/Outlook |

|---|---|---|

| Interest Rates | Net Interest Margin, Loan Demand | Q1 2025 NIM improved; anticipate benefits from declining deposit costs through 2025. |

| Inflation | Non-Interest Expenses | Projected increase in non-interest expenses for 2024, moderating from 2023. |

| Consumer Spending | Loan & Deposit Demand | Retail sales up 0.6% Jan 2024; supports demand for banking products. |

| Business Investment | Commercial Lending Demand | Projections for gradual improvement in business investment for 2024. |

| Regional GDP Growth (Texas) | Market Opportunity | Texas GDP growth outpaced national average in 2023; projected 2.5% growth in 2024. |

What You See Is What You Get

Hancock Whitney PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hancock Whitney PESTLE Analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, offering valuable strategic insights.

Sociological factors

Demographic shifts in the Gulf South significantly shape banking needs. For instance, the region's aging population, with a notable increase in individuals aged 65 and over, may drive demand for retirement planning services and wealth management. Conversely, a growing millennial and Gen Z population could increase demand for digital banking solutions and accessible credit.

Hancock Whitney's client base, spanning individuals and businesses, must be understood through these demographic lenses. As of 2024, the Gulf South continues to experience in-migration, particularly in metropolitan areas, potentially boosting the need for mortgages and small business loans. Understanding these evolving income levels and migration patterns is crucial for tailoring product development and marketing strategies.

Customer preferences are rapidly shifting, with a growing demand for seamless digital banking experiences and highly personalized financial advice. Hancock Whitney recognizes this, having invested over $100 million in technology upgrades through 2024 to bolster its digital platforms and data analytics capabilities. This focus aims to improve customer satisfaction, which stood at 85% in their latest survey.

The financial literacy of a population directly impacts the demand for specific banking products and services. For instance, a financially savvy customer might seek more complex investment options, while someone with lower literacy may prefer simpler savings accounts.

Hancock Whitney actively invests in community financial education programs. These initiatives aim to boost economic well-being by equipping individuals with essential money management skills, potentially leading to increased engagement with their financial services.

Data from the FINRA Foundation's 2023 National Financial Capability Study indicated that only 57% of Americans could answer at least four out of five questions correctly on a financial literacy quiz, highlighting a significant opportunity for banks like Hancock Whitney to bridge this knowledge gap.

Community Engagement and Social Responsibility

Hancock Whitney actively demonstrates its commitment to social responsibility through robust volunteerism, strategic philanthropy, and dedicated community development efforts. For instance, in 2023, the company reported over 15,000 associate volunteer hours dedicated to various community initiatives, a slight increase from 2022's 14,500 hours. This engagement is not merely about time; it's about tangible impact, such as their ongoing support for projects like building playgrounds in underserved areas and providing crucial aid to numerous non-profit organizations across the Gulf South region.

The bank’s focus on enriching lives is evident in its targeted programs. In 2024, Hancock Whitney pledged $5 million over five years to support affordable housing initiatives, aiming to create or preserve over 1,000 housing units by 2029. This commitment underscores a deeper understanding of societal needs and a proactive approach to fostering well-being within the communities it serves.

- Volunteer Hours: Over 15,000 associate volunteer hours reported in 2023.

- Philanthropic Pledge: $5 million committed to affordable housing initiatives through 2029.

- Community Impact: Focus on tangible projects like playground construction and non-profit support.

- Regional Focus: Deep commitment to improving the lives of people in the Gulf South.

Workforce Demographics and Talent Acquisition

Attracting and retaining a skilled workforce is a critical sociological challenge for Hancock Whitney, especially within the highly competitive financial services sector. The company's approximately 3,500 associates are the backbone of its operations, and a strong internal culture, driven by core values, is key to its success.

Hancock Whitney's focus on its associates is evident in its efforts to foster a positive work environment. This includes investing in training and development programs designed to enhance employee skills and career progression, which is crucial for talent retention in a rapidly evolving industry.

- Employee Engagement: Initiatives aimed at boosting employee morale and commitment are vital for productivity and service quality.

- Talent Development: Continuous learning opportunities ensure the workforce remains adept at navigating financial market changes and technological advancements.

- Diversity and Inclusion: A diverse workforce often brings a wider range of perspectives, enhancing problem-solving and innovation within the company.

- Workforce Planning: Proactive strategies are needed to anticipate future talent needs and address potential skill gaps.

Sociological factors significantly influence Hancock Whitney's operational landscape, with demographic shifts like an aging population and growing younger demographics impacting service demands. The company's investment in digital banking and personalized advice reflects a response to evolving customer preferences, aiming to maintain its 85% customer satisfaction rating. Furthermore, a focus on financial literacy through community programs addresses a gap, as only 57% of Americans demonstrated strong financial literacy in a 2023 study.

Hancock Whitney's commitment to social responsibility is demonstrated through substantial community engagement, with over 15,000 associate volunteer hours in 2023 and a $5 million pledge for affordable housing. Attracting and retaining a skilled workforce of approximately 3,500 associates is also a key sociological consideration, addressed through investments in training and development to foster a positive work environment.

Technological factors

Hancock Whitney's competitive edge hinges on embracing digital banking and mobile platforms. In 2024, the company rolled out updated mobile applications, offering customers round-the-clock access to their accounts, mobile wallet capabilities, streamlined bill payment, and convenient mobile check deposits. This strategic move directly addresses the growing consumer demand for accessible and user-friendly digital financial services.

Hancock Whitney, like all financial institutions, operates under the constant threat of cyberattacks, necessitating substantial and ongoing investment in cybersecurity. Protecting sensitive customer data is paramount, and the bank must deploy advanced technologies and strategies to prevent breaches. The financial services sector experienced a 22% increase in reported cyber incidents in 2023, highlighting the escalating risks.

Federal regulations, such as the Gramm-Leach-Bliley Act, and various state-level data protection laws impose strict requirements on financial firms like Hancock Whitney. These mandates require the implementation of comprehensive information security programs, including risk assessments, employee training, and incident response plans, to ensure the safeguarding of consumer data.

Hancock Whitney is leveraging automation and AI to streamline operations, aiming for enhanced efficiency and improved customer interactions. This technological integration supports the company's strategic procurement efforts to meet expense targets, as seen in their ongoing investments in digital transformation initiatives. For instance, in 2023, the company reported a significant increase in digital transaction volumes, indicating successful adoption of automated processes.

Financial Technology (FinTech) Partnerships and Competition

The escalating presence of FinTech firms is a dual-edged sword for established institutions like Hancock Whitney, offering avenues for collaboration while simultaneously intensifying competition. Hancock Whitney needs to actively assess how innovations in financial technology could either disrupt its current service offerings or unlock new avenues for expansion.

Emerging FinTech solutions, particularly in areas like digital payments, lending platforms, and wealth management, are reshaping customer expectations and operational efficiencies. For instance, the digital lending market saw significant growth, with FinTech lenders originating a substantial portion of small business loans in recent years, a trend that continues to accelerate into 2024 and 2025.

- Partnership Potential: Collaborating with FinTechs can allow traditional banks to integrate innovative services, such as AI-powered chatbots for customer service or blockchain for faster transaction processing, enhancing customer experience and operational efficiency.

- Competitive Landscape: FinTechs often operate with lower overheads and greater agility, enabling them to offer competitive rates and faster service delivery, directly challenging traditional banking models.

- Disruptive Technologies: Advancements in areas like open banking and embedded finance are creating new competitive pressures and opportunities, requiring banks to adapt their strategies to remain relevant.

- Investment and Acquisition: Many banks are responding by investing in or acquiring FinTech startups to gain access to new technologies and customer bases, a trend expected to continue as the market matures through 2025.

Data Analytics and Business Intelligence

Hancock Whitney's strategic use of data analytics and business intelligence is crucial for understanding its customer base and market dynamics. By leveraging these tools, the bank can identify emerging trends and better assess potential risks, leading to more effective strategies. For instance, in 2024, the financial services sector saw a significant increase in the adoption of AI-powered analytics to personalize customer experiences and optimize operational efficiency.

This data-driven approach directly informs Hancock Whitney's investment strategies and overall business planning. The ability to analyze vast datasets allows for more precise forecasting and resource allocation. Companies that effectively utilize business intelligence reported an average of 5-10% higher revenue growth compared to their peers in recent industry surveys. This highlights the tangible benefits of integrating advanced analytics into core business functions.

Key areas where data analytics provides a competitive edge for Hancock Whitney include:

- Enhanced Customer Segmentation: Identifying distinct customer groups to tailor product offerings and marketing campaigns.

- Predictive Risk Management: Utilizing data to anticipate and mitigate credit, market, and operational risks.

- Optimized Marketing ROI: Measuring the effectiveness of campaigns and refining strategies for better returns.

- Improved Operational Efficiency: Streamlining processes by analyzing performance data and identifying bottlenecks.

Hancock Whitney's technological advancement is centered on enhancing digital accessibility and operational efficiency. The bank's investment in updated mobile applications in 2024, offering features like mobile wallets and check deposits, directly addresses evolving customer preferences for seamless digital banking. Furthermore, the strategic integration of automation and AI is streamlining internal processes, as evidenced by increased digital transaction volumes reported in 2023, supporting expense management goals.

Legal factors

Hancock Whitney navigates a stringent regulatory environment, governed by federal bodies like the Federal Deposit Insurance Corporation (FDIC) and the Consumer Financial Protection Bureau (CFPB), alongside state-level oversight. These regulations dictate crucial operational aspects, from maintaining adequate capital reserves, with the Common Equity Tier 1 (CET1) ratio being a key metric, to adhering to fair lending practices and robust consumer protection standards.

Consumer protection laws, such as those concerning data privacy and fair lending practices, significantly shape Hancock Whitney's operational framework. These regulations mandate how the bank manages customer information and extends credit, directly influencing its product development and marketing strategies.

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in enforcing these protections. For example, the CFPB's proposed Personal Financial Data Rights Rule, expected to be finalized in 2024, will further govern how financial institutions like Hancock Whitney handle and share sensitive customer data, requiring robust consent mechanisms and data security protocols.

Compliance with these evolving legal landscapes, including those related to credit reporting and fair lending, requires ongoing investment in technology and training. Failure to adhere to these consumer protection statutes can result in substantial fines and reputational damage, impacting Hancock Whitney's market position and customer trust.

Hancock Whitney operates under stringent anti-money laundering (AML) and sanctions regulations, crucial for combating financial crime. These legal frameworks mandate comprehensive internal controls, including thorough transaction monitoring and suspicious activity reporting, to ensure compliance. For instance, in 2023, the Financial Crimes Enforcement Network (FinCEN) reported over 2.7 million Suspicious Activity Reports (SARs), highlighting the pervasive nature of financial crime and the regulatory burden on financial institutions.

Data Privacy and Security Laws

Hancock Whitney must navigate a complex web of data privacy and security laws. Beyond general cybersecurity measures, specific regulations govern the collection, storage, and utilization of personally identifiable information (PII). These laws, including federal and state banking regulations, impose strict standards on how customer data is handled and protected.

For instance, the Gramm-Leach-Bliley Act (GLBA) mandates financial institutions to explain their information-sharing practices to their customers and to safeguard sensitive data. In 2024, the landscape continues to evolve with ongoing discussions and potential updates to privacy frameworks across various states, impacting how banks like Hancock Whitney manage customer trust and data stewardship.

- GLBA requirements necessitate clear customer notification of data sharing practices.

- State-specific privacy laws are increasingly influencing data handling protocols.

- Non-public information disclosure is significantly limited by federal and state banking regulations.

- Data protection standards are prescribed, requiring robust security measures for customer information.

Contract Law and Lending Agreements

Hancock Whitney's operations are heavily influenced by contract law, particularly concerning its lending and service agreements. Each agreement requires rigorous legal scrutiny to ensure it's legally sound and to minimize potential legal challenges. This is crucial given the company's substantial loan portfolio.

The enforceability of these contracts is paramount, as they form the backbone of Hancock Whitney's financial relationships with its customers. In 2024, the company reported that its total loan portfolio stood at approximately $23.4 billion, underscoring the sheer volume of contractual obligations it manages.

- Contractual Compliance: Ensuring all lending and service agreements meet legal standards is vital for Hancock Whitney's operational integrity.

- Risk Mitigation: Meticulous legal review helps prevent disputes and reduces the likelihood of costly litigation.

- Loan Portfolio Management: The vastness of its $23.4 billion loan portfolio in 2024 highlights the scale of contractual agreements.

- Regulatory Adherence: Contract law is a fundamental component of the broader regulatory framework governing financial institutions.

Hancock Whitney's legal environment is shaped by a robust framework of federal and state regulations, impacting everything from capital adequacy to consumer interactions.

Key regulatory bodies like the FDIC and CFPB enforce rules on fair lending, data privacy, and anti-money laundering, requiring significant compliance efforts and investments.

For instance, the CFPB's ongoing work on personal financial data rights in 2024 will necessitate enhanced consent and security protocols for customer information, directly affecting how Hancock Whitney operates.

Contract law is also fundamental, governing Hancock Whitney's extensive loan portfolio, which reached approximately $23.4 billion in 2024, making adherence to contractual terms critical for financial stability and risk management.

| Regulatory Area | Key Legislation/Body | Impact on Hancock Whitney | 2024/2025 Focus |

|---|---|---|---|

| Consumer Protection | CFPB, Fair Lending Laws | Mandates fair credit practices, data privacy | Personal Financial Data Rights Rule implementation |

| Financial Crime | FinCEN, AML Regulations | Requires transaction monitoring, SAR filing | Continued vigilance against evolving financial crime |

| Data Security | GLBA, State Privacy Laws | Governs PII handling and protection | Adapting to evolving state-specific privacy mandates |

| Contractual Obligations | Contract Law | Underpins loan and service agreements | Managing $23.4 billion loan portfolio requires strict compliance |

Environmental factors

Hancock Whitney's Gulf South footprint makes it particularly vulnerable to climate change and natural disasters like hurricanes. These events pose physical risks that could impact loan collateral values, increase insurance expenses, and cause operational disruptions. For instance, the economic impact of Hurricane Ida in 2021, which caused billions in damages across Louisiana, highlights the potential financial strain on the region and its businesses, directly affecting borrowers and the bank's asset quality.

Hancock Whitney is increasingly aligning its corporate strategy with growing investor and public demand for Environmental, Social, and Governance (ESG) factors. This focus is evident in their detailed ESG reports, which outline tangible actions taken to enhance sustainability.

The company's commitment to environmental stewardship is demonstrated through specific initiatives aimed at reducing its ecological footprint. For instance, Hancock Whitney has reported efforts to decrease energy consumption across its operations and has invested in upgrading its HVAC systems, contributing to greater energy efficiency.

Hancock Whitney's operational costs are directly influenced by the availability and price of natural resources, especially energy. Fluctuations in oil and gas prices, for instance, can impact everything from transportation costs to the overall economic climate, affecting consumer and business spending, which in turn influences loan demand and deposit growth for the bank.

The company is actively addressing environmental concerns through tangible actions. For example, Hancock Whitney has invested in upgrading its HVAC systems to boost energy efficiency, a move that not only reduces its carbon footprint but also lowers utility expenses. These upgrades also focus on preventing refrigerant leakage, contributing to broader environmental protection efforts.

Pollution and Waste Management

While not a manufacturing giant, Hancock Whitney, like any modern business, contributes to waste generation and resource consumption through its daily operations. The company acknowledges this and integrates responsible waste management practices into its broader environmental, social, and governance (ESG) strategy. This commitment aims to minimize its ecological impact.

Hancock Whitney's focus on sustainability includes efforts to reduce its carbon footprint and manage waste streams effectively. For instance, in 2023, the company reported progress in its digital transformation initiatives, which inherently reduce paper consumption and associated waste. Their commitment extends to exploring more sustainable operational practices, aligning with increasing regulatory and stakeholder expectations for environmental stewardship.

- Waste Reduction Initiatives: Focused efforts to decrease paper usage and promote recycling programs across all branches.

- Resource Efficiency: Implementing energy-saving measures in office spaces and data centers to lower overall resource consumption.

- ESG Reporting: Transparency in reporting environmental performance metrics, including waste generation and management strategies.

- Supplier Engagement: Encouraging and partnering with suppliers who demonstrate strong environmental responsibility.

Regulatory Requirements for Environmental Impact

While Hancock Whitney is a financial institution, environmental regulations still influence its operations, particularly in lending and real estate. The bank must consider the environmental impact of industries it finances and conduct thorough due diligence on properties, especially in light of increasing climate risk awareness.

Hancock Whitney's enterprise risk management framework actively incorporates climate risk, acknowledging its potential financial implications. This includes assessing risks associated with lending to sectors with significant environmental footprints, such as energy or agriculture, and understanding the physical and transitional risks these sectors face.

- Climate Risk Integration: Hancock Whitney's enterprise risk management includes assessing climate-related financial risks.

- Lending Scrutiny: Environmental regulations can affect lending decisions for industries with substantial environmental impacts.

- Real Estate Due Diligence: Environmental impact assessments are crucial for real estate transactions.

- Regulatory Compliance: Adherence to evolving environmental laws is a key consideration for financial institutions.

Hancock Whitney's Gulf Coast presence exposes it to significant climate-related risks, such as hurricanes, which can impact property values and increase operational costs. For example, the bank's 2023 ESG report highlights ongoing investments in energy efficiency, such as HVAC upgrades, to mitigate operational expenses and environmental impact. The company also actively manages waste streams, with digital transformation efforts in 2023 showing a reduction in paper consumption.

Environmental regulations influence Hancock Whitney's lending practices, requiring due diligence on industries and properties with potential environmental impacts. The bank integrates climate risk into its enterprise risk management, assessing how sectors like energy and agriculture might be affected by physical and transitional risks.

| Environmental Factor | Impact on Hancock Whitney | Mitigation Strategy/Action |

|---|---|---|

| Climate Change & Natural Disasters | Physical risks to collateral, increased insurance, operational disruption. | Integrating climate risk into enterprise risk management; assessing lending to climate-vulnerable sectors. |

| Energy Consumption & Costs | Fluctuations affect operational expenses and economic climate. | Investing in energy efficiency upgrades (e.g., HVAC systems); reducing refrigerant leakage. |

| Waste Generation & Resource Use | Operational impact on ecological footprint. | Waste reduction initiatives (e.g., paper usage reduction via digital transformation); promoting recycling. |

| Environmental Regulations | Influence lending decisions and real estate due diligence. | Conducting environmental impact assessments for financed industries and properties; ensuring regulatory compliance. |

PESTLE Analysis Data Sources

Our Hancock Whitney PESTLE Analysis is informed by a comprehensive blend of data, including official reports from regulatory bodies, economic indicators from reputable financial institutions, and industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.